FxPro review and test – Is it a trusted broker or not?

Table of Contents

REVIEW: | REGULATION: | ASSETS: | MINIMUM SPREAD: | MINIMUM DEPOSIT: |

|---|---|---|---|---|

(4.9 / 5) (4.9 / 5) | FCA, CySEC, FSCA, SCB | Seven classes, 1,400 markets | Variable 0.0 Pips | $ 100 |

Should you choose FxPro as your broker? What makes FxPro one of the trusted and best Forex Brokers in the trading industry? In this review, we will break down the qualities of FxPro that make it one of the largest and most trusted brokers in the industry. Furthermore, we will tackle its tools, platforms, and trading conditions. Together, we will find out if FxPro is a legit broker, or is it a scam, and why it is maybe the best broker.

(Risk warning: 72.87% of CFD accounts lose money)

What is FxPro? – The company presented

FxPro is a global and award-winning broker that offers CFDs on six asset classes: Forex, Shares, Spot Indices, Futures, Spot Metals, and Spot Energies. It was founded in 2006 that aims to reshape online trading. It is the first broker to sponsor an F1 team in the year 2008 and has expanded exponentially since 2012. FxPro is voted as ‘Best Broker’ from the year 2015 to 2017 by the Financial Times. Ever since the establishment was in operation, it has successfully expanded to serve both retail and institutional clients in more than 170 countries worldwide and is still keep on growing up to today.

FxPro is the world’s number one forex broker, according to more than 60 international and UK awards.

FxPro provides its clients access to top-tier liquidity and advanced trade execution with no dealing desk intervention. The company has a capital of €100.000.000 (actual Tier 1) and has won over 60 international awards. It has 1,300,000 client accounts, seven global sponsorships, four trading platforms, six asset classes, more than 7000 orders executed per second, over 11.06 ms average execution time, and is successfully operating in the trading industry for over 15 years.

The brand is a popular, trustworthy, reliable, and large broker.

Important facts about FxPro:

⭐ Rating: | 4.9 / 5 |

🏛 Founded: | 2006 |

💻 Trading platforms: | FxPro Trading Platform, cTrader, MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $100 |

💱 Account Currencies: | EUR, USD, GBP, AUD, CHF, JPY, PLN |

💸 Withdrawal limit: | None |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | No |

📊 Assets: | Forex, Futures, Indices, Shares, Metals, Energy, Cryptocurrencies |

💳 Payment methods: | Bank transfer, broker transfer, Visa, Mastercard, Maestro, Skrill, Neteller |

🧮 Fees: | Depending on the account type, variable overnight fees |

📞 Support: | 25 / 5 support via phone or e-mail |

🌎 Languages: | 29 languages |

(Risk warning: 72.87% of CFD accounts lose money)

Is FxPro regulated? – Regulation and safety for customers

FxPro has established the highest standards of safety for its clients’ funds. The company is regulated by 4industry regulations. The brand promotes a strong proponent of transparency to its clients, and client funds are kept in major international banks and are fully segregated from the company’s own funds.

FxPro UK Limited is authorized and regulated by the FCA since 2010. FxPro Financial Services Limited is authorized and regulated by CySEC since 2007 and by the FSCA since 2015. FxPro Financial Service Limited is regulated by the FSCA. FxPro Global Markets Limited is authorized and regulated by the SCB.

Regulation is very important in order for the trader to determine if the broker is legit. Each broker needs to pass certain criteria in order to attain a license. As a trader, you need to make sure that the broker is regulated for the safety of your investments. With FxPro, you can definitely say that it is a trusted and reliable broker since it has several regulations and it shows transparency to its clients.

FxPro is regulated by the following:

- Financial Conduct Authority in the United Kingdom (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority in South Africa (FSCA)

- Securities Commission of The Bahamas (SCB)

Financial security for customer funds

As mentioned above, as FxPro promotes a strong proponent of transparency to their clients, the client funds are kept in major international banks and are fully segregated from the company’s own funds. This ensures that client funds cannot be used for any other purpose. The company takes the safety of its client’s funds very seriously.

Also, FxPro has participated in the Financial Services Compensation Scheme (FSCS), which allows clients to claim compensation in the event that FxPro were to become insolvent. Clients are being offered as well by FxPro negative balance protection, which is under the new EU guidelines that prevent clients from losing more money than they have already deposited. In addition, FxPro Financial Services Limited is a member of the Investor Compensation Fund (ICF). The FSCS insures customer deposits up to £85,000 per client, and the ICF ensures customer deposits up to €20,000 per client.

Summary of the regulation and financial security:

- Multi-regulated online broker

- Offers Financial Service Compensation Scheme (FSCS) up to £85,000 per client

- Investor Compensation Fund (ICF) up to €20,000 per client

- Segregated Customer Funds

- Offers FxPro Negative Balance Protection

- 2-step verification

FxPro has several regulations, and it shows transparency to its clients.

What are the pros and cons of FxPro?

FxPro is one of the largest brokers in the world, with more than 60 international awards. They claim to be the number one broker in the world, with more than 600 million orders executed. Like any other company, the platform has its advantages and disadvantages, and in this section, we will go over all of them.

Pros of FxPro | Cons of FxPro |

✔ Trades are executed impressively fast at less than 13ms on average | ✘ Not all trading tactics are allowed |

✔ Very low slippage, 86% of the orders were executed at the requested price in 2022 | ✘ Relatively high margins |

✔ Impressive variety of supported languages | |

✔ A lot of tools and assets are available | |

✔ Award-winning customer support with a fast response time | |

✔ High commitment to transparency, reliability, and innovation | |

✔ Easy to navigate, also suitable for trading beginners |

Is FxPro user-friendly?

In this section, we will take a closer look at how user-friendly the platform is, compared to other brokers.

Criteria | Rating |

General Website Design and Setup | ★★★★★ The site is one of the most intuitive and easy-to-use platforms we have seen so far |

Sign-up Process | ★★★★ Sign-up process for an account is extremely easy and quick. However, the creation of a demo account is a bit tricky |

Usability of trading area | ★★★★ Good selection of trading platforms available for all preferences |

Usability of mobile app | ★★★★★ Website is optimized for mobile users, and a dedicated mobile app is available |

(Risk warning: 72.87% of CFD accounts lose money)

FxPro trading offers: Review of the trading conditions

The investment services of FxPro offer to trade CFDs on six asset classes: Forex, Shares, Cryptocurrencies, Futures, Spot Metals, and Spot Energies. FxPro is a global and award-winning broker with over 60 international and UK awards. FxPro is voted as ‘Best Broker’ from the year 2015-2017 by the Financial Times. Since that, the establishment was in operation, it had successfully expanded to serve both retail and institutional clients in more than 170 countries worldwide and is still growing and expanding today. FxPro provides its clients access to top-tier liquidity and advanced trade execution with no dealing desk intervention.

It has gathered 32 awards for being the best Forex Broker, 16 awards for being the best Forex provider, 13 awards for best Forex tools/service, and seven awards for best Forex platform. We can definitely say that this broker is a trustworthy and excellent broker.

The company has a capital of €100.000.000 (actual Tier 1), 1,300,000 client registered accounts, seven global sponsorships, four trading platforms, seven asset classes, more than 7000 orders executed per second, over 11.06 ms average execution time, and is successfully operating on the trading industry for over 15 years. It is one of the largest Forex Brokers in the trading industry, and the company offers powerful yet easy-to-use trading platforms both web and mobile. The platforms of FxPro are not only user-friendly but also offer fast execution.

The company has shown its excellence throughout the years and has been named as the best forex provider according to over 60 international and UK awards that it has gathered.

The company offers traders more than 250 instruments to trade and was awarded as ‘Most Trusted Brand, UK’ by the Global Brands Magazine and has about 370,000,000 orders executed so far. It has excellent tools and excellent customer support and services.

It offers competitive floating spreads on all of the platforms, and maximum leverage is up to 1:500 (CySEC 1:30, FCA 1:30, SCB 1:200, professional clients 1:500). On MT4/MT5 accounts, traders are only charged the spread on any instrument, and there is no commission. On cTrader accounts, the spreads are much lower (from 0 on major FX pairs), but there is a commission charge for each trade ($45 per $ 1 million USD traded ). Also, FxPro offers an MT4 Fixed Spread account which has fixed spreads on the seven major FX pairs.

FxPro has a disclaimer about investing, especially trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. About 77% of retail investor accounts lose money when trading CFDs with this provider. Traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing money.

Facts about the conditions for traders:

- Over 250 different markets and instruments

- Seven asset classes (Forex, Futures, Indices, Shares, Metals, Energies, Cryptocurrencies)

- Offers investment with Forex and CFDs

- Spreads are variable from 0.0 pips

- Offers four types of trading platforms

- No dealing desk execution

- More than 7,000 orders executed per second

- Free demo account

- Maximum Leverage is 1:500 (CySEC 1:30, FCA 1:30, SCB 1:200, professional clients 1:500)

- Over 11.06 ms average execution time

- Minimum deposit of $ 100 (recommended $ 500)

- Award-winning forex broker and CFD broker with over 60 international and UK awards

(Risk warning: 72.87% of CFD accounts lose money)

Test of the FxPro trading platforms:

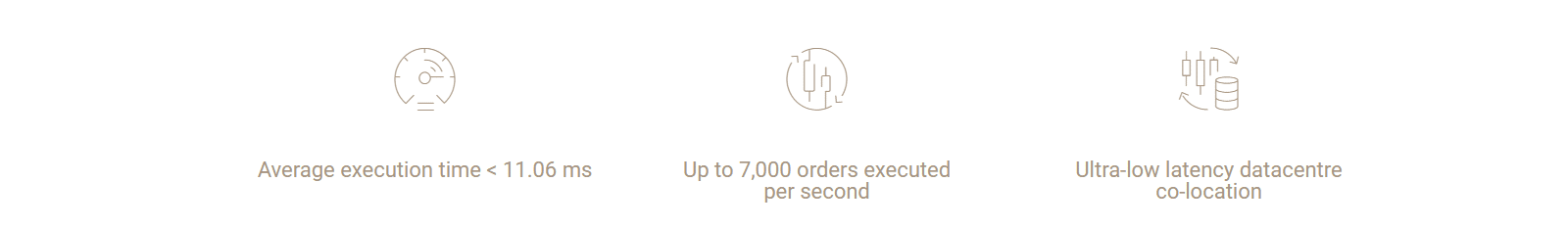

FxPro broker has powerful platforms that can be used on both web (and/or desktop) and mobile. The company has four platforms that promote to support any type of trader with their unique trading style. FxPro is known to be one of the best Forex Brokers, and their platforms have greatly contributed to this recognition. FxPro has won over 60 international awards, and some of the awards recognized the capabilities of the company’s trading platforms. It was named ‘Best Forex Platform’ by Forex Awards and ‘Best Forex Trading Platform’ by Investors Chronicle and Financial Times.

It provides its clients with a wide range of desktop, web, and mobile trading platforms, which include MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge. These platforms are customizable, user-friendly, reliable, fast, secure, and have advanced tools.

FxPro offers the following platforms:

- FxPro MetaTrader 4

- FxPro MetaTrader 5

- FxPro cTrader

- FxPro Edge

FxPro MetaTrader 4

The MT4 platform has an advanced trading infrastructure, competitive pricing, and superior order execution without dealing desk intervention. It is designed to facilitate a smooth and efficient trading experience. The platform provides everything a trader needs to chart assets, place orders, and management positions. MT4 is one of the most powerful combinations in online forex trading and is fully customizable.

(Risk warning: 72.87% of CFD accounts lose money)

FxPro MetaTrader 5

The MT5 platform provides traders with everything they need to trade the financial markets. The platform is a powerful web-based platform that allows traders to access global markets without the need to download or install any software. It is easy to use and fully customizable to suit any trading style. It allows chart assets at 21 different time frames and gives the ability to have up to 100 charts open at any given time. It has a low spread from 0.6 pips, has Buy Stop Limit and Sell Stop Limit orders, tick chart trading, and market depth information. FxPro was named ‘Best MT5 Broker’ in 2015 and 2016 during UK Forex Awards.

FxPro cTrader

The cTrader platform of FxPro is a powerful trading platform that offers the best available bid and asks prices, even from the most competitive institutions. Spreads are from 0 pips, give customers access to full market depth, no restrictions on stop/limit levels, and have full market execution capacity. Traders are able to view the full market depth on an impressive user interface. You can use cTrader from either a web platform or on your mobile phone.

FxPro Edge

The FxPro Edge platform is the latest addition to the platform being offered by FxPro. It is a highly customizable web platform that enables traders to place their orders without the need to download and install any software and provides investors with a new way to trade the markets in the form of Spread Betting while using some of the tightest spreads across all other platforms. This platform gives hundreds of instruments across six asset classes. It has a limited risk account at no additional cost, no commissions, and is tax-free.

Facts about FxPro platforms:

- Can be used via the web or mobile

- User-Friendly

- Advanced trading tools

- Powerful and popular platforms

- Has new features and enhanced customization capabilities

- Reliable software

- Fast and secure

(Risk warning: 72.87% of CFD accounts lose money)

Professional charting and analysis are possible

Charting is possible with FxPro, and the brand offers good charting options. Traders can create watchlists that they can customize and also possible for multiple viewing. Traders can choose multiple time frames to monitor the markets and can conveniently add multiple trading indicators.

To know how much risk you wanna take on, it is very essential to have technical analysis as your tool. It helps you know the correct position sizing and any levels where a trader may expect stronger demand or supply to come that may cause a reversal in price. In order to understand the market behavior, technical analysis helps you know what will be your next step.

FxPro offers standard trading tools such as technical analysis and Forex news, which are very helpful in trading.

The essence of charting and knowing technical analysis is to help you understand the trend and volatility of the markets, which will let you determine your next move for a better trade.

The company also allows its clients to see other clients’ positioning, which gives a sense of market positioning. It provides various features for charting packages and indicators. You can conduct daily technical analysis with over 30 technical indicators with this broker.

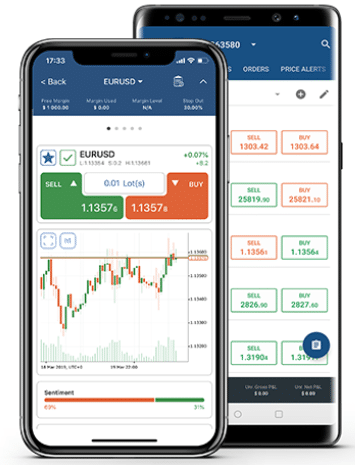

Mobile trading (App) is possible with FxPro

FxPro offers mobile trading with an app available to download on iOS and Android devices. Using FxDirect, you can monitor the markets on the go with this mobile application of FxPro and take advantage of the ultra-low latency trading infrastructure, award-winning order execution, and deep liquidity. You can use any platform you like, from MT4, MT5, cTrader, and FxPro Edge. You can trade anywhere you go and anytime that you want.

Also, FxPro offers streaming market news with the mobile app, with major headlines that impact the market. This is a great advantage to keeping yourself updated with the volatility of the markets. With this, traders can follow market developments on the go in real-time.

FxPro mobile trading app is offering as well good charting options. Watchlists are very customizable and also possible for multiple viewing. You can choose multiple time frames to monitor and can conveniently add multiple trading indicators. After setting up a chart, the app allows traders to trade from the chart itself without ease.

Features of the FxPro mobile trading app:

- Display Charts

- Read Market News

- Allows you to use all types of orders

- Customizable

- Free Demo Account

- Search and select instruments

- On-the-go trading insights

- Advanced Trading Tools

- Customer Support

- General Access to all mobile-friendly and useful features for online trading

(Risk warning: 72.87% of CFD accounts lose money)

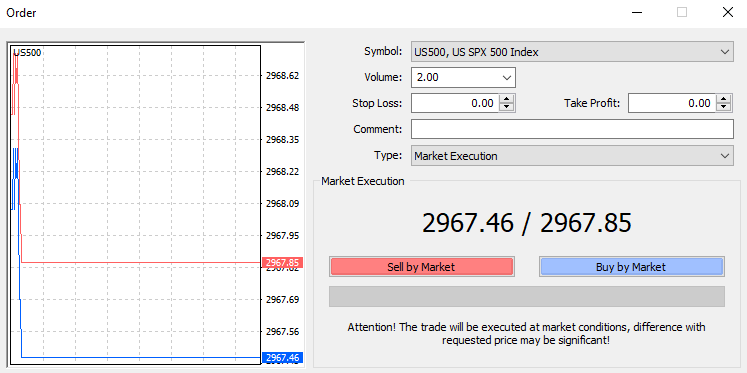

FxPro trading tutorial: How to trade

FxPro has about 1,300,000 trading accounts registered and open with this Forex Broker. It is very easy to create an account and start trading with FxPro. You need to first register and open a live trading account, then verify your account by uploading your documents as required, after that, log in and fund your account, and finally, you can start trading with FxPro on more than 250 instruments.

Once you have finished creating an account and you are ready to trade, you can go ahead and choose the asset you want to analyze. Then, analyze the asset you picked and make a forecast of the price movement. Afterward, you should open the order mask and can customize your position. Once you finished customizing your position, choose the order volume and buy or sell the asset you want. Once you have positioned your trade, you can track the market prices from there.

Step-by-step tutorial:

- Choose an asset you want to analyze

- Analyze the asset and make a forecast of the price movement

- Open the order mask

- Customize your position

- Choose the order volume

- Buy or sell the asset you want

(Risk warning: 72.87% of CFD accounts lose money)

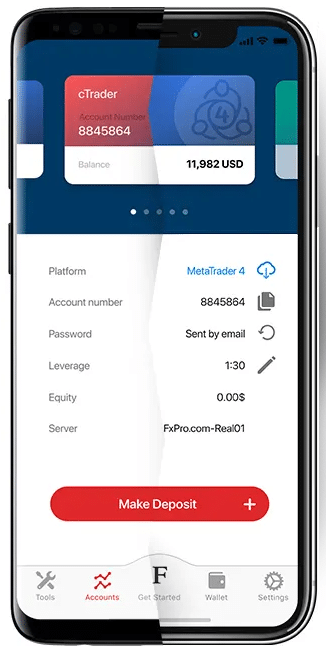

How to open your account with FxPro

It is very easy and fast to open an account with this broker. FxPro offers accounts, namely the FxPro MT4 account, FxPro MT5 account, and FxPro cTrader account. The FxPro Edge account is offered to UK-based traders, which allows investors to invest in the market using spread betting.

The firm also offers a free demo account where you can practice trading first before going live. We highly recommend getting a demo account first and being comfortable with the platform that you intend to use in order to avoid accidental investments.

Register an account with FxPro

When creating an account with FxPro, you need to register first, fill up the information needed, and send or upload the necessary documents in order to verify your account, and then you are ready to trade.

Free demo account with FxPro

FxPro offers a free demo account that allows experienced traders to experiment and test new strategies, as well as help beginners learn how to trade in a risk-free environment. Demo accounts can be recharged with funds via FxPro Direct and present real market conditions and prices. However, demo accounts will be deactivated if there is no activity for a period of 30 days. Also, MT4 and MT5 demo accounts are limited to a maximum of 70 open positions.

The demo accounts will be deactivated if there is no activity for a period of 30 days.

(Risk warning: 72.87% of CFD accounts lose money)

Review of the deposit and withdrawal process

FxPro has developed an easy way for customers to execute funding and withdrawals for their customers by using FxPro Wallet. Customers can now transfer funds between their FxPro Wallet and trading accounts at any time they wish. FxPro Wallet is a ground-breaking money tool as well as a risk management tool. It works as a central account from which clients can transfer money to all their other trading accounts with a few simple clicks. The main advantage of making deposits into the FxPro Wallet as opposed to funding the account directly is that the deposited funds are completely protected from any open positions that may have in the trading account.

In depositing funds into FxPro Wallet, all you have to do is log in to your FxPro Direct, select ‘Deposit Funds’ or ‘Wallet’, and choose your preferred payment option. To withdraw funds from your FxPro Wallet, you need to log in to your FxPro Direct and select ‘Withdraw’ or ‘Wallet’. For transferring funds from your FxPro Wallet to your trading account, log in to your FxPro Direct, and click on the green ‘Manage Funds’ button on the left-hand side.

Any transfers from your FxPro Wallet to your trading accounts in a different currency will be converted as per the platform rates, and the currency of your FxPro Wallet should be in the same currency as your deposits and withdrawals in order to avoid conversion fees.

Available currencies for FxPro Wallet:

- FxPro UK Limited: USD, EUR, GBP, AUD, CHF, JPY, and PLN.

- FxPro Financial Services Limited: USD, EUR, GBP, AUD, CHF, JPY, PLN, and ZAR.

- FxPro Global Markets Limited: EUR, USD, GBP, CHF, JPY, PLN, AUD, and ZAR.

The FxPro wallet is a ground-breaking money tool as well as a risk management tool.

FxPro accepts Bank Wire transfers, Credit/Debit cards, PayPal, Neteller, Moneybookers (Skrill), and some more methods available as per the country of residence. For international bank wire deposits, it may take 3-5 working days for funds to reflect in your FxPro Wallet. FxPro does not charge for bank wire deposits, but the sending and correspondent banks may charge according to their own fee structure. When withdrawing, FxPro’s sending bank may charge up to $25 (Eurobank $25, Hellenic $14 & Barclays £14).

GBP transfers between UK banks usually reflect within the same day, and there are no fees.

SEPA transfers usually reflect within the same day, and the fees are very low (usually a few euros).

Payment methods that can be used:

- Bank Wire transfers

- Credit/Debit cards

- PayPal

- Neteller

- Skrill (Moneybookers)

- Some more methods are available as per the country of residence

In the cart below, you will find an overview of the fees and processing times of the different payment options.

Payment Methode | Processing time for deposit | Fees |

Bank transfer | 2-3 days | None |

Broker-to-broker transfer | 4-5 days | None |

Skrill | One day | None |

Neteller | One day | None |

Credit cards | Within 10 minutes | None |

(Risk warning: 72.87% of CFD accounts lose money)

Please note that customers who are funded by card may only be able to withdraw up to the amount that they funded by the specific card in the last six months or one year, depending on the card processor used. Also, please be aware that you must withdraw via the same method used to fund your account.

If you have any questions or inquiries about the payment methods of FxPro, you can contact their support for funding at [email protected].

FxPro offers several payment methods that can be used in depositing and withdrawing funds.

Fees and costs for FxPro Trader

The recommended initial minimum deposit of FxPro is $ 100 (the company itself recommends depositing a minimum of $ 500). The inactivity fee is charged after 12 months of no trading activity, which is $15 and is followed by a $5 monthly fee.

On MT4/MT5 & Spread betting accounts, FxPro doesn’t charge any commission on any instruments. Traders are only charged by the spread on which the company has applied a small markup (and any applicable swap charges).

The swap fee is calculated as:

Swap fee = [(one pip/exchange rate) X trade size (lot size) X swap value in points] / 10

On cTrader accounts, when trading Forex & Metals, there is a commission fee of $45 for every 1 million USD traded upon opening a position and $45 upon closing the position. However, the spreads on cTrader are lower than those of other account types.

Here is the following information that is relevant when you use FxPro:

- The initial minimum deposit is $ 100

- The inactivity fee is $15 after 12 months of no trading activity, followed by a $5 monthly fee

- Commission fee of $45 for every $1,000,000 traded upon opening a position and $45 upon closing the position (Forex & Metals on cTrader)

- Charges swap fee

- No hidden fees

Is there negative balance protection at FxPro?

Yes, there is a negative balance protection for all clients as part of the client agreement, given it is not manipulated and given in good faith. Therefore you can rest assured that you won’t lose more money than you have available in your account.

(Risk warning: 72.87% of CFD accounts lose money)

Support and service for traders in different languages

Customer support of FxPro is rated five stars and has won several awards due to its excellent customer service. It operates 24 hours a day, five days a week. FxPro customer service is multilingual and supports the following languages: English, Spanish, French, German, Portuguese, Italian, Polish, Czech, Hungarian, Swedish, Bulgarian, Finnish, Lithuanian, Danish, Croatian, Estonian, Norwegian, Romanian, Russian, Indian, Arabic, Indonesian, Malaysian, Chinese, Japanese, Korean, Thai, Taiwanese, and Vietnamese.

You can contact their support via email, live chat, or phone call. FxPro live chat is definitely the fastest way to get in touch to answer your query. It only takes a few seconds for the agent to respond and assist you. The customer support agents are very reliable, professional, and very helpful. We can say that the broker is reputable and is putting in great effort to assist their clients with excellent service.

There are also training and educational materials being offered by FxPro to help their clients who are fresh in trading. The materials are in the form of articles and a short film covering the basic trading level.

Facts about the support:

- Multilingual 24/5 customer support

- 5-star rated customer service

- Award-winning customer support and services

- Offers training and educational materials

- Phone support

- Live chat support

- Email and fax support

- Online support center with FAQs

GLOBAL ENGLISH: | UNITED KINGDOM: | CYPRUS: | BAHAMAS: |

|---|---|---|---|

+44(0)203-151-5550 | 08000-463-050 | +357-25-969-200 | +1 242 603 2224 |

(Risk warning: 72.87% of CFD accounts lose money)

What are the best alternatives to FxPro?

We are almost done with this article, but before we conclude the article, we would like to introduce you to our favorite alternatives for FxPro.

Captial.com

Capital.com is a reputable Forex and CFD trading platform that was established in 2016. Because of its good reputation and user-friendly platform, the site has over 280,000 users from all around the world. Multiple authorities regulate the broker, making it an excellent choice whether you are an experienced trader or just starting out. Read our in-depth capital.com review here.

RoboForex

RoboForex is next on our list of the best FxPro alternatives. You can trade a wide range of assets with this broker, and their biggest advantage is the low minimum deposit of just $10. Furthermore, your assets are quite secure because the broker is fully licensed by the IFSC Belize. Furthermore, the broker is owned by a large corporation with headquarters in Europe. Finally, Roboforex provides a variety of account kinds, giving you a lot of choices. All of these factors combine to make the broker one of the top FxPro alternatives. Read our detailed RoboForex review here.

XTB

XTB is one of the world’s most well-known broker systems. XTB was created in Poland in 2006 and has enjoyed rapid growth since then. This broker can trade over 3,000 different assets across six asset categories for you. But don’t just take our word for it; customers have given XTB numerous honors, and it is highly known for its excellent customer service. For example, every customer has access to personalized one-on-one support and a learning center with a wealth of resources. Read our full review here.

Conclusion of the review: Is FxPro legit? – We think, yes!

FxPro is an award-winning broker that promotes transparency and gives excellent service to its clients. It is the best forex broker according to over 60 international and UK awards. The brand is a global broker that offers CFDs on seven asset classes: Forex, Shares, Spot Indices, Futures, Spot Metals, and Spot Energies. The company offers customers market opportunities with more than 1,400 instruments available to trade on. It has competitive spreads and offers maximum leverage up to 1:500.

It has been operating for more than 15 years of ubiquitous presence in the trading industry. We can definitely say that FxPro always gives its best and excellence to its clients, not only in support and services but as well as its platforms and tools.

The brand is regulated by the highest regulations, and we can definitely say that it is legit, trusted, reliable, and probably one of the best Forex Brokers.

Advantages:

- Multi-regulated company

- Transparent trading experience

- High security of investments

- Excellent customer support and services

- One of the largest Forex Brokers in the trading industry

- Number 1 forex broker as per over 60 international and UK awards

- Advanced and highly-functional software

- User-friendly platforms

- Offers mobile trading

- Offers free demo account

- Reliable and competitive spreads

FxPro is a legit online broker for investing in more than 250 markets. The company shows trustworthiness and good conditions for traders.

Trusted Broker Reviews

Experienced and professional traders since 2013(Risk warning: 72.87% of CFD accounts lose money)

FAQs- The most asked questions about FxPro:

Is FxPro a commission-based broker?

FxPro levies transaction fees of $35 for every million Dollars transacted on the cTrader system. Assuming your account is in a denomination apart from USD, you must calculate this amount. This is handled by FxPro’s Commission Calculator.

How does FxPro generate revenue?

FxPro makes money through a combo of swaps and commissions. Spreads on the EUR/GBP begin at 1.5 pips on the MetaTrader 4 Trading System and 0.2 pips on the cTrader platform, which also charges commissions. On the firm’s site, investors may view comprehensive commissions for every asset on the cTrader system.

Can I purchase equities on FxPro?

You have the option to purchase but also sell stock at FxPro without first purchasing the actual stock. This is due to the fact that everything they sell is a contract for difference (CFD), which allows you to wager on the price volatility of an asset without technically owning the physical asset.

How much time do FxPro withdrawals take?

Debit and Credit Card withdrawals may take up to 5-7 working days, and global bank withdrawals may take up to 3-5 working days, based on your bank. Local transactions, as well as digital wallet transactions, often appear within the same working day.

See other articles about online brokers:

Last Updated on June 8, 2023 by Res Marty