List of the 10 best traders & investors in the world in comparison

Table of Contents

The best traders in the world allow novice traders to learn from their experience. Trading requires traders to have patience and learn from their mistakes. The best traders in the world were not perfect. But they honed their trading skills to become better at it.

Several traders’ trading journey is highly inspiring. However, these ten best traders of all time have a lot of knowledge for traders. Let’s explore the top ten traders who started small but ended up big.

Here is the famous list, we will go into detail about in this article:

- Benjamin Graham

- Warren Buffet

- Andrew Hall

- George Soros

- John D. Arnold

- Nick Leeson

- Richard Dennis

- William Delbert Gann

- Bill Miller

- Paul Tudor Jones

1. Benjamin Graham

While on his trading journey, it is uncanny for any trader not to have heard about The Intelligent Investor. It is a great book that has all the best trading principles in one place. Benjamin Graham is the investor and trader who put this book together.

Good to know!

Here are some Benjamin Graham facts:

- Benjamin Graham was born in a British family. However, his family soon shifted to New York

- This trader has an extreme interest in trading right from the start

- Benjamin was also a great economist and a remarkable professor

- He believed that a trader’s way to making money from the stock market is to invest in value stocks

- He further emphasized holding stocks for the long term

Benjamin Graham took a keen interest in analyzing market situations. Because of his trading tactics, he successfully built a very high net worth.

Glimpses of Benjamin Graham’s trading strategies:

- A trader has a better chance of making money when he makes a trade diversification very optimally

- An investor should invest in companies that have been around for a long time

- Benjamin was always curious about looking at the payment history of the dividends offered by the company

- Also, he believed that a trader should believe in value investing to benefit in the long run

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

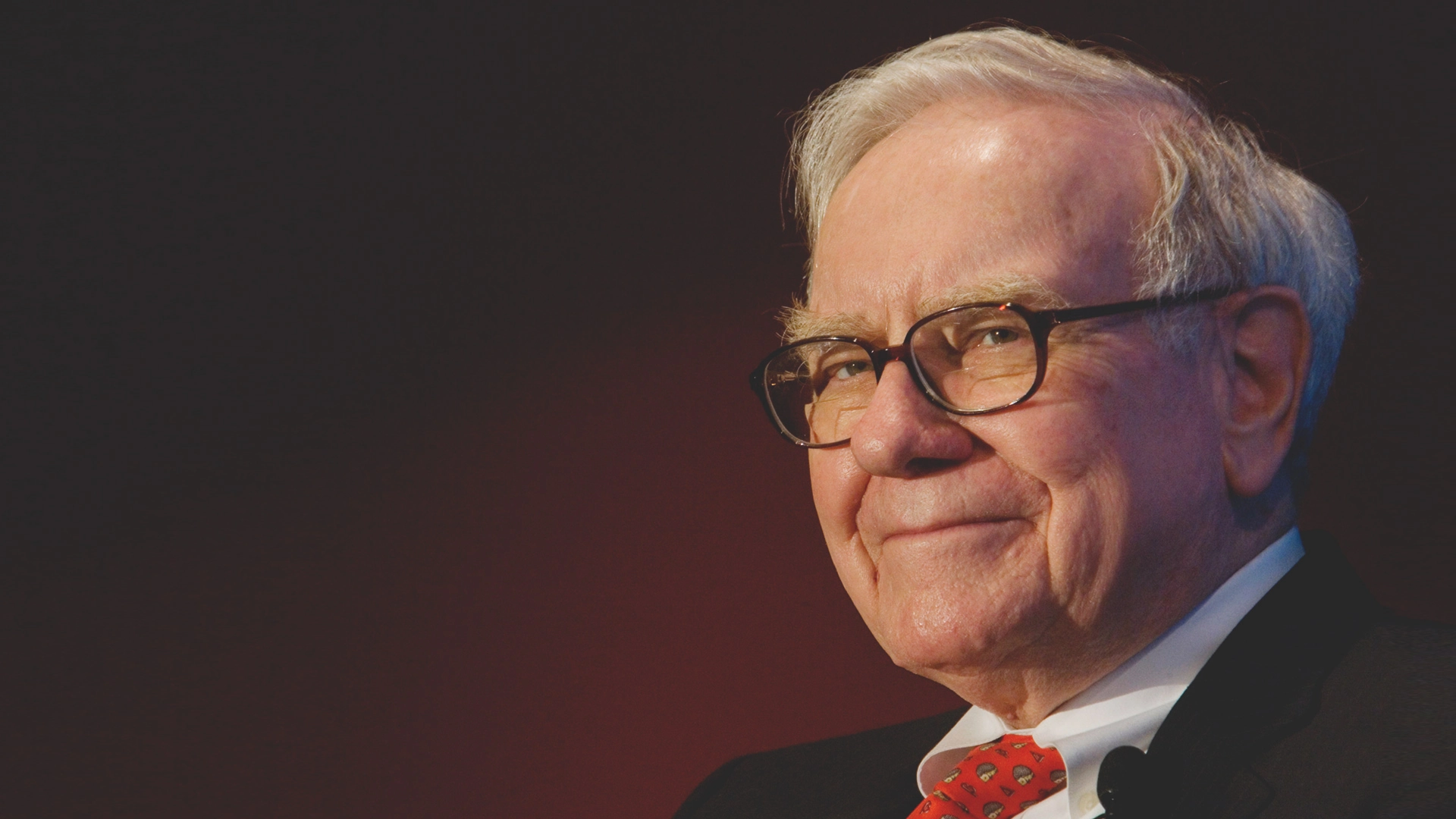

2. Warren Buffett

This great trader’s life journey is not unknown to anyone. Warren Buffett stands among the richest man in the world. The credit owed to his trading skills and tactics.

Good to know!

Here is some biographical information about Warren Buffett:

- Besides being an investor, Warren Buffet plays a great role as an American business magnate

- His net worth exceeds 110 billion USD

- He hails from Nebraska

- Warren Buffett started his investment journey with a small amount

- In addition, he believes in a simple trading philosophy

Warren Buffet’s trading skills and tactics make him the richest man.

Glimpses of Warren Buffet’s trading strategies:

- Warren Buffett likes to invest in stocks with lower intrinsic value than they can have later

- The investor is an ardent believer that investing in a company whose work you can understand brings you profits

- Further, Warren has always followed the principle that one must not try investing more than his means

- Risk management is another trading strategy that Warren considers extremely important. He likes to diversify his trades

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

3. Andrew Hall

It is stupendous for a person to become rich by trading derivatives. However, a person can do that if he can tap the market opportunity of price fluctuations.

Good to know!

A trader can get insight into Andrew Hall’s life with some facts below:

- The trader hails from England and is an excellent risk manager

- He worked at British Petroleum

- During his time at BP, he ascertained the trading opportunities in energy. That is when Andrew Hall took to trading derivatives

- Andrew made massive wealth through the oil price fluctuations. He believed that oil prices would see a hike, thus bringing them higher profits

Glimpses of Andrew Hall’s trading strategies:

- Andrew Hall is a far-sighted trader. He perfectly analyzes the market and sees the opportunities it brings for traders

- The trader focuses on finding the perfect opportunity to acquire or get rid of the security he is holding

- In addition, Andrew Hall paid great attention to trends throughout his trading journey. It was the reason Andrew could judge the opportunity that oil trading brought

4. George Soros

Just like most successful traders, George Soros is also a great philanthropist. The wealth that he earned through trading allowed him to donate to various charitable causes.

Good to know!

A few things about George Soros are as follows:

- George follows a different approach when trading. He looks forward to benefitting from short-term fluctuations

- He is a Hungarian investor who started his investment career early

- George Soros also opened his hedge fund

- Besides, he is also known to be involved in several political connections

Glimpses of George Soros’s trading strategies:

- George Soros likes to speculate in the market and benefit from short-term movements

- Trend analysis is the famous trading strategy of George Soros. It helps the investor depict when the price of an asset rises so that he can benefit from it

- George liked to keep himself updated with regional and global economic trends. It helped him plan his trading moves in a much better way

- Besides, George committed mistakes while trading. However, he ensured that his future trading strategies considered those mistakes

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

5. John D. Arnold

John D. Arnold had a very inspiring trading journey. This trader from America excelled in trading energy products. John Arnold is famous because he became a millionaire young.

Good to know!

Some facts about John D. Arnold are as follows:

- John D. Arnold has a reputation for having the best trading skills

- He is a believer in the fact that anyone can earn from any underlying market if they analyze it properly

- John was a young lad when he started his first business. At the tender age of 14, he opened his first business

- Mathematics and economics were his favorite subjects, and he graduated from them

Glimpses of John D. Arnold’s trading strategies:

- As one of the best traders, John Arnold believed that a trader must center his trading strategy around the market he is trading, So adequate knowledge of the market is a must

- He considered the demand and supply of the underlying asset he traded. After all, these two components are the driving factors of any asset’s price

- Market trend knowledge is another guiding light traders can use in their trading journey

- Finally, research and technical analysis with proper risk management help traders get into profitable trading

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

6. Nick Leeson

Another great trader who makes it to the list of the best traders is Nick Leeson. The trader went through a lot of troubles and made several mistakes on his trading journey. However, he came out victorious because of his well-defined trading strategies.

Here are some facts about Nick Leeson:

- Nick Lesson belongs to a British family. He started his career working as a clerk in an ordinary place

- His experience took him to work in banks such as Barings Bank and Morgan Stanley

- He got into derivative trading at 27 when he was in Singapore

- Under his watch, his company made a loss. However, Nick Leeson did things to cover up these losses and recover from them

- At present, the trader owns a net worth of $3 million

Glimpses into Nick Leeson’s trading strategies:

- Nick Leeson’s trading strategies usually revolved around low-risk arbitrage opportunities. These opportunities offered him a perfect way to leverage and make money

- He diversified his investments in derivatives so that he could earn potential profits every time

- Nick was also an ardent follower of the straddle trading strategy

- Besides, the trader avoided trading in highly volatile markets because he believed it could jeopardize his investments

7. Richard Dennis

The best traders list also included the name Richard Dennis. This great trader hails from Chicago. He has a reputation for being the best futures trader.

Good to know!

Some brief information about Richard Dennis is as follows:

- Richard Dennis is widely popular with the name ‘the prince of the pit’

- He is part of an Irish Catholic family

- Richard started his career by working at the Chicago Mercantile Exchange

- Later, he got a place at MidAmerica Commodity Exchange

Glimpses of Richard Dennis’s trading strategies:

- Richard Dennis recommends being very clear about the underlying market you wish to trade in

- Like most traders’ trading strategies, Richard Dennis also believes in checking the trend

- Keep a check on your entry and exit positions in the market

- Also, traders must use the option of stopping losses to their trading losses

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

8. William Delbert Gann

William Delbert Gann is another amazing trader that ruled the finance market when he traded. The trader had perfect finance strategies that he put to use while trading. In addition, William used ancient mathematics and astronomy to ascertain his trading moves.

He developed various trading methods that helped him stack his fortunes.

Before are some William Delbert Gann facts that might interest you:

- The trader got into trading at the young age of 24

- He was well-versed in Greek and Egyptian culture

- During his time, he accumulated a wealth equivalent to 5 million USD

- He also came up with several trading publications that traders use even today

- Gann believed in following trends to know the amount an asset would assume the next day

- All his trading strategies were based on astronomical and ancient mathematical calculations

Glimpses of William Delbert Gann’s trading strategies:

- William kept a check on the weekly movement of an asset’s price. He believed that if an asset rose on Friday, it might have a higher value in the upcoming week.

- Usually, William would consider it a buy signal if an asset crossed its all-time high price

- In addition, the investor also relied on the trend and technical analysis

9. Bill Miller

The trader is on the list of the best traders because of his trading skills and the immense wealth he accumulated with such trading skills. Bill Miller is not just a great trader but also a great American philanthropist. He has exceptional fund management skills.

Biller Miller’s biographical information is as follows:

- Bill Miller is from North Carolina

- Bill Miller was an excellent student who excelled in economics and graduated with the same degree

- The investor also served in the US military

- He owns a net worth of USD 1.8 billion

- Also, he became a legendary fund manager later in his career

Glimpses of Bill Miller’s trading strategies:

- Bill Miller’s trading strategies revolved around assessing market situations

- He believed in understanding the trading world’s market inefficiencies

- Capital allocation of the traders’ investments should be the best

- In addition, traders should also consider trade diversification

10. Paul Tudor Jones

He is yet another trader on the list of the best traders. After making wealth through trading, Paul Tudor Jones established his hedge fund. He believed in placing macro trades. In addition, the net wealth of Paul Tudor Jones at 7.5 billion USD.

Some facts about Paul Tudor Jones are as follows:

- Paul Tudor Jones avoided ego trading. He invested only when he thought it was worth the chance

- This trader was born in Tennessee

- He first worked as a publisher before initiating trading

- He was educated at Harvard

Glimpses of Paul Tudor Jones’s trading strategies:

- Paul believed in effective risk control

- He believed a trader should focus on minimizing losses rather than gaining money

- Move out from any trade if your trading expectations do not match

Conclusion about 10 best traders in the world

The best traders leave a very inspiring journey for traders. Traders can learn from their experiences and mistakes. These ten traders were successful in amassing huge wealth. In addition, the journey of these traders has a lot of trading lessons for traders.

Any trader can learn from the trading strategies of these traders and improvise his trading journey.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

FAQs – Frequently asked questions about 10 best traders in the world

Who is the best trader?

Several traders could amass huge wealth with the best trading strategies. The best traders list includes Bill Miller, Benjamin Graham, Warren Buffet, etc.

How can I trade like the best traders?

A trader can trade like the best trader by following several trading strategies they followed. You can consider following trends and analyzing the market properly to become the best trader.

How do the best traders trade?

The best traders trade, keeping in mind the tactics of building trading strategies considering everything. All factors that influence the market are important to consider. That is how best traders trade.

(5 / 5)

(5 / 5)