How to do forex trading with order flow

Table of Contents

How to trade the forex market with order flow and order flow indicators? – On this page, we will show you exactly how to set up your trading software and give you professional information about what you need to analyze the market successfully. There are a lot of misunderstandings about forex order flow trading and on this page, we will explain how it works correctly.

Number 1 mistake: Futures vs. spot market

For a correct order flow trading with currencies, you have to know that there are 2 different markets for forex. Most traders do not know it and this can result in an incomplete analysis.

Futures vs. Spot Market:

- Futures: Traded on the stock exchange you can buy or sell futures of currencies. There is the official volume and the future is leading the currency market. Through the transparent design of the financial product, you see the orders of other traders directly who are moving the market.

- Spot Market: Forex Brokers give you access to the “spot markets”. This can be an ECN network or other liquidity providers. The problem here is that the trading volume is depending on the network or liquidity provider. It can be banks, brokers, or other institutions. As result, the order flow differs from broker to broker.

Summary:

For doing a correct order flow analysis of the forex markets you have to use the real stock exchange data. Volumen and order flow which is provided by Forex Brokers is useless because it is depending on the liquidity provider. By using the volume of futures you get real data that is moving the markets. In the next sections, we will show you how to do it.

Metatrader 4/5 order flow trading is useless

The well-known trading platform for traders is MetaTrader 4 or 5. It does not show the real trading volume because you do not get the right data of futures in your trading platform. Besides, most indicators show only the “tick volume”. This is no trading volume. It only analyses the movement. If you compare the real volume with the MetaTrader volume you will see there is a huge difference.

- MetaTrader volume is only the tick-volume

- The MetaTrader order flow is depending on the normal chart (without order flow)

Solution: You have to analyze the futures of currencies

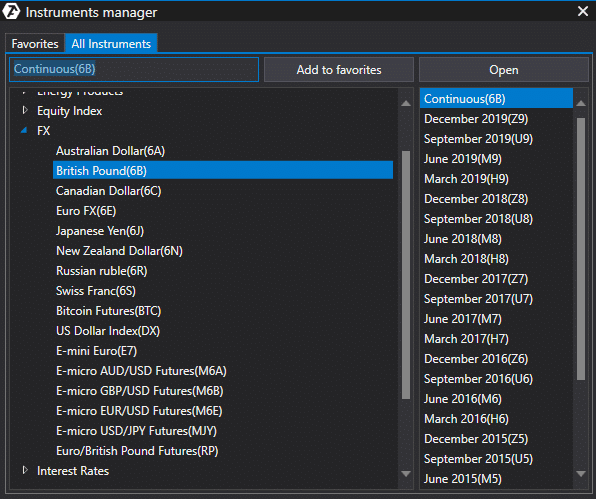

There are different solutions for you. In this section, we will show you how to get access to the real data for order flow forex trading.

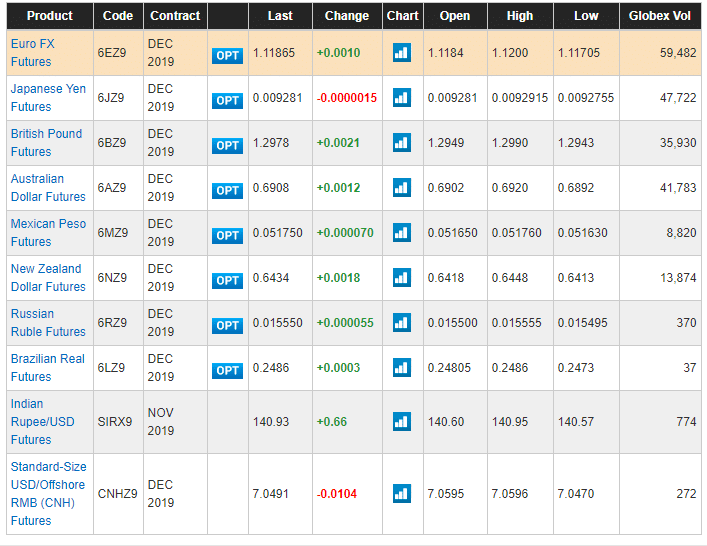

If you go to the CME homepage you can find the listed futures for currencies. There are different symbols that you eventually do not know. The futures are traded against the USD. For example, the 6E (Euro Future) is like the forex chart “EUR/USD” but if you are looking for the opposite like “USD/JPY” you have to mirror the chart or orders.

You can see the symbol for each forex future. For example, the Euro FX Future got the code “6EZ9”. Pay attention to the contract December 2019 means the code Z9. Future contracts are not for a lifetime, they got a time span and expiration time.

Main forex futures:

- Australian Dollar – 6A

- British Pound – 6B

- Canadian Dollar – 6C

- Euro – 6E

- Japanese Yen – 6J

- New Zealand Dollar – 6N

- Russian Ruble – 6R

- Swiss Franc – 6S

- US Dollar Indes – DX

There are only two options to trade a correct order flow chart. You can trade the real futures or analyze the futures and trade in the spot market. Both solutions are possible. Traders with a lot of capital of $ 20,000+ should use futures and traders with less money should use the spot market. For futures, you need more money because the minimum contract value is very high.

What do you need for a correct order flow analysis?

First of all, you will need the real data of the stock exchange. You can get access from a data feed provider. It is possible to create a demo data feed or pay for it. The price is depending on the stock exchange which you want to use. Generally, the fees are about 5 – 25$ per month.

Secondly, you will need order flow software. On the internet, you will find different software providers. On this page, we recommend using Sierra Chart or ATAS. Traders can test the software for free but it is necessary to buy a license after the test version.

After that, you have to connect the order flow software with the data feed. It is a simple process and we documented it on our webpage. Read through our full ATAS review and tutorial.

Start order flow forex trading:

- Trading Software

- Data Feed and Broker

- Connect the Data Feed and the software

- Start trading futures

For real trading with futures, you have to sign up for a data feed with your online brokerage account. The brokerage account is linked to the data and you get full access to the markets.

On this page, we recommend using the order flow software ATAS. It is easy to use for beginners and you can install it very quickly. There is a free test version for any traders who want to try it. You can buy this software with a monthly or lifetime license. It provides you with different order flow indicators, footprint chart, volume profile, order books, smart tape, and more configurable stuff for trading. From our experience, it is highly customizable and fulfills the needs of a professional trader.

Read the full review of the order flow software ATAS

Recommended Broker for forex future contract trading

For trading futures, you will need a regulated broker who will give you access to the stock exchange. We recommend the American online broker Dorman Trading. The broker is accepting international clients and is highly regulated. You can start with an account minimum of $2,500. In addition, there are no hidden fees and you can enjoy professional support. To open an account just sign in to the account form on the website.

Advantages of Dorman Trading:

- Trade forex futures contracts with low fees

- The account minimum $2,500

- No inactivity fees

- No monthly fees

- No hidden fees

- No maintenance fees

(Risk warning: Trading Futures and Options on Futures involves a substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative of future results. Stage 5 Trading Corp. is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. This is an introducing broker link and we share $3 commission with the broker)

Get a closer look into the forex order flow

There are many tools to trade forex with order flow. The most well-known tools are the footprint chart, volume profile, and order book. You can exactly see the traded volume on the chart. For a deeper look into the work of the stock exchange, you can read our article about “order flow trading”.

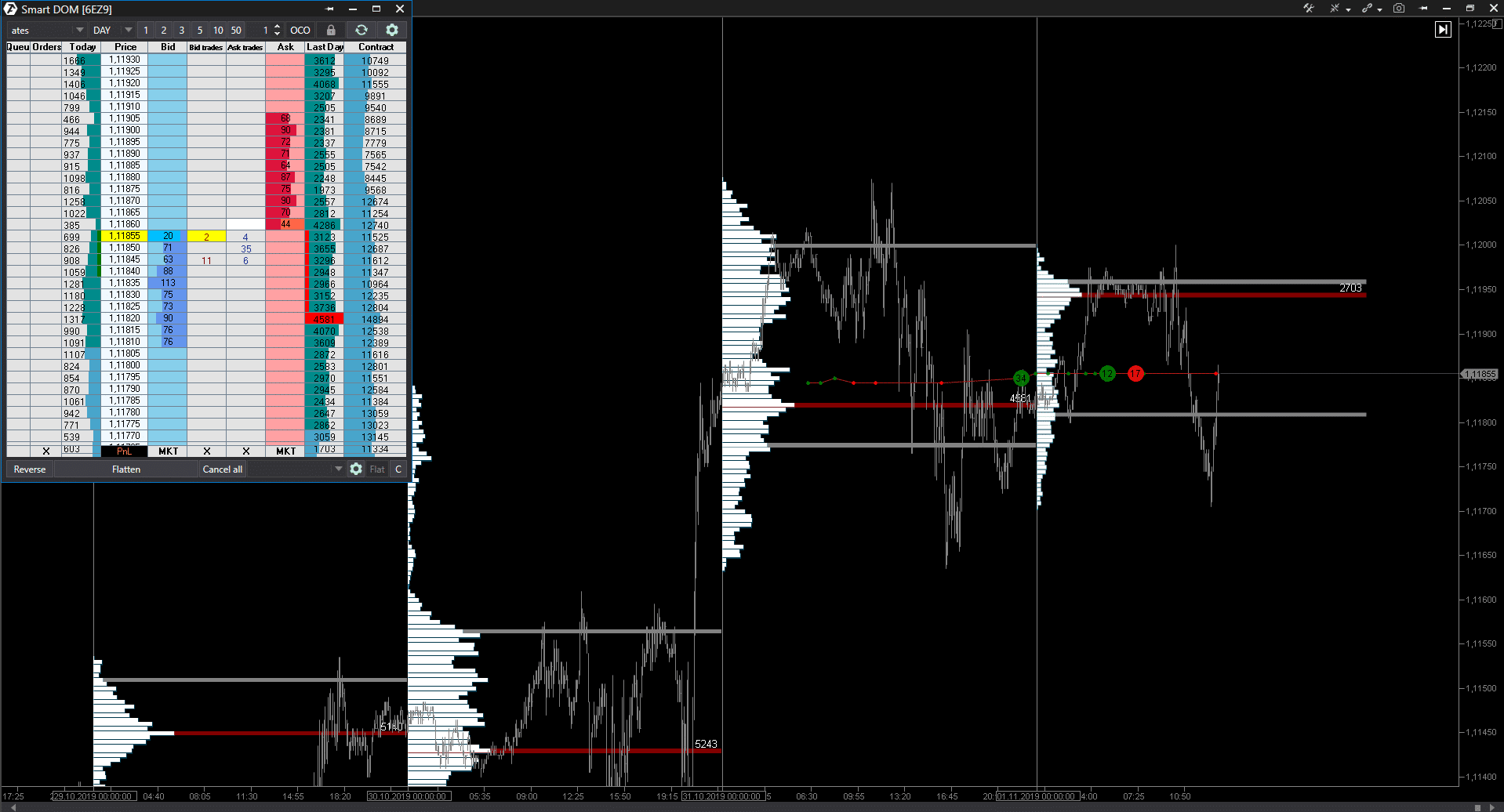

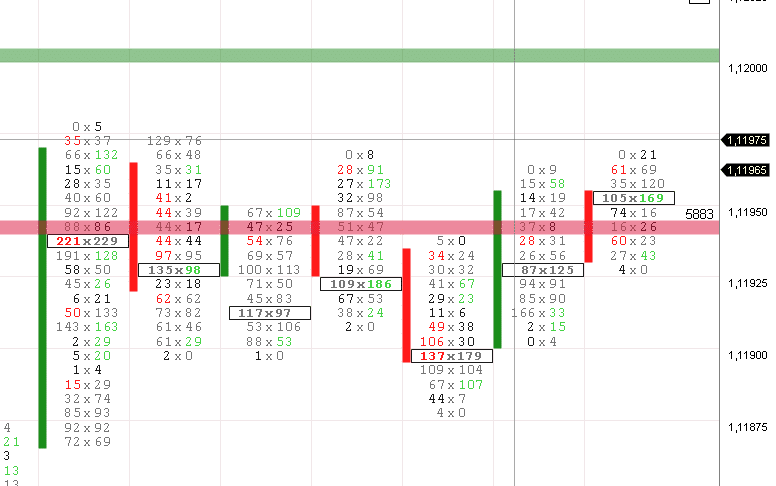

In the picture below you see the footprint chart in its nature. This chart will give you a professional view of candlesticks. On the right side, the traded ASKs and on the left side, the traded BIDs are shown. The order book is a limited order book. That means limit orders are waiting on different prices to get filled by market orders. If the trade happens you will see the result in the footprint chart and the direct order flow.

On the other hand, there are more advanced tools like the automatic recognition of big orders or the direct order flow indicator. In conclusion, the order flow in the forex is always the same. There are tools to show it through different perspectives. You have to know how the limited order book is working which you can read in our order flow article.

Technical indicators for order flow trading

Technical indicators can not show the real order flow. For traders, it is the only interpretation if you use them. There are a lot of successful strategies for technical indicators but they are useless for order flow trading.

The technical indicator only analysis the candlesticks in the past and different price levels. There are different mathematic formulas implemented which are useless for order flow trading because you do not analyze the real data of the stock exchange. For order flow trading we recommend to do not using technical indicators.

Conclusion for forex trader:

Forex Trading is a difficult topic when it comes to order flow trading. There is a lot of false information on the internet. On this page, we showed you how it works correctly.

Distinguish between the future market and the spot market. A regular forex broker will only show you the liquidity of its provider if it is not a market maker broker.

Popular data feeds are Rithmic, CTS, or CQG. Open your brokerage account and sign up for it. After that, you need real order flow software like ATAS. The spot market is traded by the MetaTrader which can not show you the real trading volume.

All in all, it is important to understand the difference between the futures market and the spot market. Forex order flow trading will give you huge advantages against other traders because they do not see the traded volume.

Advantages of forex order flow trading:

- See traded contracts

- Look into the markets

- See limit orders of other traders

- See high liquidity or less liquidity

- Deeper analysis

- Analyze the trading volume for different strategies

Successful order flow trading with the forex market is only possible if you are using the real stock exchange data

Trusted Broker Reviews

Experienced traders since 2013FAQs – The most asked questions about Order Flow:

Is order flow superior to fundamental indicators?

Assessing market fluctuations with order flow is superior to utilizing chart patterns alone since it offers investors additional data on price fluctuations. Market fluidity does not falsify as it is the foundation of price determination and the double-auction market mechanism.

What exactly is an order flow graph?

The main goal of order flow diagrams is to display the massive volumes of data produced by trade exchanges. In conjunction with the volume profiles, order flow diagrams give traders a graphical chance to acquire additional knowledge and visibility into the trading activity in live time.

Do they collect fees for order flow at Fidelity?

For stocks and ETF trades, Fidelity does not charge money for order flow. As a result, Fidelity has a strong advantage over Robinhood in terms of trading technologies since their pricing improvements are significantly greater than the industry standard, and they do not charge for order flow.

Is the order flow indicator effective?

Order Flow can’t enhance anything that doesn’t function. Order Flow may be utilized to enter and exit the market without using indicators, but you must be capable of recognizing distinct market situations that require distinct arrangements. This has nothing special about it.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller