Tickmill review and real test – Is it a scam or not?

Table of Contents

Review: | REGULATION: | MIN. DEPOSIT: | FOREX PAIRS: | SPREADS: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | FCA (UK), CySEC (EU), FSA (SE) | 100$ | 50+ | 0.0 Pips + 1 unit commission per 100.000 traded |

Are you looking for authentic experiences and a critical test for the Tickmill broker? – Then you are exactly right on this page. As traders with more than nine years of experience in the financial markets, we have tested the provider in detail for you with real money. Learn more about the conditions and seriousness of the broker. Is it worth it to invest in Forex Broker Tickmill money or not? – Inform yourself in detail now.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

What is Tickmill? – The company presented

Tickmill is an international broker for trading derivatives financial Forex and CFDs. The main headquarters are located in London: 1 Fore Street, London EC2Y 9DT, United Kingdom. For many years, the company has proven itself to offer traders professional trading on the best terms. The broker is known for the fast and cheap execution of trades in the forex market. Also, there are branches in Cyprus and Seychelles.

According to the website, Tickmill should provide an excellent trading experience with the cheapest spreads and commissions, which we will take a closer look at in the following test. Furthermore, the broker shines with many different awards in the industry and allows his traders to pursue any trading strategies.

Also, see our review video:

Facts about Tickmill:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2014 |

💻 Trading platforms: | MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $100 |

💱 Account currencies: | EUR, USD, GBP |

💸 Withdrawal limit: | Minimum $25 |

📉 Minimum trade amount: | $1,000 / 0.01 lot |

⌨️ Demo account: | Yes, unlimited |

🕌 Islamic account: | Yes |

🎁 Bonus: | $30 welcome account available |

📊 Assets: | Forex, Stock Indices, Commodities, Bonds, Cryptocurrencies, Stocks |

💳 Payment methods: | Bank transfer, Crypto payments, Skrill, Neteller, Sticpay, Fasapay, Union Pay, Webmoney |

🧮 Fees: | Starting at 0.0 pip spread, variable overnight fees, and commissions |

📞 Support: | 24 / 5 via phone, e-mail, or live chat |

🌎 Languages: | 15 languages |

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Is Tickmill a regulated online broker? – Safety for customers

Regulations and licenses are essential for traders and brokers so that a trusting relationship can be created. When a broker applies for a permit, certain criteria and requirements must be met. A violation of the policy usually means a direct loss of the license.

Tickmill is even regulated several times. The broker has licenses from several countries. It gives us a positive direct impression. European traders must trade with the English license (FCA) or CySEC license, which brings further benefits. On the other side, international traders have to choose the FSA license.

Below you will be able to find an overview of all the licenses from regulating authorities Tickmill Group obtained since they started.

- Seychelles Financial Services Authority (Tickmill Ltd)

- Financial Conduct Authority (Tickmill UK Ltd)

- Cyprus Securities and Exchange Commission (Tickmill Europe Ltd)

- Dubai Financial Services Authority (Tickmill UK Ltd)

- Labuan Financial Services Authority (Tickmill Asia Ltd)

- Financial Sector Conduct Authority (Tickmill South Africa Ltd)

Tickmill has offices and group companies in some of the most reputable financial jurisdictions in the world.

The safety of customer funds

The security of client funds should be given to a trusted broker. In online investments, trust in a broker is very important. Many smaller brokers with no license and experience sometimes mishandle money. To avoid such fraud, one should pay attention to certain criteria in broker selection.

Tickmill insures client funds separately from corporate funds to manage. For this purpose, the Barclays Bank is used, which operates internationally and is always liquid. In addition, client funds will be protected in the unlikely event of a bankruptcy or financial dilemma of Tickmill with the Financial Services Compensation Scheme (FSCS) of up to £ 85,000. This is a very high value compared to other brokers, which usually have no deposit guarantee or a smaller one.

Regulation and safety:

- Regulated by FCA, CySEC, FSA and others

- Customer funds are managed by Barclays Bank

- High deposit guarantee of 75,000 GBP (FCA license)

- Safe website communication

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

What are the pros and cons of Tickmill?

Tickmill is among the industry-leading brokers, mainly for forex trading. So if you are looking for a low-cost broker, Tickmill is among the best options available. As with every broker, Tickmill has some advantages and disadvantages, and we will discuss the most important ones.

Pros of Tickmill | Cons of Tickmill |

✔ Very fast and professional customer support | ✘ Verification of documents for a live account can be on the slow side |

✔ Among the lowest fees and commissions on the market | ✘ The minimum deposit is higher than on other sites |

✔ Ideal for Forex trading | |

✔ Webinars and e-learning section | |

✔ Tickmill will cover bank transfer fees for deposits of more than $5,000 | |

✔ No requotes and high liquidity | |

✔ Excellent service and support |

Is Tickmill easy to use?

In this section, we will cover how easy it is to navigate on the platform, navigate on the site, and wheater the platform is optimized for mobile devices. The last criteria is becoming more important as many users access or trade on their mobile phones.

Criteria | Rating |

General Website Design and Setup | ★★★★★ Website loads fast, and the interface is very easy to navigate |

Sign-up Process | ★★★★Sign-up process is smooth, but verification of the document may take some time |

Usability of trading area | ★★★★★ Offers everything you need with MetaTrader 4 and MetaTrader 5 |

Usability of mobile app | ★★★★★Web trading platforms, as well as the app, work perfectly. |

Review of the Tickmill trading conditions for traders

Tickmill is a true NDD broker (Non-Dealing Desk) with well-known liquidity providers. It is traded herewith, excluding conflict of interest between broker and customer. This is a big advantage as it is not a market maker.

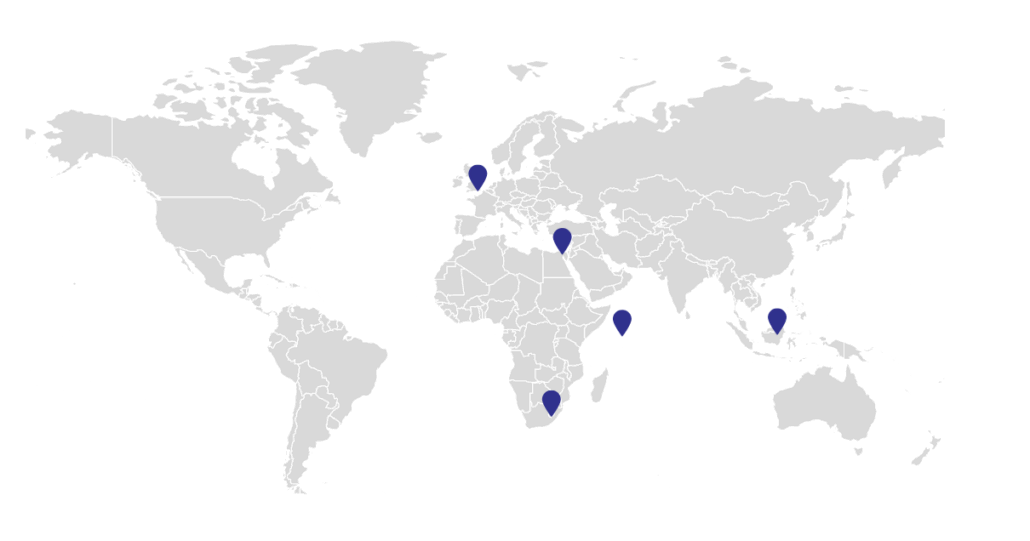

There are more than 84 instruments available on the market. The broker constantly tries to expand its offer and, for example, integrate new assets such as Bitcoin. The offer is quite manageable, and Tickmill tries to specialize with its offer on currencies (Forex). CFDs (Contracts for Difference) are also available for commodities, government bonds, or stock indices. Individual shares cannot be traded on this broker, so here’s a tiny smear in the rating that must be made.

Tickmill is characterized by its highly tight spreads and low commission. We have compared many providers in recent years, and Tickmill is and remains the cheapest. The typical spread in the EUR/USD is only 0.00 – 0.01 pips small, and the commission is a maximum of $ 2 per traded $ 100,000 (1 lot) in the pro account. Traders with higher deposits can even benefit from even smaller commissions ($ 1).

In addition, there are no requotes, as it is a true Forex Broker. This means you will always be able to open and close a position for the next best price in the market. The various liquidity providers always give liquidity, and the slippage is also very low on business news.

The trading conditions you will get with Tickmill:

- Very low spreads starting at 0.0 pips

- The extremely low commission in Pro and VIP accounts is a huge advantage

- Pay only 2$ (Pro) or 1$ (VIP) commission per 1 lot traded

- Fast execution and high liquidity

- More than 50 Forex pairs

- Max. leverage of 1:500

Currencies (Forex)

Tickmills’ main business is forex trading and providing the fastest execution on the market. There are more than 60 currency pairs available. You can trade:

- Major currencies

- Minor currencies

- Exotic currencies

The leverage can be up to 1:500, and the spreads are starting from only 0.0 pips. From our experience, the execution with Tickmill is the best of all brokers. There are no requotes, and every trading strategy is allowed. No limits iCn trading for you! To give you a better overview, below are three examples of typical spreads when you trade forex on Tickmill.

Currency Pair | Typical Spread |

USD / CAD | 0.2 |

USD / JPY | 0.1 |

AUD / USD | 0.1 |

Stock indices

Often stock indices are popular, like trading currencies. With Tickmill, you can trade more than 20 different stock indices. The offers here are very limited. But the trading conditions are quite good, and there are no added commissions. For example, the average spread in the UK100 is only 0.9 points.

- Very low spreads in indices trading

- No additional commissions

- More than 20 stock indices

- 0.2s average execution speed

Below you will find three examples of typical spreads when trading Stock indices on Tickmill.

Instrument | Typical spread |

UK100 | 0.9 |

US30 | 2.52 |

France40 | 1 |

Commodities and precious metals

Some commodities like oil, gold, and silver are offered to trade with Tickmill. For sure, there are other brokers who have more commodities in their portfolios. However, Tickmill can also provide a low spread and high liquidity on these asset types.

- Gold/USD

- Silver/USD

- Brent

- WTI

Instrument | Typical spread |

NATGAS | 0.004 |

BRENT | 0.04 |

COPPER | 0.0021 |

Bonds

An agreement between a borrower and a lender in which the borrower finances a project by issuing bonds is known as a bond. Generally, governments are the ones who issue bonds, often referred to as treasuries or securities. The bond issuer determines the interest rate charged to the investor, often known as the “borrower.” The investor receives their initial money back when the bond matures. On Tickmill, you can trade German bonds at fantastic rates.

Instrument | Typical Spread |

EURBUND | 0.026 |

EURSCHA | 0.018 |

SMALL_S2Y | 0.03 |

Cryptocurrencies

Cryptocurrencies are a very lucrative trading asset. What makes all cryptocurrencies unique is a decentralized network where transactions can be conducted without intermediaries! In other words, thanks to crypto, you can run transactions without the involvement of middlemen, such as central authorities and financial institutions. Let’s take a look at some typical spreads for cryptocurrencies on Tickmill.

Instrument | Typical Spread |

ETH / USD | 2.06 |

BTC / USD | 24.9 |

SOL / USD | 0.15 |

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Review of the Tickmill trading platform:

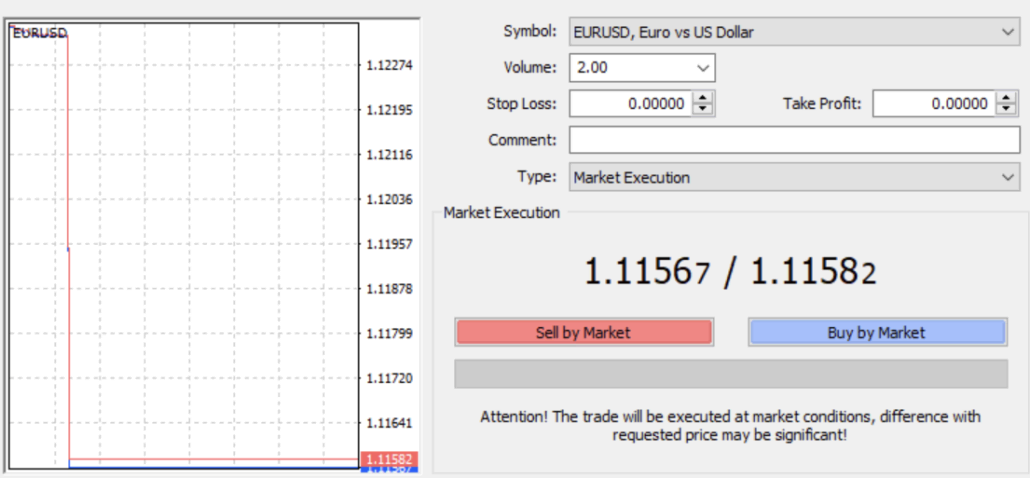

As a trading platform, the MetaTrader 4 is offered to you. This is a proven worldwide trading platform for private and professional traders. The platform is available for the browser (Web), desktop (download), Android (app), and iOS (app). With the MetaTrader, you can quickly and flexibly access the markets of Tickmill from anywhere in the world.

The MetaTrader is perfect for any trader who wants to earn sustainable money in the markets. Even small capital can be traded because there are micro lots available. In addition, there is always a guaranteed execution at Tickmill and no partial execution.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Professional charting and analysis

A trading platform should be user-friendly and flexible. This can offer the Metatrader. Several chart settings for the technical analysis are adjustable. Use the well-known candlesticks for an even better analysis of the markets. Tickmill also provides educational tutorials for beginners.

In addition, use free indicators, which are adjustable for your personal strategy. The Metatrader comes with a lot of tools after installation. If you do not have enough, you can add additional tools to Metatrader 4. Use self-programmed indicators for every chart.

Facts about the platform:

- Flexible and user-friendly trading platform

- Available for every device

- Free indicators

- Very many different analysis tools

- Automated trading possible

In addition, Tickmill offers educational material and webinars for its clients.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Trading tutorial: How do forex and CFD trading work?

Forex is the largest market worldwide. Daily several trillions of dollars are being transacted in this market. That is why it is also highly liquid and interesting for beginners and experienced traders. Tickmill offers over 60 different currency pairs, including many currencies from emerging markets. This is a massive advantage for those who are looking for an exotic currency pair for trading. For currencies, you can bet on falling or rising prices. Buy one currency and sell the other currency from the currency pair. The difference in the price is well written as profit.

CFDs are also offered. They are leveraged derivatives that can be traded on a variety of values. For the opening of a CFD trade, you do not buy directly the underlying asset, but only the contract to that value. This has several advantages because you can act with a high level of leverage and very easily place short trades. The broker rounds off the offering with CFDs on stock indices, commodities, precious metals, and bonds.

Invest in falling or rising prices and secure the position with a stop loss and take profit. These are limits that automatically close your position. Since the calculation sometimes needs to be clarified, Tickmill offers a Forex calculator. With this calculator, you can determine your risk and position size in just a few seconds.

Tickmill offers fast order execution and high liquidity

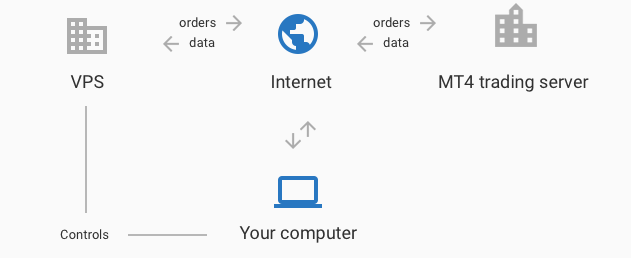

Tickmill has several data and data centers around the world. In MetaTrader 4 you can choose the best access (server) for you. The broker is also characterized by its low latency. With the connection to the live server in London, I have a latency of under 30 Ms. If that is still too slow, you can rent a VPS server.

Personally, we had no problems with the order execution. The website also emphasizes that there are no requotes. Even with large position sizes, 30 Lots + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill is a non-dealing desk broker, which has a similarity to an ECN broker. The difference between NDD and ECN is that the broker still sits between the market and clients. An obligation to pay additional funds can be excluded.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Use a VPS-Server for the best connection

The provider allows any strategies and automatic programs. Expert Advisors (EAs) can automatically run 24 hours a day through a VPS server at Tickmill. The latency is very low, and the price is $ 22 monthly.

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

Tickmill supports automated trading

Tickmill allows every strategy and also automated program. As mentioned above, you can rent a VPS server very cheaply. In connection with the Metatrader 4, it works without problems, and the setup is very simple. Moreover, program automatic programs for your trading or use provided trading systems. Today, more than 50% of order executions are made automatically in the Forex market.

Here you can see again that Tickmill is a serious NDD broker. Dubious brokers forbid strategies or automatic programs. In addition, Tickmill has no limit for stop-loss and take-profit brands. So it can be traded with minimal movements. Due to the low fees, it is profitable for scalping and day trading.

VPS-Server allows you to trade 24/7 on Tickmill.

How to open your free Tickmill account:

Another plus point for Tickmill is the simple depot opening. According to the website, you need a maximum of 3 minutes for this, and we can confirm this personally. Fill in the form with your personal data. Then you get direct access to the customer portal of Tickmill. In addition, your email must be confirmed.

After that, the account has to be verified. Thanks to the strong regulations, brokers are not allowed to pay out to unverified customers. Therefore, even after the first deposit, the account must be verified urgently. Since our account is a bit older, we can only tell you whether a deposit with verification is possible.

For verification, it is sufficient to upload your ID and proof of address. Then, the broker confirms the documents within 24 hours (weekdays). For even faster verification, contact support and say that your documents have been uploaded. Then you have access to the full functions of the trading account.

Unlimited demo account for beginners at Tickmill

The free demo account of Tickmill is perfect for beginners or experienced traders. It is unlimited and without expiration time. Traders can trade the markets with virtual assets and simulate real trading. Experienced traders learn new strategies or test new markets. For the demo account, no deposit or verification is necessary.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

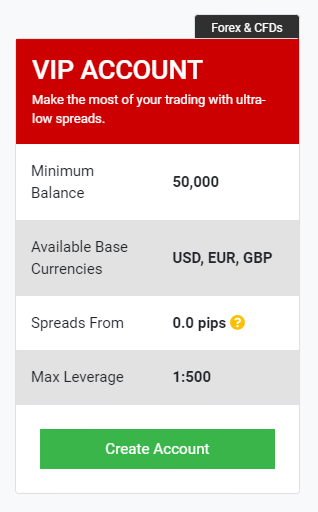

3 different account types – Which one should you choose?

Tickmill offers three types of accounts for traders. Interesting for us is only the Pro and VIP accounts. From our experience, it is not worth the classic account to open because the fees are accordingly higher than in the Pro account. In the following text, we will inform you about the terms of each account.

As described above, the fees are sensationally low. Read the table below for more details. The Pro Accounts Commission is only two units. So you pay only a fee of 4 units per completed trade. When you open a VIP account, you save another 50% because you only pay two units for each completed trade. Even with our code (under the registration button) can save another 5%.

Tickmill gives you the exact interbank spreads from 0.0 pips. Trading is smooth and fast processing is provided by European servers. Upon request, an Islamic account without swaps (interest) can be created.

➔ Read the full comparison of the Tickmill trading accounts.

CLASSIC | PRO | VIP | |

|---|---|---|---|

MIN. DEPOSIT: | $ 100 | $ 100 | $ 50,000 |

SPREADS: | 1.6 Pips | 0.0 Pips | 0.0 Pips |

LEVERAGE: | Max. 1:500 | Max. 1:500 | Max. 1:500 |

COMMISSION: | $ 0 | Two units per 100.000 traded | 1 unit per 100.000 traded |

Info: Tickmill also offers its European customers to sign up as professional traders and keep the high leverage of 1: 500.

The VIP Account is the best choice for high-volume forex traders

High-volume traders or companies can open a VIP account. From a deposit of $ 50,000, you have even cheaper fees. You then only pay 1 unit per traded lot. This makes two units per completed trade. These low costs can generate an increased profit. In addition, stop orders and limit orders are allowed close to market prices. This is a very good offer in comparison.

In summary, Tickmill account types offer a great opportunity for every trader. The terms are excellent and much better than other forex brokers. No matter if you want to trade the markets with small or big capital, Tickmill is the right decision for beginners or advanced traders.

Compare the terms between Tickmill and other brokers yourself. Tickmill is always the cheapest and has, therefore, made the first place in my Forex broker comparison. With no other broker, you get affordable trading fees without a conflict of interest.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Review of the deposit and withdrawal of Tickmill

At Tickmill, you can deposit and withdraw using the same methods. Bank transfer, credit card, Skrill, and Neteller are available. On the payment and deposit, there are no fees.

My tests and experiences have shown that the payouts are speedy, and the money is sent on the journey within 24 hours. You will receive a confirmation email after payment when the payout has been made.

How high is the minimum deposit? – Trading with a small amount of money

The minimum deposit is regularly 100$/€. You can trade in the trading platform as low as 0.01 lot. This is a tiny position size, and the risk is only a few cents high in most cases. The provider is thus broadly positioned because even larger investors can trade without problems at this broker.

Questions and tips for your transactions:

- Open your free account at Tickmill. Complete your data and verify the account. After verification, all functions of the broker are available to you.

- How much money should you deposit? – This is entirely up to the goals and ideals of the trader. Some trading strategies, for example, are not feasible with a small sum of € 100. Be sure to test the demo account before making your first deposit.

- Are my transactions with Tickmill safe? – Yes, Tickmill works only with the best banks and verified payment providers. You can check all transactions in the customer portal.

- Also, open several trading accounts in the customer portal. Thus it is possible to use different accounts for different strategies. An internal transfer takes only a few minutes.

New: Now use Sofortüberweisung (Klarna) or Paysafecard to capitalize your account even faster.

➔ Read the full tutorial of the deposit with Tickmill

➔ Read the full tutorial of the withdrawal with Tickmill (proof)

Is there negative balance protection?

The negative balance of an account is very feared by many traders. And this is also very justified. For some brokers, traders in the past have been able to build up debt or negative balance through extreme market conditions, which had to be balanced.

At Tickmill, there is no additional funding, and you are thus protected against a negative balance.

With Tickmill, you can not lose more money than your deposit.

How does this broker make money from you?

Like every forex broker, Tickmill will also make money from you via spreads and commissions. It’s worth mentioning that all forex brokers have the lowest fees and commissions. The execution is very fast, and you can benefit from very high leverage. Especially the Pro and VIP accounts are highly lucrative. Per lot traded, you will only pay $4 in commissions, which are by far the best conditions from all forex brokers.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Tickmill service and support for traders

One of the last important points in this review is trader support and service. Tickmill offers support in more than ten different languages (also African, Asia, Indian, and Thai clients). From our experience, the broker employs international employees who exclusively look after every customer.

Support is available to customers 24 hours a week, five days a week. The support is provided by chat, phone, or email. A trader should not lack anything here. My tests showed that the support is always fast and reliable!

Tickmill presented itself in different countries, for example, at the World of Trading in Frankfurt. The broker had his own stand there and sought direct contact with his clients. Service is one of the most important things for traders, and Tickmill shows confidence and seriousness.

To further improve its service, well-known and professional traders are invited to hold webinars or other information sessions. Well-known names are Giovanni Cicivelli and Mike Seidel. The saying “by traders for traders” also applies here. Tickmill tries to give its customers the best performance combined with good service.

In summary, the support from Tickmill is very good and professional. Our personal concerns were always resolved very quickly, and we can make a clear recommendation here. Overall, the overall package is rounded off with great service.

SUPPORT: | AVAILABLE: | PHONE NUMBER: | SPECIAL: |

|---|---|---|---|

Phone, Chat, Email | 24/5 | +44 (0)20 3608 6100 | Webinars, 1 to 1 support, events |

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

What are the best Tickmill alternatives?

Captial.com

Since 2016, Capital.com has operated as a well-known and trustworthy online trading platform. The broker, which has its global headquarters in London and operations in more than 50 nations, has quickly built a reputation for offering its customers an intuitive interface and cutting-edge capabilities. Over 3,000 markets, including those for shares, commodities, and currencies, are accessible through Capital.com. In addition, clients benefit from a high level of security and trust because of the broker’s regulation by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

RoboForex

On our list of the top Tickmill substitutes, RoboForex is next in line. You can trade a wide range of assets with this broker, and their key selling point is the cheap minimum deposit requirement of just $10. Your money is also very safe because the broker has an official license from the IFSC Belize. Additionally, a sizable business group with its main European offices owns the broker. Finally, Roboforex allows you a lot of versatility by providing a variety of account kinds to pick from.

XTB

One of the most well-known broker systems in the industry right now is XTB. Since its 2006 founding in Poland, XTB has experienced rapid expansion. You can trade more than 3,000 different assets with this broker, which are divided into six asset categories. But don’t just take our word for it; XTB has received numerous honors from its clients and is renowned for providing exceptional customer support. For instance, every customer has access to a learning center with a ton of resources and specialized 1 to 1 support for every client.

Conclusion of our review: Tickmill is one of the best forex brokers

Our experience and tests show on this page that Tickmill is a very good broker. He gets us a 5-star rating. We recommend this forex broker with a clear conscience. Tickmill offers an offer for every type of trading.

The broker is currently topping any competitor with the world’s cheapest fees. The trading experience is unique with this broker, and you save a lot of money on the order execution. For every trader who trades forex, this is the right provider.

If you have further questions, contact support by phone or chat. International employees are ready to help you.

Advantages:

- UK Regulation and high customer safety

- The cheapest forex broker in the world

- No requotes and high liquidity

- The best execution

- Good service and support

- The best conditions for Forex Traders

- Very low trading fees

Disadvantages:

- No stocks for trading

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Tickmill is one of the best forex brokers in the world because of its cheap trading fees and good execution.

Trusted Broker Reviews

Experienced and professional traders since 2013Read our other articles about Tickmill:

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

FAQs -The Most asked questions about Tickmill:

Is Tickmill a regulated broker?

Yes – Tickmill is regulated several times. The company is regulated and licensed by FSCA SC (Seychelles), FCA (UK), CySEC (Cyprus). European clients trade under the FCA license from the UK or Cyprus license.

Can I test Tickmill for free?

Yes – you can create a free demo account (test account) with Tickmill. This account is filled with virtual funds and thus lets you test all trading features.

What does forex trading cost at Tickmill

Tickmill is the cheapest broker, from my experience. Use the Pro account, and you pay only two units per traded lot in Forex in commission. In the VIP account (from 50.000$), Tickmill lowers the commissions to 1 unit.

How much time does Tickmill take for withdrawals?

Withdrawals, unlike certain deposit alternatives, are never immediate. Your funds will normally arrive within one working day; however, it could take a few days. At Tickmill, we conducted a withdrawal experiment, and it took only one working day for the amount to get credited.

Is Tickmill an STP brokerage firm?

Tickmill’s online brokerage investors are drawn in by 0-pip spreads, a comprehensive ECN (complete STP and DMA) system that supports all techniques, such as scalping, and a plethora of various trading products featuring 64+ currency pairings, Derivatives, gold and silver, and associated commodities.

Is Tickmill authorized in the United Kingdom?

The Financial Conduct Authority officially recognizes and supervises Tickmill UK Ltd. The FCA is an autonomous governmental organization with regulatory rights granted by the FSMA 2000 to regulate the control of both retailing and commercial banking and finance organizations in the United Kingdom.

Are there bonuses at Tickmill?

Tickmill occasionally runs different campaigns, incentives, and competitions related to FX trading. A no-deposit (welcome bonus) bonus of $ 30 is offered for all traders outside Europe. These are excellent ways to deposit some early dollars into your accounts, which you will then be able to utilize to begin trading, get a taste of the interface, or try various trade strategies.

See other articles about online brokers:

Last Updated on June 7, 2023 by Res Marty