Markets.com review and test – how good is the trading platform?

Table of Contents

REVIEW: | REGULATION: | ASSETS: | MINIMUM SPREADS: | MINIMUM DEPOSIT: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | CySEC, FSCA, ASIC, FCA | 8,200+ | Variable from 0.6 Pips | $100 |

Is Markets.com considered a recommended and trusted online broker? In trading, it is very important to know the risks and what are the important things we need to remember to understand how the markets work. In this review, we will talk about the advantage of using Markets.com as an online broker. Is it worth the try? Will it pay off our effort? What type of CFD Broker is Markets.com? Let’s find it out.

(Risk warning: 67% of retail CFD accounts lose money)

What is Markets.com? – The company presented

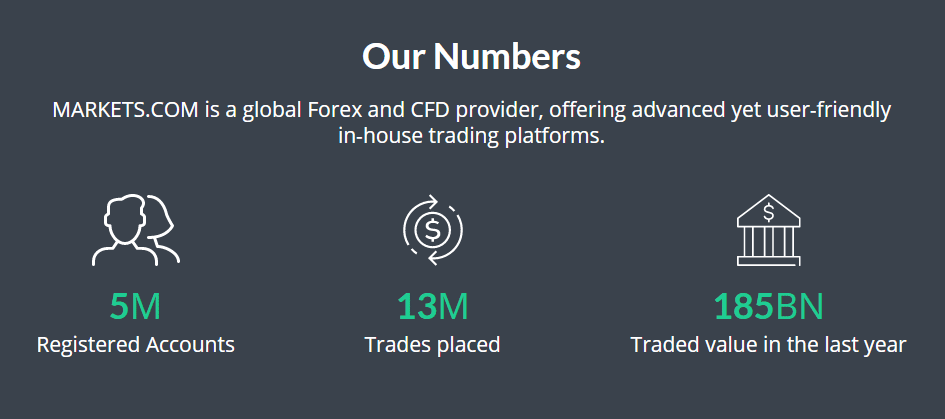

Markets.com (Marketx) is a worldwide Forex and CFD trading broker that was founded in 2010. It offers more than 8,200 trading assets and over 8,000 markets to trade, which also promotes advanced yet easy-to-use trading platforms. Makets.com provides a variety of selections for trading FX, CFDs, stocks, commodities, cryptocurrencies, indices, and ETFs. The brand is one of the best Forex Trading Platforms in the year 2017, which was judged by the 2017 UK Forex Awards. Already have about 5 million accounts registered with this broker due to its powerful big data and quantitative analysis tools.

It is operated by Safecap, which is owned by Playtech PLC. Playtech is part of the list on the stock exchange, which considers Markets.com as a trusted and safe broker.

See our full review video of the trading platform:

Facts about Markets.com:

- Founded in 2010

- Based in Europe

- A global trading platform

- Regulated and authorized

- Part of a company that is listed on the London stock exchange

- Offers fast and seamless account opening

- Offers investment with Forex and CFDs

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2010 |

💻 Trading platforms: | Web Trader, MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $100 |

💱 Account currencies: | USD, EUR, GBP, |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🎁 Bonus: | Yes, welcome bonus on the first deposit |

📊 Assets: | Forex, Shares, Commodities, Crypto, ETFs, Bonds, Blends, |

💳 Payment methods: | Visa, Mastercard, Neteller, Skrill, Wire Transfer, ZOTAPAY |

🧮 Fees: | Starting at 0.6 pip spread, variable overnight fees, and commissions |

📞 Support: | 24 / 5 support via chat, phone, or e-mail |

🌎 Languages: | 10 languages |

(Risk warning: 67% of retail CFD accounts lose money)

Is Markets.com regulated? – Regulation and safety for customers

Trading online comes with a high risk. Before choosing a brand where you’ll invest, knowing if it’s authorized or regulated is very important. This particular license can only be obtained by the brand after complying with certain aspects that are required for a broker. It is very important to inform yourself about these regulations to avoid getting scammed and losing your investments.

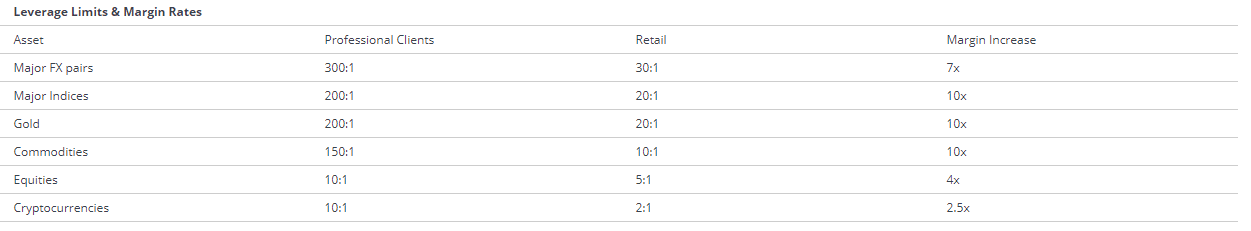

Markets.com is regulated by popular regulators, which include CySEC (Europe), FSCA (Africa), AISC (Australia), and FCA (United Kingdom). The leverage is up to 1:30 for retail clients and 1:300 for professional clients.

Markets.com is regulated by the following:

You can read more about the regulation and legalities on the official website of Markets.com. You can find this information on the lower part of the webpage. Just click on ‘Regulation and Legal Pack‘ in this section.

Financial security

Markets.com does not use the funds of its clients for its own benefit. The funds of the clients are kept in segregated bank accounts and have negative balance protection. The brand has trusted auditors that check thoroughly the brokers.

Besides, Markets.com has several licenses, which makes it an authorized and secured broker. The brand has a Financial Service Compensation Scheme (FSCS), which serves as the security for customer funds that are up to £85,000.

With Markets.com, Guaranteed Stop-Loss (GSL) is automatically set to the level of the initial margin used to open the position. This works similarly to the Stop-Loss Order, with the main difference being that the GSL is immune to price gapping or market volatility. The advantage of GSL with Markets.com is that you don’t risk more than your initial investment.

Summary of the regulation and financial security:

- Clients’ funds kept in segregated bank accounts

- Negative Balance Protection

- Electronic Verification

- Leverage up to 1:30 for retail clients and 1:300 for professional clients (Europe)

- Leverage up to 1:300 outside Europe (international)

- FSCS Investor Compensation up to £ 85,000 (depending on criteria and eligibility)

- Guaranteed Stop-Loss (GSL)

What are the pros and cons of markets.com?

Before we review the trading conditions on market.com in more detail, let’s take a quick look at the broker’s most important pros and cons. We have tested and reviewed hundreds of brokers in the past years, so we believe we can give you some helpful information after carefully testing it.

Pros of market.com | Cons of market.com |

✔ Great selection of more than 8,200 tradable instruments available | ✘ Account opening is a bit confusing, as it isn’t very clear if you open a live account or a demo account |

✔ One-click trading option available for all account types | ✘ market.com isn’t as transparent regarding fees and commissions, and the clarity of the website could be improved |

✔ Very knowledgeable customer support and a huge selection of educational material | ✘ no RAW spread accounts are available |

✔Regular support from a personal account manager | |

✔ Lightning fast execution of orders | |

✔ Transparent trading experience | |

✔ Accepts international clients from most countries | |

✔ Enhanced customization capabilities |

How good is markets.com user experience in the web and mobile versions?

Great usability, which makes it easy to navigate the platform, aside from the spreads and costs, of course. You should choose a broker you can trust and feel comfortable with. The chart below is meant to give guidance and help you in the decision process.

Criteria | Rating |

General Website Design and Setup | ★★★★ Professionally designed interface, but some information is hard to find, and the clarity of the site could be improved |

Sign-up Process | ★★★ The demo account setup is a bit confusing, and it isn’t clear if you sign up for a live account or a demo account |

Usability of trading area | ★★★★★ Both available trading platforms offer professional features and are easy to use |

Usability of mobile app | ★★★★ App works very well on all devices, but the design and user experience are slightly outdated |

Accepted countries and forbidden countries

Markets.com accepts traders from Australia, Denmark, France, Germany, India, Italy, Kuwait, Luxembourg, Norway, the United Kingdom, Qatar, Saudi Arabia, Singapore, South Africa, Sweden, United Arab Emirates, and other countries.

However, traders can’t use Markets.com coming from Belgium, Brazil, Canada, Russian Federation, Hong Kong, Indonesia, Iran, Iraq, Israel, Japan, Malaysia, New Zealand, Philippines, Puerto Rico, Switzerland, Syria, Thailand, Turkey, and the United States.

(Risk warning: 67% of retail CFD accounts lose money)

Review of the trading conditions for traders

Markets.com offers seamless trading of over 8,200 trading assets. The brand offers advanced tools for traders, including stop-loss, take-profit, entry limit, and entry-stop orders. The trading platform was uniquely designed to let traders benefit from customizable charts, studies, in-depth analyses, economic calendars, and accurate trading signals.

Since it is operated by one of the world’s fastest-growing CFD and Forex providers, namely Safecap, the brand offers powerful yet user-friendly, in-house trading platforms both for web and mobile. You can trade from a variety of selections of the following:

- Forex

- Shares

- Commodities

- Indices

- Crypto

- EFTs

- Bonds

- Blends

There are two types of trading platforms with Markets.com, and both of these platforms support immediate deposits, uploading documents, and fast withdrawals. Clients can fully manage their accounts over mobile or the web. These platforms are namely, Markets App and Markets Web Trader. Trading at Markets.com lets you benefit from zero commission, tight spreads, and leverage ratios, which are up to 1:30 for retail clients and 1:300 for professional clients.

Also, Markets.com has a Guaranteed Stop-Loss (GSL), which is automatically set to the level of the initial margin used to open the position. Because of this, you can say that you have security in terms of investing. However, you should always consider whether you can afford to take the high risk of losing your money, and this is also stated on the website of Markets.com before you can create an account.

Markets.com earns money by adding a spread on each asset. You do not pay any commissions.

Typical spreads on Markets.com :

ASSET: | VARIABLE SPREAD: |

|---|---|

EUR/USD | From 0.6 pips |

GBP/USD | From 1.0 pips |

AUD/USD | From 0.6 pips |

GOLD | From 0.3 points |

OIL | From 0.02 points |

DOW30 | From 1.5 points |

Facts about the conditions for traders:

- Over eight different market types

- Over 8,000 trading assets

- Leverage ratios up to 1:30 for retail clients and 1:300 for professional clients (Europe)

- High leverage up to 1:300 for traders with no European regulation

- Spreads are variable from 0.6 pips

- Two types of trading platform

- Mobile trading

- Offers investment with Forex and CFDs

- Reliable customer support and services

(Risk warning: 67% of retail CFD accounts lose money)

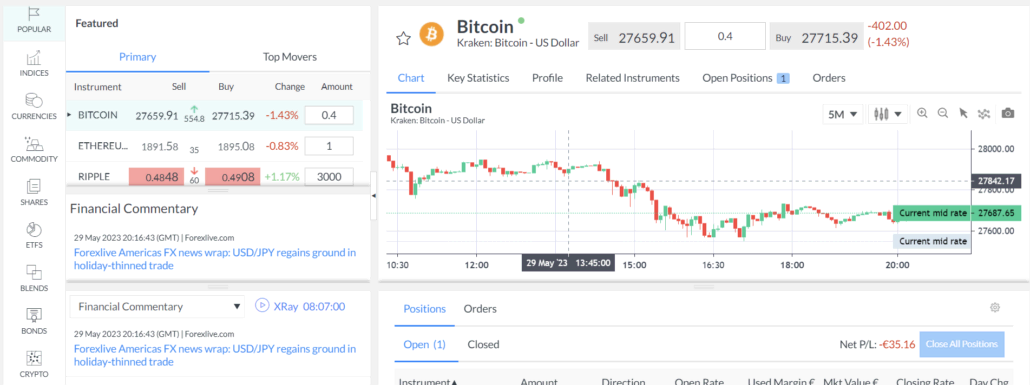

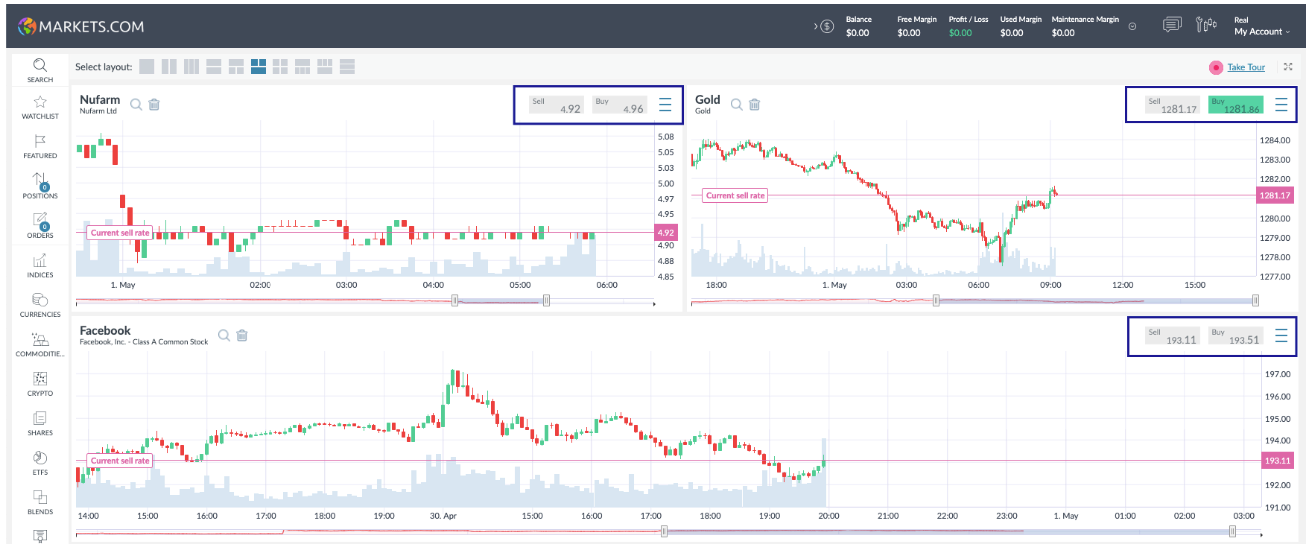

Test of the Markets.com trading platform

Customers can manage their accounts with Markets.com via mobile (Markets App) or the web (Markets Web Trader). These two types of trading platforms of Markets.com can both support immediate deposits, uploading documents, and fast withdrawals. Trading at Markets.com lets traders benefit from zero commission, tight spreads, and leverage ratios, which are up to 1:30 for retail clients and 1:300 for professional clients.

Markets.com is aware that every modern-day trader has their own specific needs in trading. The trading platforms of this brand come with many new features and enhanced customization capabilities. It includes the shortlisting of the favorite trading instruments of the trader, being able to view multiple trading charts at once, and a personalized popular trading instrument list created with proprietary algorithms. The platforms are totally responsive and are used via web, mobile, and tablet (iOS and Android). Trading on the go is possible. You can trade anywhere and anytime.

markets.com offers the following platforms:

- Markets App

- Markets Web Trader

- MetaTrader 4

- MetaTrader 5

Facts about markets.com platforms:

- Has an interactive user interface

- User-Friendly

- Advanced Trading Tools (indicators, analysis, and more)

- Has new features and enhanced customization capabilities

- Reliable

- Fast

- Secure

(Risk warning: 67% of retail CFD accounts lose money)

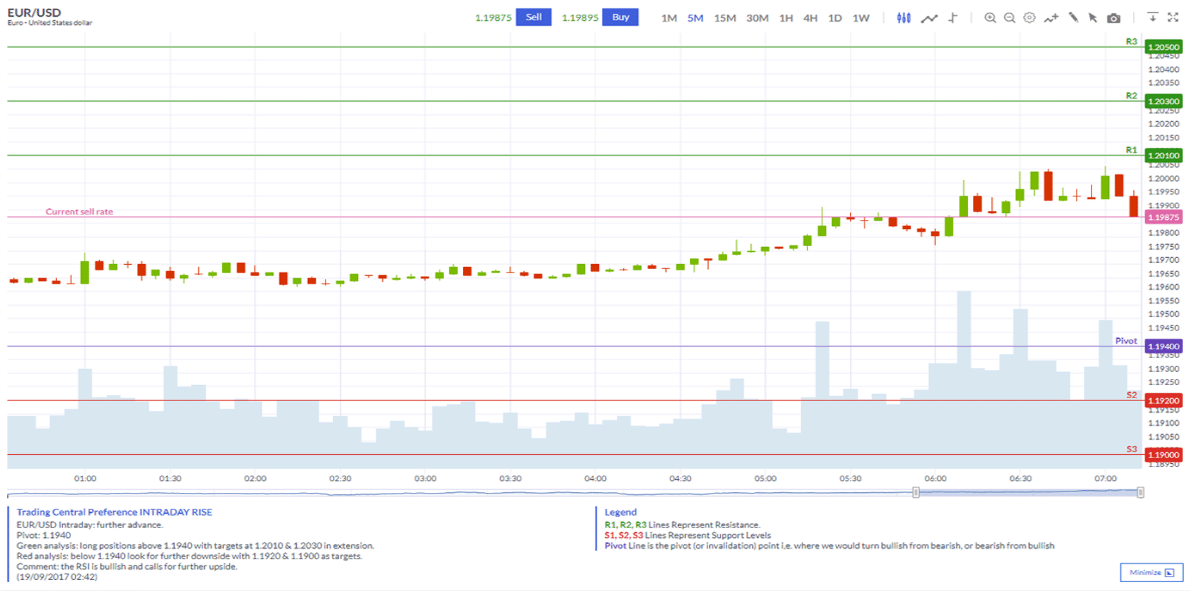

Professional charting and analysis are available

Charting is very important in online trading. It makes total sense to trade when you know how charting works. This helps you understand the movements of the markets and helps you strategize your next move in order to get a plus. The trend and volatility of the markets determine the success of your next move. When volatility is high, it means that a value can potentially be spread out over a larger range of values, and the price of the value can change intensely over a short time period in either direction.

(Risk warning: 67% of retail CFD accounts lose money)

You can view charts of up to four markets all at once and choose your preferred layout with the Markets.com platform. Its advanced charting is a big help since it can help you identify trends and opportunities that you don’t want to miss. It is professional-grade, fast, and user-friendly. You can directly trade using the Multi-Chart feature of the platform.

Technical Analysis is very important because this strategy uses past data, such as asset price movement and volume, to try and predict future trends and to identify trading opportunities and price targets. Markets.com platform gives you access to competitive industry analysis and forecasts from Trading Central. The brand offers customers on their trading platforms Trading Central analysis and data in multiple languages. The indicators of Trading Central overlay support and resists levels on the price chart of the client’s favorite assets and be able to find a summary of recent market movements, together with the suggested entry and exit points. It also offers data that can potentially help traders to understand the market trends, instrument volatility, and movement and may help traders develop strategies. It uses a fusion of analyst research and automated analytics to give traders more information with which to make trades.

Review of the mobile trading (app) by Market.com

(Risk warning: 67% of retail CFD accounts lose money)

Features of App:

- Search and select instruments

- On-the-go trading insights

- Interactive User Interface

- Advanced Trading Tools

- Free Demo Account

- Risk Management Tools

- Customer Support

Every feature from this platform is accessible in a few clicks at the most. Registration is very fast and easy, and you’ll be ready to trade on mobile in no time.

The app also highlights its risk management tools, which include online CFD trading. Markets.com offers Stop Loss, Take Profit, and more.

This trading platform offers exceptional customer support via phone, email, or live chat as well.

The brand offers customers a free unlimited demo account to practice online trading strategies. We highly recommend getting a demo account first before going or proceeding to real accounts and going live trading online.

However, one downside of mobile A is the design and setup, which is a bit outdated. The usability isn’t as good as with the web trader in our experience.

(Risk warning: 67% of retail CFD accounts lose money)

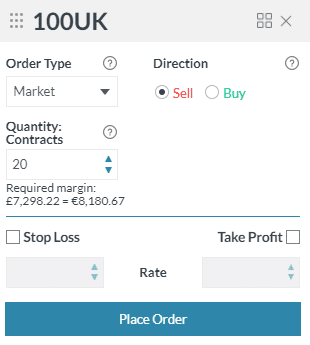

How does investing with Markets.com work? – Step-by-step tutorial

You have to know the trend and volatility of the markets in order for you to know what will be your next steps. In trading, once you understand the movements of the markets, this can give you an edge in getting good results. You have to remember that whenever volatility is high, it means that a value can potentially be spread out over a larger range of values, and the price of the value can change massively over a short period of time in either direction. Also, don’t forget to use stop loss/take profit to manage risk.

Step-by-step trading tutorial:

- Choose an asset on the platform

- Choose the size of the right position for your account

- Open the order mask and customize your position

- Select buy or sell to open a position – invest in rising or falling markets

- Use stop loss/take profit to manage risk

What is the leverage ratio on markets.com?

The leverage ratio for Markets.com is up to 1:30 for retail clients and 1:300 for professional clients.

(Risk warning: 67% of retail CFD accounts lose money)

CFD trading is fully regulated and is one of the fast-growing investment styles in the world. Even though the trader never owns an asset, CFDs reflect the movement of the underlying asset. Because of this, a trader benefits from the difference between the opening price and the closing price. For currency trading, forex exchange or the forex market now exceeds $7billions in a day. Traders can benefit from the movements of currencies around the world.

Since Markets.com is operated by one of the world’s fastest-growing CFD and Forex providers, namely Safecap, clients can trade from a variety of selections of FX, CFDs, stocks, commodities, cryptocurrencies, indices, and ETFs.

Markets.com encourages transparency with its trading platform. Because of this, clients can easily view their account information as well as their balance. It is a good thing about the brand and makes it a reliable broker.

Open your free Demo Account with Markets.com

We highly recommend getting a free demo account first with Markets.com before going live with a real account. This will greatly help you know how the movements of the markets, whether going up or down and will definitely help you practice your online trading skills. In online trading, we should be aware that there is a high risk of it. By doing so, you will also be able to experience how the platforms work and what strategies are needed to get a plus.

Account types with Markets.com

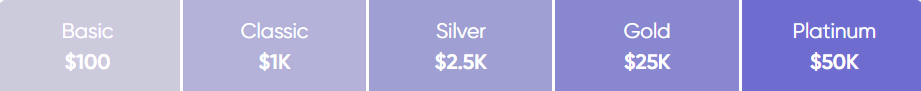

Markets.com has a standard account type with added spreads, and it is the only one. Customers can simply view their account information by going to the ‘My Account’ section of their profile. The brand also lets you see your balance. With Markets.com, the minimum initial deposit is $100. If you wish to view the balance of your funds, you can simply go to the ‘Funds Management section. There you will be able to see the number of your current funds.

Depending on the initial investment, you will be assigned a certain account level. You will find the levels and associated minimum investment below.

Which each level, you will get access to higher advantages, bonus levels, margin call SMS, communication with senior account manager spread reduction, and much more. You will find an overview of some advantages of the different account levels. In our opinion, if you are just starting out, we recommend aiming for the Classic or Silver level, if possible.

Basic | Classic | Silver | Gold | Platinum | |

Communication with senior account manager | No | Monthly | Bi-Weekly | Weekly | Daily |

Margin Call Sms | No | No | Yes | Yes | Yes |

Reuters analyst research | No | No | Yes | Yes | Yes |

Spread reduction | No | No | No | Yes | Yes |

Wire transfer fees Reimbursement | No | No | Yes | Yes | Yes |

Higher bonus levels | No | No | Yes | Yes | Yes |

(Risk warning: 67% of retail CFD accounts lose money)

Review of the deposit and withdrawal methods

Markets.com accepts all major credit cards, e-wallets, local payment methods, and wire transfers. There is no charge for commission or fees on deposits. Also, the funds are always returned in the same method used to deposit. The company does not charge commissions or fees on withdrawals as well.

Payment Methods that can be used:

- Bank transfer / Bank Wire

- Credit Cards (Visa, MasterCard)

- Skrill

- Neteller

- (Some other payment methods depend on your country of residence)

When it comes to withdrawal, the processing time depends on the withdrawal method selected. Also, due to anti-money laundering regulations, the account you transfer money to must be under your name. You can expect the following processing times for the available withdrawal methods.

Withdrawal method | Processing time |

Credit card | 2-7 business days |

Wire Transfer | 2-5 business days |

E-Wallets | Up to 24 hours |

Is a negative balance protection included when I open an account with markets.com

Yes, regardless of the account level, all your funds are protected by negative balance protection. It gives you peace of mind, no matter how fast the market moves against you, you will never lose more money than you have in your account. If it happens besides all the measurements, markets.com will automatically adjust your account balance to zero.

(Risk warning: 67% of retail CFD accounts lose money)

Markets.com support and service for traders

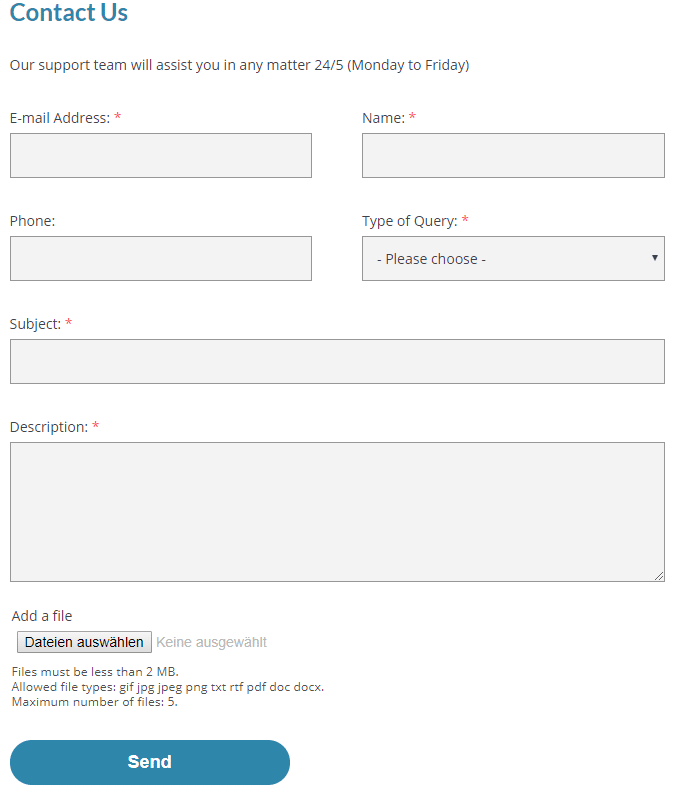

Markets.com offers a diverse selection of customer support and services. Customer service is open 24 hours a day, five days a week, and the customer agents are friendly and ready to help you with your issues. Whether your platform is not working or if you want to understand how the markets work or why an order has been rejected. The brand caters to services in over 25 languages that incorporate as well the actual platform in 15 major languages, including English, German, Spanish, Italian, French, Norwegian, Russian, Swedish, Dutch, and Arabic. Customers can reach support via email or live chat as well as phone support.

Also, Markets.com has an online support center that you can find as well as Frequently Asked Questions (FAQs). From that section, clients can find training videos that are very helpful for online trading, user guides, and basic instructions on how to manage their accounts.

Facts about the support:

- Offers services in multiple languages

- Customer service or assistance is 24/5

- Phone Support

- Live Chat Support

- Has online web query forms

- Online support center with FAQs

You can definitely send them an email by filling up their online web query, and you will be contacted by the agent.

Markets.com customer support and services are remarkably fast to respond to and absolutely reliable. You can also ask for their support regarding fees and costs while trading on the platform. In our live test, the waiting time to be connected with an agent was close to one minute, which is still very good in our opinion.

Educational material on markets.com

The amount of educational material to help you get started is also quite impressive. You can choose from blog posts, educational videos, webinars, and a traders clinic with access to podcast episodes, videos, and articles. In short, no matter what media you prefer, there is high-quality content available for anybody and totally free.

(Risk warning: 67% of retail CFD accounts lose money)

Fees and costs

It is free to open a demo or even a live account with Markets.com. Adding funds to the account and withdrawing funds do not charge any fees as well, however, Markets.com highly recommends that traders check with their payment service provider for any transaction fees or additional charges. For the initial deposit, the trader would need a minimum of $100 in funds.

However, there is a conversion fee. A small charge (0.3%) is deducted for the currency conversion when there is a discrepancy between the trading account currency and the quoted currency of the underlying asset.

Markets.com also charges an inactivity fee, which starts after three months of inactivity and is $10 per month.

Also, there are no hidden fees at Markets.com, and the company is mainly compensated for its services through the spread and daily swap charges.

Fees of Markets.com:

- The minimum initial deposit is $100

- The conversion fee of 0.3%

- No fees are involved with Crypto CFD trading (nor are there any commissions)

- Inactivity fee (after three months for $10 per month)

- No hidden fees

Please note that clients adding funds of over $2500 will be reimbursed by Markets.com for any external transaction fees that are charged, and any withdrawals with bank fees incurred by VIP clients are reimbursed by Markets.com.

How does Markets.com make money from you?

Because of the fact, that markets.com doesn’t offer a raw-spread account, the only expenses we need to consider are the added spreads, as well as additional fees such as inactivity fees, overnight swap rates, or currency conversion fees. Overall, markets.com offer you a very good value with low fees and a competitive spread.

(Risk warning: 67% of retail CFD accounts lose money)

What are the best Markets.com alternatives?

Before we conclude the article, here are our three favorite alternatives.

Captial.com

Since 2016, Capital.com has operated as a well-known and trustworthy online trading platform. The broker, which has its global headquarters in London and operations in more than 50 nations, has quickly built a reputation for offering its customers an intuitive interface and cutting-edge capabilities. Over 3,000 markets, including those for shares, commodities, and currencies, are accessible through Capital.com. In addition, clients benefit from a high level of security and trust because of the broker’s regulation by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

RoboForex

On our list of the top markets.com substitutes, RoboForex is next in line. You can trade a wide range of assets with this broker, and their key selling point is the cheap minimum deposit requirement of just $10. Your money is also very safe because the broker has an official license from the IFSC Belize. Additionally, a sizable business group with its main European offices owns the broker. Finally, Roboforex allows you a lot of versatility by providing a variety of account kinds to pick from.

XTB

One of the most well-known broker systems in the industry right now is XTB. Since its 2006 founding in Poland, XTB has experienced rapid expansion. You can trade more than 3,000 different assets with this broker, which are divided into six asset categories. But don’t just take our word for it; XTB has received numerous honors from its clients and is renowned for providing exceptional customer support. For instance, every customer has access to a learning center with a ton of resources and specialized 1 to 1 support for every client.

Is Markets.com legit or a scam? – Conclusion of the review

Markets.com is backed by a trusted trading company that is operated by Safecap and owned by Playtech PLC. It offers more than 8,200 trading assets and over 8,000 markets to trade, which has advanced yet easy-to-use trading platforms that make it a good choice for any type of trader.

It provides a variety of selections for trading FX, CFDs, stocks, commodities, cryptocurrencies, indices, and ETFs. Already have about 5 million accounts registered with this broker due to its powerful big data and quantitative analysis tools.

The brand is regulated, and we can definitely say that it is a legit, trusted, and reliable broker. The biggest advantage of this broker is the competitive spreads on stock CFDs and commodities. Also, there is very good support and education for every trader.

Advantages of Markets.com:

- Regulated company

- Accepts international traders

- User-friendly platforms

- Advanced Trading Tools

- The platform has new features and enhanced customization capabilities

- Transparent trading experience

- Over 8,200 markets to trade

- Offers free demo account

- Only a $100 minimum deposit

- Offers services in multiple languages

Overall, Markets.com is a reliable online broker which gives the client very good conditions to trade with. The trading platform is unique and suitable for professional trading.

Trusted Broker Reviews

Experienced and professional traders since 2013Lastly, Markets.com has a disclaimer that 74 – 89% of retail investor accounts lose money, whenever trading CFDs with this provider. You should make sure that you truly understand and know how CFDs work before trading CFDs with this broker.

(Risk warning: 67% of retail CFD accounts lose money)

See other articles about online brokers:

Last Updated on June 8, 2023 by Res Marty