How much does it cost to trade with eToro? Spreads & fees explained

Table of Contents

Etoro is known as the biggest CFD trading base in the world. They can provide various types of financial aid to clients across the globe due to CFD training. So what you do is buy a contract instead of the actual asset or security.

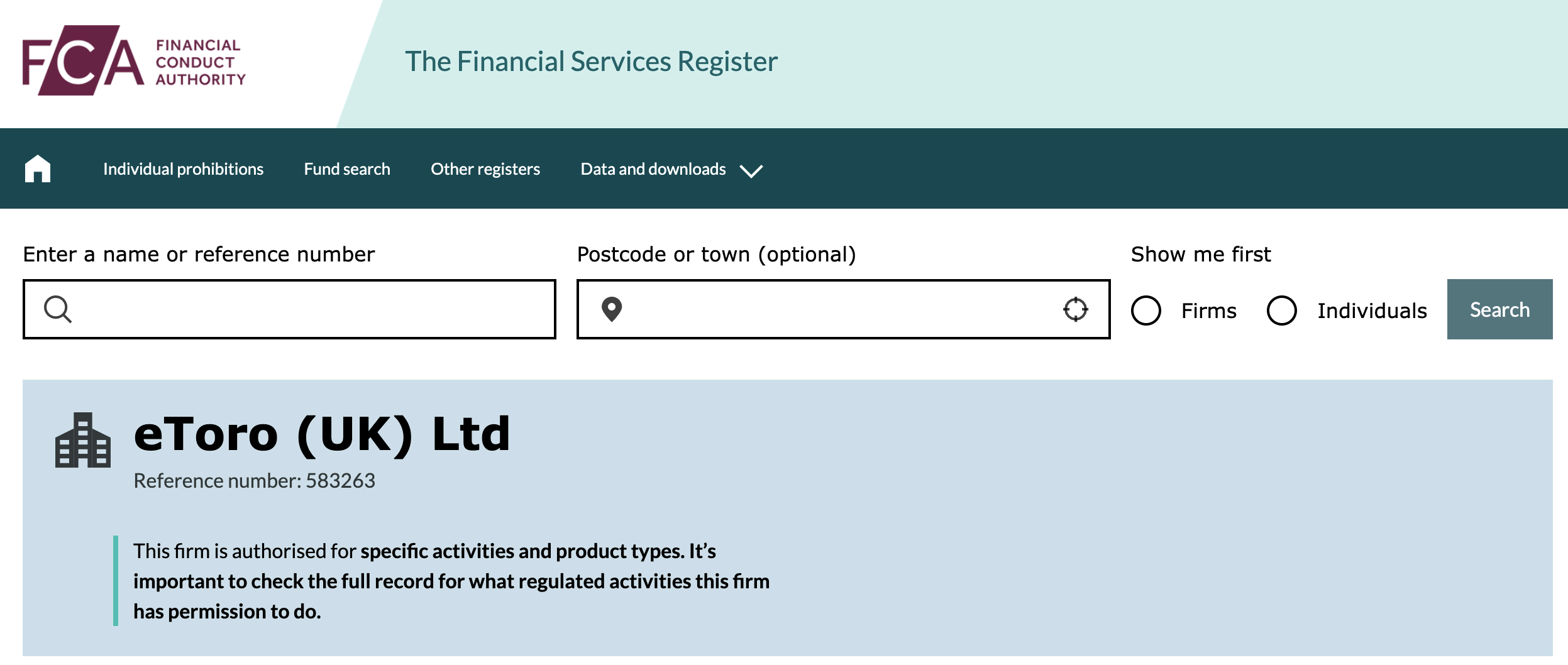

eToro is safe for usage and will not scam you, and neither has anybody been scammed. The Financial Conduct Authority (for the UK) and Australian Securities and Investment Commission (for Australians) regulate them, depending on the country you are in.

Every other client is regulated through the Cyprus Securities and Exchange(CySEC). Let us see the kinds of eToro fees that a client has to pay. Keep on reading the article below to know more about it.

All about eToro fees:

You can open an account for free with eToro! There are no management fees, and 0% of commissions are taken on stocks. You only have to pay a minimal amount of $5 as a withdrawal fee, and the FX rates are applied to all non-USD withdrawals and deposits.

By zero commission, we mean that there will be no broker fee charged to a client when they open or close the position, and it is not applied to a leveraged or short position. Capital stays at risk.

CFD trading is a method that allows an individual to invest and trade in an asset by getting in a contract with themselves and a broker instead of getting the asset directly.

The trader and broker agree to replicate the market conditions and settle down any difference among themselves when the position does close.

Short summary of the fees with eToro:

- No deposit fees

- Only a $ 5 withdrawal fee

- No commissions

- No commissions on stock trading

- Additional spread from 1.0 pips on forex, CFDs, commodities

- Swap fee for leveraged positions on CFDs

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

List of fees that occurs on trade with eToro

eToro gives zero commission on real stock trading where you buy the real stock, and you cannot use Leverage at all. eToro is a CFD broker that will let you trade stocks and even EFTS if you set Leverage to a bigger one. You have to incur some fees when trading with eToro, such as Withdrawal fees, currency conversion fees, spread fees, overnight fees, and inactivity fees.

#1 Withdrawal fees

A minimum of $5 is charged as withdrawal fees on eToro any time you withdraw your own money. Therefore, if your trading is going well, you can even withdraw a large amount of money on just a $5 withdrawal fee. However, other trading platforms do not charge this fee, so it might feel wrong to pay even if it is just $5.

How much money can you withdraw at the minimum?

There is usually a minimum amount to the money you can withdraw, which is $30. You should withdraw at least $30. However, nobody would withdraw such a small amount. The fees you incur would take up all the money you’re trying to get. You must remember that there would be a fee for currency conversion.

Let us see what currency conversion fees mean. Keep on reading to know more.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

#2 Currency conversion fees

eToro is a trading platform that trades only with dollars and no other currency. Therefore, if you wish to deposit money from any other kind of currency, you will have to pay currency conversion fees.

The conversion fee is denoted in pips, and the amount would depend on the currency. For example, if you wish to trade some money on eToro and the money you deposit is at a 1.33 GBP/USD conversion rate, then for every 1 pound, you will get 1.32 dollars.

If you didn’t have to pay a currency conversion fee and, say, convert 1000 pounds, then you would get about $1330.

The charges for conversion for GBP/USD are 50 pips which means 0.0050 or 0.5% on eToro. One pip is usually 0.0001 for GBP/USD or EUR/USD. So take the conversion rate and then subtract 50 pips from it.

1.33 – 0.0050 = 1.3250

This shows that you will have $1325 after a fee of $5 is charged.

What does the conversion fee depend upon?

The conversion fee will depend on the mode of payment you use to pay the money since eToro has different fees for conversion according to the method of payment you use. Therefore, most traders use wire transfer as it is the cheapest payment method as they save extra costs through it.

Instrument: | Fee: |

|---|---|

AUD USD | Pips 50 |

EUR USD | Pips 50 |

RUB USD | Pips 50 |

GBP USD | Pips 50 |

This is the conversion fee charged for a wire transfer for various currencies.

Instrument: | Fee: |

|---|---|

EUR USD | Pips 250 |

GBP USD | Pips 50 |

AUD USD | Pips 100 |

MYR USD | Pips 100 |

This is the conversion fee through other payment methods. Therefore, if you wish to transfer through the wire, choose the “deposit funds” button on the eToro menu and select the wire transfer option.

Now select the currency that you want the money converted into. The money transfer takes 4 to 7 business days to show on your account.

Also, you must have observed that it is better to wait for a few days to let the trade get cheap so that you can wire transfer. You incur these fees even when you withdraw money.

However, if you are copy trading, you do not need to worry about any fees as you will copy the portfolio of the trader who is trading for you. Choose traders for your portfolio that show a lower risk rating to control the financial risk you may have to incur.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

#3 Spread fees

Spread fees are charged when you purchase a stock or any other kind of asset on eToro. However, the spread fee is included in the buying price on eToro.

The spread fee depends on the asset that you want to trade. Commodities and even currencies are calculated in pips and stocks, and some other forms of assets are calculated in percentages.

For example, if you wish to buy Apple stock, the spread fee is 0.09%.

Let’s assume that you need $191.77 for 1 apple stock. And when you have to sell, it must be sold at $191.41. Therefore, the real price lies between both the prices, such as 191.60. Therefore, if you buy a single share of apple, you will have to pay $0.17 as spread fees on eToro.

#4 Overnight fees

As other trading platforms charge overnight fees, eToro charges the overnight fees. It is a small fee for the platform to lend you money and hold an asset over you. This guarantees that you will pay them back.

The fees depend on the trade you are doing. If you are trading for stocks and don’t leverage them, you don’t have to pay overnight fees.

However, if you leverage your stocks, it shows that eToro has lent you the money, and they are getting an interest over it.

For example, if you invest $1000 in US stock then, 1 month USD LIBOR (London InterBank Offered Rate) is equal to 1.55%

Libor is the interest rate at which the bank has to borrow money from one other internationally. This rate shows the bank how much it would cost to borrow money. It keeps fluctuating, so you need to keep a check on it.

Therefore, BUY position’s Daily fee = (6.4% + 1.55%) /365* 1000 = $0.22

SELL position’s daily fee = (2.9% + 1.55%)/365*1000 = $0.12

Therefore, the overnight fees are 22 cents for every day on BUY and 12 cents for SELL.

Overnight fees are only applied to the amount that is borrowed. So, if you put $1000 and leverage it three times, you have $3000. The fee will be applied to the $2000 you borrowed. The overnight fees show at the bottom of the page so the traders can see the cost for every day.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

#5 Inactivity fees

eToro will charge a monthly inactivity fee of about $10 per month if you do not log into the account for 12 months. It will keep subtracting until you log in again or run out of money balance. So remember to log in in a timely manner.

Inactivity fees are also known as Dormancy fees and are no longer allowed in the US under the Credit Card Act of 2009. It is the monthly charge incurred by your account if there is no activity on the page.

eToro minimum deposit and maximum limit

$200 is the minimum first-time deposit for most of the country. Except, USA & Australia need $50, and Israel needs $10,000.

The minimum amount will depend on the method of payment you use to deposit money. So if you transfer through the wire, the minimum should be $500, and the rest is the same. And you need to give an additional $50 for the first deposit.

You also need to complete the verification process of eToro; the maximum deposit you can pay is $2250. The maximum limit for depositing money is $10,000 every day.

#6 eToro platform fees

eToro is not a cheap platform for CFD training. However, they did reduce the fee structure in 2019. It is easy to use, and they have a lot of choices to trade from, like commodities stocks. You can trade for anything and everything through this platform.

The advantageous thing about eToro is that they extend a service known as copy trading. It provides you with all types of tools or charts that analyze traders and their risk levels. If you know a little about trading, then you can earn commissions from people by helping them copy your portfolio.

If you use eToro as your CFD trader, you could have done all kinds of investing from a single page. eToro is a multi-asserted who can invest in stocks and ETF assets and trading CFDs.

What should I be careful about?

- However, you should consider that CFD is a complex instrument, and you could risk losing a high amount of money due to Leverage. 67% of retail investors could lose money if making a trade with this provider.

- Past performance should not be taken as a future result. Trading history has to be less than 5 complete years, and they may not be a sufficient basis for the investment decision.

- Copy trading is a service given by eToro, a portfolio management service authorized and regulated by the Cyprus Securities and Exchange Commission.

eToro USA LLC does not give out CFDs and does not assume any liability, or eToro USA LLC does not give out CFDs and does not assume any liability at all, which could be the completeness of the content which must have been prepared by the partner who utilizes publicly available nonentity specific info about eToro.

Bottom line: Low trading fees on eToro

eToro is not that cheap if you compare it with other platforms, although they did conduct a decrease in their fee structure in late 2019, even if you know about social trading.

You can use eToro easily as it is super easy to understand and use. Moreover, you can choose many things for trading, such as commodities, stocks, and assets. You can check the portfolio for yourself.

eToro is considered one of the largest CFD trading platforms in the world. They provide services regarding finance for clients across the world due to trading. You don’t buy the asset or commodity, but you buy its contract. The asset is guarded by eToro.

eToro is safe to use, and you will not be scammed by it. They are also conducted by FCA (financial conduct Authority) in the UK, by the Australian Securities and Investment.

You can also join the eToro site free of cost, and the registered user would get a $100,000 demo account for free. However, they do have charges such as currency exchange fees, conversion fees, etc.

eToro is a safe option to use when it comes to trading CFDs or assets, but you do need to be assured and know to cover yourself from potential risks.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQ – The most asked questions about Etoro fees :

Is eToro free of cost?

Yes, you can be a part of eToro free of cost, and whatever registered user will receive $100,000 for free. But eToro does have charges and spreads such as withdrawal fee, currency conversion fee, etc.

What do you mean by the bid/ask rate?

Bid and Ask rates are similar to BUY/SELL prices on the eToro. The ASK rate will be applied when there is a long position (BUY). However, if the position is short (SELL), the bid rate will be applied.

What do you mean by the overnight and weekend fees?

CFD positions that are open overnight have to incur a small charge concerning the position’s value. It is an interest payment that covers the Leverage cost that you would use overnight.

Weekend fees are overnight fees. This is charged to keep the positions open throughout the weekend. A weekend fee is 3 times the overnight fee, and it is charged on a Wednesday or Friday as per the asset.

What do you mean by leverage?

Leverage stands for a temporary loan given to a trader by a broker, enabling the trader to open a trade of their own; it could be large with a small amount of capital. It is presented as a multiplier which shows how much the money invested would be worth.

What is LIBOR?

LIBOR is a commonly used rate given to other banks by banks themselves for short-term loans. LIBOR stands for London InterBank Offered Rate. A total of 35 different LIBOR rates were posted overnight for 12 months.

How are fees calculated?

Spread: Spread* Price in USD* No. of Units

Overnight fees/night: Fee*amount of units, therefore, the spread is calculated by multiplying the spread with the price and the no. of units. Overnight fees are calculated by the fees multiplied by the no. of units.

Can daily rollover fees change?

Rollover fees usually change from time to time, based on the global market situation. Even when this happens, the changes can be implemented easily. However, you should know that a fee change can always apply to open positions. We encourage up-to-date with the current rollover fees or refunds by checking the fees page.

When should I pay the overnight fee?

Overnight fees are charged every night from Monday to Friday at 17:00 EST for open CFD positions. The weekend fee is also charged on Friday for most stick ETFs. On Wednesday, most commodities and currencies are charged. An overnight fee on Friday is charged for oil and natural gas. An overnight fee for CFDs is charged daily.

How can I avoid Etoro fees?

The best way to deal with Etoro fees is through online banking or wire transfer. Most traders opt for these ideas to avoid extra Etoro fees. To make a wire transfer, follow these steps:

Go to the Etoro dashboard and select the ‘Deposit Funds’ button.

From there, choose wire transfer in the dropdown.

When selecting the currency, be careful as you select the currency your money is in.

Is there any withdrawal charge in Etoro fees?

Yes, you have to pay withdrawal charges in Etoro fees. You have to pay a minimum of $5 any time you withdraw your money. If you earn a good amount on Etoro, you can withdraw a large sum from there for just a $5 withdrawal fee. Make an account today on Etoro and get access to many benefits.

Do Etoro fees contain overnight fees?

Yes, you have to pay an overnight fee as it is under the list of Etoro fees. The overnight charge is for open CFD positions on Monday to Friday at 17:00 EST. However, there are weekend fees on Friday for most stick ETFs. Most currencies and commodities are charged on Wednesday. There is a daily overnight fee for CFD Trading.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

See more articles about online brokers here:

Last Updated on November 14, 2023 by Andre Witzel