Why should traders always set SL and TP?

Table of Contents

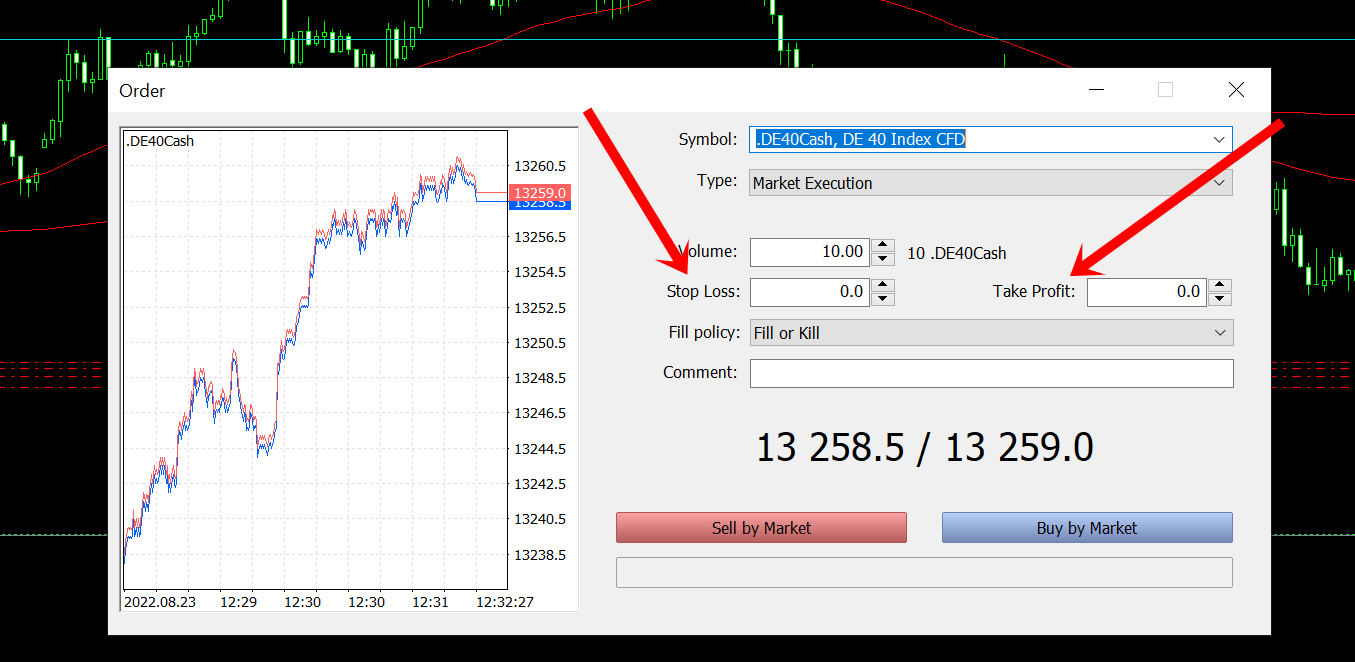

Stop-Loss (SL) and Take-Profit (TP) are two fundamental Forex principles that newcomers should become familiar with while trading.

Trade positions are automatically closed at negative values when a Stop Loss order is issued. When the price movement has moved in the trader’s selected direction to a certain price level, the Take Profit instructs the broker to automatically cancel the trading position, resulting in a positive value for the position.

The primary purpose of a stop loss is to limit losses on active transactions. In most cases, a stop loss should be placed above a strong resistance or below strong support. These should be important price levels that have been tested and shown to be sustainable.

How does stop loss and take profit orders work?

Exit strategies include using take-profit and stop-loss orders on each transaction. Once prices reach a specified level, these orders are executed and your long or short position is closed with a profit or a loss.

When it comes to placing take-profit and stop-loss orders, your trading preferences play a crucial impact. With TP/SL orders, you won’t have to second-guess your choices, whether trading candlestick patterns, chart patterns, trendlines, or technical indicators.

For traders, these are critical tools. In order to achieve long-term success in the Forex market, it’s important to see, stop loss and take profit orders explained, how they work, how to set them, and what are their true benefits. Skilled traders recommend that beginning with a focus on risk management can help you avoid making costly mistakes. Long-term traders’ primary tool for cutting their losses is the stop loss. To be a successful trader, it is critical to know when to quit the market.

By using a stop loss, you may limit the amount of money you lose on active deals, preserving your trading capital. However, it must be based on a benchmark. Support/resistance zones are perhaps the most acceptable benchmarks to utilize.

The foreign exchange market is notoriously volatile and difficult to anticipate. Prior to a deal going against your expectations, you must take profit. Take Profit may be determined using a variety of technical analysis methods. The finest SL and TP indicators are Bollinger Bands, the Relative Strength Index, and the Average Directional Index (ADI).

For long and short trades, you should pay attention to nearby support and resistance regions since this is where the market movement is most likely to halt. If your TP is set higher than these levels, you run the risk of your trades reversing against you. To make the most of these levels, your stop-loss order must be placed a few pips ahead of any of the support or resistance levels. As a result, you may be certain that by the time price reaches these critical levels, your trade will have closed out in profit.

What are the pros of setting SL and TP?

Although stop-loss and take-profit orders are both used to end the trade, they are completely opposite of each other. In the event of a profit, take-profit orders are used to close out your position. Orders to close your positions if you suffer losses will be executed through stop-loss orders at this time.

Think about the risk-to-reward ratio of each trade scenario you come across before deciding whether it’s worth taking a position in.

A stop-loss order may assist most Forex traders. If an adverse movement occurs in a security position, a stop-loss may be used to restrict the losses. Using this tool frees you from having to keep an eye on your investments on a daily basis. As a result, it serves as one-of-a-kind account protection.

Because the take-profit and stop-loss orders are automatically executed at the appropriate times, you have the freedom to do other things while still holding an open position.

A trader’s primary responsibility is to protect their money and minimize losses. Trading using Stop Loss and Take Profit (SL/TP) might assist you in attaining your trading objectives. But, remember that keeping your emotions in check when trading is also important.

Setting stop loss and take profits orders is quite beneficial for not only those traders who are new in the industry, but also for those who are experienced and seasoned investors. When it comes to generating a risk management strategy in Forex trading, stopping loss and taking profits orders should be one of the first things to keep in mind.

FAQ – The most asked questions about SL and TP :

What is the purpose of setting stop loss (SL) and take profit (TP) in a forex broker?

One of the factors contributing to the high likelihood of losing money when trading on the foreign exchange market is the market’s frequent price adjustments. You can partially use take profit and stop loss orders to mitigate these risks.

Let’s start by defining take profit in forex. When you start a trade, you can specify the minimum price increase. If the asset price rises to that level, the position will automatically shut, securing the profits produced right away.

About the stop loss Forex order, you place it to reduce losses as much as possible. You modify the maximum risk when you first enter the market.

You change the maximum risk you’re willing to accept before you enter the market. Your current position will automatically be closed out if losses fall below that threshold.

What trading advantages do stop loss and take profit offer?

Stop-loss limits the amount of money you can lose in a single trade. You can secure your previous earnings by using take profit.

Since the market is so unpredictable, they are advantageous to you. Everything may go well one second and then suddenly fall apart for no apparent reason.

The orders are also automatically carried out, so you don’t need to be in front of your computer to complete them.

Read more about trading:

Last Updated on January 27, 2023 by Arkady Müller