Forex broker vs bank – Which one is better for trading?

Table of Contents

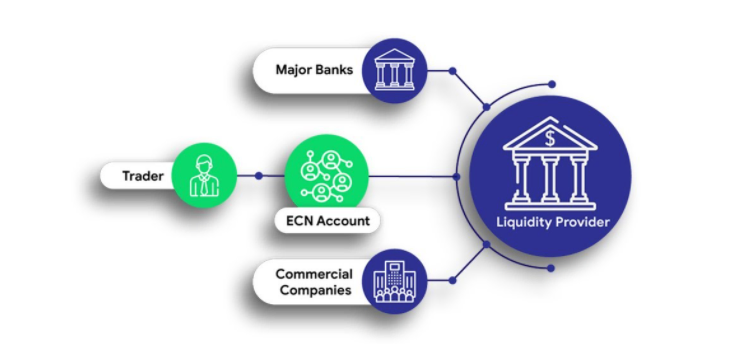

The forex market is the largest financial market with over $6billion in liquidity volume everyday. No other market comes close by half in terms of liquidity and activity.These activities involve the exchange of currencies between agreeable buyers and sellers. The banks, both Central and commercial, are key participants as it has to do with currencies. They drive most of the activities in this financial market. Other major participants include hedge funds, investors, corporations, and individuals, such as you and me.While, for the retail forex trader, the goal of trading is to make a profit, this is not the case for the big players in the market. Investors, banks, large corporations mostly carry out forex transactions to do business with other corporations abroad. For instance, when multinational companies buy goods and services from another country. Forex transactions will occur to complete the purchase.

Though, apart from this, the banks also trade forex for a profit like you and me. They may do this on their clients’ behalf (same as a broker does) or for themselves.Some commercial banks have forex trading accounts designed for this purpose. Customers who wish to trade through them open these accounts, and the bank act as the currency dealer, executing the client’s order and providing liquidity; the same thing the brokers do.Some people trade through their commercial banks instead of a broker. The banks profit from these clients through the spreads. That’s the difference between the BUY and SELL price.It may seem more practical to trade directly with a bank than with a broker, but don’t be too quick to decide. Both media have their merits and demerits, and in this article, we will examine both sides.

Advantages of trading forex through a bank

1. Eliminate the fear of fraud

If you choose to trade forex with a bank, you do not need to worry about getting scammed. As we all know, banks operate under government laws and are highly regulated. Therefore, you would be 100% sure that the company is genuine and your funds are safe. There is no chance of dealing with a scam broker. You would also be relatively safe from broker’s fraud, such as churning, stop hunting, etc.

2. Easy withdrawals and deposits

Naturally, apart from your trading account, you would have a savings account with the bank. So transfers will be easy and take much less time than dealing with a broker. Even if you don’t have an ordinary account with the bank, it is much easier to move funds between banks than two different payment platforms. Trading with a broker sometimes means waiting for a whole day for your withdrawals to drop. Or having to fulfill some stressful obligations before accessing your funds. These problems are non-existent with banks, as long as you’re their customer.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Disadvantages of trading forex through your bank

1. Large minimum deposits required

Many brokers try to be competitive and make it easy for customers to sign up with them. One of the ways they do this is by stipulating low initial minimum deposits for live trading. For as low as $10, anyone can start trading forex with some brokers. This is not the case with banks. Most of them require thousands of dollars to run a forex account. In most cases, forex traders also have to leave a considerable amount of money in their accounts while not trading.

2. Little or no leverage

Some banks that trade forex for clients may not offer leverage as high as a broker might or at all. And in some cases, when they do, the conditions for this are harsh compared to the broker. People who trade with brokers enjoy leverage as high as 1:2000. It offers an ample opportunity to increase your profits if you’re an experienced trader.

3. Bonuses and rebate offerings are rare

The bank rarely runs forex promotions where they offer rebates or bonuses to clients. Brokers do this quite often to stay competitive. Banks have no need for it as this is not a key part of their business but only a tiny fraction. Retail forex trading on behalf of clients is of little consequence to them. Therefore, no need for promotions.

This brings us to the main question:

Between forex broker and the bank, which one is better for trading?

Though brokers have their bad parts and the system is not perfect, it is better to deal with them as a retail forex trader. Unlike banks, brokers exist to help individual traders access the forex market. This is their sole focus, so they’ll render complete services to you with added benefits. With regulated brokers, you can enjoy the benefits of safety and trust that the bank offers.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Here are the reasons why you should trade Forex with a regulated broker:

1. Access to leverage

Leverage allows you to place larger trades with little funds. For instance, a $500 deposit becomes $50000 with a 1:100 leverage. If you enter a winning trade with this sum, instead of your $500, your profit is increased by a hundred-fold. And you get to keep all of it. Trading with a broker gives you access to this opportunity.

2. Ease of entry to the market

A beginner can start trading forex with a very low minimum deposit. As we mentioned, some brokers accept as low as $10 to begin. It makes it easy for anyone to test the opportunities in this financial market.

3. Round-the-clock support services

Many brokers out there provide multiple language support services that are available 24-7. If you have any issues while trading, support would always be reachable. This is not the case with most banks whose customer service is only available during business hours.

4. Regulated brokers are safe

With a regulated broker, you can enjoy the safety and trust which you experience with a bank. Regulations protect you from fraud and broker malpractice. Additionally, you get to enjoy insurance and compensation schemes in some cases.

5. Access to bonuses and rebates

Brokers usually conduct promotions to attract new customers and or reward loyal ones. So you may receive some financial bonuses and discounts while trading with a broker. This seldom occurs with banks.

6. Free practice account

A broker allows you to test their trading platforms and all their features if you want. They offer free demo accounts for this purpose. If you’re new to the trade, you would have the opportunity to get familiar with the forex trading environment before you begin.

To enjoy all these benefits, you would have to register with a well-regulated broker. Below, we outline what to look out for when choosing one.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Features of a good broker

1. Reputable license

A good broker operates under the regulation of one or more esteemed financial organizations and would have the license displayed on their website. This is the first thing to look out for when choosing a broker for your forex business. It is also safe to check that the broker is authorized in your home country as well.

Examples of these financial organizations are:

- Financial Conduct Authority FCA, UK.

- Cyprus Securities and Exchange Commission CySEC.

- Financial Service Commission Authority FSCA, South Africa.

- Securities and Exchange Commission SEC, United States.

- Australia Securities and Investment Commission ASIC.

- Etc.

2. Outstanding support services

Customer service is a key function in forex brokerage services. Knowing that support isn’t far away gives you peace of mind while trading. Therefore, you should seek out a broker that offers always-available and ready-to-help support services.

3. Competitive fees

Spreads, commissions, and other fees vary among brokers. The cost of trading with some brokers is comparably high. The good brokers ensure that their fees are competitive, either among the market average or below.

4. Easy access to funds

One of the chief features of a good broker is that they make it easy for traders to fund their accounts, and especially, withdraw their money from the trading platform. They generally provide multiple transfer methods, so that traders have different options to choose from. Withdrawing funds is not tedious and does not require fulfilling too many useless conditions. It’s essential that you specifically ask questions about this before signing up with a broker.

Basically, all these should be part of your checklist when searching for a broker.

If you’re able to find a good and regulated one, they are better and easier to deal with when it comes to retail forex trading. However, this also depends on your objectives. For some individuals who do small-time international trading, the bank might be a better option, since they’re not into forex for the profit. The banks do offer lower spreads in most cases and make it easy to move funds around. If your sole aim is to earn, then trading with a broker will provide more benefits and a more comfortable environment for you.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex Broker vs Bank :

Do the banks offer forex?

Foreign exchange can be easily purchased from any of the banks that are authorized for dealing within the foreign exchange or act as full-fledged moneychangers. In case the rupee or the equivalent exceeds INR 50,000, the complete payment is to be made through the crossed cheque/banker’s cheque or the pay order/demand draft only.

Do banks trade in forex every day? What are the risks involved in forex trading?

The banks, hedge funds, commercial companies, central banks, and individual speculators participate in forex every day for hedging and speculative purposes.

Some of the risks involved in forex trading that are faced by them all are leverage risks, interest rate risks, transaction risks, country risks, and counterparty risks.

Which strategy can be the most profitable one within forex?

Unlike day trading, position trading would need you to continue holding on to the position for weeks or sometimes even years. It is one of the best forex strategies as the traders do not have to deal with any kind of short-term price changes. Especially for the traders who are quite patient, well, this strategy might be the best one for you.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)