TradingView review and prices: Is it the best trading software?

Table of Contents

Review: | Type: | Availability: | Costs: | Assets: |

|---|---|---|---|---|

(4.9 / 5) (4.9 / 5) | Trading software | Desktop (Windows, iOS), Webtrader, Mobile app (iOS, Andorid) | Monthly subscription plans: Basic – 0 $ Pro – 14.95 $ Pro+ – 29.95 $ Premium – 59.95 $ | Forex, CFDs, Stocks, Crypto, and more |

TradingView allows traders to trade some of the best cryptocurrencies. In addition, it is a perfect trading platform for trading other assets. TradingView has several charting tools that enhance the trading experience of any trader.

Most traders love to conduct a technical analysis before they place their trades. TradingView is an ideal platform for such traders. However, it does more than offer technical indicators to traders. Let us uncover TradingView facts that explain why it is possibly the best platform for all traders.

What is TradingView- Advantages for all traders

As mentioned, TradingView is another trading platform allowing traders access to numerous trading tools. Thus, it is an innovative online trading platform that enriches any trader’s experience.

Good to know!

TradingView offers a lot of things to traders. Usually, traders use this trading platform to customize their trading experiences.

However, there are several advantages that TradingView offers traders. Let’s explore some.

Advantages of TradingView for traders:

- Traders can customize their favorite trading charts on Trandingview. It means that you can use TradingView as per your needs.

- Traders can choose and select their preferred time frames on this trading platform.

- Several patterns, designs, lines, etc., prove handy for traders.

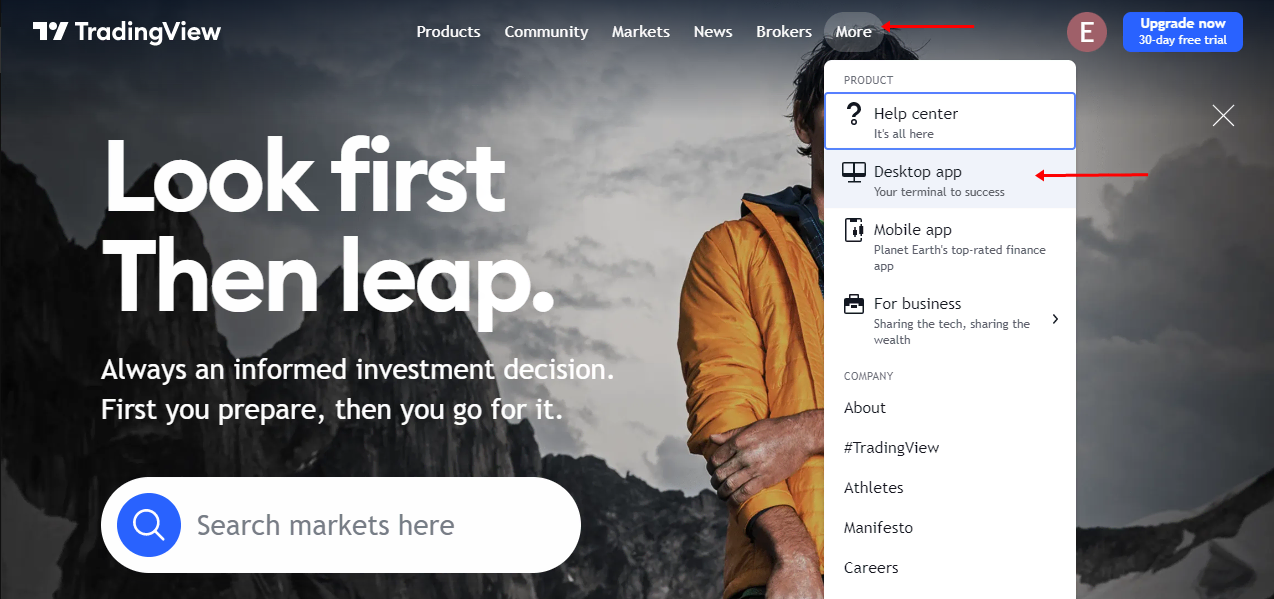

- TradingView is available in the form of mobile and PC applications. So, traders can download it on their phones and enjoy trading on the go!

- This trading platform makes charting various stocks and underlying assets easy for traders.

- It allows traders to use both free and paid trading accounts.

- The best part about trading on TradingView is that a trader can go live with his positions. You can publish your trading knowledge, positions, strategies, etc. It allows other traders to look into and learn from your trading tactics.

- Thus, traders can learn more about trading than they already know. You can always get feedback from other traders who can easily point out the loopholes in your trading strategies.

So, a trader who uses TradingView can experience immense advantages. However, you might still wonder what makes TradingView the most featured trading platform with several brokers. Knowing about the unique selling points of TradingView might interest any trader.

(Risk warning: Your capital can be at risk)

What are the unique selling points of TradingView?

There are many more than just advantages that explain why TradingView is a famous trading platform among several investors. Several unique selling points or features of TradingView make it great.

Here are some of those USPs.

Multi-time frame settings

Trading involves a lot of technical analysis. However, making such a technical analysis for a trader is possible only when he uses the right tools and sets the right time frame. For instance, if you are determining the trend of any asset, you have to check its price movements over a certain period.

Good to know!

The time frame a trader must choose depends upon several factors. For example, you might have long-term or short-term trading goals, based on which you set a time frame to conduct technical analysis.

Traders love TradingView because it allows you to do just that. It helps you choose from multiple time frames to make an accurate analysis and win your trade with profit.

Undo-redo feature

TradingView also offers an undo-redo feature to traders. Technical analysis requires traders to combine and use several indicators and charts. However, sometimes traders might make the situation messy. Most platforms do not allow you to seek a way out in such cases. A trader has to run his entire technical analysis from the start. It makes trading a hassle for them.

However, TradingView offers the undo-redo feature to traders. So, even if you mess up your trading charts or technical indicators, you can always undo it. It is a USP of TradingView that looks lucrative to many traders.

Visibility

The visibility of TradingView is perfect. A trader can easily see and monitor what the trading indicator is showing. Thus, traders can get a comprehensive view of the market sentiments.

TradingView thus helps traders to make the best out of the available opportunity.

Go-to-date feature

Most trading platforms or brokers do not offer this feature to traders. Ultimately, traders must dig a lot, which consumes too much of their time. However, if a trader wishes to know the underlying asset’s price on any stipulated date, he can use this feature on TradingView. Since other trading platforms do not offer it, TradingView is famous among investors.

High-quality images

TradingView allows traders to take high-quality images of the charts they work on. It is one USP of TradingView. Often, traders want to share their progress with fellow traders or friends. However, there is no way for them to do that. Mostly, traders would need to take a screenshot of such images.

Good to know!

Unfortunately, these screenshots are not of good quality and fail to communicate the necessary. So, TradingView offers a way out of this problem to traders. They can access high-quality images by saving them.

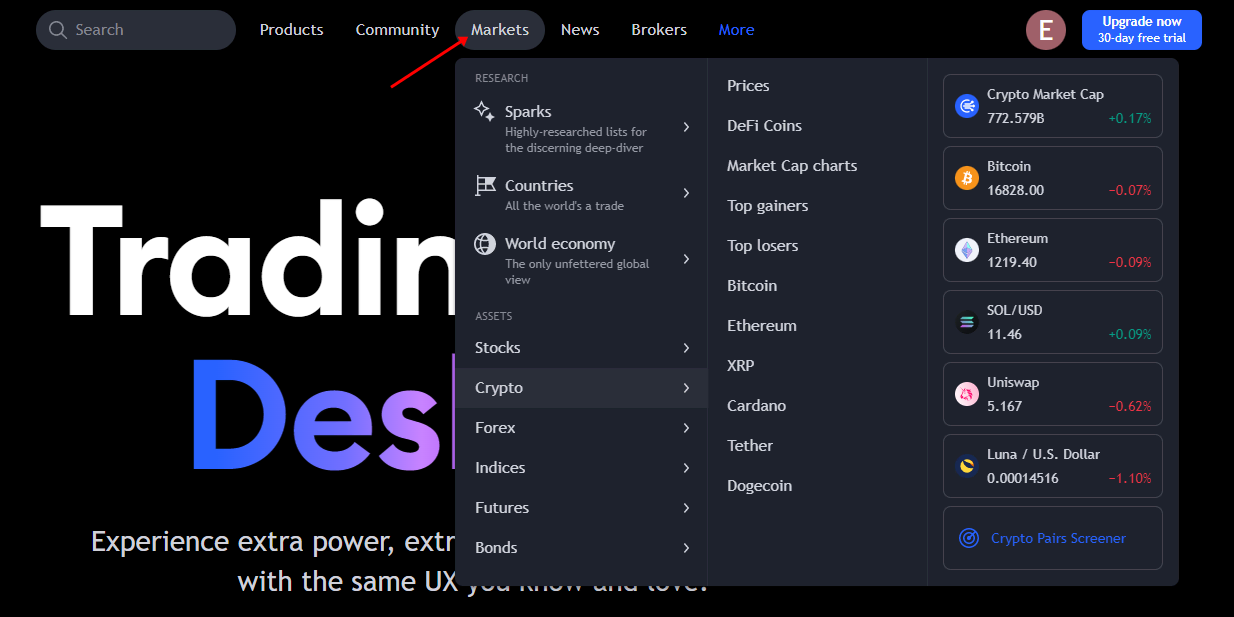

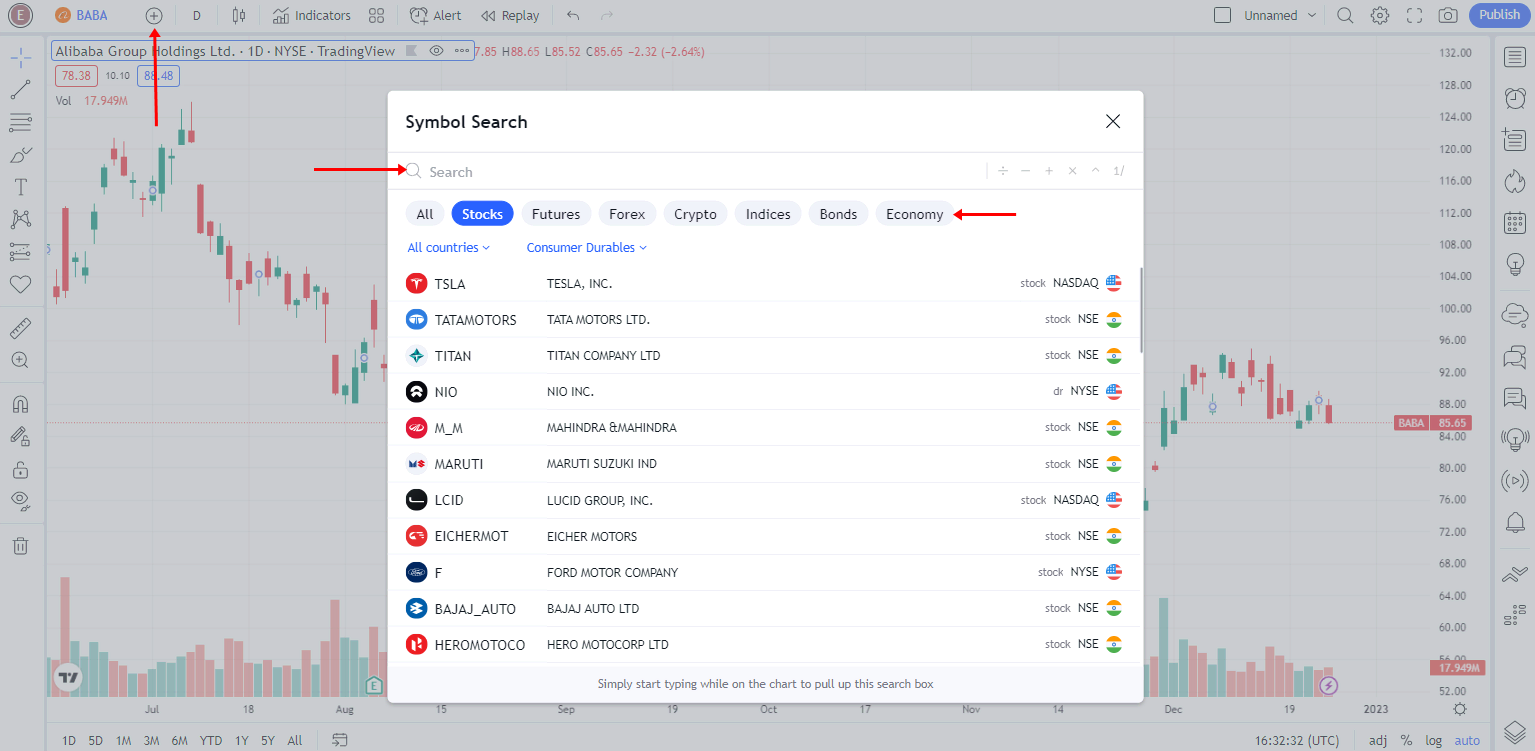

Which markets are available on TradingView?

Fortunately, TradingView is the right fit for most brokers. It offers an innovative solution to all traders. The kind of underlying market that you wish to trade is always at your disposal on this trading platform. For instance, traders can access the following market types on TradingView:

- Stock market

- Cryptocurrency market

- Forex market

- Commodity market

- Indices

Thus, traders only need to choose the kind of underlying asset they wish to trade. TradingView has a solution for every trader.

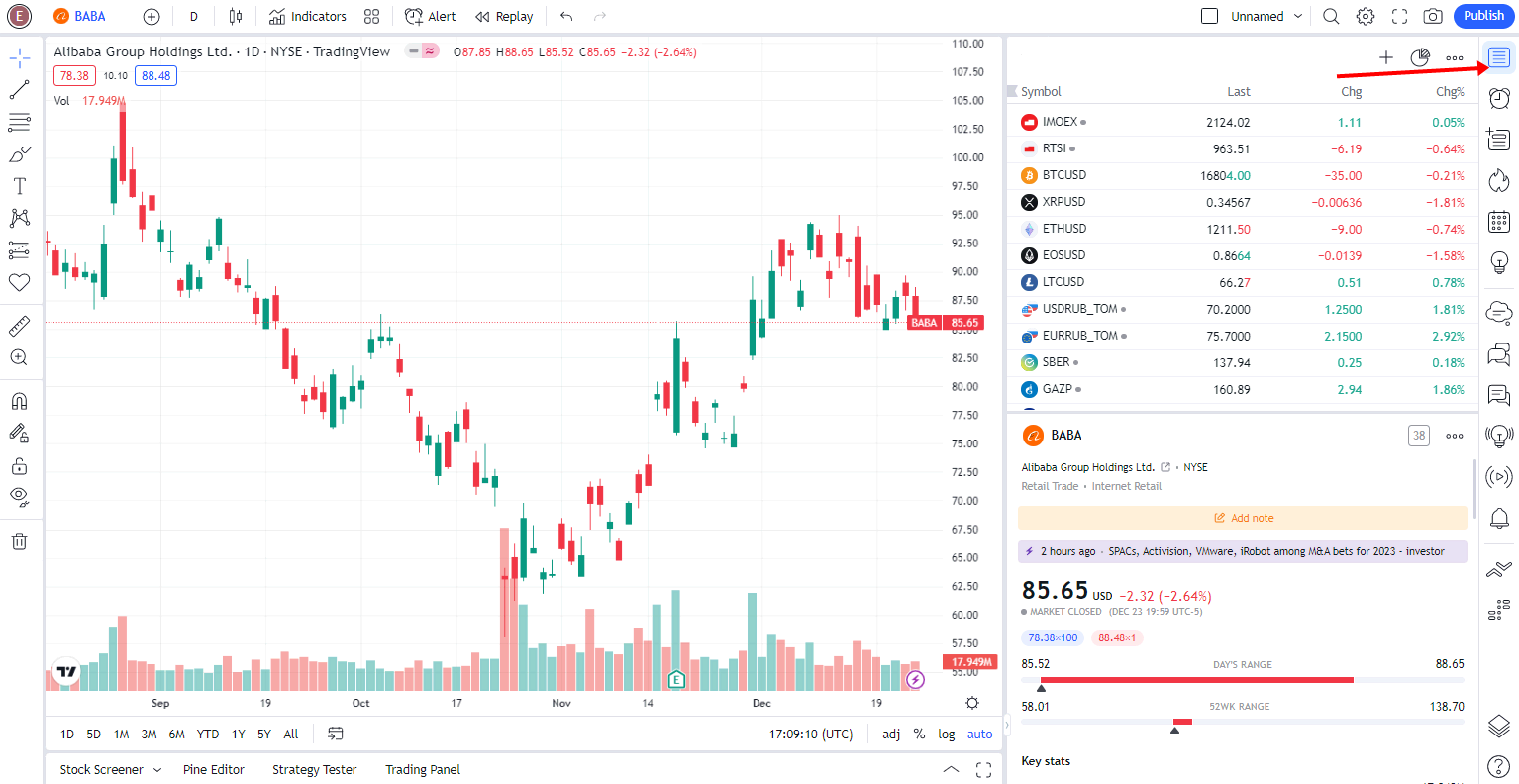

Market Data and real-time data

Traders can access both real-time data and market data on this trading platform. In addition, TradingView offers a market data widget to traders that lets them access all the leading market data.

Besides, you can access real-time data depending on whether you have a live trading account with a broker.

Market data

The market data is available on TradingView for all traders who want to trade long-term or short–term trading instruments. For instance, the broker offers you market data concerning various cryptocurrencies. In addition, you also get the data for several stock markets, commodities, indices, etc.

Good to know!

Since traders can get continuous access to the market data, they can enjoy trading with much more confidence. Moreover, conducting a technical analysis is easy for any trader when he knows any underlying asset’s market ups and downs.

It does not matter which market a trader wants to trade in. You can find all the underlying markets on Trandingview. You can even trade some of the best and leading forex pairs on this platform.

Real-time data

To access the real-time data on TradingView, a trader would need a live trading account. You can sign up with any broker who offers you a live trading account.

Traders can execute a purchase transaction for real-time data from CME exchanges. Once a trader owns this data, he wouldn’t need to make a purchase transaction again to access data on TradingView.

Good to know!

To access the real-time data on TradingView, a trader only needs to verify his trading account with the broker. When you do this, TradingView will also verify which subscriptions are available to you. Once this data is known, you can contact your broker from the Trading Panel and access the data.

Usually, the platform makes available real-time data to traders considering the following time frames:

- TradeStation broker -7 days;

- Tradovate broker – 30 days;

- AMP broker – 30 days;

- IronBeam broker – 30 days;

- Any CQG broker – 30 days;

Thus, depending upon the type of broker you sign up with to use TradingView, you will be able to use it for the following durations.

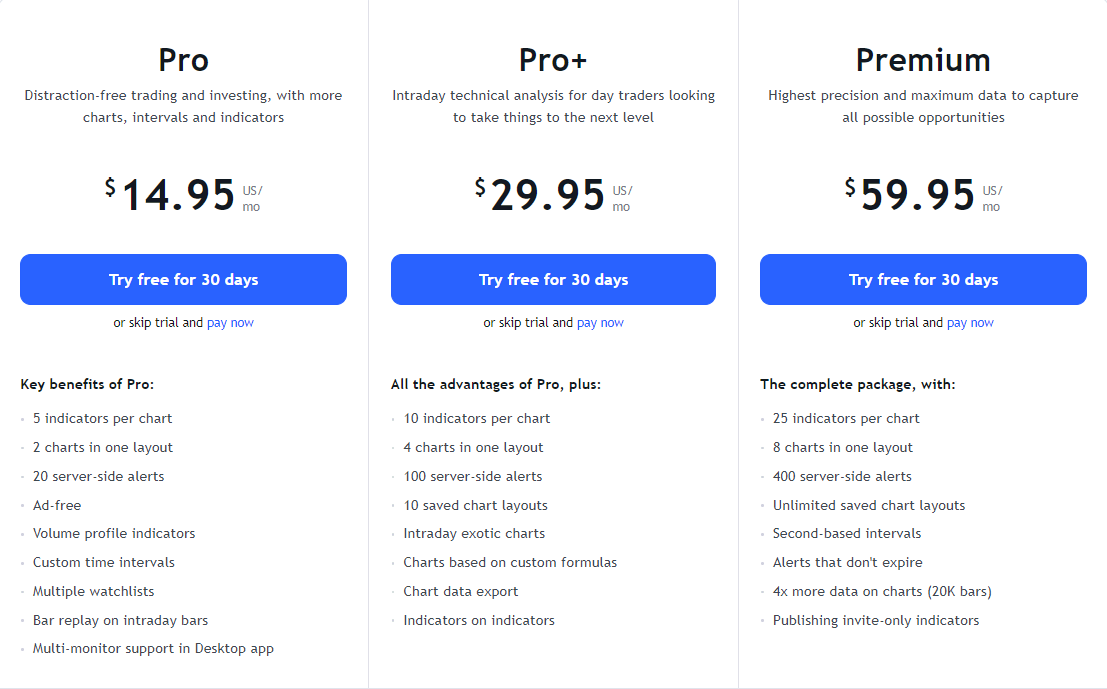

How much TradingView costs? Fees Explained

Before trading with TradingView, you must understand its cost structure. Once you do, it will become clear whether TradingView is worth the time and money.

Generally, TradingView has a very simple cost structure. Users have to pay for annual subscriptions. But, of course, there are other available options. For example, traders can choose a TradingView plan according to their trading needs.

Account type: | Monthly charge in USD: |

|---|---|

Basic | 0 |

Pro | 14.95 |

Pro+ | 29.95 |

Premium | 59.95 |

There are different account types on TradingView. Each account type has different pricing for traders. For instance, you can skip paying if you choose the most basic TradingView platform.

- The basic TradingView platform costs $0. However, as you choose the higher level of accounts on this platform, you will have to pay a charge

- TradingView Pro costs $14.95 per month. So, a trader who opts for the pro platform on TradingView must pay this charge monthly

- This trading platform also offers a Pro+ trading account to traders. However, there is a charge of $29.95 that a trader has to pay monthly

Besides, the highest and the best form of the TradingView platform, called the premium version, is available for a charge of $59.95 per month.

Apart from this, there are annual plans that a trader can opt for. The annual subscription cost is as follows:

- TradingView Pro – $155.40

- TradingView Pro+ – $299.40

- TradingView Premium $599.40 per year

Good to know!

As you can see, opting for a yearly subscription to TradingView is the best choice for any trader. A trader saves a lot of money when he chooses these plans. On the other hand, this platform also offers two-year subscription plans. If you opt for the two-year subscription, you might get a 16% discount on your purchase.

So, traders can purchase this platform depending on their trading requirements. The platform has different types of pricing for different accounts or models. All these prices are retail, which means that as an individual trader, you must pay these prices to access the platform.

Should you buy a TradingView plan? – Overview

Opting to buy something new always creates confusion. Traders must be extra cautious about a platform that can help them mint money. If you wish to know whether buying a TradingView plan is worth it, here is the overview.

Features: | Availability: |

|---|---|

Charts | Numerous charts available |

Trading indicators | All leading indicators are available; traders can use more than one indicator on charts |

Push notifications | Yes |

Demo account | Yes |

Free to use | A basic trading account is free |

Automated trading | Yes |

Good to know! – Get TradingView plans for free!

Undoubtedly, TradingView has many advantages that justify why it is a must-have for any trader. There are a lot of technical tools and indicators that a trader can access. Of course, researching this automated platform is very straightforward.

Thus, traders can simplify their trading journey. They can plan and strategize their moves with much more conviction. It proves why TradingView is the best platform and is worth it for every trader.

Besides, several key TradingView features help you get out of the dilemma.

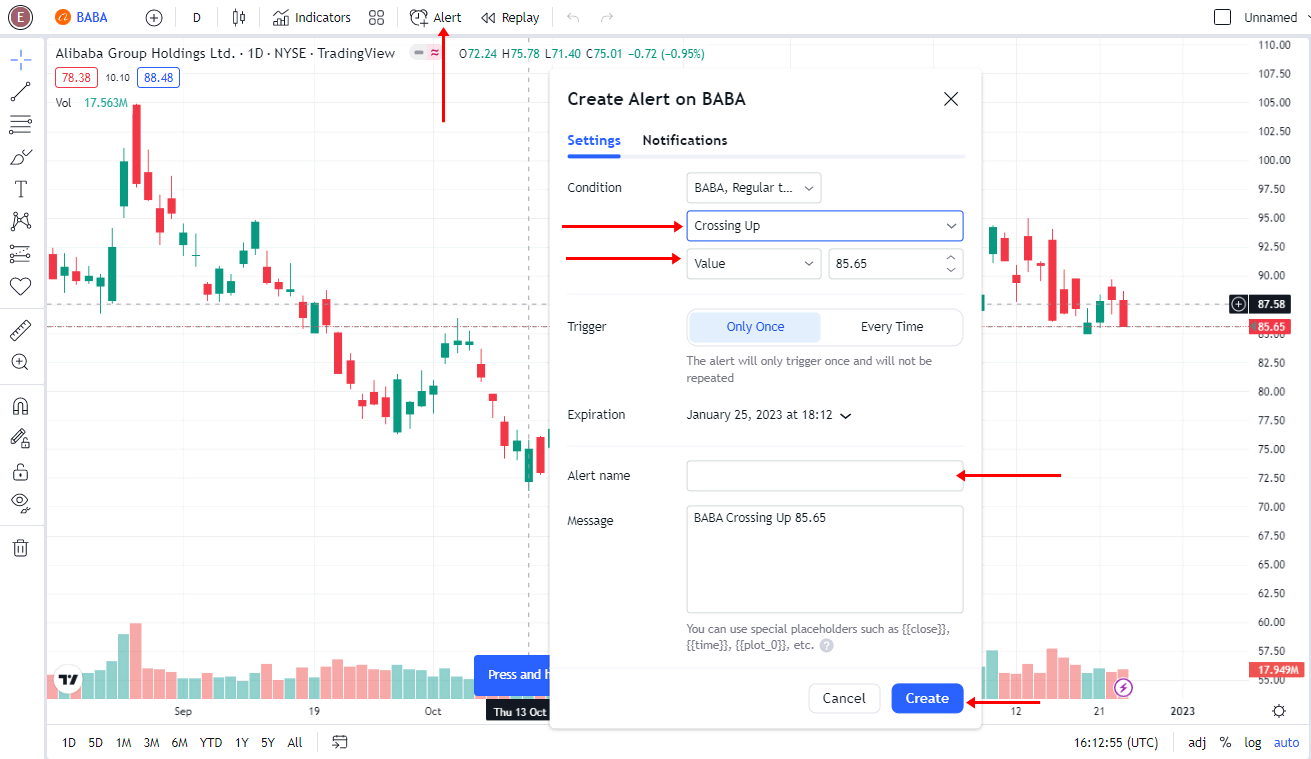

Real-time alerts

All traders want to trade on a platform that helps them minimize losses. It is possible only when traders get real-time alerts.

Real-time alerts are a characteristic feature of TradingView. In addition, you can customize the market alerts you get on this platform. Thus, being fully informed about the market happenings is possible for traders:

- Traders can set market alerts on TradingView, not dependent upon the type of device they use

- TradingView offers alerts for 12 different conditions. Traders can customize and set what they wish to see the alerts for

- This platform offers you alerts about the change in an asset’s price. Besides, it also pushes notifications when you need to check your indicators or market strategy

- You can also set up alerts as webhooks

Additional features

The two features we mentioned explain why TradingView could be the thing a trader needs. However, that is not it. Traders get many more features on TradingView that are difficult to find elsewhere. For instance:

- Traders have access to more than 30 different trading indicators. The premium account type on TradingView allows you to use more than 25 trading indicators on one chart

- You can easily test your trading strategies on this platform. So, the scope of making losses on trade is lesser for traders

- Unlike other platforms, TradingView supports paper trading

- Trading directly from the charts is possible on this platform. So, traders don’t need to worry about losing track of their technical analysis

- TradingView supports an integrated chart functionality. So, you can move from chart to chart to conduct your technical analysis

- The instrument heatmaps on TradingView are interactive

So, several features establish the reliability of this trading platform. TradingView can enhance any trader’s experience, which is why you should buy this platform.

Market Overview

TradingView allows traders to track all the markets. You can see the downfall or rise of the cryptocurrency or any other underlying asset on this platform.

Here is a list of the underlying markets that traders can access on TradingView:

- Bitcoin

- Ethereum

- Litecoin

- Bitcoin Cash

- Other cryptocurrencies

- Stocks

- Indices

- Commodities

- Metals such as gold and silver

- Forex

TradingView is a one-stop trading solution for traders who like to trade multiple assets. In addition, it is the best trading platform for traders who wish to indulge in trade diversification.

Automated technical analysis

TradingView is well known for the automated technical analysis that it allows traders to conduct. Automated technical analysis is possible since traders do not have to involve coding. The zero coding feature of TradingView allows traders to conduct technical analysis. With this technical analysis, trading becomes easy for beginners.

If a trader has no technical background or is trading for the first time, he can use the help of the automated technical analysis of TradingView.

By creating TradingView alerts, any trader can walk on the roadmap to automated trading. The pine script alerts traders when the automated trading detects price changes.

Trading ideas

All traders can live stream their trading strategies and trades on TradingView. So, if you are a beginner, you can watch the live streaming of traders of those traders who are experts in trading.

Their trades and strategies can be a base for you to build your new trading strategies. In addition, you can also generate various trading ideas from the same.

Test of the TradingView charting functions

TradingView mostly focuses on helping traders achieve a perfect technical analysis. It is possible only when a trader enjoys access to the leading tools, including charts. The extensive tools and all charts on this platform make it amazing. You can also switch between the two modes- light and dark, that TradingView offers.

The number of charts a trader can open depends upon the account type he holds. For instance:

- TradingView basic account allows traders to open only one chart

- If you opt for Pro, you can access more than one chart

Likewise, the number of charts a trader can access increases as you switch to a premium account type.

The best thing about TradingView charts is that traders can access all the leading trading indicators on the same chart. These charts offer extra speed and flexibility to traders.

Chart types

Here is a list of chart types that TradingView commonly offers traders:

- Bar chart

- Handle chart

- Hollow chart

- Colum charts

- Baseline charts

- Line and area charts

- High-low charts

- Heikin Ashi charting tools

- Renko charting tool

- Line break charts

- Kagi charts

- Point and figure charts

- Range charts

Thus, traders can use one or more charts and charting tools this broker offers.

Timeframes for charting

TradingView is a purely customizable trading platform. As a result, you can easily follow any timeframe that fits your trading needs. Usually, the most common time frames traders use on this platform usually include the following:

- 1, 5, 10, 15, 30 seconds

- 1, 3, 5, 15, 30, 45 minutes

- 1, 2, 3, 4 hours

- daily, weekly, and monthly time frame

- 1, 10, 100, 1,000 orange

If you want to choose a different time frame, you can do that without hesitation.

Compare assets on TradingView

TradingView is a perfect trading platform for finding assets that one should trade. Moreover, this broker makes trading easy since the assets can be compared easily using one or more tools.

There is an option for a ‘compare tool’ that traders can use on TradingView.

TradingView indicators

Trading indicators are the best thing about TradingView, as hundreds are available. A trader can choose any leading indicators to build their trading strategies on this platform. For instance, leading indicators such as MACD, Fibonacci Retracement, Bollinger Bands, EMA, ATR, etc., are easily available on this trading platform.

What’s better is that traders can use more than one trading indicator at any time. Thus, they can conduct a perfect technical analysis before placing their trade.

Drawing tools

TradingView offers a wide range of drawing tools to traders. Traders can access more than 90 drawing tools on this platform. In addition, you can choose among lines, trends, and geometric shapes in the tools section.

Risk-Reward tool

There is a risk-reward tool on TradingView. This tool helps traders know their position while trading.

Using the risk-reward tool, a trader can easily calculate your potential profits on the trading platform. Thus, traders can easily find a competitive edge in their trading.

Left-side function list

The left-side function list on the TradingView app contains very important tools. These include drawing tools, trends, lines, etc.

Right-side function list

The right-side function list of TradingView will show you the leading chart types. It will also allow you to access trading indicators.

If traders wish, they can merge the left and right side toolbars on TradingView. It will allow you to choose all your options from one place.

Watchlist

The TradingView watchlist will allow you to watch the leading market trends. In addition, it will show you the asset’s prices. Thus, you can easily determine the rise and fall in an asset’s price.

Details and news

A wide range of details and news is available on TradingView. The application also alerts traders when the news might affect the underlying asset’s price.

Public and private chats

Traders have the option of allowing people to trade private chats with them. On the other hand, public chats on TradingView are available for anyone to access. So to only have to click on the ‘public chat’ option and select the chat in which you wish to participate publicly.

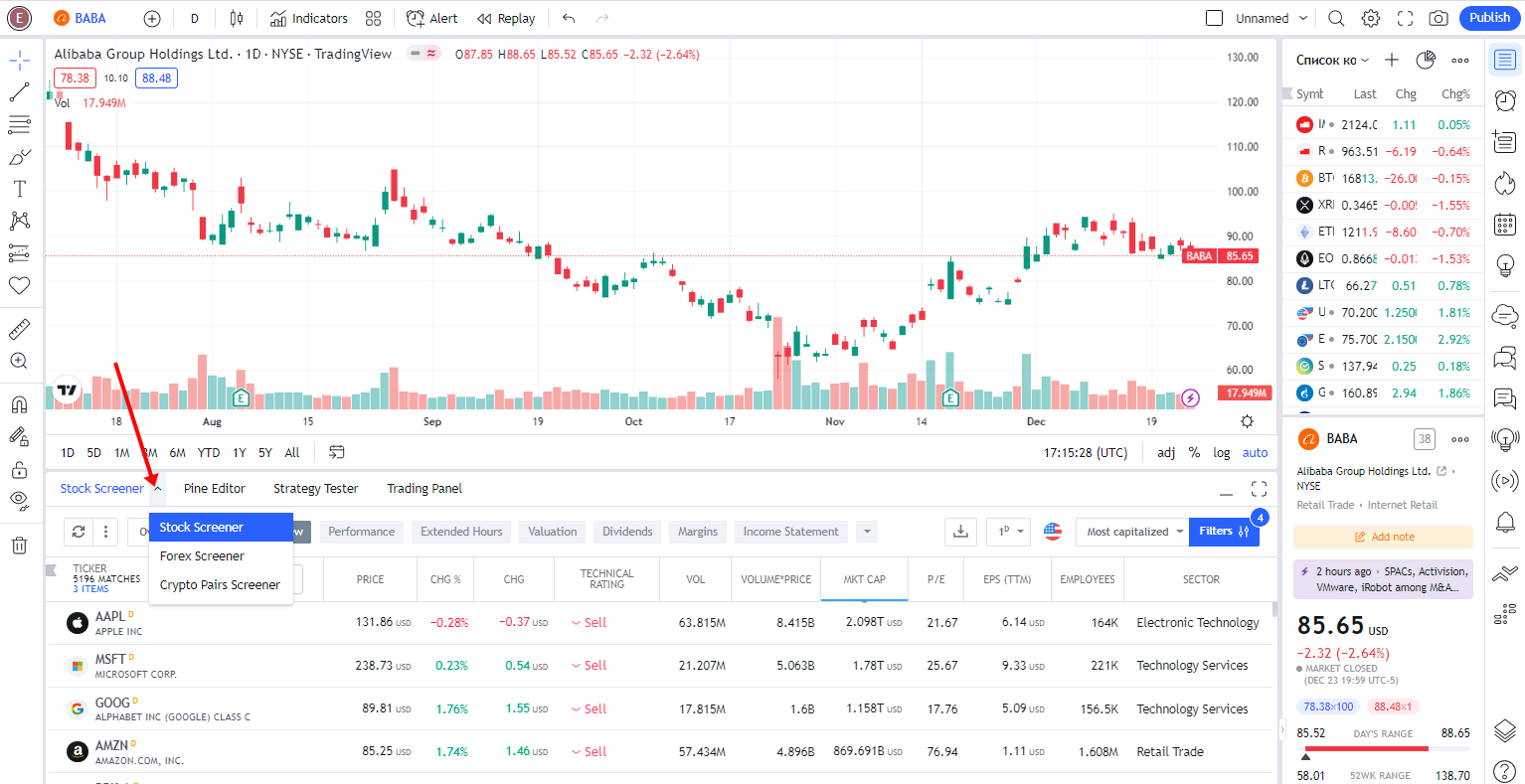

Stock screener on TradingView

Screeners are available on TradingView for not only stocks but other assets as well. You can find the forex screeners and cryptocurrency screeners as well.

You can choose from the wide range of screeners available. They will allow you to test the asset’s market performance, reputation, valuation, etc.

Strategy tester

Traders can use TradingView as a strategy tester. There are several tools that the TradingView demo account allows traders to access. You can test your strategies after you build them on a demo account.

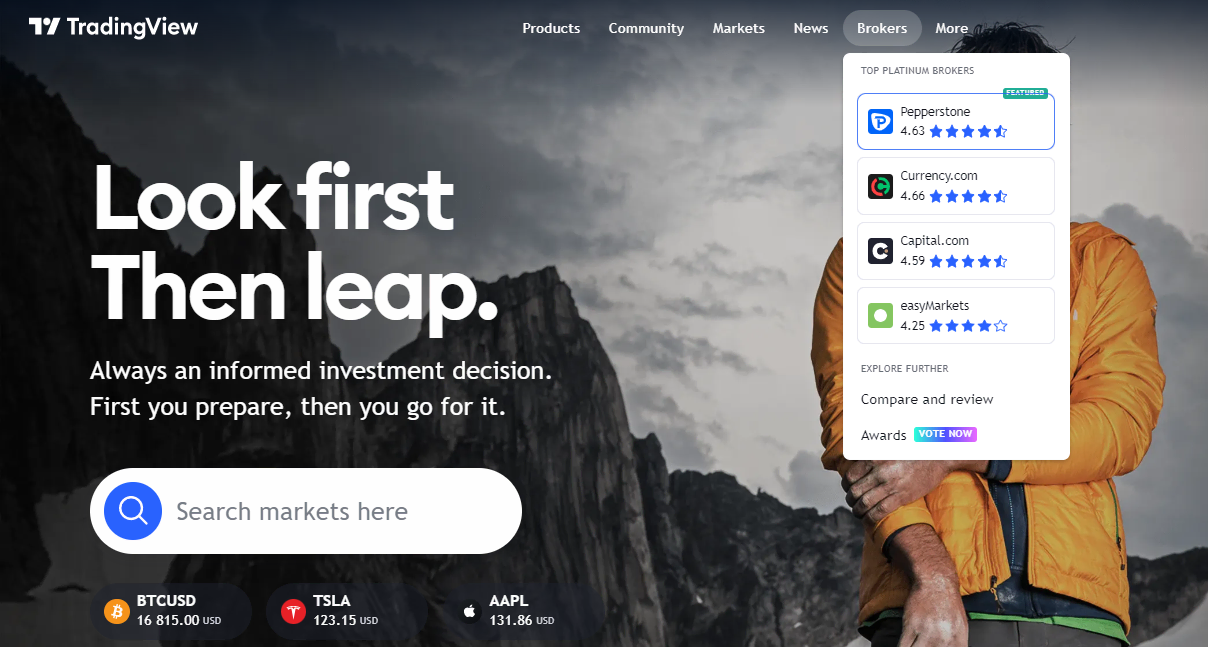

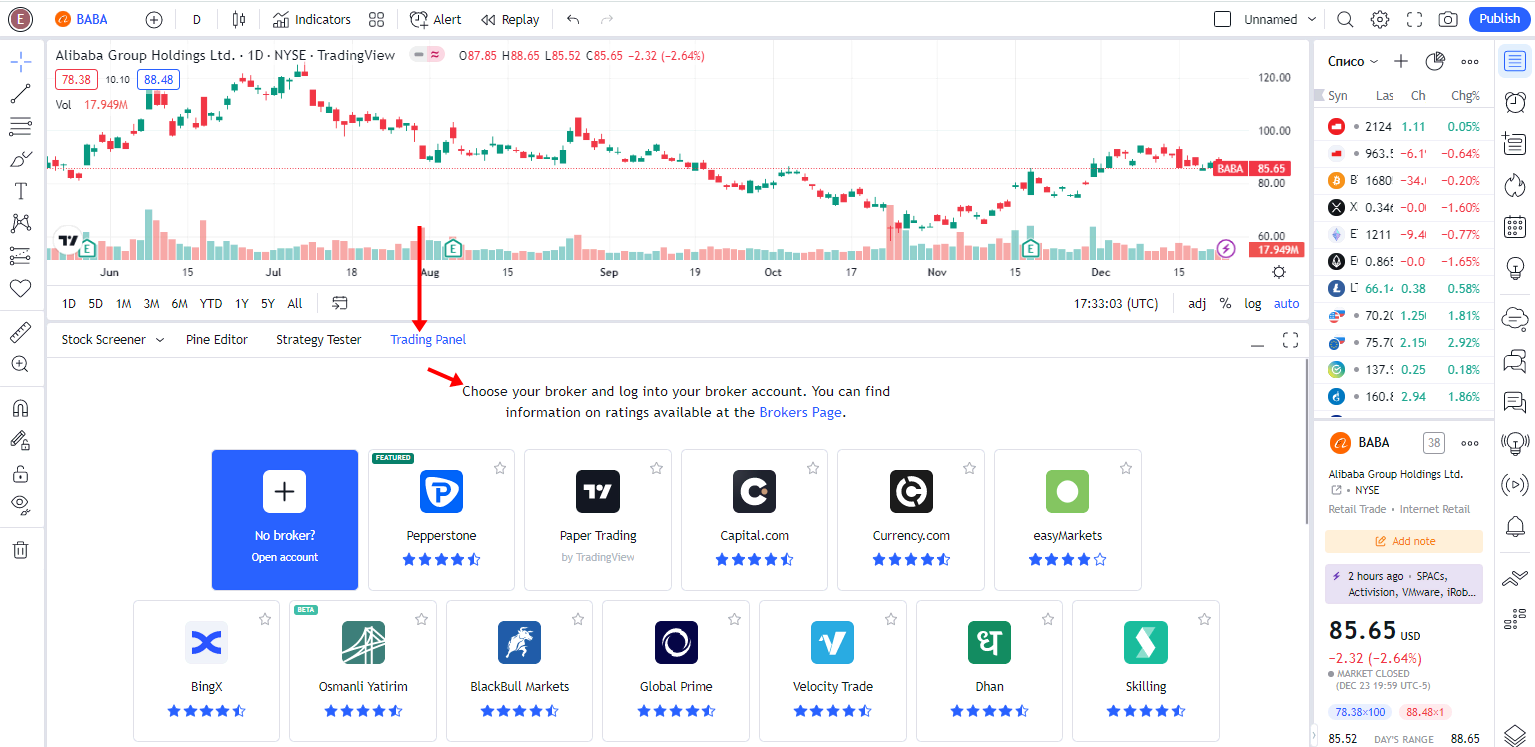

Brokers for TradingView

There are a lot of brokers in the market that works with TradingView. These brokers make the task of trading easy for traders. In addition, they ensure you can connect with TradingView to use this automated trading platform.

Some top brokers that have TradingView integrated with them include the following:

Besides these brokers, numerous other brokers have an integrated TradingView platform and offer the best services to traders.

Free demo account on TradingView

TradingView allows traders to use a free demo account. It is available for 30 days, and they can test their trading strategies without paying a penny. Traders who are beginners can use the TradingView demo account to understand the basics of trading.

It allows them to build their trading strategies and check their trading knowledge. Besides, new traders can learn more about risk and fund management on the TradingView demo account.

Support of TradingView

TradingView offers customer support to traders through many platforms. For instance, if you encounter trading problems on TradingView, you can contact their customer support through live chat, email, or phone.

How to connect MT4 to TradingView?

Traders can connect MT4 to TradingView for added automated features in trading. A trader must follow a few steps to connect MT4 to this platform:

- Signup with a broker who supports the two platforms

- Log in to the trading account with the broker

- Visit TradingView’s integration page

- Now, choose the broker you just signed up with and click connect

Doing this simple thing will allow traders to connect the two trading platforms.

Final TradingView review and conclusion

So, traders hoping to enhance their trading experience can choose this platform. It is available with all the leading brokers. Moreover, you can get into automated trading with this trading platform. It makes your trading journey much smoother and simpler.

FAQs – frequently asked questions about the TradingView:

Is TradingView free?

Yes, the basic account type of TradingView is free for all traders. However, traders will have to pay monthly or annual charges to upgrade to a higher account type on this platform.

Can you actually trade on TradingView?

Traders can use this trading platform but place trades directly from their broker.

Can you buy and sell on TradingView?

Yes, traders can buy and sell after conducting technical analysis on TradingView. They might have to place buy and sell orders through their broker. Only then would it get executed.

Why is TradingView so popular?

TradingView is popular because it offers plenty of features to traders. Traders can access the leading features of this trading platform and conduct automated trades. Besides, there are several other benefits that they can avail of when using this platform.

How many people use TradingView?

TradingView has millions of traders as its clientele since it supports many brokers. Users of those platforms trade using TradingView, offering them immense benefits.

How does TradingView make money?

When a trader wishes to use TradingView, he has to subscribe to a plan. The most genuine and the top features are available with the pro and higher level packages of TradingView. Thus, the users pay for them. It acts as a source of income for traders. They earn by displaying ads and subscription money from traders.

How do I start trading on TradingView?

To trade in TradingView, a trader must sign up with a broker who allows him to connect with the platform.

What is the best indicator in TradingView?

Trading indicators such as MACD, Fibonacci Retracement, etc., are the best in TradingView.

Can you buy crypto on TradingView?

You can buy crypto with your broker after accessing the perks of the same.

How expensive is TradingView?

TradingView is less expensive. The most basic account of TradingView is free for use by most traders.

Can I connect MT4 to TradingView?

You can connect MT4 to TradingView if your broker supports the two platforms.

What does TradingView pro give you?

TradingView Pro gives you a lot of additional features. For example, you can access more charts, tools, and technical indicators.

Does TradingView have a free trial?

You can use the TradingView demo account to test the platform.

Can I cancel the TradingView subscription after a free trial?

Yes, you can cancel the TradingView subscription after a month as your free trial ends.

Can I cancel the TradingView subscription anytime?

Yes, you can cancel your TradingView subscription anytime.

How can I use TradingView for free?

You can use TradingView for free by choosing the basic TradingView account.

How long can I use TradingView for free?

The basic account of TradingView does not cost anything. So you can use it for free as long as you want.

How much is TradingView monthly?

The cost of TradingView for every month depends upon the account type you choose. The basic account costs nothing—the pro and pro+ cost around 15 and 30 USD.

How much is the fee for TradingView?

TradingView does not have a fee. It only has a subscription that traders can pay monthly or annually.

What is TradingView premium?

TradingView premium is the highest level of TradingView account. It includes a lot of features that make trading fun for traders.

How good is TradingView?

TradingView is a very good trading platform for traders looking forward to improving their trading journey. It has all tools that perfect their trading analysis and help them make better decisions.

What is better than TradingView?

As of now, TradingView is the best platform any trader can access. It supports automated trading that makes any trader’s task easier.

What is better – TradingView or investing.com?

TradingView is better than investing.com.

Is TradingView better than MT4?

Both platforms are equally good as they support automated trading. You can integrate the two platforms for an enhanced trading experience.

Last Updated on April 28, 2023 by Andre Witzel