5 best free trading demo accounts in comparison – Practise online trading without risk

Are you looking for a free and unlimited trading demo account but struggling to choose the best one for you? – Then you came to the right place. With more than nine years of experience in online trading, I have tested many companies and presented you my list of the top five options below. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

See the overview of the best five demo trading accounts:

Broker: | Review: | Balance: | Advantages: | Free demo account: |

|---|---|---|---|---|

1. Capital.com  | $ 10,000 demo account | # Unlimited demo account # Real-live trading conditions # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Your virtual account: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Vantage Markets  | $ 10,000 demo account | # Unlimited demo account # Great custom options for demo account set-up # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Your virtual account: (Risk warning: Your capital can be at risk) | |

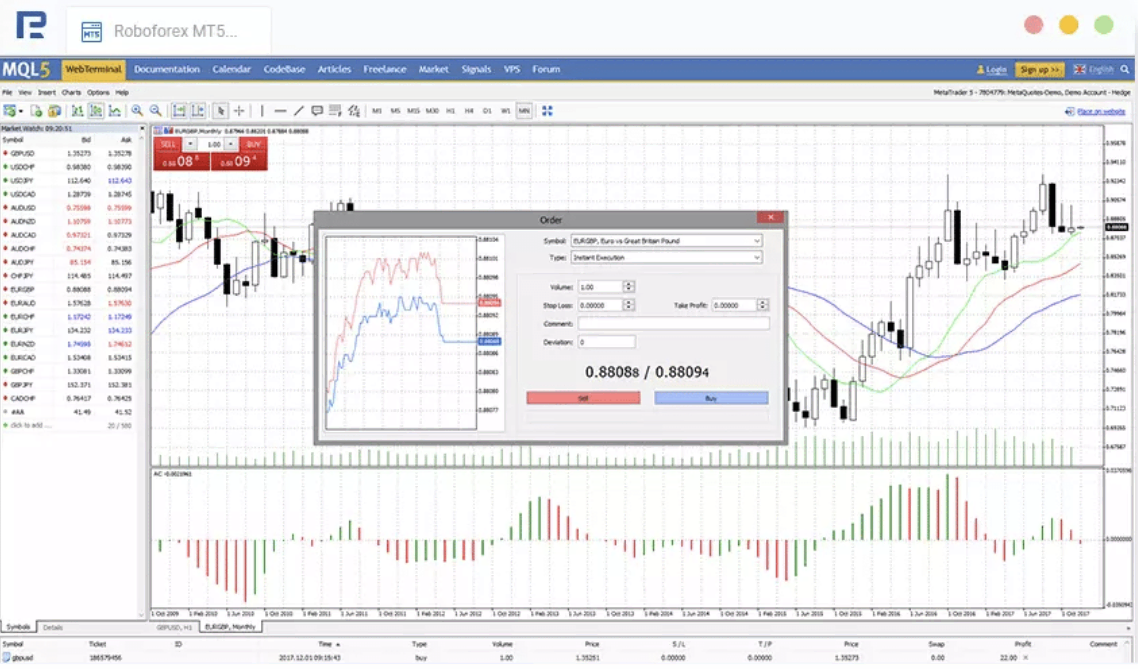

3. RoboForex  | $ 10,000 demo account | # Acess to MT4/5 on demo account # High leverage up to 1:2000 # Free bonus # ECN accounts # Crypto deposit/withdrawal | Your virtual account: (Risk warning: Your capital can be at risk) | |

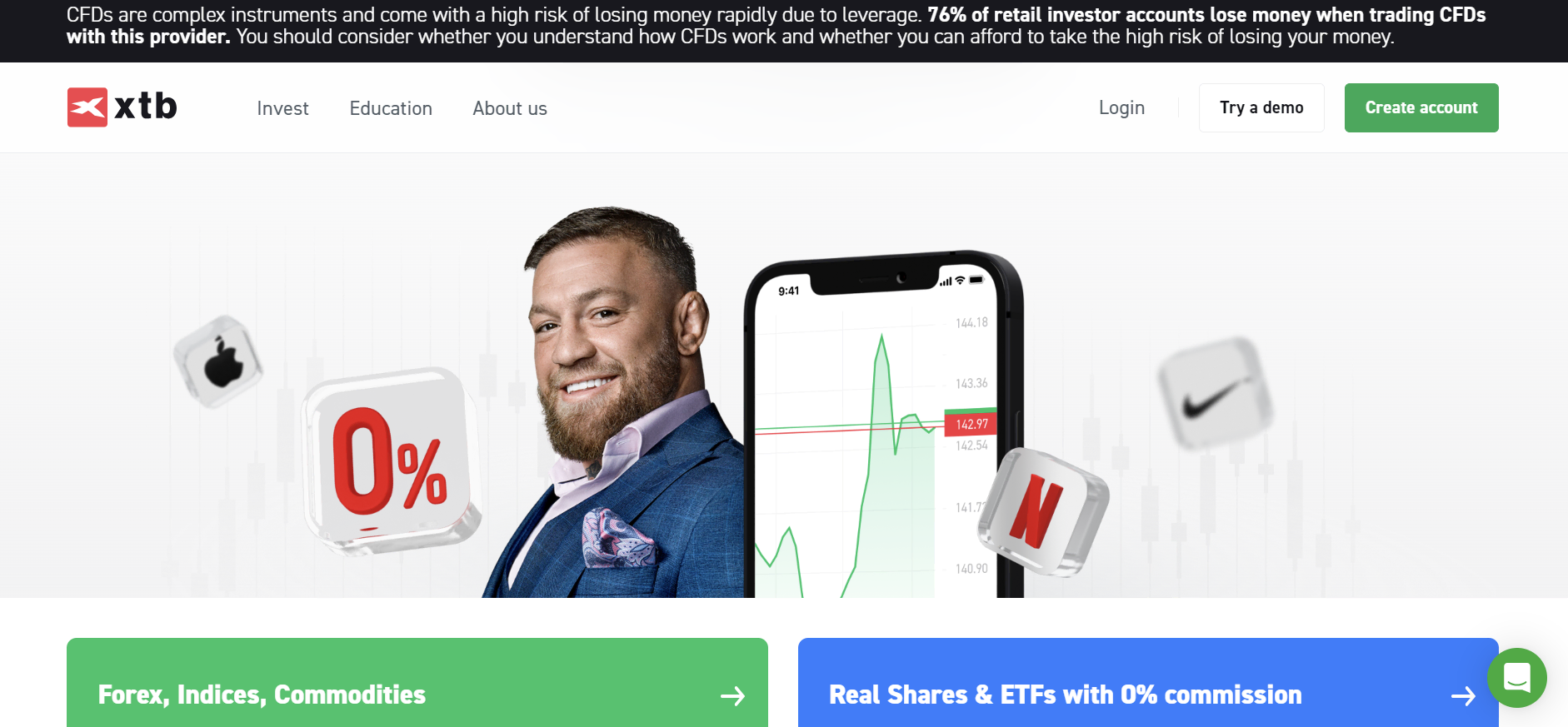

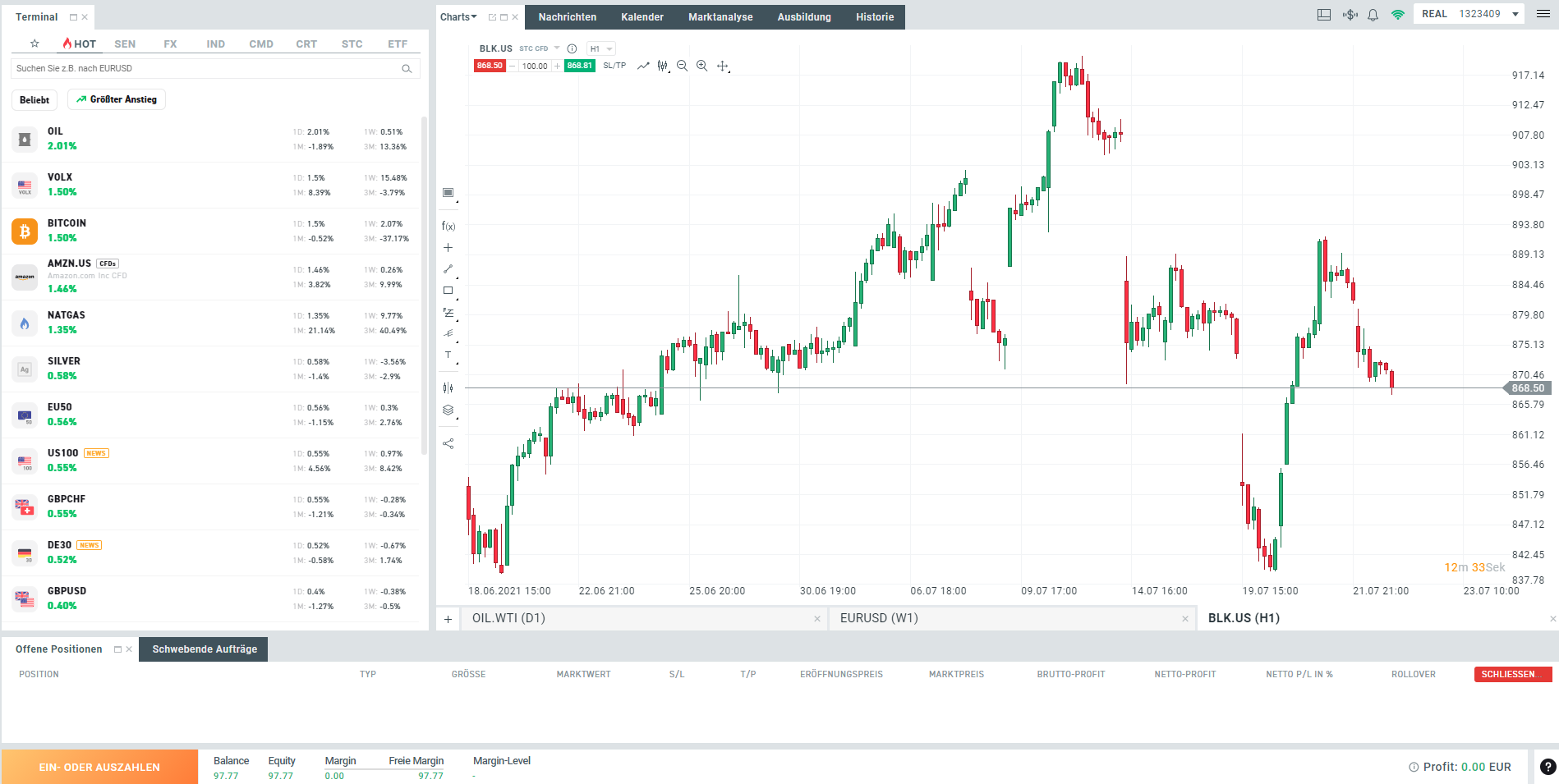

4.XTB | $ 100,000 demo account | # Acess to xStation 5 trading software # Hundreds of indicators and chart editing tools # Instruments for technical and fundamental analysis # Access to ‘News’ and ‘Education’ sections | Your virtual account: (Risk warning: 72% of retail CFD accounts lose money) | |

5.Libertex  | $ 50,000 demo account | # Easy sign-up process # Unlimited demo account access # Unlimited demo account access # Commissions from 0.0003% # Tight spreads from 0,1 pips | Your virtual account: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

What is a demo account?

A demo account is often referred to as a test account and is a free-to-use trading account with virtual funds. It allows you to familiarize yourself with a particular trading platform, as well as test and improve your trading strategy risk-free. Every reputable broker should offer a free demo account to their clients.

I highly recommend testing any new broker with a demo account, regardless of your experience level. The design and layout of each broker are slightly different, and it definitely helps to familiarize yourself with any new platform. The sign-up is fairly easy and takes less than two minutes in most cases.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Of course, the quality of any demo account is closely associated with the real-life trading conditions of the respective broker. It doesn’t help if the demo account leaves a stellar impression, but the real-life trading conditions suck. Also, the characteristics (trading executions spread, financial instruments, analytical instruments, etc.) should be similar on the demo and live account. However, compared to an account with real money, a demo account is great for testing new things. Feel free to sign up for multiple demo accounts if needed, to find the perfect match.

My favorite demo accounts I reviewed for this article:

Criteria for a good trading demo account:

Not every trading demo account is optimal for retail traders. That’s why there are different criteria that make a good broker. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with official regulations and financial licenses, there are no differences in demo and real money trading from our experience.

Criteria for a good demo account:

- A demo account should always be free to use

- Ideally, the demo account isn’t limited in

- Make sure there is no difference between the demo account and real money trading

- You should be able to recharge the demo account with virtual funds at any time

- All functions, trading assets, platforms, and analytical tools should be available without restrictions

List of the five best demo trading accounts

Now, as promised, let’s take a deeper look into my top five demo trading accounts and what makes them stand out. I will also introduce the broker company as well as the pros and cons to help you make behind each account to help you make the best decision possible.

Capital.com

The Cyprus-based online broker capital.com is an online broker company that stands out in the world of forex trading. The company started out in 2016 with the mission to provide a user-friendly and innovative trading experience and soon experienced rapid growth. Today, more than 500,000 traders are part of the community, and more than $530 billion dollars in trading volume has been traded via the platform since its launch.

I can say without a doubt, that Capital.com is one of the safest brokers on the market, and they are regulated by the world by top-tier authorities like the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC) and the Financial Services Authority (FSA). These regulatory bodies ensure the highest level of investor protection and compliance with stringent financial standards possible.

A wide range of 3,000+ assets for traders in all major asset categories, with very low costs leaves absolutely no room for complaints. When I tested the platform, minimum spreads for various markets started from 0.004 in stocks, and 0.07 in indices, commodities 0.018, and currencies 0.7 pips. Zero commission on most instruments and cutting-edge technology are just some of the advantages when you sign up with Capital.com.

What truly distinguishes the platform is a comprehensive suite of analytical tools, including AI-driven insights and an intuitive mobile app. There are very few other competitors that can compete with capital.com in that field. I found that Capital.com quite often sets standards for the entire industry, and other companies often copy the same new features a few months later. Their constant efforts to improve the trading experience, make their platform one of the most beginner-friendly and intuitive ones. Should you ever run into any issues the 24/7 customer support is always ready to help and there are great educational resources available for free.

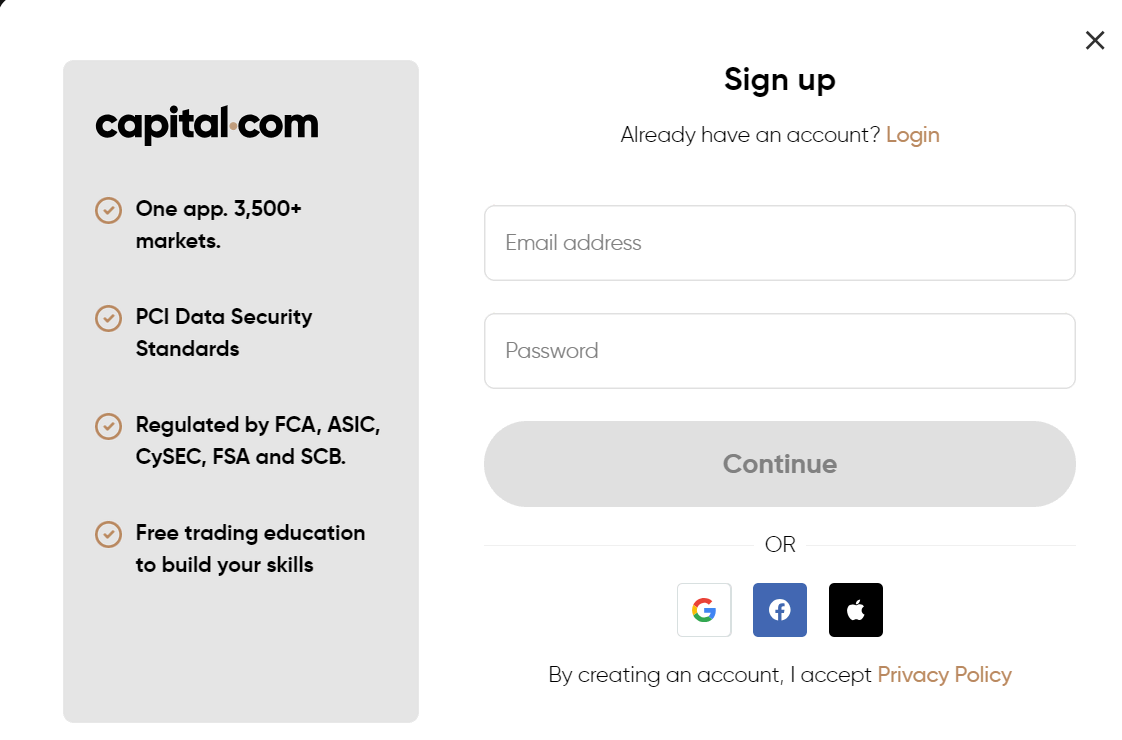

Free demo account on Capital.com

Based on my tests, the clear winner for the best demo account is clearly capital.com. Let me explain to you why. To sign up for a demo account, all you need to enter is your e-mail address and a password of your choice. There is no need to enter your phone number which I think is really a great plus because it lowers the entry barriers and you won’t be bothered with marketing calls.

Overall, you can create a demo account in less than a minute, and it will take you immediately to the very intuitive web trading platform. As a standard setting, you will have $1,000 in virtual funds available on your demo account and you can refill the account with one click of a button should you need it. Even if you have never been on a trading platform before, you will figure out how to change an asset or open a position in minutes.

Access to smart charts, 75+ indicators and drawing tools, in-depth courses, and trading guides are just a few of the other perks you will get with a demo account. Overall, I can say that Capital.com has one of the best trading platforms for beginners and one of the best demo accounts. Still, there are also a few drawbacks, which I will outline in the table below.

advantages of capital.com demo account | disadvantages of capita.com demo account |

|---|---|

✔ Awarded platform with artificial intelligence | ✘ Demo account balance is lower than with most other sites |

✔ Access to 24/7 customer support | ✘Some assets are locked on the demo account |

✔ Huge variety of 3,000+ markets | |

✔ Unlimited demo account | |

✔ Transition to a live account is very easy | |

✔ Free access to extensive and high-quality educational material | |

✔ No phone number is required for demo account creation | |

✔ Very fast sign-up process | |

✔ Low spreads and no commissions | |

✔ Low minimum deposit for live accounts | |

✔ Full Access to demo trading account via app |

(Risk warning: 78.1% of retail CFD accounts lose money)

Vantage Markets

Vantage Markets is a prominent brokerage firm from Australia, with ASIC and CIMA regulations, in addition to regular audits by KPMG. The broker serves clients from around the world and has been on the market for more than 10 years now. Vantage Markets is also one of the few true ECN brokers. This means that the broker is connected to a network of large liquidity providers.

Their offer of leverage up to 1:500 in combination with very low fees and commissions is what makes the company so successful in my opinion. They also benefit, because they offer a way around the strict European ESMA leverage limitations. Also, you get to choose between spread-based and commission-based account types, which gives you way more flexibility with your trading strategy. If you are unsure, which account type is best for you, I found their customer support to be very knowledgeable and helpful.

Vantage Markets offers a diverse range of assets for traders, including 44+ forex pairs, 15+ stock indices, 10+ commodities, 40+ cryptocurrencies, and 500+ stocks. While it is true, that the selection is a bit smaller than with some other brokers, the company makes up for it, by giving access to MetaTrader 4/5, ProTrader, and a great in-house app for mobile trading. One thing that’s quite rare is the option to use MetaTrader on the web version, which allows you to skip the download process and saves precious resources on your own device.

As I mentioned earlier, Vantage Markets excels in offering exceptional trading conditions. The spreads start at 0.0001 pips and the commissions per lot are some of the lowest I have ever seen. You can expect to pay only 5 Euros or $6 per lot for example. To make things even better, there are also no hidden fees for currency exchanges or withdrawal fees on Vantage markets. They are plain and simple one of the best brokers in terms of costs and fees.

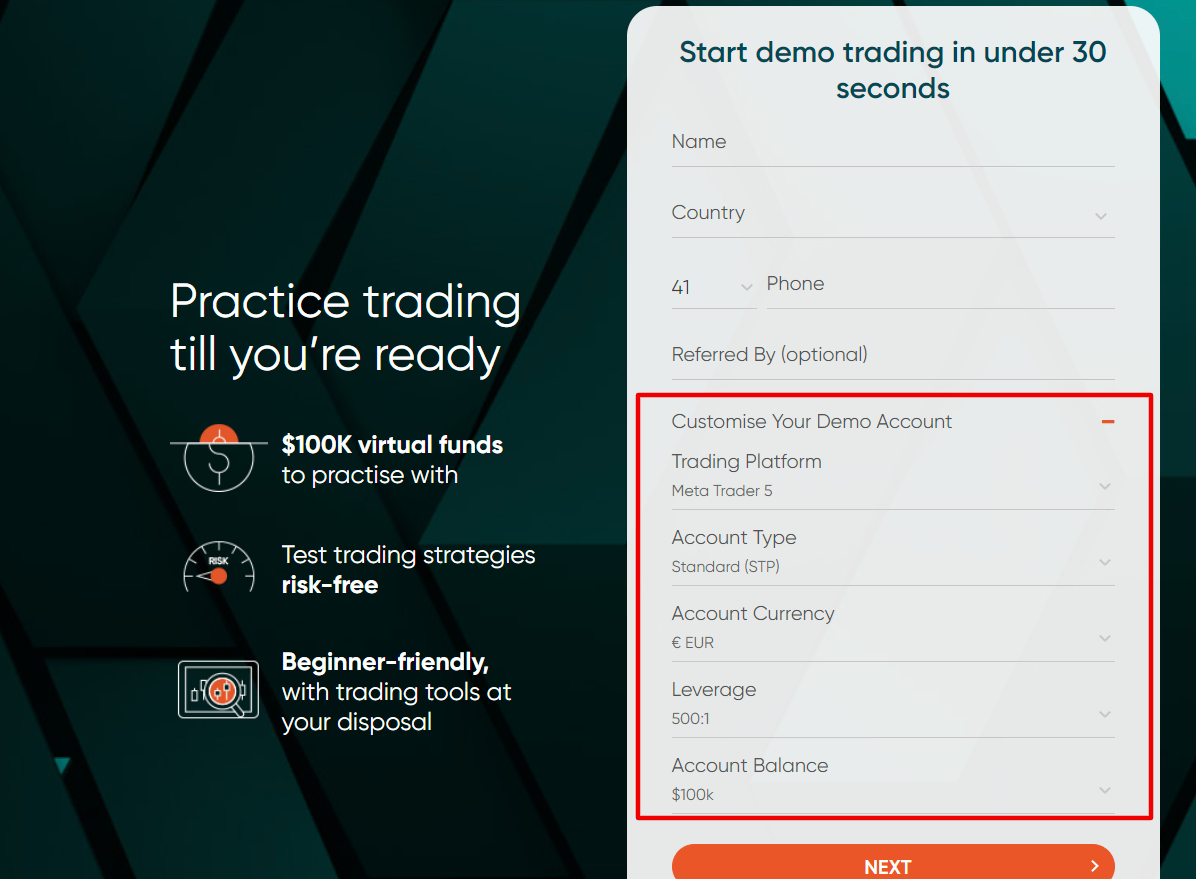

Free demo account on Vantage Markets

One true advantage of a Vantage Markets demo account starts when you sign up. During the process, you have the option to customize the settings and choose the leverage level, account base currency, account type, and trading platform. There are no differences or limitations whatsoever compared to a live account, which is a huge plus in my opinion. The sign-up is also very quick and you even have the option to connect with a Google account.

The demo account on Vantage Markets comes with a generous 100k in virtual funds and is absolutely unlimited. The Vantage app in the App Store or Google Play Store is another highlight, as you can easily connect with your demo account and practice from anywhere you like.

To sum it up, a demo account on Vantage Markets is great for practice trading with high leverage up to 1:500. A high leverage is very beneficial for certain trading strategies, but it also amplifies the potential losses, which is why you really should practice on a demo account first. If you plan to learn the features of MetaTrader 4/5 (which is the world’s most popular trading software) or ProTrader, a Vantage Markets demo account is perfect for you.

advantages of vantage markets demo account | disadvantages of vantage markets demo account |

|---|---|

✔ 100k in virtual funds is very generous | ✘ Fewer tradable assets than with the competitors |

✔ The Vantage Markets demo trading platform is ideal for practicing leverage trading | |

✔ All account types and assets from live accounts are available | |

✔ Unlimited demo account | |

✔ Demo account settings are highly customizable | |

✔ Easy to change a demo account into a live account | |

✔ The Vantage app is available for demo accounts | |

✔ Supports MetaTrader 4 / 5 | |

✔ Extremely low fees on a live account |

RoboForex

RoboForex, a dynamic and innovative trading company, has emerged as a prominent player in the global financial markets. They are offering a wide range of more than 12,000+ tradable assets. Founded in 2009, RoboForex has rapidly grown and offers excellent trading conditions and (due to offshore regulations in Belize) some of the highest leverage levels for all account types. Nevertheless, the broker has an excellent security reputation, and customer funds are protected by the broker’s civil liability insurance of up to 2.5 million dollars. In addition, all clients are protected by negative balance protection, therefore you can not lose more money than your investment in your trading account.

Another reason, why RoboForex is so popular is the low minimum investment of only $10. Also, you will get access to some of the world’s most popular and reliable trading platforms (MetaTrader and cTrader). The available indicators, technical drawing tools, and different charts on the web trader, mobile app, and external trading platforms are among the best in the industry, in my experience.

Lastly, I should mention the excellent customer support. No matter what questions or issues you might have, the company offers very helpful customer support on a 24/7 basis. You can contact RoboForex via e-mail or phone, but the most convenient contact method is the chat feature via the official website. When I tested it, the response was actually very quick, less than 30 seconds in one instance.

Free demo account on RoboForex

The demo account on RoboForex is one of my favorite options, mainly because it is truly unlimited. The initial account comes with a generous $100,000 in virtual funds, but you can easily reload it should you ever run out of virtual funds. The trading conditions are exactly the same as on a real-life account, and the account is more than suitable to practice high-leverage trading.

It took me literally less than two minutes to sign up for a 100% free demo account with RoboForex. All you need is to enter your name, last name, e-mail, and phone number. After that, you have full access to cTrader or MetaTrader, you can even test and familiarize yourself with the platform and both trading software.

advantages of Roboforex demo account | disadvantages of roboforex demo account |

|---|---|

✔ 100k in virtual funds is very generous | ✘ The UX on the RoboForex website/account could be improved |

✔ The RoboForex demo account is best for practicing high-leverage trading | |

✔ No limitations for scalpers | |

✔ Knowledgeable and helpful customer support is available 24/7 | |

✔ Cheap trading conditions for both, demo and live account | |

✔ Full access to MetaTrader and cTrader with a demo account | |

✔ Great selection of indicators and analysis tools available with a demo account |

XTB

Founded in 2002, XTB is one of the largest stock exchange-listed FX & CFD brokers in the world, widely recognized for its superior customer service and innovative trading solutions. It operates with transparency and is regulated by some of the world’s most reputable financial authorities, including the UK’s Financial Conduct Authority (FCA) and Poland’s Komisja Nadzoru Finansowego (KNF).

XTB offers over 1500 global markets, including Forex, Indices, Commodities, Crypto, Shares, and ETFs, via two popular trading platforms – xStation 5 and MetaTrader4. This extensive portfolio makes it an ideal choice for diversified investors. Thanks to the great popularity and a great number of happy clients, the broker is one of the best choices for investors looking for the highest possible security. XTB has branches in more than twelve countries, holds multiple licenses from European regulation authorities, and the company is even present on the Polish stock market.

The groundbreaking xStation5 trading software offers AI-assisted trading experience and simplifies decision-making a lot while still giving you access to all analysis tools and information you might need. The software is available for any device you can think of, desktop, mobile, and web, and is even compatible with smartwatches and tablets.

XTB demo account

The XTB demo account stands out for its exceptional features, offering traders a unique opportunity to practice and hone their trading skills in a risk-free environment. What makes it special is the generous amount of virtual funds it provides. With a substantial virtual capital of $100,000, traders have ample resources to simulate real-market scenarios and test various trading strategies.

I also really appreciate the fact, that the sign-up process for the demo account is possible without providing a phone number. All you need to enter is a few basic information, name, and e-mail address is sufficient. The clear structure also helps new traders to navigate around the trading platform quickly.

This sizable sum of virtual funds allows for extensive experimentation and learning, ensuring that you become confident and proficient traders before venturing into live markets. Besides the demo account, the educational on the company’s website is one of the best I have seen so far. You will find blogs, videos, and even webinars at your free disposal to help you to a successful start. In short, XTB’s demo account is an invaluable tool for traders of all levels, helping them gain experience and confidence without the stress of real financial risk.

advantages of xtb demo account | disadvantages of xtb demo account |

|---|---|

✔ Full access to industry-leading xStation 5 trading software | ✘ The website doesn’t offer a two-factor identification |

✔ The XTB demo account is highly compatible with most devices | |

✔ Personalized support if you ever get stuck | |

✔ The company offers one of the best educational sections for new traders | |

✔ Competitive spread fees | |

✔ No hidden fees or commissions |

Libertex

Libertex is a broker with a 20-year+ long history in the trading industry. It was founded back in 1997 which is a very good sign for its reputation because it usually scam brokers disappear rather quickly. The company also has a valid regulation from the Cyprus Securities and Exchange Commission (CySEC) which is one of the most trusted regulators in the world.

With Libertex you will have access to more than 250 hand-selected markets including stocks, cryptos, forex, and metals as well as more niche assets. I will be the first one to admit that the selection of assets is more limited than with some of the much bigger trading companies on this list. Still, it offers everything you need in terms of indicators, trading platforms, and lucrative trading conditions. The target audience of Libertex is mostly traders with some experience, which explains the lack of educational material or extensive trading information on the site. However, especially if you are looking to load your trading account via PayPal later, I highly recommend giving Libertex a shot.

Personally, I like the broker mainly for the very low spreads and commissions, which is the company’s greatest strength. Libertex has more of a personal atmosphere with a great focus on trust and personal connection between the client and the support staff.

Demo account on Libertex

Once you sign up for a demo account with Libertex, you will get a balance of $50,000 added to your virtual account. All you need to register is your name and your e-mail address making the creation of a test account very easy and hassle-free. The design and layout of the web trader are highly self-explaining so you start training pretty much instantly.

You also have the option to trade with MetaTrader software, although the learning curve is more steep if you have absolutely no pre-existing knowledge. On the other side, because it is the most popular trading software, you will easily find tutorials and guides if you need them.

advantages of Libertex demo account | disadvantages of Libertex demo account |

|---|---|

✔ Demo account opening is easy and extremely fast | ✘ Tradable assets are more limited than with some other brokers |

✔ Possibility to deposit funds via Paypal | ✘ Availability of customer support is below average |

✔ Libertex is licensed by one of the world’s top regulators | |

✔ Webtrader is extremely easy to use | |

✔ The demo account gives full access to all features of the live account |

Advantages and disadvantages of demo accounts

A trading demo account is an account filled with virtual credit (play money). It comes with many great advantages, mainly the possibility to test your trading strategy risk-free. The account is particularly suitable for beginners who want to start trading. You can easily collect your first trading experience in a demo account and change to a live account with real money later.

With any serious broker, the spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Now, let’s go over some of the advantages and disadvantages of an online trading demo account.

Advantages of demo accounts | disadvantages of demo accounts |

|---|---|

✔ No financial risk when testing new trading strategies | ✘ Demo accounts can’t replicate the psychological factor when trading |

✔ Insides of the trading platform and functions of the different brokers | ✘ Some indicators might be unavailable on demo accounts |

✔ Possibility of training with real-life market conditions | |

✔ Better understanding of trading jargon/expressions |

Trade more than 6,000 markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Are there any differences between a demo account and a live account?

With good brokers, there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers, you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread have no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, it is usually also possible to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker, one can recharge the account very simply in a few clicks. If you have any questions you can contact the support.

Trade more than 6,000 markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

What to consider before moving from a demo account to real money

Before you take the next step and transition from a demo account to a live account. Real capital trading comes with more risks therefore, I recommend to consider these aspects:

Additional costs: On some demo accounts, there are no spread fees or commissions charged such as in the live account. Keep in mind to consider these additional costs to maintain profitability if that’s the case. However, with most demo account providers I recommend in this article, the trading conditions are 1:1 the same.

Psychological factors: Psychological factors are a very critical aspect, because simulated trading with demo accounts can’t prepare you for that. Try to avoid emotional decisions by choosing the size of your positions reasonably and set clear goals how much of a profit or loss you can handle per day. I would also not recommend to trade for extended time periods as it requires a high level of concentration. So give yourself a break frequently.

Profitability: Make sure you feel confident and have demonstrated constistant profitability on a demo account, at least over the period of one month. If you are in doubt, I would tend to recommend to extend the demo account period because there are additional (emotional) factors that comes into play with a live account.

How to sign up for a demo account

Now I am going to explain you in detail, how you can sign-up for a demo account. I will use capital.com as an example for a broker today. If you decide to go with any other broker, the steps are usually quite simalar, only the layout and design of the website could be a bit different. In rare cases, there is no button to sign-up for a demo account available at first sight. In this case, often you can create a regular account and create a demo account via the customer portal later.

1) Sign-up process

The first thing I need to do is to find the official website of capital.com. On there you have the option to login or sign up in the top right corner. Since I am creating a new demo account I will hit sign up and all I need to do now is to enter my e-mail adress and choose a password.

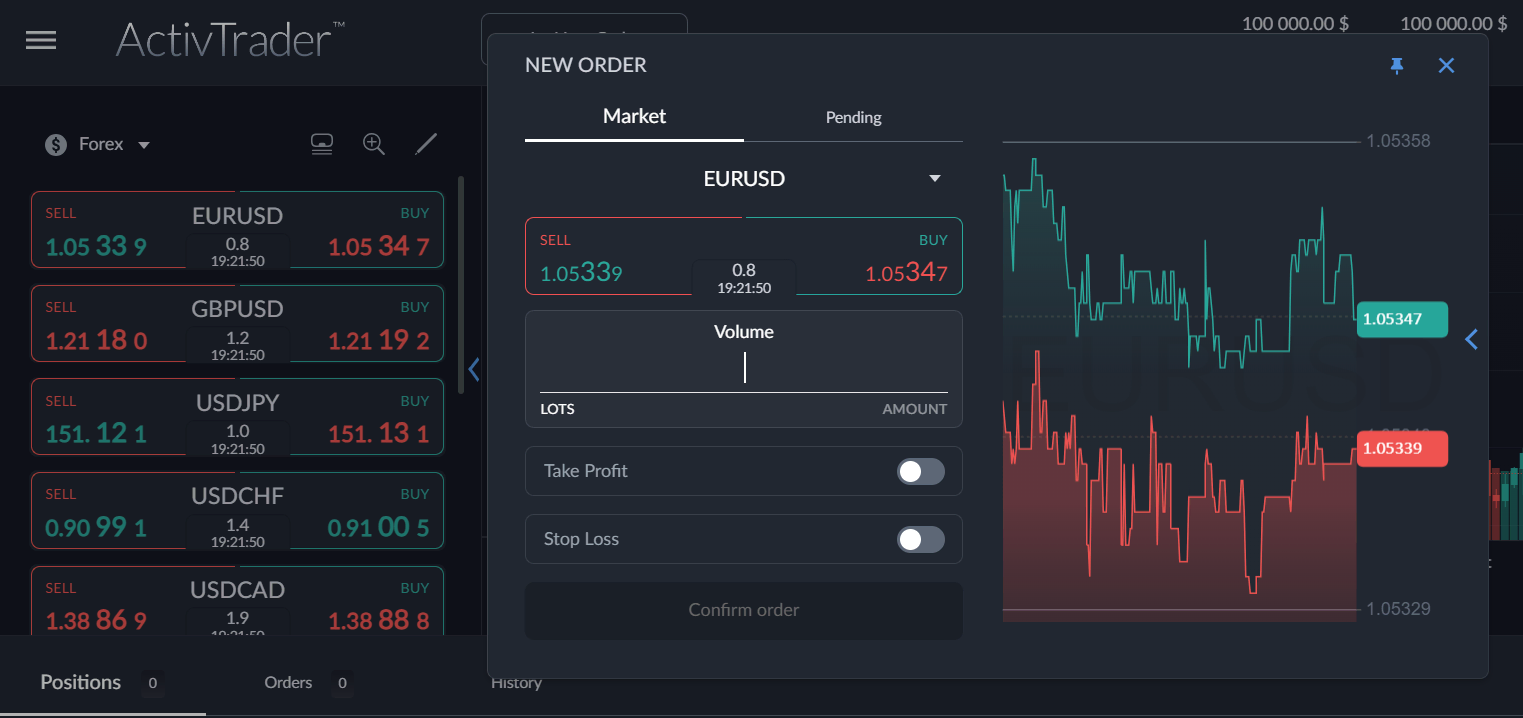

2) Place your first trade

Immedialy after, you will be redirected to the webtrader where you can analyze assets, and open and close positions with virtual funds and a leverage of 1:100. As you can see, the entire process in very uncomplicated and should take you less than a minute.

Trading demo account without signing up

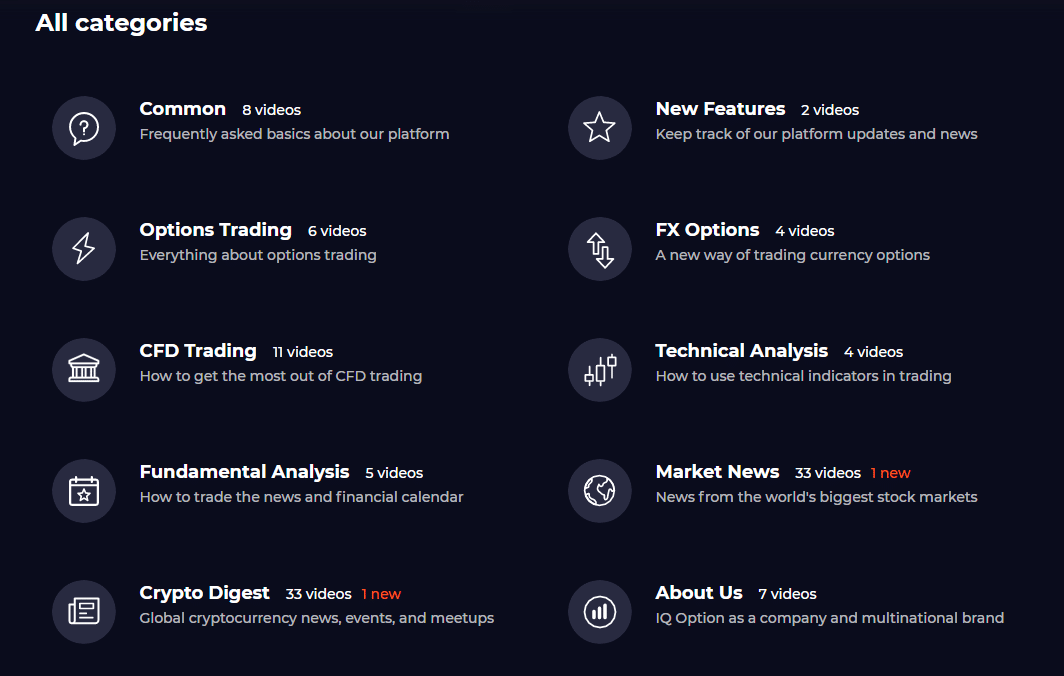

There are also a few selected brokers that allow you to practice with a demo account without even signing up. ActivTrades is an example of such a broker. You can use their demo account for 30 days without registering.

The broker company was founded in 2001 in Switzerland and moved the headquarter to London in 2005. The fact that the company has a long and transparent history and has been on the market for more than 20 years now is a great sign. They know what they need to offer to their clients to offer an attractive offer. Activetrades also won more seven awards from reputable industry magazines in 2023 alone.

Their trading platform is very intuitive and easy to understand. It only takes three clicks to open your first position on the demo account and the amount of analytical instruments is good too.

Additional training resources for new traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. An additional resource is the free educational section, which many broker companies offer. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. You can also read my 10 Trading Tips.

Conclusion: The demo account is the best way to learn online trading

The trading demo account is suitable for any trader and I highly recommend you take advantage of it before trading real money. Even if you already have trading experience, testing new strategies and familiarizing yourself with the platform of a new broker in the demo account setting is never wrong. In addition, the creation of such an account is done in a few minutes. Online Brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

But, what is the best demo account overall, if I had to name just one? For me, the demo account of capital.com is the clear winner here. The broker company is not only highly regulated and safe, but the trading platform is best for beginners and experienced traders alike. Since the demo accounts are always free, you can also sign up with every broker in this article, and decide for yourself, which platform you like most.

But, no matter which company from my list you decide to go with, the demo account is one of the most important tools for a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your free demo trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

Trusted Broker Reviews

Experienced traders since 2013Trade more than 6,000 markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQs- The most asked questions about Trading demo account:

Do demo accounts offer leverage? Do they allow scalping?

Nearly every broker that offers demo accounts offers leverage. Some brokers offer extremely high leverage up to 1:2000. But there are a few reputable brokers who do not offer leverage in their demo accounts. The same applies to scalping – some brokers offer demo accounts that offer it, and some don’t. Scalping refers to making several-day trades in the forex market to profit from small price movements.

How long does it take to open a demo account?

Signing up for a demo account typically takes around two minutes. All you need to do is sign up with the broker and verify your email, and you should be ready to trade. The requirements and exact sign-up process are slightly different from company to company. Some brokers demand your phone number for example.

How long should I practice in a demo account?

From my experience, you should practice in the demo account until you make constant profits with your demo account and feel comfortable for the next step. Personally I would say, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money. I highly recommend keeping a statistic about your trades. Some trading platforms offer tools and very transparent statistics about that. Alternatively, you can always keep a track record on an external software like Trademeteria.

Are demo accounts always free and unlimited?

In general, a demo account is always free of charge. Every trustworthy broker usually offers a demo account. It is a win-win situation for you and the broker company. The amount of virtual funds varies from broker to broker and the user conditions vary from broker to broker, but it can usually be recharged quite easily.

See other articles about trading:

Last Updated on November 2, 2023 by Res Marty

(5 / 5)

(5 / 5) (4.8 / 5)

(4.8 / 5)