ETX Capital review and test – How good is the online broker?

Table of Contents

| Review: | Regulation: | Min. Deposit: | Assets: | Spreads: | Education: |

|---|---|---|---|---|---|

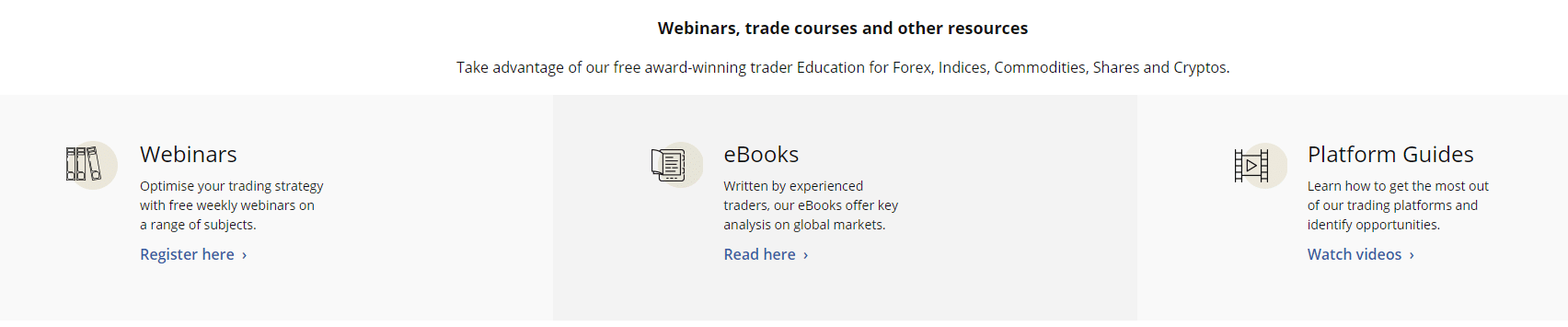

(4.9 / 5) (4.9 / 5) | FCA (UK) | 250$ | 5,000+ Forex, Stocks, Indices, Commodities, Cryptocurrencies | Starting 0.6 pips | Webinars, eBooks, Tutorials, Coachings |

Should you open an account with the Forex and CFD Broker ETX Capital or not? – With more than 10 years of experience in online trading we will test the broker in the following review. We will give you a deeper look into the conditions for trading online and the trading platform. Learn about what does the online broker ETX Capital is offering its traders. Should you invest your money? – Find out in the next sections.PreviousNext

What is ETX Capital – The company presented:

ETX Capital is a solid company that was launched into the CFD business fifty years ago (Monecor Ltd). The FCA is regulating it. There’s a broad range of trade on ETX Capital, a top industry-leading forex trading platform with a healthy and competitive spread. The CFD Broker is known to provide a flexible trading encounter for customers and gives additional helpful materials like educational materials for clients.

Brokers like ETX Capital offers all their clients permission to access top competitive prices in more than 5,000 several markets as well as balanced management of their customer services. Though the platform has many supporters or fans from all over the countries across the world, its main headquarters is in London. ETX Capital is the popular name for Monecor in London, a big company behind ETX Capital.

The Financial Conduct Authority authorizes it under the Financial Services Register. Monecor London, as a company, was launched in 1965. It is also rooted in the London Stock Exchange (LSE). It is important to note that CFDs are broad tools and can be accompanied by a high risk of losing real cash quickly because of leverage. So it is recommended to first watch and understand how CFDs function well, but you may decide to put in your money only if you know the risks involved.

Main facts about ETX:

- Founded in 2002

- United Kingdom-based Forex and CFD Broker

- CFDs and Spread betting

- Internation clients accepted

- More than 5,000 markets

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Financial security for tradersJust as mentioned before, Monecor is the mother company of ETX Capital, listed under LSE. ETX Capital is mainly a UK-based FX brokerage. That is why it is regulated and controlled by the FCA. The ETX Capital Company has a considerable presence in the EU region. Also, it has so many affiliates scatter across the globe in countries like Africa, Russia, and the Middle East. Thus, the CFD Broker is a trusted company that transacts deals in high-quality financial services that do not affect the confidence of its customers in any form. Generally, each online broker that is regulated by FCA always has a fair percentage of regard and accountability towards all their clients, and ETX Capital, in particular, ensures that it complies with the several terms and conditions as regards making sure that their customers are well treated and secured from any form of financial consequences.  Since the FCA regulates the ETX Capital, the Markets in Financial Directive permit the broker to function as a licensed entity in the whole of the European Union. There is a Financial Service Compensation Scheme (FSCS) which safe the client’s money up to £85,000. If a bank or a broker goes bankrupt you are very safe. Fact about financial security:

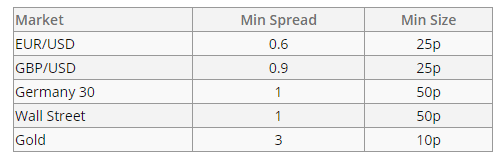

Review of the trading conditions:ETX Capital offers trading with leveraged financial products (CFDs) and Spread Betting. More than 5,000 different markets are available. This includes forex, commodities, stocks, indices, cryptocurrencies, and more exotic assets. The leverage is 1:30 for retail clients and 1:500 for professional clients because of the new regulation.  When it comes to spreads the broker only offers spread-based accounts. The advantage of this is that you pay no commission on most of your trades (some assets can include commissions). The spread is starting with 0.6 pips in forex and 1 point in indices. The trading costs are very competitive with other CFD Brokers. A trader can open a free demo account or a live account. The minimum deposit for real money trading is 250$. In addition, different base currencies are offered for the trading account. ETX Capital provides a very fast execution by using large and trusted liquidity providers. All in all, the company provides very good conditions for investors. Trading conditions:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) ETX Capital trading software testAs excellent researchers, we have spent several months studying several CFD platforms. When we made test research on ETX Capital, the following was what we discovered about the platform. ETX Capital offers two types of trading platforms. There is the MetaTrader 4 and the own developed ETX Trader Pro. Both software is available for any device. You can use your computer, smartphone, or tablet. There is not so much difference between the MetaTrader 4 and the ETF Trader Pro. Both software come with multiple chart types, technical indicators, and customizable tools. Facts about the trading software:

MetaTrader 4 MetaTrader 4 is one of the most popular trading software for many years. A lot of brokers offer this software to trade with. It is highly customizable and if you are able to program you can develop your own indicators or trading systems. Also, automated trading is supported by this software. Trading is quite easy on the platform and you can open trade with only one click by the order window. Create your own strategies and templates which you can duplicate on other charts. Analyzing is not difficult with MetaTrader 4 because you got so many options to do it. ETX Trader Pro The ETX Trader Pro software is developed by ETX Capital. The Software gives you the same tools as the MetaTrader but the interface is much smoother and user-friendly. Multiple chart types, technical indicators, and drawing tools are available for analysis. In addition, you get access to dynamic risk management which helps you to control the risk of different positions very easily. The charts can be customized by drag and drop options which is a huge advantage because you can do it very fast. Especially for beginners, you will get a better overview of the markets than in MetaTrader 4. In conclusion, the ETX Trader Pro is a little bit better than the MetaTrader 4 but does not support automated trading. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Analysis and charting:ETX Capital has different display styles that are accompanied by a broad range of trading tools that meets a trader’s requirement. It is possible to do your research and save the settings just as you want. No stress, it’s just a click on the chart button on the particular market. Right there, you can select the Charts window and click on the kind of selection and style you want.  The style of a chart can be updated just as you want. If you want to make any changes, open the chart by clicking on the search bar. Select the chart image to open a new window, and then click on “Types” and “Charts” to change the style of your chart. You can also get the chart opened in a new browser tab. Navigate to the top right of the chart and click on “Move to New Window.” There are so many indicators provided for ETX Capital charts. You can add or remove them by navigating to the “Studies” tab on the particular chart. Select the symbol you want to remove or add and update the settings. Click on copy and close. After this action, you should be able to see the indicator on your chart. How to trade with ETX Capital:It is either a trader who opens a Spread bet position or selects to make transactions on CFDs. Forex with ETX Capital can be carried out in two separate ways, such as a CFD or as a Spread bet. This is one of the vital decisions to make because it is a core strategy of any trade, and the kind of deal selected may influence the period a position is held open. You can keep going long or short, based on your choice. Note that for the fact that you are forecasting market volatility and the updates in prices of FX markets with either a CFD account or Spread bet account, you may decide to go long or go short, meaning you either Buy or Sell. So depending on your chosen trade as a trader, you may either feel bearish or bullish about the longevity of the particular market.

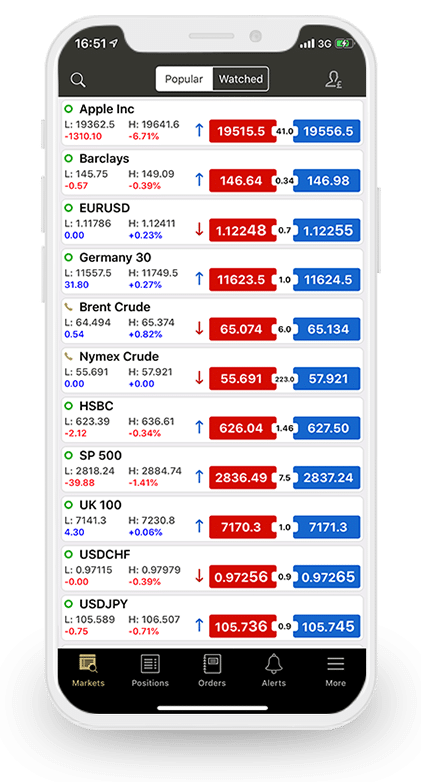

Traders are to manage their risks. The FX market is one of the largest liquid markets across the globe, with various trading activities under it. So, it is advised that when trading or placing your trade, you have to be extra careful to guide yourself from any possible losses, as well as excess market movements. There is a broad range of risk management instruments that are made available to every trader on the ETX Capital platform. These tools are the stop losses, limit orders, and guaranteed Stops, and they are used to control the level of risk on the platform. If you are a new trader, you can begin with a small trade that fits your financial capability. Do not try to over-leverage your account by dealing with transactions that are more than your wallet. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Mobile Trading with ETX Capital It is available on Android of v33.0.0 above and iOS. The application looks just the same as the official website with the same controls and functionalities. All kinds of trade types and offers are the same on the mobile platform, also are the account management features and trade history. ETX Capital clients have free access to the mobile app. The download is fast and straightforward, and the trader can log in with their detail to make a fast trade. Note that the ETX Trader Pro and MetaTrader 4 are available for any device. You only need one account each to get access to the markets on your devices. Advantages of mobile trading:

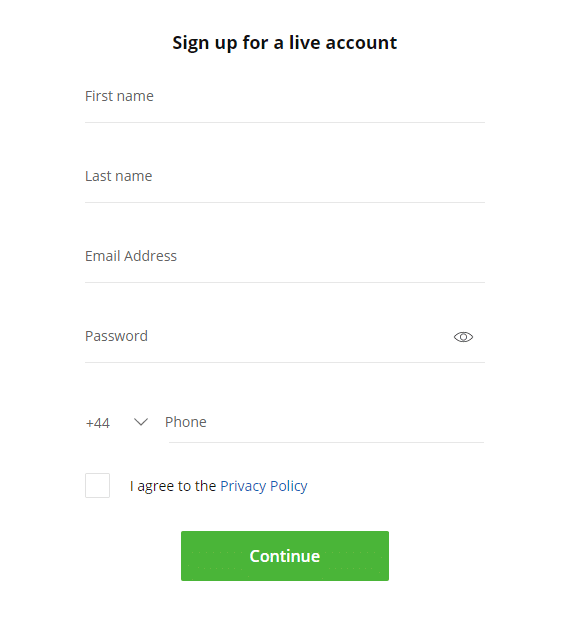

How to open your account:Creating an account on the ETX Capital platform is secure. Just visit the ETX official site and click on the create account button. The system will demand that you select your country of origin from a list. Before you can be allowed to trade on the platform as a first-timer, there are some questionnaires you must answer. You would be asked to input your email, name, country of origin, and functioning phone number. You would be told to select your kind of trading platform, which could be MT4, TraderPro. Also, you will select your currency, which could be USD, EUR, or GBP.  You will then be questioned about your financial background and trading skills. When this information is completed, there will remain two more steps for the trader to complete. You will be asked to verify your account before funding it. Then you have to upload a document to verify your identity and your residential address. These documents can be quickly loaded on the website by dragging and dropping them on the form. Also, you can do it on the mobile app. Funds can be deposited and withdrawn on the ETX Capital platform through several methods. The minimum deposit amount on accounts is £250, or it is equivalent to your chosen currency. Simple steps to open the account:

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|