Trusted Broker Reviews – Online brokers for traders

The variety of online brokers on the internet is very huge, so it is necessary to do a transparent review and comparison of the companies. First of all, you should know which financial instrument you want to trade and then searching for the right broker. This can be stocks, forex, CFDs, cryptocurrencies, or options. But in any case, the criteria for a reliable broker are the same. On this page, we tested different companies with real money, whether it is a Forex Broker, CFD Broker, or offshore Broker you will find the best one for your situation.

Furthermore, we will provide you helpful information about learning how to trade, using Social Trading and professional order flow trading which will give advantages to the markets and other traders.

Forex Brokers

Trade currencies with the best conditions. Low fees, fast execution, and professional platforms.

CFD Brokers

Go long or short in more than 9,000 different markets with leverage.

Crypto Exchanges

Trade the new and volatile markets. High profit in a short time horizon is possible.

Digital Option Brokers

Earn up to 100% on investment in a short or long time horizon. Fixed time trades.

Trading Tools

Trading tools can help you to do analysis and better trades.

ECN Brokers

Trade with high liquidity without conflict of interest. Transparent forex trading.

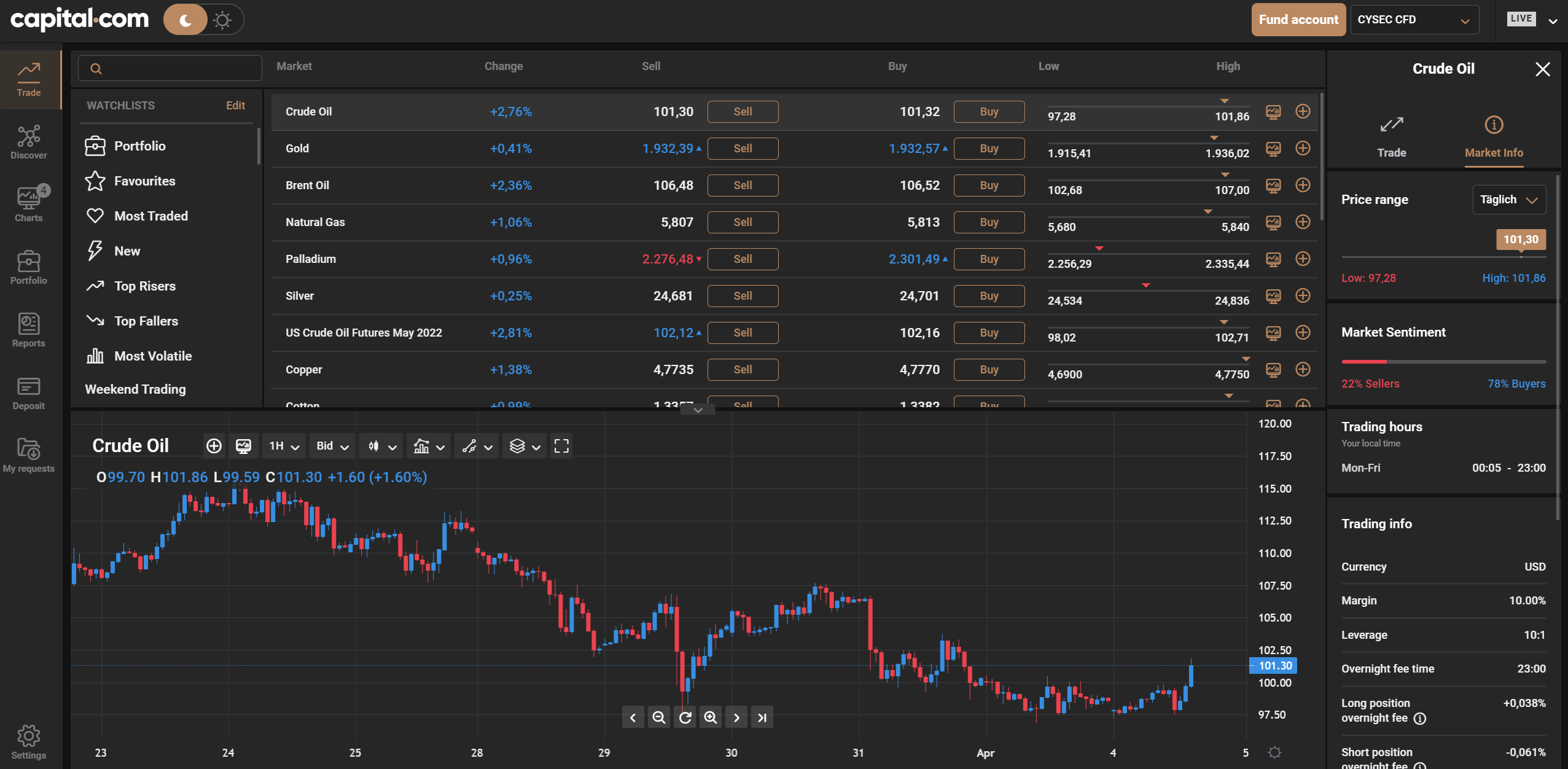

Online broker of the month: Capital.com

Capital.com is our online broker of the month. It is a regulated trading platform in Europe (Cyprus (CySEC), Australia (ASIC), United Kindom (FCA), and the Bahamas (SCB)). The platform provides more than 3,000+ different markets to trade with small trading fees. You can start with a free demo account or a minimum deposit of only $ 20 for deposits with credit card. Nowadays, Capital.com is perfect for trading CFDs on stocks, indices, and commodities. You can profit from user-friendly trading software and a huge variety of assets. Moreover, the company offers professional trading education and live webinars for any trader. We can recommend Capital.com to anyone who wants to start trading or is searching for a better broker.

Advantages of Capital.com:

- Regulated by CySEC, ASIC, SCB, and FCA

- Trade more than 3,000+ markets

- CFDs for Forex, stocks, ETFs, commodities, indices, cryptocurrencies

- Free demo account

- The minimum deposit is $ 20 (for deposits with credit card)

- Spreads from 0.0 pips without commission

- Professional support and service

- User-friendly trading platform for any device

(Risk warning: 78.1% of retail CFD accounts lose money)

Get professional trading knowledge:

Furthermore, you will find educational material about trading on this website. We will show you tips and tricks for successful online trading. Our focus is on helping beginners as well as advanced traders with a wide range of further training material that covers many topics like order flow trading, trading tips, earn money with trading, and more. We are trying that traders will not do the mistakes we did in the past. You can learn from our experience and save hard-earned money.

Learn how to trade

- Step by step tutorials

- For beginners and advanced traders

- Profitable strategies

- Professional knowledge for free

- Become a successful trader

Order Flow Trading

- Professional analysis

- Orderbook trading

- Volume Profile

- Footprint Chart

- Order Flow Software tutorial

Focus on safety and service for traders of Online Brokers

The most important fact to check on a reliable broker is safety for customers. The broker should be regulated and licensed. There are some criminals who build scam websites to do a big fraud on their clients. For our reviews, official regulation of an official financial authoritarian is required. Brokers have to fulfill certain conditions to get these licenses. In order to violate the rules, they would lose their license and a lot of money.

Furthermore, there should be a possibility to contact your broker in different ways. Most brokers offer support via phone, chat, or email 24 hours on normal working days. Clearly, the support language is English but many brokers offer support in different languages like German, Thai, or Chinese.

To improve your trading skills and results you can join the education center of the broker. Videos, tutorials, webinars, and sometimes 1 to 1 coaching are provided. Nowadays the broker wants you to profit because they can earn more money through a profitable trader than a losing trader. In the following reviews, you will see what the brokers offer for their clients.

Start with a free demo account

As a trader, you should start with a free demo account. Any broker on this homepage will provide an unlimited and free demo account for practice. This is an account with virtual money that simulates trading with real money. You can try out all the functions of the trading platform. Especially for beginners, it is a good way to improve trading skills and strategies. In conclusion, always we recommend using the demo account first so you can see by yourself if you like the trading conditions or not.

How to open your trading account

Now it is important that the account opening process is fast and without problems. With most brokers, it is very easy to open your account in less than 5 minutes. First of all, you should fill in your personal data in the account form to do the first step. We recommend using the right data otherwise the broker will not allow you to trade with real money.

After that, you get direct access to the trading platform. Any regulated Forex Broker needs a full verification of your account. That means the broker verifies your identity. It happens through uploading some documents on the broker’s homepage. It depends on the broker in which documents are required. Follow the steps in the account dashboard. It is simple and easy.

Some brokers let you trade real money without verification (for a demo account you do not need it). Personally, we recommend verifying your account is complete before you do your first deposit. Sometimes it happens that the broker does not accept specific customers through the verification process.

Step by step to open your account:

- Insert your personal and correct data in the account form

- Now you can use the demo account

- Fulfill the registration process through the verification

- After the verification, you can do your first deposit

The criteria for trusted online brokers

To achieve a good overall result, you have to consider different criteria during the test. All brokers in my experience reports have been extensively tested against these criteria. It is crucial that there is a good overall package for the trader, which has the best conditions. Personally, we would never use a broker or recommend one before we did not check these criteria.

You can do it by yourself or you can read through our reviews which we build up after these criteria.

Criteria for a reliable online broker:

- Regulation and licensed company

- Safety of customer funds

- Good conditions to trade

- Which trading platform is available?

- Free demo account

- No hidden fees

- Professional support and service

Regulations and licenses are very important for online trading

As mentioned above, before you sign up with any online broker you should search for financial regulation and license on the companies website. Most of the time you will find the license number on the bottom of the homepage or on the main menu. The regulations are very strict for the brokers. Often the broker has to get a license otherwise the company can not do business in the ceratin country.

There are companies that allow you to trade under different licenses because sometimes there is a limit for leveraged products (Europe) by the regulator. But the brokers are smart so clients can sign up with a foreign license to get the benefit of high leverage. In the next points, you will see the most known regulation authorities in the world.

Popular and safe regulations:

What is the minimum deposit for live trading?

Happy news for you. Today most brokers require a minimum deposit of only 1$ between 250$. Due to the stronger competition, the minimum deposit amount getting smaller. Which deposit amount you should use we can not recommend to you. This depends on your situation but you should only use money that you can afford to lose.

Online broker deposit and withdrawal

Before it comes to real money trading the deposit should be happening. The online brokers offer different payment methods for a free deposit. In most cases, there are zero fees for your deposit. You can use electronic payment methods like credit cards or electronic wallets like Skrill, Neteller, or cryptocurrencies. Also, the normal method of bank wire is available.

You can use methods like:

- Bank wire and international transfer

- Electronic payments

- Neteller, Skrill, ePayments

- Yandex Money, UnionPay, Klarna

- Cryptocurrencies

- Broker to Broker transfer

How does a broker earn money?

Forex and CFD trading becomes more and more popular. It is the most traded market in the world. Every day there is a transaction volume of billions US-Dollars. The market is open 24 hours per week. No matter how much capital you want to invest with forex trading you can start with a small amount of money or big investments.

In order to get around fraud, we have checked the following providers thoroughly. In our reviews, we will show you secure CFD and Forex Brokers which provide you with the best conditions for trading. For example, it is very important to choose a cheap provider when you do day trading because the trading volume will be very high.

There are only two options for a broker to earn money but generally, they earn money through the client’s trading activity. On the one hand, the broker can give their clients a higher spread than the normal market’s spread. The difference is earning. On the other hand, the broker can charge a commission per trade and can give their clients the true market spread. From our experience, the second way is the cheapest account model for the trader.

Social Trading: Let other people trade for you

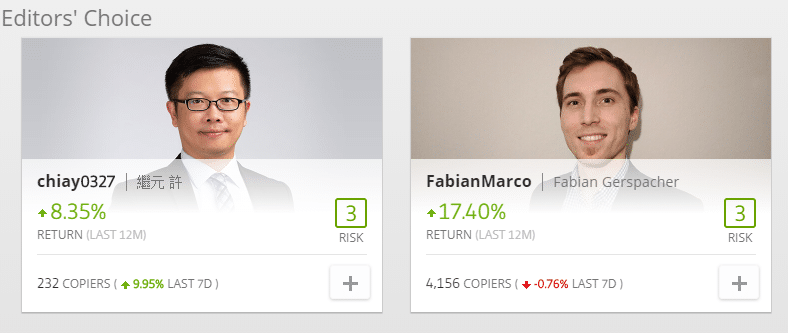

Trading and investing is not easy and you need a lot of knowledge. Professional traders develop trading strategies with thousands of factors to beat the market. In addition, as a retail trader, you fight against big banks and very intelligent people with a lot of money. Social Trading is an opportunity to trade automatically by using other successful traders. With the world’s famous social trading platform eToro you can copy other traders and invest in different portfolios. We have reviewed the platform and give you a full investment tutorial for beginners on “Social Trading“.

Advantages of Social Trading:

- Start with small capital

- Copy other traders automated

- Diversification of portfolios

- Do own risk management

- Get copied and earn additional money

Conclusion: Successful trading can be done with a reliable Online Broker

Nowadays you can start trading online very fast and invest in the financial markets by signing up for an online broker. On the one hand, there are a lot of different offers and it seems that one broker is better than the other. On the other hand, it is hard to find the best online broker with good conditions because most beginners and advanced traders got a lack knowledge about this topic. That is why we developed this website to make it easier for you to find good companies to trade with.