ROInvesting review and test – How good is the broker?

Table of Contents

| REVIEW: | REGULATION: | ASSET: | MIN. DEPOSIT: | MINI. SPREAD: |

|---|---|---|---|---|

(4.5 / 5) (4.5 / 5) | CySEC | 350+ | $250 | Variable 1.8 pips |

Security and reliability keep the broker credible. ROInvesting claims to be an innovative, secure, and reliable broker. How serious is ROInvesting in delivering quality products and services? Is this online broker worth the shot? Let’s find out together in this review.

What is ROInvesting? – The company presented

ROInvesting offers its clients the ability to trade CFDs online on a range of assets, which includes forex, shares, indices, commodities, cryptocurrencies, ETFs, and metals. It offers access to more than 350 assets and 10,000 markets. The company was founded in 2017 with a simple vision of improving all the benefits of technology for all types of traders – beginner up to professional level.

The firm claims to be committed to engaging the latest innovations not just in their trading platform, but as well with their products and services. This includes the continuous improvements of their customer support, education center, analysis tools, market alerts, and all of their products. Also, ROInvesting is proud to be a CFD broker partner of AC Milan (AC Mailand) football club.

Facts about ROInvesting:

- Founded in 2017

- Over 350 assets

- Markets include forex, shares, indices, commodities, cryptocurrencies, ETFs, and metals

- Global broker

- Award-winning and Innovative broker

- Highest level of data safety

- AC Mailand sponsorship

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Is ROInvesting regulated? – Regulation and safety for customers

In order to operate legitimately, a broker must pass certain criteria that are implemented by a real regulator. This serves as your protection from scammers. Nowadays, there are a lot of scammers online and you must be vigilant to protect your investments. “ROInvesting” adheres to strict regulations that are designated to ensure the protection and transparency of its clients. It is a leading Cyprus Investment Firms (CIF) licensed and regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 269/15.

ROInvesting is regulated by the following:

Financial security

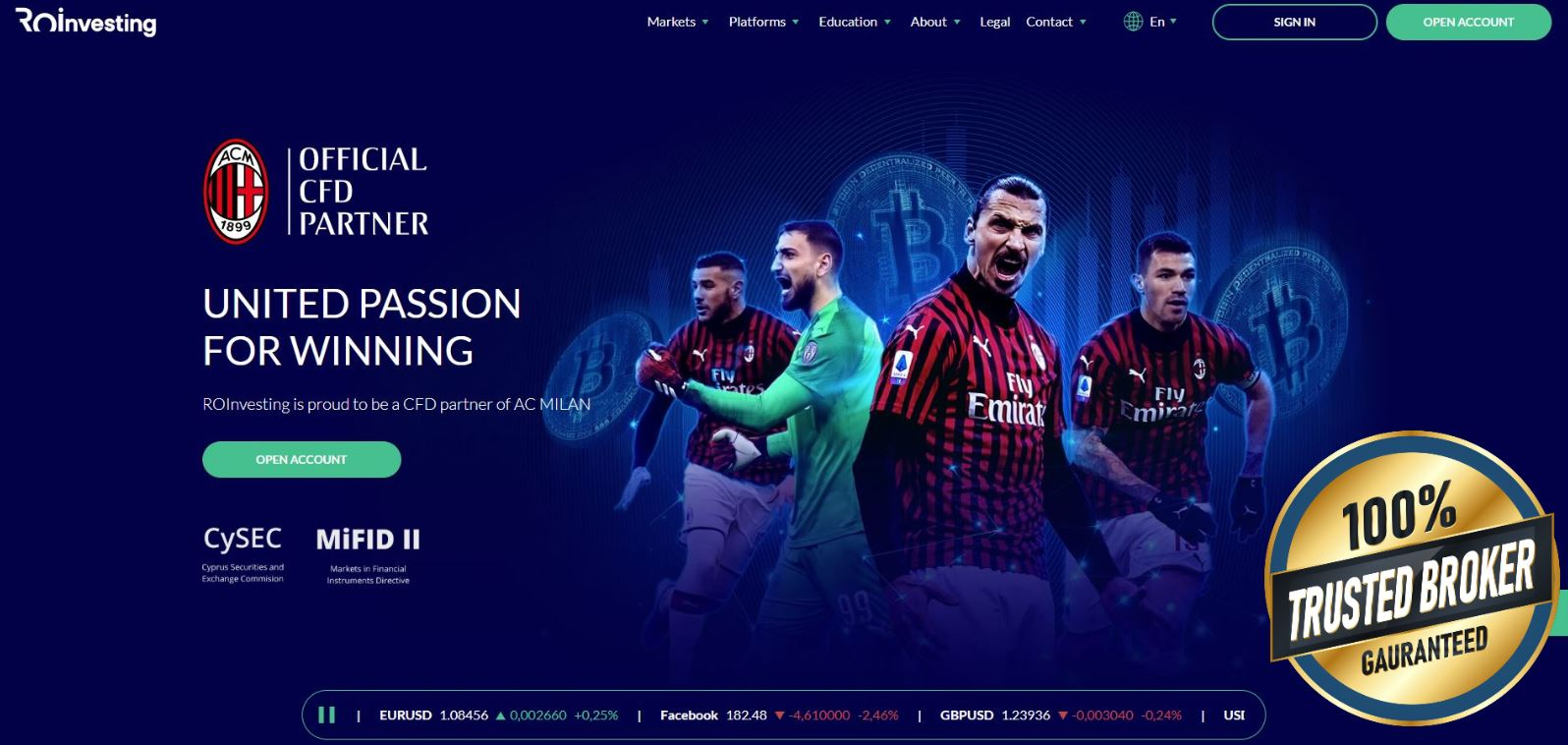

Security is very important to all traders and this has the biggest role in choosing a broker. ROInvesting provides ancillary services to its clients. These include the following: Safekeeping and administration of financial instruments including custodianship and related services. Second, ranting credits or loans to one or more financial instruments, where the firms granting the credits or loan are involved in the transaction. Third, foreign exchange services where are connected to the provision of investment services.

This broker promotes reliability and high security. It has Level 1 PCI compliance service moderation, all the servers are in SAS 70 certified data centers, it has a firewall and SSL software. All transmitted data with this broker is securely encrypted and therefore implements high security.

Summary of regulation and financial security:

- Regulated

- Offers ancillary services

- Firewalls and SSL software

- Strong data encryption

- Secure servers

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Test of the ROInvesting trading platformsPlatforms being offered by the broker take a huge part in a trader’s trading journey. ROinvesting offers three types of platforms to its clients. Trading Platforms:

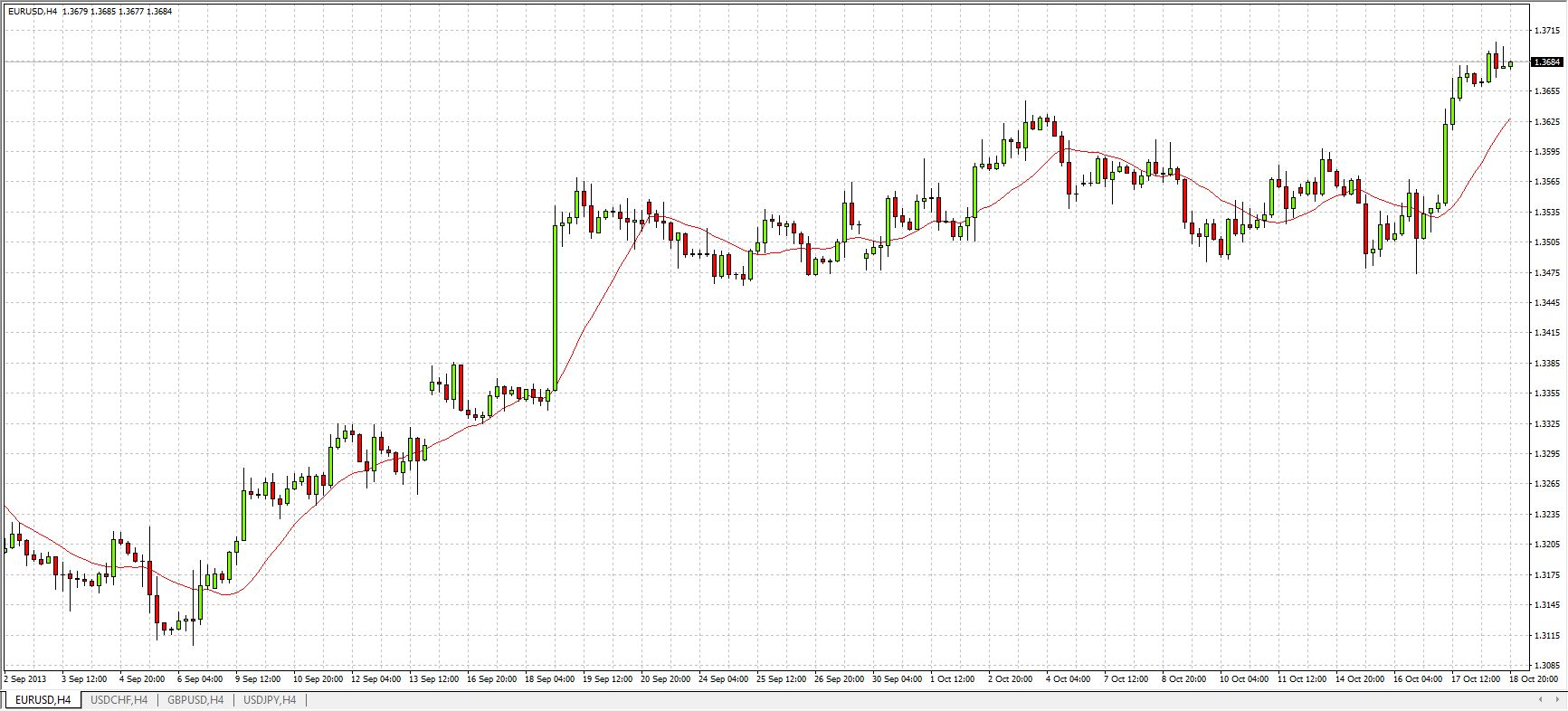

WebTrader PlatformThe WebTrader Platform gives you a smooth and convenient trading experience to directly trade from your browser without the need to download software. It can perform any task that is available on MetaTrader 4 platform. The good thing about this platform of ROInvesting is that it gives you the ability to analyze financial markets by exploring the diverse portfolio options by performing trades with just a few clicks as long as connected to the internet. It has a one-click trading functionality and is well-developed. The technical engine of this platform has first-rate functionality, which makes it easier to implement different trading strategies, define entry and exit points, and send trading orders. It is user-friendly and secure due to the fact that it puts extra effort into data encryption and information safety.  MetaTrader 4 (MT4) PlatformMetaTrader 4 (MT4) Platform is the most popular trading platform used by millions of traders online. This is due to the fact that MT4 is user-friendly, delivers the most effective and fast execution of trading orders. This platform requires downloading. Once installed, the trader can enjoy price dynamics in detail, opening, and closing trades, setting stops and entry limits, performing technical analysis and many other benefits that help steer any type of trader and their way to the top of the market. It promotes trading excellence, ensures high reliability, fast execution, and high security due to the fact that all the transmitted data is securely encrypted. It also features multiple chart windows to compare various assets. ROInvesting MT4 has a real-time balance level and you can definitely track the movements of the markets. It has automatic Stop Loss/Take Profit functions, in-platform price alerts, the benefit of one-click account switching, and has active platform support and live chat.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 78.1% of retail CFD accounts lose money) Mobile Trading (App) PlatformThe Mobile Trading (App) Platform of ROInvesting is powered by MetaTrader 4’s technology engine that provides top-of-the-line trading on Android and iOS-based devices. This platform (app) gives traders the ability to trade whenever and wherever they want as long as connected to the internet. It is user-friendly and secure. Traders can use it from smartphones or tablets, exclusively or together with their desktop platforms.  This Platform (App) is free and available to download in GooglePlay (for Android) and AppStore (for iOS). It has a one-click trading function, gives you a seamless and quick trading experience. It gives you the ability to use nine timeframes, will keep you on track on news on trading conditions, has online chat, and one-tap action functionality. Plus, you can turn on notifications to keep you updated about the markets and other important market news. It has first-rate security technology that will definitely give you confidence in trading wherever you go. Professional charting and analysis is possibleCharting and analysis take an important role in trading. This is because charting enables the trader to keep a record and track the movements of the market. With that, traders will also be able to understand and read the market easily through this chart. The volatility of the markets lets you determine whether to buy or to sell. Charting gives traders a record of the historical prices in the markets. When you use technical analysis together with charting, you can expect better trading results. This simply illustrates that because technical analysis is a method of analyzing the markets and predicting the price movements, and together with charting, you would have the edge to determine or predict whether the price value will go up or downward. ROInvesting charting is interactive and has a multiple chart windows function that enables you to compare various assets. It has 30 built-in technical indicators that include Fibonacci retracements, moving averages, and many more. We can say that the charting capability of ROInvesting platform is quite impressive.  The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|