IC Markets broker review and test – Is it a scam or not?

Table of Contents

REVIEW: | REGULATION: | SPREADS: | ASSETS: | MIN. DEPOSIT: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | ASIC, FSA, CySEC | 0.0 Pips | 2,000+ | $ 200 |

Is IC Markets a serious Forex and CFD Broker or not? – With more than nine years of experience in the financial markets, we tested the company for you with real money. Read our experiences and get a detailed overview of the conditions, advantages, and disadvantages for traders. Is it really wise to invest money with this broker? – Inform yourself now.

(Risk warning: Your capital can be at risk)

What is IC Markets? – The company presented

IC Markets is an Australian No-Dealing-Desk broker that accepts international clients. The address of the broker is International Capital Markets Pty Ltd, Level 6 309 Kent Street, Sydney NSW, 2000 AUSTRALIA. Founded in 2007, the company has a proven track record so far. The secret of the broker is that it provides true and direct market access and has very favorable trading fees for the best technology in trading.

Safety is a top priority at IC Markets. Customer balances are managed separately from company funds at the Australian National Bank (NAB). In addition, the broker has the largest liquidity providers involved, which shows a high degree of seriousness. Therefore, there is a fast execution of orders, and no requotes. High liquidity for traders is provided by IC Markets.

At the moment, the company is expanding in other countries and gaining huge popularity. The company has headquarters in Australia, Seychelles, and Cyprus. Most traders are trading under the Seychelles entity because there is high leverage of up to 1:500 allowed for every customer.

Facts about IC Markets:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2007 |

💻 Trading platforms: | CTrader, MetaTrader 4, Meta Trader 5 |

💰 Minimum deposit: | $200 |

💱 Account currencies: | AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD, HKD |

💸 Withdrawal limit: | None |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes, 5,000,000 limit |

🕌 Islamic account: | Yes |

🎁 Bonus: | No bonus |

📊 Assets: | Forex, commodities, indices, stocks, bonds, crypto, futures |

💳 Payment methods: | Credit and Debit cards, Paypal, Neteller, Skrill, Wire Transfer, Rapidpay, Clarna |

🧮 Fees: | Depending on the account type, variable overnight fees |

📞 Support: | 24/7 via live chat, e-mail, or phone |

🌎 Languages: | Nine languages |

(Risk warning: Your capital can be at risk)

What are the pros and cons of IC Markets?

IC Markets is a broker with an excellent reputation and has been on the market for years. A very good indication of the quality of the broker is their Trustpilot ratings. IC Markets is rated with 4.8 / 5 points and has more than 28,000 reviews. Nevertheless, every broker has its advantages and weaknesses, and we will give you our honest opinion after carefully testing many options on the market.

Pros of IC Markets | Cons of IC Markets |

✔ Offers an educational section for trading beginners | ✘ The platform can be overwhelming for beginners due to the variety of options |

✔ Great selection of trading platforms, compatible with all devices | ✘ Deposit and withdrawal options are limited in some countries |

✔ Industry-leading customer service | ✘ No negative balance protection |

✔ Extremely fair swap rate | |

✔ Huge selection of assets to trade | |

✔ Great for high-volume trading | |

✔ Transparent fee structure and no hidden fees |

Is IC Markets regulated? – Regulation and safety for Traders

Regulation by an official authority is very important for online trading. A license gives the broker a trustworthy relationship with the customer. To obtain such a license, IC Markets must comply with certain rules and requirements. Violating these requirements would mean an immediate loss of the license. Therefore fraud on the customer can be excluded here.

IC Markets is regulated by the ASIC (Australia), FSA (Seychelles), and CySEC (Cyprus). It is an independent institution of the state government agency. Customer money transactions are conducted by National Australia Bank (NAB) and Westpac Banking Corporation (Westpac). These are both top international banks that have high liquidity. In addition, IC Markets uses external and independent auditors who control the broker.

The broker makes a very serious impression on us, and we can assume that this is not a scam:

- Regulation by the ASIC in Australia

- Regulated by the FSA in Seychelles

- Regulated by the CySEC in Cyprus

- Separate accounts at major banks

- The external auditor of the broker

See some partners of the broker:

(Risk warning: Your capital can be at risk)

IC Markets and the ESMA regulations

In 2018, the leverage on derivative financial products Forex and CFDs in Europe was extremely limited. European brokers can only offer a maximum leverage of 1:30 to customers. This is meant to protect private investors but ultimately destroys various strategies and opportunities for traders. It is not possible to prevent traders from losing money on the stock market because you always take a risk. Even with small leverage, European traders will lose money.

IC Markets is located outside the European Economic Area and is not affected by this regulation. Traders continue to hold leverage of 1:500 on this broker with the Seychelles license.

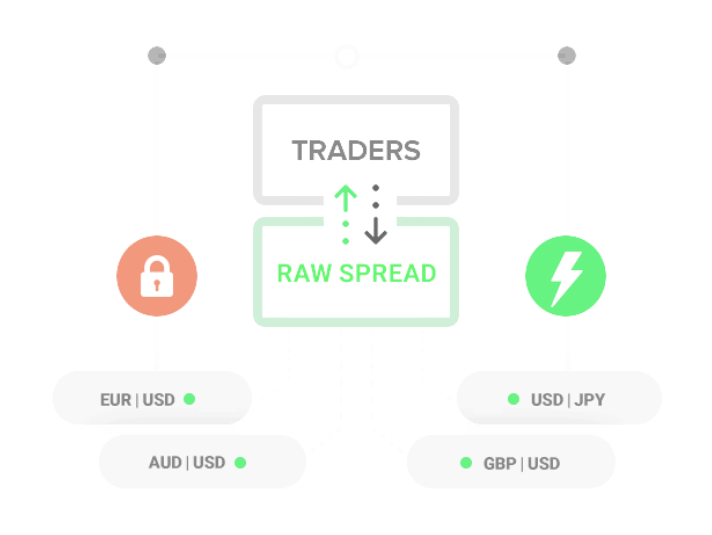

The big advantage for customers: It is a real direct market access broker

IC Markets is actually one of the few direct market access brokers. The company also gives private traders access to institutional trading via raw spread access. IC Markets only earns money at the commission per order execution or spread (STP), and a conflict of interest is 100% excluded! The website also directly recognizes the broker’s liquidity providers. These include major international banks, which provide direct access to the interbank market.

A monthly volume report can also be viewed transparently on the homepage. More than $ 1,000 billion was transacted in 2021 in a single month.

(Risk warning: Your capital can be at risk)

Is IC Markets easy to use?

In this segment, we will discuss and rate the user experience of IC Markets. Every rating will also depend on personal preferences and is therefore not 100% objective.

Criteria | Rating |

General Website Design and Setup | ★★★★★ structure and design of the website are easy to understand and navigate |

Sign-up Process | ★★★★★ Sign-up process for a demo account is extremely easy and quick |

Usability of trading area | ★★★★ Good selection of trading platforms available for all preferences |

Usability of mobile app | ★★★★★ Website is optimized for mobile users, and dedicated mobile app is available |

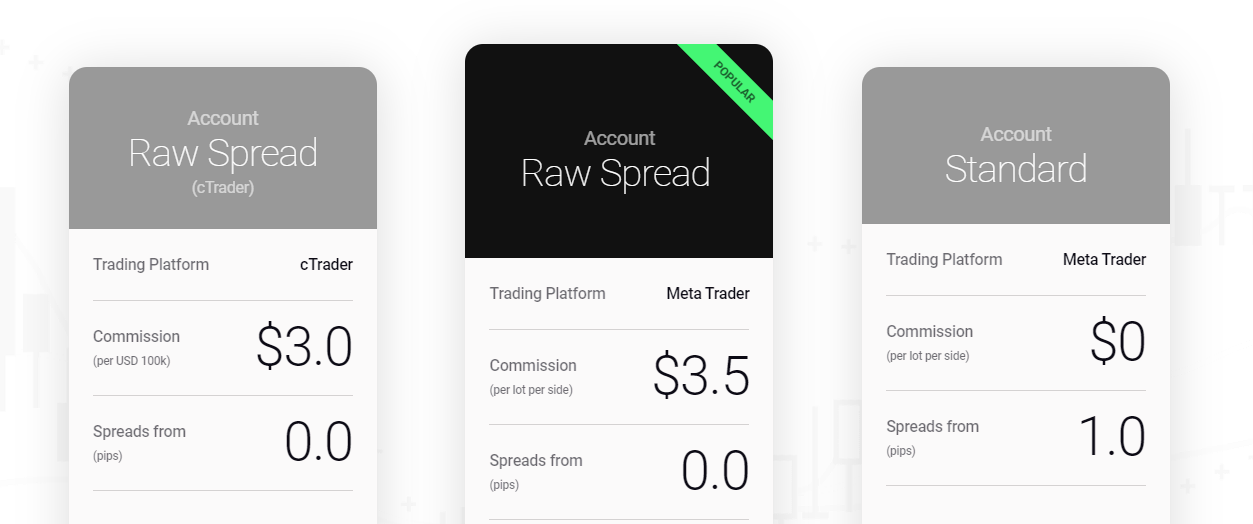

The offer and conditions for traders – What can you trade? – Fees and more

IC Markets offers to trade in forex (currencies), CFDs (bonds, indices, commodities, cryptocurrencies), and futures. There are more than 2,000 different assets available. The conditions are perfect from my experience and test. In comparison, you can rarely find cheaper and safer brokers.

The spreads start at 0.0 pips, and the commission is $ 3 per trade for $ 100,000 in cTrader. In the Metatrader, the commission has been increased by 50 cents to $ 3.50. A change to this broker is worthwhile even because of the low fees for trading.

See the account types and trading fees:

| ACCOUNT TYPES | |||

|---|---|---|---|

| ASSET: | Standard account | Raw Spread account (MetaTrader) | Raw Spread account (cTrader) |

| FOREX: | From 1.0 pips variable | From 0.0 pips | From 0.0 pips |

| FOREX COMMISSION: | No | $3.5 per 1 lot traded | $3.0 per 1 lot traded |

| DE30 (NO COMMISSION) | 0.95 points | 0.95 points | 0.95 points |

| S&P500 (NO COMMISSION) | 0.6 points | 0.6 points | 0.6 points |

| US30 (NO COMMISSION) | 2.3 points | 2.3 points | 2.3 points |

| OIL (NO COMMISSION) | 0.040 | 0.040 | 0.040 |

| GOLD | 1.0 points | 0.0 points + $3.5 per 1 lot traded | 0.0 points + $3.0 per 1 lot traded |

| BITCOIN (NO COMMISSION) | $5 | $5 | $5 |

Forex

As discussed before, IC Markets is one of the largest forex brokers, with 61 currency pairs available to trade. The spreads are super low, especially if you are using the raw spread account. There is a real 0.0 pip spread on more than ten currency pairs. Furthermore, you can see in the order book that there are high liquidity and reasonable pricing for retail traders. It is one of the best FX providers.

Commodities

More than 28 different commodities are available for trading via CFDs. You can go long or short on them. The conditions are quite good here, too. It is possible to trade Brent, Cocoa, Coffee, Corn, Soybean, Sugar, Wheat, WTI, and some more commodities. The spreads are very low, and there is no commission for trades.

Indices

Indices are very popular among traders. There are 25 indices from all over the world available. You will pay no commissions and get a low spread here. For example, the NASDAQ indices are available from 2.0 points minimum spread.

Cryptocurrencies

Cryptocurrencies are hyped right now, and you can trade them on IC Markets via CFD 24 hours per week. You will pay no commissions and a low spread. The funny thing here is that it is cheaper to trade CFDs on IC Markets than buy the actual currency on an exchange.

Shares/stocks:

Also, access stocks at IC Markets. American and Australian stocks are offered. In total, over 2,100 stocks from American and European exchanges are available. Depending on the security, the leverage is variable. The stocks are traded via CFD, but dividend payout is also available. The exchanges are ASX, NASDAQ, and NYSE.

Bonds:

Bonds offer traders the opportunity to speculate on interest rates and global risk-on/risk-off sentiment, hedging or balancing exposure on equities, and diversify their strategy. Choose from nine bonds to trade with no commissions and a leverage of up to 1:5.

Futures:

Futures are among the most popular forms of CFDs. On IC Markets, you have four future indices to trade.

Execution:

The execution in the live account works in real-time. With the data center in New York and London (financial centers of the world), you get an unrivaled fast execution. If that’s not enough, you can hire a VPS server for even faster access. Since IC Markets is a true direct market access broker, price manipulation is excluded. In addition, there are no requotes, and your position will always be executed at the next best price. There are no hidden fees for traders. The real “raw spreads” are offered. In addition, the broker is supplied by various liquidity providers. This means that there is always sufficient liquidity available (even for high trading volumes).

Conditions for traders:

- Raw spreads from 0.0 pips

- Commission-based trading accounts

- Leverage of up to 1:500

- Over 2,000 assets for trading

- Trading already from 0.01 Microlot

- Free demo account

- A low minimum deposit of $200

In summary, trader terms are outstanding with this broker. If you are looking for a good forex provider, you should switch now. However, there are no shares in IC Markets to trade, which is why you have to make small cuts.

(Risk warning: Your capital can be at risk)

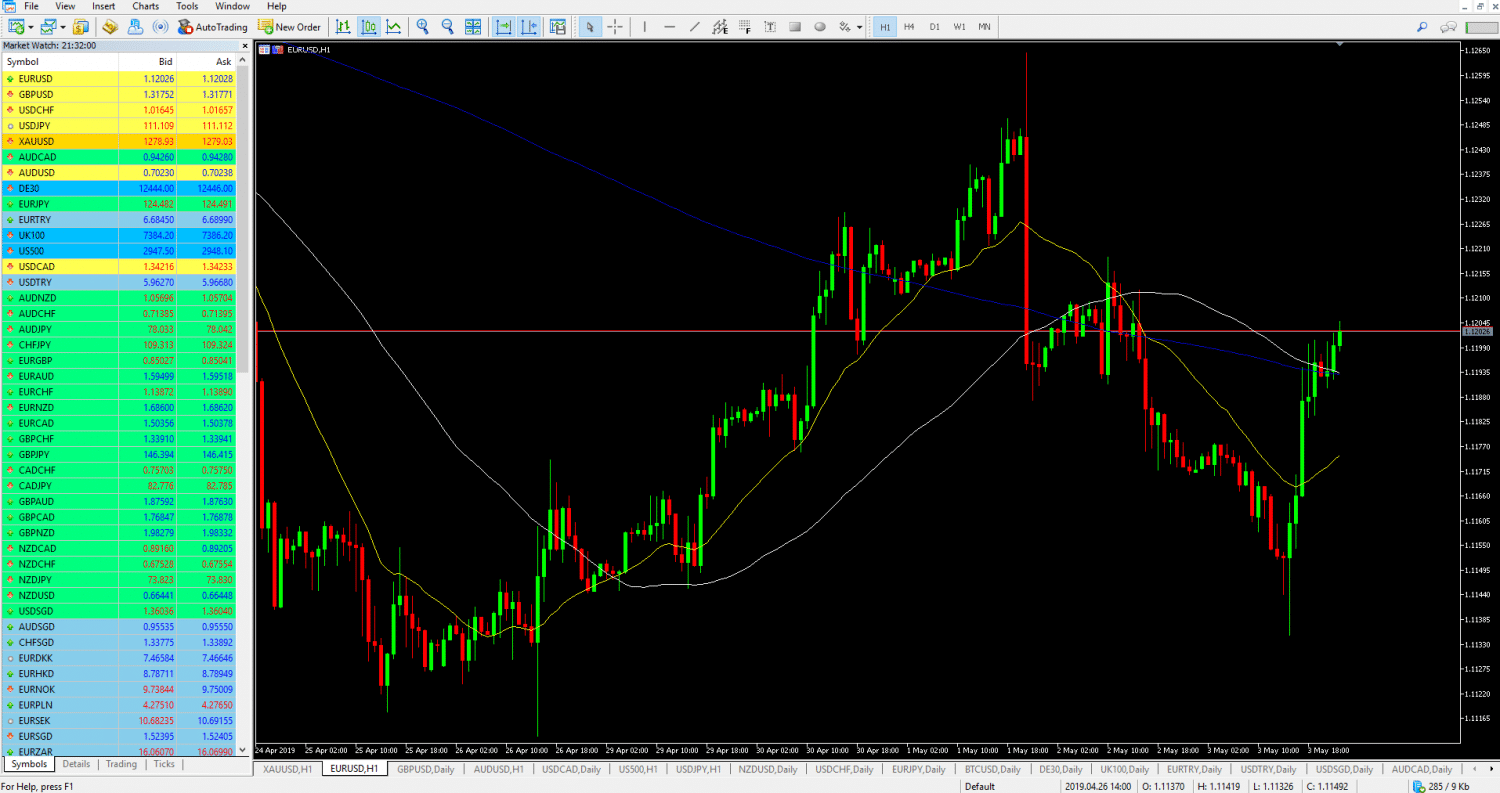

The trading platform of IC Markets

IC Markets offers the well-known trading platform MetaTrader 4/5 and cTrader. The MetaTrader is available for computers, smartphones, and tablets. The software can also be started from the browser. The cTrader is available for browsers and mobile devices.

The trading platforms are evidence of high security and have been in use for many years. The MetaTrader is the world’s most popular trading platform for private traders. You can make any settings yourself and create your own strategies. The MetaTrader works flawlessly and gives you direct access to the markets.

The following trading platforms are available:

- MetaTrader 4

- MetaTrader 5

- cTrader

- Mobile apps for each platform

MetaTrader 4 and 5

The trading platforms testify to high security and have been in use for many years. Metatrader is the world’s most famous platform for trading private traders. You can make any settings yourself and create your own strategies. MetaTrader works flawlessly and gives you direct access to the markets.

In the picture above, you can see the MetaTrader 5. This is the world’s most popular trading platform for private traders because it offers an incomparable user-friendly interface and trading settings. Besides free indicators, automated trading, and multi-charting, MetaTrader is customizable for any trading style.

IC Markets itself states with its statistics that most of the order volume comes from automated systems. The broker supports you to use an automated system. For this purpose, you can rent a Virtual Private Server at IC Market and run the system 24 hours a day.

You can program such systems using the built-in editor in the trading platform. But of course, you need a suitable trading strategy.

MetaTrader is also available for any device. Use your mobile device at any time to access the portfolio. The MetaTrader is, from my experience, one of the best trading platforms with countless possibilities to realize his trading.

(Risk warning: Your capital can be at risk)

Plugins for MetaTrader 4

IC Markets offers free extensions for the software in the form of plugins. These can be easily downloaded and then inserted into the software. This includes, for example, a tick chart extension or additional indicators.

These extensions can help you a lot in analyzing or managing the trades. The following plugins are offered:

- Alarm Manager

- Correlation matrix/trader

- Trading Terminal

- Market Manager

- Mini Terminal

- Market destination trader

- Trading session map

- Excel RTD

- Invisible orders

- Tick Chart Trader

- Additional indicators

cTrader

For more experienced clients who like to trade with the order book or liquidity, CTrader is offered. It should be noted that both trading platforms are available free of charge, and you do not have to pay any account maintenance fees. Through CTrader, you get insight directly into the market liquidity without intermediaries.

Personally, we are not pro in using cTrader because we much prefer to use MetaTrader for our strategies. However, if you are a scalper with high order volume, then cTrader is the right choice for you. The commissions per trade in Forex are another 50 cents cheaper. Also, cTrader gives you a better insight into liquidity than MetaTrader.

Facts about the trading platforms:

- MetaTrader 4/5 and the cTrader are offered

- Available for any device (including mobile)

- Professional tools are available

- Numerous charting tools

- Direct market access without intermediaries

- Trading directly from the order book is possible

- Free of charge and no account maintenance fees

(Risk warning: Your capital can be at risk)

Charting and Analysis

The trading platform MetaTrader offers a huge range of analysis and charting material. Choose between different chart types and configure them as you want. Indicators and technical drawing tools are free.

More than 50 different indicators are available on the platform. For advanced traders, there is the possibility to insert extern indicators, which you can download on the internet. Each indicator is personally customizable. There are a lot of functions that we cannot mention here. In addition, technical drawing tools are available for doing technical analysis.

Facts about the trading platform:

- Available for any device

- Free indicators

- Free technical tools

- Configure your own strategies

- Customizable and user-friendly

- Automatic trading and robots

Automatic Trading

The terms of IC Markets are also perfect for automated trading! The company itself states that more than 60% of the trades delivered each day are from automated systems. The data center is located in New York, and with a VPS server, you have the best access to the markets. This allows you to get the best prices in the market and open and close trades in less than a second.

Furthermore, the broker is characterized by low latency. The average execution speed is less than 40 milliseconds. From our experience, there is also virtually no slippage (even with positions with more than ten lots).

The free Demo Account of IC Markets

IC Markets offers an unlimited and free demo account for traders. In the personal area, you can open different demo accounts for your purpose. The demo account is an account with virtual money. It simulates trading with real money 1:1, and we recommend using it before you start with real money. In addition, the demo account is the best way to practice new strategies and markets.

FIrst of all, you should try out the broker with the free demo account.

(Risk warning: Your capital can be at risk)

Account types at IC Markets – Which one is the best type?

We get a lot of requests because of the account types at IC Markets. Generally, there are two different accounts. The raw spread and STP (Standard) account. There is only one difference in the billing of fees. With the raw spread account, you get the real spreads directly from the market but pay about $ 3.5 or $ 3.0 commission per traded lot. There is no commission for the STP (Standard) account, but there is an additional spread (from 1.0 pips).

In summary, you will pay less with the raw spread account. The difference is minimal, but you should not neglect it. Again, the preferences of a trader apply.

There are only two different account types:

- Raw spread account (DMA) with $ 3.5 / $ 3.0 commission and from 0.0 pip spread

- STP (Standard) account with 0 $ commission and from 1.0 pip spread

How to open your free account:

Opening an account with IC Markets is very easy. Just fill out the form and start trading. First of all, you have to insert your real name and phone number. Then the broker will ask you for additional information about your identity. Through the regulation of the ASIC, the Forex Broker has to verify your identity and account before you can start trading real money. But from my experience, it is an easy process to verify the account. We recommend doing this as fast as possible to get access to all functions of the platform.

(Risk warning: Your capital can be at risk)

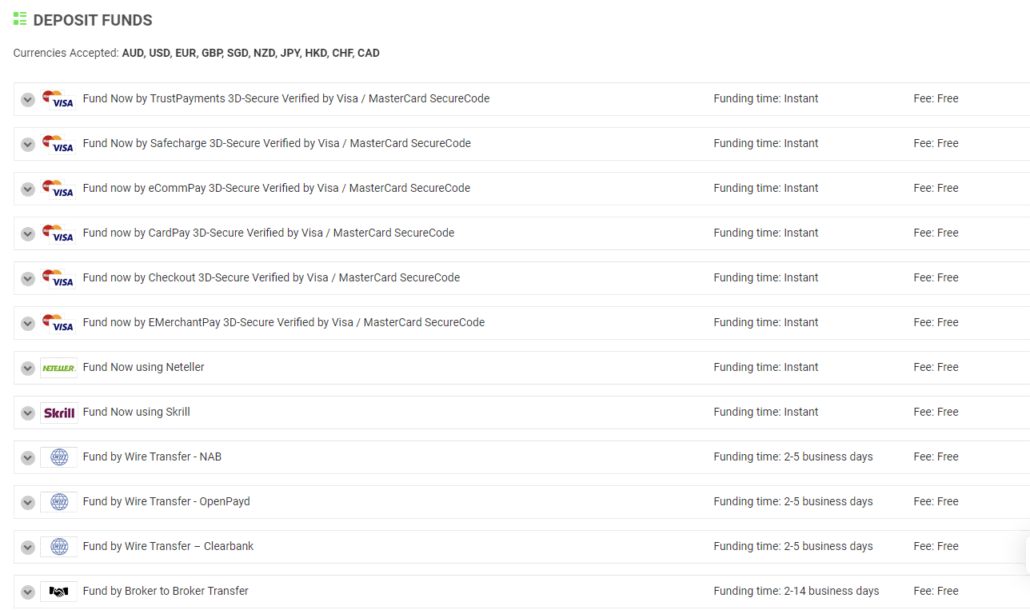

The withdrawal and deposit at IC Markets

The payout and deposit at IC Markets work smoothly. The broker offers a total of 15 methods to capitalize on the account. The broker is surprised that he even offers Bitcoin and PayPal as payment methods.

Deposits are well written in real-time, depending on the method. My payouts have always been confirmed and executed within 24 hours. Make sure your account is fully verified.

There are no fees or hidden costs. On deposits and withdrawals, the broker requires no fees. However, a bank transfer can be costly if your bank charges you for international transfers. The trading account is available in AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, and CHF.

Payment methods:

- Credit Card (Master, VISA)

- PayPal

- E-Wallets (Skrill, Neteller and more)

- Wire Transfer

- RapidPay

- Klarna

(Risk warning: Your capital can be at risk)

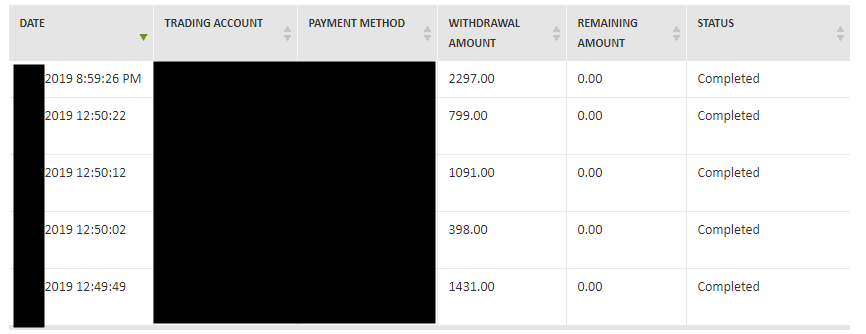

Our real withdrawal proof

We uploaded our IC Markets review video on youtube, and we got different comments from people who say that IC Markets is a Scam Broker. Withdrawals would not happen, or the broker is manipulating the spreads. From my experience, there is no scam or fraud on this broker.

Often beginners or traders without experience in the markets make big losses and claim the broker for it. Personally, we never got a problem with IC Markets and the trading and withdrawal of profit. In the next picture, we will show you our payout of money:

How to do a withdrawal with IC Markets

IC Markets would like to use the same payment method for a withdrawal as for your deposit. So if you have deposited funds via bank transfer, these funds will also be paid out via bank transfer. The Forex broker does not charge any fees for withdrawals. However, in the case of an international wire transfer, the bank charges $20.

For withdrawal, the broker may request additional documents from you. For example, if you want to withdraw to a new bank account, IC Markets will ask for a bank statement to actually confirm the account. You will then be informed about this automatically. From my experience, a withdrawal works smoothly. It is confirmed within a few hours.

Is there a negative “Balance Protection”?

At IC Markets, there is no negative balance protection from our experience. This only shows that it is a real direct market access broker. Similar to futures trading, the account can end up in very extreme situations in a negative state.

Usually, this does not happen if you use balanced risk management and do not burden your account with oversized positions. IC Markets automatically stops all positions with 50% margin overstepping. A higher value is also adjustable. So you should be protected under normal circumstances.

For IC Markets, it is also not possible to get negative balance protection for its customer as it is trading on real market conditions. If there is no counterparty in the market, you can close the position later. However, this is rarely the case as the markets are very liquid.

(Risk warning: Your capital can be at risk)

How does this broker make money from you?

Depending if you decide to go with a standard account or a raw spread account, the way how IC Markets will make money from you will vary.

For Raw Spread Accounts: There is a commission charge of $7 per standard lot round turn

For Standard Accounts: There is no fixed commission per trade on standard accounts, but instead, there is a markup applied to the spread of 1 pip above the raw Inter-bank rate IC Markets receives from their liquidity providers.

Additionally, like most brokers, IC Markets has variable overnight fees, and additional charges may apply, depending on your trading habits.

Customer support and service at IC Markets

The language of the support is English. The website is translated into different languages. More than ten languages are available. The support works 24 hours a day from Monday to Friday and is available via chat, telephone, or email.

The speed of support is outstanding. For example, you get a direct answer via chat support. The employees work quickly and can help you with your problems.

For beginners, there are analyzes and video tutorials for the platform. Sometimes well-known guests are invited to webinars. You will then receive a notification via email. Taken together, the support is pretty good because you always get professional help directly. However, you have to make a small smear because there is no support in every language.

- Support 24 hours per week (working days)

- Phone, Email, and Chat-Support

| CUSTOMER SUPPORT: | |

|---|---|

| PHONE (INTERNATIONAL): | +61 (0)2 8014 4280 |

| ADDRESS: | IC Markets HIS Buildings, Providence Mahe, Seychelles |

| EMAIL: | [email protected] |

| SUPPORT: | 24/7 |

| LIVE-CHAT: | Yes |

IC Markets also offers an institutional service

If you are an asset manager, broker, or introducing broker, IC Markets is the right partner for you. The broker also offers other brokers to send liquidity to them. Or you register as a partner with IC Markets and recruit other customers. It is also possible to offer a copy trading service.

Asset managers

The company offers good conditions for trading currencies to asset managers. You can manage the money of your clients.

Parter and Introducing Broker of IC Markets

You can promote IC Markets and bring new clients to the broker. The Forex broker shares a part of the paid commissions with you. For example, you offer a strategy for free and then register the client through you with IC Markets. The client pays commissions when using the strategy, which the broker shares with you.

Countries

More and more people want direct access to the direct Forex market. IC Markets accept traders from around the globe. There are some exceptions: The broker does not accept traders from the U.S., Canada, Israel, or Iran.

The fast-growing area of the world is the Asian and African markets. They accept traders from China, India, the Philippines, Indonesia, South Africa, Ghana, and more.

(Risk warning: Your capital can be at risk)

IC Markets alternatives – what are the best options?

Every trader has personal preferences and expectations for their brokers, therefore if IC Markets isn’t the right fit for you, you can find three great alternatives below:

Capital.com

Capital.com is a trusted Forex and CFD trader platform and was founded in 2016. The platform has more than 280,000 users from around the world thanks to its excellent reputation and beginner-friendly platform. Multiple authorities regulate the broker and, overall, a perfect choice, no matter if you are experienced with trading or just starting out. Read our detailed review of capital.com here.

XTB

XTB is currently among the best-known broker platforms in the world. XTB was founded back in 2006 in Poland and has seen steep growth ever since. More than 3,000 different assets in six asset categories are available to trade for you with this broker. But don’t just take our word; customers awarded XTB with multiple awards, and it is well known for its outstanding customer service. For example, every customer has access to dedicated 1 to 1 support for every client and a learning center with tons of resources.

RoboForex

Last but not least on our list of the best IC Markets alternatives is RoboForex. With this broker, you can trade a wide variety of assets, and their main advantage is the low minimum deposit of just $10. Additionally, your funds are very safe as the IFSC Belize officially licenses the broker. Also, the broker is owned by a big company group with headquarters in Europe. Finally, Roboforex also offers many account types to choose from, which gives you a lot of flexibility. All of these makes the broker one of the best IC Markets alternative. Read our indepth RoboFores-review here.

Our conclusion: IC Markets is one of the best raw spread Forex Brokers

IC Markets is my personally favored Forex Broker because here you are without conflicts of interest to very small fees. Unlike most providers, this broker has real direct market access. Thus unlimited profits can be made and the broker earns only the commission of its money.

The cost is reduced to the lowest, and in this area, you can not find a cheaper provider. The designs and the service are sensational. We can recommend this broker to any trader who wants to trade with large or small capital.

In conclusion, IC Markets is one of the few top brokers worldwide that can be recommended with a clear conscience. Start now with the free demo account and test the provider yourself.

The advantages of IC Markets:

- Regulated and safe Forex Broker

- Real raw spread trading

- The best conditions for traders (0.0 pips spread + commission)

- Metatrader 4 and 5, and cTrader

- Very fast support

- No hidden fees

- The best broker for high-volume trading through big liquidity providers

- Free demo account

- Minimum deposit 200$

If you search for a reliable Forex Broker without conflict of interest and good conditions, you should choose IC Markets.

Trusted Broker Reviews

Experienced and professional traders since 2013(Risk warning: Your capital can be at risk)

FAQs – The most asked questions about IC Markets:

At IC Markets, is it possible to use a demo account?

You can use the services of IC Markets to conduct trades with a demo account. The business provides a demo account with no time limit and is available without cost. However, you cannot utilize this service if you reside in the US or another nation that does not accept your home currency.

Does IC Markets provide a different account types?

The answer is yes. There are three different account types at IC Markets: Standard, Raw Spread, and cTrader. Both have unique features and commission costs. For example, the spreads are lowest in a normal account and slightly larger in a raw spread account. This is a fantastic place to start if you’re unsure if IC Markets provides a guaranteed stop loss.

What is the minimum withdrawal amount from IC Markets?

The minimum withdrawal amount from IC Markets is unrestricted, allowing traders to withdraw any amount they choose.

IC Markets has a $200 minimum deposit requirement. No set minimum is required for withdrawals. But when making withdrawals, the business advises customers to be aware of bank fees. To avoid surprises, figure out how many fees will be incurred.

See other articles about online brokers:

Last Updated on June 7, 2023 by Res Marty