Libertex review and test – Is it a good choice to trade?

Table of Contents

Review: | Underlying Assets: | Min. Deposit: | Regulation: | Spreads: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | 250+ | 100€ | CySEC | Tight spreads |

The CFD broker Libertex claims to be one of the most popular brokers in the trading industry. Is this broker as good as it says it is? Should we risk and trust this broker for our investments? Let’s find out together in this detailed review based on our experience with this broker.

What is Libertex? – The company presented:

Libertex is one of the most experienced brokers in the trading industry that is operating online and is a member of Libertex Group, founded in 1997. Libertex is a CFD Broker based in Cyprus and has more than 2 million customers. Libertex offers trading in Contract For Difference. The company’s main office is at 116 Gladstonos Street, Michael Kyprianou building, 1st Floor, Limassol 3032, Cyprus.

Libertex platform has a large regular customer base, and it has won more than 40 international awards. We have reviewed this broker, and it gave us a good impression. The company’s online operations, products, and services are quite impressive. Basically, this company is legitimately operating with the majority of customers within the EEA area.

⭐ Rating: | 5 / 5 |

🏛 Founded: | 1997 |

💻 Trading platforms: | Libertex WebTrader, MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $100 |

💱 Account currencies: | EUR, GBP, CHF, PLN |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | 20 EUR |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | Yes |

📊 Assets: | Cryptocurrencies, Indices, Metals, Stocks, Forex, Agriculture, ETFs |

💳 Payment methods: | PayPal, Debit- Credit Cards, Instant bank transfer, Skrill, Neteller, bank transfer |

🧮 Fees: | Variable fees and commissions |

📞 Support: | 24 / 5 via e-mail, phone, and contact form |

🌎 Languages: | 8 languages |

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Is Libertex regulated? – Regulation of the broker

One most important things a trader must remember is to make sure that the broker is regulated before trading. This regulation is basically proof that the broker is operating legally and has passed the criteria to gain a license to be a legit trading broker. Please be aware that CFDs and other trading products are usually regulated in the EU and may only be offered to end customers by licensed providers.

This broker keeps the funds of the customer separate from the company’s own money. Libertex can offer its products within the EEA area and in Switzerland. In addition, the platform of this broker is encrypted, so you do not need to worry about the security of your information shared with this company.

Summary of the regulation and financial security:

- Regulated by CySEC

- Separate storage of customers’ funds

- Regulated payment methods

- Platforms are encrypted

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

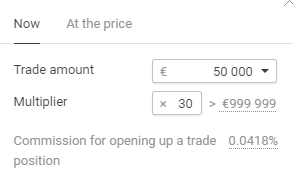

Review of trading conditions for traders – Trading CFDs with tight spread

You can trade on both rising or falling prices with Libertex. The maximum leverage for private traders is up to 1:30, and it varies according to the underlying asset. All customers can use a demo account with virtual funds of up to €50,000 to test the trading platform themselves. The minimum deposit for a live account is only €100.

Furthermore, Libertex has a wide range of underlying assets. More than 250 different underlying assets are available with this broker. You can trade CFDs on stocks, currencies, cryptocurrencies, and more. We think that Libertex endeavors to add new and interesting underlying assets to the platform.

The following CFDs are available at Libertex:

- Cryptocurrencies

- Indices

- Oil and gas

- Metals

- Shares

- Currencies (forex)

- Agriculture

- ETFs

There is one trade commission that must be paid per trade. Basically, this is how the broker earns money. The commission starts from 0.0003% per position and depends on the position size. Libertex has developed its own platform – the Libertex Web platform and Libertex Mobile App Platform. Also, the broker offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms will be discussed later on in this review.

We can say that Libertex is a good and fair broker due to its trading conditions for its traders. It has a lot of good points and advantages compared to its providers.

Facts about conditions for traders:

- Free demo account with €50,000 virtual funds

- The minimum deposit is €100

- More than 250 different underlying assets

- Tight spreads

- Commissions from 0.0003%

- Leverage maximum up to 1:30 (private)

- Libertex Web Platform, Libertex Mobile (App) Platform and MetaTrader 4 (MT4), MetaTrader 5(MT5)

What are the pros and cons of Libertex?

We like to see trusted brokers with a long history on the market because it usually shows they are doing something right. Libertex is a great example of such a broker, with has been around for decades. But as always, just because they have been here for a long time, it doesn’t automatically mean they are doing everything perfectly. To find the pros and cons ourselves, we tested Libertex extensively, and here are our results.

Pros of Libertex | Cons of Libertex |

✔ Extremely trusted and well-regulated broker with a long history and good reputation | ✘ The amount of tradable instruments is quite small compared to other brokers |

✔ No speeds and very small commissions per trade | ✘ The platform lacks auto-trading features, and the usability of the app isn’t great |

✔ Account opening is easy and extremely fast | ✘ Availability of customer support is below average |

✔ Possibility to deposit funds via Paypal |

Is Libertex better than other brokers when it comes to usability?

Usability is one of the key aspects to consider when choosing a broker, in my opinion. But how well does Libertex score in this regard? Is it better than other brokers? Read on to find out.

Criteria | Rating |

General Website Design and Setup | ★★★★ Website design and set-up are pretty clean and easy to navigate |

Sign-up Process | ★★★★★ Unlimited demo account and smooth sign-up process |

Usability of trading area | ★★★★ Trading site is simple and easy to understand, but other brokers make it easier to track open positions. |

Usability of mobile app | ★★★ Solid mobile app with standard features, but doesn’t stand out |

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Test of the Libertex trading platforms

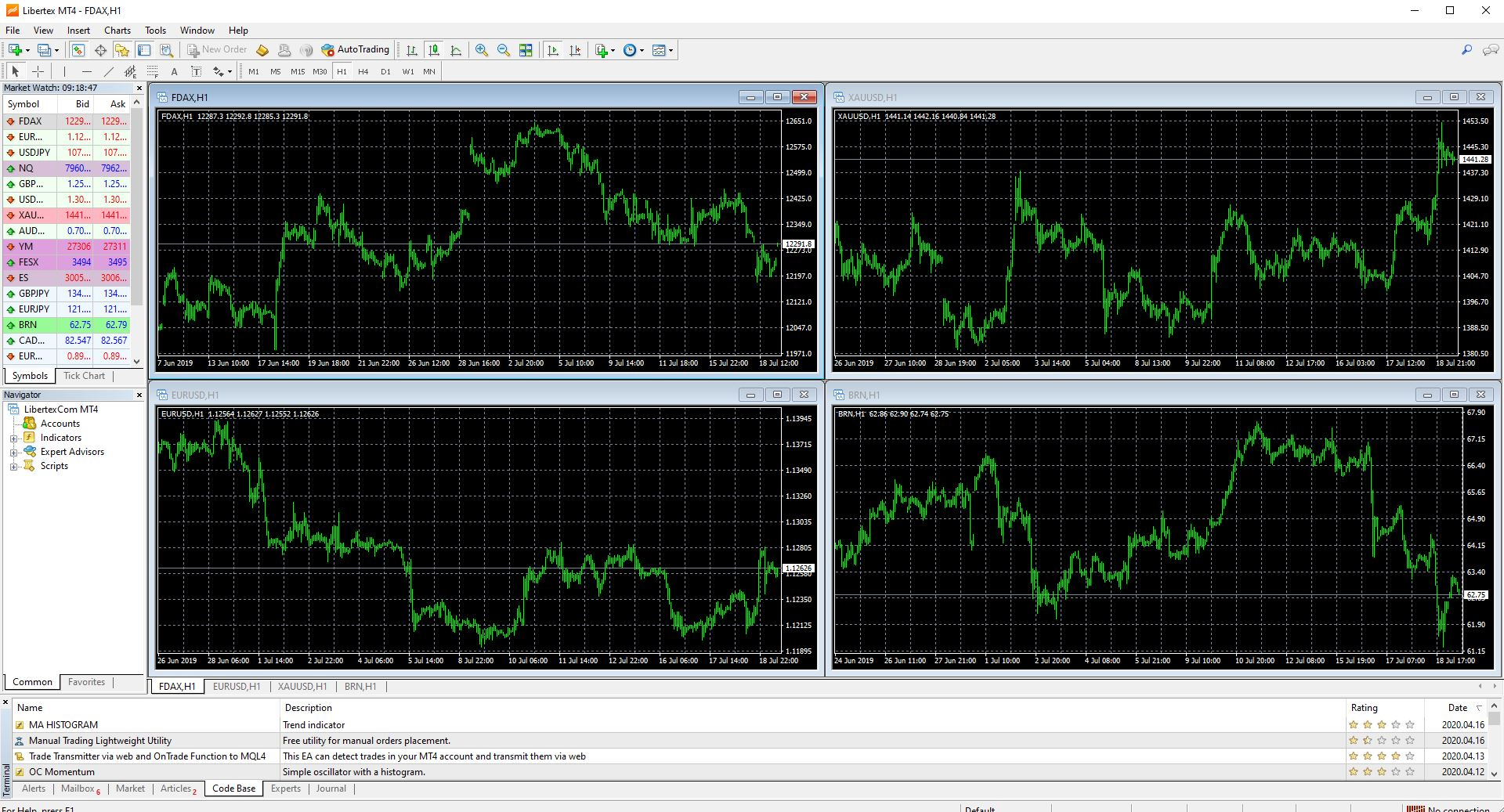

Libertex offers professional and competitive platforms. This broker has its own web platform and mobile (app) platform. Additionally, Libertex has partnered with the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Libertex offers the following platforms:

- Libertex Web Platform

- Libertex Mobile (App) Platform

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

Libertex Web-Platform

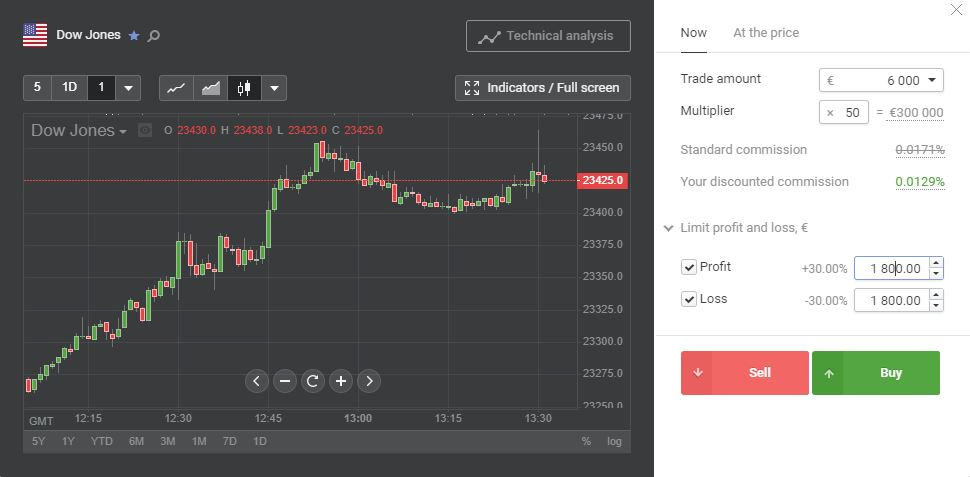

The Libertex Web Platform has ten different languages and offers traders a good overview of all functions. This platform enables traders to trade directly from a browser and doesn’t require downloading any software. You can have access to over 250 underlying assets and be able to trade CFDs with tight spreads. Libertex Web Platform has given a good impression to us due to its user-friendly interface. It has good indicators and tables traders to manage their capital.

As you can see in the center of the picture of the Libertex Web Platform, there is the chart and the current market. For better analysis, charts can also be shown on a full screen. You will find several tradable markets offered by Libetex on the search option. The tradable markets are on the left side, and on the right are the current positions or account balances. In our opinion, this Libertex Web Platform is quite impressive due to its well-improved charting that has been developed over the years. One more good thing about this platform is that it offers traders extensive information on every underlying asset. The news and information section are published by Libertex.

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Libertex Mobile (App) platform

Mobile trading is possible with Libertex through its Libertex Mobile (App) Platform. This platform is developed by Libertex and has the same functions the Libertex Web Platform offers. The only difference is that this platform requires a download of the App. This App is available in AppStore for iOS and GooglePlay for Android. This is a hassle-free option for traders to trade wherever they are and whenever they want as long as connected to the internet.

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

MetaTrader 4 platform

Libertex offers as well one of the most popular professional trading platforms. This platform is MetaTrader 4 (MT4). It offers CFD on more than 43 currency pairs and 100 effective trading tools. This platform is free to download and is available on the official website of Libertex. It offers a No Dealing Desk (NDD) option. MT4 is famous for its good indicators and good functions, and no wonder a good broker like Libertex chose this platform.

Facts about the platforms offered by Libertex:

- Clear design

- User-friendly and competitive platform

- Suits any type of trader – beginner and/or professional

- Fast market selection

- Transparent position management

- News and other market information are available

- Charting is possible

- Has good indicators

- Offers mobile trading

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Charting and analysis are possible

Charting enables you to read the movements of the markets. It also keeps you on track with the historical prices of the market. Libertex offers extensive charting for every underlying asset to its traders. Also, there is an option to make the chart in full-screen mode, which carries out a professional analysis. This broker has numerous free indicators and drawing tools. Usually, chart analysis is the most important tool used in trades.

Libertex has used the design of one of the best charting platforms for traders. This design is from Tradingview.com. Almost every indicator and every tool are available on this platform. Additionally. all the tools can be independently adapted to the chart or the trading strategy. Depending on the method, you can select different chart displays and time units for the analysis. The software from Libertex is very user-friendly. Therefore, we think that this is a good tool for trading and is well-organized.

Libertex trading tutorial: How to trade

Knowing how to trade and knowing how trading works is obviously very essential in the trading industry. Before going live, one must first know how to execute a trade. Libertex has a user-friendly order mask. This is one more good thing about this broker. You can make any setting you prefer before opening any position.

First, you have to select an underlying asset you want to trade. Second, choose the trading amount (margin or security deposit). The multiplier is by default. Then, check possible trading fees. Afterward, secure the position with a stop loss and take profit.

The commission (fee) is also shown to the trader transparently by the broker before each transaction.

Step-by-step tutorial:

- Select a market you want to trade

- Choose the trading amount (margin or security deposit)

- The multiplier is, by default

- Check possible trading fees

- Select a stop loss and take a profit

- Bet on rising and falling prices

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Free Libertex demo account

The Libertex demo account is free and has €50,000 virtual funds with it. We highly recommend that you get a demo account first before trading live to avoid unintended trading executions. Also, this is due to the fact that trading requires skills. It is best to practice and enhance your trading skills first, especially if you are new in the trading industry. A demo account will help you a lot with your market analysis skills, strategies, and trading decisions. The demo account is available on all platforms offered by Libertex.

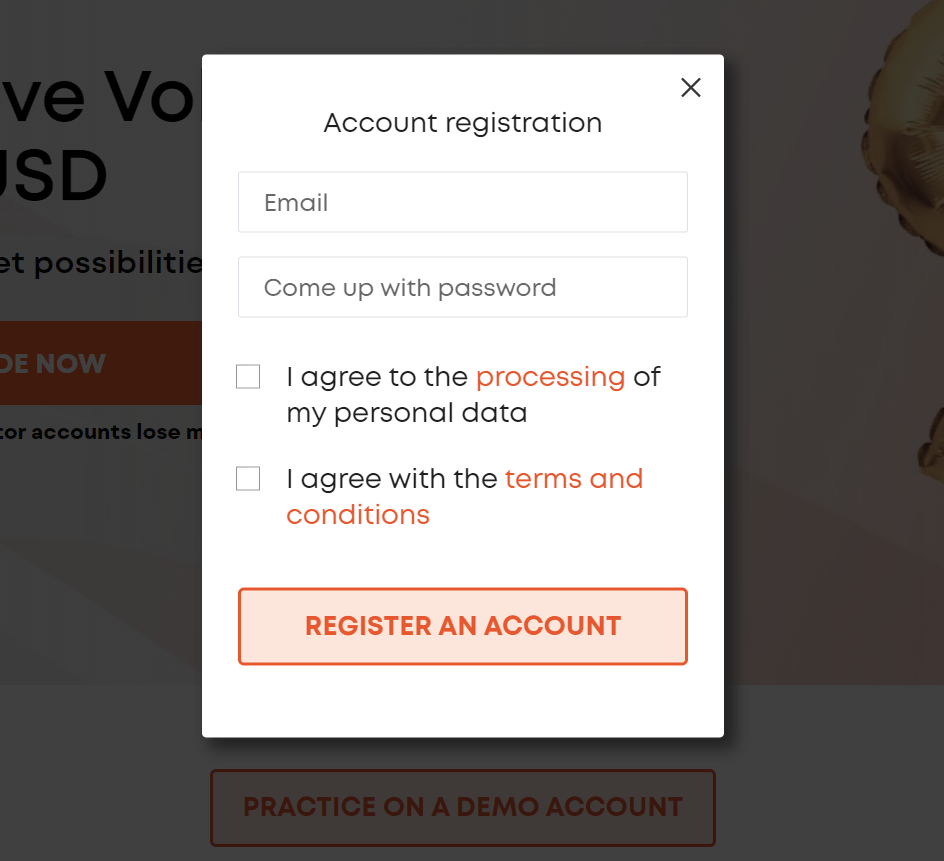

How to open your account

Opening an account with Libertex is very easy and fast. All you need is to give in your email address and create a password to gain access to the trading platform of Libertex. After the registration, an email confirmation will be sent to your email. After that, you can already use the platform and try all the functions in the free demo account.

When you decide to trade live and not a demo, you can fund your account directly, and the minimum deposit is €100 with no fees. We would recommend that you complete the verification of your account before proceeding with trading real money for security. If you deposit funds without verifying the account and later have problems with verification, there might be difficulty in the withdrawal of funds. As much as possible, we would like to avoid that. So it is best to verify the account right away.

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

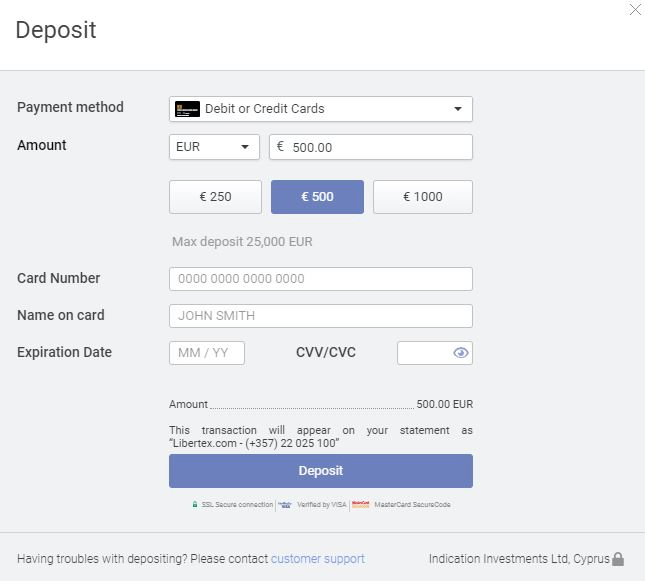

Reviews of deposit and withdrawal

Processing deposits and withdrawals with Libertex are quite easy and fast as opening an account. There are several payment methods you can use in funding your Libertex account and four types of payment methods for withdrawing them. The minimum deposit is €100 with no extra fees charged it. Payments are very fast processed with this broker.

All payment methods used for depositing funds are absolutely free with Libertex. There are payment methods that instantly process your funds. However, it depends on what type of payment method is used. Usually, the maximum processing time takes only three days with Libertex.

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Payment methods that can be used for deposits:

- Debit/credit cards

- Bank Transfer

- Sofort

- SEPA/International bank wire

- Trustly

- GiroPay

- RapidTransfer

- Skrill

- Neteller

- P24

- iDEAL

- Multibanco

- Rapid Transfer

- Teleingreso (Voucher)

For withdrawals, some small fees may be charged, but are still manageable.

Here is a detailed illustration of the fees for withdrawals:

WITHDRAWAL METHOD: | FEE: |

|---|---|

Debit/credit card | €1 |

Skrill, PayPal | Free |

Neteller | 1% |

Bank Transfer | 0,5% min. €2, max. €10 |

Payment methods that can be used for withdrawals:

- Credit/debit cards

- Skrill, PayPal

- SEPA/International bank wire

- Neteller

Is there negative balance protection at Libertex?

Yes, Libertex does come with negative balance protection for its traders. If markets move against you in a rapid fashion, Libertex will automatically reset your account to zero should the balance go negative.

Fees and costs for Libertex traders

One more thing to look forward to when trading with Libertex is that deposits are free, and there is no account management fee*. For withdrawals, there is a possible charge depending on what type of payment method is used. Usually, this fee is just a small fee and is manageable. This broker is financed by trade commissions per trade. This starts at 0.003% and depends on the market traded. Since that Libertex is a CFD broker, please be informed that CFDs are leveraged assets. With this said, there is an overnight financing fee that may apply if you use a lever, but it still depends on the market and position size.

In our opinion, Libertex is one of the brokers in the trading industry that is inexpensive. There are also no hidden fees, and the broker is very transparent with regard to the fees to its customers.

*If the Client’s Account is inactive for 180 calendar days (i.e., there is no trading, no open positions, no withdrawals or deposits), the Company reserves the right to charge an account maintenance fee of 10 EUR per month. (Applies to clients with a total account balance of fewer than 5000 euros).

Facts about fees and costs:

- The minimum deposit is €100

- No deposit fee

- No account management fee (except 180 days of inactivity)

- Tight spreads

- Commission fee per trade from 0.003%

- Withdrawal fees may apply depending on what payment method used

How does Libertex make money from you?

Libertex will take a small commission fee from the trades you place and make the majority of its income from a small commission on the trades you place via the platform. However, there are also some currency pairs and assets you can trade without commissions. Overall, Libertex will take parts of its revenue and reinvest it in new tools, customer support, and security of the site to guarantee you a professional and reliable platform. Compared to other brokers, Libertex is known to have relatively low fees and no hidden fees as well.

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

Support and service of Libertex

Reliable customer support is very important to each and every trader. As traders, we want to choose a broker that is easy to reach and quick to respond to. The channels offered by the broker for customer support are also one thing we look at as a broker. Libertex operates five days a week. This support is available on the phone, chat, and email. Additionally, there are social media channels where you can reach Libertex. This is through WhatsApp and Facebook. The support is available in 8 languages.

SUPPORT: | LANGUAGES: | METHODS: | PHONE: | EMAIL: |

|---|---|---|---|---|

Monday to Friday from 8 a.m. to 6 p.m. CET | Eight languages | Telephone, email, chat, WhatsApp | +357 22 025 100 |

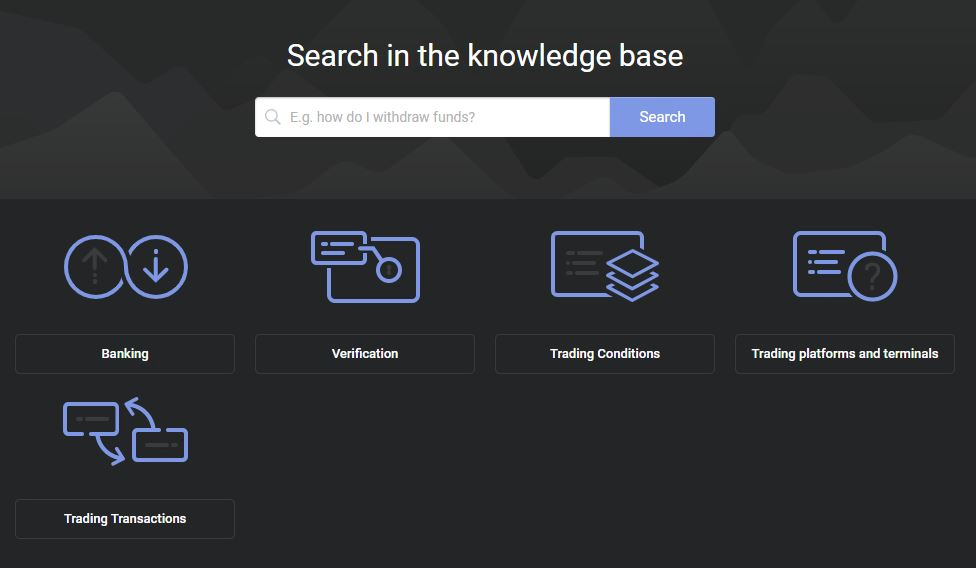

Additionally, Libertex offers a wide range of advanced educational materials, such as training courses for every trader. These programs are suitable for any type of trader – whether beginner or professional. These training programs are available in 8 different languages. Also, there are a Frequently Ask Questions (FAQs) Section on the website of the broker itself that you will surely find useful and helpful.

- English

- Italiano

- Deutsch

- Nederlands

- Espanol

- Francis

- Portugues

- Dutch

- Polish

Plus, Libertex has a large knowledge base. Please see the image below:

We can say that Libertex is a broker that cares a lot about its traders and gives a lot of ways to show their support to their customers through their customer support products and services. Also, there are live webinars that customers can benefit from. How great is that? We think Libertex as a broker is reliable and good support to any trader.

Facts about support:

- 24/5 support

- Available in over eight languages

- FAQs

- Free educational materials – Video courses

- Webinars

- Reliable support and professional staff

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

What are the best Libertex-alternatives?

If you are still looking for the perfect broker, take a look at our three favorite alternative companies. All of them have a high reputation and multiple regulations, and some of them have been around for decades, so therefore, they offer a very high level of security.

Capital.com

Capital.com is, in our opinion, one of the best brokers for beginners, thanks to a huge educational section, a beginner-friendly platform, and great dedicated support. The minimum trading amount on capital.com are slightly higher, but on the other hand, they have more than 3,000 assets to choose from. Learn more about capital.com and dedicated yourself to which broker is better for you.

RoboForex

If you are looking for an overwhelming selection of more than 12,000 assets and very lucrative leverage, look no further. RoboForex is a great alternative for you in this scenario, especially if you already have some trading knowledge. The company is headquartered in Belize, has more than 900,000 customers from around the world, and is definitely an alternative we can recommend. Read our full review here.

XTB

XTB is one of the leading brokers in the industry and is great for new traders and more experienced people alike. What we particularly like about XTB is their designated and award-winning support for each client. Also, the broker can score with very competitive spread fees and is one of the best choices if the security of your funds is a major concern for you.

Conclusion of the review: Libertex is a legit CFD Broker

We can say that this CFD broker has much to offer compared to other trading providers. It is fully regulated and is a sponsor of a football club. Libertex has more than 250 available underlying assets to trade on. This includes CFDs on 50 different cryptocurrencies, EAA countries covered, and more than 2 million clients. It has won more than 40 international awards.

Traders who choose Libertex as their broker definitely have a lot of choices. We think that this broker has a really good policy on charging fees. It is an advantage that this broker doesn’t charge any fee for deposits and has minor charges for withdrawals that are very manageable. The platform is also impressive and well-designed. It is user-friendly yet very competitive.

We recommend this broker due to its excellent in giving various choices to its traders, reasonable trading fees, and great support to its clients.

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your moneyAdvantages:

- The minimum deposit is € 20

- Offers free demo account with € 50,000 virtual funds

- Member of Libertex Group has been on the market since 1997

- More than 250 different trading underlying assets

- Multifunctional and user-friendly platform

- Over eight different languages, customer support

- No deposit fees and reasonable trading fees

- Offers several CFDs cryptocurrencies

- Popular trading platform

Libertex shows us strong experience in CFD Trading. It is a user-friendly platform with good trading fees.

Trusted Broker Reviews

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

See other broker reviews:

Last Updated on June 8, 2023 by Res Marty