Forex broker versus trader – What is the difference?

Table of Contents

The foreign exchange market is made up of different players that come together to buy and sell currencies at an agreed price. The trader and the broker are an inseparable pair that also participate in the day-to-day activities of this market. They are among the minor players, and one can not do without the other in the forex market.

So, what’s the difference between the forex broker and the trader?

A forex trader is anyone who buys and sells currency pairs in the forex market. While a broker is a person or a company that connects the traders to the market. The trader can not access the forex market without a broker, and the broker would be irrelevant without the trader. So both need each other if they wish to participate in this financial market. There are different types of brokers and traders in this industry, and we will introduce them, their roles, and how they operate to you. Let’s start with the brokers.

The role of the broker

A forex broker or brokerage firm serves as a bridge that links traders to the market. As a forex trader, you can not enter the market directly. You need a brokerage account, which can only be obtained through a forex broker or brokerage company.

When you place an order, it is the broker that executes it. They do so by sending the order to a Liquidity Provider for an opposite trade to complete the transaction. A BUY order requires a corresponding SELL for it to be filled. It is your broker that searches for this trade. This is done by contacting liquidity providers, who could be other larger brokers, hedge funds, or investment banks.

If the broker is a market maker, most time, they have to provide liquidity for your trade by taking the opposite side. For this reason, most traders are wary of market makers, preferring ECN and STPs instead. However, liquidity is often assured with these ones.

Below, we will explain these three (3) types of brokers.

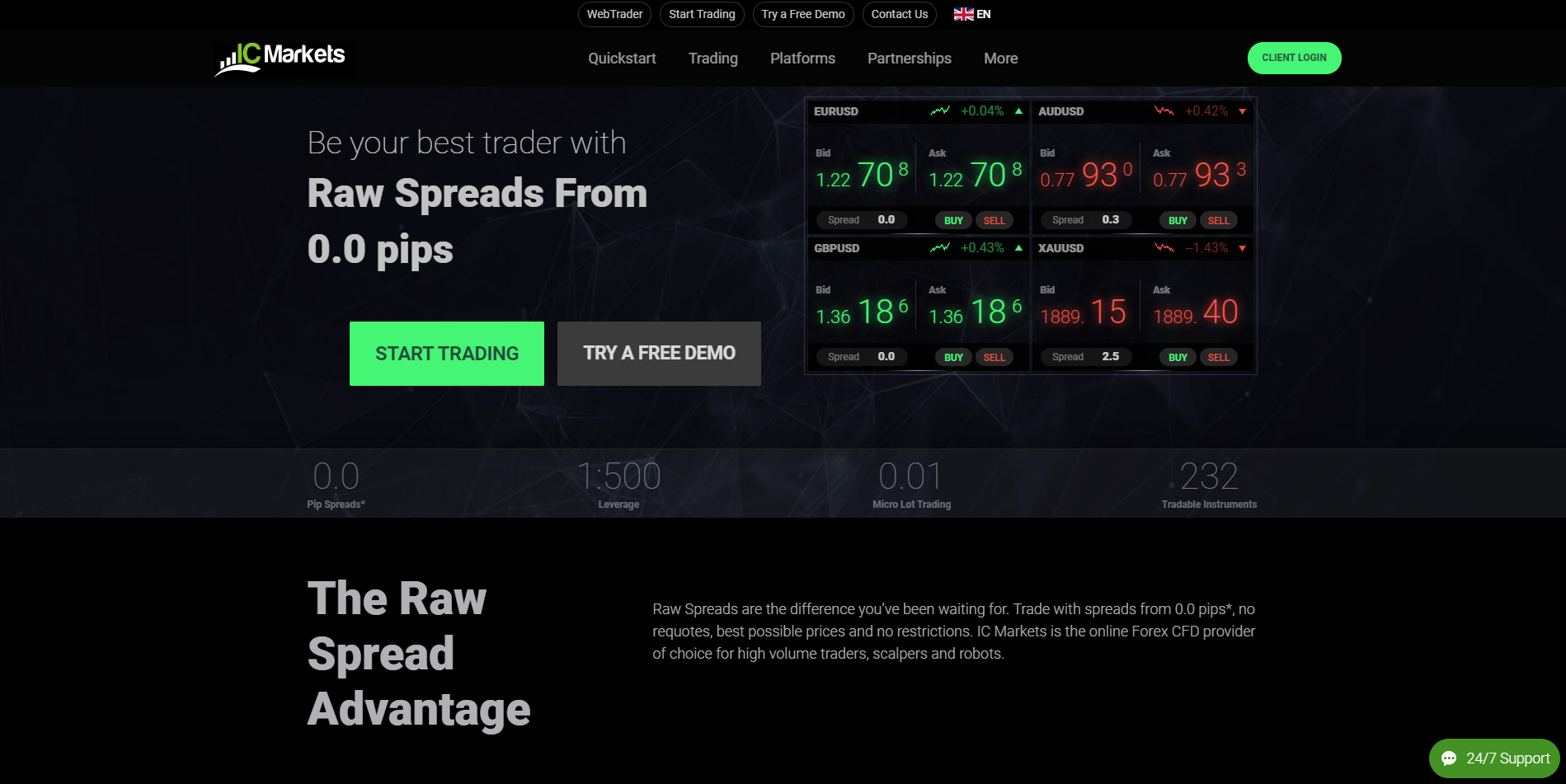

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Types of brokers

Brokers fall any of these two(2) categories;

- Dealing desk

- Non-dealing desk.

1. Dealing desk broker

They are also called market makers. These brokers provide liquidity by creating a market for their traders. It means they ensure that there is an opposite position for their clients’ trade. Most times, this means taking the opposite side and becoming a counterparty to that trade. For instance, if you enter a SELL position, they enter the BUY. Naturally, this presents a conflict of interest, as one side is hoping the other would lose. Some traders avoid dealing desk brokers because of this. But they are very reliable when it comes to ensuring that your order is filled.

2. Non-dealing desk brokers

This category consists of two types of brokers;

I. ECN

II. STP

ECN broker

ECN means Electronic Communications Network. These types of brokers provide liquidity by creating an electronic platform where different market participants can trade forex with each other. The ECN platform usually consists of other forex traders, such as hedge funds, investment banks, institutional traders, and individuals. The trader’s order is placed in this pool with all these participants. Once it is matched with the best price and the transaction has been completed, the broker takes their commission.

STP broker

STP is an abbreviation for Straight-Through-Processing. These brokers are similar to the ECN ones in that they never take the opposite side of the trader’s position. When you place a trade with this type of broker, they send your order to different larger liquidity providers, intending to match it with the best price in the market. These are intermediaries between the trader and the liquidity providers.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

How do brokers make money?

There are different sources of revenue for the broker. They include:

1. Spreads

The spread is the difference between the BUY and the SELL price in your quote. It represents the broker’s fee for that trade and is the most common source of profit for brokers. It may be a fixed sum of pip, or it may vary according to market conditions.

It all depends on the broker’s style of business.

2. Commissions from trade

Some brokers charge commission for every trade executed. The ECN brokers always charge this fee for their services. Most brokers who charge commissions have very low spreads. And in some cases, you may find that the spreads with a particular broker are equivalent to the spreads plus commission with another.

3. Other fees

Brokers may assign fees to some of their services, such as withdrawal fees, inactivity fees, and overnight fees. The inactivity fees may accrue if the trader does not use their account for a specified period. While the overnight charges are paid by traders who leave their positions open longer than 1-business day. Not all brokers charge the inactivity fees, but overnight/swap seems to require funds to run it. There are no fixed charges. The amount charged usually depends on the broker.

4. Sale of trading tools

Most tools are free and come as extras once you register with the broker. But some special or advanced ones might be sold to traders. Some brokers also sell trading courses and earn extra money from this.

Next, let’s talk about the traders. They are divided into two categories in the forex market, and below we give a brief introduction of each of them.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Types of traders

1. Retail traders

Retail forex traders are individuals that trade the market with funds from their personal income. They do not do this on behalf of anyone or organizations. They trade for themselves, and most do it on a part-time basis. These traders make up only a tiny fraction of the market. They can not deal directly because their capital is minimal. So they have to go through brokers who create a suitable trading environment for them and ensure they get liquidity for their trade. Retail traders are individuals like you and me. They are divided into different types according to their trading styles. These include:

Scalpers

Day traders

Swing traders

Positional traders.

2. Institutional traders

These types of traders are part of the big players in the market. They trade with large amounts of capital, and they do it directly. Institutional traders do not need brokers to enter the market. They have direct access because of the large sum of capital that they handle. Some of them trade their monies, others on behalf of big clients, but most of them do both. Because of the huge cash they handle, they’re more risk-conscious than the average trader. Their emphasis is on risk management and diversification of portfolios. So apart from forex pairs, they tend to trade many other assets in the financial market. Institutional traders include the following:

- Mutual funds

- Investment banks

- Hedge funds

- Investment companies

- Some commercial corporations

- High net-worth individuals may also fall under this category because they’re able to trade directly with the above-mentioned big guys in the market.

- You may think some institutional traders seem like brokers since they also trade for clients. However, they are very different, and we’ll explain how.

What is the difference between a broker and an institutional trader?

The institutional trader handling a client’s accounts would trade currency pairs according to the wishes of his boss in an investment firm. This trader has no contact with the client in question.

The investment manager assigns different clients’ accounts to this trader and instructs them to devise suitable strategies to grow the funds. These accounts usually contain large sums. Institutional traders don’t work with chump change.

Such traders may decide to do forex or any other assets. Most of them trade several markets simultaneously and usually use a long-term approach, leaving positions open for a while. They focus on fundamental analysis and are highly risk-conscious.

A forex broker, on the other hand, works directly with his or her clients, the retail traders. These clients choose their trading strategy, though the broker may offer advice. They can decide on short or long-term trading.

Both market participants are also different in the way they make a profit. We already explained the broker’s source of revenue.

Institutional traders’ source of income

Institutional traders trade the forex market for themselves and make a profit from there. They also make their money by charging investors a small percentage of the funds they handle. Additionally, some of them may charge sales commission and other fees, depending on the size of the investment.

Similarities between the trader and the broker

We should mention though, that these types of traders are trained professionals like qualified brokers. They had to study, take exams and obtain certifications. And in most countries, you must have a license as a professional trader before you can work as one.

Anyone can trade the forex market with the help of a broker. You can choose to get trained and certified. And with the right amount of capital or company, you can trade like a professional.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex broker versus trader :

Are brokers the same as traders?

While both the traders and brokers are known to deal with securities, the brokers also act as the sales agents who either act on their own behalf or for the securities/brokerage firm. They are known to be responsible for both obtaining and maintaining the roaster of regular individual customers or retail customers, or institutional customers.

Can a forex broker become a forex trader?

With proper experience and a good track record, one can definitely progress to become a trader, fund manager, or relationship manager. One can even become a partner or simply set up one’s own business.

Why are forex brokers needed by forex traders?

Unlike the middle or back office, brokers can generate revenue. At the same time, they connect the buyers and sellers and earn a commission on every successful transaction through them. The more trades the trader trades through the broker, the higher the amount of money the broker will be making. Also, the more the broker’s services are taken by the increased number of traders, the more money is earnt by the broker.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)