Pepperstone broker review and test – how good is the platform?

Table of Contents

REVIEW: | REGULATION: | ASSETS: | MIN. SPREAD: | DEPOSIT: |

|---|---|---|---|---|

(4.9 / 5) (4.9 / 5) | FCA, ASIC, DSFA, SCB | 180+ | Variable from 0.0 pips + commission | Minimum $ 200 |

Trading online is getting more popular, and selections of Forex Brokers are getting more difficult due to the large numbers it has expanded. The question is, are you choosing a legit online broker, or is it a scam? In this review, we will talk about one of the largest Forex Brokers in the world – Pepperstone. We will discuss the company, its trading platforms, and other features on why it is a recommended Forex Broker. Let’s find out together whether Pepperstone is a trusted broker or is it a scam.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What is Pepperstone? – company presented

Pepperstone was founded by a team of experienced traders with the same goal of improving the world of online trading. The company was founded in the year 2010 in Melbourne, Australia. The company grew and became one of the largest Forex Brokers in the world. It aims to create a world of tech-enabled trading in which aspiring traders can take opportunities and challenge the global markets.

This broker is trusted by over 73,000 traders worldwide and processes an average of $12.55 billion (US dollars) of trades every day, which makes it one of the world’s largest forex brokers.

Pepperstone has won multiple prestigious awards from Investment Trends, Deloitte, and Compare Forex Brokers and is also recognized for its consistency in exceptional customer service, excellent trading conditions, number one for spreads, and value for money.

Facts about Pepperstone:

- Founded in 2010

- One of the largest Forex Brokers in the world

- Authorized and regulated

- Award-winning Forex and CFD broker

- 24/5 multilingual customer support

⭐ Rating: | 4.9 / 5 |

🏛 Founded: | 2010 |

💻 Trading platforms: | TradingView, MetaTrader 4, MetaTrader 5, cTrader, Capitalise.ai |

💰 Minimum deposit: | No minimum deposit |

💱 Account Currencies: | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | No |

📊 Assets: | Forex, Shares ETFs, Indices, Commodities |

💳 Payment methods: | Bank transfer, Visa, Mastercard, Paypal |

🧮 Fees: | From 1.0 pip spread on standard accounts, variable commissions, and overnight fees |

📞 Support: | 24 / 5 support via phone, live chat, Whatsapp |

🌎 Languages: | 15 languages |

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Is Pepperstone regulated? – Regulation and safety for customers

One thing you need to know to avoid being scammed in online trading is to know if the broker is regulated and authorized. Online trading companies are being examined and have to pass certain criteria before getting regulated by an official regulatory authority.

Pepperstone is an Australian-based forex trading company that is authorized and regulated by multiple highly trusted regulatory authorities – Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities Investment Commission (ASIC) in Australia, Dubai Financial Service Authority (DFSA) in the United Arab Emirates, and Securities Commission Of the Bahamas (SCB) are just a few of them. You will find all regulation authorities, Pepperstone is controlled by below. Also, the company holds professional indemnity insurance through Lloyd’s of London.

Pepperstone is regulated by the following:

- Financial Conduct Authority (FCA)

- Australian Securities Investment Commission (ASIC)

- Dubai Financial Service Authority (DFSA)

- Securities Commission Of The Bahamas (SCB)

- Captial Market Authority (CMA)

- Cyprus Securities and Exchange Commission (CySec)

- Federal Financial Supervisory Authority (BaFin)

Financial security

Pepperstone is well known for its consistency in giving great value for money. The company offers clients access to raw spreads to let clients know exactly what they are getting charged and what the company earns. This integrity of the company for transparency of how the funds are being used gained the trust of a large number of clients, which is why Pepperstone is a trusted broker.

Additionally, UK traders receive protection up to £85,000 under the Financial Services Compensation Scheme Protection (FSCS). The funds of the traders using Pepperstone are being held in segregated accounts at the National Australia Bank to avoid misuse of the funds.

Summary of the regulation and financial security:

- Regulated by multiple highly trusted regulatory authorities

- Segregated customer funds

- Transparency to clients regarding funds

- Financial Service Compensation Scheme £85,000

- Audited by Deloitte

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the pros and cons of Pepperstone?

Pepperstone is among the largest brokers in the world. Originally an Australian-based company, they currently have offices and employees in Australia, the Bahamas, Cyprus, Dubai, Germany, Kenya, and the UK, and they won’t go anywhere soon. Therefore, and thank the various regulations, your funds are extremely safe at Pepperstone. We gathered the most important additional pros and cons in the table below.

Pros of Pepperstone | Cons of Pepperstone |

✔ A lot of trading platforms and advanced analysis tools are available | ✘ Low leverage compared to some other brokers |

✔ No minimum deposit | ✘ Only two account types are available |

✔ Excellent reviews on Trustpilot | ✘ Verification for live account took more than 48 hours in our test |

✔ Fast execution of orders | |

✔ Customer support is friendly, competent, and helpful | |

✔ Competitive spreads | |

✔ Award-winning broker | |

✔ All trading platforms are multi-lingual |

Is Pepperstone easy to use?

In this section, we will take a closer look at the usability and the setup of the platform. How easy is it to open a demo account? Is the mobile version of the trading app working flawlessly? And is all essential information easily accessible or hard to find? Below you will find our take on how well Pepperstone does in terms of usability.

Criteria | Rating |

General Website Design and Setup | ★★★★★ The website is clean, easy to navigate has fast loading times. Overall a great first impression |

Sign-up Process | ★★★★ Sign-up process for an account is easy, but the process isn’t quite as fast and convenient as with other brokers |

Usability of trading area | ★★★★★ Great variety of trading platforms for everyone |

Usability of mobile app | ★★★★★ Website is optimized for mobile users, and the app works perfectly |

What educational resources does Pepperstone offer?

Especially if you are a trading beginner, the options, terms, etc., can be overwhelming. Pepperstone and other large brokers offer a variety of educational content in various forms to help you get started. In short, here is what resources you will find on Pepperstone.

Trading Guides

The first resources are extensive trading guides in the form of written articles and blog posts. These are grouped into articles for beginners and intermediate and contain useful information as well as real-life examples and are a great way to start diving in.

Webinars

These are held live once per week on average, and you can sign up for free if you click on the education tab on the website. Experienced traders will cover various topics related to trading, such as overcoming the thread of overtrading, trading strategies for the close, and much more. At the time of writing, there are more than 120 webinars available to watch if you include all the past webinars as well.

Educational videos

In the educational video section, there are currently around twenty educational explainer videos with important trading information. The videos relate to trading rules in general but also explain the Pepperstone fees or cover what proper risk management includes, for example.

Review of the trading conditions for traders

Pepperstone offers investment services for trading with Forex, Stocks, Indices, ETFs, and commodities. The company offers customers a range of market opportunities with 180+ instruments available to trade. Spreads are charged in the base currency that is being traded, and commission is always charged in the same currency type the traders use in their accounts. It has two types of accounts, namely ‘Razor Account’ and ‘Standard Account’, and has advanced platforms that are user-friendly to any type of trader.

Pepperstone offers:

- Forex

- Stocks

- Indices

- Commodities

- ETFs

What to know about Pepperstone is that it is an award-winning broker for its customer service and support, and educational materials. Pepperstone was awarded several awards, such as “Best Forex Trading Support” in the 2018 UK Forex Awards, number one for Customer Service and for Education Materials in 2017 Australia FX Report Investment Trends Winner, and number one Overall Client Satisfaction and number one for Customer Service in 2016 Australia FX Investment Trends Report Winner. Recent awards include the award “Broker of the Year” in 2022 and “Best Overall Broker 2023” by daytrading.com.

We can definitely say that Pepperstone is not just an excellent broker in terms of customer support and services but also in terms of the process and execution of trading online. The awards that it has gathered serve as proof. Pepperstone also won the following awards: ‘Best Forex ECN Broker‘ and ‘Best Forex Trading Conditions’ in 2018 UK Forex Awards, ‘Best Australian Broker’ and ‘Best Trading Platform’ in Compareforexbrokers.com.au, number one for ‘Spreads’, ‘Value for Money’, ‘Risk Management, and ‘Fund Withdrawal’ in 2017 Australia FX Report Investment Trends Winner.

Pepperstone offers a very fast execution for your orders.

Also, the Governor of Victoria Export Awards (GOVEA) named this broker as ‘Exporter of the Year’ and gave the title ‘Digital Technologies Award’. In the year 2012, the Australian Growth Company Awards awarded Pepperstone’s Growth Company of the Year Awards and ‘The Financial Services Growth Company of the Year Awards’. Furthermore, in 2016 Australia FX Investment Trends Report Winner, the company won as number one for ‘Overall Client Satisfaction’, ‘Execution Speed’, ‘Value for Money’, ‘Spreads’, ‘Platform Ease of Use’, ‘Platform Reliability’, and ‘Commissions’. Pepperstone is an excellent, reputable, regulated, and trusted broker.

Facts about the conditions for traders:

- Free demo account for 30 days

- Minimum 0.01 lots trading size

- Maximum 100 lots trading size

- Scalping and hedging allowed

- Expert advisors allowed

- No dealing desk execution

- Uses Electronic Communications Networks (ECN) to connect directly with 22 liquidity providers

- Spreads are variable from 0.0 pips

- Two account types

- Aims to provide low trading costs and fast execution across a wide range of instruments

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Test of the Pepperstone trading platform

Every trader has his own style, skill level, and strategies. It is very important to know what platforms a broker offers you in order to succeed with online trading. That is a good thing about using Pepperstone as your Forex Broker because it offers platforms that suit any type of trader. The company has three powerful, user-friendly, and popular platforms that you can use wherever you’re in your trading journey. These platforms are free and can be used on mobile, tablet, desktop, and web apps.

Pepperstone offers the following platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- TradingView

- Capitalise.ai

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

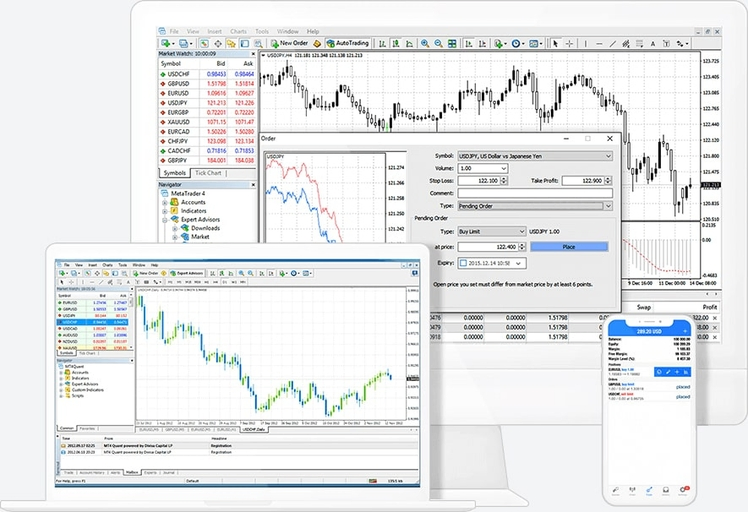

MetaTrader 4 and MetaTrader 5

MetaTrader 4 platform is the most popular platform of Pepperstone that enhances your trading experience with live quotes, real-time charts, in-depth news, and analytics. These platforms as well as serve as a host of order management tools, indicators, and Expert Advisors. It enables you to customize the platform to the way you trade. MT4 gives you access to 28 indicators and EAs with Pepperstone’s Smart Trader Tools and lets you choose from thousands of other online tools to plug into the platform. With Autochartist, traders can statistically identify significant market movements. By the use of MetaQuotes Language 4 (MQL4), traders can build and run their EAs.

This platform can give a competitive event, whatever skill level you have as a trader. With its rich and highly customizable trading environment, it will absolutely help improve your trading performance. Also, it highlights its best features, including its 85 pre-installed indicators, which are available on the desktop app (for greater insight into market trends).

It has analysis tools that empower traders to make better-informed decisions, gives you access to 28 additional Smart Trader Tools, has flexible order types to suit the trader’s strategies, multiple chart setups that help traders control their positions quickly and efficiently, automated trading which allows you to trade the markets 24/5 without any intervention, and lastly has backtesting capability for more robust Expert Advisors. It is free and can be used in both demos and live accounts.

MetaTrader 5 platform is the most powerful platform of Pepperstone and is recommended for traders that need advanced financial trading functions and superior tools for analysis. MT5 is the simplest and easiest platform to use and understand. It has faster processing times, with its newly released ability to hedge traders’ positions, advanced pending orders, and the newest tools and indicators that can help traders take their trading to the next level.

Also, it provides as well exceptional features that can help traders stay ahead of the markets. It has greater functionality and a more powerful release than MetaTrader. It is easy to use and easier to code because of its MQL5, has advanced platform customization, optimized processing of expert advisors and indicators, and has access to Smart Trader Tools and Autochartist. It gives you the ability to hedge your positions, offers you a built-in economic calendar, has 21 timeframes with a maximum of 500 total orders, optimized processing speeds, and advanced pending orders.

The difference between MT4 and MT5 is MetaQuotes Language (MQL) which is a built-in language for programming trading strategies. MT5 uses MQL5, which gives a number of advantages over MT4’s MQL4. MQL5 highlights its object-oriented programming feature, has improved debugging tools, has a similar syntax to that of C++ programming language, and advanced events management model.

MT4 and MT5 platforms both support the following languages:

Arabic, Bulgarian, Chinese (simplified, PRC), Chinese (Traditional, Taiwan), Croatian, Czech, Danish, Dutch, English, Estonian, Farsi/Persian, French, German, Greek, Hebrew, Hungarian, Indonesian, Italian, Japanese, Korean, Latvian, Lithuanian, Malay, Mongolian, Polish, Portuguese, Romanian, Russian, Serbian, Slovak, Spanish, Swedish, Tajik, Thai, Turkish, Ukrainian, Uzbek, Vietnamese.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

cTrader

cTrader platform is the most user-friendly platform of Pepperstone that has advanced trading capabilities. It lets you customize coding and do fast execution and entry. It offers a lot of education programs and analyses that help you make better trading decisions. This platform is perfect for traders getting into trading and designed to replicate an institutional trading environment, including depth of market.

This platform also has optimized the processing of expert advisors and indicators. It is as well as a pride of this platform that it has advanced risk management and order functionality, with coding in C# and opening API available.

Due to the advanced features of cTrader, detailed trade analysis is possible, which allows traders to understand their strengths and weaknesses. It has a large range of indicators, detailed order tickets, which include base currency dollar value or pip distance, and the ability to add multiple take-profit orders. Plus, the platform embodies comprehensive educational videos.

cTrader Automate (formerly known as cAlgo) is advanced platform customization that is also a highlight of the best features of cTrader. You can download this from the App Store for iOS and Google Play for Android.

It supports the following languages:

English, Russian, French, Spanish, Portuguese, Polish, Japanese, Korean, Chinese, Italian, Greek, Turkish, Hungarian, and German.

Facts about Pepperstone platforms:

- User-Friendly

- Powerful and popular platforms

- Supports several languages

- Advanced tools

- Reliable and secure

- Fast

- Supports automated trading

TradingView

If you sign-up for a Razor account on Pepperstone, you have the option to connect your cTrader platform to TradingView. The platform is ideal for technical analysis but offers much more. It is an innovative and smart solution for many brokers, with most assets being covered. With TradingView, you can access most market types, such as the stock market, cryptocurrency market, forex market, and many others.

Several features and tools make TradingView unique and a great tool for traders. For example, some of the unique selling points are the multi-timeframe settings, an undo-redo feature, and a Go-to-date feature.

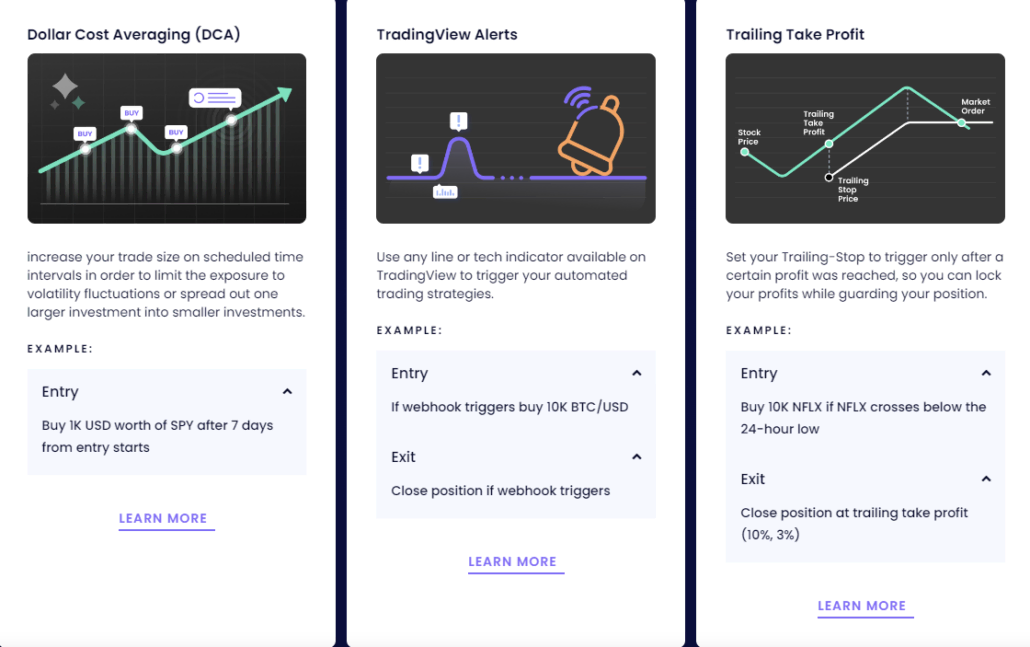

Capitalise.ai

The MetaTrader 4 comes with a very interesting feature, as you have the possibility to connect your account with capitalise.ai. This external platform allows you to automate your trades based on a pre-defined strategy, and what makes it unique is that everything is text-based. You simply define your entry and exit points in everyday English, and Capitalise.ai takes care of the rest.

It is a rather new option available but certainly worth taking a look at. With modern technology developing, the platform might have the potential to revolutionize the trading industry, but keep in mind it is still at the early stages of development and shouldn’t be trusted blindly. Like anywhere else, tools are here to make your life easier, but it is still you in charge of making ultimate decisions and responsibility.

Professional charting and analysis are possible

All charts are a different portrayal of supply and demand, and technical analysis is an essential skill that you need to embrace in online trading. It is important to know to chart in trading online because it is an important ingredient for a successful trade, whether it is a line chart, a bar chart, Renko, or a candlestick chart. Charts cluster every buy and sell transaction on that market or instrument at any given moment. Once you understand how charting works, it can be very powerful on your trading journey.

Technical analysis is a very important tool to assess how much risk a trader is prepared to take on, as well as correct position sizing and any levels where a trader may expect stronger demand or supply to come in that may cause a reversal in price. In order to understand the rhythm, flow, and trends in market behavior, technical analysis helps you know what will be your next move.

It lets you understand the trend and volatility of the markets, which is important in getting better results. It is not so much about prediction as it is about probability because, in reality, the markets are a series of random events. If it is used correctly, it can be highly profitable.

Charting and analysis tools:

- Different chart types

- Customizable indicators

- Drawing tools for technical analysis

- Market depth

- Automated trading supported

- Implement extern tools

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

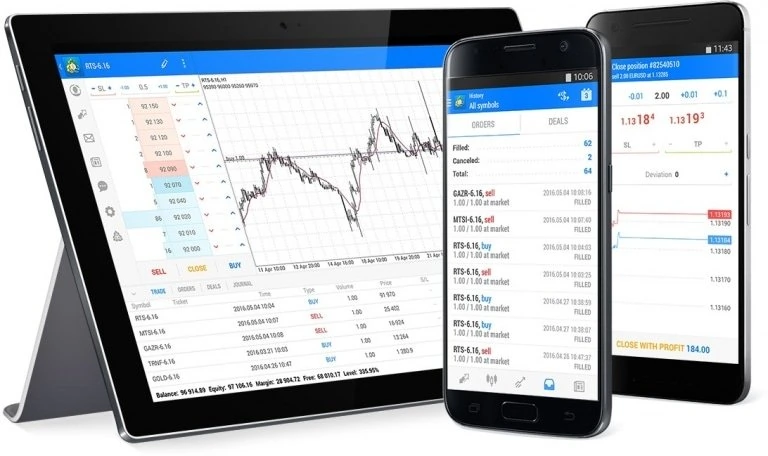

Mobile Trading (App) is possible with Pepperstone:

The good thing about trading with Pepperstone is that its platforms can be used on mobile, tablet, desktop, and web apps. Nowadays, mobile trading is a trend due to its accessibility. It is more convenient to have your platforms on your mobile device in order to keep track of your trades and also to be able to trade anywhere and anytime.

Pepperstone offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) to its customers, which are the most popular mobile trading apps in the world. These trading platforms are very easy to use, have advanced tools, are customizable, and have a whole lot of other features that give you a big edge in online trading.

Features of MT4/5 App:

- User-Friendly

- Advanced Tools

- Has MetaQuotes Language (MQL4 and MQL5)

- Display Charts

- Customizable

- View Live FX Quotes

- Market News

- Change Time Frames

- Can Add Indicators

- Can Use All Types Of Orders

- Access Trading History

- Supports Several Languages

What we recommend for first-time traders is to explore first the platform’s features by getting a demo account to avoid unintentional trade executions and also to practice trading skills for a better trading experience.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

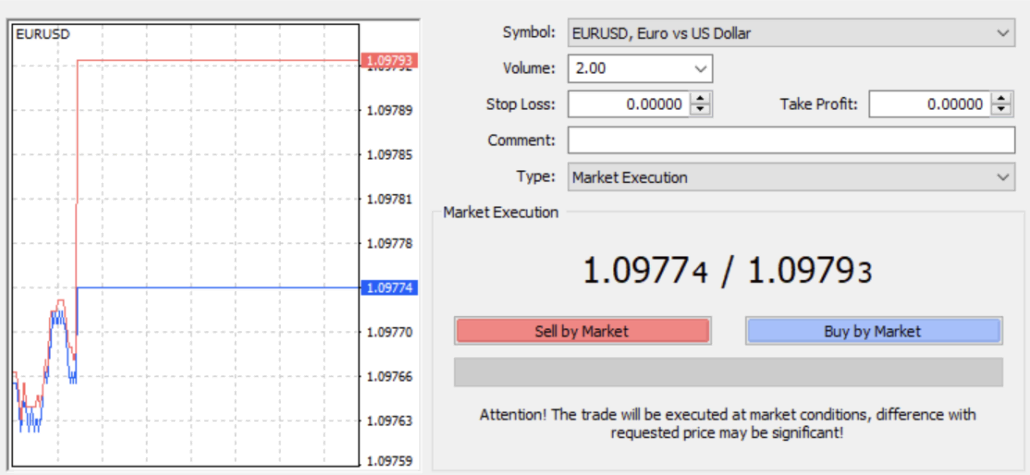

Pepperstone trading tutorial: How to trade

Knowing the movements of the market is very important in trading online. Your steps to a better result depend on the trend and volatility of the market. When volatility is high, be aware that it can potentially be spread out over a larger range of values, and the price of the value can change dramatically over a short period of time in any direction.

In online trading, first, you need to decide on which market you wish to trade on. Once you select an asset that you want to analyze, you can go ahead and open the order mask and customize your position. Afterward, you have to choose the order volume, and then you can either buy or sell the asset.

Step-by-step tutorial:

- Select an asset that you want to analyze

- Analyze the asset

- Open the order mask and customize your position

- Choose the order volume

- Buy or sell the asset you want

Pepperstone offers to trade with Forex, CFDs (Index CFDs and Share CFDs), cryptocurrencies, and commodities. CFD trading is one of the most popular trading investment styles around the globe. Basically, CFD provides exposure to the trader in the market without the trader owning the underlying asset. It allows the trader to have a view of the future direction or movement of the market. With this, the trader can determine the degree of profit or loss.

How to open your account

It is very fast and easy to open an account with Pepperstone. The instructions for creating an account are displayed on the official website of Pepperstone (https://pepperstone.com) when you go to the ‘Create an Account page, right next to the ‘Account Registration’ section.

It takes only a few steps:

First, enter your email and create a password. Second, fill out the application with your details. Third, provide your account opening ID, which can be uploaded online during your application. Your application will be reviewed first by Pepperstone’s back office team, and once your documents have been verified and the application has been approved, then you will receive your trading account login details. For live accounts or if you wanna go live trading with real money, you can add funds and start to trade afterward.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Free Pepperstone demo account

Pepperstone offers a free demo account for 30 days. It includes up to $50,000 in virtual funds and has real market pricing. We highly recommend that traders use a demo account first to practice trading skills before going live to avoid unintentional investments. It is best to know first how the platforms work and are comfortable with them before starting to trade a real account.

Account types of Pepperstone

Pepperstone offers its traders two account types that are suitable for any type of trader’s needs.

Razor account:

Razor account gives you access to institutional-grade spreads from 0.0 pips at just AUD$7 per lot. It includes raw spreads, which means that Pepperstone passes the spreads they received from liquidity providers directly onto their clients. This account best suits scalpers or algorithmic traders.

Standard account:

The standard account offers competitive spreads and is commission-free. It includes raw spread + 1 pip increase (e.g., 0 pip spread plus 1 pip = 1 pip (0.5 pip each way for bid and ask prices). This account best suits traders that are new to trading or prefer to place long-term trades.

Razor Account | Standard Account | |

Institutional grade spreads | Yes | Yes |

Average EUR / USD spread | 0 – 0.3 pips | 1 -1.3 pips |

Commission | $2-3 per lot traded | $0 |

Overnight fees | Variable fees | Variable fees |

Best for | Scalpers and algorithmic traders | Trading beginners |

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Review of the deposit and withdrawal

It is easy to manage an account with Pepperstone, and payments are a lot easier too. The clients are given access to their own secure client area, where they can access all their funding as well as withdrawals. It is safe and secure and has a simple process.

There are a few points that you need to take note of with regard to the process. Withdrawal forms that are received before 21:00 (GMT) will be processed the following day. If it were received before 07:00 (AEST), then it’ll be processed on the same day. Your Pepperstone trading account should match the name (or joint) of the bank account that you are using due to third-party transaction regulations. Because of this, funds can only be returned to a bank account in the same name (or joint) as your Pepperstone account.

Also, any International Telegraphic Transfer (TT) fees charged by Pepperstone’s banking institution are passed on to the Client (most International TTs are approximately AUD$20). If you wish to use Bank Wire Transfer, withdrawals usually take 3-5 working days to reach your account. However, in some cases, in any payment method chosen, there may be unforeseen circumstances whereby withdrawal times may be longer.

Payment Methods that can be used:

- Visa

- Mastercard

- Bank transfer

- PayPal

- Skrill

- Neteller

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Fees and costs for Pepperstone Trader

Pepperstone doesn’t charge any internal fees for deposits or withdrawals. However, you should bear in mind that it depends on what type of payment method you are using, and there might be a transaction fee from that type of channel. The fees that are charged by that certain payment method used are the responsibility of the client.

The company requires a minimum deposit of $200 or equivalent. Its $0 fee-free funding options are a big plus for this broker. Pepperstone does not charge an inactivity fee, and it’s something any trader can look forward to. Customers can enjoy a $0 commission on Pepperstone’s Standard Account or raw spreads on Razor Account.

Important information about fees of Pepperstone:

- Minimum Spread: variable 0.0 Pips

- Fixed commissions may occur (depending on the account type)

- No inactivity fee

- Base currencies available: AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD

Is there a negative balance protection at Pepperstone?

Yes, Pepperstone takes multiple actions to minimize your risk and has an automated stop-out policy. The level at which our automated stop-out occurs depends on the platform you’re using. Additionally, if, in fast-moving market conditions, your account balance turns negative, Pepperstones policy is to clear it and return the balance to zero as soon as possible.

In rare cases where the account balance isn’t automatically reset to zero, you can e-mail their customer support and request a full trade investigation.

How does this broker make money from you?

Added spreads and commissions, among with additional fees for extra services, are the main source of income for most brokers, and Pepperstone is no exception. Unlike many other sites, Pepperstone doesn’t charge an inactivity fee but has fees variable fees for rollovers (open overnight positions).

For standard accounts, the current spread on most trading pairs is a minimum of 1.0 pip, with is quite cheap. Razor account holders benefit from a low commission of $2-3 per lot traded, depending on the platform you use. Overall, the commission structure of Pepperstone is more than fair, and they offer quite cheap spreads and commissions.

Pepperstone customer support and service review

Pepperstone is known to be an award-winning broker for its customer service and support. The company was awarded ‘Best Forex Trading Support’ in the 2018 UK Forex Awards, number one for Customer Service and for Education Materials in the 2017 Australia FX Report Investment Trends Winner, and number one for Overall Client Satisfaction and number one for Customer Service in 2016 Australia FX Investment Trends Report Winner.

It has a frequently asked questions (FAQs) section on its official website, which any trader will find very helpful. These are very helpful for any type of trader and have a client manager who supports the trading journey of each trader with this broker. The company strongly promotes knowledge and expertise in online trading from industry-leading analysts and market strategists. The customer support operates 24/5 and is multilingual support. Pepperstone also offers free educational resources, which include trading guides, webinars, and how-to videos.

We can truly say that the customer service and support of Pepperstone are remarkable.

Facts about the support:

- Award-winning Customer Support and Educational Materials

- Multilingual 24/5 Customer Support

- Phone support

- Email Support

- Live Chat Support

- Free Educational Resources

Accepted countries and forbidden countries

Pepperstone accepts traders from Australia, Canada, Denmark, France, Germany, Hong Kong, Italy, Kuwait, Luxembourg, Norway, Qatar, Saudi Arabia, Singapore, South Africa, Sweden, Thailand, United Arab Emirates, the United Kingdom, and most other countries.

However, traders coming from the United States, India, and New Zealand can not use Pepperstone.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the best Pepperstone alternatives?

No broker is perfect for everyone, and it all comes down to your requirements and expectations. With that said, it is worth mentioning Pepperstone is one of the largest broker companies in the world, with an excellent reputation and exceptionally high customer satisfaction. Nevertheless, you will find three of our favorite alternatives below:

Captial.com

Founded in 2016, Capital.com is a reputable forex and CFD trading platform. Since the platform is user-friendly for beginners and has a stellar reputation, it has more than 280,000 members from all around the world. Regardless of whether you have trading experience or are just getting started, the broker is well-regulated by numerous authorities and is a great choice overall. Check out our in-depth review of capital.com here.

RoboForex.com

Next, our list of the top Pepperstone substitutes is RoboForex. You can trade a wide range of assets with this broker, and their key selling point is the cheap minimum deposit requirement of just $10. Your money is also very safe because the broker has an official license from the IFSC Belize. Additionally, a sizable business group with its main offices in Europe owns the broker. Finally, Roboforex allows you a lot of versatility by providing a variety of account kinds to pick from. The broker is among the greatest Pepperstone alternatives as a result of all of them. Read our in-depth evaluation of RoboForex here.

XTB

One of the most well-known broker systems in the industry right now is XTB. Since its 2006 founding in Poland, XTB has experienced rapid expansion. You can trade more than 3,000 different assets with this broker, which are divided into six asset categories. But don’t just take our word for it; XTB has received numerous honors from its clients and is renowned for providing exceptional customer support. For instance, every customer has access to a learning center with a ton of resources and specialized 1 to 1 support for every client. Read our take on XTB here.

Conclusion of the review: Is Pepperstone legit or a scam? – It is a trusted broker

Pepperstone is an award-winning broker that welcomes any type of trader. It provides a variety of selections for trading FX, CFDs (Index CFDs and Share CFDs), cryptocurrencies, and commodities. The company offers customers a range of market opportunities with 150+ instruments available to trade. It has low spreads and up to 500:1 leverage, and a $3 round turn commission on FX which will definitely give you the confidence to trade with them.

The company is reputable, always giving its best to its clients with its excellent customer support and services, as well as giving good educational resources to traders. Its numerous awards serve as proof that this broker is legit. We can say that Pepperstone is an excellent Forex Broker, regulated and trusted.

Advantages:

- Global regulation (multiple times)

- Offers free demo account for 30 days

- Advanced Tools

- Transparent trading experience

- User-friendly platforms

- Multilingual platforms

- 24/5 multilingual customer support

- Excellent support and services

- Free excellent educational resources

- Award-winning broker

- Offers mobile trading

- Reliable and competitive spreads

Disadvantages:

- Do not accept traders from the United States, India, and New Zealand

For forex trading, Pepperstone is at the top of most online brokers. You can expect good conditions and professional service.

Trusted Broker Reviews

Experienced and professional traders since 2013(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

FAQs- The most asked questions about Pepperstone:

Can my Pepperstone demo account’s expiry be extended?

Pepperstone deletes all demo accounts after 30 days. However, if you have a live trading account on the platform, you can email Pepperstone customer support and request them to set a non-expiry on the demo account.

Can traders change the leverage on their Pepperstone trading account?

Changing a trading account’s leverage may be required to carry out some trading strategies. You can change your leverage in a few clicks and taps by navigating to the secure client area. All you have to do is click on the pen icon next to the trading account you want to change leverage for and use the appropriate option. But remember, changing the leverage impacts the margin for a trade’s size.

How many trading accounts can a trader have on Pepperstone?

A trader can have up to a hundred live accounts with Pepperstone. However, at least ten of the trader’s accounts should have over ten currency units to operate additional accounts.

How long does Pepperstone take to process a withdrawal?

The withdrawals are processed during Australian business hours. The company typically processes withdrawals in one business day. Once the withdrawal is sent, the ETA will depend on the method of withdrawal the trade chose. Wire transfers take up to five business days, but if you choose a method like Paypal, you will receive the funds in two business days.

See other articles about online brokers:

Last Updated on June 8, 2023 by Res Marty