Amana Capital review and test – How good is the online broker?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.6 / 5) (4.6 / 5) | FCA, CySEC, DFSA, CMA, LFSA, FSC | $50 | 360+ | From 0.01 lot |

Amana Capital Group is known throughout the financial world as one of the top-tier online trading specialists, which has access to international financial markets in more than eighty countries. It is a well-regulated brokerage company that prioritizes rookie traders. They are given a wide range of educational tools to assist them in their path to becoming better traders. They are also provided tighter spreads on the least costly accounts. However, upon upgrading, the more expensive ones have better trading conditions.

The online platform’s main draw in attracting potential clients is it supports the two best online tools which traders prefer to use: MT4 (Meta Trader 4) and MT5 (Meta Trader 5), which will be further hashed out in a section below. Two tools serve as a magnet to potential clients: accessing it freely with Trade Captain and AutoChartist, two of the best third-party applications that provide thorough trading analysis.

We have over nine years of experience and have thoroughly examined this platform and its abilities. We will be delving into the many aspects that make it one of the leading online brokers in the business. After reading this review, you will be judging for yourself if it is the best trading platform for you or not.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Get to know Amana Capital: The company vision

Amana Capital’s vision and drive are to be the leading innovator that provides the most advanced financial services, fully anticipating the financial market needs. They intend to develop their business model by abiding by the demand for high-quality trading services. Thus, they can extend the reach of their brand of operations to the farthest regions of the planet that sorely lacks access to their superb technology.

They constantly upgrade and enhance their services and watch out for fluctuating market trends in support of their strategies for development and technology. In shorter terms, their vision is to modify their reach for maximum efficiency by providing quality financial services yet unmatched by other online brokers.

Amana Capital is one of the best CFD (Contracts for Differences) brokerage firms in the world. Their main draws are their multiple regulations, their wide range of tradable assets that amount to three-hundred sixty, and sophisticated techs like MT4 and MT5. The trading platform also has particular tools for the most adept traders like trading signals, VPS (Virtual Private Server), market analysis, and the latest news.

The company came into existence in Beirut, Lebanon, in 2010, led by CEO Ahmad Khatib. Since then, the company has steadily risen in momentum and acclaim in the financial world. They have a reach of over eighty countries and have offices in London, Dubai, Cyprus, Beirut, Labuan, Mauritius, and Sri Lanka. Amana Capital’s current owners are private investors who have different businesses all over the world. They have become a powerful conglomerate. Capital Guidance and Manara Capital functions as their representatives. They ensure their proliferation in the fast-paced world of international finance.

Their shareholders have an esteemable reputation through the construction of various businesses. They also invest in a diversity of assets like public securities, private companies, and real estate.

Nice to know:

The talented team that works for Amana Capital are expert in their respective marketing fields. All are incredibly adept and work hard in delivering the best and most streamlined technology that they can provide to traders all over the world.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) Review of Amana Capital trading platformsFor investors trading with Amana Capital, there are different trading platforms and tools that can be applied. Among others, traders can opt for the world-famous MetaTrader platforms 4 and 5. In addition, however, there are other tools and useful trading helpers to choose from. We show you what is on offer.  MT4 or MetaTrader 4This type of trading platform has been the prevalent tool in the foreign exchange market throughout the world. It is relatively easy to use and navigate. It is ideal for novice traders because of its clean and laden user interface. It isn’t exclusively for beginners only, but also more advanced traders. Furthermore, it is still capable enough to provide them with enough trading tools to satisfy their sophisticated trading techniques.  MT4 functions very well to gain highly complex market analysis and effective trading. It also corresponds a great deal to EAs or expert advisors, which is software for automated trading. There is a strategy tester already built-in, which makes the EA software function over the historical data. Yet, its functionality is severely limited. The best aspect of the MT4 is flexibility. Its capability can be further enhanced, if you install plugin applications that correspond to the language that Meta Quotes utilize. Online traders can use a good amount of scripts, EAs, indicators from the Meta Quotes, and other online sources. A MetaEditor is also included, which enables you to customize the tools and functionality of the platform. Here are the many MT4 versions that Amana Capital uses:

MT5 or Meta Trader 5MT5 was created as a follow-up feature for MT4. Its creators had noticed that traders prefer its functioning and tools, so they developed a new one with enhanced operability. MT4 add-ons and EAS that were specifically made for it do not operate anymore in MT5. The MT5 platform is more robust and complicated and might be a little confusing for a novice trader. It is highly effective for more advanced and sophisticated online dealings. There are versions available in the form of mobile apps and applicable in all iOS and Android devices, as well as applications for desktop computers.  Here are significant features that you might find to be useful once you prefer to use them:

Additional Mobile App FeaturesIt was briefly mentioned above, which will be further included in this section. Here are more features:

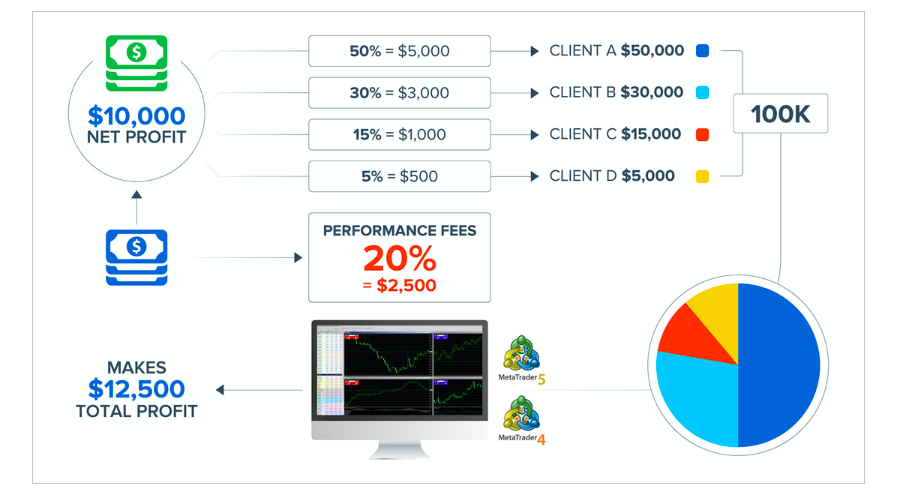

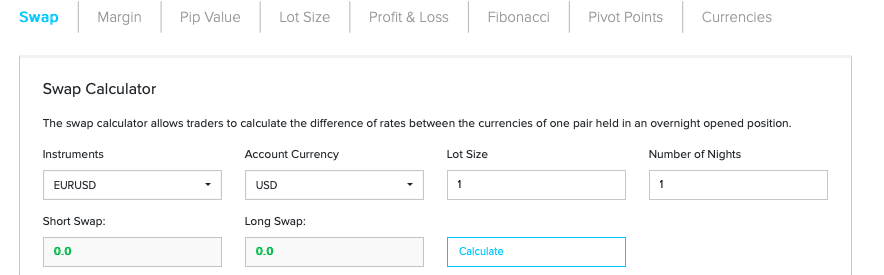

ZuluTradeIf you are an ardent online social media practitioner, then you will like this tool. The main difference is that it deals with social trading. Amana Capital has collaborated with ZuluTrade so that its users will have the best of both worlds which will make trading very engaging and collaborative.  Once you have opened an Amana Capital account, you have the option to also create a ZuluTrade account by putting in your information on the ZuluTrade web form, which will be sent to them once you finish. The ZuluTrade network has many traders throughout the world that also serve as signal providers. Similar to social media, you can follow a particular trader and duplicate his trades on your account. The provider will then get a commission once a follower earns a profit. It is not an assurance that you can get guaranteed earnings, so you should understand the gambling risks in online trading. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) RiskPulseThis tool is akin to AI technology, wherein it has the capability of analysis of the trader’s data and output. It is for free as an add-on if you prefer to include it or not. It has a dashboard that will show your overall performance in trading, make predictions, and provide tips to better your abilities.  MAM or Multi-Account ManagerIt is particularly created for account managers that do the work of trading for other traders. They can only generate commission from the profits they can gather. Amana Capital has that software included in the platform and accessible to those more advanced traders. It works well in unison with ZuluTrade, wherein both tools can complement each other and work for the benefit of the user. The way it works is that the MAM user opens a master account, and other traders’ accounts are linked to it. He will then trade all the accounts at the same time using his master account. There is no assurance that you can turn a profit using this method, but it is applicable for traders with many contacts in the forex market.  Amana Capital Trading SignalsThis tool works best in conjunction with another tool called “Autochartist.” Its functionality works by real-time scanning and charting and sends notifications to the traders if signals and favorable opportunities arise. With Autochartist, you can also get significant market updates and an economic calendar. Financial calculatorsHere are the different calculators available in the platform that can be especially handy for traders:

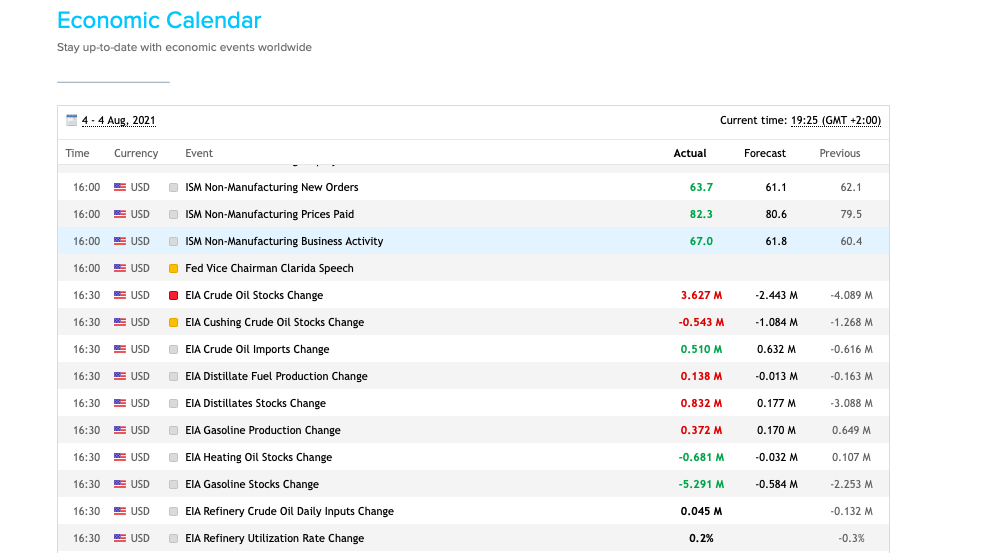

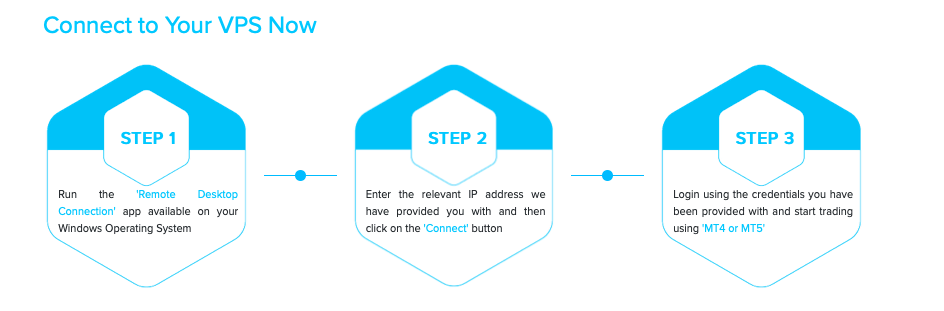

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Economic calendarIt mainly shows economic events in asset-rich countries that can significantly affect the worldwide foreign exchange market. Experienced traders ponder over these events and predict their effect, either positively or negatively. They can keep the analysis, which can be practicable in the future.  Trade CaptainAmana Capital Group owns Trade Captain, which has a website in www.tradecaptain.com. The site offers crucial tools for the trade like daily market analysis and updates, educational articles, and trends. There are eBooks for training in the Arabic language also found on the website. VPS or Virtual Private ServerThis tool is free for “active trader” accounts and is very useful for advanced traders that have to operate around-the-clock trading systems on a virtual server. It will decrease latency and guaranteeing dependable connections even when their platforms are not functioning on their machines.  Education and ResearchAmana Capital has a useful method for assisting newcomers in the trading industry. They have a wide array of educational materials that are balanced and highly structured. These are accessible in all of Amana Capital’s versions:

Types of accountsWhen choosing the account type, you are able to utilize it once you will open an Amana Capital account. It will be dependent on your level of experience and what you want to trade. If you want to only trade in foreign exchange or CFDs, you can opt for the Amana Classic. For more experienced and sophisticated ones, you can select between Amana Elite or Amana Active. If you want to trade in US shares, you can opt for the Shares or the ZuluTrade account.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Deposit and withdrawalAmana Capital has many ways to fund an account, and there may be fees involved, which is dependent on the method:

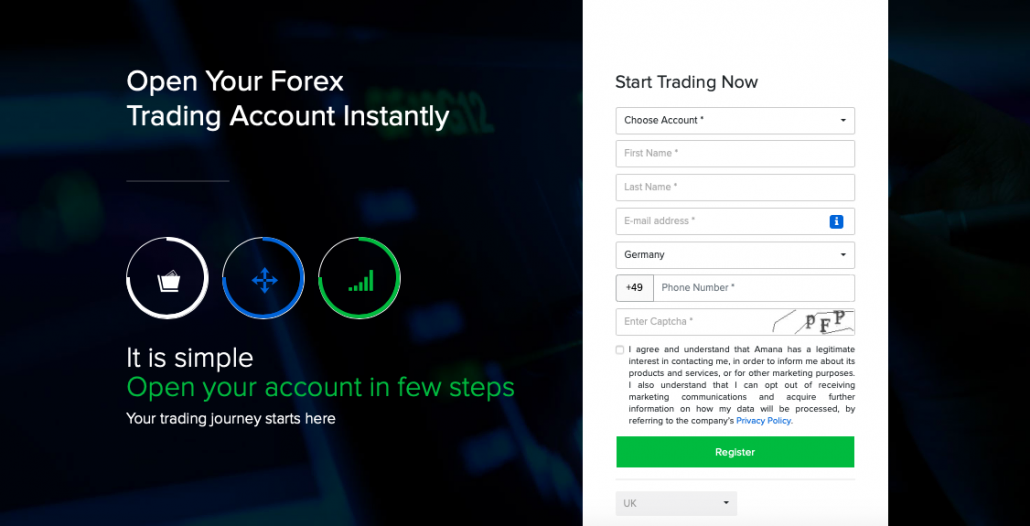

If you are truly earnest in opening an Amana Capital account, it is to your advantage to review all the fees involved. You would not want unknown or hidden fees to occur that you have no knowledge about and might cause issues in the future. Opening an accountCreating an Amana Capital account online is relatively easy and no-frills. To begin, go to the page, wherein you will find a “Start Trading Now” tab and a “Try Demo” link. Click on the former, which will open a web form for registration. Pick the type of account, which is dependent on your level of trading expertise. Input your details like your name, phone number, email address, etc. Once you have gone through all the terms and conditions, click “Register.”  Then another page will pop up, which requires more specific info like employment details, trading experience, financial worth, etc. It may ask for you to upload your ID details for verification purposes. If everything is up-to-date and correct, your account is valid. You can begin trading. The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|