easyMarkets review and broker test – Is it a scam or not?

Table of Contents

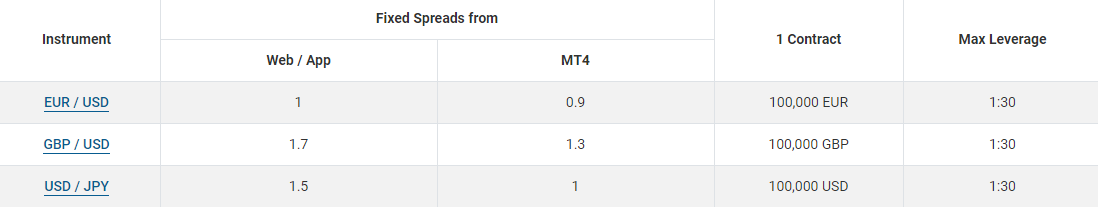

| Review: | Regulation: | Assets: | Min. Spreads: | Min. Deposit: |

|---|---|---|---|---|

(4.5 / 5) (4.5 / 5) | CySEC, ASIC | 200+ | Starting 0.9 pips fixed | $100 |

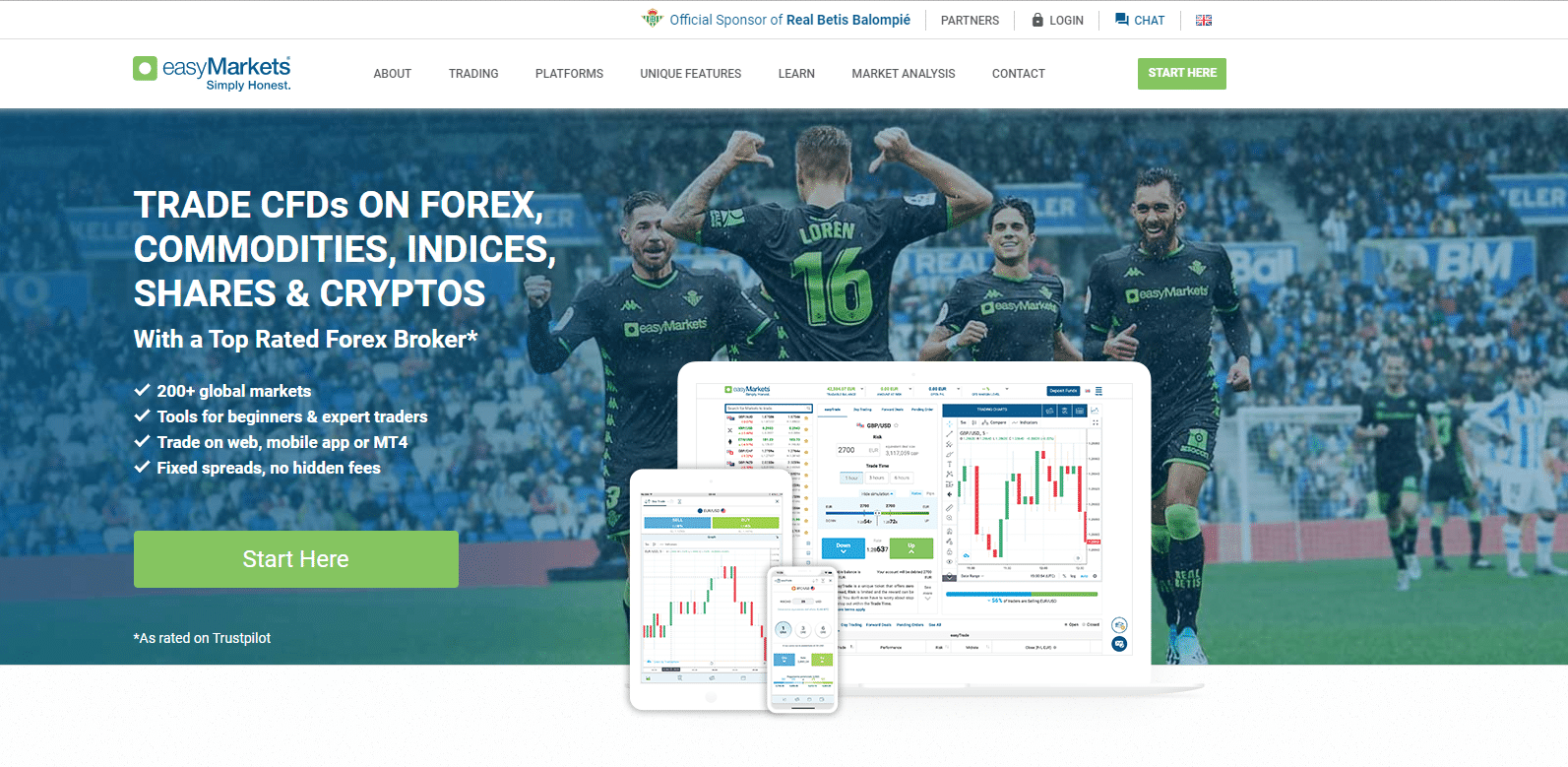

Traders seek an honest online broker that offers uncomplicated trading. easyMarkets claims to offer simple trading, honesty, and transparency to its clients. How serious and dedicated is easyMarkets with its core values? Is this broker legit and trustworthy? In this review, we will find out together if easyMarkets stands to its core concepts with online trading.

What is easyMarkets? – The company presented

easyMarkets is an online broker that dedicates itself to its core like a simple and honest broker. The firm was founded in 2001 and offers more than 200 tradable assets with its competitive platforms. It provides a variety of selections for trading FX, CFDs, shares, commodities, cryptocurrencies, and indices. The brand was founded on the idea of democratizing trading and with the value of a transparent trading experience. The platforms of easyMarkets were developed into as user-friendly platforms as possible while ensuring that it is still powerful and versatile enough for experienced traders.

In the beginning, the firm started accepting initial deposits from $25 and only offered Forex to trade at the time, until it grew to the company that it is now. Over the years, easyMarkets expanded its trading options and CFD offerings to include global indices, energy, metals, and more. in 2016, the name of the company was changed from easy-forex to easyMarkets.

Facts about easyMarkets:

- Founded in 2001

- Regulated and authorized

- A global trading platform

- Offers 200+ global markets

- Offers transparent trading experience

- Offers user-friendly yet powerful and versatile platforms

- Offers investment with Forex and CFDs

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

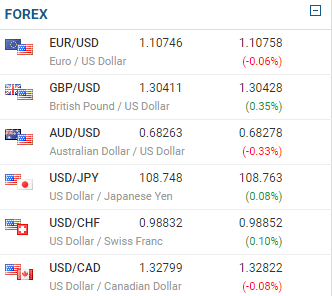

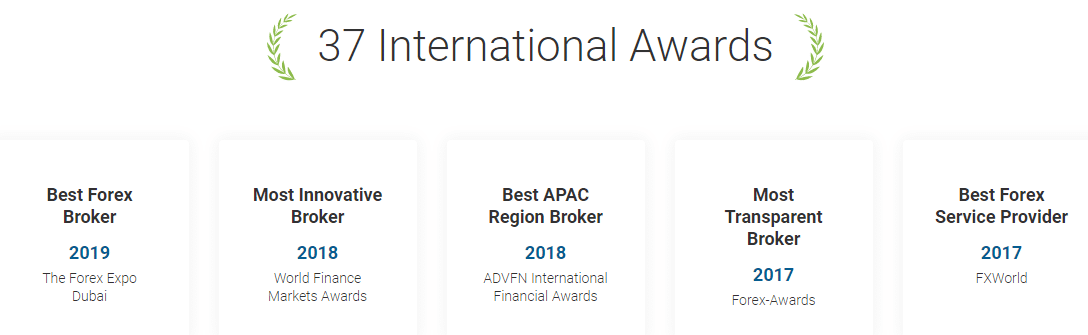

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Review of the trading conditions for tradersHonesty is one of the core concepts of easyMarkets, it has dedicated its excellence to its traders. The firm offers $100 as a minimum initial deposit for a standard account and fixed spreads. As part as well of its core values, easyMarkets commit to giving its clients a simple and transparent trading experience. The firm has developed its platforms and trading tool as simple and user-friendly, yet powerful instruments for any type of trader. The firm offers 200+ global markets and provides a variety of selections for trading FX, CFDs, shares, commodities, cryptocurrencies, and indices for traders to trade. The maximum leverage is 1:400 for all account types (international traders) and 1:30 for EU/UK traders.  easyMarkets have gathered 37 international awards for the past years of its excellence. This broker has been recognized this year as the ‘Best Forex Broker’ in 2019 The Forex Expo Dubai. Also, it was named ‘Most Innovative Broker’ in the year 2018 during World Finance Markets Awards. And in the same year, it was named as ‘Best APAC Region Broker by ADVFN International Financial Awards. In 2017, it was named as ‘Most Transparent Broker’ by Forex Awards and ‘Best Forex Service Provider in FXWorld. To know more about the awards easyMarkets won, you can visit their official website and go to the ‘Awards’ section on their homepage.  With these awards, we can say that easyMarkets is living up to its core values as a simple, honest, and transparent broker that gives good service to its traders. Facts about the conditions for traders:

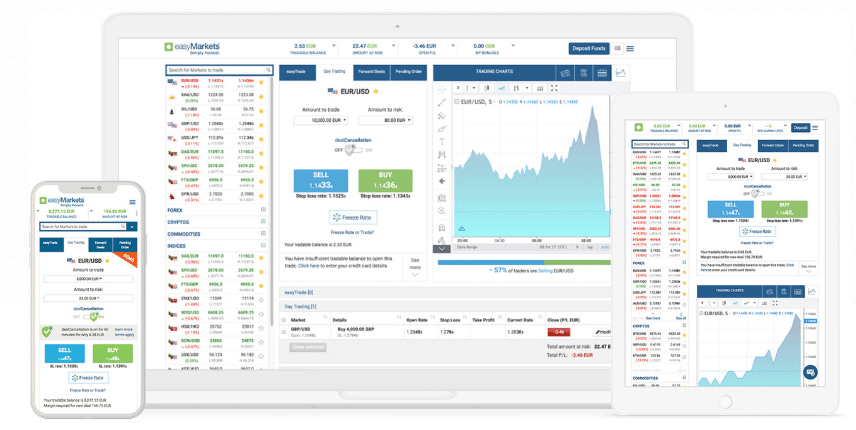

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Test of the easyMarkets trading platformsThe platforms of easyMarkets were developed into as user-friendly platforms as possible while ensuring that it is still powerful and versatile enough for experienced traders. easyMarkets offers platforms for web, desktop, and mobile trading. This platform is well-developed and promotes simple trading as the core concept of the broker’s brand. easyMarkets offers the following platforms:

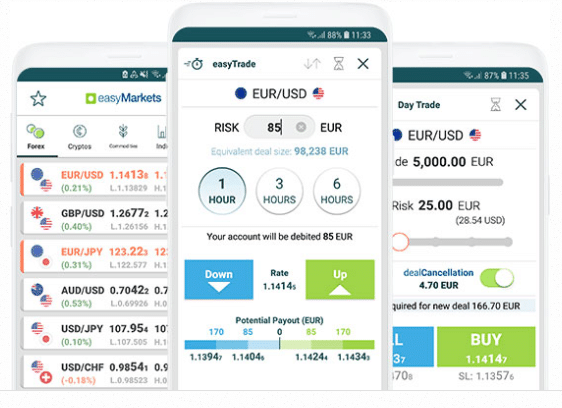

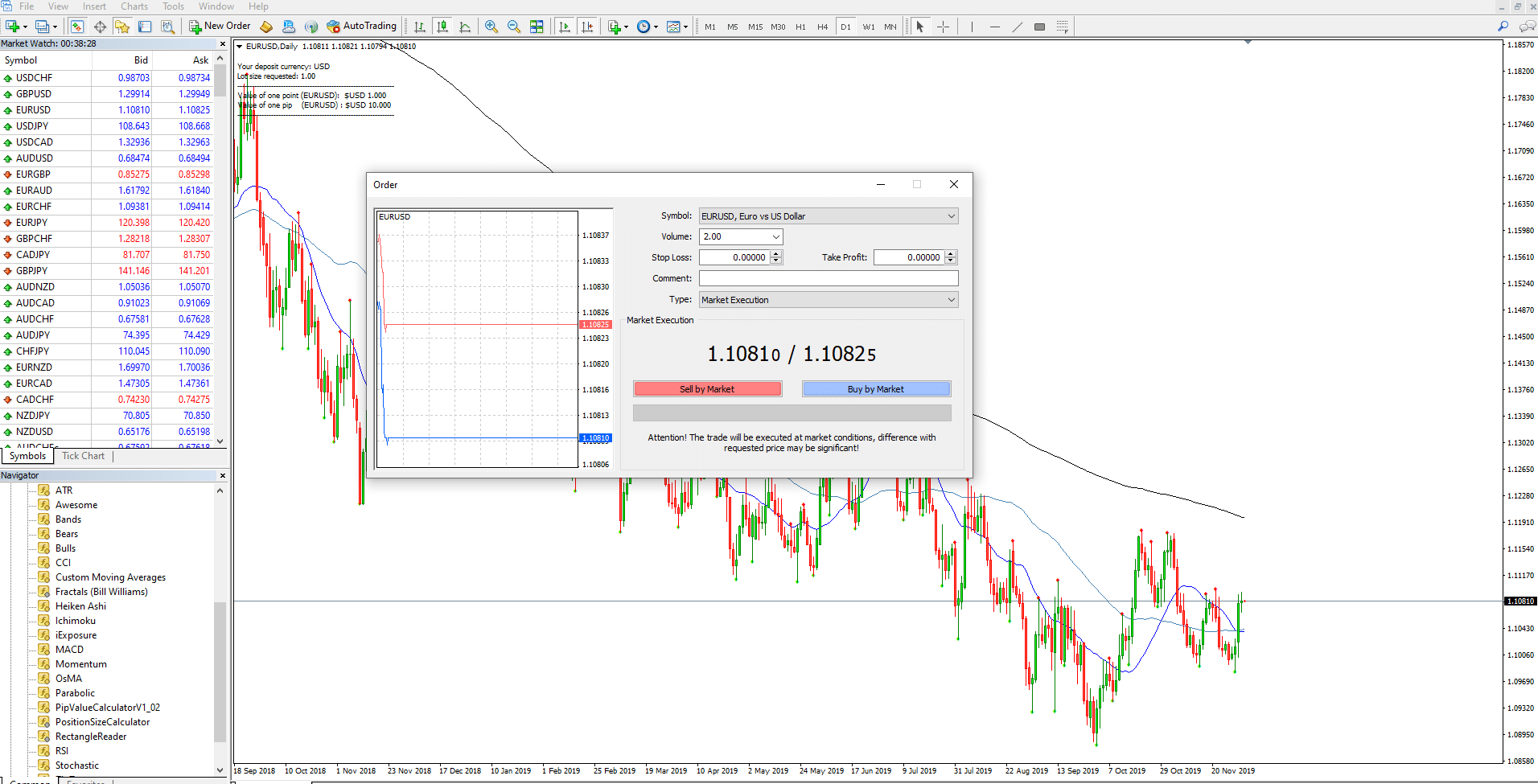

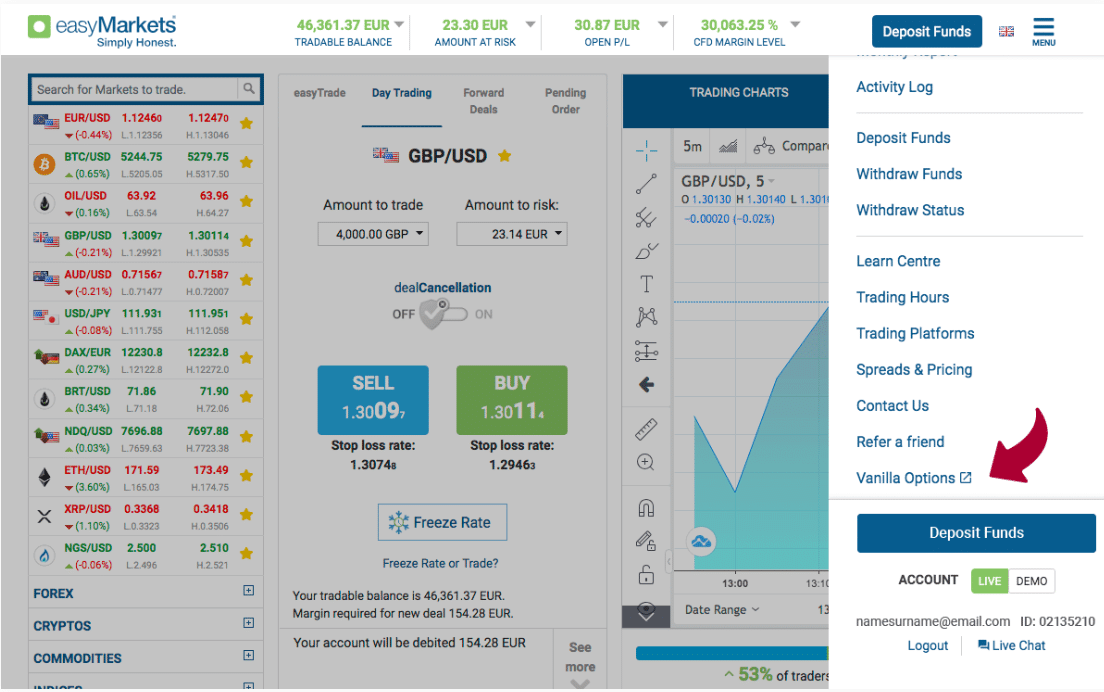

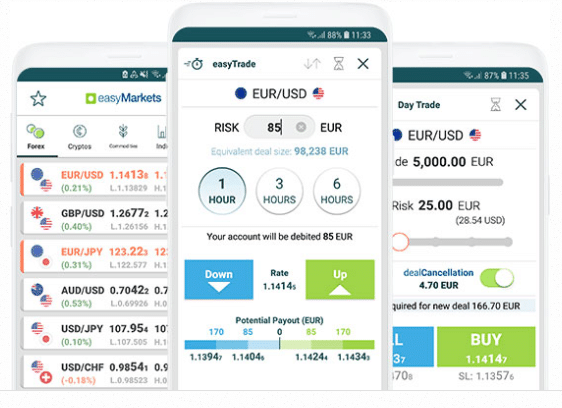

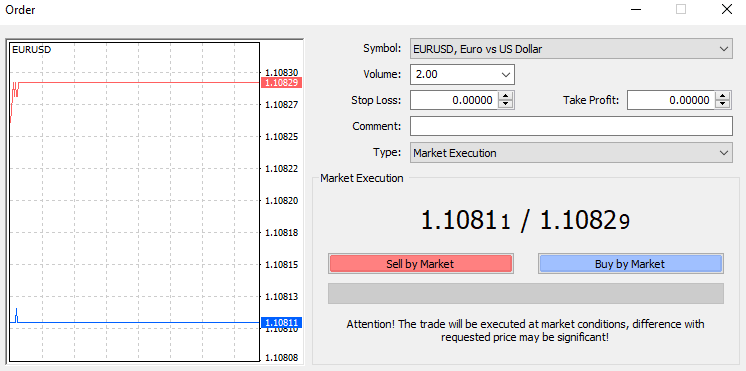

easyMarkets PlatformeasyMarkets platform is simple and versatile. It is user-friendly and can suit any type of trader at any skill level. It has a lot of features for experienced traders yet is friendly to use for new clients. Also, traders receive easyMarkets free guaranteed stop loss, no slippage, fixed spreads, and no funding or withdrawal fees. It has powerful and well-developed tools for daily trading. The easyMarkets Web platform is a powerful platform that does not require downloading software. With this platform, traders can access all listed assets easily. It runs on all operating systems with 81 technical indicators and other analytical tools. Also, it gives several drawing tools for analysis. It caters to News Headline and Financial Calendar, which are important ingredients for fundamental analysis.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) easyMarkets Mobile AppeasyMarkets have also developed a mobile app trading platform so traders can trade anywhere and anytime they want. This platform is called easyMarkets Mobile App. It is accessible, simple, intuitive, and powerful on iOS or Android devices. It gives traders access to markets everywhere whenever connected to the internet. This platform enables clients to access market news and live prices without leaving the app. It embodies powerful tools in your day-to-day trading. It has analytical tools such as technical indicators and charts and you can monitor your account in real-time in the palm of your hand. This app is available for download in AppStore for iOS and GooglePlay for Android devices.  easyMarkets MetaTrader 4 (MT4)MetaTrader 4 is a popular trading platform amongst traders and easyMarkets included this powerful platform in their list. This platform allows traders to use advanced trading knowledge to customize their terminals and display multiple live charts while using technical indicator overlays. Due to its ability to integrate a wealth of features that allow tailored market analysis and automated trading, most traders choose to use the MT4 platform. This platform is as well as preferred by advanced traders because it shows an amount of information displayed in one window.  It has pre-installed indicators and analysis tools. Traders are able to customize and create trading templates or choose from pre-designed templates. easy Markets MetaTrader 4 (MT4) has 80+ markets including currencies, metals, commodities, indices, and cryptocurrencies. It has fixed spreads for price transparency and all expert advisors are allowed. Also, no matter what type of order you place, easyMarkets guarantees no dealer intervention. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) easyMarkets Vanilla OptionseasyMarkets Vanilla Options is a unique trading platform that lets traders explore trading in a completely new and exciting way. easyMarkets have developed its independent vanilla options platform which is designed to be user-friendly and promotes simplicity in trading as its core concept the company. Vanilla Options are a popular financial product. It is used by institutional traders to hedge against volatility but also for long-term trading. This platform is simple, yet allows to quickly access easyMarkets CFD and easyTrade platform. It has powerful tools and will give you an exciting trading experience.  Facts about easyMarkets platforms:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Professional Charting and Analysis is possibleeasyMarkets has analytical tools – technical indicators and charts. These tools are very important in getting better trades. Charting helps you identify the movement of the markets. The trend and volatility of the markets are very significant because it determines the success of your next move. When volatility is high, it means that a value can potentially be spread out over a larger range of values and the price of the value can change intensely over a short time period in either direction.  Another important thing to know is how does technical analysis works and helps you with your trades. A technical indicator is a mathematical calculation based on historic price, volume, or open interest information. This tool aims to forecast the financial market direction. With that said, it helps you know which movement to take next in order to get a plus. easyMarkets platforms offer both of these analytical tools. Professional charting and technical analysis is possible and made simple. As one of the core values of easyMarkets, it commits to making trading simple and honest to its clients. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Review of the Mobile Trading (App) by easyMarketseasyMarkets Mobile Trading Platform gives traders access to markets everywhere whenever connected to the internet in the palm of their hand. This mobile app trading platform was developed by easyMarkets so traders can trade anywhere and anytime they want. It is accessible, simple, intuitive, and powerful on iOS or Android devices. This platform enables clients to access market news and live prices without leaving the app. It embodies powerful tools in your day-to-day trading. This platform is user-friendly and powerful. It has analytical tools such as technical indicators and charts and you can monitor your account in real-time in the palm of your hand. This app is available for download in AppStore for iOS and GooglePlay for Android devices.  Features of App:

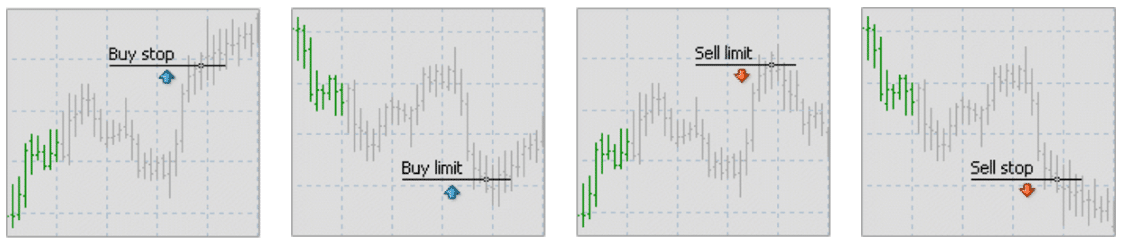

How does easyMarkets Trading work? – Step by step tutorialTrend and volatility of the markets are the things you need to know in order to determine your next steps in trading. In order to know this, you need to keep track of the movements of the markets you wish to trade on. Whenever volatility is high, a value can potentially be spread out over a larger range of values. The price of the value can change massively over a short period of time in either direction. In trading, first, you need to choose a market you would like to trade on. Choose an asset on the platform, then select the size of the right position for your account. Once done, open the order mask and customize your position. Invest in rising or falling markets in selecting either buy or sell to open a position.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Market Orders are the most straightforward type of order. This opens a trade where you either place buy or sell orders at the current market price. While Pending Orders is a type of order that allows you to buy or sell at a pre-determined price in the future. This can be ‘Buy Stop’, ‘Sell Stop’, ‘Buy Limit’, and/or ‘Sell Limit’. When you select ‘Buy Stop’, you should set the price you would like your position to open at. This type of order can be used when the current price is lower than the value you set. When traders think the price will reach a certain level and continue increasing, they usually use this. ‘Sell Stop’ allows you to open a position at a predetermined price level. It is much alike to ‘Buy Stop’, however, the difference is the current price is higher than the value set. This one is usually used by traders that assume the price will reach a level and continue falling. When the trader’s instrument’s price reaches the level set, a buy order will be performed, and this is called ‘Buy Limit’. It is used when the price is falling, and it is assumed that it will reach a price and increase. ‘Sell Limit’ opens a sell order when the instrument’s price reaches the level set. When the price is assumed will reach a level after increasing and then reverse and drop.  Step by step trading tutorial:

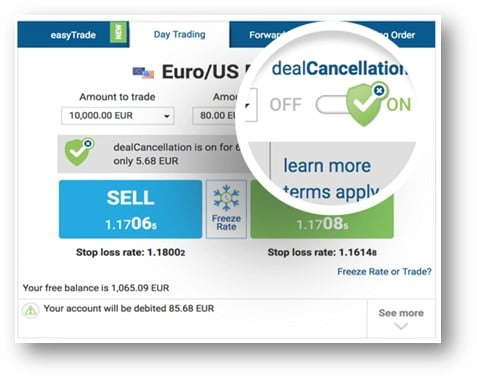

Special features of the trading platform of easyMarkets:easyMarkets offers some unique features for traders who want to succeed. They are developed by the broker and outstanding. With the “deal cancellation”, you can undo losing trades within an hour for a small fee. This is a good opportunity for traders who are trading news events. Protect you against high volatility with this tool.  Another interesting tool is the “freeze rate”. You can freeze the price for 3 seconds. It can be helpful by trading market news or get the exact execution.  Special tools by easyMarkets:

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|