24Option review and test – Is it a scam or not?

Table of Contents

| REVIEW: | REGULATION: | SPREADS: | MIN. DEPOSIT: | SPECIAL: |

|---|---|---|---|---|

(4 / 5) (4 / 5) | CySEC (EU) | Starting 1.1 pips | 100$/€ | Account types |

Are you looking for a real experience with the CFD Broker 24Option? – Then you have come to the right place. In the following sections, we have taken a closer look at the provider of speculative financial products. Now read our trusted test report about the conditions and the service for customers. Is it really safe to invest your money here? – Find out more about the company 24Option.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

What is 24option? – The CFD broker presented

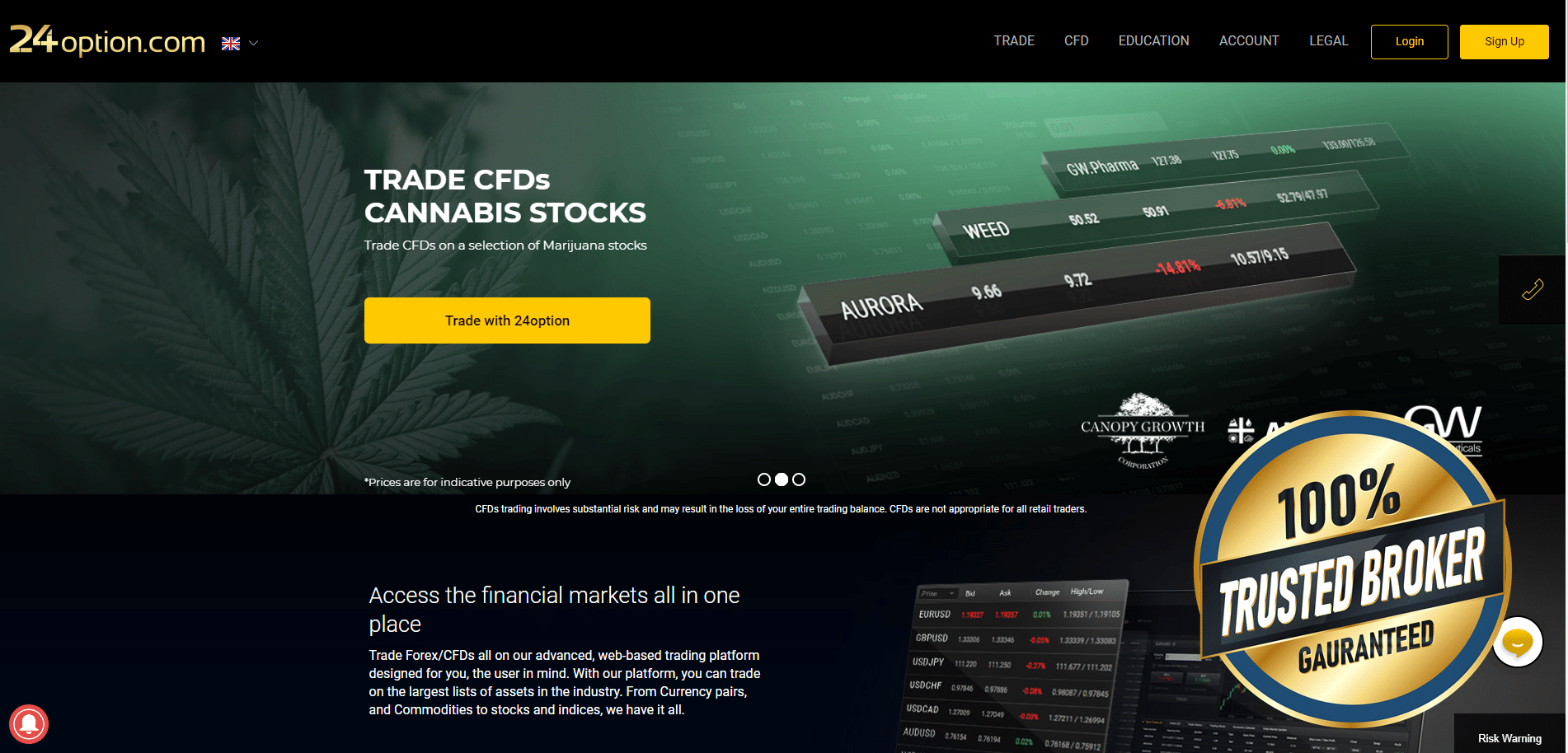

24Option is an international company founded in 2009 and operated by Rodeler (LTD) Limited. It is active in online trading and offers various financial products as a broker. The broker specializes in the distribution of CFDs (Contract for difference) which can be traded on stocks, commodities, currencies, or cryptocurrencies. A few years ago, the provider was number 1 in options trading. Due to stricter regulations, the offer was switched to CFDs.

The company got branches all over the world and provides trading support in different languages. Besides, on the homepage, you can see that 24Option is a sponsor of Juventus FC. This makes the first serious impression for us. In addition, the trading experience with this provider should be sensational. It is advertised with cheap spreads and a professional trading platform. We will check in the following test report whether this is really true.

Facts about the company:

- International online broker

- Based in Cyprus (EU)

- Founded in 2009

- Multi-language support

- Sponsor of Juventus FC

- Trading platform for any device

Regulation and safety of customer funds

Security and trustworthiness must be 100% given when investing with an online broker. CFD providers in the European Union must be strictly regulated by official financial supervisors so that they can offer certain financial products at all. A regulation or license is always linked to conditions and criteria. The broker must adhere to the guidelines, otherwise, the license may be withdrawn. In my experience, fraud involving a regulated broker in Europe can be ruled out.

24Option is regulated by CySEC with license number 207/13 and the IFSC 60/440/TS/19. The broker is managed by Rodeler Limited, which also holds a license. Rodeler Limited is regulated by the IFSC in Belize. The necessary licenses are therefore available from this company.

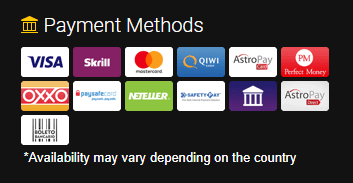

The security of customer money is also an important point when it comes to choosing a good broker. 24Option uses regulated and approved payment methods (credit card, Skrill, Neteller, etc.) for its customer’s transactions. The funds of the company and traders are also kept strictly separate in different bank accounts. In summary, there is no need to worry about the security of this broker’s deposits and withdrawals.

Facts about the regulation:

- Regulated by the CySEC (EU) 207/12

- Regulated by the IFSC (for international traders)

- Registered in different countries of the EU

- Regulated payment methods

- Segregated bank accounts

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Review of the conditions for 24Option traders

What can 24Option offer a trader or investor anyway? – Leveraged financial products are offered. This means that you need less capital (security line) on the account to trade a higher position in the markets. In most cases, it is even very necessary to make a profit in a short period of time. Especially small accounts benefit from high leverage.

In general, it always depends on the asset and which leverage you want to use. Some markets are very volatile (strong movements) and some markets are less volatile. 24Option offers over 250+ different values that can be traded on the trading platform. These include cryptocurrencies, forex, stocks, commodities, and indices. The offerer surprises with its various offers and is quite competitive.

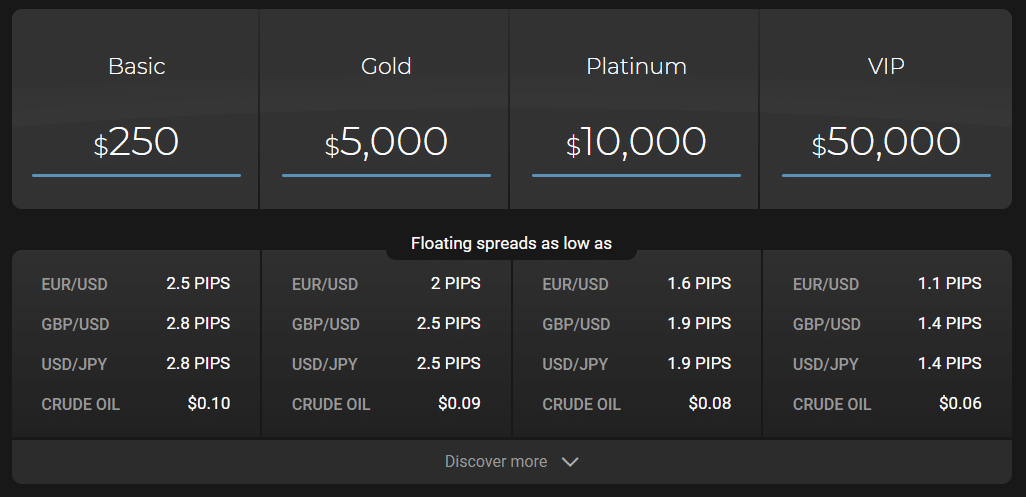

The CFD Broker tries to expand his offer more and more. The newest values of the platform are the brand hot cannabis stocks, which offer very good chance risk ratios. 24Option is financed exclusively by the spreads on the offered assets. This is a difference between the buying and selling price, which can also depend on market volatility. For example, spreads start in EUR/USD from 1.1 pips and can even be further reduced with a higher account level. In total, 24Option offers a very good offer for traders who want to invest in numerous markets.

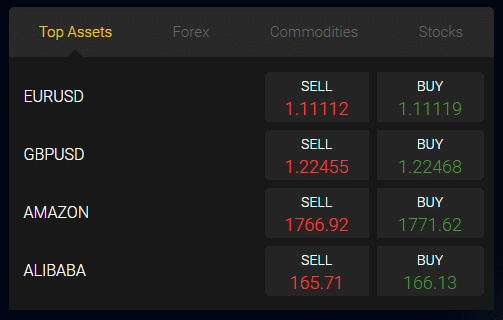

Example spreads (depending on the market situation):

| ASSET: | SPREADS FROM: |

|---|---|

| EUR/USD | 1.1 pips |

| GBP/USD | 1.4 pips |

| USD/JPY | 1.4 pips |

| Crude Oil | 0.09 points |

Facts about the conditions:

- CFD trading with a maximum leverage of 1:500 (professional and international investors), 1:30 leverage for European retail clients

- Minimum deposit 100$

- Spreads starting at 1.1 pips

- More than 250 assets (stocks, forex, cryptocurrencies, indices)

- Innovative and new markets

- Go short and long

- Account types (VIP)

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

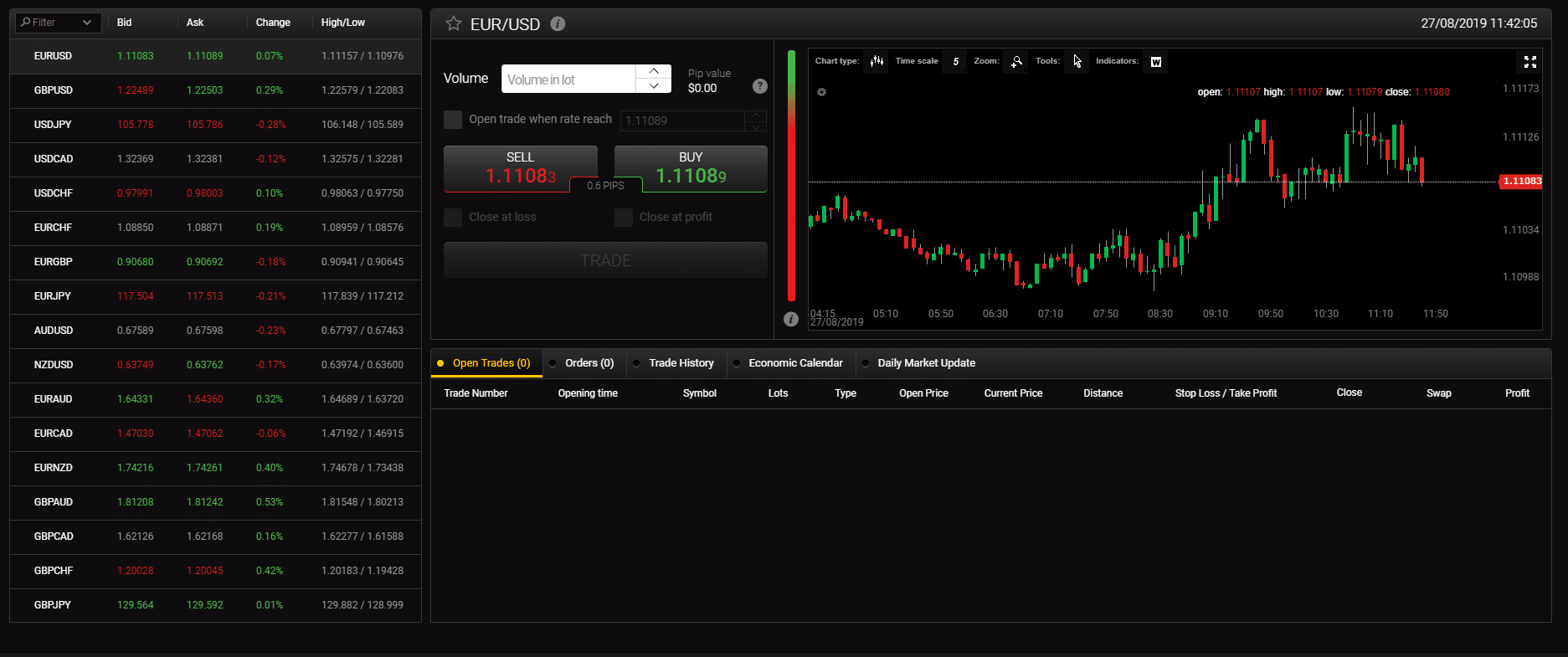

24Option trading platform test

24Option offers its developed trading platform and app. Besides, the broker offers the worldwide popular Metatrader 4. How does 24Option work? – many traders ask. Trading is quite simple.

24Option offers the following platforms:

- MetaTrader 4

- WebTrader

- App

The trading platform gives you direct access to the financial markets. The left bar allows you to select the various assets. The chart window serves a trader with many setting options for analysis. Below, you can see your current portfolio and keep an eye on your capital at all times.

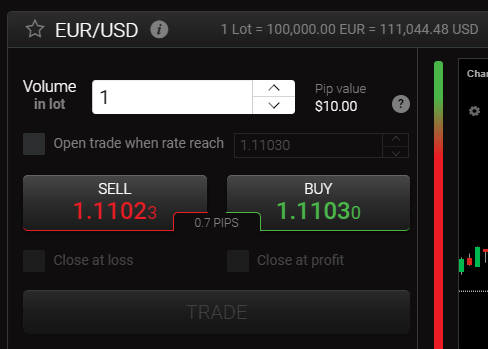

Positions can be opened or closed on the market in just a few clicks. The trading platform also transparently displays all fees and costs for current positions. Adjust the position sizes to your account balance using a built-in calculator.

Professional charting and analysis are possible

The charts can be displayed in 6 different variants. In addition, the trading platform offers a range of tools for technical analysis of the markets. For example, more than 30 different indicators are available, which can be displayed at the trader’s request. Drawing tools for self-analysis are of course also available via the 24Option trading platform. If the browser window is too small for you, you can also switch to full-screen mode. In a nutshell, this platform offers all the necessary tools a trader needs.

If you still don’t have enough, you can use the platform Metatrader 4. It offers even more setting options than the web-based trading platform.

Facts about the functions:

- Free indicators

- Customizable tools

- News and professional technical analysis

- Trading signals

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Trading tutorial: How to trade with 24Option?

In this short step by step guide we will show you the trading functions:

- First, make a sufficient analysis of the markets and generate trading ideas. A trade should be carefully planned before execution.

- The trader should now set himself a possible loss limit and target. The loss can be limited with the stop loss, which automatically closes the position at a certain price.

- Now you know the risk range of the trade and have to determine the position size in lots. You can trade from 0.01 lots, which is about 1000 units of the base currency in Forex. Then the pip value is displayed and you can also see how much risk the trader is taking in a stop loss.

- Now buy or sell an asset on the 24Option platform. Short selling (selling) is very easy thanks to the CFDs and gives the trader a lot of functionality for his portfolio.

- Take the profit manually or automatically through the take profit (profit target)

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

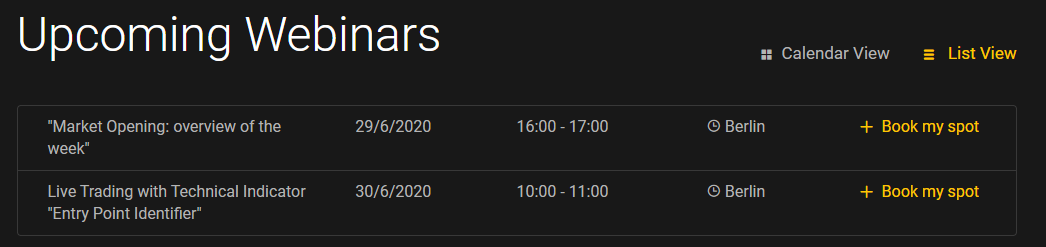

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Free and unlimited demo account for practice24Option offers a new customer a free demo account for testing the trading platform. The virtual account is completely free and you do not need to make a deposit. It simulates 1 to 1 real money trading. Especially beginners should use the demo account to gain first experiences. We also recommend that every advanced trader starts trading in the demo account first. So you can familiarize yourself with the trading platform and also try out certain strategies. The different account types and their advantagesWith 24Option, different account models are offered to customers. The higher your account status, the more benefits you can enjoy. What is really positive is that you get good support even with the smallest account (Basic). Webinars and seminars are available almost daily. Each account includes a free demo account with €100,000 in credit, a platform introduction, daily market reports, an introduction to the financial markets, and a personal contact. At the higher account levels, you can expect an extended service through professional analyses (technical and fundamental). The payouts of capital will also be free of charge. There are also cheaper spreads for different account levels. In the picture below you will see a quick overview:  Review of the 24Option deposit and withdrawalOn the Internet, you hear again and again about cases of fraud with online brokers, which do not payout. From our experience, we can say that 24Option pays out 100%. We know through our community many traders, which get the money and the profit paid out with this broker. On the positive side, there are many different methods and no fees for depositing money. With the Basic and silver accounts, there are small fees for the payout, which are no longer there at higher account levels. We will go into this in more detail in a moment. How long does the payout take with 24Option? The broker processes your payment within a maximum of 3 days (working days). Usually, it only takes a few hours until the payout is released. In the past, there were sometimes delays, because the customer rush to the broker was extremely high. A regulated broker pays out 100%. There are many ways to make a deposit and a withdrawal:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) The 24Option minimum depositThe minimum deposit is only 100$/€ with this CFD Broker. So you can already participate in the financial markets with very little capital. Trading is already possible without verification. Nevertheless, the company must verify you, otherwise, it can come to the freezing of the account. Facts about the payments:

Is there negative balance protection?Many traders are afraid of the obligation to make margin calls when trading in leveraged products. The past has shown that this can cause extreme levels of debt. But we can reassure you because with 24Option there is no margin call obligation and your account can never end up in a negative balance. 24Option trading fees comparedFrom our test results and evaluations, we can assure you that there are no hidden costs. You can see all the costs and fees on the homepage. In addition, the support always tells you what fees may apply. These fees can occur:

Test of the support and service for 24Option tradersAnother important criterion for a trustworthy broker is customer support and service. As a trader, you should have a direct point of contact if you have any questions or problems. For example, the service should work quickly when emergencies occur and you have to close a trading position via support. 24Option offers very broad customer support. The general support is available 24/5 during the week by phone, email, or chat. There are different branches who are working during normal working hours until about 18 pm. From our experience, we can say that the support with 24Option works really well. Professionally trained staff is always ready to help you. It doesn’t matter if you have questions about the broker, the trading software, or the in and out halves. 24Option knows how to take its customer’s questions very seriously.  In addition, the broker offers a good service for the further training of the traders. Free webinars are held and there is a large training center on the website. Beginners should quickly understand trading with this broker and improve their skills by knowing 24Option. Finally, the support from his personal account managers makes a good impression on us. Facts of the support:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Conclusion of the review: Is 24Option a scam or a good CFD Broker?On this page, we have given you a detailed overview of the CFD Broker 24Option. In our opinion, this company is not a fraud. The broker offers you speculative financial products, which of course also have a risk, but offer a high chance of profit. A trader should always be aware of the risk. High profits can be achieved with reasonable risk. For us, 24Option is a good overall winner in online trading. The broker offers favorable conditions for international trading and is very competitive due to its low spreads. We scored with the low minimum deposit, the differentiated selection of values, and the customer support. In addition, the fees are quite small compared to other providers. 24Option is definitely an interesting broker for beginners and advanced traders looking for a reliable partner. Disadvantages of 24Option:

Advantages of 24Option:

24Option is an average CFD Broker with exclusive support and competitive conditions. (4 / 5) Trusted Broker ReviewsExperienced traders since 2013Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) FAQs- The most asked questions about 24Option:What account types does 24Option offer?24Option has four account types: Basic, Silver, Gold, and Platinum. The basic account supplies the daily market brief, access to the demo account, a dedicated account manager, and access to webinars. The Silver account adds one-on-one, and several other tutorials into the mix and maintenance is free. The Gold account offers free withdrawals, and Platinum account holders enjoy spreads. What fees does 24Option charge?24Option’s fee structure is relatively pricier than that of other brokers. While no deposit, financing fees, and commissions are charged, there is a €10 maintenance fee. Dormant accounts are charged up to €200 if left unused for six months. Additionally, there are no discounts on large-volume trades, even though the company offers account tiers. Though the first withdrawal is free, you must pay a 3.5% fee on all subsequent withdrawals. The high overall costs have led to some traders turning away from the platform. Does 24Option offer an Islamic account? Are there any charges?The company doesn’t offer an Islamic account. Is 24Option the best broker to learn to trade?24Option has a massive online education center offering tutorials for beginner and intermediate traders. The introductory trading course is especially helpful for complete beginners. In regard to trading education, 24Option is one of the best brokers to sign up with. See other articles about online brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2019-08-27 06:19:532023-01-27 15:52:4724Option |