5 Best offshore Forex & CFD Brokers with no ESMA regulation outside Europe

Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open Account: |

|---|---|---|---|---|---|---|

1. RoboForex  | IFSC (BE) | Starting 0.0 pips + $6 commission per 1 lot | 9,000+ | + Huge varierity + Micro accounts + Bonus program + Leverage 1:2000 + ECN accounts | Live-account from $10 (Risk Warning: Your capital can be at risk) | |

2. Thunder Forex  | FSA (SEY) | Starting 0.0 pips + $3.5 commission per 1 lot | 250+ | + Fast execution + High security + Leverage 1:400 + ECN accounts | Live-account from $100(Risk Warning: Your capital can be at risk) | |

3. Vantage FX  | CIMA (Cayman) | Starting 0.0 pips + 2$ commission per 1 lot | 1,000+ | + Leverage 1:500 + ECN Broker + Personal service | Live-account from $200(Risk Warning: Your capital can be at risk) | |

4. OctaFX  | / | Starting 0.2 pips (no commission) | 100+ | + Free bonus + BTC payments + Copy trading + cTrader + ECN accounts | Live-account from $100(Risk Warning: Your capital can be at risk) | |

5. IC Markets  | FSA (SEY) | Starting 0.0 pips + 3$ commission per 1 lot | 232+ | + Good conditions + RAW Spreads + High liquidity + High leverage | Live-account from $200(Risk Warning: Your capital can be at risk) |

➜ Trading with offshore brokers is fully legal. Offshore trading means you sign up with a broker who is based in another country than you.

You still need high leverage in Forex and CFD trading or want to trade offshore? – Then from 2018, you have to choose a broker with a regulation outside the EU. Since 2018, the leverage for all brokers with European regulation by ESMA is limited to 1:30. The following list and table will show you the best online brokers outside the EU. Find out more in the following texts.

Do the ESMA regulations kill small traders? (Europe only)

The latest changes for private traders from Europe are making big news and give huge attention to this topic. Many traders see themselves as extremely limited in their opportunities to operate in the markets. Unfortunately, this is the truth, because you need a lot more capital to trade a certain position size.

These regulations will apply to European brokers from 1.08.2018:

- The ban of Binary Options

- Maximum leverage for retail traders is 1:30

- 50% margin stop out

In plain language, this means: You need now directly 3.333€ at the capital (margin), in order to trade 1 lot in EUR/USD for example. The funny thing is that 1 futures contract with some brokers only needs $500 or less. Personally, we think these changes are useless to protect customers from overleverage their accounts because there are other financial products that can be riskier.

These rules particularly affect these traders:

- Traders who want to trade more than 1 positions in the markets

- Traders who want to hedge with different trades

- Traders who want to trade high volume for short term trades

To choose a Forex & CFD offshore broker is not that difficult

What can traders do to stop getting hit by the new rules in their countries? – Since the ESMA is only responsible for the European Economic Area, a trader can simply register with a broker who is not trading under European regulation. A broker outside the EU must be deliberately chosen.

The brokers presented above have solved the regulatory problem very cleverly. Actually, these companies are also based in Europe and have regulations there. Brokers operate internationally and therefore have many different regulations and licenses. They can simply trade under another license (outside the EU) to keep the high leverage.

How to get high leverage:

- Choose a broker with a license where is high leverage allowed

- Most brokers act international so they got different regulators

- Keep your high leverage

Forex & CFD brokers outside the EU – Review, and conditions

The brokers compared above can offer you almost all international language support. BDSwiss even has customers all over Europe. In comparison, we paid attention to the service, fees, and trading offers. In summary, all providers are very inexpensive and have only small differences in the area of trading fees. In addition, the companies presented have been on the market for many years and therefore have a lot of experience.

It is more important, however, that the broker is regulated and licensed. There are also unregulated brokers who offer the high leverage. We generally advise against these providers, as it is very dubious. Despite the offer of financial products outside the EU, one can speak of good companies here.

Criteria for a reliable broker:

- Regulation and licensing by an official financial supervisory authority

- Good connection to the trading platform without interruptions

- Fast support during official trading hours

- Favorable fees and costs for trading

- The broker should have no hidden costs

- High selection and supply of assets (traders have preferences here)

Regulations and licenses are important

Brokers outside the EU and international also hold regulations and licenses from state supervisory authorities. These regulations are essential for a secure and transparent market. It is strongly discouraged to trade with unregulated brokers. In this way, fraud can be prevented because regulations are only issued under certain conditions and criteria. Australia, for example, is a popular country. There are high-security standards and brokers are regulated by the ASIC, IFSC, or VFSC.

All companies shown on this website are regulated, so fraud can be ruled out. As mentioned above, some brokers (BDSwiss and Roboforex) even have a European license and a branch in Europe.

Easy and fast account opening for traders

Opening a securities account with a foreign broker does not normally present the trader with a challenge, as the websites are usually available in different languages. Similar to European brokers, you have to enter your personal data and verify your account before trading real money. This requires a picture of an identity card and proof of residence. As a rule, the accounts are verified within less than 24 hours.

The demo account for risk-free trading

The brokers shown above can of course also be tested first in a demo account. This is a special account that simulates real money trading with virtual money. You can test the trading platform in detail and check the broker’s offer. It is also suitable for developing and testing new strategies.

Review of the trading platforms of offshore brokers

Another criterion for a good broker is a professional trading platform. Brokers outside the EU also have a wide range of trading platforms. For example, MetaTrader 4 and 5 are offered worldwide. This is a universal trading platform for computers, browsers, and mobile devices.

The Metatrader software is available for any device.

The following brokers offer Metatrader 4 and 5:

Charting and analysis for successful trading

We think many visitors of this website will already know the Metatrader 4 or 5. Nevertheless, we would like to mention that this platform is very flexible. Besides the possibility to use several devices, you can insert and adjust indicators and technical tools independently. Also, self-programmed programs or indicators can be inserted. Already after the installation, the Metatrader brings more than 40 indicators with it. Also drawing tools for the technical analysis are available and freely usable. The software is one of the best solutions for any trading style and can therefore be recommended.

Free tools:

- Indicators

- Technical tools

- Automatic trading

- Customize your trading platform

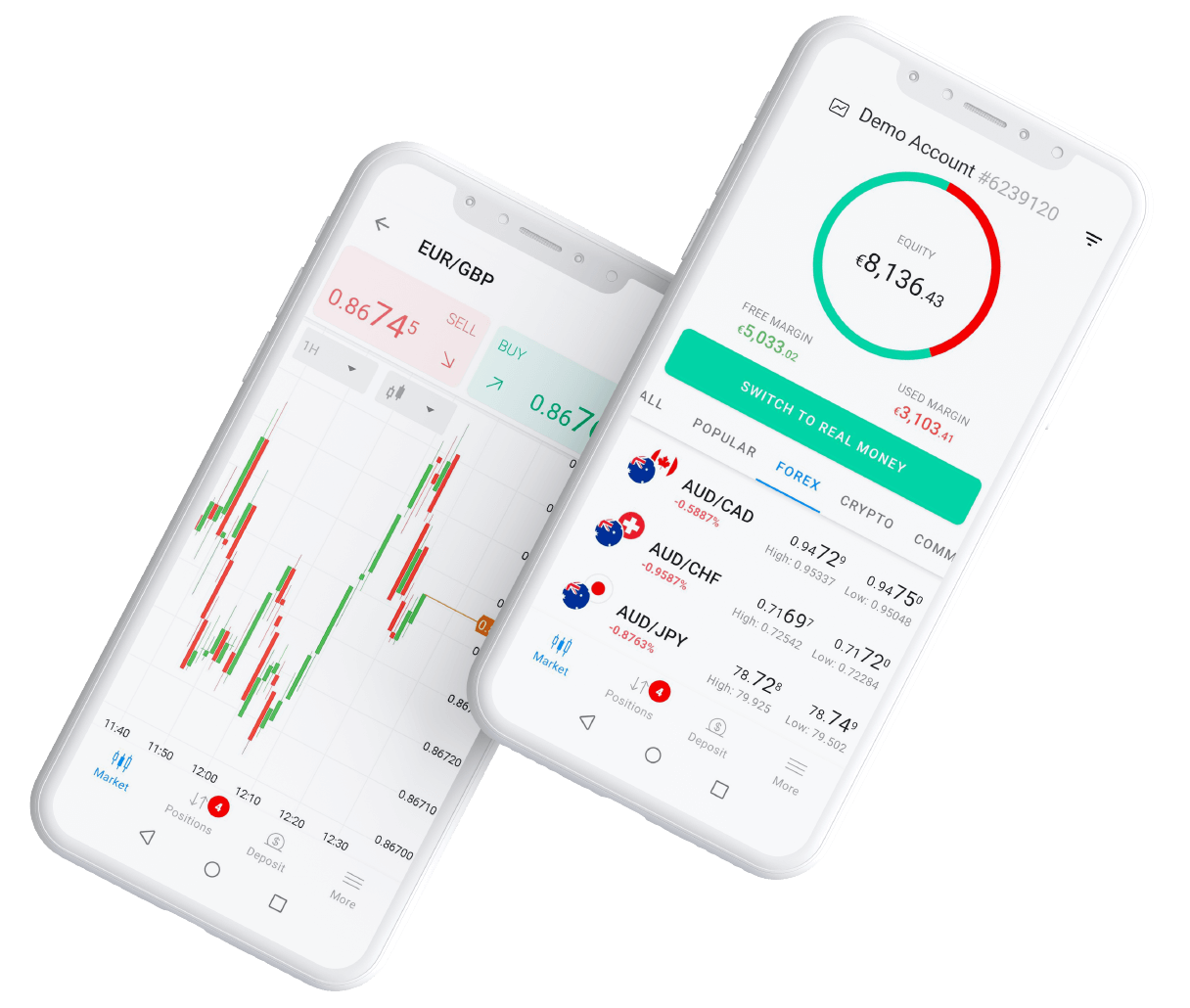

Mobile trading for any device (app)

Mobile trading is nowadays a very important feature of a trading platform. Especially many newcomers want to trade from a mobile device. This has massive advantages because positions can be opened and closed on the move. There is one single access for each device. So nothing stands in the way of a portfolio check. Use Apple iOS and Android devices for the Metatrader 4 and 5 App. It also runs smoothly and is flexible.

How to deposit and withdraw on offshore Forex & CFD brokers?

Deposits and withdrawals are just as easy as with European brokers. In most cases, the same payment methods are offered. Deposits and withdrawals can be made using electronic methods. There are usually no fees for this. In my comparison, no fees are charged by brokers for the deposit.

In our experience, the payouts also work smoothly. With BDSwiss, RoboForex, Vantage FX, and IC Markets there are usually no fees for the payout. However, there may be fees for smaller payouts below €200. All in all, well-known methods such as bank transfer, Neteller, Skrill, credit card, and cryptocurrencies are offered. A deposit and withdrawal are therefore not problematic.

Popular payment methods:

- Credit cards

- E-Wallets (Skrill, Neteller, WebMoney, Yandex)

- Bank wire

- Cryptocurrencies (Bitcoin, Ethereum, and more)

- Online banking

Review of the support and service for traders

The support and service for traders is another characteristic of a good broker. Support should respond quickly and competently. In case of questions or problems, good service is essential. The companies presented on this page offer telephone, email, and chat support. This usually works 24/5 a week (weekdays). RoboForex is an exception with 24/7 support.

International support in your native language is also available from brokers without an EU license. In this comparison Vantage FX and IC Markets are the only brokers who only offer English support. However, the websites have been translated into different languages. All other companies employ international employees who are professionally trained. Additionally, further service is offered in the form of webinars, analyses, and coachings. In summary, all brokers passed the support test and we could not find any deficiencies.

Facts about the support:

- Support 24/7 possible

- Support in different languages

- Service via phone, email, or chat

- Webinars, account managers, and education material

- The websites are available in different languages (English, Asia, Russian, and more)

Conclusion: Forex and CFD trading can be done internationally without limits

The new European regulations for over-the-counter financial products are a big problem for some traders. For every problem, however, there is usually a solution, as we have presented to you on this page.

With the leverage of maximal 1:30, it is possible to trade, but certain strategies or trading methods no longer work. A way out is only offered by a broker who is not registered under a European license. Some brokers are registered in the EU, but customers can trade under non-European licenses.

Finding a broker without ESMA restrictions is quite possible for Forex and CFD providers after this comparison. Test the proposed brokers yourself in the demo account.

Good luck with your trading.

Read through the full reviews:

Last Updated on April 18, 2023 by Res Marty

(5 / 5)

(5 / 5)