5 best Forex Brokers & platforms with micro accounts in comparison

Table of Contents

See the best list of the 5 best Forex Brokers with micro accounts:

Broker: | Review: | MINIMUM DEPOSIT: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex  | $10 | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + 1:2000 Leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. FBS  | $1 | IFSC, CySEC | 500+ (40+ currency pairs) | + MT4 & MT5 + 24/7 support + Bonus program + Low spreads + Low commissions + Leverage up to 1:3000 + International trading | Live account from $1(Risk warning: Your capital can be at risk) | |

3. XM Forex  | $5 | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Cheap trading fees + No hidden costs + Regulated and safe + International trading + 1000+ assets | Live account from $5(Risk warning: Your capital can be at risk) | |

4. HotForex  XM trading logo XM trading logo | $5 | FCA, FSCA, FSA, SV, DFSA | 150+ (47+ currency pairs) | + Multi-regulated + Low min. deposit + International trading + Supports MT4 & MT5 + Professional support | Live account from $5(Risk warning: Your capital can be at risk) | |

5. OctaFX  | $100 | : CySEC | 100+ (28+ currency pairs) | + Leverage up to 1:500 + Supports MT4 & MT5 + Spreads from 0.2 pips + Low commissions + Deposit bonus + Many account types | Live account from $100(Risk warning: Your capital can be at risk) |

Forex trading gives everyone the opportunity to earn money while speculating on exchange rates. It takes time to master this investment and make fair gains from it. That’s why it is wise to start small and gradually increase your capital as you improve your trading strategies and skills.

Fortunately, forex brokers offer different types of trading accounts, including micro. A micro account is an account that allows you to trade small contract sizes. That’s why it is generally called micro-accounts. Most new traders begin their forex trading with a micro account to experience real market scenarios and build confidence. Experienced traders also sign up for micro accounts to test trading strategies with little financial risk. Because of these reasons, micro accounts are in high demand. Many brokers now make provisions for it in their offerings.

We will introduce to you five (5) of our favorite forex brokers that offer micro accounts to clients in this article.

List of the five best forex brokers’ micro accounts:

1. RoboForex

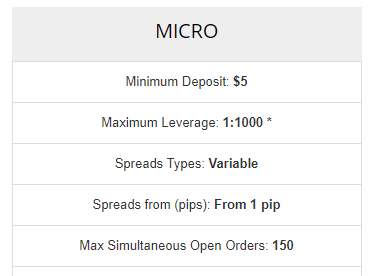

RoboForex was founded in 2009 in Belize. Since then, the brokerage has grown and now has over 3million customers globally. It operates three types of accounts. Among which is the micro called the CENT account.

RoboForex cent (micro) account requires a minimum deposit of $10. Newly registered traders get a $30 bonus in addition to the $10 deposited. Cent account holders can also enjoy bonus offers and leverage up to 1:2000.

The trader can trade up to 10000 lot size with this deposit, depending on the leverage they get. The account is offered on RoboForex’s in-house platform, the RTrader, Mt4, and Mt5. And traders can access their accounts on their apple or android mobile phones.

Spreads on RoboForex micro accounts can go as low as 1.3pips which is better than the market average for micro-accounts. There are no commission and swap fees. Deposits and withdrawals are also free.

RoboForex at a glance:

- Founded – 2009

- Regulation – CySEC, IFSC.

- Minimum deposit – $10

- Spreads – from 0pips (Minimum 1.3 for the micro account)

- Leverage – 1:2000

- Assets – 32 forex pairs, commodities, indices, stocks, ETFs.

- Support – 24-7

- Platforms – Mt4, Mt5, cTrader, Rtrader.

Pros of trading with Roboforex:

I. Conducive trading conditions

II. Easy registration process

III. Withdrawals are processed on time

Cons of trading with Roboforex:

I. Limited currency options to trade

II. No cryptocurrency assets

(Risk Warning: Your capital can be at risk)

2. FBS

FBS is another reputable broker offering micro accounts and other types. The brokerage firm is based in Cyprus and regulated by CySEC, ASIC, FSCA, and IFSC. Traders have four options of accounts to choose from, including:

- Cent,

- Standard,

- Micro, and

- Zero spread account.

The broker’s micro account requires a $5 minimum deposit. But traders from Europe can not open trade on its micro account. FBS is famous among Asians, especially in Indonesia. And the broker won several awards as the best broker in the Asian market.

There is no minimum lot size for its micro account, and traders can test-trade with a demo for up to 90-days.

Spreads for this account are fixed at 3pips, and leverage of up to 1:3000 is available. Micro accounts on FBS are commission-free. So active traders who do high volume get to enjoy low trading fees here.

FBS Summary:

- Founded – 2009

- Regulation – CySEC, IFSC, FSCA, and ASIC.

- Minimum deposit – $5

- Spreads – from 0pip (3-pip fixed for micro)

- Leverage – 1:3000

- Assets – 35 forex pairs, CFD, stocks, indices, metal.

- Platforms – Mt4, Mt5.

- Support – 24-7, multilingual.

FBS benefits:

I. Stable trading environment

II. Easy sign-up with a low minimum deposit.

III. Dependable support service

FBS drawbacks:

I. Only a few assets to trade

II. Some services are not available to European clients.

(Risk Warning: Your capital can be at risk)

3. XM

XM is one of the best brokers in the market that offers micro trading. The broker offers different types of accounts that fit different trading styles.

XM account types include:

- XM micro account

- XM standard

- XM zero

- XM ultra-low accounts.

On the XM micro account, you can enter contract size as minute as 10-units. This account can be operated on the broker’s Mt4 and Mt5 trading platforms. The minimum deposit required for this account is $5, with which traders can begin live trading with ease. The standard and zero accounts require $50 and $100 minimum deposits, and there are no hidden fees.

The broker’s free demo is unlimited. Traders can test the trading environment until they are comfortable enough with the platform. The competitive spreads and minimal lot size make XM an ideal broker for traders who wish to avoid high risks. New traders and old ones who feel like testing a newly-discovered strategy will find the account favorable.

XM overview:

- Established – 2009

- Regulation – ASIC, FCA

- Minimum deposit – $5

- Spreads – from 0.4pips ( 2.5pips average for micro accounts)

- Leverage – 1:888

- Assets – 55+ forex pairs and CFDs

- Support – 24-7

- Platform – Mt4, Mt5, webTrader.

Pros of XM brokerage account:

I. Quality trading tools in a conducive trading environment.

II. Competitive fees and reasonable leverage

III. Attractive bonus and incentive packages

Cons of XM brokerage account:

I. The broker charges an inactivity fee after one year of non-trading.

(Risk warning: 75.59% of retail CFD accounts lose)

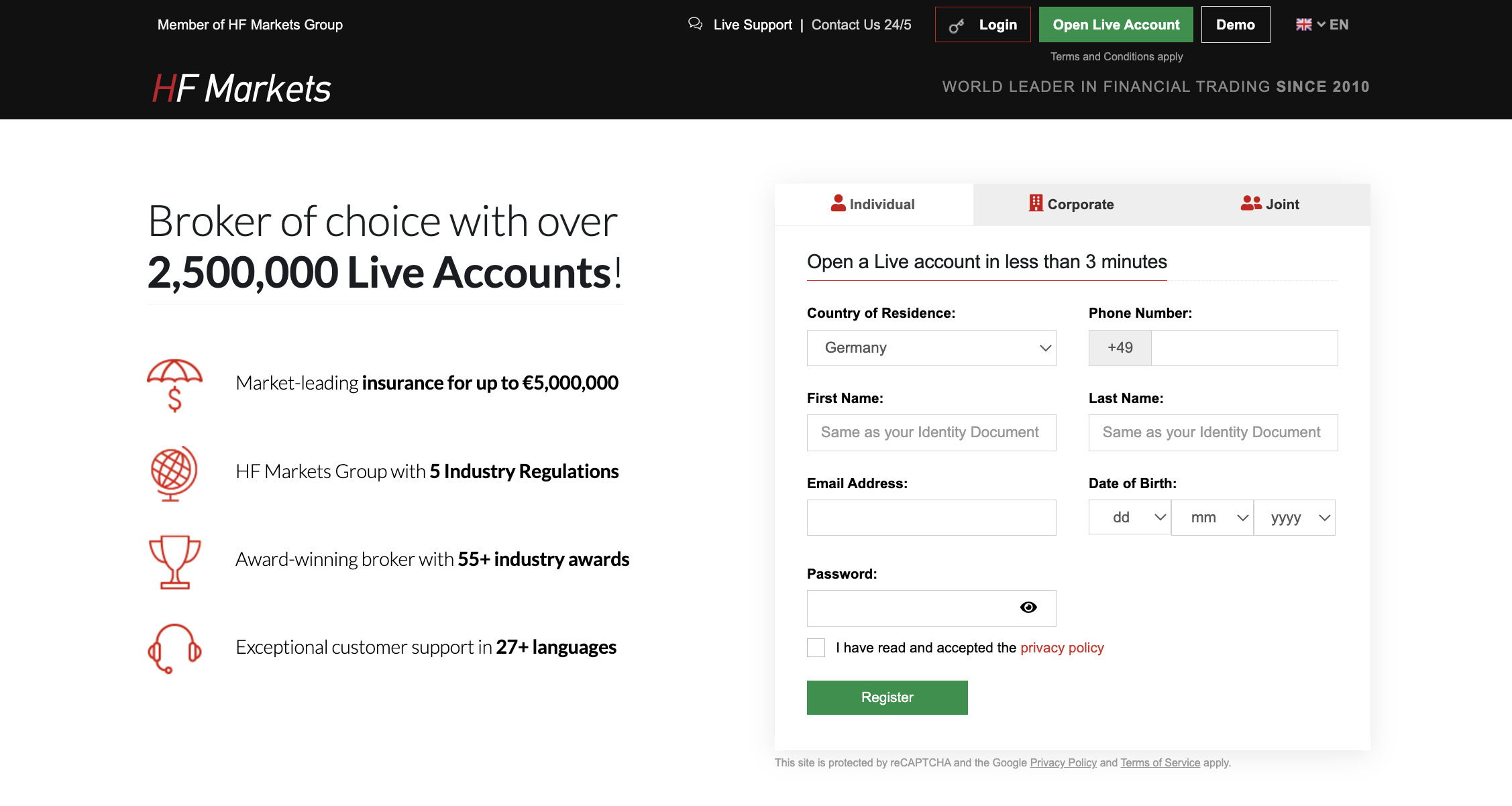

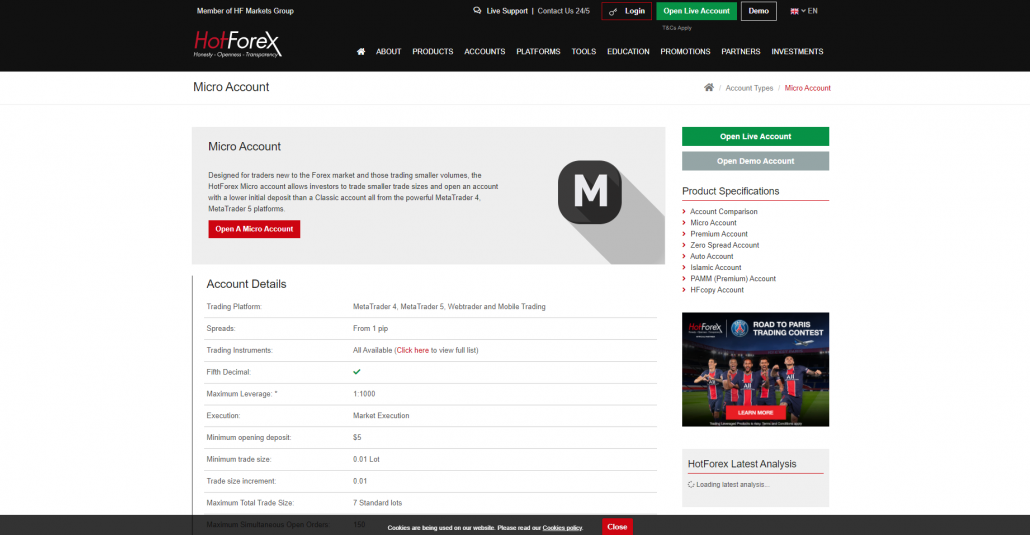

4. HotForex

Hotforex offers up to eight (8) account types. Among which is a micro trading account. The micro and standard accounts can be used for trading small lot sizes (micro trading). The minimum deposit for the micro account is $50, while the standard requires $100. The broker offers its service on the popular Mt4 and Mt5, giving traders access to lots of helpful tools. Copy trading is also available here, but it requires a minimum deposit of $300 to copy a successful trader. Its demo account is unlimited, so traders can practice and test for as long as they want without risking their funds.

Hotforex at a glance:

- Founded – 2010

- Licenses – CySEC, FSCA, FCA, DFSA

- Minimum deposit – $50

- Spreads – from 0.2pips (from 1pip for micro account)

- Leverage – 1:1000

- Assets – 47 forex pairs, CFDs, indices, stocks, and bonds.

- Support – 24-7 availability

- Platform – Mt4, Mt5, webTrader

Advantages of trading with Hotforex:

I. Wide selection of market instruments available to trade

II. Competitive fees and bonus packages

III. Exceptional education content for beginners

The disadvantage of trading with Hotforex:

I. EU clients can not trade some instruments with this broker.

(Risk Warning: Your capital can be at risk)

5. OctaFX

OctaFX is another reputable broker offering micro trading services in several accounts. The three account types are:

- ECN

- Standard

- Micro account

The broker allows micro trading on all these accounts.

The minimum deposit for the micro account is $100 and higher for other types. But users can trade small lots in these accounts listed. The Mt4 and Mt5 are famous trading platforms that most trusted brokers use because of their efficiency and practical trading tools.

OctaFX also supports copy trading. Newcomers can imitate successful traders while learning and improving their skills with this service.

Its demo account is available to every trader for unlimited periods. So you can test your new techniques or practice trading till you are comfortable enough to enter the market for real.

Traders can choose fixed or variable spread, depending on their preference. The broker’s spread is among the lowest, with a floating spread from 0.4pips and a fixed spread set at 2pips.

OctaFX summary:

- Year founded – 2011

- License – CySEC

- Minimum deposit – $100

- Spreads – fixed: 2.0pips. Floating: from 0.4pips

- Leverage – 1:500

- Assets – 30+ forex pairs, CFDs on gold, silver, energy.

- Platforms – Mt4, Mt5, cTrader

- Support – 24-7

Pros of OctaFX brokerage account:

I. Spreads are competitive. There are no commissions or hidden fees.

II. Copy trading is available

Cons of OctaFX brokerage account:

I. Cryptocurrency assets are not available on the cTrader.

II. Limited assets to trade

(Risk Warning: Your capital can be at risk)

What is a micro account in forex trading?

Micro account refers to trading accounts that allow the user to trade small lot sizes. The account offers the opportunity to begin forex trading with little capital and risks.

With regular accounts, traders require sizable leverage to trade. But micro-accounts give you the opportunity to trade the quantity you wish, reducing your leverage and risks.

The standard quantity offered in micro forex accounts is 1,000 units of lot size. Though some brokers might give more than this.

Micro account is ideal for traders who are new and wish to test the market environment. People sign up for micro accounts to learn actual forex trading with little risk. Some who have just discovered a new trading strategy and wish to test it with little risk also sign up for micro-accounts.

People who trade low volume prefer the micro account. Traders who earn a living from forex are better off with a standard account where they can trade larger contracts.

Micro accounts allow small-time traders to enjoy professional forex trading. Novice traders can learn and understand the volatility of the forex market and how to manage risks through the micro accounts.

A lot of micro accounts come with low minimum deposits. It makes it easy for anyone to begin forex trading in a less-risky setting while experiencing the in-depth market environment. Many believe that it is more realistic to trade a micro account than a demo. This makes a micro account an ideal test account for those who wish to experience the real thing.

The minimum lot a trader can work with on this account will depend on the broker. But most brokers set it at 1,000 units. The maximum varies as well according to the amount of equity, the leverage available for the account, and the broker.

How does a forex micro account work?

As stated before, this account handles small volume traders that fall between 1 micro lot. Most of the forex brokers have the volume within this range. 1 micro account stands for 1000 units of the currency or asset you are trading.

The micro account has all the features of other high-volume forex trading accounts like the standard account. It has a low minimum deposit of around $25, while other forex brokers have no minimum deposit.

Although it is advisable to use $100 when using the micro account, which will help you deal with other trading costs. You can also make some viable profit using this amount.

They also have low forex spreads and minimum trading costs. Forex traders can use the leverage to trade if they open bigger positions. They offer trading platforms like the Meta Trader four and five, or any trading platform.

You get the complete experience of trading forex, but at a smaller scale than the standard and premium accounts. For new traders who start with the demo account, it is an opportunity to introduce them to live forex accounts.

Difference between micro and mini account

The major difference between micro and mini accounts is the size of the trade.

A micro lot size means at least 1,000 units lot size. While a mini account allows trading from 10,000 units.

Other differences between the two types of accounts will depend on the conditions set by the broker for both account types.

How to open a micro account:

You may have tested a demo and wish to start trading forex live. You may have decided to switch brokers, or you learned about new trading strategies and hope to test them in a low-risk setting. Whatever your reasons are for wanting a micro account, we will show you how to set one up in a few steps.

Step-1. Sign up with the broker.

Visit your preferred broker’s website and register with them by entering your personal information.

Follow the link sent to your email to verify your contact information and continue the registration.

Step-2. Download and install the broker’s trading app.

Whether it’s the Mt4, Mt5, or a proprietary trading platform, it should be available for easy download on any internet-enabled device. Install the app on your device and log in.

Step-3. Fund your account.

The broker should provide convenient deposit methods that you can use. If one method fails or is unavailable in your region, there should be others that would work. The brokers we mentioned above all offer popular and straightforward funding options, including credit/debit cards, wire transfers, Skrill, and other famous online payments.

Step-4. Start trading live.

Once you have deposited funds in your account, your balance will show on your dashboard. You can then place buy or sell orders accordingly.

How to use a micro account:

Micro accounts allow you to trade the smallest size of the contract, as we have said. Novice traders can use micro accounts to master the basics of forex trading before they upgrade to bigger investments. Experienced traders can use it for testing before they invest fully in a trading strategy.

Here’s how to use a micro account to your advantage:

1. Invest a small amount.

We know this is an obvious point but it is worth mentioning. Fortunately, there is a maximum amount of lot size. But if your goal is practice or test, we recommend you fund with the minimum deposit.

2. Keep track of your performance.

Treat the account as though you have huge capital invested in it. Your goal is to understand the trading environment or test your trading techniques. Things would be no different if you trade with a standard or mini account. So monitor your performance and adjust your style regularly to improve your chances.

3. Monitor the trading conditions.

If the broker spreads are floating, determine its average spread. Keep track of your trading costs in terms of time and funds. What percentage of time you earn profits, the profit size in relation to losses, all the fees you incur while trading. Keeping track of these things will help you decide if trading is profitable for you or not.

4. Try out different trading approaches

If one strategy is not showing a favorable result, try another. Keep learning and practicing new strategies to find what works for you.

5. Set a time limit to upgrade your account.

Give yourself a target and set aside time to upgrade to bigger accounts. Once that time elapses, you can reevaluate your performance if you don’t achieve the target.

6. Use leverage wisely.

As we have said, micro accounts are mostly for testing or practicing forex trading. The goal is to trade in a real-life market with less risk. Taking high leverage defeats this purpose. It is wiser to use leverage as low as possible until you fully master the trade.

Advantages of an forex micro account:

Forex micro accounts offer several benefits as you may have already identified some. Among these advantages are:

1. It is easy to control the risk

With a low minimum deposit, you can have more control and flexibility in your account. If the trade moves against you, the loss would always be minimal because the contract size is small too. Though you only enjoy this low-risk when you use little or no leverage.

2. No chance of a negative balance.

Micro account holders ideally trade on minimal or no leverage at all. This way the account can not go into a negative if the trades fail. So micro accounts are generally safe from negative balance.

3. Open as many trades as you want.

Contrary to popular beliefs, people can make money on forex micro-accounts. Scalpers can open as many positions as they want and accumulate reasonable profit. Experienced traders use it for leverage trading and make huge profits too.

4. Beginners can use it to improve.

As we have mentioned, the forex micro account is ideal for novice traders. With it, they can learn all that’s necessary to succeed in forex trading. They can gradually upgrade as they get better in the trade.

Disadvantages of forex micro account:

1. Higher spreads.

Unfortunately, micro accounts usually come with higher spreads than a standard account. Sometimes this can eat into the trader’s profit.

Demo account vs forex micro account

Demo accounts allow you to test a broker’s trading platform or acquaint yourself with the forex market before you get involved.

Demo accounts come with virtual funds for traders to use. So you don’t need to make any deposits.

You may wonder why you need to put in money to test or practice trading when free demo accounts are everywhere.

We recommend using a broker’s demo before trading with the broker. In addition to the demo, a micro account helps you transition effectively into real-life trading.

Micro accounts are more realistic than demos since your real funds would be involved. Moreover, some important risk management features are not available on most demos. Orders such as stop-loss, and limit orders might require a real live account to experience their functions. So after practicing with a demo, we recommend you start trading with a micro account. Then upgrade when the time is right.

Conclusion – Choosing a micro account is a great way to get started

Forex micro account is suitable for everyone, including beginners and experienced traders. Though if you wish you trade forex full time, other account types might be more appropriate. Beginners can use it to transition from the demo into real trading. It helps you practice all you have learned and you get to experience real market conditions with minimal financial risks. The goal is not to make huge profits yet, but to fully understand market volatility and master different trading strategies.

Experienced traders can try that new trading approach in a real market situation with less risk (small amount).

The forex brokers mentioned above all offer excellent trading conditions with forex micro-accounts. With them, you can trade with trusted brokers at competitive charges.

Remember to set a logical target and upgrade your trading accounts from micro to standard once you achieve your aim.

FAQ – The most asked questions about Forex brokers with micro accounts :

What is a micro Mt4 account?

Micro account on MetaTrader 4 is designed for traders who wish to trade small contract sizes. Most brokers offer trading services on Mt4. This means if you have a micro account with the broker, you can trade on that platform.

How much does a micro lot cost in forex?

One micro-lot cost $0.10. Most brokers offer a minimum of 1000 units for a micro account. This is equal to $100. Therefore, with as little as $100, you can trade forex on a micro account without leverage.

Is a micro account the same as a cent account?

This depends on the broker. Some brokers’ micro accounts are named cent accounts. While for others, these are two different account types.

Can you make money with a forex micro account?

Yes. Most scalpers open many slots during the day and accumulate reasonable profits. Experienced traders use leverage and earn large sums with the little capital they invested.

How do forex micro accounts work?

Traders open a micro account with any broker and are allowed to trade lot sizes as low as 1,000 units. This is contrary to the 100,000 units that make up one standard lot. Micro accounts give small-time low budget individuals the opportunity to take part in forex trading.

Do regulated brokers allow micro lot trading?

Yes. Many market-leading regulated brokers offer trading accounts that allow micro lot trading.

What is a forex broker micro account?

Forex micro lots, or 1,000 units, are the smallest possible trading size. Because of this, forex micro lot accounts let traders speculate on pairs like USD/CAD with as little as $1,000.

Importantly, traders are not obligated to reach the full $1,000 minimum when using leverage. For instance, US traders have access to leverage of 1:50 when trading major pairs. So a micro lot trade would only require a $20 total commitment.

In the end, the top micro forex accounts we found are designed for casual retail traders who like to take lesser risks.

How can I open a forex broker micro account?

Once you are done with the trial in a demo account, it is time to open a forex broker micro account. So, let us know the detailed procedure.

Step 1- Visit the broker website of your choice, and register by providing your details; later, verify the contact information using the link you received in your email.

Step 2 – Download and install the trading app

Step 3- Add funds to your account

Step 4 – Start trading live from your account

What advantages can I avail myself by having a forex broker micro account?

You can avail many advantages by opening a forex broker micro account. A few are listed for your ease.

1. Reduces the risk of money

2. Safe from negative balance

3. You can trade as many as you want

4. Ideal for beginners

Last Updated on September 30, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)