GO Markets review and test – How good is the broker?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.7 / 5) (4.7 / 5) | CySEC, ASIC | 100€ | 60+ | From 0.0 pips (+ $ 2 commission per 1 lot trade) |

Go Markets has been in the brokerage business for a long time. It is one of the pioneers in the foreign exchange industry. They have built their company from the ground up, becoming one of the powerhouse online brokers in the whole world. But how good is the broker and is it really worth investing your money there? In our detailed review and test, we will present you with all details before signing up with this trading platform.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What is GO Markets? – The company presented

Go Markets is rightfully a trailblazer in the world of finance and burst into the scene in 2006. It is renowned for being one of the first brokerage firms that adapted the MT4 or Meta Trader 4 platform for their website. It has since made upgrades and included MT5 or Meta Trader 5 in 2018, and in 2012, it acquired the Web Trader browser into its system.

The company has its base of operations in Melbourne, Australia, and is principally owned by Octava, a Singaporean firm. Go Markets Ltd (or is also known as Go Markets SVG) is a company that specializes in forex, index, commodities, and CFDs trading. In 2017, the company added the FTSE China A50 and the US Dollar indices to its wide array of CFD index products.

Also in 2017, Christopher Gore was selected as Go Markets CEO or Chief Executive Officer. He first joined the company in 2009 as a financial analyst, and in 2013, became the Director and Responsible Manager.

What is Go Markets?

Go Markets SVG is a division of the Go Markets group, which has offices in Cyprus, London, Taiwan, Dubai, and Australia.

Company vision:

They have an all-encompassing vision of being the first (and perhaps only) choice for trading and offering the best experience to their customers through dependable customer support, low-latency trade execution, honest pricing, and featuring user-friendly and stable online platform.

Company values:

Go Markets’ utmost priority is geared towards their clients. They have a client-first approach and attempt to be the number 1 option for CFD (Contract for Difference) and forex trading for beginner and seasoned traders alike.

They have integrity and compliance by abiding by the strictest standards in regulation. They also have put ethical measures in place, to provide a sincerely transparent online service that they can be proud of and differentiated from the others. Innovation is the benchmark as well as the foundation that Go Markets stands upon. They are devoted to providing a high-quality and groundbreaking computer interface, which provides clients with safe transactions and interactions in the financial market.

Their ultimate goal is simply being the best in the business and maintaining the pioneering work ethic that had put them on the map in the first place. They strive to also grow in the global finance industry, thus leaving its positive and indelible mark. We have over nine years of experience and made a thorough research on this online platform and the support it provides. Once you have read this review entirely, it will aid in your decision-making process whether you are going to utilize it or not.

The regulation of GO Markets – How safe is It?

GO Markets broker is regulated in Cyprus. CySEC, as the financial regulator in the country, is considered a reputable authority that audits and controls the broker’s machinations. Thus, investors can be sure that the broker meets all the necessary requirements to participate in transparent financial transactions.

Here are the mandatory security measures that brokers must fulfill from the regulating entities:

- Adhering to the ASIC safety standards.

- Clients’ funds are segregated from company stocks with the Commonwealth Bank and the National Australia Bank.

- Having a procedure of initiating a margin call to lessen the chance of getting a negative balance in their accounts.

- The company is an Australian Financial Complaints Authority member. It has an external dispute resolution scheme in place.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) Trading countriesNot every country accepts GO Markets for trading. We researched the countries that allow trading with the broker as well as the countries that don’t accept the broker. Trading Hours:Forex trading hours run from Monday midnight to Friday midnight (GMT+3). For the other assets, they run at different times, which you can find on the broker’s website. Countries that Don’t Accept Go Markets

Countries that Accept Go Markets:

Review of the GO Markets trading platform In the following, we will take a closer look at the trading platform of Go Markets together in the test. We will focus on the world-famous MetaTrader trading platform and the account models that await you at Go Markets. In addition, we will look at contact options and how reliable and qualitative customer support really is. MT4 or MT5? (MetaTrader)Go Markets and MT4 have a long and impressive history and helped elevated each other to their present status today. This trading tool has long been regarded as a benchmark for the worldwide foreign exchange industry. Go Markets’ experience with MT4 has been beneficial, thus producing outstanding features that are second to none like the MT4 Genesis (which will be explained further in a segment below). It was developed further due to the increasing client base. It has been a favorable alternative for rookie and more seasoned forex traders alike, utilizing EAs or Expert Advisors and detailed examination of financial markets. In more than ten years that Go Markets utilized MT4 as their powerhouse tool, they have created premier trading capabilities like:

MT4 GenesisIt is an add-on to MT4 that enhances its abilities to its full capacity and enables trading with commodities, forex, and indices. Also, it is a set of EA or Expert Advisor programs that can be easily implemented with a mouse click. In more than ten years since Go Markets had used MT4 as their trading platform, they have developed add-ons that would greatly aid their clients in managing risk, maximizing their trading capabilities, and finding new opportunities for trading.  Here are the benefits if you upgrade to MT4 Genesis:

You can learn more about MT4 tutorial videos in the Education Centre portion of the menu tab. It’s located in the upper right corner of the website. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Upgrade from MT4 to MT5There is another fantastic trading tool, which is MT5. It is an innovative version of MT4 and has more features and capabilities. However, it is not yet available for trading on Go Markets and is still “coming soon.” If you want to use it once it is available, you have to know about its specifications first. It is designed to be multi-functional, have easier navigation, and be more advanced. It enables easy trading access and is the best option for the modern and technologically savvy trader. Here are its many features:

When the MT4 is available, it will allow you the capability of movement from one place to another while trading from a mobile device. You can place trades at any time of the day with various tools and features to select. Web TraderThis trading software provides all the capabilities of MT4 and MT5 that are fully accessible directly from any web browser. You do not need to download any app or extension. It permits the customers to trade with CFDs and engage in price analysis in any place where you can get internet. It is a reasonable choice for users that needs to be uncomplicated and easy manner. It is compatible with the regular OS or operating systems like Linux, Windows, and Mac. Mobile AppThere is Go Markets mobile application for Android and iOS devices, which can be downloaded on App Store or Google Play. You can trade any time of the day, in any place you can be, with mobile MT4 or MT5. It has the same tool’s features as the desktop version and has the same services. Go Markets additional tools and features:There are other extra-special tools offered to rookies and expert traders alike:

Foreign exchange involves trading in fast-moving markets, and you need a tool that provides real-time access as quickly as possible. With VPS, it provides constant access and speed when you trade, and with Go Markets VPS, you can achieve maximum efficiency of the platforms for trading. It grants you to accomplish trades with EAs or Expert Advisors in an easy and fast manner. Here are the many benefits:

To access VPS in Go Markets, just send a message to their support team, either via email or on the “Chat” tab on the website. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) GO Markets types of accounts There are two account types, and both require a minimum deposit of two hundred US dollars and available in nine currencies.

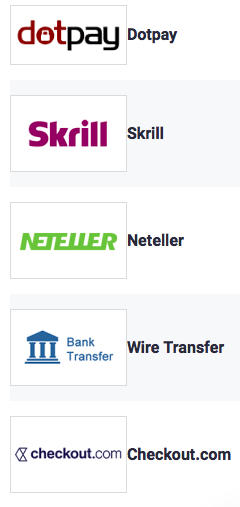

There is a third option: a demo account, which you can use to practice. Just click on the “Try a Free Demo” tab on the homepage to try it out. GO Markets payment methods: How to deposit and withdraw money Here are funding alternatives for the Go Markets account types available in many base currencies:

There are no fees for depositing. All funding methods are immediate, except for BPAY and bank wire transfer, which takes three days. To withdraw funds, you can send in a request through the Go Markets client portal. Requests made before one pm AEST will be actioned on the same day, and all done after will be processed on the following business day. The length of time the funds will show in the account is dependent on the payment service provider. The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|