10 best Forex Trading demo accounts in comparison – Free and unlimited access

Table of Contents

Trading foreign exchange is not a walk in the park. Even the most well-seasoned traders have difficulty reading the market and devising a viable strategy. What more if you are just starting out? Luckily, there are tons of educational materials out there for you. You could even sign up for weekly or daily lessons with a professional.

But all the courses and webinars are not enough to prepare you for the real deal. You’re going to need training on the field. This is where demo accounts come in. In this review, you will be reading about the 10 best forex trading demo accounts and a little bit of information about each broker. You will also find some tips and tricks on how to properly trade the asset.

See the list of the 10 best forex trading demo accounts:

Broker: | Review: | Demo: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | Free and unlimited demo account | FCA, CySEC, ASIC, SCB | 3,000+ (70+ currency pairs) | + Individual offers + Best trading platform + No commissions + Best education + Personal support | Free demo account(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | Free and unlimited demo account | IFSC | 9,000+ (40+ currency pairs) | + Huge variety + Micro accounts + Bonus program + Leverage 1:2000 + ECN accounts | Free demo account (Risk warning: Your capital can be at risk) | |

3. IQ Option  | Free and unlimited demo account | / | 300+ (40+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Free demo account(Risk warning: Your capital might be at risk) | |

4. XTB  | Free and unlimited demo account | More than 10 | 3,000+ (50+ currency pairs) | + Huge variety + Good platform + Best service + Personal service | Free demo account(Risk warning: 72% of retail CFD accounts lose money) | |

5. Etoro  | Free and unlimited demo account | CySEC, FCA, ASIC | 3,000+ (52+ currency pairs) | + Best for beginners + Social Trading + Instant execution + PayPal + Copy portfolios | Free demo account76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. **Please note that instruments restrictions may apply according to region | |

6. XM Forex  | Free and unlimited demo account | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Huge variety + Micro accounts + Daily webinars + Personal service | Free demo account(Risk warning: 75.59% of retail CFD accounts lose) | |

7. FXCM  | Free and unlimited demo account | FCA, AFSL, FSCA | 200+ (50+ currency pairs) | + NDD/ECN Broker + High liquidity + Institutional service | Free demo account(Risk warning: 74% of CFD accounts lose money) | |

8. FxPro  | Free and unlimited demo account | FCA, CySEC, FSCA, DFSA, SCB | 250+ (50+ currency pairs) | + High liquidity + NDD Broker + No requotes + No commissions | Free demo account(Risk warning: 72.87% of CFD accounts lose money) | |

9. Libertex  | Free and unlimited demo account | CySEC | 300+ (40+ currency pairs) | + Beginner-friendly + No spread trading + 50+ Cryptocurrencies + Professional charting | Free demo account(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) | |

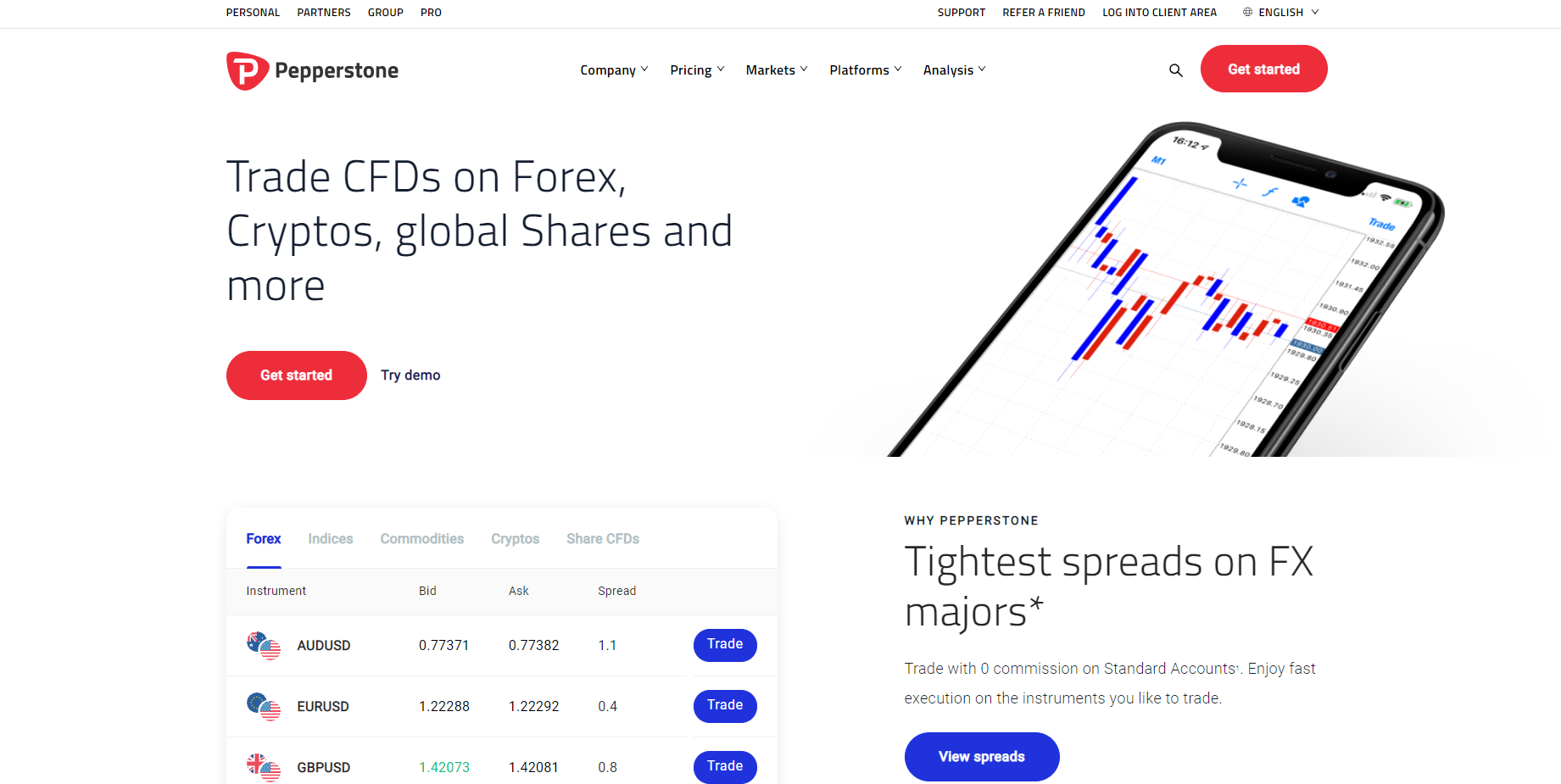

10. Pepperstone  | Free and unlimited demo account | FCA, ASIC,CySEC, BaFin, DFSA, SCB, CMA | 1,200+ (60+ currency pairs) | + Fast execution + Large FX Broker + Good service | Free demo account(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

How to find the best forex demo account:

In finance, it is important to practice before you invest your hard-earned dollars. The smallest mistake can cost you huge amounts of money. That is why everyone should use a demo account. Even professional traders are using demo accounts to learn new strategies, for example. A good demo account should be free and unlimited for customers. Most brokers are offering these types of accounts. Furthermore, if you choose a demo account, we recommend using a reliable and secure broker with good conditions. Because we think every investor wants to get the best trading conditions when switching from demo to real money trading.

See the list of best practice accounts. Below you will find deeper reviews and tests of the platforms:

- Capital.com – The best platform overall and the lowest fees

- RoboForex – free bonus available, and ECN spreads

- IQ Option – User-friendly platform for beginners

- XTB – great customer support

- Etoro – learn investing with social trading

- XM – good customer support

- FXCM – multiple platforms

- FxPro – fast execution and fair spreads

- Libertex – no spread trading

- Pepperstone – professional fx broker

1. Capital.com

Capital.com is a multi-award-winning forex broker based in the United Kingdom, Cyprus, the Bahams, and Australia. With over $ 200 billion in monthly trading volume, over 1.5 million registered accounts, and services offered in more than 180 countries, this company is sure to provide traders with all the services they would need to succeed in the trading scene.

Capital.com offers more than 70 currency pairs, including seven of the major pairs, including EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD. With their demo account, you will be able to practice trading these in real time. Capital.com’s demo account is completely free, and you will be given a virtual credit of $10,000.

Signing up for a demo account with Capital.com takes less than a minute. All you have to do is input your full name, country of residence, phone number, date of birth, email, and chosen password. Once you verify your email, you’re free to use their demo account for as long as you want.

Before you get to start practicing, you will have to choose among four of their free demo accounts. You could practice on their MetaTrader 4 platform, their Capital.com Mobile App, or their WebTrader.

If, for whatever reason, you decide to practice on a completely different account or you want to change your virtual balance, all you need to do is contact their customer support team via email, chat, phone, or other online messengers, and they will take care of the rest. You can also reach them via telephone in your preferred language. They offer support in German, French, English, Greek, Italian, Portuguese, and Spanish. Capital.com does not accept clients from the United States of America.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. RoboForex

RoboForex is a multi-asset online broker that was founded in 2009 and had a main office located in Belize. Over the years, this company has gained more than three million clients. RoboForex also established partnerships with popular brands and celebrities. This makes it one of the most well-known forex brokers on the market.

Along with over 12,000 trading instruments, you will have the opportunity to trade more than 40 currency pairs with this broker. Among these pairs are major, minor, and exotic pairs. You also get to choose which of the four trading platforms you want to practice on.

First, you will need to sign up by filling up the registration form. They will ask for your email, full name, and mobile number. Next, choose the demo account option, select which platform you want to use (MetaTrader 4, MetaTrader 5, cTrader, or R Trader), your account type, your desired leverage, and how much virtual funds you want to use.

You will have access to all their tools on your desired platform for 90 days. If you wish to extend this, you will need to create a new demo account under a new email and name. If you encounter any problems, you can contact customer support via email, telephone, or live chat through Telegram, Facebook Messenger, Skype, Whatsapp, and Viber.

They support English, Thai, Ukrainian, Arabic, Czech, Chinese, Taiwanese, Kazakh, Malay, Vietnamese, Portuguese, and Spanish, and they’re available 24 hours a day, seven days a week.

It’s important to note that if you are from the Russian Federation, Australia, Japan, Canada, or the United States of America, you will not be able to register for an account with RoboForex.

(Risk warning: Your capital can be at risk)

3. IQ Option

This particular broker has over 48 million users with over 1 million trades per day. This ensures that this broker is very well-known and trusted all over the world.

You can practice trading 25 forex pairs like EUR/USD, USD/JPY, AUD/USD, and many more. Their practice account comes equipped with $10,000 of virtual funds, and you have full access to their trading platform. This account is also refillable, so you can trade as much as you want. You can download their app on the Google Play Store or Apple App Store. This is also available on the desktop.

To sign up for their free practice account, input your full name, country of residence, phone number or email, and your password. You can also sign up via your social media accounts, specifically your Facebook or Gmail accounts.

If you encounter any problems, you can contact their 24/7 customer support via telephone. This is available in Brazil, Nigeria, Colombia, Macau, Indonesia, Thailand, Mexico, UAE, India, Argentina, Vietnam, Saudi Arabia, South Africa, Chile, Taiwan, and Hong Kong.

IQ Option does not accept traders from several countries. Please find the up-to-date list of countries on the official website.

(Risk warning: Your capital might be at risk)

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.

4. XTB

XTB is one of the largest stock exchange-listed forex brokers in the whole world. It is also known as the leading European broker and was founded in 2004. They have won numerous rewards and have offices in over 10 countries, including Germany, France, Chile, and Poland.

They have over 50 forex pairs that you can practice trading. You will find both major as well as exotic pairs on their world-class platform, the xStation 5. It’s very easy to use, and it even has a mobile version so you can practice trading wherever you are.

XTB’s free demo account gives you full access to their platform for four weeks. With a virtual fund of $100,000, clients can trade risk-free. All you have to do to start practicing with XTB is fill up their form. Simply input your email and your country of residence and hit the submit button. It won’t take you more than a minute to do this.

Their customer service is available from Sundays to Fridays. They support different languages, including Arabic, Thai, Vietnamese, Turkish, Slovak, Spanish, Romanian, Russian, Polish, Portuguese, Italian, Hungarian, German, French, English, and Czech.

Traders from the United States of America, Romania, Kenya, Iran, Iraq, Syria, Cuba, Uganda, Ethiopia, Bosnia and Herzegovina, Pakistan, India, Turkey, Israel, Mauritius, Singapore, Slovakia, Japan, Australia, and Canada can not use XTB’s demo account.

(Risk warning: 72% of retail CFD accounts lose money)

5. eToro

**Please note that instruments restrictions may apply according to region

This famous multi-asset platform is a well-known financial services provider with a main office that can be found in Cyprus. It was established in 2007, and this broker continues to grow each year.

With over 50 forex pairs, you will be able to trade the currency pairs of your choice in real time without risking actual cash. Signing up to eToro’s platform will give you access to both a live and a practice account. You can sign up by signing in with your Apple account, Facebook account, or Google account.

Alternatively, making an account from scratch is very easy. You just need to input your desired username, email, and password. To start practicing on eToro’s platform, change to a virtual portfolio from the drop-down box found underneath your username.

This is totally free, and you don’t even need to add funds to your real account to be able to access your virtual portfolio. Additionally, you are given $100,000 in virtual funds so you can practice all your trading strategies. If you want to see your funds in a different currency, you can change them with a click of a button.

If you encounter any problems, they have a built-in help center on their platform. Here you will find some of the most common questions that users ask. If you can’t find the answer to your question at their help center, you can contact their customer service representatives by opening a ticket with your query and specific concern.

Keep in mind that you cannot sign up with this particular broker if you are from Singapore, Hong Kong, Canada, Japan, Turkey, or Iran.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

6. XM

XM is fairly young compared to other companies, but this does not mean that they don’t offer the same services that older brokers do. Despite it operating for only ten years, they already have over 3 million clients from 196 countries.

They have 57 currency pairs that include both major and exotic pairs as well. XM uses both MetaTrader 4 and MetaTrader 5 platforms, including MT4’s Multiterminal and their mobile versions. Signing up for a demo account gives you access to all of these.

To open a demo account, they will ask you for your full name, country of residence, address, contact number, email, and preferred language. You can also customize your trading account details. You get to choose which platform to use, your desired currency, how much you want to virtually invest, your leverage, as well as your account type.

Their platform supports English, Arabic, Bengali, Czech, Dutch, Filipino, French, German, Greek, Hungarian, Indonesian, Italian, Korean, Malay, Polish, Portuguese, Russian, Chinese, Spanish, Swedish, Thai, Traditional Chinese, and Vietnamese.

Customer support is available 24/5 via live chat and email. Clients from Spain, Portugal, Iran, Israel, Canada, and the United States of America can not sign up for an account with XM.

(Risk warning: 75.59% of retail CFD accounts lose)

7. FXCM

This specific broker, which was founded in 1999, is well known for its features as a forex broker as well as a broker to the most liquid markets. They have offices located around the world, which include Sydney and Berlin.

FXCM only offers 40 currency pairs, including commodity pairs like AUS/USD, NZD/USD, and USD/CAD. You can virtually trade these assets on FXCM’s platform for free by signing up for their demo account. Here, you will be able to trade these assets in live market conditions with a virtual fund of £50,000.

All you have to do is input your email and country of residence, and you can access all the features on FXCM’s platform 24 hours a day, five days a week. This platform is also available on Google Play and Apple iTunes, so you can trade on your mobile device or tablet.

Their customer service can be reached via email, WhatsApp, SMS message, or telephone. You can refer to their website to find the specific number for your country of residence.

It’s important to note that if you’re from Ukraine, Iceland, the United States of America, the United Arab Emirates, Trinidad and Tobago, Turkey, Thailand, Singapore, Saudi Arabia, Russia, Qatar, Philippines, Pakistan, Norway, New Zealand, Mexico, Malaysia, Kenya, Japan, Israel, Iran, India, Hong Kong, Greece, Egypt, Costa Rica, Colombia, Switzerland, Canada, Brazil, Belgium, Saint Barthelemy, Bahrain, and Argentian, you can not avail for a demo or live account with this broker.

(Risk warning: 74% of CFD accounts lose money)

8. FxPro

This company operates under many names, but it is mainly known as FxPro. With the experience of over 15 years, this broker has expanded its reach to over 170 counties and has over 7000 executed trades per second.

They offer 15 major forex and 55 minor pairs that you can practice trading using their free demo account. By signing up, you will gain access to all their platforms as well as $100,000 in virtual funds to use to trade in real time. Keep in mind that your demo account is only available for 180 days.

Signing up is a straightforward process. They will ask for your country of residence, full name, email, and desired password. Unlike registering for their live accounts, you won’t need to add funds or upload documents that they will need to verify with you.

FxPro’s customer service is available 24/5 and supports different languages. These include English, French, Dutch, Russian, Arabic, Chinese, Spanish, Polish, Italian, Hungarian, Portugues, Indonesian, Malay, Vietnamese, Indian, Japanese, Korean, Czech, and Swiss. Getting a response might take a while, but rest assured that their customer service representatives are knowledgeable and will be able to assist you regardless of your concern.

This broker offers its services around the globe except for clients from Iraq, New Zealand, Myanmar, Zimbabwe, Canada, the United States of America, and Iran.

(Risk warning: 72.87% of CFD accounts lose money)

9. Libertex

Libertex, also known as Libertex Group, operated under Indication Investments Ltd and was founded in 1997. To date, they have more than 2 million clients from 11 different countries.

This multi-award-winning broker has more than 50 currency pairs for clients to trade. Opening a demo account with Libertex entitles you to €50,000 in virtual funds and access to all their trading platforms. This allows you to practice trading their offered currency pairs with no risk.

Signing up for a demo account is the same as signing up for a live account. All you need is your email and password, and you can start honing your trading skills. Once you feel you’re ready, you can easily switch from your demo account to your live account.

Despite not having an online chat system, you can contact them via email. It may take a while to get a response, around an hour to one business day, but you can rest assured that your questions will be answered, and you will get the help you need from them. Their website supports seven languages: English, Spanish, Italian, Polish, Dutch, French, and Portuguese.

This particular broker offers its services to countries that are a part of the European Economic Area or EEA.

(Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.)

10. Pepperstone

At first glance, Pepperstone does not seem like it is on par with any of the big-shot brokers out there. Since it has only been operating for 11 years and they seem to offer mediocre service, one might think that this broker does not deserve to be on this list.

However, the numerous awards they’ve won and overall customer satisfaction rating begs to differ. This is exactly why Pepperstone has been regarded as one of the largest forex brokers in the world.

On their platform, you will have the opportunity to trade 180 forex pairs, including major, minor, and exotic pairs. This gives you more choices and opportunities to test out your trading strategies on different pairs.

Pepperstone’s demo account gives you 30 days of risk-free trading with a virtual fund of £50,000. You will also get to choose whether you want to train on their MetaTrader 4 or cTrader platform. Within the given 30 days, you will be able to access all the tools and services that are provided on your platform of choice.

You can freely contact their customer support representatives at any hour during weekdays. You can either call them on their landline or send them an email with your query or concern. You can also check their support tab to see a list of all the popular FAQs. Their website also supports Chinese, Spanish, Vietnamese, and Thai.

Pepperstone accepts clients from almost all countries except for Saudi Arabia, Canada, Brazil, New Zealand, India, and the United States of America.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What is a forex trading demo account?

As the name suggests, a forex demo account allows you to trade forex or currency pairs using virtual cash and would never put your real-life capital at risk. You’re usually given access to more than 50 pairs, and they usually include the major pairs and major currencies.

This is the type of account that allows the user or client to practice new and old strategies. In almost all cases, the demo account users, like live account holders, are given full and unlimited access to the brokers’ platform. In some cases, however, there is either a specified time limit that they can use the platform, and for some, the virtual fund allocated for you is non-adjustable.

Having a demo account is the safest way to learn how to trade and is a fast and efficient way for you to learn the ropes in the world of trading and forex. For new clients and beginners alike, a tutorial provided by most brokers would be enough for you to navigate the platform and all its intricacies.

Depending on the platform and broker you use for the demo account, you can even reset your account balance or perhaps make a new account to start fresh if you want to try something new or use up your virtual funds in your previous account. No documents such as ID and signed documents will be asked of you, but there may be a limit to the number of accounts you can create. Be sure to check each broker for their guidelines on demo accounts.

Why you should use the demo account:

Given that you’ll have full access to the platform, you’ll learn how to manually set up your trades, and you’ll be given first-hand experience at reading charts and customizing them to your liking. With the virtual funds credited to your account, it is definitely okay to make mistakes and use them to your heart’s content. Practicing and choosing the right leverage, allocation, and trade management strategies will help you become a better trader.

Trades on this account may be done manually or can even be done using a bot or ExpertAdvisors that are coded by the client or subscribed through a third-party programmer. Some platforms allow backtesting to test out existing strategies and bots through the ups and downs over the past year. Using such would give you an idea of your hit rate, average gains, drawdowns, and other advanced data such as beta and estimated CAGR (compound annual growth rate)

For forex demo accounts specifically, it is good to simulate the real trading conditions such as spread difference, the live movement of prices, and the commissions you will incur per trade. With mostly all trading pairs available, you’ll be able to differentiate the major, minor, and exotic pairs.

Traders, in general, sometimes also hit a losing streak or may encounter a situation that leads to trading anxiety. Having demo accounts would fix this and bring back the confidence you need to enter your trades and have conviction in them.

- Practice forex trading

- Learn new trading strategies

- Have access to real-time charts

- Learn chart analysis

- Get your first experience in trading

- Trade without risk

(Risk warning: 78.1% of retail CFD accounts lose money)

Features of a good forex demo account

Below, we explain what you should expect from a good demo account. If any of these items are missing, you might want to try another broker’s demo to have the ultimate trading experience before you proceed.

1. A device-friendly trading platform

As we’ve mentioned, most brokers use popular platforms, such as the Meta traders 4 and 5, cTrader, etc. Some use their in-house ones. Others combine both. No matter the platform, it should be compatible with your usual devices, including smartphones and laptops. With this, you can tell how easy it would be to access your real account once you start.

2. Trade in a live market environment

The demo account simulates a real trading environment. Therefore, you should experience live market conditions. All the prices must be displayed in real-time.

3. Use the trading manual

The best brokers offer a start guide in their demo accounts to help newcomers find their way.

4. You should have at least one month of access

A demo account should come with at least one month of access, and it must be free. Some brokers offer lifetime access to their demo accounts. Traders can practice as much as they want to, till they’re comfortable enough to trade the forex market.

5. Trading tools and live updates

The demo account shows you the broker’s trading environment. It should indicate all the trading tools, including the technical indicators, live news, and research tools that the broker provides. If these are missing, they might be missing in the real accounts.

Forex trading may appear unchallenging to a novice looking in from the outside. The idea of just speculating in the direction that you believe the price will move sounds simple enough. However, this is not the case. It requires some study of market operations and a lot of practice to trade the market. The practice can only be done through trading, which needs money. Fortunately, demo accounts are a solution to this problem. Brokers offer fake funds and a real-like market for traders to practice as much as they can through it.

It is crucial to take advantage of the opportunity to learn about market environments and forex trading before one enters this space. Traders should use a demo account for as long as possible before they trade live. New traders especially should familiarize themselves with all the risk functions and ensure they know how to set a stop-loss, limit-order, and take profit. These features are vital in trading activities, and traders can only learn to use them through trading. A demo account gives you access to practice all of these and more without risking your funds.

Advantages and disadvantages:

Trading forex has a lot of advantages, especially when traded using a demo account. It’s a large and global market with a lot of liquidity and market players as well. It can be traded 24 hours a day, and this provides a good avenue for beginners to learn, given its volatility.

Generally, trading forex would only cost you a small trading fee in the form of swaps, commissions, or spreads. Some of these fees might not even be present, depending on the trading conditions of the broker you choose to partner with.

Furthermore, using leverage could possibly exponentially increase your possible gains, even for demo accounts. Keep in mind that whatever gains or losses you incur in your demo account will not affect your real-life capital. Having all of these trading conditions simulated on a demo account would prepare you to trade with real money once you use your live account.

With all of these advantages of trading forex, even on a demo account, there are quite a few disadvantages that you should keep in mind. Spending too much time trading on a demo account might make one overconfident. You might get too comfortable because you’re not spending actual money. Comfort breeds negligence. Once you start trading on a live account, there is no room for negligence.

How to trade forex

Take note of your total available capital. That way, you can ensure that for every trade, you can keep a mental or physical note on the amount of capital you are risking and the amount you are prepared to lose in the event that the trade goes wrong.

Once you find an asset you want to trade, input your desired lot size and type of execution. Should you choose to enter the trade at a certain price rather than just Market Execution, be sure to double-check the value with your desired trade direction, may it be long or short. Margin is automatically applied to your account, but you still need to set up your stop loss levels and take profit levels.

Benefits of a Forex demo account to traders.

1. New traders can learn Forex trading

Without a demo account, novice traders would have to learn practical forex trading by signing up a live account. This means they would have to deposit money in a live trading account and trade for real. A demo account eliminates this problem. Newcomers can learn to trade forex in a risk-free environment, with their money safely in their pockets.

Most brokers offer forex education for newbies. So the new trader can combine this education with live tests. They can build their trading skills before entering the market for real.

2. Experience the broker’s trading platform

Many brokers offer popular trading platforms, such as Mt4, Mt5, cTrader, or others. Some combine any of these with a proprietary trading platform. Both beginners and experienced traders can familiarize themselves with what the broker offers through demo accounts. We recommend that traders should be conversant with the following functions before they trade forex in a live account:

I. Placing stop loss and take profit orders.

II. The type of spreads offered (fixed or variable)

III. What lot size can be traded with your capital.

These points are crucial knowledge for the forex trader, and they can only be understood through trading. Fortunately, demo trading allows you to learn these things without risks.

3. Learn trading strategies and test them

A new trader can take advantage of the many forex educations offered online or by the broker, learning different trading approaches. They can then practice these trading strategies using a free demo. This is how most experienced traders could improve their skills. Newcomers can take advantage of demo accounts as well.

4. Establish a suitable trading routine

The forex market is always open, but nòt all the time might be appropriate for trading your desired pair. And not all the time might be suitable for you. Through a demo account, you can determine what time or times are suitable for you to trade comfortably. You can then set your routine before you start trading live.

How to use a demo account effectively

A demo account is only fully beneficial if you use it effectively to prepare to trade forex successfully. Here are a few ways to do this:

1. Come up with a plan for your live trading.

While practicing with a demo account, the trader should create a plan for when they would be trading live. This plan should include the following:

I. Choose your preferred currency pair (pairs).

There are over a hundred currency pairs, and not all of them have high liquidity. The major pairs make up 85% of the total liquidity in the market. So the trader, at this stage, must decide on the crosses they would like to focus on for profitability. This will allow them to understand the spreads and the price movements of their choice currencies before they begin.

II. Trading time.

Though the market is always open on weekdays, not all time will be suitable for the pair (pairs) you choose. Your plan should include the appropriate time for your trading.

III. Trading strategies.

The demo account allows you to test the strategies you’ve learned or read about. Be sure to try out several strategies and stick with the ones you’re most comfortable with.

IV. Risk management style.

Risk management is essential in forex trading as the market is highly volatile. You need to determine how you will use tools such as stop-loss or take-profit, and note it down in your plan.

Once you’ve drawn up this plan, use it consistently on the demo account to see the results it yields. Then you can adjust it if necessary, and keep testing till it consistently produces favorable outcomes.

2. Set a goal to move to a live account

The purpose of using a demo account is to trade forex in a live account with real money. Give yourself a target for when you would make this move. It could be after thirty trades or after achieving a set amount of profit. The demo account should help you transition smoothly into a live trading environment.

Final tips and tricks

With all the assets available in your demo account, you’ll realize that there is a difference between the currency’s spread and volatility. Most traders would prefer to trade only the major pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, and NZD/USD as seven choices between the major currencies are enough for diversity in volatility and opportunities. These major pairs are more than enough to handle your liquidity concerns as well since they are the most traded pairs.

Using the demo account, familiarize yourself with lot sizes, margin levels, and the terminology used by each broker, as these vary depending on the asset traded and choice of broker.

Since forex is a 24/5 market, it’s a great starting point to practice charting especially using intraday charts and short-term trends. This gives you the advantage of learning how to trade even longer-term charts as patterns emerge using different indicators and techniques.

Forex is generally a ranging market meaning the strategies here are a bit different from other asset classes. Being able to identify supports and resistances gives you an edge in trading pivot levels and would most likely increase and improve your hit rate.

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about the Forex demo account :

Why should I open a Forex demo account?

A demo account helps you know how to perform Forex trading without the risk of losing your capital. Referred to as a practice account, it helps novice traders get familiar with the tools and features of the trading platform.

How many days can I use the Forex demo account?

After registering with a Forex broker, you have 1 month to utilize the demo account.

Can I open more than one Forex demo account?

No, you cannot open multiple demo accounts. However, you can open many accounts using different email addresses.

Can I renew my Forex demo account?

You cannot renew your demo account after using it for 30 days. You cannot even access the account with your login details. You can seek the help of your Forex broker if you need more time to learn about trading Forex.

How do I proceed if I misplace my login information for my Forex demo account?

If you forgot the username, password, or both, you could retrieve them by contacting your Forex broker for the required assistance. A validation link will be sent to the email address you’ve provided. You need to click the link to substantiate your identification. The broker will then reset the password or user name and request you to enter new particulars.

How long should I trade on the forex broker demo account?

A demo trading before going live should be done for four to six months. Aim for two to three months at a bare minimum. Also, remember that if something needs to be fixed while you trade live, you can always go back to the demo version. This happens to many Forex traders regularly. Additionally, it’s likely that whenever you need to change your trading strategy, you’ll frequently return to the demo account.

Can I withdraw funds from my forex broker demo account?

No, withdrawals from a demo account are not permitted. As mentioned, the money in a sample account is only virtual and not real money. Trading on a demo account is not meant for making money or losing money; rather, it is meant for learning and practicing new methods. Learn their trading strategies by following them!

Last Updated on January 3, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)