BitMEX review and test: Best crypto exchange for margin trading?

Table of Contents

Review: | Assets: | Leverage: | Security: | Volume: |

|---|---|---|---|---|

(4.4 / 5) (4.4 / 5) | Perpetual Contracts, Traditional Futures, Quanto Futures | Maximum of 1:100 | Multisignature scheme, Amazon servers, high wallet security | More than $2.50 billion / 24 hours |

If you’ve been trading cryptocurrencies for a while, you will want to trade in higher volumes than you can afford to. Margin trading is the perfect solution for you – but until recently, there haven’t been a lot of exchanges that offer good leverage. BitMEX has been in the market for years now and is best known for offering up to 100x leverage to traders.

But if it offers high leverage to traders, why isn’t it more popular? Is BitMEX secure? More importantly, is it the right exchange for you? We answer all that and more in this unbiased cryptocurrency exchange review.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

What is BitMEX – introduction of the exchange

BitMEX is short for Bitcoin Mercantile Exchange, and as the name states, it’s a crypto exchange platform that enables derivative trading. Seychelles-based company HDR Global Trading Limited owns BitMEX, but it has offices worldwide. The founders Arthur Hayes, Ben Delo, and Samuel Reed established BitMEX in 2014. The company was financed with funding from family and friends.

While BitMEX is best-known for offering perpetual futures, the company didn’t offer the derivative product till 2016. After introducing the feature, many traders adopted BitMEX as their go-to platform, and by 2018, Ben Delo had become the UK’s first cryptocurrency billionaire.

The company had never been hacked and had a good track record until July 2019, when a Bloomberg report revealed that the Commodity Futures Trading Commission (CFTC) is investigating BitMEX. The CFTC suspected that the company had broken the law by allowing US citizens to trade using the platform.

On October 1, 2020, a little over a year after the initial reports came out, the founding members were indicted for violating the US Bank Secrecy Act. No anti-money laundering measures had been implemented on BitMEX. As of January 2021, all the defendants are at large – Samuel Reed was released only a week after being indicted after paying a $5 million bond.

US IPs are blocked on the platform, and BitMEX’s legal issues make it less trustworthy in traders’ eyes. However, it remains to be one of the leading margin trading exchanges worldwide.

Facts about the company:

- Founded in 2014

- The company is based in Seychelles

- Accepts international customers

- Leading exchange for margin trading

BitMEX – Who it is for:

BitMEX is a lot different from other exchanges since it is primarily a margin trading exchange. You cannot buy and sell cryptocurrencies using the platform directly. To trade, you must buy and sell contracts for crypto and then optionally couple it with leverage.

The platform allows you to trade over a dozen cryptocurrencies, but no fiat currencies are accepted, and you can only deposit and withdraw Bitcoins. When trading Bitcoin, you can use up to 100x leverage. However, leverage is limited to 50x when trading Ethereum and 33.3x when trading Litecoin. However, with high leverage, you can lose a lot of money quickly.

If you primarily trade Bitcoin, BitMEX is right for you since it offers both spot and futures trading options. However, if you also trade other currencies, you will only be able to trade them in a futures market.

It’s important to note that since BitMEX uses Bitcoin as the engine, the profits you make and also your losses will be represented in Bitcoins and not in fiat currency. Here’s a quick look at the type of contracts available on BitMEX:

Available contracts:

The exchange gives you access to four different derivative products:

- Traditional Contracts: These represent an agreement to buy or sell a cryptocurrency at a specified time and price in the future. These are available for all cryptocurrencies on the platform.

- Perpetual Contracts: These are similar to traditional contracts, except there is no expiry like traditional contracts have. Perpetual contracts are only available for Bitcoin.

- Upside Profit Contracts: The buyer can take a chunk of the profits produced from the trade. These are available for Bitcoin only.

- Downside Profit Contracts: The buyer can take a chunk of the losses produced from the trade. These are also available for Bitcoin only.

BitMEX is an excellent option for experienced crypto traders that want to trade futures and swaps. The interface poses too steep of a learning curve for a casual trader – if you’re a beginner, BitMEX is not the right exchange for you.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

BitMEX regulation and safety

BitMEX enables millions of users to trade over a dozen cryptocurrencies, but it is a fully Bitcoin-denominated exchange. To trade on the exchange, you will need to use a spot exchange to buy BTC with fiat currency. You must then transfer it to your address before you can begin trading. Top traders prefer using BitMEX to trade crypto, and it has a trading volume of over $3 billion per day. The company understands the criticality of having the right security measures in place.

Security measures:

BitMEX boasts some of the industry’s best wallet security, which is one of the reason’s why it has never been hacked. BitMEX was one of the first companies to employ a multi-signature withdrawal and deposit system. Every address that BitMEX issues work on approval from multiple parties and most of the funds are stored in an air-gapped state.

Even if hackers manage to compromise the company’s security and take over the servers, the trading engine, and all the databases, they wouldn’t have access to enough keys to steal funds. But that’s not even the most impressive part.

BitMEX ensures that every withdrawal is audited by hand – not once, but twice before it’s finalized. Also, private keys are not stored on servers, making the funds that much secure. Every deposit address that the exchange platform encounters is verified by a third-party service, ensuring that the addresses contain the keys managed by the company’s founders.

If an address’s public key does not match up, the trade is halted and reported to BitMEX employees. The company may not be regulated, but features like these make it just as secure.

BitMEX uses Amazon Web Services to store data and host its platform. AWS is known for its world-class security. The company’s trading engine is also one of a kind – it is entirely written in kdb+, which is only used by major banks for aiding customers with high-frequency trading.

While it doesn’t come enabled by default, BitMEX offers a two-factor authentication feature, helping you protect your account from unauthorized access. Users can also enable strict IP pinning to get notified when their account is accessed from an unknown device. Furthermore, withdrawal requests must be authorized by the user via a link in the email.

- BitMEX has never been hacked

- Multi-signature deposit and withdrawal system

- Withdrawals are audited by hand

- Amazon Web Service

- IP-Address blocks

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Hacking attempts and security slip-ups

As mentioned earlier, BitMEX has never been hacked before. The company’s security measures act as an effective defense against hackers. BitMEX’s proven track record speaks volumes about its security.

However, in October 2019, the company slipped up and revealed a thousand user email addresses to its employees in an internal email. While no users were hacked and the platform remained safe, the slip-up is a sign of mismanagement and could potentially lead to a security breach.

Although the company boasts that it audits over 100 transactions every second, the legal issues it has been dealing with coupled with the email leak make the company difficult to trust.

Regulatory compliance

BitMEX is registered in the Republic of Seychelles. It is owned by HDR Global Trading Limited and is licensed under the International Business Companies Act of 1994. The company number is 148707. While the licensing legitimizes BitMEX for traders worldwide, according to the terms of service and as evident by the company’s current legal issues, it does not operate in the United States of America.

Consequently, BitMEX has not obtained the BitLicense, which is an agreement that guarantees that a company will actively work to prevent money laundering. The founders of the company were indicted after the CFTC investigation, and the UK Watchdogs are still investigating BitMEX to determine whether the platform falls in line with current legal requirements.

The lack of compliance with regulatory authorities and the prevailing legal issues have led to a reduction in trust for the company by traders in its niche audience.

On October 1, 2020, the founders were indicted for violating the US Bank Secrecy Act. However, all the defendants are currently at large. Samuel Reed, the CTO, was released from custody after paying a 5-million-dollar bond.

A little after their arrest, it was announced that the founders are stepping down from their respective roles. On January 7, 2021, it was revealed on a BitMEX blog that the company now has a fully verified userbase and complies with the US’s know-your-customer laws. However, the company is still not available for use by crypto traders in the country.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Trading conditions, offers, and fees for trades

The ease of making an account is one of the best things about BitMEX. You don’t have to upload any documents or even supply a new photo to use the exchange.

You can begin trading right after you create an account. Since there are no account levels, your account is not subject to any trading limits. You’ll have full flexibility in trading and withdrawing your funds after completing your registration. However, if you activate the two-factor authentication feature and lose your authenticator device, you will need to submit identification documents to reset the code.

In summary, all you need is an email address, consent that you are over 18 years old, and confirmation that you don’t live in the US to use BitMEX. It is one of the handfuls of exchanges that lets you trade anonymously.

The competitive fees make BitMEX the go-to option for high-volume traders that prefer margin trading.

BitMEX fees:

The fee structure might change because of the market conditions.

Perpetual Contracts:

| Asset: | Leverage: | Maker Fee: | Taker Fee: | Long funding: | Short funding: | Funding interval: |

|---|---|---|---|---|---|---|

| BITCOIN (XBT) | 100x | -0.0250% | 0.0750% | 0.0100% | -0.0100% | Every 8 hours |

| BITCOIN CASH (BCH) | 25x | -0.0250% | 0.0750% | 0.1220% | -0.1220% | Every 8 hours |

| CHAINLINK (LINK) | 50x | -0.0250% | 0.0750% | 0.2500% | -0.2500% | Every 8 hours |

| ETHEREUM (ETH) | 50x | -0.0250% | 0.0750% | 0.1626% | -0.1626% | Every 8 hours |

| LITECOIN (XRP) | 33.33x | -0.0250% | 0.0750% | 0.0760% | -0.0760% | Every 8 hours |

| RIPPLE (XRP) | 50x | -0.0250% | 0.0750% | 0.1524% | -0.1524% | Every 8 hours |

Traditional Futures:

| Asset: | Leverage: | Maker fee: | Taker fee: | Settlement fee: |

|---|---|---|---|---|

| BITCOIN (XTB) | 33.33x | -0.0250% | 0.0750% | 0.0500% |

| BITCOIN CASH (BCH) | 25x | -0.0250% | 0.0750% | 0.0500% |

| CARDANO (ADA) | 50x | -0.0250% | 0.0750% | 0.0500% |

| EOS TOKEN (EOS) | 25x | -0.0250% | 0.0750% | 0.0500% |

| ETHEREUM (ETH) | 50x | -0.0250% | 0.0750% | 0.0500% |

| LITECOIN (LTC) | 25x | -0.0250% | 0.0750% | 0.0500% |

| RIPPLE (XRP) | 33.33x | -0.0250% | 0.0750% | 0.0500% |

| TRON (TRX) | 25x | -0.0250% | 0.0750% | 0.0500% |

Quanto Futures:

| Asset: | Leverage: | Maker fee: | Taker fee: | Settlement fee: |

|---|---|---|---|---|

| BINANCE COIN (BNB) | 33.33x | -0.0250% | 0.0750% | 0.0000% |

| CARDANO (ADA) | 25x | -0.0250% | 0.0750% | 0.0000% |

| CHAINLINK (LINK) | 50x | -0.0250% | 0.0750% | 0.0000% |

| EOS TOKEN (EOS) | 25x | -0.0250% | 0.0750% | 0.0000% |

| ETHEREUM (ETH) | 50x | -0.0250% | 0.0750% | 0.0000% |

| POLKADOT (DOT) | 25x | -0.0250% | 0.0750% | 0.0000% |

| TEZOS (XTZ) | 33.33x | -0.0250% | 0.0750% | 0.0000% |

| YEARN. FINANCE (YFI) | 25x | -0.0250% | 0.0750% | 0.0000% |

BitMEX limits and liquidation

As mentioned earlier, BitMEX does not require any verification, and there are no account levels, either. There are no withdrawal limits for any user. However, there is a minimum deposit you must make to trade. The minimum amount is not fixed and varies from trade to trade.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Test of the BitMEX trading platform

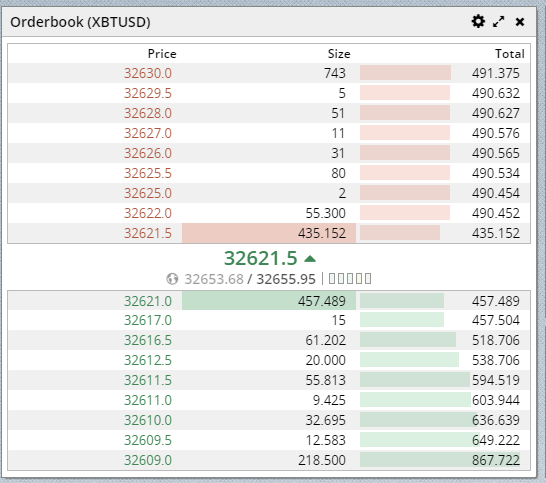

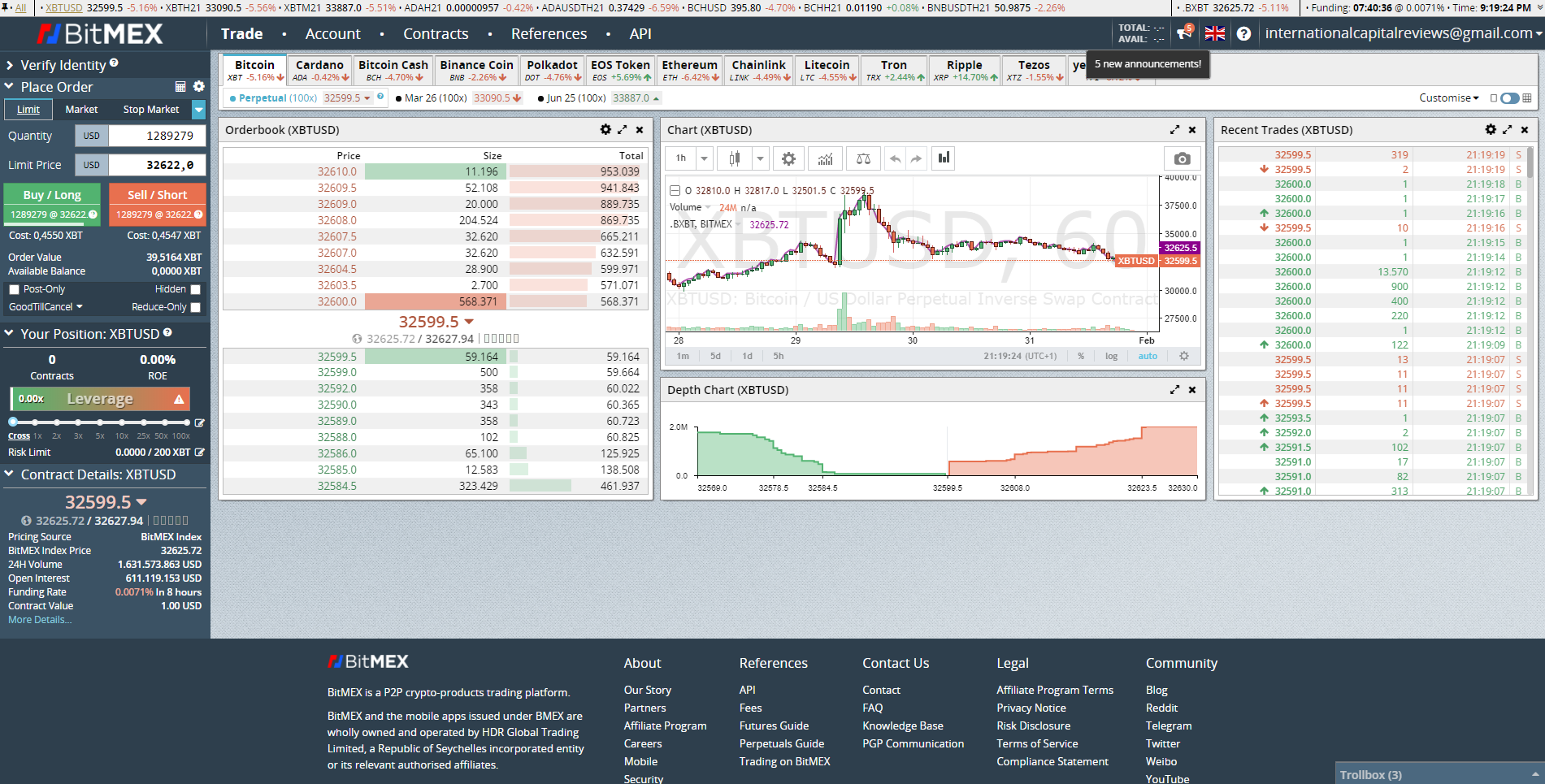

The BitMEX interface feels a little outdated at first glance, but it has all the features a crypto trader needs to make smart trades. You can customize several widgets freely, enabling you to personalize the interface according to your needs. TradingView gives you clear visibility of the chart, and you can also change how the chart looks.

See a screenshot of the desktop platform:

The column on the left shows you your position and contact details, and the place order section on the top-left helps you quickly buy and sell your currencies.

The center of the screen is split into four sections. The order book section gives you an overview of all the currently open buying and selling orders. The recent trades section is right next to it, giving you a look at what other traders are doing. The third section gives you an overview of your positions, active orders stops, fills, and also gives you access to your order history.

The chart is at the very bottom of the screen. You can switch the representation, change the time interval, and search through and use one of the many indicators. BitMEX’s chart is loaded with all the tools you will ever need to trade smarter. It is also possible to use a full-screen version or change the columns.

BitMEX’s interface is very useful by default, but the fact that it is customizable makes it much easier to use. If you don’t use a certain section, you can simply get rid of it.

The web-based trading platform is solely designed for desktop use – which is certainly not a dealbreaker since the interface is too complex to work with on a mobile phone. If you’ve used other trading platforms, you will agree that it is not beginner-friendly while the interface is intuitive.

Mobile App

Until a few months ago, BitMEX users would need to rely on an unofficial Android application to use the platform. However, the company recently released its mobile app allowing you to trade on the move. It is available on both Android and iOS.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

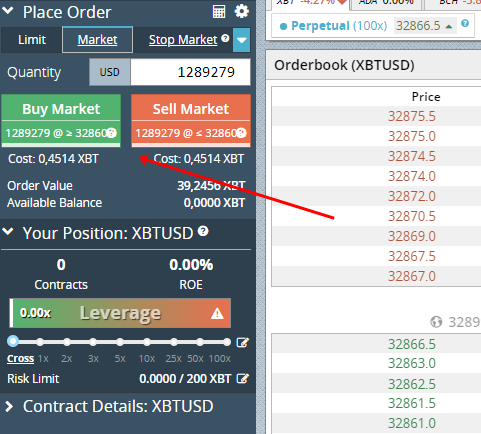

How to trade with BitMEX?

To trade with BitMEX:

Step 1: Deposit funds

Navigate to the interface, and click on the “Account” tab at the top of the screen. You will be redirected to your wallet.

You must then click on the “Deposit” button and copy your wallet address. Alternatively, you can also scan the QR code and deposit Bitcoin into the wallet.

Step 2: Select your cryptocurrency

Click on the “Trade” button at the top of the interface. From the trading screen that opens up, select the cryptocurrency you want to trade.

Step 3: Set the details of your trade

Type in the order you want to place on the column on the left side of the screen. Also, enter the quantity you want to buy or sell in US dollars.

Next, use the slider under the order box to set your leverage.

Step 4: Open your position

If you believe the price will rise, click on the “Buy Market” button. On the other hand, if you believe the price will fall, click on the “Sell Market” button.

An order confirmation screen will pop up with all the details of the order. Review the order’s details and then click on the “Buy” or “Sell” button to open your position.

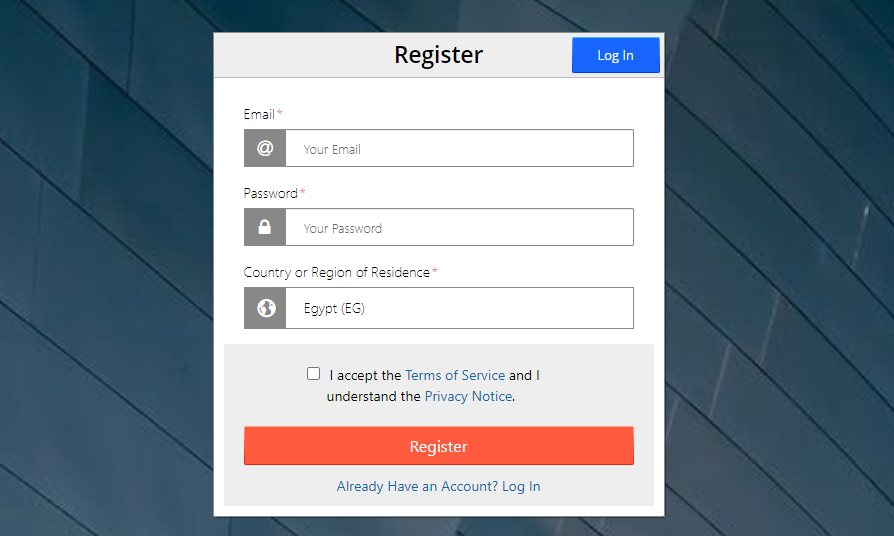

How to open an account with BitMEX?

BitMEX makes opening an account a lot easier than other exchanges do. All you have to do is:

- Navigate to bitmex.com.

- Click on the “Register” button.

- Enter your name and email address, then set your password and create your account.

- Confirm your email address using the email that will appear in your inbox shortly.

And that’s it; you are ready to trade with BitMEX. No verification procedure is required, and BitMEX is one of the only exchanges that enable you to trade anonymously. You can find your BTC address by clicking on the “Deposit” button on the homepage. You must wire some Bitcoin to this address so you can begin trading.

The best alternatives for crypto traders: Trade cryptocurrencies CFDs with the best conditions and a regulated broker

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20 by card: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

BitMEX Privacy

The company shares your data with the subsidiaries of the HDR Group to improve its services. The data is also shared with some third-party vendors so the business can function.

However, the data the company collects is kept secure. Every BitMEX system requires multiple authentication forms to grant access, including hardware tokens. While individual systems can communicate with each other, they can only do so across approved secure channels that are monitored 24/7.

(Risk Warning: Your capital can be at risk)

Does BitMEX offer demo accounts? -Testnet

While the BitMEX interface is not the most beginner-friendly, the TestNet demo account the company supplies attract new crypto traders to the platform. After you make an account on BitMEX, you get access to a demo version of the platform, allowing you to practice trading strategies without needing to risk any funds.

The practice platform has a green version of the BitMEX logo, enabling users to distinguish between the two versions.

Is there a Negative Balance Protection in BitMEX?

Yes, BitMEX does offer negative balance protection. Consider the following instance – you trade margin cross, and your account’s balance is used to cover any potential loss. In other words, your account’s balance is your collateral.

If the trade goes your way, you will make a considerable profit. If the trade goes wrong, you will lose all of your money – but your balance will never dip under zero. The liquidation price mechanism, coupled with the negative balance protection, safeguards you from getting into debt.

BitMEX deposits and withdrawals

As mentioned earlier, the platform does not charge any fee for deposits or withdrawals. However, since the platform works on Bitcoin, you will need to pay the Bitcoin Network fee as you always need to. Those fees are set dynamically and depend on the load of the Bitcoin blockchain.

Support and service

Another big advantage of using BitMEX is that the website is packed with information and features. If you’re a complete beginner, the support center offers all the information you need to get started and make profitable trades.

If you need support, you can open an email ticket, or if you have a more general inquiry, you can use “Trollbox.” It is a public chatbox where traders interact with each other and answer each other’s queries. There is no telephone support, but we don’t consider it a dealbreaker since most crypto exchanges don’t have one.

Accepted countries and forbidden countries

Besides the USA, the exchange does not work in:

- Cuba

- Crimea

- Sevastopol

- Ontario, Canada

- Quebec, Canada

- Hong Kong

- Iran

- Syria

- Seychelles

- Bermuda

- Crimea

- Sevastopol

- Sudan

- North Korea

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion on our BitMEX review: Good exchange for margin trading

The feature-loaded interface, demo trading features, decent security measures, and excellent support make BitMEX an enticing exchange. However, the ongoing legal issues and the 2019 security slip up make the company harder to trust.

More mainstream exchanges, including Binance, have added support for leverage trading. While BitMEX is a great platform, we’re reasonably skeptical about the security measures taken. For practicing trading strategies using a demo account, BitMEX is an excellent option. But if you want to trade in large volumes and make use of a lot of leverage, you’re better off using Binance, eToro, Plus500, or ByBit.

Advantages of BitMEX:

- High-security features

- Fast deposits and withdrawals

- High leverage possible up to 1:100

- Free demo account

- High liquidity and volume

- API trading possible

BitMEX is the perfect cryptocurrency exchange for professional traders. But the interface is maybe not suitable for new beginners.

Trusted Broker Reviews

Experienced traders since 2013Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about BitMEX :

What are the trading fees of BitMEX?

No fees are assessed for deposits or withdrawals on BitMEX, as the platform solely deals in Bitcoin. The modest but contract-specific trading fees are based on the structure of the contract itself, the cryptocurrencies and fiat currencies involved, and the volume of trading.

Is BitMEX a secure platform?

BitMEX has never been hacked in part because it has some of the most significant wallet security in the business. Private keys are not kept on servers, which makes money even safer. A third-party provider checks the deposit addresses encountered by the exchange platform. BitMEX’s data storage and hosting infrastructure is built on Amazon Web Services.

What is the limitation of BitMEX?

There is no verification process on BitMEX, and no different account tiers are available to users. Free withdrawals are available at any time. On the other hand, you’ll need to put down at least some cash before you can start trading. There is no fixed amount, and it varies from market to market.

Is there a trial version of BitMEX?

The BitMEXTestNet demo account attracts novice crypto traders, even though the interface isn’t beginner-friendly. After signing up for BitMEX, you’ll have access to a risk-free demo version of the site, where you may try out different trading methods.

More articles about crypto exchanges:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)