How do I add funds to my online trading demo account?

A demo account is a free trading account offered by a broker to practice trading different assets.

The main feature of a demo account is that it is not real. It offers dummy money for you to place trades. So, the money you win or lose in a demo account is not really loss or gain.

Beginners use demo accounts to gain relevant knowledge and experience. In contrast, experienced traders use a demo account to test new trading strategies.

Demo accounts also make it easy for brokers to attract new customers. Plus, the procedure of opening a demo account is quite simple. But do you know how to add funds to the demo account?

Read on to know how you can deposit funds and practice trading.

Table of Contents

Steps to deposit funds into a demo account

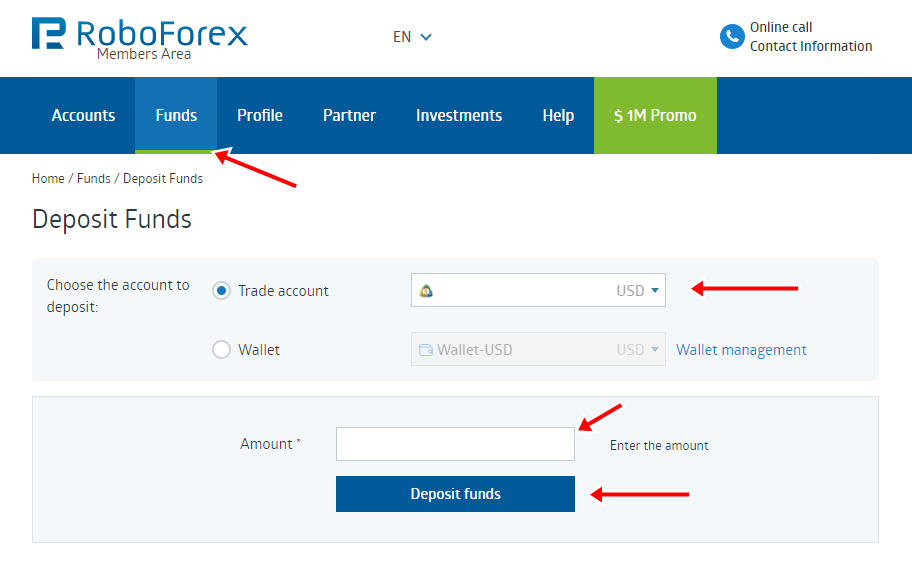

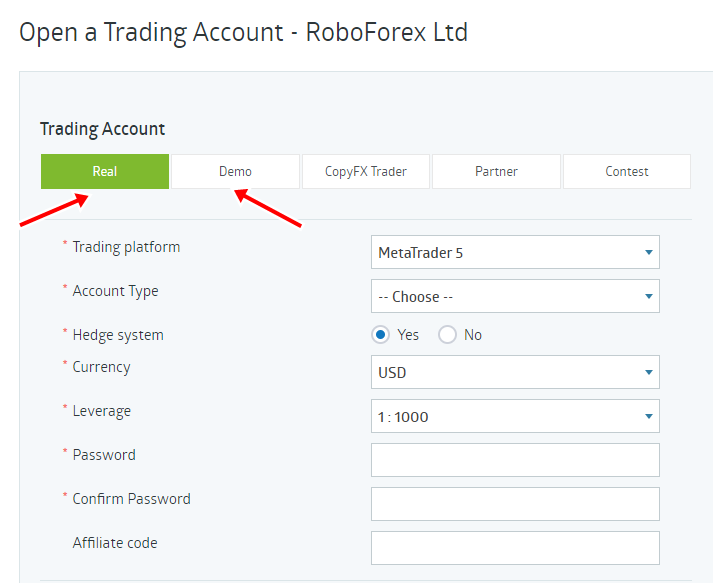

Follow these steps to add funds to your trading demo account:

- Log in to your trading broker account

- Visit the Demo Account section and then click on Deposit Funds

- You can select an acceptable amount of up to 10000 USD from the broker to top up your demo account

- Click on Deposit, so your demo account balance is instantly updated

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Pros of using a demo account

Demo accounts are popular among both novice and experienced traders to practice trading or try different strategies.

Here are some more benefits of using a demo account:

1. Understand the market

If you are new to the trading market, never start trading through a live account. Why? Well, your lack of market knowledge and experience could make you lose trades. After losing consecutive trades, your confidence level and interest in trading will drop.

That’s why you should begin with a demo account to understand whether or not you actually like trading. If you like it, you can practice different strategies.

2. Check the broker trading condition

Before registering as a trading broker, it’s important to check the trading conditions through a demo trading account. By practicing trades through a demo account, you can easily check the comfort level of a trading platform.

Trying out brokers also helps you understand their services and features. Plus, you can test different trading strategies for the assets offered by the broker.

3. Make risk-free mistakes

Each trader wants to know how much they can gain or lose before actually putting in real money. A demo account lets you practice in an environment that looks very similar to the real thing.

So, when you make mistakes or gain profit, you get an idea of how you will perform in the real setting. In addition, you can also learn from your mistakes.

4. Practice risk management

The key to success is practicing risk management. You must know good risk and money management techniques to enjoy consistent and sustained success. You can apply your knowledge and trading skills in a demo account to see how they work.

New traders are guilty of ignoring and overlooking many principles of risk management. But as beginners gain experience, they appreciate the value of understanding risk management.

5. Test trading strategies

Do you want to test your trading strategies without any risk? A demo account is the best place to try your strategies. Plus, demo accounts closely resemble real accounts. A good example is here an XTB demo account. That means you get to know how your strategies will perform in the real setting.

Furthermore, when you practice through a demo account, it lets you optimize your trading strategy without loss.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Cons of demo trading

While demo account trading is beneficial, it also includes certain disadvantages. You will notice most of these drawbacks once you switch from a demo account to a live account.

1. Overtrading

Many traders get excited and end up overtrading. The idea of a demo account is to encourage traders, but many traders end up overtrading. Unfortunately, when they move from the dummy account to a real one, they carry this habit, which makes them lose money.

For the real trading market, traders need to be aware of the maximum number of trades they should make. If your trading strategy does not permit you to make more trades, don’t do it.

2. Difference in a demo and live accounts

While demo accounts are designed to look similar to live accounts, the way how trades are executed on both accounts is different.

The main difference is that trades do not leave the platform in the demo account. But in a live account, your trades are filled with market execution. Also, losses and profits in a demo account are not your actual loss or gain. But in real accounts, you lose real money.

Conclusion about how to add funds to the online trading demo account

Funding a demo account is not difficult. You can follow the steps mentioned in this post to add extra funds.

After successfully adding funds, start trading through a demo account to gain a better market understanding and knowledge. You can also test your strategies to make successful trades through a live account.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel