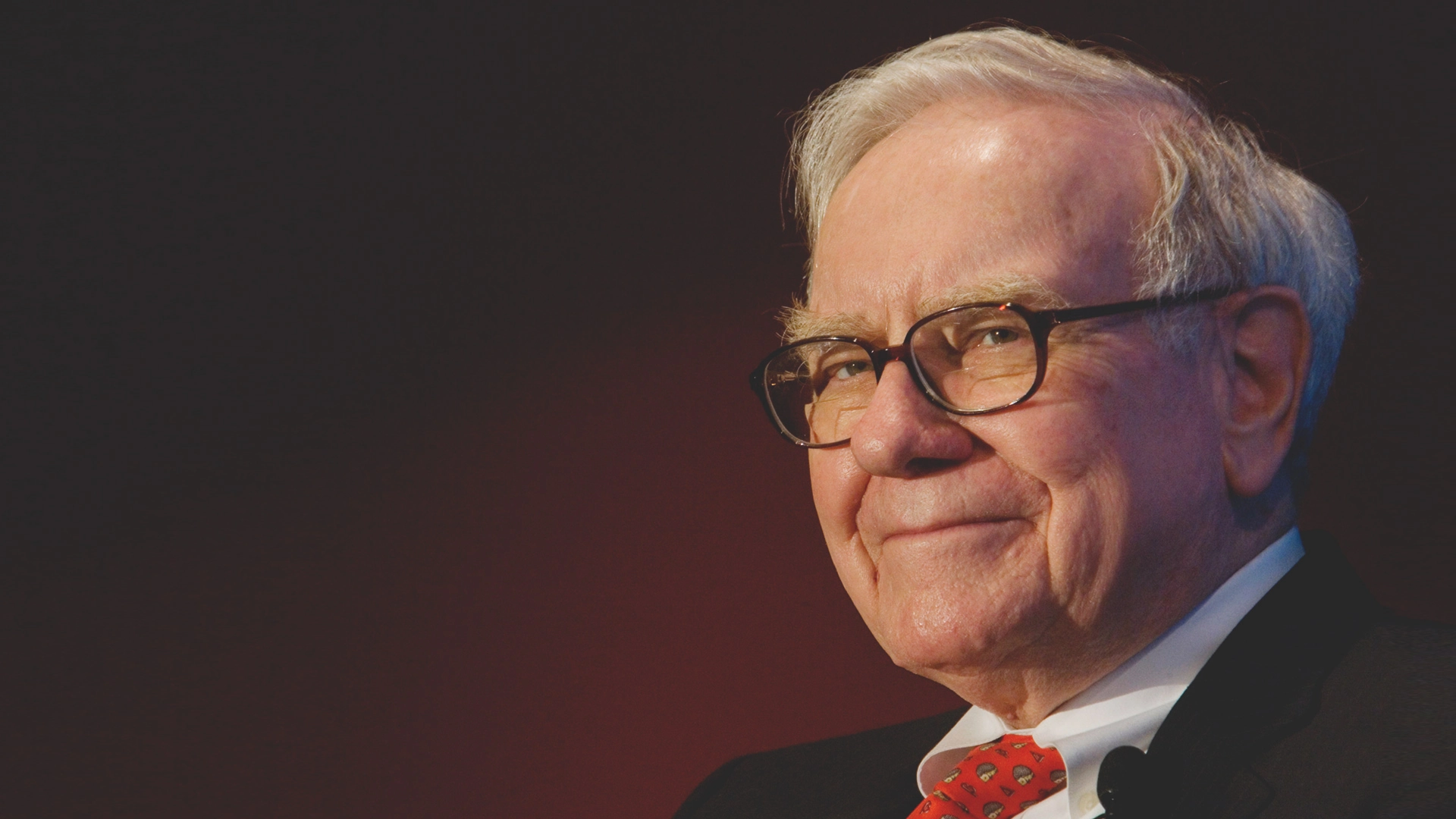

Who is Warren Buffett? – History of the trader and investor

Table of Contents

Warren Buffett is an American business magnate. He excels in various fields. From delivering amazing management skills in business to trading exceptionally well, Warren Buffett is a sigma. This trader has revolutionized the trading world by letting investors know what it’s like to trade with the correct trading strategies.

Warren Buffett succeeded in accumulating immense wealth through trading. No, he does not have too many trading secrets. Warren was just like any ordinary trader who started small. However, his knowledge and strategies led him to become the best trader in the world.

Let’s explore more about Warren Buffett.

About Warren Buffett

Date of birth: | 30.08.1930 |

Wealth: | 62 billion USD |

Strategies: | – emphasizes return on equity – value investor – debt-to-equity ratio is very important – likes to invest in those companies that are public – does not purchase the IPOs – a trader should diversify his trades – follow the long-term approach |

Website: | |

Interesting facts: | – attended the Wharton School of the University of Pennsylvania – attained further degrees from the University of Columbia – attended the New York Institute of Finance – he has pledged to give away 99% of his wealth to philanthropic causes – avid reader |

Besides being a great trader, Warren Buffett is also an amazing philanthropist and a business tycoon. This trader has accumulated a net worth that is unimaginable. According to several reports, Warren Buffett stands next to great business tycoons in the world’s richest persons list.

Good to know!

Also, the greatest share of this holding lies with him, thus contributing to his wealth.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Biography of Warren Buffett

Before taking a look at the trading strategies of Warren Buffett, a trader must look at some details about his life:

- Warren Buffett was brought up in Ohama, Nebraska

- In 1947, Warren attended the Wharton School of the University of Pennsylvania

- He then shifted to the University of Nebraska and graduated at 19

- He attained further degrees from the University of Columbia

- Warren has had a keen interest in investing right from the beginning

- He even molded the concept of value investing

- Warren Buffett also attended the New York Institute of Finance. Here he tried to focus on economics to build a background that helped him carry on trading

- Warren Buffett is also known as Oracle or sage of Omaha

- In addition, Warren Buffett is also considered a frugal person. Despite his massive wealth, Warren spends after careful thought

- The trader is also a great philanthropist. He has pledged to give away 99% of his wealth to philanthropic causes

- He contributes a major share of his wealth to Bill and Melinda Gates foundation. In addition, he also founded The Giving Pledge in 2010. Bill Gates is his partner in this foundation

Career

From 1951 to 1954, Warren Buffett worked at Buffet-Fall and Company. After a while, he returned to Omaha. He opted to take Dale Carnegie’s public speaking course. At this time, he also worked as a stockbroker.

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

The net worth of Warren Buffett

According to Forbes, Warren Buffett owns a net worth of $62 billion. Even after donating a lot of his wealth to charity in 2009, Warren was still the second richest man in the United States of America. At that time, he owned a wealth of $37 billion.

Interestingly, it was only Bill Gates who ranked higher than Buffett.

Trading and investment strategies of Warren Buffett

Warren Buffett follows an investment philosophy that helps him on enough money while trading. Benjamin Graham’s school of value investing contributed to Buffett building expert knowledge in trading.

Good to know!

Here are a few things Warren considers while building his trading strategies.

Company performance

Warren Buffett always emphasizes return on equity. He judges whether a stock is worthy by calculating the return on investment. Warren checks the company’s performance to determine whether the return on equity is up to the mark.

Also, looking at only one or two years of performance is not enough, according to Warren. He believes that a trader should consider at least 10 years of historical performance while purchasing the shares of any company.

Company debt

The debt-to-equity ratio is another thing that traders must consider while considering purchasing shares of any company. According to Buffet, a trader must invest in a company with a low debt-to-equity ratio.

Profit margins

Profit margins matter significantly for any trader. After all, a trader invests in any company only to earn a substantial profit.

A trader’s trading strategy should revolve around the profit margins of any company. He should divide the net income by sales to calculate the margin he can expect from a company.

Good to know!

Publicity of the company

Warren likes to invest in those companies that are public. However, it doesn’t mean that a trader invests in a company that just went public. A company should have been on the public radar for at least 10 years.

So, Warren does not purchase the IPOs of the companies that came into existence only now. However, it is because Warren admits that he does not understand the technologies in today’s world.

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

What can you learn from Warren Buffett?

There are several lessons that Warren Buffett leaves for traders. Since his trading decisions are well-centered, he does not waste much time on unnecessary technical analysis.

A few lessons traders can use from Warren Buffett’s journey are as follows.

Invest in what you understand

Warren never invests in something or any technology that he does not understand. That is why he does not invest in the IPOs of upcoming companies.

Good to know!

Read

Warren Buffett is an avid reader. A lot of his trading knowledge is because of reading. He believes that any trader should devote maximum time to reading. It helps any trader to gather new trading ideas. Skipping reading might stagnate the mind of any trader.

Diversification

Most traders lose money in the trading market because they purchase only one stock. However, Warren believes that a trader should diversify his trades.

Even though diversification would work only up to a point, it is not unknown that it offers many benefits.

Avoid following the herd

If a trader follows everything other traders say, it might not allow him to make money. Even if the market acts differently, a trader should use his mind before placing any trade.

Follow the long-term approach

If a trader wants to build stability in his wealth, he must follow the long-term approach. The long-term approach will allow traders to keep securities for a long time. So a trader can be confident that his portfolio will work perfectly for the greater part of his life.

Conclusion about the investing experience of Warren Buffett

Traders can learn a lot of things from Warren Buffett. He is an excellent trader who made immense wealth because of his trading decisions. However, Warren Buffett, just like other traders, started small. His reading habits and market analysis helps him make an edge in the trading world.

Following the footsteps of Warren Buffett might make you a similar trader. However, it is also essential that a trader control his emotions while trading.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQs – frequently asked questions about Warren Buffett

Is Warren Buffett a remarkable trader?

Yes, Warren Buffett is a great trader. He accumulated massive wealth throughout his trading journey. He could generate such wealth because of the knowledge and expertise that he built over time.

Apart from being a great investor, Warren Buffett is also an American business tycoon who stands next to the richest man in the world.

Can Warren Buffett’s trading strategies help me?

Warren Buffett’s trading strategies can help any trader. However, it also depends upon the trader’s trading goals. If you want to make long-term investments, one of his trading strategies might work well for you.

What is Warren Buffett’s great message for traders?

Warren Buffett always recommends traders invest only in those securities in which they believe. He always invests in something that he understands well. So if you understand any technology well or the business the company is running, you can invest in that.

Last Updated on February 26, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)