FXTM (ForexTime) review and test for new investors – Good choice or not?

Table of Contents

| Review: | Regulation: | Asset: | Min. Deposit: | Min. Spread: |

|---|---|---|---|---|

(4.9 / 5) (4.9 / 5) | FCA, CySEC, FSCA | 5 classes, 250+ markets | $/€/£ 10 | Variable 0.0 pips |

Is there such a broker that exists that suits all types of traders? FXTM (ForexTime) is an award-winning global broker that is known for giving several options and choices to its client to get more from their trades. How serious is FXTM? Is the broker legit and reliable? The brand commits to provide a transparent trading experience. Is this true? Let’s find out together in this review.

What is FXTM? – The company presented

ForexTime (FXTM) is a leading global broker that offers traders the ability to trade Forex and CFDs. FXTM is founded by Andrey Dashin in the year 2011. The brand specializes in leveraged trading, which gives traders the potential to generate financial returns on both rising and falling prices across Forex, indices, commodities, and shares. The brand dedicates itself to giving its best to serve its clients, both experienced (professional) and beginners. This broker is trusted by over 2 million individuals worldwide. FXTM has gathered more than 25 awards for its products and services since it started in the trading industry.

Facts about FXTM:

- Founded in 2011

- Founder: Andrey Dashin

- Global broker

- Forex and CFD broker

- Available in more than 150 countries

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Is FXTM regulated? – Regulation and safety for customers

Before trading with any broker, make sure that the broker is regulated. Regulation is a license gained by the broker that passed certain criteria in order to operate legitimately in the trading industry. Without this regulation, the broker is not authorized and is not legit. It is important for us as traders to protect our money and investments. This regulation will serve as your protection from scammers circulating online.

FXTM is regulated by top-tier regulators. It is regulated by the Financial Conduct Authority (FCA) in the UK with license number 777911, Cyprus Securities and Exchange Commission (CySEC) in EU with CIF license number 185/12, and Financial Sector Conduct Authority (FSCA) in other countries.

FXTM is regulated by the following:

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA)

Financial security

The security of our finances and investments is our top priority as traders. FXTM understands this and that is why the brand all its services offers full segregation of funds for retail clients. These funds are kept in top-tier banks and fully segregated from the assets of the firm. The brand is a member of the Investor Compensation Fund (ICF), which is a scheme that serves to protect retail clients and compensate the clients in the event that the company fails to return funds and financial instruments belonging to those clients, due to financial problems, as applicable.

Also, the FXTM adopted the SSL (Secure Sockets Layer) network security protocol. This is to guarantee a secure connection for all communications with its clients. It also protects customers during transactions with the company. Additionally, FXTM commits to providing complete transparency to its clients. Furthermore, during the process of opening an account with FXTM, there is a security pin being sent to the phone number or email entered during the registration. These are extra security measures the brand practices in order to maintain the safety and security of its clients in its trading environment as a broker.

Summary of regulations and financial security:

- Regulated and authorized

- Transparent broker

- Segregated client funds in top-tier banks

- Investor Compensation Fund

- SSL (Secure Sockets Layer) network security protocol

- Secure trading environment

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Test of the FXTM trading platformsFXTM offers platforms that are suitable for any type of trader – beginner or professional. The brand offers platforms that you can trade anytime and anywhere you want as long as connected to the internet.  FXTM Platforms:

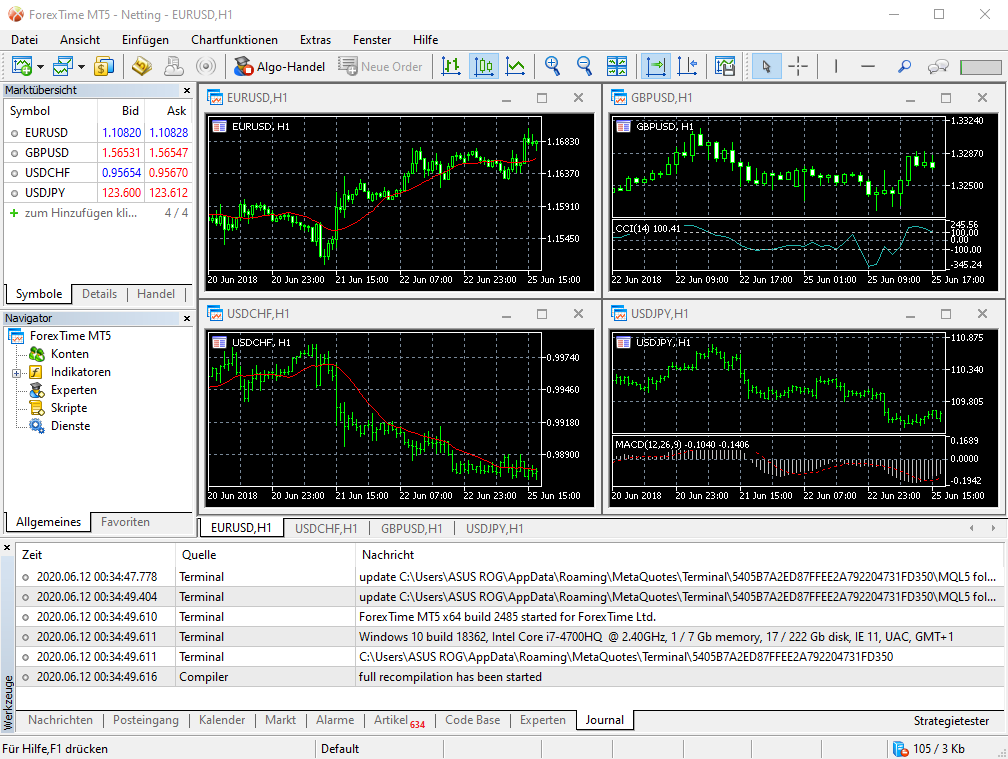

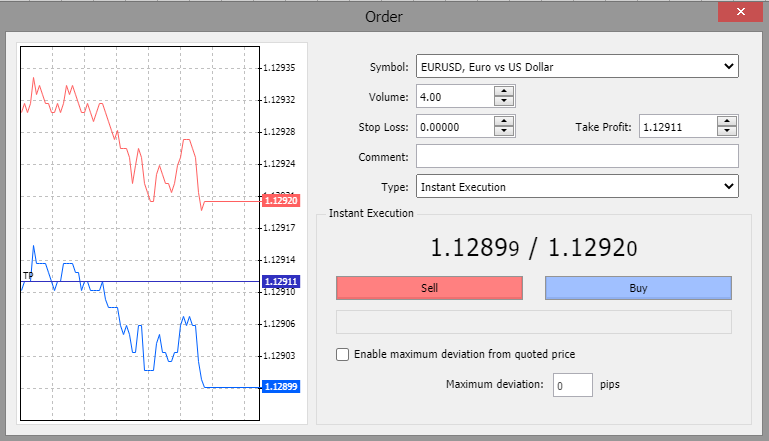

MetaTrader 4 (MT4)FXTM offers the most popular and well-known platform amongst traders – the MetaTrader 4 Platform (MT4). A stand-alone online platform that is developed by MetaQuotes Software. This platform is no doubt famous and the choice of the majority of traders due to its features, functions, and capabilities. FXTM’s MT4 is available and free to download on PC, Mac, mobile, and tablet. It is available in more than 20 languages. MT4 with FXTM provides traders access to a range of markets and several different financial instruments. These instruments include foreign exchange, commodities, indices, and CFDs. It has helpful tools that are helpful in analyzing markets and as well as managing trades. Also, it offers easy-to-read interactive charts and access to over 30 technical indicators that will surely help traders identify market trends and signals for entry and exit points. It gives confidence and security due to the fact that it has a powerful security system and multi-device functionality.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) MetaTrader 5 (MT5)MetaTrader 5 (MT5) is the latest and most advanced trading platform developed by MetaQuotes Software. FXTM’s MT5, like the MT4 Platform, is also available and free to download on PC, Mac, mobile, and tablet. However, MT5 is available in more than 30 languages, unlike MT4 that only has more than 20 languages. MT5 has a smart interface that enhances the overall trading experience of a trader. Also, it has rich functionality, fundamental technical analysis, built-in copy trading, and automated trading. This platform has 44 graphical objects and has an integrated economic calendar. Additionally, MT5 includes a multi-threaded strategy tester, convenient fund transfer between accounts, and system alerts that will surely keep you updated with the markets’ trends.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) FXTM TraderFXTM Trader gives traders the ability to trade on the palm with their hands. This platform is designed for mobile trading and on-the-go trading. This App is available and free to download in AppleStore (for iOS) and GooglePlay (for Android). The app is simple, yet powerful, and user-friendly. It has more than 250 trading instruments, which can keep you on track with your balance, profit, and latest rates. FXTM Trader is a secure and safe app, the currency rates are available 24/5, and have unlimited access to MyFXTM, which enables you to deposit, withdraw, and monitor your funds in seconds. This platform offers convenience, simplicity, and will surely give you a great trading experience, wherever you go and whenever you want.  Professional charting and analysis is availableCharting options with FXTM are good and the brand has advanced charting tools. Traders can choose multiple time frames with FXTM to track the markets, can conveniently add multiple indicators, plus it is highly customizable. Charting is very important in trading because it is a graphical representation of the market movements and volatility. It helps traders better determine what step should be taken in order to get successful trades. FXTM has a professional charting system that is user-friendly. Technical analysis is also one thing you should know and use for better trades. This strategy helps you predict future trends that enable you to identify trading opportunities in either direction. This makes sense due to the fact that technical analysis uses past data of asset price movement and volume. FXTM offers platforms that are competitive and have good indicators. Also, it has powerful integrated tools giving you a great trading experience.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) FXTM trading tutorial: How to tradeTrading requires decision-making and analysis of the markets. Obviously, before getting successful trades, you should know how trading works. Markets can be considered as the bloodstream of trading. This is due to the fact that with the movements of the markets, with prices going up and down, its volatility keeps trading alive and possible. You should know first which market you would like to analyze and trade. It is easier to decide whether to buy or sell when you understand the volatility of the markets. For instance, if you think that the market value is going to fall, then choose to sell instead of buy. But, if you think that the price is going to increase in value, choose to buy instead of sell. Then right after, analyze the asset and determine a forecast of the price movement. Open order mask in the platform. Next, customize your position and choose the order volume. Lastly, decide whether to buy or sell.  Step by step tutorial:

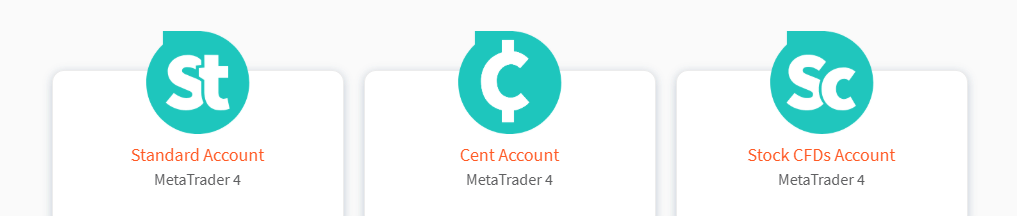

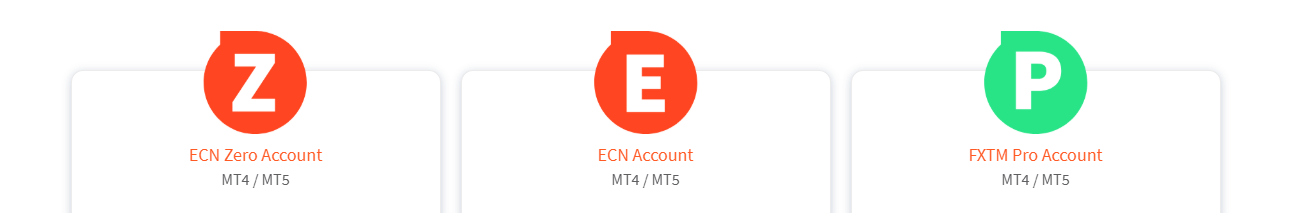

Free FXTM demo account – Use it to practice tradingWe highly recommend getting a free demo account first before going live. This is due to the fact that trading requires a high risk of money and investments. You should know first if you truly understand trading and how it works before deciding to trade real funds. As much as possible, we would like to avoid unintended trading executions. FXTM offers its clients a free demo account, specifically on formats or account types of the following: Standard, Cent, ECN, and ECN Zero. The brand believes that these account types are perfect to practice with (both beginner and professional). These accounts have real market conditions and traders can definitely practice and experiment with different trading strategies. It has free virtual funds with it so traders can practice their trading skills without risking real money. How to open an account with FXTMOpening an account with FXTM (ForexTime) is easy. You need to fill in the necessary details needed in order to register. This includes your first and last name, phone number, country of residence, email, and simply create a password to secure your account. For security purposes, during the registration, you will receive a pin to the phone number that you have entered. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Accounts types with FXTMFXTM live trading accounts have their own conditions. It is tailored to different types of traders depending on their individual needs, investment goals, and financial background. FXTM commits to be the broker that suits any type of trader, whether beginner or professional. With this said, the account types are designed to specific trading level experience, and wherever market the trader has the interest to trade with. The brand has made these several options of accounts so traders can choose which suits them best.  The Standard Accounts are categorized into three types: Standard Account, Cent Account, and Shares/Stock CFDs Account. These accounts are available on MetaTrader 4 (MT4) platform. The account currency for the three accounts is USD / EUR / GBP (for Cent Account specifically, US Cent / EU Cent / GBP Pence). Both the Standard Account and Cent Account offer a free demo account, however, the stock CFDs Account doesn’t. All three have the same Limit & Stop Levels of 1 spread, Margin Call of 80%, Order Execution is instant, swap-free, no commission, 50% Stop Out, Minimum Volume in Lots per Trade, and Step Lot is 0.01. Standard Account and Shares/Stock CFDs Account requires a minimum deposit of $/€/£ 100, while the Cent Account requires $/€/£ 10. The spread of each is different. With Standard Account, it is from 1.3, Cent Account from 1.5, and Shares/Stock CFDs Account from 0.3.  The ECN Accounts are categorized into three types as well namely: ECN Account, ECN Zero Account, and FXTM Pro Account. All three accounts are available on MetaTrader 4 and 5 (MT4 and MT5) Platforms. Both ECN Zero Account and ECN Account offer free demos available except FXTM Pro Account. The account currency for all accounts is USD / EUR / GBP, Margin Call of 80%, Stop Out of 50%, swap-free for MT4 platform (except MT5), Maximum Number of Orders is unlimited, Maximum Number of Pending Orders is 300, Minimum Volume in Lots per Trade and Step Lot of 0.01. ECN Accounts require a different amount of minimum deposit. The ECN Account is $/€/£ 500, while ECN Zero Account requires $/€/£ 200, and FXTM Pro Account requires $/€/£ 25 000. The spread of each is different as well. With ECN Account, it is from 0.1, ECN Zero Account from 1.5, and FXTM Pro Account from 0 pips. Account types:Standard (MT4)

ECN (MT4/MT5)

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|