KuCoin review and test – is it an underrated cryptocurrency exchange?

Table of Contents

Review: | Assets: | Fees: | Leverage: |

|---|---|---|---|

(4.8 / 5) (4.8 / 5) | Spot trading, margin trading, Futures | 0.0% – 0.1% | Maximum of 1:10 |

After the success of Bitcoin back in 2011, there has never been a shortage of cryptocurrency exchanges in the industry. But both new and experienced traders are always on the lookout for a better exchange – one that offers more features and convenience at a lower cost.

KuCoin has some of the most competitive fees on the market, allows both margin and futures trading, accepts fiat currencies, and also makes partaking in IEOs easy. So, why isn’t it as popular as Binance or Coinbase? And more importantly, is it worth taking the time to sign up and use? Here’s an in-depth KuCoin review of the exchange to help you find out.

What is KuCoin? – The company presented

KuCoin is a globally renowned crypto exchange that enables traders of all skill levels to trade over 200 cryptocurrencies and digital assets. The exchange was launched in September 2017, making it one of the newer exchanges in the industry. Despite being a relatively new exchange, KuCoin has quickly grown to become one of the industry’s biggest crypto exchanges. It has over six million users and boasts a daily trading volume of over $800 million.

It was founded by a group of finance experts who worked on iBox PAY and helped found Ant Financial. In just four years, the company has grown its userbase to over six million and now operates in more than 200 countries. KuCoin’s headquarters are located in Singapore; however, the company has active crypto trader communities globally. It proudly claims that one in every four traders in the world uses KuCoin.

2019 was an eventful year for the company. The interface was upgraded to “Platform 2.0,” making the interface a lot easier to use. The update to the interface also gives users access to a new API and additional advanced order types. Futures and margin trading were introduced in June of the same year, and users could get up to 10x leverage on their trades.

2020 was just as eventful for the company despite the slowdown of the economy. An instant exchange service was introduced, and support for several additional payment methods was added.

Quick facts about KuCoin:

- Founded in 2017

- Headquartered in Singapore

- Margin trading possible

- Future trading possible

- More than 700 million trades daily

- High volume exchange

The best alternatives for crypto traders: Trade cryptocurrencies CFDs with the best conditions and a regulated broker

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20 by card: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

Who it is for – KuCoin features:

Besides the easy-to-use interface and the wide array of services, the several payment options make KuCoin an attractive option to traders.

Some of the best features of the platform include:

- Outstanding Customer Support: You can get your issues resolved right as you encounter them. The customer support team is available around the clock and is easy to reach. You can get support over email and also using the phone app.

- KuCoin Shares: The KCS feature enables crypto lending, staking, and soft staking, allowing you to earn interest on your cryptocurrencies.

- Non-Custodial Trading: If you’re concerned about the safety of the crypto in your account, you can enable non-custodial trading on your KuCoin wallet to protect your funds.

- Several IEOs: KuCoin Spotlight enables you to partake in promising initial exchange offerings and make a good profit.

- Bank-Grade Security: Every KuCoin customer gets access to micro-withdrawal wallets and dynamic multi-factor authentication. Furthermore, the company has risk control departments dedicated to ensuring the upkeep of strict security standards.

But perhaps the best thing about the exchange is that it offers generous profit-sharing incentives. The company states that 90% of the trading fees it charges customers cycle back around to the customer’s wallet in the form of KCS tokens. These benefits, coupled with the lower fees, make KuCoin the right exchange for both new and seasoned crypto traders.

Regulation and safety – how safe is KuCoin?

KuCoin allows its six-million-plus users to trade over 200 cryptocurrencies and also enables them to make a profit on their crypto by lending them out. It has a daily trading volume of over $800 million.

The stakes are high, and KuCoin takes several measures to ensure that user funds and data remain safe from hackers.

Security measures:

The exchange stores the majority of the funds in cold-wallets, which are drives that are disconnected from the internet, making them impossible to hack. Users can enable two-factor authentication to fortify their account’s security and set security questions to prevent hackers from accessing their accounts.

You can choose to enable the anti-phishing safety phrase in the emails you receive from KuCoin to ensure you don’t click on any malicious links. Users can also set a trading password, which acts as a second layer of security and ensures no one other than you can trade with your funds.

Features like phone verification, email notifications, and login IP restrictions make your KuCoin account that much more secure. Even if KuCoin were to get hacked, all the affected users would get their funds back since prominent insurance firm Lockton ensures the company’s funds. While the exchange is quite secure, it is never a good idea to keep all of your funds saved on an exchange. Moving funds to a private wallet is the best way to ensure your crypto remains safe.

- Cold-wallets

- Two-factor authentication

- Email verification

- Phone verification

- Insurance service

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Hacking attempts and security slip-ups

For most of its existence, the exchange maintained an excellent reputation in the industry, which came under attack on Sep 26, 2020. It was found that approximately $281 million worth of crypto had been stolen from KuCoin, most of which was either Bitcoin or Ethereum.

The hacker(s) managed to obtain the private keys to the company’s hot wallets and quickly transferred the funds to their accounts.

When the breach was found, the company transferred the funds remaining in the hot wallets to new wallets. All deposits and withdrawals were frozen on the exchange to prevent further losses.

While the exchange’s cold wallets remained unaffected, the losses were significant.

The company investigated the hack in conjunction with international law enforcement. $204 million of the stolen funds were recovered within a month of the hack, and since the funds were insured, the rest of the funds were replenished.

The CEO of the company, Johnny Lyu, handled the situation perfectly. He was transparent and kept KuCoin users informed about developments over his social media handles, official company blogs, and he also spoke about the hack on his live stream.

Regulatory compliance

KuCoin is not regulated by any regulatory agency, which some traders perceive as a red flag. However, the company has a reputable founding team and offers excellent support, making it trustworthy.

That being said, exchanges like Binance have an edge over KuCoin, since, in addition to offering an outstanding set of features, they are regulated by reputed regulatory agencies. While KuCoin operates in the United States, it does not operate in New York since it does not possess a BitLicense.

Trading conditions for customers

In November 2018, about a year after it launched, KuCoin implemented exchange-wide KYC verification. User verification reduces the risk of the platform being used for an illicit activity like money laundering.

But users do not have to complete the verification process to use the platform – it is optional. You can trade without submitting any ID to KuCoin; however, you will have a low withdrawal limit of 2BTC. Additionally, if you lose your password and haven’t verified your account, recovering your account will be very challenging.

KuCoin fees

As mentioned earlier, KuCoin offers some of the most competitive rates of all crypto exchanges. The fee structure is relatively easy to understand, even for new traders.

Spot trading fees

Every trade you make will attract a 0.1% fee, which is the same as what Binance charges its customers. The fee decreases the more you trade and is calculated based on your 30-day trading volume.

Your KuCoin Shares holdings also play a role in the fees you pay the company to trade.

| Tier | Min. KCS holding (30 days) | 30-day trade volume in BTC | Maker/ taker fee | KCS pay fees |

|---|---|---|---|---|

| LV 0 | 0 | lower than 50 | 0.1%/0.1% | 0.08%/0.08% |

| LV 1 | 1000 | higher than 50 | 0.09%/0.1% | 0.072%/0.08% |

| LV 2 | 10000 | higher than 200 | 0.07%/0.09% | 0.056%/0.072% |

| LV 3 | 20000 | higher than 500 | 0.05%/0.08% | 0.04%/0.064% |

| LV 4 | 30000 | higher than 1000 | 0.03%/0.07% | 0.024%/0.056% |

| LV 5 | 40000 | higher than 2000 | 0.0%/0.07% | 0.0%/0.056% |

| LV 6 | 50000 | higher than 4000 | 0.0%/0.06% | 0.0%/0.048% |

| LV 7 | 60000 | higher than 8000 | 0.0%/0.05% | 0.0%/0.04% |

| LV 8 | 70000 | higher than 15000 | 0.005%/0.045% | 0.005%/0.036% |

| LV 9 | 80000 | higher than 25000 | -0.005%/0.04% | 0.005%/0.036% |

| LV 10 | 90000 | higher than 40000 | 0.005%/0.035% | 0.005%/0.028% |

| LV 11 | 1000000 | higher than 60000 | -0.005%/0.03% | 0.005%/0.024% |

| LV 12 | 150000 | higher than 80000 | 0.005%/0.025% | -0.005%/0.02% |

Future Trading Fees:

Just like spot trading, futures trading also has a floating 30-day trading window. Furthermore, if you have KCS, you will get a discount based on their tier system.

| Tier: | Min. KVCS holding (30 days) | 30-day trade volume in BTC | Maker/ taker fee |

|---|---|---|---|

| LV 0 | 0 | lower than 100 | 0.02%/0.06% |

| LV 1 | 1000 | higher than 100 | 0.015%/0.06% |

| LV 2 | 10000 | higher than 400 | 0.01%/0.06% |

| LV 3 | 20000 | higher than1000 | 0.01%/0.06% |

| LV 4 | 30000 | higher than 2000 | 0.01%/0.04% |

| LV 5 | 40000 | higher than 3000 | 0.0%/0.04% |

| LV 6 | 50000 | higher than 6000 | 0.0%/0.038% |

| LV 7 | 60000 | higher than 12000 | 0.0%/0.035% |

| LV 8 | 70000 | higher than 20000 | -0.003%/0.032% |

| LV 9 | 80000 | higher than 40000 | -0.006%/0.03% |

| LV 10 | 90000 | higher than 80000 | -0.009%/0.03% |

| LV 11 | 100000 | higher than 120000 | -0.012%/0.03% |

| LV 12 | 150000 | higher than 160000 | -0.015%/0.03% |

KuCoin also enables you to buy crypto using fiat currencies. You can use your bank account or card to purchase whatever cryptocurrency you want to buy. But depending on the payment method, the fees charged vary between 5% and 7%. If you use Simplex to buy crypto, you will only pay a 3.5% fee.

KuCoin limits and liquidation

KuCoin has three account levels, each of which has unique limits:

- Unverified Account: When you sign up and confirm your email with the company, you have an unverified account. It has a withdrawal limit of 2 BTC per day.

- Verified Individual Account: If you choose to submit your identification documents – such as a passport – to KuCoin after you sign up, your account will be upgraded to Verified Individual Account. You will also need to prove where you live by submitting a utility bill or an equivalent document. After verification, your account’s withdrawal limit is raised to 100 BTC per day.

- Verified Institutional Account: If you act on behalf of an institution, you can get in touch with the KuCoin support team and upgrade your account to Verified Institutional Account. Your withdrawal limit will increase to 500 BTC per day.

While verification is not required, we recommend that you verify your KuCoin account right after signing up since account recovery becomes a lot easier. Furthermore, fiat-to-crypto trading is only enabled for verified KuCoin users.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Test of the KuCoin trading platform

One of the best things about KuCoin is undoubtedly the interface. It is easy to use and is powered by a robust API. Furthermore, it employs an advanced core trading engine that enables it to process millions of transactions in a second.

KuCoin also allows you to switch back to its older interface, which looks less modern and more straightforward. All accounts load the new interface by default, but once you switch to the old one, your account will always load in the older interface.

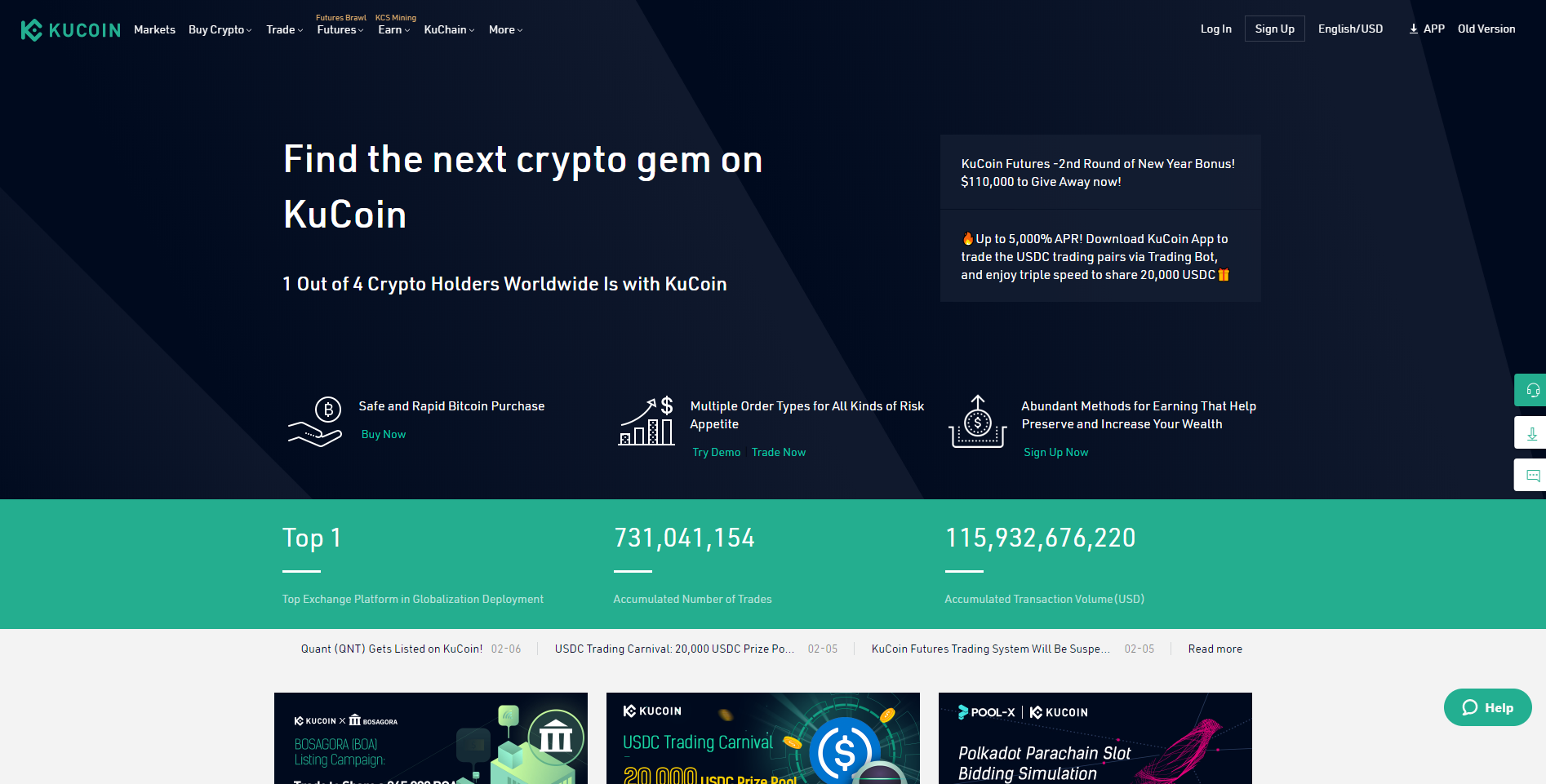

See the trading platform of KuCoin below:

Making a trade is easy – all you have to do is click on the “Markets” tab on the top of the page. You can then search for the market you want to trade in, and on selecting the market, you will be redirected to the trading window.

The price chart is powered by Tradingview.com and comes loaded with several advanced charting tools that help you with Technical Analysis.

You will also see the order placement windows in the trading window. From here, you can place Limit, Market, Stop Limit, and Stop Market orders. If you like to use complex strategies when trading, you can specify additional order characteristics, such as Post-Only, Hidden, or Time In Force.

The order book will show you all of your open buys and sell orders. The interface also includes a news panel and a recent trades window. If you’ve never traded before, you will find the interface a little confusing. However, experienced traders will appreciate the intuitiveness of the interface.

See the order book of KuCoin:

KuCoin users can also trade when they’re on the move by installing the KuCoin mobile app on their phone. It is available for both Android and iOS devices.

How to trade with KuCoin?

Trading with KuCoin is a lot less complicated than some other exchanges make it. After you fund your account, click on the “Markets” button on the top of the page. Search for the cryptocurrency you want to buy using the search box on the page’s top-right corner.

You will then see all of the different trading pairs available for that currency. Click on the pair that has the currency you deposited in your account.

The main trading screen will appear, and you may need to enter a trading password to access the interface. When you do, you will find a buy box on the right side of the screen. Enter the quantity of the cryptocurrency you want to buy, and click the “Best Price” button. Finally, click on the green “Buy” button to complete the trade.

You can trade:

- Spot market

- Margin trading (maximum 1:10 leverage)

- Futures trading

Order types:

- Market Order

- Limit Order

- Stop Limit

- Stop Market

The best alternatives for crypto traders: Trade cryptocurrencies CFDs with the best conditions and a regulated broker

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20 by card: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

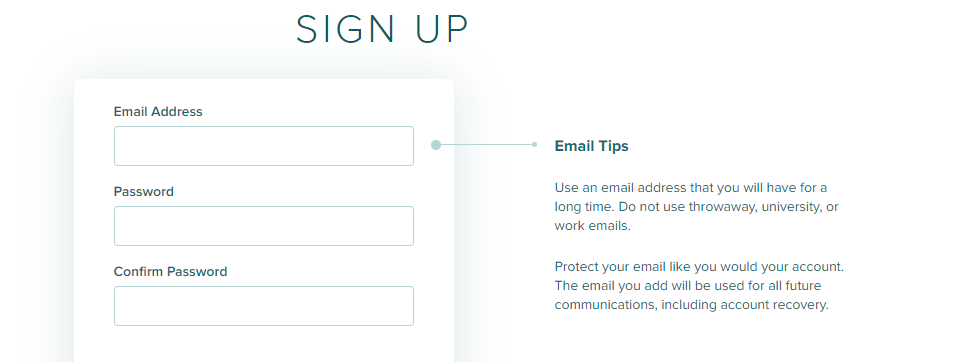

How to open an account with KuCoin?

Opening an account with KuCoin takes less than a minute. All you have to do is:

- Navigate to https://www.kucoin.com/.

- Click on the “Sign Up” button on the top-left corner of the screen.

- On the sign-up page, enter your email address and phone number. Next, set your account’s password before clicking the “Send Code” button. A verification code will appear in your inbox, which you must enter in the field that appears.

- Finally, you must agree with the company’s terms of use and complete the captcha. Confirm your email address by clicking the link in the mail you receive, and you can then trade crypto using KuCoin.

Make sure you spend some time setting up your account’s security. Two-factor authentication, anti-phishing phrases, and security questions are not activated by default. You must turn on these features using the settings menu.

Does KuCoin offer demo accounts?

Yes, the company does offer demo accounts to users. KuCoin Sandbox is a simulated environment that is disconnected from the actual exchange.

You can test out trading strategies by visiting sandbox.kucoin.com.

To use the sandbox environment to test your trading strategies:

- Create an account in the sandbox environment.

- Also, generate new API keys.

- Log into your demo account.

- Make use of the test assets to simulate transactions.

It is important to note that the environment is currently in its testing stages, and the front-end isn’t perfect. There’s a good chance you will experience glitches.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

KuCoin privacy for customers

The company does collect your data, and some of it is shared with third parties for marketing purposes. But you don’t need to worry about your data’s security since the company takes several security measures to keep your data safe.

KuCoin protects your data and transaction information from unauthorized access, alteration, and disclosure by employing appropriate storage and processing practices. All the data that is exchanged between you and the site is encrypted using SSL technology. Furthermore, the KuCoin website complies with PCI vulnerability standards, making it that much more secure.

If the collected data is no longer being used or is no longer required for business or legal purposes, it will be destroyed or anonymized immediately. To learn more about how the company uses your data, you can check out the privacy policy.

Is there a Negative Balance Protection in KuCoin?

Suppose your account dips in the negative when you’re trading, and the debts cannot be fully covered when the trade is liquidated. In that case, the negative balance procedure will be executed automatically.

The insurance fund will cover the debt, and if the insurance fund isn’t large enough to cover the debt, it will automatically pay as much of the debt as possible. When the procedure is being executed, your account will have a negative balance, and you will not be able to withdraw any amount from your account. After you’ve paid off the negative balance by transferring assets from your other accounts to your margin account, the suspension will be lifted.

KuCoin deposits and withdrawals

Making deposits on KuCoin does not cost any money. However, withdrawals do attract charges, and these charges vary from currency to currency.

For the most part, the company’s fees are the same as Binance’s fees. However, there are differences in some cases. You can find the shortened version of the fee structure below. If you want to look at the company’s complete fee structure, visit the official website.

| Cryptocurrency: | fee: |

|---|---|

| BITCOIN | 0.0004 BTC |

| ETHEREUM | 0.004 ETH |

| LITECOIN | 0.001 LTC |

| DASH | 0.002 DASH |

| RIPPLE | 0.1 XRP |

| EOS | 0.1 EOS |

| TRON | 1 TRX |

| TETHER (OMNI) | 4.99 USDT |

| TETHER (ERC20) | 0.99 USDT |

| TETHER (TRC20/EOS) | 0.99 USDT |

| NEO | Free |

It is important to note that KuCoin is a crypto-to-crypto exchange, and you cannot deposit fiat currencies on your account. However, the exchange does enable you to buy cryptocurrencies using third-party integrations like Banxa. You can buy crypto via KuCoin by navigating to the “Buy Crypto” section of the website.

It is possible to make a P2P Fiat-Trade and pay with the following methods:

- Credit cards

- Debit cards

- Simplex

- Bank transfer

- PayPal

- Sepa

- Interac

Support and service

KuCoin’s customer support team is on standby 24/7, and you can reach them over email. You can also get support on the mobile app, and the help center and FAQ center are loaded with guides and material that can guide you through fixing any issues you encounter.

KuCoin has active communities on Facebook, Telegram, Twitter, Reddit, and YouTube. While you cannot get account-related support on these channels, you can interact with other users and learn more about trading effectively on the platform.

Accepted countries and forbidden countries

The company is available in over 200 countries, including Australia, United Kingdom, Japan, Hong Kong, Singapore, and the United States.

It’s important to note that while KuCoin is available in the USA, it does not offer any KYC service in the country. Furthermore, there is no official statement about when it will be available. But you can still create an account and trade crypto – but the catch is you have to operate under the limit of 2BTC per day.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion of the KuCoin review: No scam – Professional exchange for beginners and advanced traders

The low fees and excellent interface are more than enough to attract the average trader to the platform. From our experience, we can say that it is definitely not a scam.

However, the easy sign-ups, top-notch security features, outstanding customer support, and features like non-custodial trading and KuCoin Spotlight make it worth choosing over other exchanges.

Regardless of whether you’re a new trader or have been trading for years, KuCoin will cater to your trading needs perfectly.

Advantages of KuCoin:

- Fast account opening and KYC

- Huge variety of assets

- Margin Trading (1:10 leverage)

- Futures

- Spot trading

- Professional trading platform

- P2P fiat to cryptocurrency transaction

- Fast customer support

- Low trading fees

KuCoin is a suitable cryptocurrency exchange for beginners and advanced traders. You can trade with low trading fees.

Trusted Broker Review

Experienced traders since 2013Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about KuCoin :

Is KuCoin useful for beginners?

If you’re just getting started with cryptocurrency, KuCoin is the exchange to use. The trading platform provided by the exchange is user-friendly enough that even a complete newcomer may master it fast.

Should one invest in KuCoin?

When investing in cryptocurrencies, KuCoin is the best exchange out there. It has a large user base, a diverse range of supported assets and services, competitive trading costs, and strong liquidity.

How to open a KuCoin account?

Go to https://www.kucoin.com/.

Select the “Sign Up” link at the screen’s top left.

Enter your email address and phone number on the signup page. Click the “Send Code” button after changing your account password. You’ll receive a verification number in your inbox; use that to fill out the form.

Next, check off the box that indicates you’ve read and agree to the company’s terms of service.

After registration and clicking on the verification link in the welcome email, you can access KuCoin.

Is it safe to use KuCoin?

KuCoin has multiple safeguards to prevent hackers from accessing user accounts and private information. Users can activate two-factor authentication. An additional protection against unauthorised use of your funds is the option to set a trading password, which can be changed at any time. The security of your KuCoin account is bolstered by features like phone verification, email notifications, and login IP restrictions.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)