5 best Forex Brokers & platforms with no minimum deposit

Table of Contents

See the list of the 5 best Forex Brokers with no minimum deposit:

Broker: | Review: | Minimum deposit: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. XTB  | $0 | More than 10 | 3,000+ (48+ currency pairs) | + Low spreads + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $0(Risk warning: 72% of retail CFD accounts lose money) | |

2. IG  | $0 | FCA (UK), NFA (US), AFSL (AU) | 17,000+ (80+ currency pairs) | + Over 17.000+ assets + No hidden fees + Education for traders + Broker since 1974 + Fully regulated | Live account from $0(Risk warning: Your capital can be at risk) | |

3. AXI  | $0 | FCA, ASIC, IFC | 1000+ (70+ currency pairs) | + Low forex fees + No deposit fees + No withdrawal fees + 24/5 support + $0 minimum deposit | Live account from $0(Risk warning: Your capital can be at risk) | |

4. InstaForex  | $0 | FCA, AFSL, FSCA | 200+ (50+ currency pairs) | + Multilingual support + User-friendly broker + Bonus programs + Leverage up to 1:1000 | Live account from $0(Risk warning: Your capital can be at risk) | |

5. Think Markets  | $0 | FSCA, FCA, ASIC, FSA Seychelles, CySEC | 1500+ (40+ currency pairs) | + Narrow market spreads + Multi-regulated + SocialTrading + Great support team | Live account from $0(Risk warning: Your capital can be at risk) |

The minimum deposit is factor forex brokers consider before opening an account on any forex broker. It plays a role in the strategy and objectives of the forex broker to what they want to achieve trading forex.

The forex industry is so competitive that some forex brokers offer no minimum deposit. It has made the forex industry accessible for people from all corners with varying living statuses.

Forex brokers without an initial deposit have some advantages and disadvantages. We will look at a few that are leading in the industry.

What is a minimum deposit on a Forex broker?

The minimum deposit is also known as the initial deposit. It is the least amount forex traders require to deposit on the forex broker when they open a forex account. The amount varies from one forex broker to another.

It also depends on the type of account a forex trader opens. Professional, pro, and expert accounts have a higher initial deposit. It can range from $500-$10,000, and it is high because of the added trading features added to the account.

The standard, mini and micro accounts have average, low, or no initial deposit. They are accounts targeted at new and learning forex traders. The initial deposit acts like the capital forex traders use when they begin forex trading with a forex broker.

Advantages of Forex brokers without minimum deposits:

1. They are affordable for new Forex traders

When a new retail forex trader starts forex trading, they might not have enough financial resources to open big positions. They require a forex account that has affordable trading costs with no minimum deposits.

Therefore, a forex broker without a minimum deposit attracts many new forex investors.

2. Forex traders can test the platform without a minimum deposit

No minimum deposit brokers enable traders to test their platforms without spending on capital. The forex trader can decide on how much they are willing to trade.

3. Allows traders to practice new strategies

It is also a way to practice strategies as they can risk whatever amount they wish to since there is no restriction. When testing out a new strategy, you don’t know how the market will react. Using a no minimum deposit allows the trader to choose how much they are willing to risk.

Disadvantages of a no minimum deposit Forex broker:

1. Hidden fees

Some unregulated forex brokers lure unsuspecting forex brokers with no deposits. The forex traders start trading and find hidden fees charged from the account.

Most of the time, the forex traders are unaware of the charges. It could be commissions or account maintenance fees. It is an illegal way forex brokers use to profit from traders.

2. Scams

The forex industry is one of many where scammers masquerade as forex brokers. Most have no minimum deposits and attract a lot of clients. Once they deposit their platforms, these scams use illegal ways to manipulate the trades such that forex traders lose.

Other forex traders find out that they cannot withdraw their profits from the forex brokers. Scammers target new forex traders who don’t know how to verify the forex brokers before depositing. It has made forex traders skeptical about the whole forex platform

List of 3 best Forex brokers with no minimum deposit

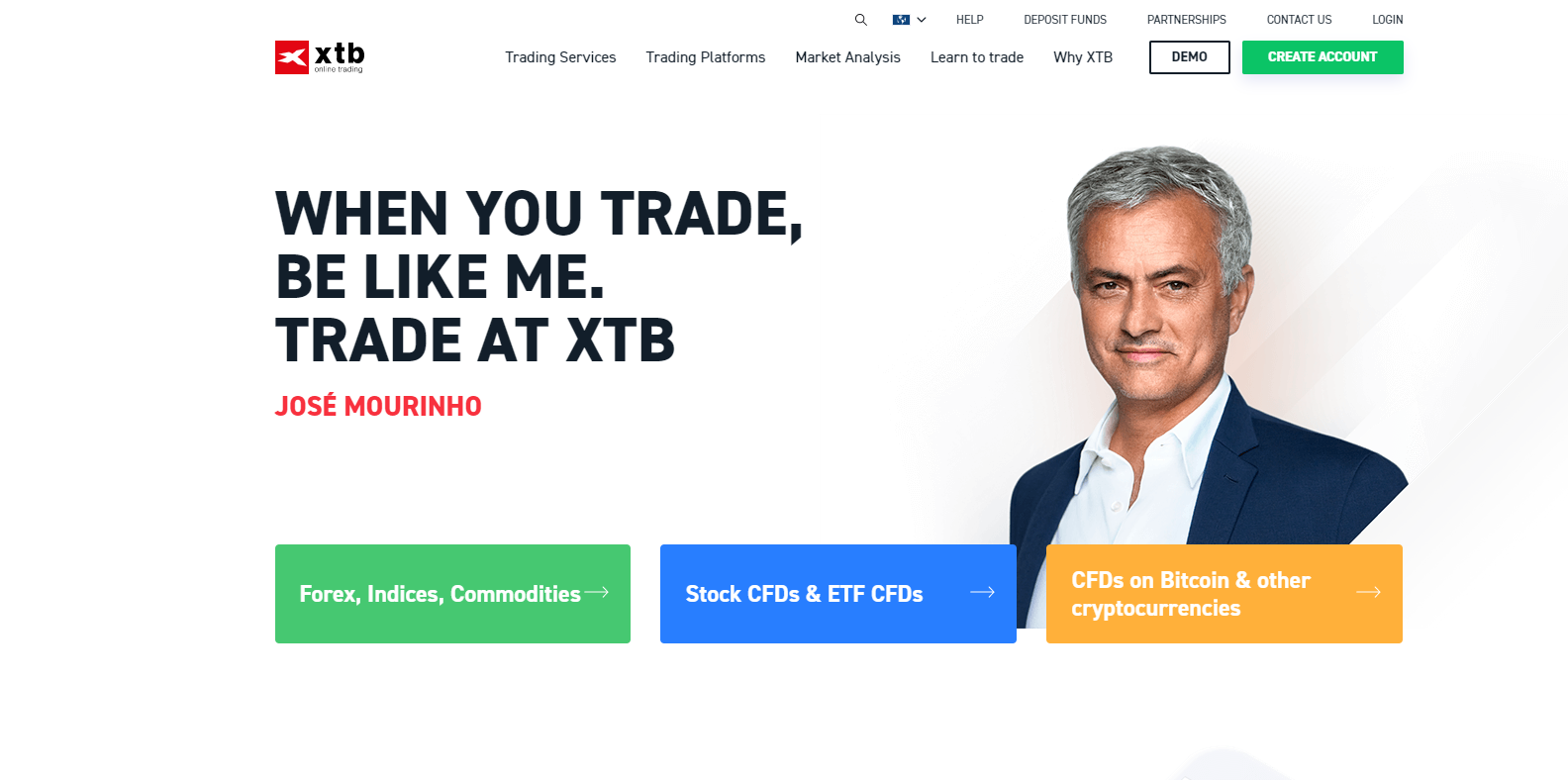

1. XTB

This is a forex broker founded in 2002 and is regulated by the financial conduct authority (FCA) and (CySEC) of Cyprus. It is a highly trusted tier-1 trading broker and has a record of providing quality forex broking services for two decades.

It has offices based in 13 countries worldwide and over 250,000 forex traders. It is one of the leading forex brokers in the industry with a 0 minimum deposit. On XTB, forex traders can access 1500 financial markets. Some include indices, CFDs, commodities, and forex.

Pros of XTB

- Low overall trading fees for most financial markets.

- A user-friendly interface is suitable for all forex traders.

- Simple to register an account and takes a short time.

- Free deposit and withdrawal fees.

- It is a trusted forex broker because of its long record since 2002.

- A variety of educational materials.

Cons of XTB

- You can access a few financial markets using this forex broker as it operates with CFDs.

- It has limited access to research materials for analyzing the market.

- It charges high fees when trading using CFDs.

(Risk warning: 72% of retail CFD accounts lose money)

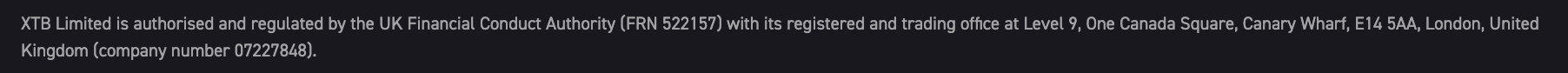

Account types on XTB

They offer three account types, demo, standard, and pro accounts. The standard account has a leverage of 1:30, but it also depends on the region, some regulated regions have lower leverage.

Forex traders can open positions in most financial markets for as low as 1 micro lot. The professional account is also available, but it requires qualifications before you use it.

They have an Islamic account for the Islamic traders who adhere to the sharia laws. It is similar to the other forex accounts, but forex brokers cannot access the cryptocurrency market using this account. The commissions are slightly higher in the Islamic trading account.

XTB features:

They have a demo account that forex brokers get encouraged to open to understanding the software. It is also a great way to practice how to trade in different markets. It has educational resources such as blogs, webinars, and videos.

You can get forex trading courses specifically designed for different levels of experience. They have detailed and extensive educational content all over their platform. New traders can take advantage of these resources to learn how to trade in any market.

XTB has access to trading tools like market analysis and news for forex traders. It uses advanced technology, starting with its charting software. Traders can access more than 30 charting tools and technical indicators.

You can access the financial market with the Meta Trader 4 or the xStation 5 trading platforms. They also give access to their platform via the XTB forex broker via a mobile application, a desktop, and a web-based version.

One setback of the XTB broker is that it does not have an automated platform. It has made up for these by providing research from forex expert analysts and other third-party professionals.

Fees and commissions

XTB has averagely low fees and commissions charged for most markets. They have no deposit, withdrawal, or account fees. Forex spreads vary from one country but start from 0.1 pips in the United Kingdom.

XTB charges a commission on stocks, ETFs, and CFDs at a rate of 0.08%. They have no commission for trades above 100,000 Euros and have an inactivity fee of $10 after a year charged monthly.

Withdrawals and deposits

There are no withdrawals and deposit fees on XTB, but there is a conversion fee from one currency to another. You can avoid this by creating a digital wallet since it is cheaper to convert currencies.

XTB accepts payment methods like bank transfers and credit cards like Visa MasterCards and Maestro. They also use Skrill, PayPal, Pay U, and Ecompay digital wallets. It is free to deposit on this platform, and the currency you use to deposit is Euros.

Customer support

Customer support is available 24/5 for customers within Europe but is 24 hours every day for clients outside Europe. Customer support is available in different languages like Romanian.

They are responsive within 24 hours through their Email, live chat, or phone support.

(Risk warning: 72% of retail CFD accounts lose money)

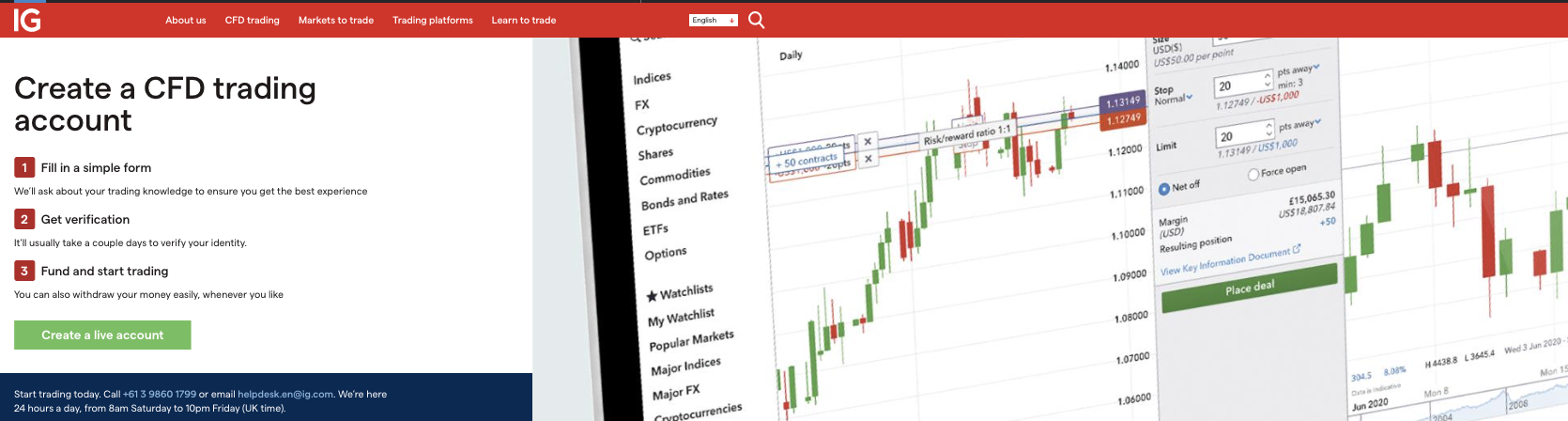

2. IG

It is among the popular forex brokers where traders can open an account with no initial deposit on bank transfers. It was founded in 1974 and has a record of providing forex services for over 170,000 clients globally.

In IG forex traders can access stocks, CFDs, Cryptocurrency CFDs, and forex trading markets. It is safe since it has been in the market for a long time. It is also regulated by the top six tier-1 regulating bodies in the forex industry.

They include;

- Australian Securities and Investments Commission in Australia

- Financial Conduct Authority from the United Kingdom

- Commodity Futures Trading Commission of the United States of America

- Swiss Financial Market Authority of Switzerland

- Monetary Authority of Singapore

They set up security for their clients with two-step verification.

Forex traders can open position sizes starting from 0.01 micro-lots, and leverage 1:30. The leverage varies with the regulation of a country since they dictate it in their jurisdiction.

Pros

- A library of forex trading educational resources for all traders.

- It has the top forex trading broker platform.

- It has a secure trading environment, regulated by 6 top-tier forex regulatory commissions.

- It caters to diverse forex traders with a variety of accounts.

- It is available in most countries in the world, including the USA.

Cons

- High trading fees when you use CFDs.

- Limited access to other financial markets for USA traders

(Risk Warning: Your capital can be at risk)

Account types on IG:

IG has 7 types of forex trading accounts having specific features. Meant to cater to different diversities of traders, creating a competitive environment. The trading account, options trading account, the limited-risk account, the share dealing account, and the exchange account.

It also has a professional account for expert traders. There is also the Islamic account that follows Sharia laws. Sharia laws exempt Muslims from paying overnight fees. It is one of the other fees that the laws deem exploitative.

IG features

IG has features that help traders get the best trading experience. It has a free demo account that traders can use after registering the demo account. It has over 20000 virtual funds where forex traders can get familiar with the IG platform.

It has comprehensive study materials for forex traders who want to learn to trade any financial market. It has the IG library, which has resources that cater to beginners to experienced traders.

IG has a mobile app, IG academy, dedicated to only educational resources. IG utilizes the Meta Trader 4 and its proprietary trading platform. They also have the ProRealTime, FIX API, and the L2 dealer trading platforms.

These trading platforms with automated trading features. Traders have the option of manual or automated methods to execute trades. You can access these trading platforms via the mobile application, the desktop, and the web-based version.

It has a user-friendly platform that any trader can easily understand. It also has trading signals and charting software, where traders can observe different financial markets in different time frames.

There are over 30 signal indicators, forex traders also have access to the Autochartist and the Daily Fx. Traders can get information about the market and make informed trading choices.

IG trading fees

Ig uses the direct market access system for its platforms. This allows them to give narrow spreads close to the liquidity providers. They have an average forex spread of 0.2 pips for the EUR/USD.

The commissions are high than other forex brokers but don’t have deposit or withdrawal fees. They charge $12 as an inactivity fee when the account is not in use for a year.

Deposits and withdrawals

You can deposit using bank transfer methods, Credit and debit cards, and e-wallets. They accept e-wallets such as Neteller, Skrill, and PayPal.

Customer support

IG caters to its different customers by providing customer support in various major languages. Their customer care team gives fast responses, making them reliable. Forex traders contact them through live chat, social media platforms, and telephone.

(Risk Warning: Your capital can be at risk)

3. AXI

It was previously known as Axitrader when it got launched in 2007. In 2020, it rebranded as AXI and is an Australian-based forex broker. It is regulated in many countries, with top tier 1 regulators.

It has no minimum deposit requirements to open an account. Forex traders are free to choose how much they wish to use for trading as long as it is sufficient to trade and avoid a margin call.

They include;

- Financial conduct authority

- Australian Securities and Investment Commission from Australia

- Financial Conduct Authority in the United Kingdom

- Dubai Financial Services Authority in Dubai

AXI gives traders access to various lot sizes from the mini size to the standard lot size, you can start from as little as 0.01 micro-lots. Traders can access Commodities, CFDs, cryptocurrencies, and foreign currencies.

Pros

- It has a user-friendly forex platform.

- It does not charge fees for withdrawal and deposits.

- It has a top-of-the-market customer care team.

- It offers a variety of trading resources.

Cons

- The demo account is limited to 30 days.

- Customer care is only available five days a week.

(Risk warning: 73.4% of retail CFD accounts lose money)

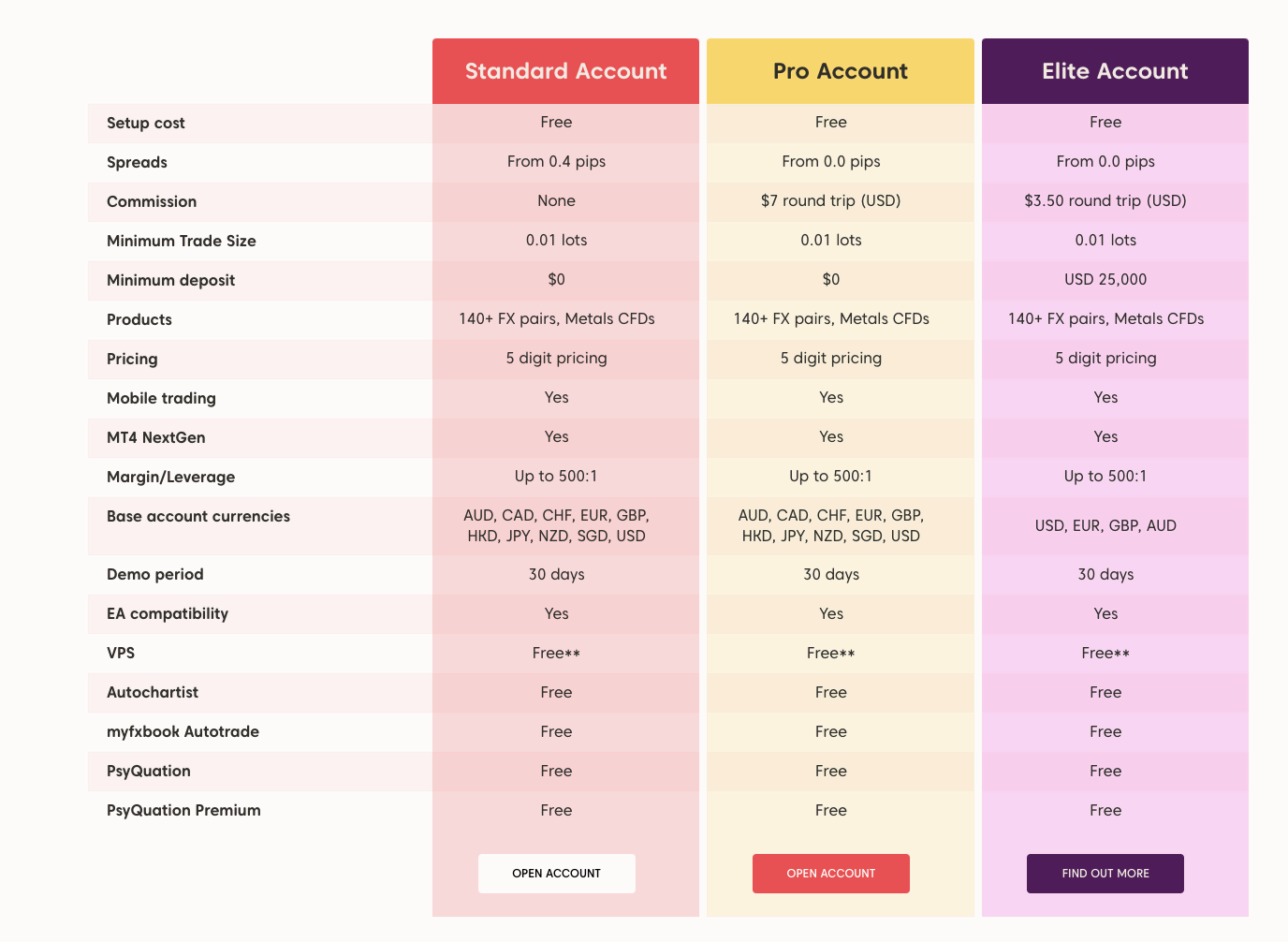

Accounts on AXI

On AXI forex traders can open the standard account or the pro account. A standard account has no commission and trading fees but has high forex spreads. The pro account has a commission of $7 but has low forex spreads.

You can open an individual, a joint, or a co-operate account. There is an option of an Islamic account for Muslim traders.

Features of the AXI forex broker

It has a free demo account for thirty days when forex traders can look at the AXI platform and practice trading. It has access to many instruments and leverage of up to 1:500. Furthermore, it is a good tool for new traders to use before moving to live to trade.

AXI forex broker has access to quality educational articles and ebooks with well-researched topics from many instruments. They have educative videos and courses designed for forex traders. They can learn different markets and strategies when approaching them.

It has the Auto-chartist enabled in its Meta Trader 4 trading platform that helps new traders with trading signals. It also has a copy trading platform and an automated trading feature that places its traders ahead of the game.

AXI works with Psy-Quation which, performs market price analysis and provides the data to forex traders. It allows traders to make insightful decisions and reduces losses.

VPS hosting gives traders a conducive environment for trading and reduces laxity. All these features are available on the mobile application, the desktop, and the web-based versions.

AXI trading fees

The spreads on AXI depend on the forex account you open. The standard account has forex spreads starting from 0.4 pips and varies with the instrument and currency. It also has no commissions, and it has high forex spreads.

The pro account has narrow spreads that start from0.0 pips, but they have a $7 commission per lot. It has no deposit and withdrawal fees but has an inactivity fee of $10 after a year of inactivity that auto-renews every month.

Payment methods

You can fund your AXI account using credit and debit cards such as Visa, Master Card, and Maestro. You can also use Skrill, Union Pay, and Neteller.

Customer support

Their customer support is among the top in the forex industry. It supports numerous languages used around the world. You can contact them via email and live chat for 24 hours for only five days.

(Risk warning: 73.4% of retail CFD accounts lose money)

4. InstaForex

It is a direct market access forex broker with no minimum deposit when you register an account. It got founded in 2008 with its headquarters in Russia and has a client base of 7 million traders.

Traders on Instaforex can access 200 trading instruments. It gets regulated by Cyprus Securities and exchange commission. Forex traders can open positions starting from 0.1 lot size.

It has a slightly different lot size as one standard lot in Instaforex is equal to 10,000 currency units instead of the traditional 100,000.

Pros

- It caters to diversity through multiple languages

- It has the quality and reliable analysis of different markets.

- It has a variety of educational resources.

- It has a high leverage ratio.

- You can deposit using cryptocurrency like bitcoin.

- New traders can benefit from the PAMM and copy trading services.

Cons

- Customer support is available only for 5 days.

(Risk Warning: Your capital can be at risk)

Accounts on InstaForex

It has 5 account types, each designed with features. The standard, ECN, Scalping, Eurica, and ECN Pro account. The standard forex account has a free deposit but high trading costs, while the ECN and scalping have a minimum deposit of $100.

The ECN Pro is for professional traders, while the Eurica is for new forex traders.

It has a free demo account, which you can access after registration. It has a wide selection of educational materials that forex traders can use when trading. There are webinars, videos, courses, seminars, and videos.

It has the ECN feature that allows traders to trade at low costs. Traders can access over 100 foreign currencies, stocks, commodities, and futures using ECN. It offers leverage as high as 1:1000, but it also depends on the country’s regulatory laws.

InstaForex uses the Meta trader 4 trading platform to access the market. Another important aspect is research and analysis performed by over 30 analysts. They have a comprehensive analysis, profitable for all traders.

You can use the automated system for trading on InstaForex. It has a desktop version, a mobile application, and a web-based platform. You can access PAMM accounts, copy trading, and social trading options on InstaForex.

Fees

InstaForex has floating spreads at an average of 0.8 pips, but it varies with the type of account and the region you are trading from. It has no deposit and withdrawal fees but has an inactivity fee of $10 per month after a year of inactivity.

Payment platforms

It accepts Credit and Debit cards, and cryptocurrencies like bitcoin. Also, you can choose from options such as Skrill, Neteller, Sorfort, B2BinPay, and PayCo. The payment methods also depend on the location of the forex trader.

Customer support

Their customer support is responsive and available 24 /5. You can contact them through email, social media platforms, and live chats.

(Risk Warning: Your capital can be at risk)

5. Think Markets

It is a forex broker that launched in 2010 in London, UK. It has over 500,000 customers and serves more than 180 countries. Traders can access forex, commodities, stocks, indices, cryptocurrencies, and precious metals.

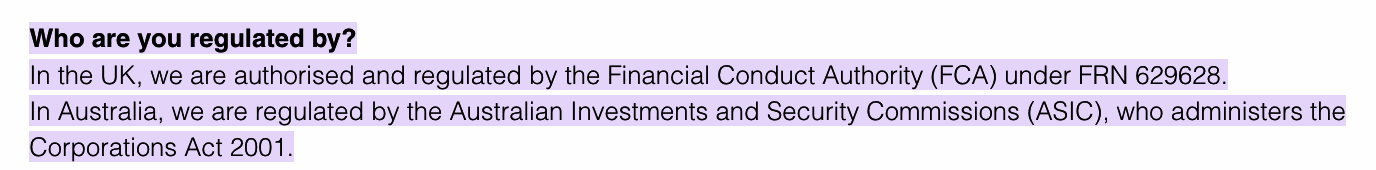

It is a forex trader that is known for having no minimum deposit. It is regulated by the ;

- Australian Securities and Investments Commission in Australia

- The Financial Conduct Authority in the United Kingdom

- The Financial Services Authority in Seychelles

- South Africa’s Financial Services Conduct Authority

Pros

- They have a range of trading platforms with trading tools

- It is regulated in many countries

- It has a user-friendly platform that is easy to open and use

- Forex traders can access different forex markets

- Their customer care team is available 24/7

Cons

- It does not offer a comprehensive analysis of the market

- It doesn’t have binary options

(Risk Warning: Your capital can be at risk)

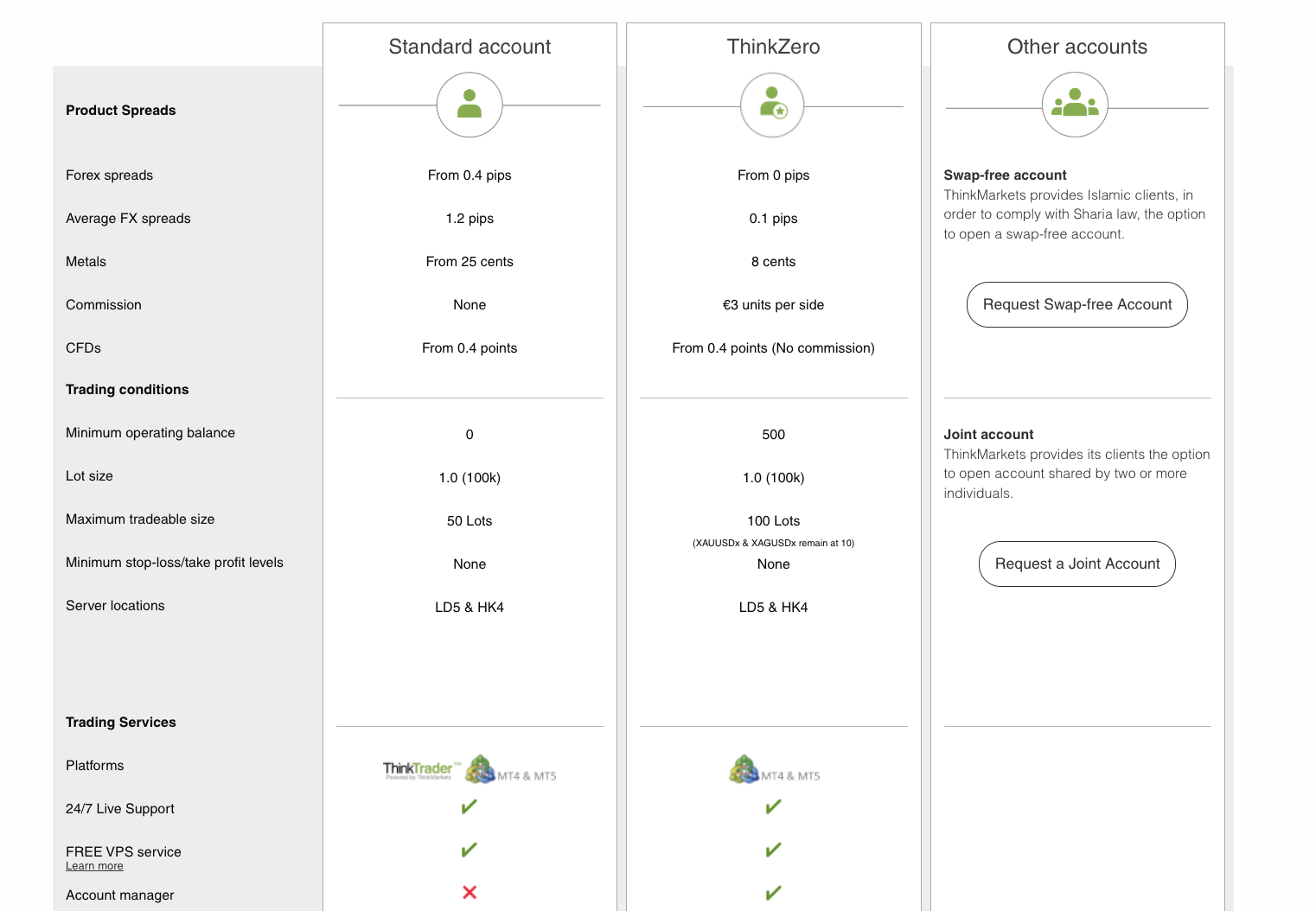

Account types

Think Markets has two types of accounts, the standard account with low spreads, no commissions, and no minimum deposit. The Think Zero account has low forex spreads and a minimum deposit of $500.

Features of Think Markets:

Thinks Markets has a variety of charting software, forex indicators drawing tools, and more than 100 signals from the market. All this is available using the Meta Trader 4 and 5, and has its proprietary trading platform, think trader.

It offers leverage of 1:200 in most financial markets, but it changes depending on the type of regulation in a region. It has a mobile application, a desktop version, and a web-based version. Which provides access to forex trading accounts at any time of the day, wherever the clients are.

You can access automated trading on their trading platforms. It has a demo account with funds as high as $25000, but it lasts three months. It has a library of educational resources such as webinars, videos, and tutorials for all types of forex traders.

Fees and commissions

The spreads depend on the accounts, for the standard account has forex spreads ranging from1.2 pips. This account allows traders to open positions where the maximum lot size is 50 lots and has no commission.

The ThinkZero account has forex spreads of 0.1 pips and a commission of 3.5 in every trade. It has low forex spreads, which can be used for forex traders who want to open positions. It has no deposit or withdrawal fees.

Payment platforms

Forex traders can use credit and debit cards to deposit or withdraw currencies, Skrill, Bitpay, and Neteller. It accepts bitcoin, and the process takes a few minutes.

Customer care

Their customer care is present 24/7, and you can contact them via Email, Telephone, and live chat. They are present on social media.

(Risk Warning: Your capital can be at risk)

Advantages of a forex broker with a low minimum deposit

A good option for new forex traders

New investors in forex may be intimidated when they are scanning the market for a forex broker. There are forex brokers who ask for thousands of money before you can start trading. Brokers that offer low minimum deposits often attract a lot of new investors.

It is because many people want to start forex trading with small deposits. So that they gradually grow their accounts. Having to start with minimal deposits is a great way to learn how to manage a trading account.

Low risks

There is a chance that forex brokers that give small minimum deposits allow opening small positions. Trading in forex comes with rewards and risks. A small trading position is less risky than opening a big trading position.

Forex brokers that offer small deposits can get forex traders to open small trading positions. It reduces the risks of losing all your funds in one day. You can gradually increase the trading position with time.

It does not mean that they are low-risk brokers. The risk is less with a small trading position than with a large one.

Chance to diversify your portfolio

Traders can use the forex brokers with a small minimum deposit to open positions with more than one currency pair. It is a strategy that you can use as an opportunity to buy more than one forex pair.

It helps to balance the profits and losses. It is easier to lose investments when they are all in one account. It is easier when you lose in one currency pair. Because you have another forex currency that makes profits to recover your losses.

Access to educational materials

Forex brokers need you to open an account to access trading educational materials. They have webinars, videos, and educational forex trading classes. Some have research materials that offer great help for any forex trader.

The forex brokers have a minimum deposit of $10, and lower are affordable for new traders. Forex traders can open accounts to get resources for making better trading decisions.

Disadvantages of low deposit forex brokers

Hidden fees

It is like some charges that get charged without the user’s consent or knowledge. It can be in the withdrawal fees or deposit fees. Many forex trading brokers with a low minimum deposit recover this by having hidden fees.

Fraudulent brokers

Many people claim to be forex trading experts and lure innocent victims to scams. They have increased with the growth in the popularity of forex trading. They can say that they have no minimum deposit and can make thousands of dollars.

Some with no minimum deposit attract investors who lose thousands of dollars trading.

Conclusion: Trading with no minimum deposit is available

As the forex trading industry has become saturated with forex brokers, they compete to get clients. The minimum deposit holds back many forex traders from accessing forex brokers.

Having no minimum deposit allows forex brokers to get more clients. It also allows traders to test out their features without risking funds using the demo account.

FAQ – The most asked questions about Forex Brokers with no minimum deposit :

What is a no minimum deposit Forex broker?

These forex brokers have not clearly stated a fixed amount you need to deposit to access their trading platforms.

Is it possible to trade Forex with no minimum deposit?

No, you require to deposit some amount to start forex trading. Forex trading is like any other business and needs capital to work. No minimum deposit forex brokers allow forex traders to choose the amount they wish to deposit.

Can I access the demo account if I’ve not funded anything on the live trading account?

For some forex brokers, yes. Others may require you to deposit a certain amount to access it.

Why should a trader choose a forex broker with no minimum deposit?

A trader should choose a forex broker with no minimum deposit to avoid hard and fast trading rules. A minimum deposit amount keeps any trader bound. If you wish to avoid such a situation, you must choose a forex broker who does not stipulate any minimum deposit amount.

Which is the best forex broker with no minimum deposit?

Almost all forex brokers stipulate a minimum deposit amount for traders. So, finding the best forex broker with no minimum deposit would be challenging. However, as per our research, 5 forex brokers do not charge any minimum deposit amount from traders. They include the following.

XTB

IG

AXI

InstaForex

Think Markets

In addition, these brokers offer you the best-in-class services for forex trading. They make any trader’s trading experience better.

How can I sign up with a forex broker with no minimum deposit?

Once you have selected a forex broker with no minimum deposit, you can sign up by visiting their trading platform. These forex brokers offer you a ‘signup’ option. You can click on it to initiate trading without paying any minimum deposit amount. After entering your details, you will have successfully traded with these brokers.

Which forex broker requires the lowest minimum deposit? Can I start trading with $10?

If you’re a forex trader and you’re curious about which brokerage firm has the lowest initial investment, RoboForex is the place to go.

The new traders or investors have a lower opening capital. They prefer to start with a smaller contribution. So, it is possible to start forex trading with a minimum of $10 and, in many cases, even less than $10.

Last Updated on September 30, 2023 by Andre Witzel

(5 / 5)

(5 / 5)