How do forex brokers make money? – The sources of income listed

Table of Contents

If you want to start buying or selling currencies in the forex market, you need a forex broker. A forex broker is a middle ground between the buyers and the sellers in the forex market.

Therefore, you have to know their role and how they work to ensure that the exchange of forex currencies flows smoothly. Understanding the function of a forex broker will assist you in making decisions on the type of forex broker you want.

There are various ways that they contribute to their services during trading. However, you need to know how they charge for their services.

In the Forex market, traders and speculators can buy and sell different currencies depending on whether the currency will rise or fall in value. The foreign exchange market, or forex market, carries a high level of risk and is traded in excess of $5 trillion per day.

Traders must go through an intermediary, such as a currency broker, to place a trade. Regardless of profit or loss caused by individual traders, forex brokers make money on commissions and fees, some of which are hidden. Understanding how a forex broker makes money will help you choose the right broker.

How do forex brokers earn money?

There are many ways to make money with your business. Fees for trading volume may vary depending on the product (currency pair) and the company’s greed. On average, this fee is about $5 per $100,000 traded volume.

Some brokers charge no fees and their main income is the spread, which is the difference between the purchase and sale price of a currency. Compared to retail exchanges like your bank, Forex brokers offer much narrower spreads. For example, if an exchange buys €1 for $1.03 and sells for $1.15, that means the EUR/USD spread is 0.12. If you buy and sell 1 lot ($100,000) immediately on such an exchange, you lose $12,000.

Brokers, on the other hand, have access to large liquidity providers and spreads are typically small fractions of 1%. The broker can offer the same EUR/USD pair at $0.00005, i.e. 2400x less spread than the exchange. This means that traders can process large volumes while paying small fees.

The broker’s earnings are the difference between the liquidity provider’s spread and the final traded spread. This is why it is important to find a liquidity provider with the smallest spreads that are attractive to traders and can grow. Brokers using spreads are interested in professionals who benefit from trading in bulk.

Alternative source of income

Some Forex brokers charge extra for “bells and whistles” in customer service and training. For example, some provide signals, others provide in-depth analysis, and even offer private training courses and webinars for those willing to pay more or are willing to pay a higher price. This means that if you are good at trading and have the right money management skills, you will hardly ever need these.

Another way some Forex brokers can make money is by financing “loans”. Remember that buying or selling currency with margin is actually taking out a loan. It can be a bit risky and difficult, but suffice it to say that an organized forex broker can accept interest paid in real interbank markets that you will not be involved in. Despite what people say, retailers don’t even come close to real interbank markets. Because to work in this field, the order has to be much larger. Forex brokers typically work with liquidity providers that store these orders in smaller pieces, allowing people to trade back and forth. Real interbank markets include the largest banks in the world that don’t mind small $500 transactions (for example).

Forex traders often say brokers are interested in seeing their clients lose. Can you capitalize on a retailer’s failures?

There are brokers who act as counterparties in their clients’ trades without the involvement of major marketers. Brokers in this case really benefit from traders who “blow up” their deposits, and sometimes this annoys their clients because the brokers seem interested in their failures. Nevertheless, these terms mean faster order execution, which is advantageous for those who prefer high-frequency trades.

Unfortunately, some brokers abuse this plan and offer their clients non-market quotes. These companies are short-lived, but honest in-house work can be profitable without changing prices.

On the other hand, for a broker there is always the risk of high-yield professional traders causing the broker to go bankrupt, and this can only be avoided with a balanced risk management.

Overview of how forex brokers make money

In the following, we give you an overview of the respective positions.

Forex spreads

It is the way most forex brokers make money. The forex spread is the difference you get from subtracting the bidding price from the asking price. The bidding price is what you will get after selling a currency.

The asking price is what you pay when you want to buy a currency. The difference between these two amounts is the spreads, which the forex broker charges. In the forex market, you sell the currency at a lower price than you bought it.

It is because the broker will have to sell it at a higher price to make profits. Forex spreads are in form of pips, which is a small unit of the price and expressed in four decimal places. There are countries like the Japanese yen that are in two decimal places.

An example is the EUR/USD has a bid price of 1.2030 and an ask price of 1.2034. It is expressed as 1.2030/1.2034, where the difference is 0.0004. In this case, the spread is four pips.

There are two types of forex spreads

The variable/the floating spreads or the fixed spreads. The variable spreads change according to the prices of the currency in the market. It is affected by liquidity and volatility of the market prices.

The fixed spreads don’t change, are set at a specific price, and are not affected by the market conditions. Between the fixed and the variable prices, the variable price is often cheaper. The fixed spreads could be high because the broker has to factor in the market conditions.

The value of the spreads depends on the type of broker you are using. There are dealing desk forex brokers, the non-dealing desk forex brokers/market makers and the ECN forex brokers. ECN forex brokers offer tight spreads since they deal with liquidity providers.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Commission

Apart from the spreads, traders charge commissions according to the size of the position or the lot size. The commission is like the charges you get for buying a lot size, let us say a fraction of a percentage of a lot size.

Such that they cut their commission according to the volume that you trade. Some forex brokers don’t charge commission on the trade, but they have wide spreads. Others charge both the commission and the forex spreads on the trade.

Transactional fees

Transactional fees consist of withdrawal and deposit fees. It is a percentage of the amount that you withdraw or deposit. For some forex brokers, the higher the withdrawn funds, the lower the withdrawal fee.

It is to attract more withdrawals or deposits. It can get charged from a withdrawal limit, say more than $20,000 attracts a withdrawal fee. Many forex brokers do not have these fees, and those with them charge a small percentage.

Margin/ leverage

It is like getting a loan from a forex broker to open a trading position that is bigger than what you can afford. The leverage and margin do not have an interest rate. So how do the forex brokers make money?

They profit from attracting investors to trade more using leverage. Forex has more traders because of the forex leverage offered from forex brokers. It is how it works, say a forex broker gives a 1:10 forex leverage. This means that with $100, you can open a position worth $1000.

When forex traders use leverage to open positions, the forex brokers earn from the commissions and spreads and other charges.

Overnight fees

This fee gets charged when your position remains open overnight using leverage. These charges cater for the cost of the open position. It is often an interest rate charged from the total size of the open position.

This fee gets charged every night the position remains open. The charges start running at different times, based on the forex market you are trading on.

Inactivity fees

It is the amount charged for an inactive account. Forex brokers make money through brokerage services. They can only earn if there is buying and selling. There are forex traders that can open a trading account and have no trading activities.

These accounts remain dormant, which means the forex broker is not earning from them. To make forex traders active, forex brokers introduce inactivity fees. After some time, for example, six months or a year, they charge an inactivity fee.

It could be charged for every month $10 after a year of inactivity. It is also one way they can earn from an inactive account.

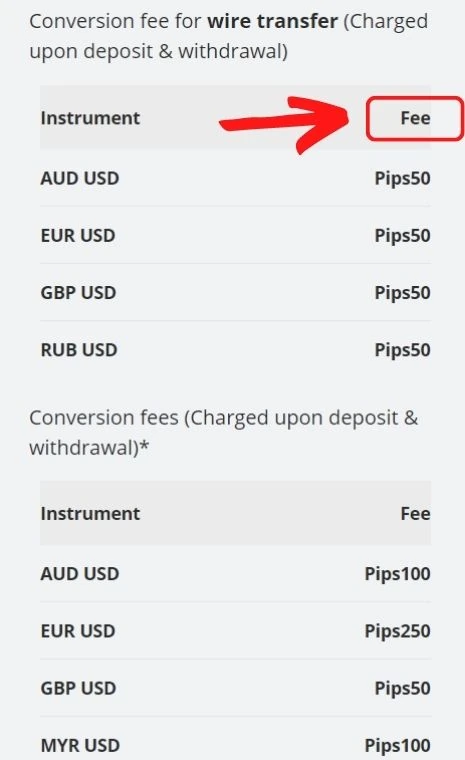

Conversion fee

In forex trading, you have to buy certain currencies that you want to trade. Some payment platforms cannot convert local currencies to the other forex currencies to trade. Your forex broker can charge a small conversion fee when you want to buy a currency.

Forex trading resources

Forex brokers can charge a certain fee to access certain trading tools. These trading tools are; specific trend indicators, trading platforms, technical analysis tools. These forex trading tools are assets that enable us to make better decisions.

Other forex traders charge a fee to access the forex educational materials. They could be forex trading classes, tutorials and beneficial webinars. It is hard to acquire or create trading courses and other educational materials.

That is why they charge a fee before you can access these resources. Some resources like trading platforms have features that place a forex trader ahead in the market. The output from investing in these resources is higher than the fee paid.

Other charges

These are like charges for giving you forex signals. Forex brokers hire forex experts to provide trading signals for their traders. In such an instance, pay them some fee for the trading signals and insights.

This type of forex broker is suitable for traders who don’t have the time to research for themselves. The forex broker performs the technical and fundamental analysis for them.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Hidden costs that you should know

The popularity of forex trading has grown over the last decade. It is due to many advertisements of people who have made millions forex trading. It has attracted thousands of people towards opening forex accounts.

Due to this, the sector has attracted a couple of forex scams claiming to be forex brokers. In addition to that, there are forex brokers that charge hidden fees. A couple of people have reported losing their investments to shady forex brokers.

Here are some ways forex brokers can charge hidden costs to profit from forex traders.

Slippage

It occurs when there is a delay in the execution of orders due to market conditions. It happens such that you can buy or sell currencies at a lower price than what you quoted. Which is a positive slippage.

Or you can buy at a higher price than what you quoted, which is a negative slippage. Some trading brokers take advantage of this slippage to make profits. The price of a currency you want to buy could fall, and the forex broker will buy it at a lower price.

They then sell to you at your quoted price and profit from the difference. Forex traders should look at the market prices before making any orders to avoid exploitation.

A markup spread

It is when forex brokers put up false forex spreads to make more profits. For example, a liquidity provider offers a forex spread of 0.5 to an ECN broker. The broker then adds more such that they display 1.5 to the forex trader.

In the end, the forex broker makes more profits at the expense of the forex broker. It is crucial to look at the market spreads to see if they charge more.

Taxes

Countries that make forex trading an income-earning activity charge taxes on the income. It happens when you withdraw profits. It is why forex traders should consider adding the costs of taxes when they are trading.

Other ways how forex brokers make money

Forex brokers are rewarded in two ways. The first is the spread between the buy and sell prices of a currency pair.

For example, Euro-USD. The dollar pair is priced at 1.20010 Bid and 1.20022 Ask, with a spread between the two of 0.00012, referred 1.2 pips. When a retail customer opens a position at the requested price and then closes at the offered price, the currency broker receives the spread amount.

Second, some brokers charge extra fees. Some charge a transaction fee or monthly fee to access certain software interfaces, or a fee to access special trading products as exotic options.

The foreign exchange industry is regulated by the Commodity Futures Trading Commission and the National Futures Association.

Competition among currency brokers is fierce today, and most companies believe they should eliminate as many fees as possible to attract retail customers. Many now offer free or minimal trading fees for their spreads.

Some forex brokers even make money from their trades. This can be problematic if the transaction creates a conflict of interest with the customer. Regulations have limited this practice.

The role of a currency broker

Currency exchange brokers accept and execute orders to buy or sell currency. Forex brokers usually operate on the over-the-counter market. This is a market that is not subject to the same rules as other financial exchanges, and a forex broker may not fall under many of the rules for trading securities. This market also doesn’t have a central clearing mechanism, so you have to be careful that your counterparties don’t trade by default. Be sure to research and know the capitalization of the broker before proceeding. Be careful when choosing a reliable currency broker.

Forex broker regulations

The industry is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Most consumers don’t consider how brokers generate money when trading Forex. Nevertheless, this is an important concept to grasp before making a deposit, as you’ll be aware of how money moves across the system. Nobody will be more concerned about your account than you will ever be, so take that into consideration when deciding who to trust. I’ll examine at how Forex brokers earn profit and what function they play in promoting liquidity in this article.

Learning ways Forex brokers make money will assist you in selecting the best broker. Most brokers have a few fees that they employ to make money off of their clients. Knowing what these possibilities are can make you realize where your money goes.

When returning to fulfil a buy or sell order, the broker charges a fee for each trade or spread. This is how Forex brokers make money. The difference between the bid price and the ask price increases. The buy price is the price you get when you sell the currency, and the sell price is the price you have to pay to buy the currency. The difference between the buy price and the sell price is the broker’s spread. Brokers may also charge fees and spreads for trades. Some brokers may claim to offer trades without commission. These brokers are likely to receive commissions by expanding the spread of their trades.

Spreads can be fixed or variable, depending on the movement of the market. Variable spreads may change due to major market events such as interest rate fluctuations. This can be good or bad for you. When the market becomes unstable, you can pay much more than expected. Another aspect to be aware of is that currency brokers can have different spreads for buying and selling the same currency. Therefore, you need to pay close attention to your pricing. Capital-rich brokers who work with several large Forex firms to get competitive prices usually offer competitive prices.

An important source of income is broker fees

Some Forex brokers charge a fee for each trade, while others charge the difference between the bid and ask prices. The main way Forex brokers make money is by maintaining spreads or charging a specific fee for each round. Some brokers charge for both, but they are becoming less common these days because lower prices are needed to commercialize the business. Unfortunately, knowledgeable Forex brokers have previously mentioned that there are no commission trades, but they usually use more spreads to compensate for this.

Some of them use both variable and fixed spreads. What this means that their spreads are fixed and sometimes they are variable. In a liquidity pool with floating spreads, the size of the spread depends on the number of orders available. When major US announcements, such as non-farm pay, come out, the variance tends to widen. Because of this, you can pay more than you expect in a volatile market. This is the biggest advantage of fixed spreads. At least because you know how much you have to pay to make trading easier.

Conclusion – Now you know how forex brokers make money!

Trading costs are crucial points to consider before choosing a forex broker. It is because the trading costs will contribute to the profits that you will make. High charges could lead to losses.

There are different ways in which forex traders charge for their services. Good forex brokers indicate their costs and are clear about how they earn. Forex traders must check for registration before choosing a broker.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about how forex brokers make money:

How do forex brokers make money?

In general, the brokerage amount makes up the fees for all the transactions. Online brokers offering free trades receive the fees through other services along with the exchange fees.

If you are still wondering how forex brokers make money, margin or leverage, slippage, spreads, taxes, transactional fees, markup spread, overnight fees, inactivity fees, conversion fees, foreign trading resources, and hidden costs are some of the other ways through which they earn.

A forex broker can generate income by accepting and executing traders’ orders. When traders signup with a forex broker, they place their forex trades through their trading platform. So, a trader earns commissions for offering traders a perfect trading platform. That is the income source for a forex broker.

Can one make a living through earning as a forex trader? Is forex trading gambling?

Yes, it is totally possible to make a daily income through trading forex. However, one will be required to follow all of the initial start-up steps and will be required to take care of how the trades are being executed.

In case the trader is relying more upon intuition instead of level-headed analysis, then in that case trading can be recognized as gambling. It is all dependent upon how the forex is put into practice. Note that knowledge is power, and it isn’t an empty phase, as this is what distinguishes the successful traders and ones who are not so outstanding.

Can forex brokerage firms be trusted?

The regulated forex brokers within the major hub always are trustworthy. For the ones in the emerging hubs, even they can be trustworthy. However, caution is to be warranted.

What fees does a forex broker levy on traders to make money?

There are different fees that any forex broker would levy on traders to make money. For instance, activity fees, trading fees, and other non-trading fees comprise the income sources for a forex broker. Different forex brokers can charge different percentages of fees from traders. Thus, different forex brokers have different revenue. A trader has to pay these fees and cannot avoid them under any circumstances.

What is the role of commissions in helping forex brokers make money?

A forex broker can make money by charging commissions from traders. There is a percentage of commission that forex brokers fix. This percentage usually ranges between 1-4 percent. It serves as the main source of income for a forex broker. Besides, some forex brokers might charge traders money for using their trading platform. So, a trader would have to pay that fee too. Thus, there are not one but many income sources for a forex broker.

Last Updated on February 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5)