The 5 best online trading accounts in comparison – Reviews for traders

Table of Contents

One of the most well-known types of jobs that can be done in the comfort of your own home is trading. No wonder more and more people are jumping on the bandwagon in hopes of making a living out of this risky profession.

But trading does not always have to involve risk. With the right amount of knowledge, research, and data, you can surely minimize the chances of loss or even heighten your chances of gain. The trick is finding the right broker to partner with.

This broker should have all the necessary tools and educational materials that you need to succeed in the trading scene. Here is a comprehensive review of the five best online trading accounts that offer everything you might need to jumpstart your career.

See the list of the 5 best online trading accounts:

BROKER: | Review: | Online trading available: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. XTB | Yes | Starting 0.1 pips | 3,000+ | + More than 3,000 different markets + Very good trading conditions + Direct market access + Bonus Program | Live account from $0(Risk warning: 76% of retail CFD accounts lose money) | |

2. Vantage Markets | Yes | Starting 0.0 pips | 400+ | + Real ECN Trading + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Live account from $200(Risk warning: Your capital can be at risk) | |

3. Markets.com | Yes | Starting 0.6 Pips | 250+ | + Accepts international traders + Free demo account + Low spreads and commission +24-hour support + More than 100 different markets | Live account from $250(Risk warning: 67% of retail CFD accounts lose money) | |

4. Libertex | Yes | Starting 0.0 pips | 250+ | + Offers free demo account with € 50,000 virtual funds + More than 250 different trading underlying assets + Over five different languages customer support + Offers several CFDs + Popular trading platform | Live account from $100(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) | |

5. eToro  | Yes | Starting 1.0 pips | 3,000+ | + A regulated and safe company + Social and copy trading + Innovative and user-friendly platform + Professional support + Minimum deposit from $ 100 | Live account from $ 10051% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. **Please note that instruments restrictions may apply according to region |

See the list of the 5 best online trading accounts:

- XTB – Very good trading conditions

- Vantage Markets – Reliable support and service

- Markets.com – Over 8,200 markets to trade

- Libertex – Popular trading platform

- Etoro – Leverage up to 1:30 for European traders

1. XTB – Very good trading conditions

XTB is proud of being one of the largest forex and CFD brokers globally, giving clients access to over 2,000 assets. Since its inception in 2004, it has gained over 280,000 registered customers and has won numerous awards.

This particular broker is regulated in multiple countries. XTB MENA has a category 3A license issued by the DFSA or the Dubai Financial Services Authority. The Comisión Nacional del Mercado de Valores regulates XTB Spain.

XTB UK operates under license 522157 issued by the FCA or the Financial Conduct Authority. XTB Europe has been issued a license with the number 169/12 by the CySEC or the Cyprus Securities and Exchange Commission. Lastly, XTB International has been regulated by the Belize International Financial Services Commission.

With more than 57 forex pairs, 1846 stock CFDs, 135 ETF CFDs, 30 indices, and many more, this broker will surely diversify your portfolio as well as expose you to a wide variety of trading instruments to jumpstart your trading career easily.

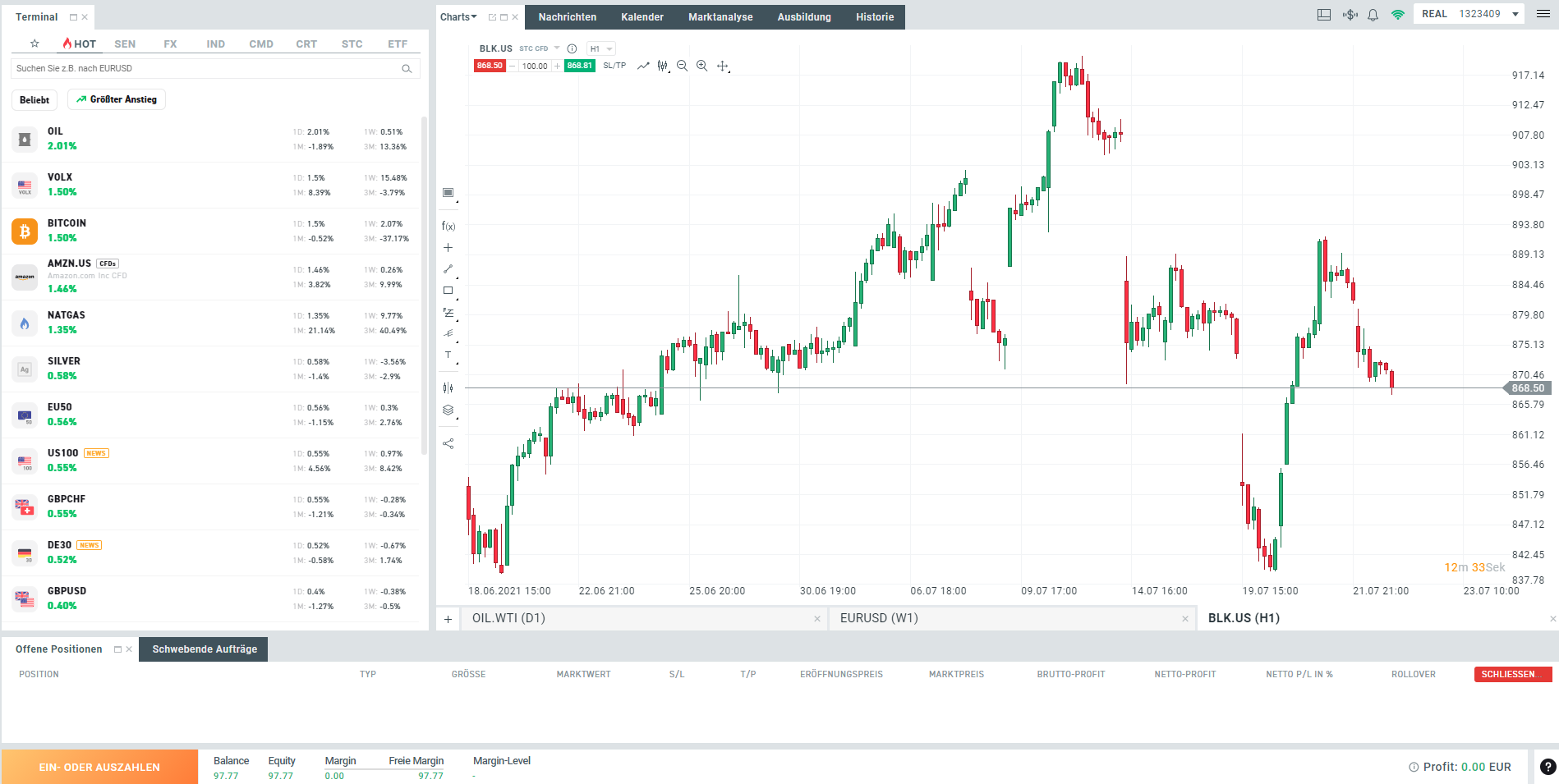

These assets can be traded on XTB’s sophisticated trading platform known as the xStation 5. This platform can easily be accessed via Firefox, Safari, Chrome, and Opera. A desktop app and a mobile app are also available for download if you would rather have separate software. It is free to download, and it doesn’t take up much space on your desktop or mobile device.

XTB’s demo account feature also comes in handy for beginners as well as seasoned traders. Beginners often use it to practice or develop their trading skills and test their knowledge before they start trading live. Professionals also use it to test out new things to see if their strategy is viable for the asset they want to trade.

The demo account is free and can be accessed without making a deposit. You can trade on XTB’s platform using virtual funds for 30 days. If the demo account isn’t enough to give you the knowledge you need, XTB also has numerous educational materials readily available on its website. You can even access market news, price tables, as well as the market calendar to better prepare yourself for your next or first trade.

XTB’s customer support representatives are available 24/5 via the live chat system on its website. You may also reach them by giving them a call. Chat support, as well as phone support, is available in different languages. These languages are Arabic, Thai, Vietnamese, Turkish, Slovak, Spanish, Romanian, Russian, Portuguese, Polish, Italian, Hungarian, German, French, Czech, and English.

Keep in mind, however, that XTB is not available for traders from the United States, Romania, Kenya, Iran, Iraq, Syria, Cuba, Uganda, Ethiopia, Bosnia and Herzegovina, Pakistan, Turkey, India, Israel, Mauritius, Slovakia, Singapore, Japan, Canada, and Australia.

Advantages of the XTB online trading account:

- Multiple regulated online broker

- No minimum deposit ($0)

- Free demo account

- Professional trading platform

- Free analysis

- Free education, webinars, support

- Low and competitive spreads

- More than 2,000 assets to trade

(Risk warning: 74% – 89% of retail CFD accounts lose money)

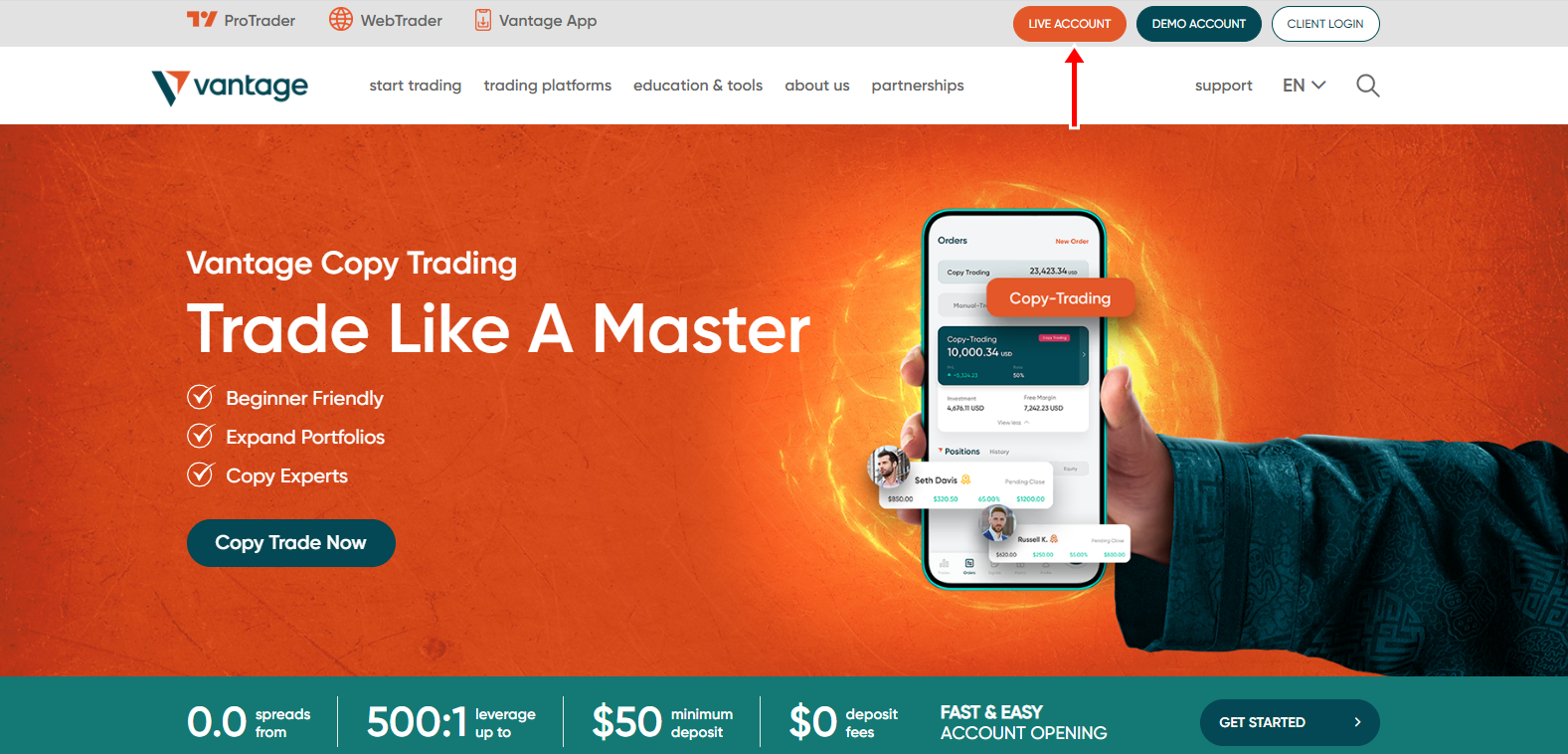

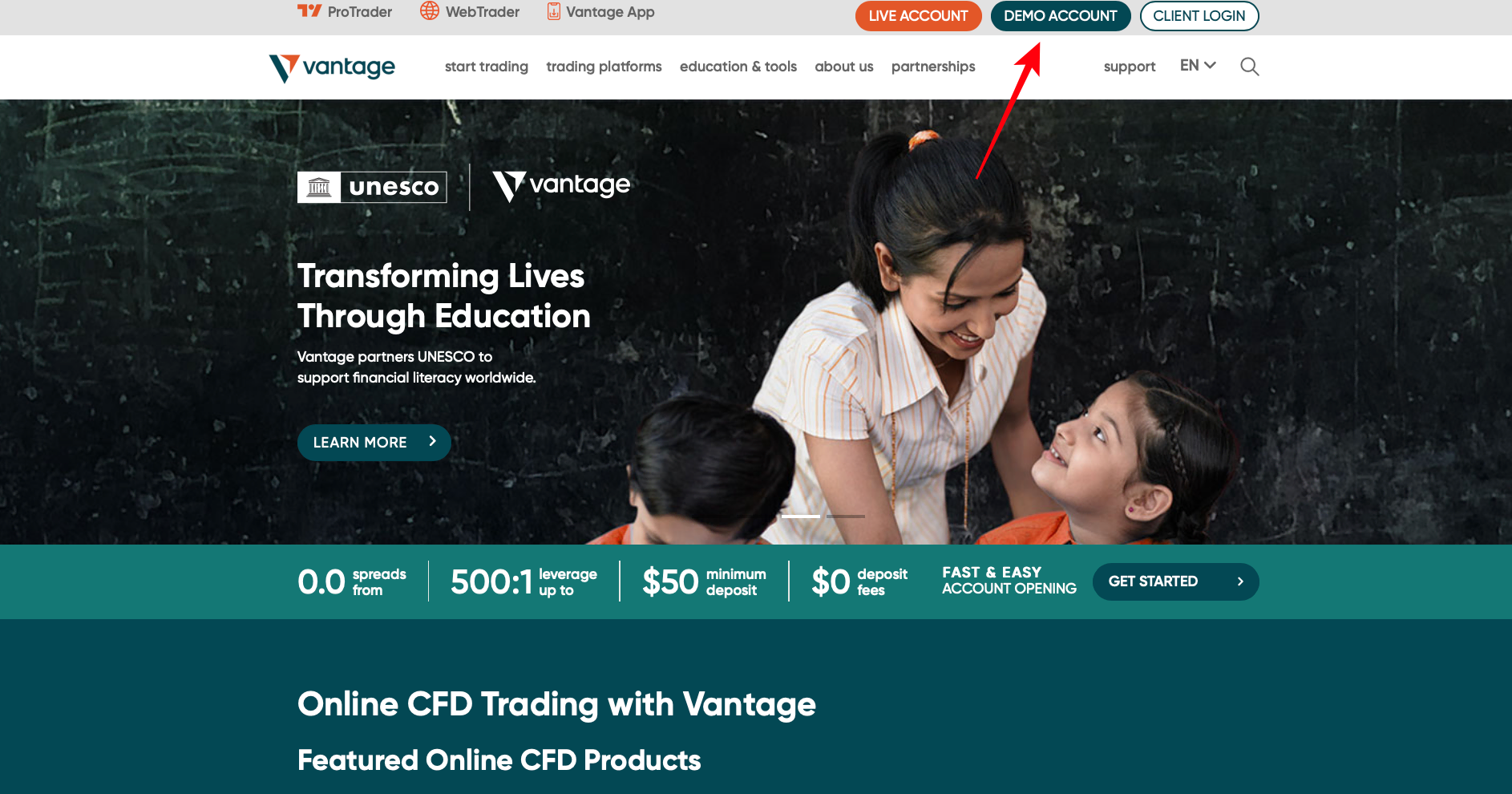

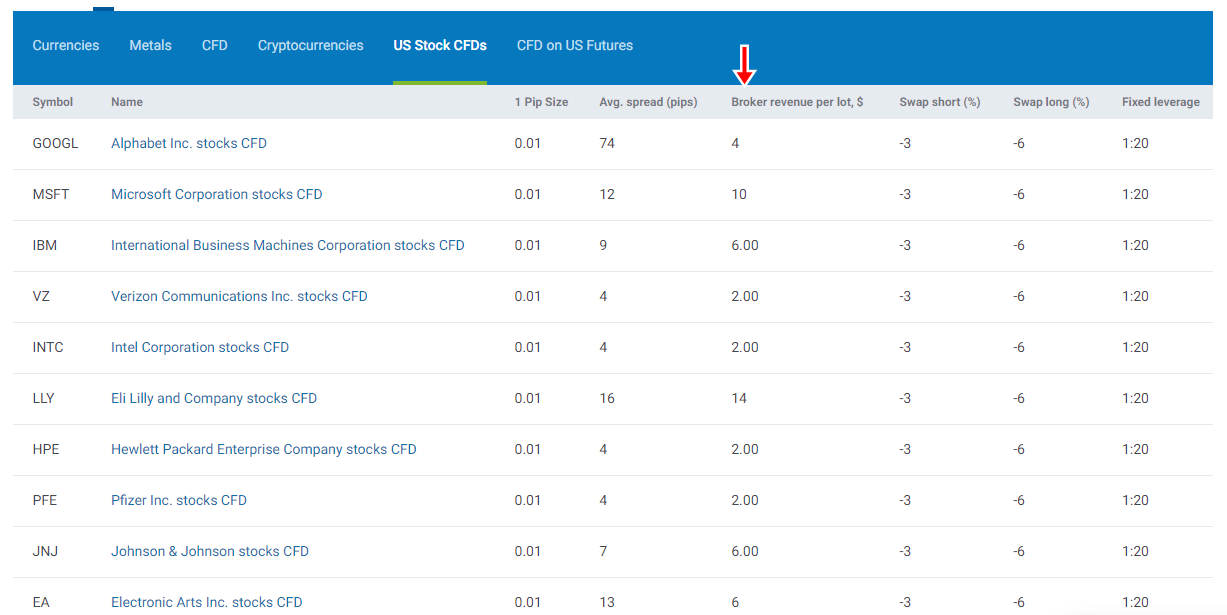

2. Vantage Markets – Reliable support and service

Vantage Markets is an international broker for Forex (currency pairs) and CFDs (Contracts for Difference). The company has existed since 2009 and knows exactly how to respond to the wishes of its customers. The broker is mainly based in Level 29, 31 Market Street, Sydney NSW 2000, Australia, and accepts traders from almost every country. But they also got business addresses in the Cayman Islands and Vanuatu.

Vantage stands for transparent trading in the financial markets. This can only be claimed by some brokers and is very difficult to recognize, especially for beginners. The strengths of Vantage Markets are transparent order execution and liquidity provision. It is one of the few actual ECN brokers. The broker is connected to a network of large liquidity providers. These accept the orders of the traders. The liquidity providers are transparently visible on the homepage. Large, well-known banks (HSBC, Bank of America, UBS, and others) are among them.

The company must have an official license (through licensing/regulation) from a government authority to offer financial products. In the event of a breach of these rules, there is a threat of immediate withdrawal of the regulation and license. Regulation thus creates a high trust between the trader and the broker. Fraud can be 99% excluded with a fully regulated provider.

Overall, Vantage Markets offers a very high level of security. The broker is regulated by the Australian regulator ASIC, the Cayman Islands Monetary Authority CIMA, and is audited by KPMG (auditing firm).

Reasons why Vantage Markets is one of the safest brokers:

- Clients’ funds are held at one of the top 20 banks in the world

- Vantage Markets is audited by the auditors of KPMG

- Regulation and licensing by the Australian regulator ASIC

- Regulation and licensing by the Cayman Islands Monetary Authority

- Liability insurance of over 20 million USD

High leverage for European traders – Avoid ESMA regulation

The new ESMA regulations mean that brokers in the EU can no longer lend high leverage to private traders. The maximum leverage for private traders in Europe is 1:30. As a result, many trading strategies are no longer feasible, and trading is restricted by many traders. A way out of the new bureaucracy will provide brokers with a license and regulation outside Europe. Vantage Markets is unaffected by ESMA regulation and offers all traders high leverage of 1: 500. Also, traders can trade under the ASIC or CIMA regulation.

Facts about the trading conditions:

- Minimum deposit of $ 200

- Over 300 different markets

- Several account models (commission-based and spread-based)

- Leverage up to 1:500

- No account maintenance fees

- Very cheap trading fees

- Spreads starting at 0.0 Pips

(Risk warning: Your capital can be at risk)

3. Markets.com – Over 8,200 markets to trade

Founded in 2008, Markets.com has been providing its clients with various options and amazing services. It won “Best Trading Platform” in 2020 and continues to add more awards to its collection. Markets.com is also known for being a part of Finalto Limited, a former TradeTech Group.

Finalto Limited is regulated by the FSC or the Financial Services Commission, FCA, and CySEC. This is one of the most well-known regulatory companies that only regulates trustworthy brokers like Markets.com. You can even access Markets.com’s Privacy Policy, Risk Disclosure Statement, and other important documents on its website.

Markets.com offers multiple tradeable assets on its proprietary platform. There are over 2.000 stocks or market shares from various countries like the United States, United Kingdom, Sweden, Italy, Spain, Denmark, Australia, Germany, Netherlands, Finland, Hong Kong, Greece, Norway, South Africa, and other countries worldwide.

There are 67 forex pairs in total, including the seven major currency pairs as well as some minor and exotic pairs. Also, there are 60 ETFs or Exchange-traded funds to trade as well. You can see a complete list of the available ETFs on the website.

Below are the other five asset classes available on Markets.com:

- Currencies

- Commodities

- Stocks

- Indices

- Cryptocurrencies

If you check out the list of available assets on the website, you will see their corresponding leverage, spread, and trading session.

Markets.com, as previously mentioned, utilizes its own award-winning and user-friendly trading platform. But for traders who are more accustomed to using the well-known MT4 or MT5 platform, those are available as well. These are also mobile applications, so you can trade on the go.

This broker, just like most brokers, offers a free demo account for potential clients. This demo account comes with virtual funds so you can familiarize yourself with Markets.com’s platform or practice trading or testing out your strategies before your next live trade. However, keep in mind that if there is no new activity on your demo account within 90 days, Markets.com will automatically close that account, and you will need to contact them if you want to reopen it.

Creating a demo account is the same as creating a live account. Fill up the sign-up form found on the website. The form will ask for basic details such as your email address and password. You will also be required to choose your preferred currency. Your choices are GBP, EUR, USD, DKK, AUD, PLN, NOK, ZAR, CHF, or SEK.

If you still find yourself struggling when trading, Markets.com has a knowledge center as well as a set of useful tools that will help you learn more about trading the different asset classes available on this particular platform.

Markets.com’s dedicated support team is also available 24/5 via live chat or phone. Getting in touch with them is fairly easy, and the representatives are knowledgeable and quick to respond. Additionally, this specific broker’s website supports English, Spanish, and Arabic. The website is easy to navigate as well as pleasing to the eye.

It is also worth noting that Markets.com does not cater to traders from the United States, the Russian Federation, Japan, Brazil, Canada, Belgium, Israel, Turkey, New Zealand, Syria, Iraq, Iran, Hong Kong, Puerto Rico, Singapore, and India.

Facts about the Markets.com online trading account:

- Multiple regulated company

- Part of a stock-exchange listed company

- Free demo account

- Low minimum deposit of $250

- Trade more than 3,000 markets on one platform

- Professional trading platforms available

- Personal customer support

- Low and competitive spreads

- No commissions

(Risk warning: 74% – 89% of retail CFD accounts lose money)

4. Libertex – Popular trading platform

Libertex is one of the oldest brokers on our list. Created in 1997, this broker is known for being the trading company of Indication Investments Ltd. Currently, this broker has over 2.9 million registered clients from more than ten countries worldwide. Libertex has won numerous awards during its 20-plus years in the market.

This broker is closely monitored and regulated by the CySEC or the Cyprus Securities and Exchange Commission, and its license number is 164/12. They are transparent when it comes to their fees, and you can access Libertex privacy policy as well as essential documents with a click of a button.

With Libertex’s own trading platform, you gain access to multiple assets that are sure to diversify your portfolio and help hone your skills as an experienced trader. Among these assets are stocks of famous companies such as Apple, Microsoft, Google, Amazon, Tesla, Facebook, and many more.

There are also major, minor, and exotic forex pairs like EUR/USD, GBP/USD, USD/NOK, CHF/SGD, and so much more. You can see all the available forex pairs on Libertex’s website. But Libertex does not only offer forex and stocks.

All these can be traded on Libertex’s web-based platform or mobile application. The application is free and is available for download from the Apple App Store, Huawei AppGallery, and Google Play Store. There is also a free demo account feature that you can use to see if the platform performs the way you want it to.

A demo account will surely help beginners and professionals hone their skills or even devise new strategies on how to tackle the market or asset they choose to trade. Just like most brokers, Libertex also has an education tab as well as a blog, so you can see the latest news and learn a thing or two about trading.

If you are ready to trade live, a minimum deposit of 100 EUR is required by Libertex. However, the next time you deposit funds to your account, the minimum deposit will be lowered to 10 EUR.

If you have any concerns or additional questions, you can contact Libertex’s customer support representatives via the live chat system on the website, or you can email them at [email protected]. When reaching out via email, you may have to wait a day before you get a response, but they will surely answer any of your queries and will gladly assist you. The website can be viewed in different languages for ease of use. These languages are English, Portuguese, Polski, Italian, Dutch, Spanish, French, and German.

Facts of the Libertex trading account:

- Regulated online broker

- €100 minimum deposit

- Free demo account with a virtual balance

- Multiple assets to trade

- No spread trading – only small commissions

- MetaTrader, Web-platform, Mobile app

- Easy-to-use platform

(Risk warning: 74% – 89% of retail CFD accounts lose money)

5. Etoro – Leverage up to 1:30 for European traders

**Please note that instruments restrictions may apply according to region

Traders and non-traders alike have heard of this broker. May it be through a YouTube ad, Facebook ad, or a friend who uses this broker, eToro has surely grown since its inception. Because of its extensive reach and aggressive marketing now it has more than 20 million clients from over 100 countries.

This broker has 49 tradeable currency pairs, consisting of both major, minor, and exotic pairs. There are also more than 200 ETFs for users of this broker to trade, which gives them maximum exposure to the available assets on the market.

Stocks can also be traded with eToro. Some of the most well-known names, like Microsoft, Apple, Tesla, Facebook, and Coca-Cola, can be found on the list of stocks available on eToro’s trading platform. Additionally, there are various commodities, indices available on this broker’s platform.

This broker’s award-winning platform can also be tested with the use of a demo account or virtual portfolio. This feature is completely free, and all you have to do is sign up and download the application or access the platform via your browser of choice.

Registration is quick and easy. All you need is your email address. Another way to sign up is by connecting your Facebook or Google account to eToro. This makes it easier for you to create an account so you can start trading as soon as possible.

You will have a virtual balance of $100,000 that you can use to trade all the available assets with zero risks. You will gain access to the platform along with its various trading tools, and you can even interact with other brokers using eToro to get a second opinion.

When trading with a live account, keep in mind that the minimum deposit required by the broker depends on your country of residence. It can be as low as $100 and as high as $10,000. You can see a complete list of this and trading conditions, on the website.

The trading platform is so easy to use it’s almost impossible to get lost. However, if you do have any problems with the platform and can’t seem to find your way around it, there is a help desk that can direct you to where you need to go and give you the necessary information you need. There are no hidden fees, and you can get all the information that you need on the website.

The platform also supports multiple languages for ease of use. These languages are English, Italian, Spanish, Russian, German, Chinese, Arabic, French, Polish, Norwegian, Dutch, Swedish, Portuguese, Czech, Romanian, Vietnamese, Finnish, and Thai.

The downside, however, is eToro is not available for traders from Saudi Arabia, India, Singapore, New Zealand, Hong Kong, Canada, Japan, Turkey, Madagascar, Iran, and Macao. There are, however, many alternatives out there.

Facts about the eToro trading account:

- Regulated by multiple regulators

- Minimum deposit of $100

- Accepted in a lot of countries

- Free demo account with virtual money

- More than 3,000 markets (CFDs, stocks, indices, forex, and more)

- Spreads from 1.0 pips

- Stock trading without commissions

- User-friendly trading platform

- Multilanguage support

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is an online trading account?

Online Trading Accounts allow retail traders and investors to trade at a low cost as well as access to the market and the available assets at any time before online trading accounts were a thing, those that would want to invest needed to contact a broker through a call or text message and let them make a trade for you.

Investing through a traditional broker entailed a lot of complications that included late trades and higher brokerage costs. With the online trading account, however, clients are able to enjoy fast executions while bypassing fees that would come from consulting a real-live broker.

Nowadays, online trading accounts even provide research materials for all their clients to gain expert advice on the market. These trading accounts can be accessed on multiple devices that include computers and even Android and Apple mobile phones.

- Desktop trading

- Mobile trading (app)

- Web trading (browser)

Online brokerage accounts also allow multiple assets to be traded but still would depend on their scope of services. However, most of the top brokerages offer stocks, currencies, indices, and commodities as assets.

Usually, users can freely change their leverage without directly contacting customer service or even using margin. Although a few brokerages would require you to contact a designated person for these concerns, the process is hassle-free and doesn’t require any more paperwork.

With the rise of new services and features, most online brokers already offer 0 commission trades as well as a full range of services that include charting and even trading derivatives. With these kinds of accounts, clients are able to monitor their assets to the next level and plan ahead in anticipation of future market conditions.

Some of these accounts go the extra mile to provide an in-depth analysis of trade analytics and portfolio performance. These help users identify their strengths and weaknesses and would further improve their performance.

Here’s why you should have an online trading account:

- One major benefit of having a trading account is smooth and continuous transactions. Plus, online trading accounts make transferring and selling assets easy

- A trading account allows you to enter the market anytime through a laptop, mobile phone, or other devices

- Registered traders can expect better customer support. No matter what the issue is regarding, the team of experts will always assist you

- A trading account gives you a clear idea about the extra charges so you can get more clarity on each trade

Things to consider when opening a trading account

Here’s what you need to consider when opening a trading account:

- Trust and legacies

- Protection against harm

- Range of assets

- High-Quality support services

1. Trust and legacies

Almost never you should open a trading account with a broker that does not have a large investment base or national presence. If a broker is not reliable, it’s likely that your deposited money and trades are under threat.

2. Protection against harm

Over the years, cyber threats in the trading world have increased. That’s why choosing a broker with the highest security level is important.

3. Range of assets

A trading broker offering a limited range of assets can also limit your chances of winning trades. A reliable trading platform offers a variety of assets for you to choose one. When you have a variety of assets, you can use different trading strategies to make winning trades.

4. High-Quality support services

Your selected broker must offer a variety of support services so you can easily contact the experts. Many trading brokers offer different support services, including phone calls, email, live chat, FAQs, and more.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

6 simple steps to open a new online trading account

- Choose a broker

- Get in touch with the broker

- Complete KYC and fill out a form

- Application verification process

- Fund your account

- Place buy or sell orders

Step 1: Choose a broker

Choosing a reliable trading broker to create your trading account is essential. But with so many options, choosing a broker is not easy. The trading brokers in the market claim to offer the best services; however, you cannot trust them all.

Instead, you can do thorough research to find the best broker. Compare the offered services, minimum deposit amount, tools, withdrawal process, deposit process, and other features.

Step 2: Get in touch with the broker

Once you have selected the broker, the next thing to do is enquire about the trading account opening procedure.

Depending on your broker of choice, the method of creating an online trading account varies. For some, you will need to fill in a form that requires a lot of information, such as your email address, phone number, complete name, etc.

On the other hand, some brokers only require you to input your email or link your social media account. Once you finish filling out the form or signing in, you will need to verify your email. After you verify it, you will need to deposit funds to your online trading account, so you can start trading live.

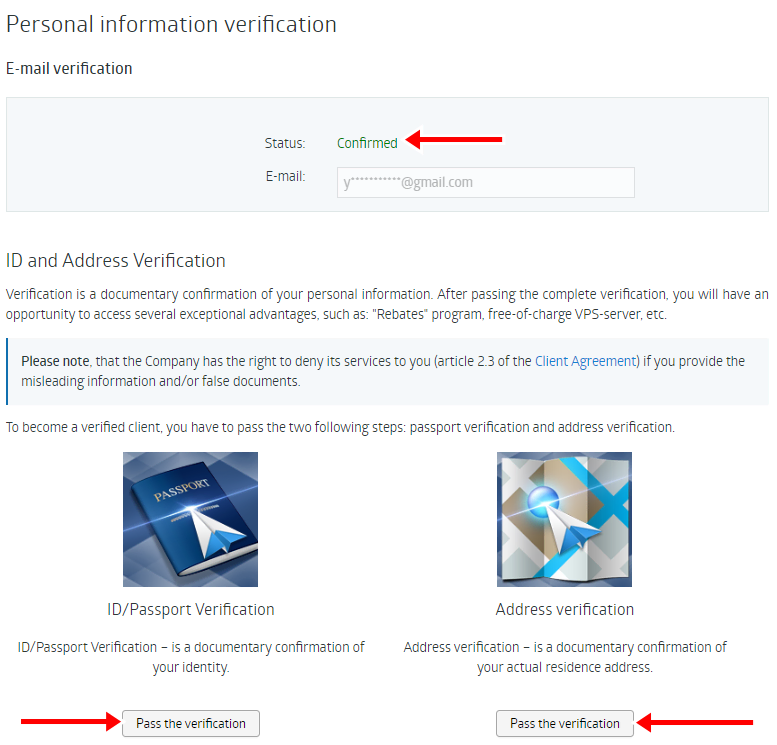

Step 3: Complete KYC and fill out a form

Begin the account opening process by filling out a form and completing KYC details. You can complete the easy form-filling process in no time. Don’t forget to submit your identity and residential proof with the account opening form.

Step 4: Application verification process

The verification process of your trading account begins after you have submitted the form and KYC documents. Thoroughly check the details to avoid errors. Following this, your trading account becomes active. You can use the credits to start your trading journey.

Step 5: Fund your account

Once you become a registered trader, your broker offers you access to a demo account so you can gain proper knowledge. In fact, you can practice your trading strategies through a dummy account to increase your profits.

After you gain confidence in your trading, you can move to a live trading account by adding a minimum deposit amount. Different trading brokers accept different payment methods.

Step 6: Place buy or sell orders

After gaining access to a live trading account, place buy or sell orders to begin your trading journey.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

How long does it take to open a trading account?

Several variables, including the kind of account being opened and the nation in which the user resides, might affect how long it typically takes to open a trading account.

A fundamental individual trading account normally opens the fastest of all the different types of accounts. This is due to the fact that these accounts have simpler eligibility criteria and application procedures. On average, a simple individual trading account can be opened anywhere from a few minutes to a few days.

Margin and managed accounts are two more sophisticated account types that could take longer to open. Before opening one of these types of accounts, additional conditions and approval procedures are typically necessary. For instance, margin accounts might have a higher minimum deposit requirement and a risk tolerance test. Managed accounts might need additional paperwork like financial statements or proof of net worth like unmanaged accounts. Therefore, opening a margin or managed account could take a few days to a few weeks.

The typical time it takes to open account changes based on the nation. The procedure might go more quickly and effectively in developed nations with established financial systems. This is because these nations have established rules and laws in place to safeguard investors’ rights and guarantee a simple account opening process. The procedure might take longer in developing nations or nations with more complicated regulatory environments.

This is so that opening an account won’t be slowed down by the possibility that these nations have stricter rules and laws. Due to the increased complexity, the broker could also ask for additional documentation and take longer to confirm the applicant’s identification.

Factors that can affect the time it takes to open a trading account

- The requirements and procedures of the broker

- The level of account complexity

- The person’s capacity to deliver all necessary documentation

The requirements and procedures of the broker

The procedures and conditions for opening a trading account may vary amongst brokers, impacting how long it takes to open an account. Opening an account may take longer with some brokers because of more stringent identity verification procedures or extensive documentation requirements. The time it takes to open an account might also be impacted by the prolonged application processing times experienced by some brokers.

Additionally, the amount of time required to open an account may vary depending on the broker’s regulatory and compliance requirements. Brokers must go by several rules and laws, including Know Your Customer (KYC) and Anti-Money Laundering (AML), which will verify the identity of the person opening the account and may need some time.

The level of account complexity

The length of time it takes to open an account might vary depending on the type of account being opened. Acquiring a basic individual trading account, for instance, might be quicker and easier than opening a more sophisticated account type, like a managed account or a margin account.

These accounts may have different specifications, such as greater minimum deposit amounts, more thorough documentation, and other approval processes that could take some time.

The person’s capacity to deliver all necessary documentation

The time it takes to open a trading account can also depend on the person’s capacity to furnish all necessary papers and information. Opening an account could take longer if someone needs to supply the required paperwork or information.

This may require more necessary documents, such as identification and proof of address. Furthermore, because the process is more complicated if the person is creating an account from a distant nation, the broker might need to see additional paperwork and take longer to verify the person’s identity.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Online demo trading account

The brokers listed above all have a free demo account feature. Beginners or professional traders can use demo accounts. Usually, traders use a demo account to check out the features of a certain platform before they deposit funds into their accounts. This is one way of knowing if a broker is legit and puts their clients above anything else.

A demo account can also act as a training ground for newbies. Here, they can apply what they have learned or even learn a new thing or two. Professionals also use this to test out their theories or strategies to prepare themselves for their next live trade better.

Demo accounts come equipped with virtual funds that you can use. The amount of virtual funds depends on the broker. Some brokers have a 30-day trial period. Others don’t. Some also give you the option to replenish your funds once you’ve lost them.

Deposits – How to deposit money

Before you decide on which broker to partner up with, make sure you familiarize yourself with their minimum deposits as well as the required amount for each account type if there’s more than one. The deposit process is also quite easy since you can do it from the broker’s platform.

Multiple payment methods are also supported to ensure that you can easily add funds to your account without delay. These methods range from credit cards (Visa and MasterCard), wire transfers, and online wallets like PayPal, Neteller, Skrill, and many more. Usually, there are no deposit fees charged by the broker. But it wouldn’t hurt to double-check to prevent any misunderstanding.

Popular deposit and withdrawal methods:

- Bankwire

- Credit Cards

- Debit Cards

- PayPal

- Electronic Wallets (Skrill, Neteller, ADVCash, and more)

- Cryptocurrencies

Withdrawals – how to withdraw money

The payment methods offered by your broker also double as a withdrawal method. To withdraw funds, you will need to send in a request via your broker’s platform, and they will need to verify your proof of address and ID.

Withdrawals usually take an hour to process, but it can take a couple of days before it reflects on your account, depending on your broker. Also, keep in mind that there may be withdrawal fees when you opt to withdraw your funds using a credit card. Again, double-check to avoid any problems in the future.

Fees for an online trading account

When it comes to fees, it varies depending on the broker; below a list of possible charges will be provided. But make sure that there are no registration or hidden fees. All the brokers listed above are transparent about their charges, and you can easily access their terms and conditions via their websites.

- Account opening charge

- Account maintenance charge

- Custodial fees

- Transaction fees

Account opening charge

Many trading brokers charge a nominal account opening charge, but some brokers don’t charge any fee. Trading firms that charge these fees also levy the charge when a trader reopens their account.

Account maintenance charge

Trading brokers take a small account maintenance charge from their registered traders, which needs to be paid in advance. The account maintenance fee for each broker is different.

Custodial fees

Some trading brokers charge custodial fees every month. Companies that have already paid one-time charges to the depository don’t have to pay any custodial fees for ISIN.

Transaction fees

Lastly, trading brokers charge transaction fees on a monthly basis for buying and selling assets through the trading platform. Some brokers charge a flat fee for each transaction but some charge a % based on the value of the transaction. Depending on the type of transaction, the trading fees can differ.

Conclusion about 5 best online trading accounts in comparison

Each of the brokers listed above has its own pros and cons. Depending on how you see things, what you consider to be a good perk may be a deal-breaker for other traders.

The information above about 5 best online brokers will help you make an informed decision when it comes to choosing which broker to partner with for your online trading journey. However, you should do your own research as well and check out each of their websites before you make a decision.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about Online Trading accounts:

Is online trading safe?

This depends on the broker you choose to partner with. Make sure to double-check if any of the well-known regulatory companies regulate that broker. Also, the website of said broker should be SSL Certified to ensure that all your personal data, bank details, and log-in credentials are safe from unwanted third parties like hackers.

When trading online, there are always risks involved. So to avoid huge losses, do your research, get a second opinion, practice, and only invest what you can afford to lose.

Can I open a trading account online?

Of course! Opening an account is very easy, and it usually doesn’t take more than a minute. The verification process for some brokers is also straightforward to ensure that you can start trading with them as soon as possible.

Can I start trading with $100?

You can definitely start trading with only $100 if you partner with the right broker. Most brokers require a minimum deposit of $200, but if you do your research and look hard enough, you’ll find companies that only require at least $50 to $100 as your initial deposit.

What is an online trading account?

An online trading account is one that allows you to trade online. Traders can conduct online trading with the help of an online trading account. Several online brokers or trading platforms allow traders to use online trading accounts.

How to use an online trading account?

A trader can use an online trading account to place an online trade. However, a trader must sign up for an online trading account. Several brokers operate to offer traders a platform where they can sign up for an online trading account. After filling in relevant details, a trader can easily use the trading account to place trades. They can search for the underlying assets on the trading platform.

How can I fund my online trading account?

The broker with which you sign up for an online trading account allows you to fund your trading account. They offer you several payment methods that you can use. You can use bank transfers, cryptocurrency, etc., to fund it.

What is an online trading account’s benefit?

The benefit of an online trading account is that it allows you to trade online. Besides, it allows access to underlying assets in different trading markets. So, it offers you an income source where you can generate profits.

See our other articles about online trading:

Last Updated on September 2, 2024 by Andre Witzel

(5 / 5)

(5 / 5)