Forex brokers without swap fees – The 5 best ones in comparison

Table of Contents

See the list of the 5 best Forex Brokers without swap fees:

Broker: | Review: | SWAP-Fees | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | $0 | IFSC | 12000+ | + Fast execution + Regulated by the IFSC + Low trading fees + No hidden costs + Free bonus | Live account from $10(Risk warning: Your capital can be at risk) | |

2. Pepperstone | $0 | FCA, ASIC, DSFA, SCB | 180+ | + Many awards + Huge diversity + Many account types + Low spreads + Low commissions | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

3. XM | $0 | IFSC, CySEC, ASIC | 1000+ | + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) | |

4. XTB | $0 | More than 10 regulators | 1000+ | + Multi-regulated + User-friendly + Mobile trading + Competitive spreads + Free demo account | Live account from $1(Risk warning: 72% of retail CFD accounts lose money) | |

5. BlackBull Markets | $0 | FSPR, FSCL | 100+ | + Authorized broker + Multi-regulated + Great support + Low spreads + High leverage | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Introduction

Forex traders use different methods and strategies when trading. They choose the strategies based on the type of financial market, capital and market trend. There are many types of strategies that we can classify into two categories, short- term and long term strategies.

Short term trading strategies are for traders buying and selling within a short time like scalping and day trading. Long term trading strategies is when traders open positions for a long time like two days, a week or a month.

One example of a long term trading strategy is trend trading. When traders open trading positions for more than a day and the position rolls over to the next day, they have to pay a swap fee.

What is a swap fee?

Forex brokers charge swap fees when a forex trader opens a position that remains open overnight. The swap fee is also called the rollover fee. forex traders that open short term positions like an hour or some minutes don’t pay the swap fees.

Swap fees can also stand for the difference in the interest rates of a currency pair. It means that the swap fee varies with the interest of the currency pair. There are two kinds of swap fees to consider when you open a position overnight.

They are known as long or positive swap fees and short or negative swap fees. When you go short overnight on any currency pair like the EUR/USD, you will pay the interest for holding the currency overnight. If you go long on the same pair, you will earn interest for holding the position overnight.

What is a forex broker without swap fees?

These are forex brokers having trading accounts where the forex traders don’t have to pay the overnight fee or the swap interest accrued overnight. These accounts are often called swap-free accounts, which Muslim traders mostly use.

They use it because of their Sharia laws that forbid gambling. Forex brokers without swap fees earn through forex spreads and other trading costs.

List of the five best forex brokers without swap fees in comparison:

1. RoboForex

Founded in 2009, it is a forex broker offering a swap-free trading account to around three million forex traders. It has access to financial markets such as stocks, ETFs, metals, commodities, energies, stocks and forex.

Regulation

RoboForex has regulations from: The International Financial Service Commission in Belize.

Account types and the swap-free account

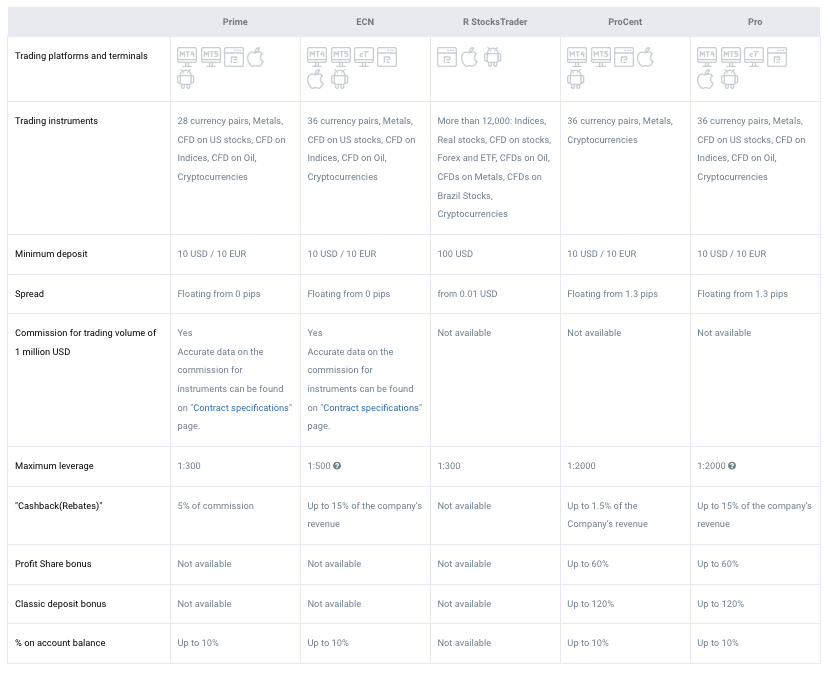

It has 5 types of trading accounts, Prime, ECN, Pro-Cent, Pro-Standard and the R-stocks trader account. These trading accounts have different spreads and commissions that forex traders can choose from.

The swap-free account has fixed commissions, and the charges vary depending on the size of the opened position. The swap-free account in Roboforex uses the Meta Trader 4 trading platform. Swap-free account is available for traders using the Standard and the Pro-Cent accounts, which support MT4.

If a forex trader wants to exchange their trading account to a swap-free account, they can ask customer care for help. Trading conditions remain the same, except for the rollover fees. Commissions for different trading instruments vary, and they are on their website.

Forex traders using the swap-free account have the option of changing from the swap-free account back to the Standard trading account by contacting the support team. Forex traders are required not to have any open positions when they change to swap-free accounts.

Fees of RoboForex

RoboForex has low fees, spreads and commissions for its traders. The average forex spreads for standard accounts range from 1.4 pips and a commission of $6. The minimum deposit is $10 for other trading accounts except for the R-stocks trader, which has a minimum deposit of $100.

You can open position sizes starting from 0.01 lots to 100 lots. It has an inactivity fee of $100 for accounts with no activity for over a year.

Features of RoboForex

- A demo account that forex traders can use to practice risk-free trading using virtual funds.

- It has integrated MetaTrader 4, 5, c Trader, R stocks trader trading platforms with quality trading tools.

- High forex leverage of up to 1:2000

- It has an affiliate programme where traders can get up to 20% of royalty on trades placed.

- Fast execution rates on buying and selling orders due to ECN and STP.

- It has the Expert advisor, MQL4 and MQL5 for algorithmic trading experience.

- Roboforex has research materials through trading analysis from professional traders.

- It has articles, videos and courses for educational purposes, forex traders can also participate in contests to learn more about forex trading.

- The customer care team is available 24/7 through emails, live chat and phone calls.

- It accepts payment methods such as credit/debit cards, bank transfers and digital wallets.

Pros of RoboForex

- Low trading fees

- Fast execution rates

- Social trading available on RoboForex

- Several trading accounts

- RoboForex bonus is available

- Low RoboForex minimum deposit of $10

- Fast deposits and withdrawals on RoboForex

- Negative balance protection

Cons of RoboForex

- It has limited trading instruments

(Risk warning: Your capital can be at risk)

2. Pepperstone

This forex broker was developed in 2010 and has operated for 10+ serving over 50,000 clients in many countries. It offers a wide range of trading instruments such as forex, shares, cryptocurrency, metals and commodities.

Regulation

- It has regulations from tier 1 and 2 regulations

- Regulated by the Financial Conduct Authority of the UK

- Regulated by the Australian Securities and Investment Commission

- Regulated by the Dubai Financial Services Authority

Account types and the swap-free account

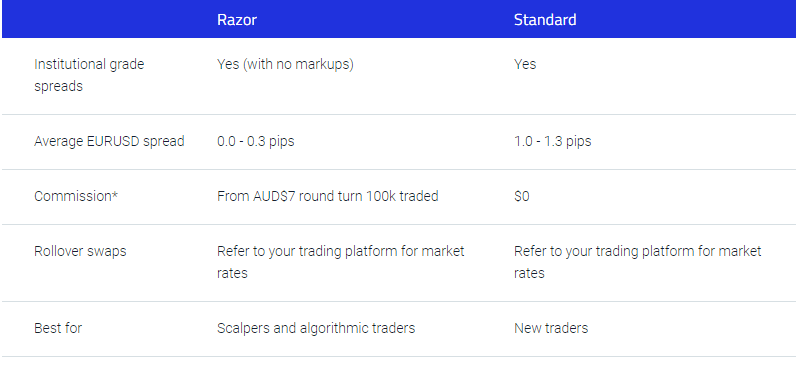

Pepperstone has four types of trading accounts, Edge Standard, Edge Active traders, Razor and the Edge swap-free account. The accounts have similar features, but the Razor account has a commission on trades.

The Edge swap-free account has a minimum deposit of $200 and an average spread of 1.0-1.2 pips. Forex traders cannot use the Razor and the Edge Standard account at the same time as the swap-free account.

It has limited access to exotic currency pairs, and it has an administration fee for open positions past ten days charged per a Standard lot size. These charges are different from the type of asset, and the charges get displayed on the website.

Fees of Pepperstone

The forex spreads start from 0.0-0.3 for the razor account and 1.0-1.3 for the Standard account. The razor account has commissions of $ for a position of $100,000. The Standard has higher spreads but no commissions.

The minimum deposit for opening an account at Pepperstone is $200, and the minimum position you can open is 0.01 lots. The maximum average forex traders can get is 1:200 at Pepperstone. Therefore, the fees on Pepperstone can be considered very low.

Features of Pepperstone

- Pepperstone has a demo account that traders use to practice strategies.

- It has incorporated the MetaTrader 4, 5, c Trader trading platforms.

- It has clear charts and several indicators with other trading tools adding to a heightened user experience.

- Both available trading accounts have access to algorithmic trading from the cTrader

- Traders can access this trading platform via mobile app, desktop and website version.

- It has financial research starting from its experts, Auto-chartist and Expert advisors enabled during live trading.

- Social/copy trading is present via Tradency, Mirror trader, Duplitrade and MyFXbook. It requires a minimum of $5000account balance to start copy trading.

- Forex traders get fundamental and technical analysis from daily news, articles and videos through the website and on its Youtube channel.

- New traders can use its trading tutorials on the learning centre presented as articles, videos and webinars.

- Their customer support is available 24/5 via phone calls, email addresses and live chat.

- Payment platforms include credit/ debit cards, bank transfers, e-wallets such as Skrill, Neteller, PayPal, UnionPay and others.

Pros

- Wide range of trading platforms to choose from

- Low trading fees

- Variety of forex trading tools

- Copy/ social trading

- Negative balance protection

- Low Pepperstone minimum deposit and free deposits in general

- Free withdrawals on Pepperstone

- Fast account opening process

Cons

- Average educational resources

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

3. XM

This forex broker has served forex traders for 14 years since it got founded in 2009. Its users can access trading instruments such as stocks, CFDs, indices, metals and energies CFDs.

Regulation

XM has regulations from:

- Australian Securities and Investment commission

- International Financial Services Commission in Belize

- Cyprus Securities and Exchange Commission

Account types and the swap-free account

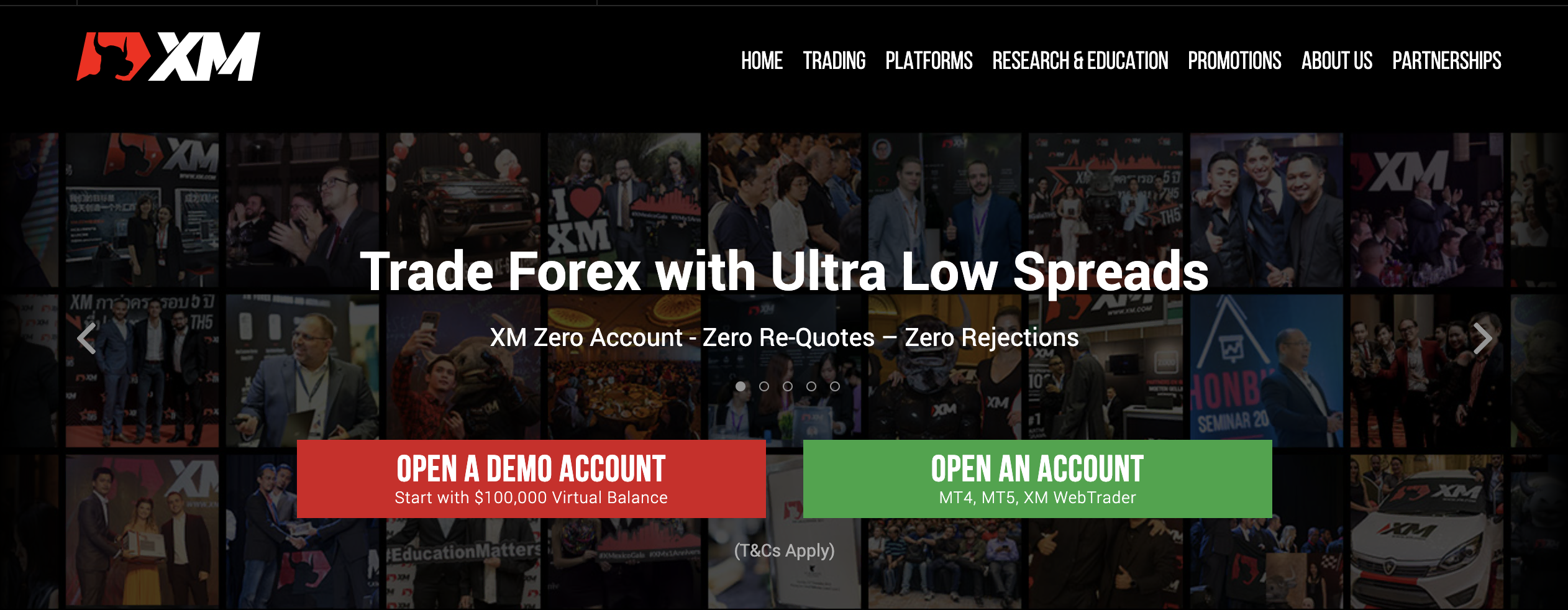

Traders have an option of four trading accounts, Micro, Standard, XM shares and the XM ultra-low account. Features on all the trading accounts include the negative balance protection, leverage starting from 1:1 to 1:888.

Forex traders can convert any of these four accounts at XM to swap-free. The minimum deposit to open a swap-free account is $5, and it uses the MT4 trading platform. The spreads on the swap-free accounts start from 0.0-1.0 pips with zero commissions.

To convert an account to a swap-free account, they apply on the online form on the website. The application form needs some details that after filling in submit and wait for the application to get accepted.

They will need verification of documents using the Know Your Client (KYC) process of identification. If you get accepted, they send a confirmation email of swap-free status. Sometimes they reject traders applications to reduce misuse of the Islamic account.

Features of the swap-free account include no interest charges on overnight positions, fixed commissions and spreads on assets. Other trading factors are the same as other trading accounts based on the type of account before conversion.

Traders can contact the customer support team if they have any clarification regarding the swap-free account on the XM broker.

Fees of XM

The forex spreads start from as low as 1.0 pips, but for the XM ultra-low, it starts from 0.6 pips. There is no commission for other trading accounts except for the XM Zero account. The leverage for all trading accounts starts from 1:1 to 1:888 that traders can choose from.

Countries in the EU and the US can access leverage starting from 1:30 because of the regulations. The minimum deposit to open a trading account is $5, and traders can open positions starting from0.01 lots. It also has an inactivity fee of $15 per month for inactive accounts for 12 months.

Features of XM

- The XM demo account has $100,000 virtual money and provides a similar effect as trading in the live trading account.

- A free VPS which traders can use to eliminate lagging and improve the execution speed.

- XM has integrated the MT4, MT5 and the XM web trader as trading platforms with advanced trading tools.

- Traders can use the MQL4 and 5 for automated trading and an additional Expert Advisor that generates trading signals from the financial markets.

- It offers a library of educational materials from videos, seminars, courses. It also has webinars hosted by an expert instructor and is one of the best.

- Traders can find research materials, starting from financial news, trading ideas, technical and fundamental analysis.

- Its platform is easily accessible through its mobile app, desktop and web trading version that has access to Meta Trader 4 and 5.

- The customer support is present 24/5 in 25 languages via live chat, email or phone calls.

- There is no deposit or withdrawal fee and traders can use credit/debit cards, bank transfers and e-wallets.

Pros of XM

- Quality educational materials

- Low minimum deposit on XM trading of $5

- It is a secure trading platform owing to regulation from the tier 1 and 2 jurisdictions

- User-friendly platform for all traders

- Fast execution rates

- Free withdrawals on XM

- Several trading tools from the leading trading platforms

Cons of XM

- Limited portfolio of trading instruments in the EU

- Customer support is only present for 5 days a week

(Risk warning: 75.59% of retail CFD accounts lose)

4. XTB

It is a publicly-traded forex broker founded in 2002 that has clients worldwide and offices in 11 countries. It has to access trading instruments like forex, commodities, stocks, indices, CFDs, ETFs and indices.

Regulation

XTB has regulations from several financial regulators:

- Financial Conduct Authority in the UK

- International Financial Services Commission in Belize

- Polish Securities and Exchange Commission

- Cyprus Securities and Exchange Commission

- Financial Sector Conduct Authority from South Africa

Account types and the swap-free account

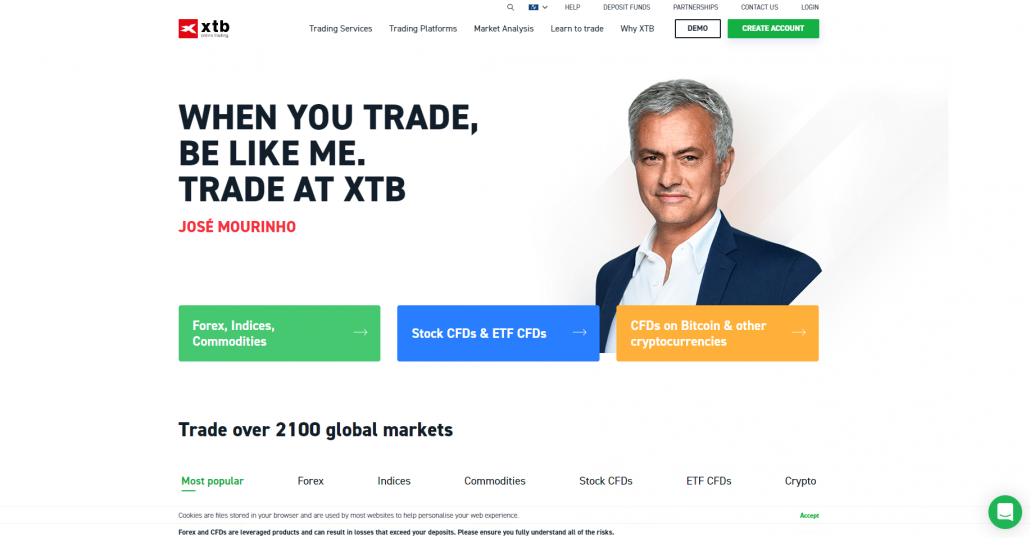

There are two accounts that users can open, Standard and the Pro account. The most accessible is the Standard account which has no minimum deposit, and traders can open positions from as low as 0.01 lots. The pro account is for expert and professional traders who trade higher volumes.

It has a swap-free account that traders can open or swap with the Standard account. Its users can access over 2100 trading instruments such as forex, commodities, stocks, indices, CFDs, ETFs and commodities. It has high leverage of 1:500, which changes at times.

The average forex spreads range from 0.7 pips, and the minimal trading position you can open on the swap-free is 0.01 lots. It uses the X station 5 trading platform, also available on the web version, mobile app and the desktop with the swap-free account.

XTBs swap-free account has no commission for trading indices, commodities, forex, stock and ETF CFDs. Yet, you cannot access cryptocurrency on the swap-free account. They don’t charge anything to set up the account.

Forex traders on XTB can go to the website to look at other fixed commissions charged on other trading assets through the XTB website.

Fees

The spreads and fees on XTB are low. They offer forex spreads from 0.5 pips on the standard account. The maximum leverage is 1:500, and it has no commissions charged on CFDs, EFTs, forex, indices, cryptocurrency and commodities.

The pro account has commissions but spreads starting from 0.01 pips. It has an inactivity fee of $10 if there are no activities on a trading account for more than a year.

Features

- XTB has a demo account that traders use to check the its trading platform and has a limit of 30 days.

- It uses the MetaTrader 4, X station 5 trading platforms for the desktop and web versions, whereas the mobile version has the X station, mobile trader.

- X station 5 allows traders to zoom in on different time frames, utilise several indicators and save drawings on the trading charts.

- It also has a notification of events at the bottom of a price chart, more than 30 drawing tools and technical indicators.

- Users can access the social/ copy trading available on XTB mobile, desktop and web platforms.

- It has trading signals from its internal market analysers and third party experts like Thomson Reuters.

- The technical and fundamental research is presented on the X station 5 trading platform and has news, articles and weekly webinars.

- It has researched comprehensive educational content via videos, articles and webinars on its learn to trade section.

- Their customer support is available 24/5 in 16 languages via emails, phone calls and live chat.

- XTB accepts payment methods such as bank transfers, credit/debit cards and e-wallets such as Skrill, Neteller, PaySafe, PayPal and others.

- The minimum deposit on XTB is low compared to many other brokers.

Pros

- A wide range of educational materials for new and experienced traders

- Quality trading tools from top of the range trading platforms

- Low trading fees

- It has a negative balance protection

- High leverage of 1:3000

- Free withdrawals on XTB for most payment methods

- It has regulations from many jurisdictions

Cons

- It has limited trading instruments

(Risk warning: 72% of retail CFD accounts lose money)

5. BlackBull Markets

It is a forex broker founded in 2014 with thousands of forex traders and has headquarters in New Zealand. Blackbull market users can access trading instruments such as trade CFDs, forex and stocks.

Regulation

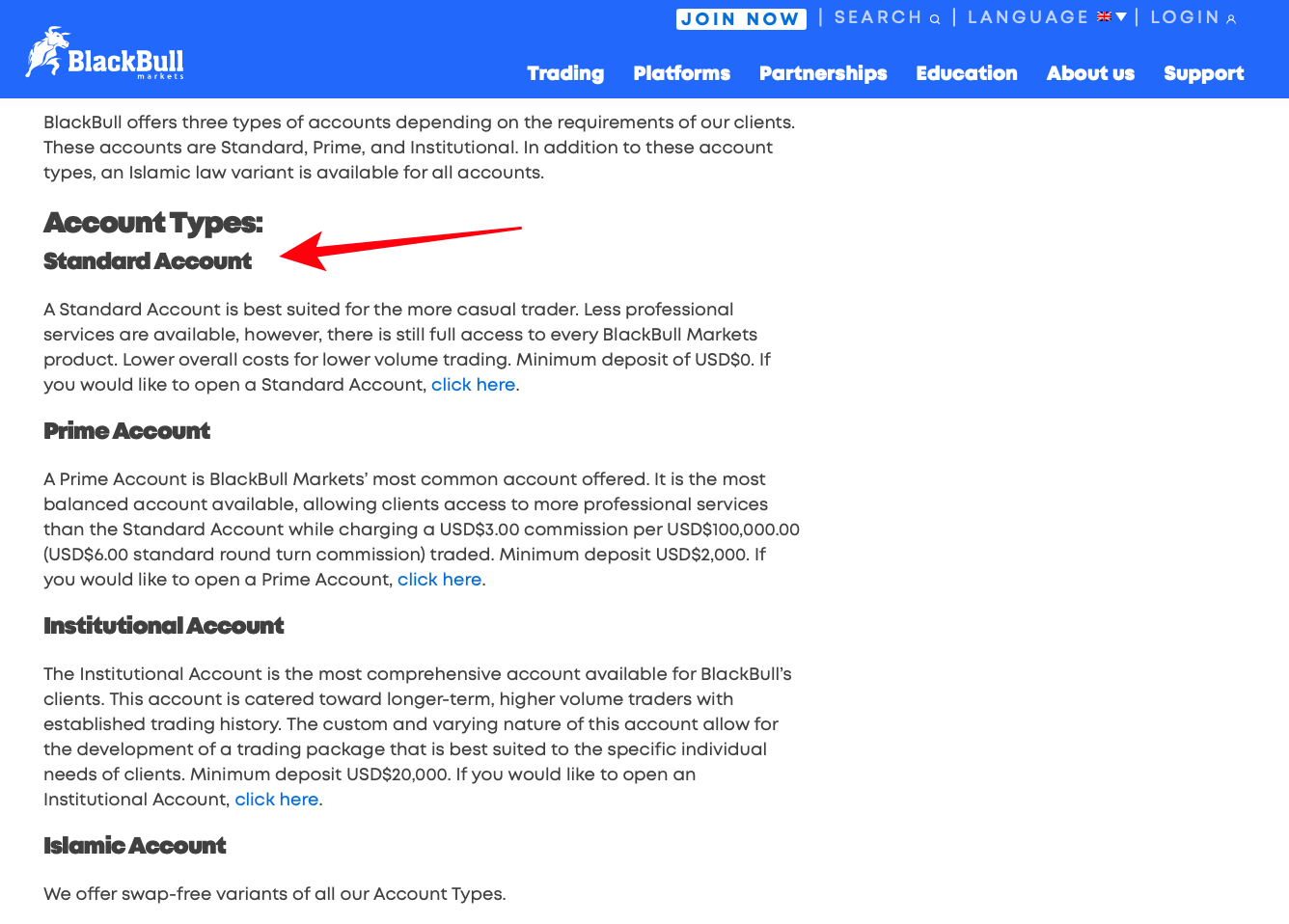

Account types and swap fees

Balackbull markets have three account types, Standard for casual forex traders, Prime account for professional traders. The institutional trading account is for high volume traders.

There is a swap-free trading account that traders can exchange for any three trading accounts. It has all the trading instruments that the Blackbull market offers, and traders can open trades of up to 0.01 micro lots using this account.

This account is for Muslim traders who follow sharia laws against some interests, such as the overnight interest. It has high leverage of up to 1:500, and forex traders can contact customer support to help them set up a swap-free account.

Fees

Forex spreads on Blackbull markets are an average of 0.8 pips for the standard accounts, while the prime and the institutional start from 0.0 pips. The Standard has no commission, but the Prime has a forex commission of $ 6 per round lot.

The minimum deposit varies with the type of account, the Standard has $200, Prime $2000, and the institutional has $20,000. It has no inactivity or deposit fee but a withdrawal fee of $5.

Features

- It has a limited demo account for 30 days, but the client can access virtual funds of up to $100,000.

- Blackbull markets have integrated the Meta Trader 4,5 and web trader trading platforms.

- It offers access to analysis tools, automated trading, expert Advisors, advanced charting software, virtual private suffer.

- The MT5 trading platforms have hedging options, more time frames on charts, increased technical indicators and drawing tools.

- The MT4 and 5 are available on the mobile app and desktop, while the web trader is present on the desktop and the website platforms.

- Copy/social trading applications using Zulutrade and MyFX book.

- It offers both technical and fundamental analysis through daily videos and articles.

- Educational materials on their learning centre consist of video tutorials on various trading instruments. The more educational content in video format is on the Youtube channel.

- Their customer support is available in 15 languages via emails, live chat and phone calls.

Pros

- It has fast execution rates

- MT4 and 5 is available

- Quality trading tools

- Low trading costs

Cons

- No negative balance protection

- Limited research materials.

(Risk warning: Your capital can be at risk)

Conclusion – Swap free accounts have lots of benefits

Swap fees can be costly when trading a high volume of any asset in forex. It is more significant for traders who use long term trading methods that can last for weeks or months. Some forex traders can deal with this cost by accounting for the budget.

Others find it inconvenient when they open a trade overnight for various reasons. It is why forex traders prefer forex brokers without swap fees or swap-free accounts. Muslim traders mostly use it and, is known as the Islamic account.

FAQ – The most asked questions about Forex brokers without swap fees:

How much deposit do you need to open a swap-free account?

The deposit depends on the type of forex broker and the account type you want to open with the swap-free account.

Can I get charged a commission on a swap-free account?

The commissions also depend on the type of forex broker you have. Other brokers have no commission while other accounts have commission. most of these commissions are often fixed and displayed on the website or trading platform.

Is the swap-free account only for Muslim traders?

No, Islamic Sharia laws strictly prohibit some types of interests charged on funds. It is why forex brokers have a swap-free account for Muslim traders. Non-Muslim traders also have the option of opening a swap-free account.

What exactly is a swap-free trading account?

This trading account does not produce swaps, as the name would imply. Brokers charge traders a “swap” as a rollover interest or commission when they hold onto a position for more than a day (overnight). You can trade as a result without paying any overnight costs.

How is swap calculated?

Online brokers typically pay or charge differential interest on currency pairs for positions that are carried over to the following day. You have the choice to hold onto your position overnight after the conclusion of a trading day. Brokers will add (pay) or subtract (charge) this interest from the client’s account, depending on how much interest is generated.

How are swap-free accounts earning money?

Islamic or swap-free accounts only generate income from foreign exchange. It also does away with the prohibition on gambling, which is categorically prohibited by Sharia Law, in addition to the limit on interest.

What does swap mean when trading forex?

Swap refers to the interest given or received for the overnight holding of positions. It might be either negative or positive depending on the currencies’ interest rates you trade. However, most dealers offer swap-free options because not everyone is able to pay or receive such costs.

Last Updated on May 24, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)