4 best Forex Brokers & platforms with low spread and no commission in comparison

Table of Contents

See the list of the 4 best Forex Brokers with low spread and no commission:

Broker: | Review: | COMMISSION & Spreads: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | $ 0 commission | Spreads from 0.8 pips IFSC (Belize) | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Account types + High leverage possible (1:2000) + Attractive bonus program + Low spreads + Low commissions + 9,000+ assets available | Live account from $10 (Risk warning: Your capital can be at risk) | |

2. Capital.com  | $ 0 commission Spreads from 0.1 pips | FCA (UK), CySEC (CY), ASIC (AU), SCB (BH), SCA (UAE) | 3,000+ (70+ currency pairs) | + Low spreads + No commissions (*other fees can apply) + High security + Multi-Regulated company + 3,000+ markets + Personal support | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

3. Vantage Markets  | $ 0 commission Spreads from 0.5 pips | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + Supports MT4 & MT5 + Low trading fees + No hidden costs + Offers a free bonus + Fully regulated | Live account from $ 200(Risk warning: Your capital can be at risk) | |

4. XTB  | $ 0 commission Spreads from 0.5 pips | More than 10 | 3000+ (48+ currency pairs) | + Spreads from 0.1 pips + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $0(Risk warning: Your capital can be at risk) |

As forex traders are choosing a forex broker, one of the factors they consider is the trading costs. Forex traders understand how important it is to choose a forex broker with low trading fees. It implies finding a forex broker offering tight forex spreads with low or no commission. Forex trading can become expensive when the trading fees are soaring. Traders who prefer scalping or day trading prefer tight spreads and low commissions. It is because the profits could be small, and high trading fees can cut into the profits leading to losses.

How do low trading fees help in Forex trading?

Having forex brokers with low spreads and no commission is favorable for forex traders. It allows traders to manage their financial resources since they spend less on forex spreads and commissions. Forex brokers can offer no trading commission but have forex spreads; it is how they earn.

Advantages of low spreads and no commission:

1. Low trading costs

When forex trading, forex spreads are something traders have to account for budgeting. A forex spread cost for an asset could build up into high trading costs when you trade a high volume. It is good to have a forex broker with low spreads and no commission.

2. Assists in choosing a strategy

Low trading costs help traders decide how they are going to open positions. The market can be volatile at times, so having low spreads and commissions allows you to use more strategies when trading a financial market.

3. Practice trading

Low spreads and no commission allow traders to implement a new strategy without risking most of their funds. If the strategy was a success on the demo account, they could start using it on the live account, and the low trading fees help to cut the costs.

List of the 4 best Forex brokers with low spreads and no commission

1. RoboForex

It is a forex broker with 9 million customers worldwide and has provided forex brokerage services since 2009. It has access to 12000 financial markets starting with forex, stocks, cryptocurrency, indices, Commodities, ETFs, and metals.

It is regulated by the International Financial Services Commission of Belize.

Pros and cons of Roboforex

Pros

- It has a low minimum deposit.

- It has quality forex trading tools.

- Low trading costs.

- Variety of forex trading accounts.

- It has a good track record of forex trading.

Cons

- It is regulated in a few countries.

- Customer support is available 24/5

(Risk Warning: Your capital can be at risk)

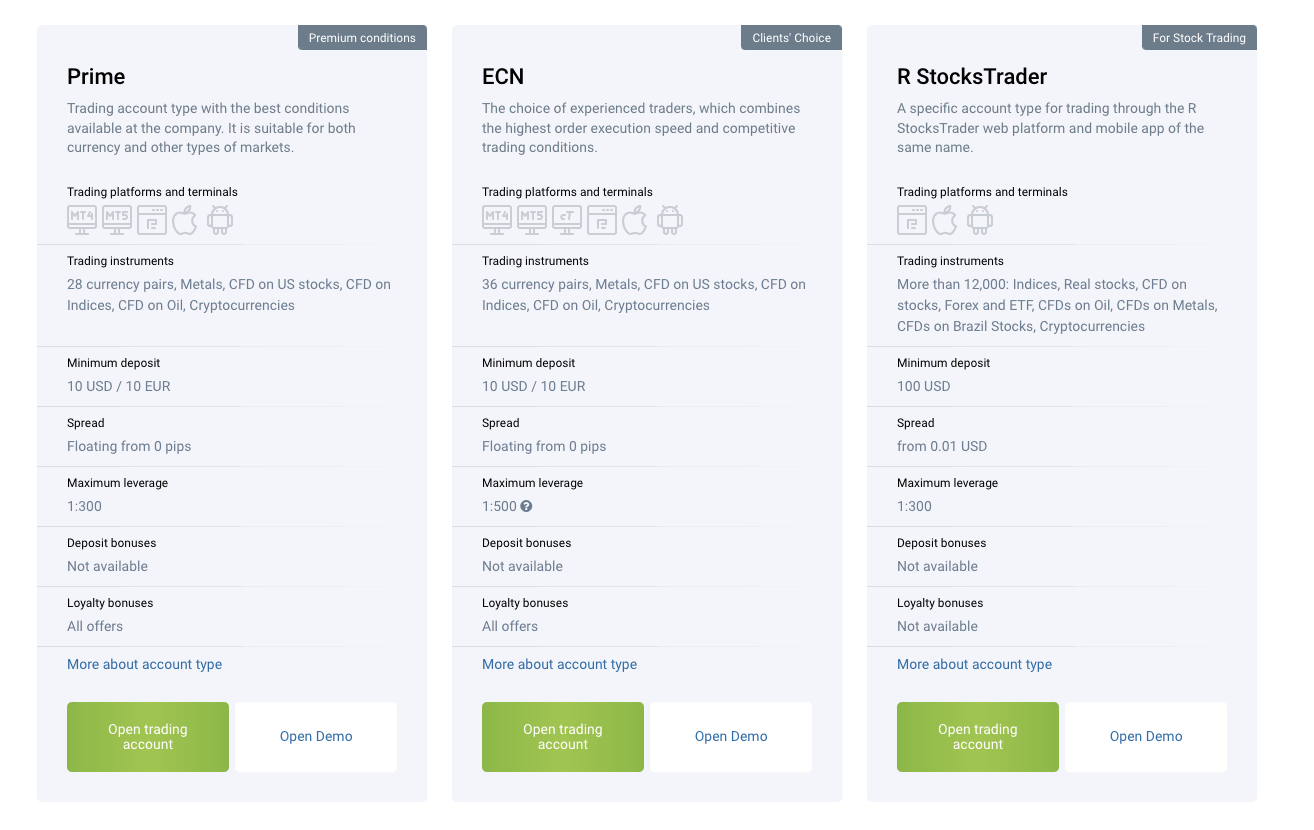

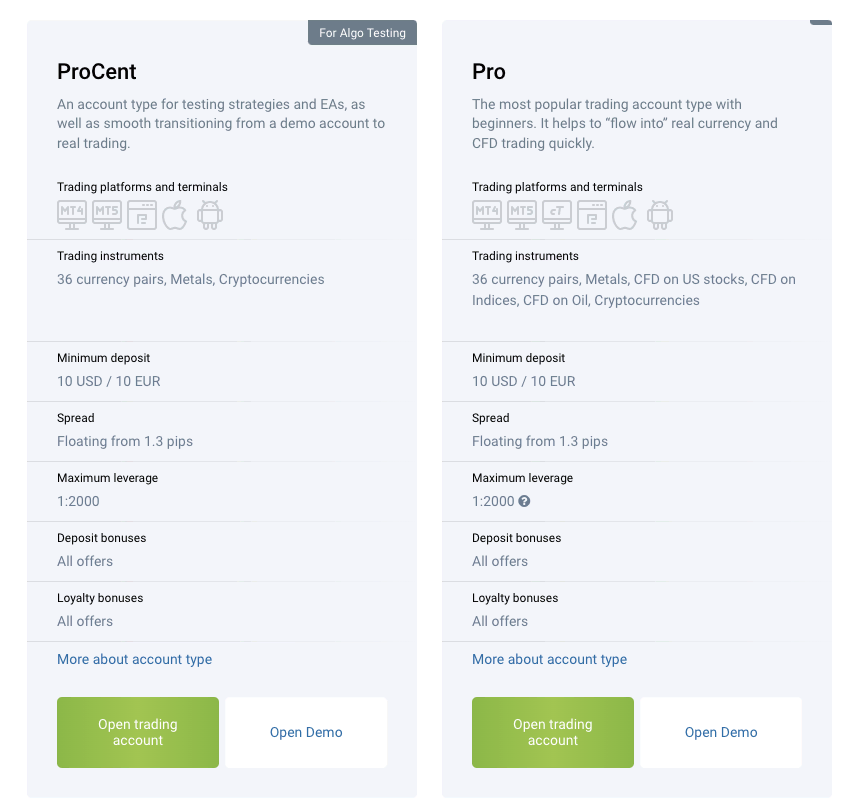

Account types at RoboForex

Roboforex has five types of accounts, Prime, ECN, R stocks trader, Pro-cent, and Pro accounts. The prime trading account has a minimum deposit of $10, the ECN has $10, the R stocks trader has $100, Pro-cent is $10, and the pro is $100.

They also have an Islamic account for Muslim traders.

Features on RoboForex

It has negative balance protection since it offers high leverage of up to 1:2000. It also has a demo account for traders to try out the features on the platform. It offers access to four trading platforms, Meta Trader 4, Meta Trader 5, its proprietary platform, R Stocks trader, and the c Trader.

These trading platforms have features that provide their users with an excellent trading experience in the financial markets. R stocks trader has an automated feature that traders can use to execute strategies.

There is also a multi-terminal for traders which monitors different trading accounts. It offers multiple charts, indicators, and drawing tools for technical analysis. It also has these platforms that are available in mobile platforms, desktop, and web versions.

It has a copy trading option known as copyFX, where traders can copy expert traders, or expert traders can get copied for a commission. It allows traders to learn while earning, and others make a commission teaching others how to trade.

It has a VPS server for clients but has some criteria to access it. It has research and educational content such as trading ideas, a news feed, and a strategy builder. The educational content is available in videos and articles, making it easy to access the information you need to trade.

Their customer support is available in different languages through phone calls, emails, and live chat.

Spreads and commissions

The spreads and commissions vary with the type of accounts. The Pro Cent and the pro account have no commission and have forex spreads starting from 1.3 pips. The Prime and the ECN accounts have tight forex spreads starting from 0.0 pips and a low commission.

The R-stock trader has no commissions, and for all these accounts, traders can open position sizes starting from 0.01 lots.

Other fees

It has no inactivity and deposit fees, and some payment methods attract some withdrawal fees. Forex traders can deposit on RoboForex using credit/debit cards, master cards, electronic wallets like Visa, MasterCard, bank transfer, Skrill, Neteller, and other methods.

(Risk Warning: Your capital can be at risk)

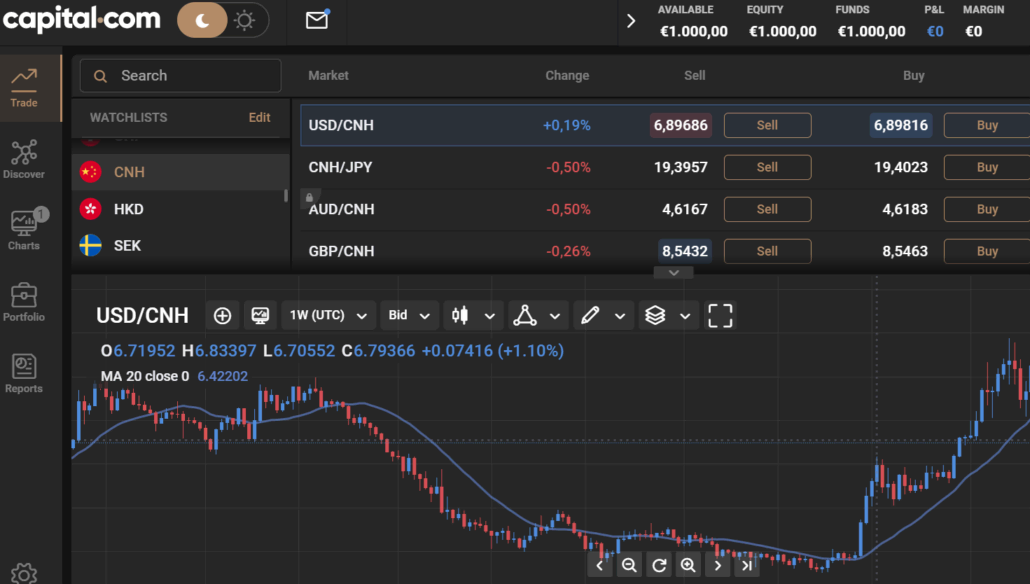

2. Capital.com

It has had over 580,000 forex traders worldwide since it got launched in 2016, and it serves over 50 countries in the world. Capital.com users have access to over 3,000 trading instruments that range from indices, cryptocurrencies, commodities, shares, and forex via CFDs.

It is regulated by

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities and Exchange Commission in Cyprus

- Australian Securities and Investments Commission

- SCB (The Bahamas)

- SCA in the UAE

Pros and cons of Capital.com:

Pros

- It has a wide range of educational resources.

- Quality research and presentation of trading information.

- Simple registration and verification process.

- Low trading fees.

- Quality customer support for clients.

Cons

- Limited trading instruments in some regions.

(Risk warning: 75% of retail CFD accounts lose money)

Features of Capital.com

It has a user-friendly interface integrated with Artificial Intelligence to enhance the service provision. Forex traders can start with the demo account available for practice and a learning resource for new traders.

It offers three trading platforms, the Meta Trader 4, its proprietary trading platform, and the trading view web platform. These trading platforms offer excellent price charts. Over 50 indicators watch lists and the trading center for trading signals.

It has a library of educational materials from experts who presented and researched articles, video content, and courses. It has well-researched information, such as news and analysis of the financial markets.

The materials are available on the platforms and youtube covering the most important topics like financial management and trading psychology. These courses are beneficial for all traders as they range from fundamental to expert trading knowledge.

Spreads and commission

Capital.com has no commissions (other fees can apply) for most trades, and forex spreads are low compared to other forex brokers. The average spread starts from 0.6 for the EUR/USD with no commissions. It is an average of 0.8 for most of the other financial markets.

Other trading fees

Its leverage depends on the region you are from because of the regulations imposed on trading with leverage. It has no deposit, withdrawal fees. It accepts various payment methods like bank transfers, credit/debit cards, and electronic wallets.

(Risk warning: 75% of retail CFD accounts lose money)

3. Vantage Markets

Vantage Markets is a forex broker launched in 2009 as vantage FX but rebranded in 2015 into Vantage Markets. It offers over 270 trading instruments ranging from forex, CFDs, Cryptocurrency, indices, and commodities.

Vantage Markets is regulated by the following:

- Australian Securities and Exchange Commission

- Financial Conduct Authority in the United Kingdom

- Cayman Islands Monetary Authority

Pros and cons of Vantage Markets

Pros

- It is regulated by tier 1 regulators.

- Top of the market trading tools and resources.

- Low trading fees

- The fast and simple registration process

- Wide range of payment methods to use.

Cons

- Limited trading instruments

- High minimum deposits

(Risk warning: Your capital can be at risk)

Account types at Vantage Markets

It has three types of accounts, the Standard STP, Raw ECN, and Pro ECN. The standard STP has an initial deposit of $200, the Raw ECN has $500, and the Pro ECN has $20000. It has a swap-free Islamic account that follows Sharia laws.

Features of Vantage Markets

It is one of the forex brokers that offer the Meta Trader 4 and Meta Trader 5 trading platforms. They offer customizable charting software that you can change to landscape. It also provides over 100 technical indicators, copies trading via Zulu trade, Dupli trade, and auto-trading features from Myfxbooks.

Its users can access market research through trading central to investors with over $1000 equity in their accounts. It has trading ideas for its clients, such as video content published on its youtube account.

It has video content as educational resources from trading central, and forex traders can learn trading from the beginner level to the expert level. Its users also benefit from the demo account they use to practice new strategies that they have learned.

Spreads and commissions

Vantage FX has no commission for the Standard STP account, which has forex spreads that range from 1.4 pips. The Raw ECN account has low forex spreads that start from 0.0 pips and a low commission of $3 round turn.

The Pro ECN has low spreads that start from as low as 0.0 pips and commissions of $2 per round turn. Vantage Markets has the standard account offering low forex spreads with no commission.

Other trading fees

They have no account, deposit, withdrawal, or inactivity fees. Forex traders can deposit using bank transfers, credit/debit cards, and electronic wallets.

(Risk warning: Your capital can be at risk)

4. XTB

It was founded in 2002 in Poland and has grown over the last two decades, giving a long track record in the forex market. Forex traders can trade a variety of financial assets starting from Indices, commodities, forex, shares, and cryptocurrencies.

It is regulated by the financial conduct authority of the United Kingdom.

Pros and cons of XTB

Pros

- Low trading fees.

- Simple account opening process.

- Low trading costs.

- Negative balance protection.

- Quality customer support team.

Cons

- Has limited trading instruments.

Account types on XTB

It has two types of trading accounts Standard and Swap-free accounts, both trading accounts have no trading deposits and no commission. The standard account is the main account, while the swap-free is like an Islamic account.

(Risk warning: 72% of retail CFD accounts lose money)

Features of XTB

The demo account is for traders to use when they want to familiarize themselves with the XTB trading platform and its features. The demo account has the Meta Trader 4, and its proprietary platform x station 5 trading platform integrated.

The courses get divided into categories, from fundamental knowledge to expert-level forex trading courses. New traders can take these courses, such as articles and videos to grow their trading skills. Some of the content is on the website, while others can get accessed when you open an account.

As part of news and analysis, XTB provides financial news from the best third-party news providers. It also has an economic calendar for forex traders. The news consists of comprehensive fundamental and technical analyses of different financial markets.

XTB has a mobile application, desktop, and web-based trading platform. The customer support team is present 24/5 to answer any questions traders could face. Users can contact them through live chat, email, or phone calls.

Spreads and commission

It has forex spreads starting from 0.5 and zero commission for the standard account. The swap-free account has forex spreads starting from 0.7 pips and no commission. These costs are low compared to many industry top forex brokers.

It has a leverage of 1:500 for both forex accounts, and traders can open position sizes from as low as 0.01 lots.

Other trading fees

It has an inactivity fee of $10 every month for forex trading accounts dormant for more than a year. The overnight fees vary with the position size and the asset, and it has no withdrawal and deposit fees. Forex traders can use a variety of payment methods.

It accepts credit/debit cards, bank transfers, and electronic transfers such as Paydoo, PayPal, PaySafe, Skrill, Neteller, Safety pay, etc.

(Risk warning: 72% of retail CFD accounts lose money)

Conclusion – There are good brokers that allow no-commission trading

As the forex industry has grown, new forex brokers emerge every year with new features. A few mentioned that they are changing the game towards trading fees. Forex traders have an easier time budgeting for forex trading while creating suitable trading strategies.

It is cheaper to trade financial markets with advanced features coupled with low spreads and no commission. Forex brokers with low trading fees also benefit from high-volume traders signing up on their trading platforms.

It has created liquidity for both the investors and the forex broker. It is also an option that new forex traders can use when they start forex trading.

FAQ – The most asked questions about Forex Brokers with low spread:

What is the difference between spreads and commission?

Forex spreads are inbuilt into the buy and sell prices of an asset. It is the difference between the bidding and the asking price. It is affected by the volatility and liquidity of the financial asset you are buying or selling.

Commissions are a fixed percentage or price in dollars charged when you open and close a position. The forex brokers could either charge a commission, forex spread, or both of them in a trade.

How do Forex brokers with low spreads and no commission earn their income?

There are many other ways brokers earn income, like overnight fees and conversion fees. Other than that, forex brokers earn from the tight spreads because traders often trade in volumes. Short-term forex traders, like day traders, trade small volumes several times a day.

The brokers, therefore, generate income through the high volumes that forex traders make and other trading fees.

Which is the best commission and spreads?

The best spreads that forex brokers can offer start from 0.0 pips or those closest to the market prices. Forex brokers with spreads ranging from 0.0- 1.0 pips have tight forex spreads, which are considered close to market prices.

The best commission a forex broker can offer is zero commissions on any trade. Forex brokers either offer zero commissions with some spreads or some commissions with zero spreads. The lowest forex trading costs are those with low spreads and no commissions.

Which is the best forex broker with low spreads and zero commission?

Only minimal spreads and zero-commission forex brokers should be selected by traders. It is because a trader wouldn’t want to spare a substantial part of his trading income for fees and commissions. It would double up the trading costs for any trader. As a result, a trader searches for the finest forex broker with minimal spreads and no commissions. Here are five forex brokers that you can trust.

Capital.com

Vantage Markets

RoboForex

XTB

What is the benefit of choosing a forex broker with a low spread and no commissions?

To cut his trading expenses, an investor must select a forex brokerage with minimal spreads and 0% commission. If a broker charges high commissions or spreads, it will leave traders with nothing. Your actual profit margin would lower considerably. So, you should choose a forex broker with low spreads and no commission.

How can a trader choose a forex broker with a low spread and zero commission?

By evaluating additional aspects, a trader might select a forex brokerage with a low spread and minimal commissions. For instance, you can choose the best forex broker only when you access the kind of trading platform they offer. Besides, the forex broker should also offer innovative solutions for a trader’s benefit.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5)