Etoro demo account: How to use it – Trading tutorial

Table of Contents

So, for any trader who focuses particularly on social trading, Etoro may be the best choice. It serves in various countries across the globe with registered offices in Cyprus, the UK, the US, and Australia. It offers its clients a safety assurance as well since it is a regulated broker. Agencies such as FCA, ASIC, and CySEC regulate the operations with strict guidelines, so even the new traders can trust Etoro. Now, a beginner trader can easily open a demo account and start trading with more than 3,000 instruments from leading global markets.

However, before knowing the process of opening a demo account with Etoro, we must understand the basics.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to open a demo account with Etoro?

Opening a demo account marks the beginning of a trader’s journey into online trading. A demo account should always be the first step regardless of the markets that the trader wants to explore. It allows the trader to understand the trading dynamics, be it Forex, stocks, or commodities.

With the help of a demo account, she can know which strategies are working and which are not. Based on that, only a trader can take progressive steps. So, a demo account opening should be the least complicated since its primary purpose is to ease future trading. Etoro understands the needs of a new trader, and that is why registering and setting up a demo account following the simple steps below is sufficient.

Etoro rating: | 4.8/5 |

Demo account: | Yes |

Regulators: | ASIC, FCA, CYSEC |

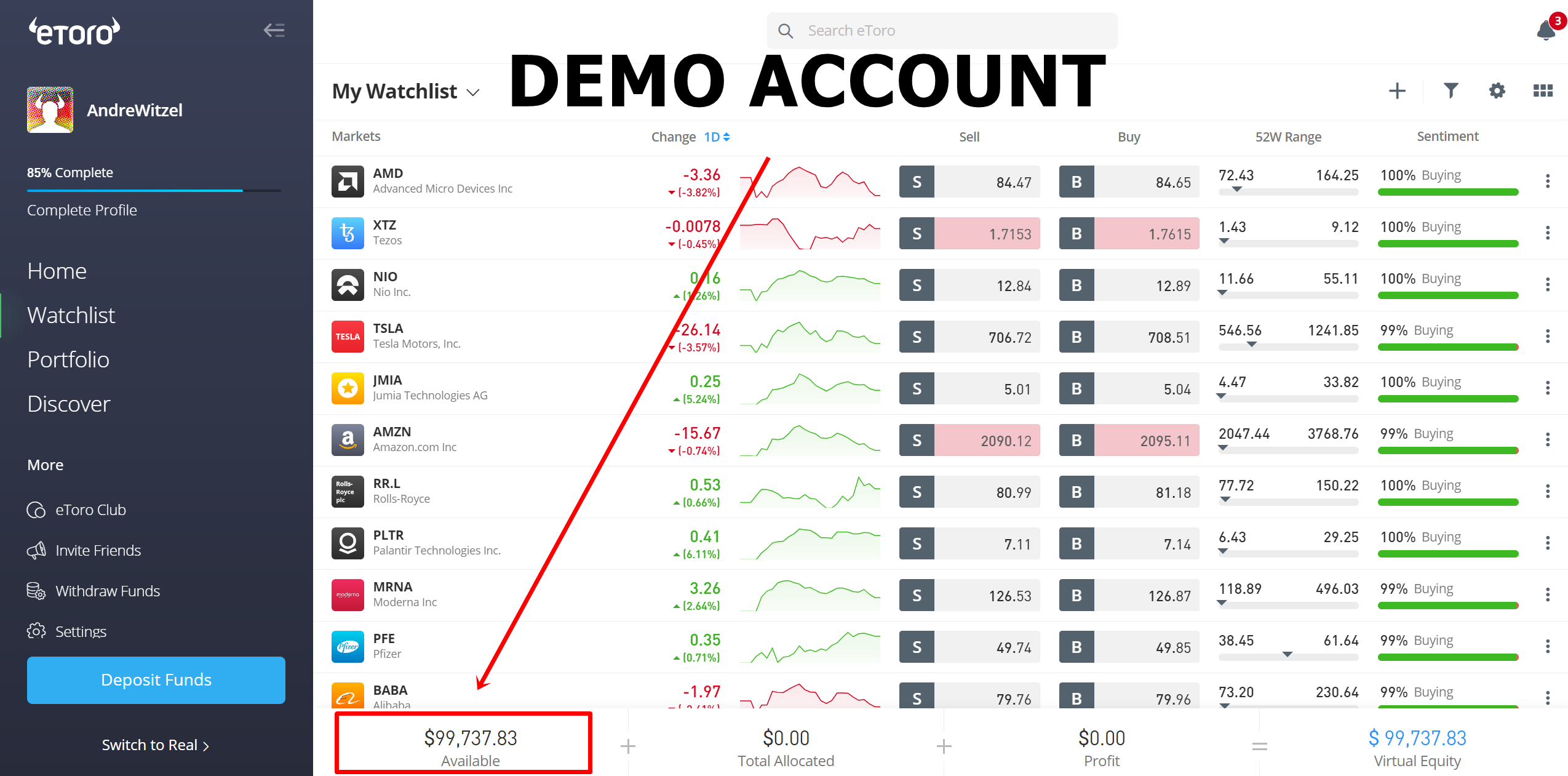

The minimum deposit on a demo account: | $ 100,000 |

Demo trading cost: | $0 |

Total currency pairs | 47 |

Demo account virtual money | $ 100,000 |

Demo account activation time | Direct after registration |

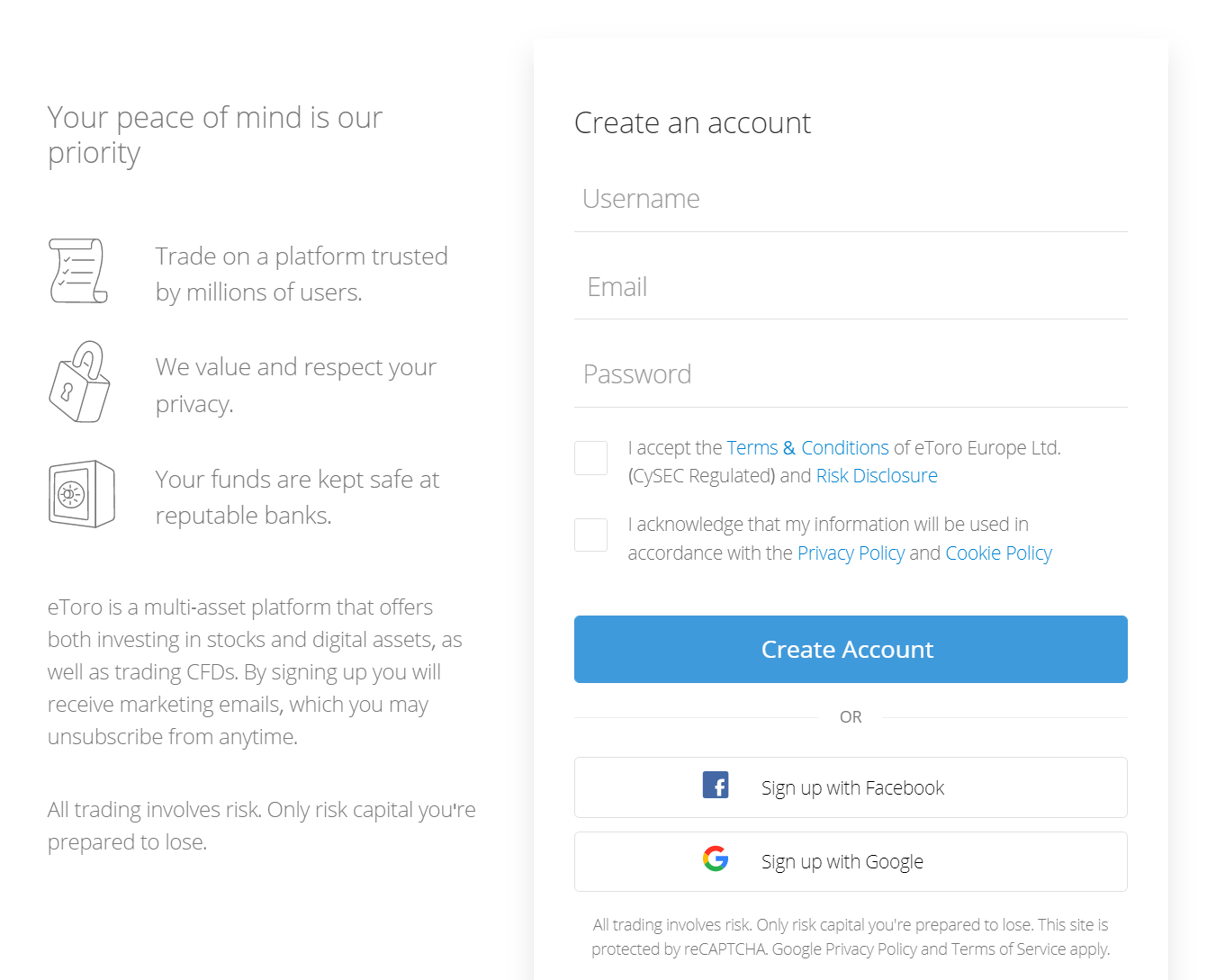

- The first step in an Etoro demo account tutorial is no different from others. You need to merely visit the Etoro website, where you can find the sign-up button by navigating to the top. Clicking on it will redirect you to further steps.

- The next step is for a trader to register on the Etoro website before signing up, if not done before. It will give them access to a switching option. A trader can switch between a live account to a virtual account by using that option. The virtual and demo accounts are not different; we need to click on the same since we are concerned about the demo account.

- Now, by selecting the sign-up option again, the trader can be redirected to an online application page. She needs to fill in the personal details on that page, such as her first and last name. The trader will also be asked to select a username and a password for later use. Then she needs to enter the mobile number.

- Now, the Etoro webpage will take the trader to a terms and conditions page. She needs to read all the clauses carefully and then agree on the same. Etoro also receives permission to use your information if you agree to all the terms. So, it may use the information for the privacy policy and the cookie policy.

- Now, the trader can see a create account option. Clicking on it will further take her to a new page.

- On this page, the trader gets to enter into the trading platform that allows them to trade, deposit funds, access trade markets, copy people, and more.

- Finally, the trader can end the process while completing their account information and clicking the Complete Profile button.

With Etoro, the account a trader creates can serve two purposes. It can be a live account, but the trader gets the option of switching to a virtual account. So, it can serve as a demo or practice account by selecting the live dropdown and changing it to virtual from the two options.

It is understandable how intimidating trading can be for beginners without prior knowledge, skill, or experience. Therefore, the feature of a demo account from Etoro can give a broad and risk-free environment for beginner traders.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to use the Etoro demo account?

Using the demo account in Etoro is fairly simple as compared with others. We know that a demo account is often referred to as a practice account. It provides the traders with the ability and freedom to explore all the offerings without running the risk of incurring losses. Moreover, it utilizes virtual money, not subject to any financial risk.

The Etoro demo account is to familiarize beginner traders with a live trading environment. So, they can build up their trading skills by actively participating in trades and developing strategies. It will help them in their trading future.

However, the Etoro demo account is not merely intended only for beginners. Instead, it can provide advanced traders the opportunity to explore what Etoro has to offer in their live trading portfolio.

Therefore, after grasping all the steps for opening the Etoro demo account, we must move on to know the steps to use it.

You can start your first trade with a few simple steps. But before that, you must ensure that you enter the market on time, as the markets open and close around the world, and you cannot trade any asset at any time. Let us now look into the steps.

- The first step is to search for the virtual stock ticker. For example, the company Apple lists it as AAPL. So after you search for your choice of stock, you can click on the first result.

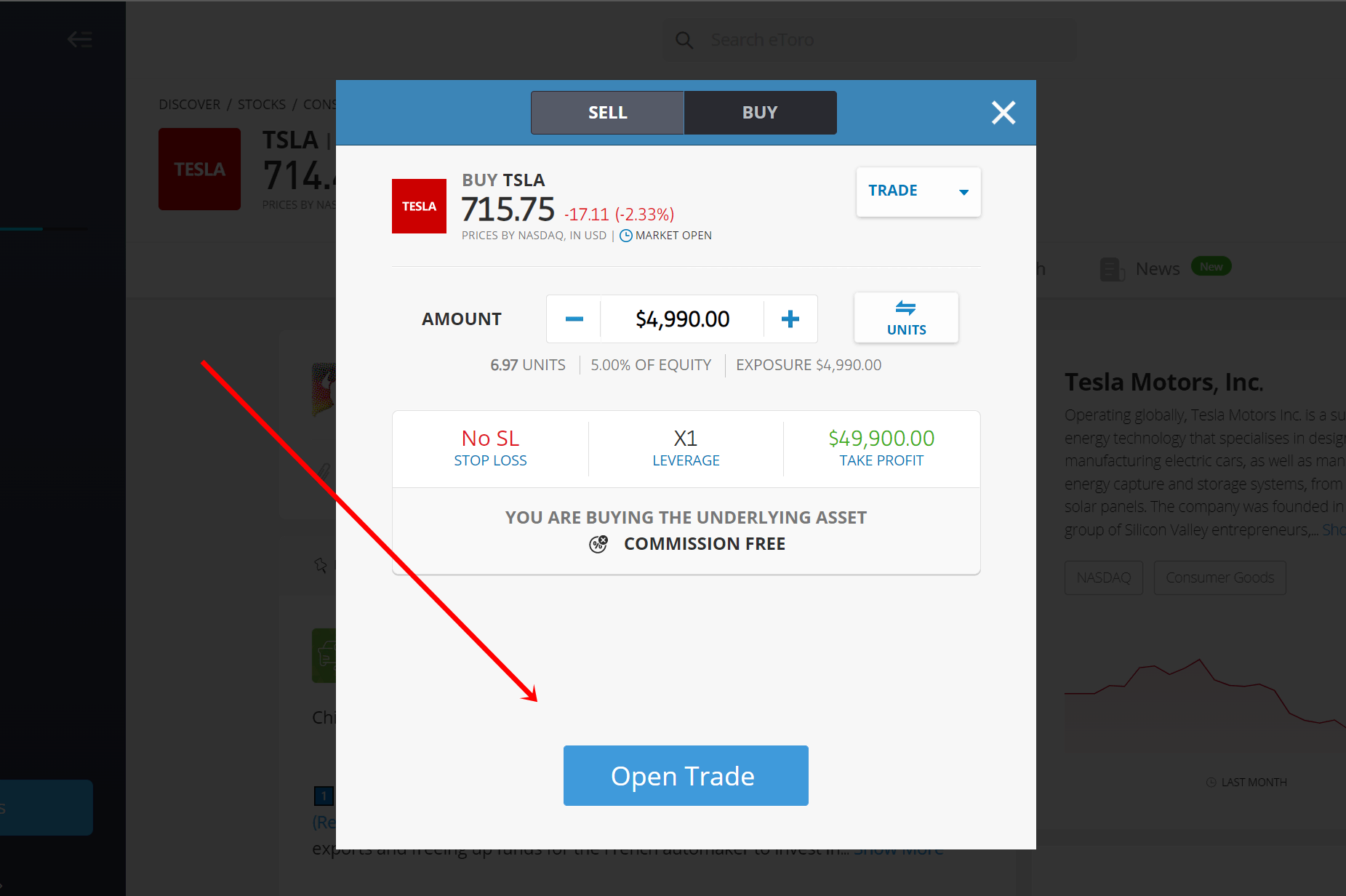

- Next, you need to locate the Trade button, which shall be present in the top right corner of the page. Then click on the same.

- This step is to select the Buy option, further which you can also click on the Open Trade button. After doing so, you can even have the opportunity to test or modify the amount and add a stop-loss limit. It offers other variables also. However, sticking to a simple trade at first is always advisable.

- Lastly, you can go to your portfolio and view the virtual shares. A similar process applies to other assets as well. The assets you buy will stay in the portfolio till you decide to sell them. Moreover, you can also track the asset’s value movement and your profit or loss details. Based on that information, you can decide to sell the stock at any time or hold it.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Features

The demo account in Etoro is simple, intuitive, and innovative. A trader can experience all the features that it offers. The foremost quality is easy management of your virtual portfolio. Etoro has a clean and simple interface that uses cookies to track your preferences.

With its demo account, you can follow the trends in real time for each instrument. You can take the help of advanced analysis tools it offers for that. Moreover, you get to experiment with various risk levels only with Etoro. You can apply leverages and add a stop-loss limit also while trading in high risk-assets.

As we mentioned before, Etoro is one of the best social trading brokers. So, you can connect with the best traders globally and copy their portfolios through the demo account. Additionally, you can try its ready-made thematic portfolios as well.

If we look into the charges, Etoro does not charge any commission for its demo account. It means you can trade freely. Moreover, it also gives a free $100,000 for practice into the account.

Expiry time of the demo account on eToro:

Since a demo account is free from most of the costs, most brokers do not give a long duration in it. However, the Etoro demo account stands apart in having unlimited validity.

Conclusion: Free and unlimited demo account is available on eToro

Etoro is among the best brokers available out there. However, it has particular expertise in social trading as well. A trader can join Etoro and begin the trades with its easy-to-use demo account. The demo account opening process is visibly simple and offers many added benefits that are too free of cost. So, we can conclude that it can be considered an ideal broker for beginners and experts in trading.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQ – The most asked questions about Etoro demo account :

How do a demo and a live trading account differ?

A demo account is a practice account that enables traders to trade in a risk-free environment. They are most suitable for beginners who need experience with trading to build their game. However, the advanced traders can also put their strategies to the test in it with virtual money given by the broker. At the same time, in a live trading account, the money is real, and the risk of losing the funds is also real.

Does Etoro offer a separate demo account?

Etoro does offer a demo account, but we cannot claim it to be

a separate account. The trader gets the option to switch between the live and demo account.

Can you convert the demo account to a live trading account with Etoro?

Many brokers require you to convert separately into a live trading account once the demo validity is over. But, Etoro offers a unique feature of switching between live and demo modes in one account itself. So, there is not any need to convert it.

How can a trader use the Etoro demo account?

A trader can use the Etoro demo account by registering with the platform. The following steps help a trader.

Click on the ‘demo account’ option offered by Etoro

Enter your details

Click on ‘submit.’

These three simple steps help traders sign on to the Etoro demo account. The demo account will be useful for any trader wishing to test this platform.

How many funds does a trader get in his Etoro demo account?

When a trader signs up for the Etoro demo account, he gets virtual funds of $100,000. Thus, these funds are adequate for any trader interested in learning how to trade. You can learn how to trade and enjoy not being intimidated by the fear of losing money. Thus, anyone who wants to learn about trading can find the perfect platform on Etoro.

Does a trader need to pay any fee to use the Etoro demo account?

No, the Etoro demo account is free for any trader wishing to test the trading platform or learn to trade. You can use the virtual funds of $100,000 without paying any charges for 30 days. After that, Etoro might charge you fees to use the demo account.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Read more about online brokers here:

Last Updated on November 14, 2023 by Andre Witzel