Score Priority review and test – Scam or not?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.3 / 5) (4.3 / 5) | FINRA | $1000 | Stocks, Options and ETFs | Unknown |

Just2Trade is dead. Or rather, it has been rebranded as Score Priority. The rebranding took place in January 2020, but that’s all that changed. It’s still the same global online trading broker that it has always been.

For the sake of clarity, we won’t use its old moniker but stick throughout with its correct name of Score Priority (SPC).

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

What is Score Priority?

Score Priority is a mature platform that’s ditched its funky 90s-echoing name in part due to a desire to attract new institutional customers.

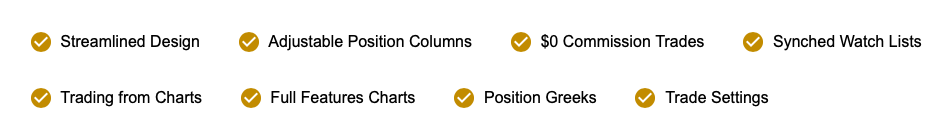

It is US-focused but does accept international customers. There are, however, different criteria and rules that apply to overseas clients. On Score Priority, you can trade US stocks, options, ETFs, futures, equities, commodities, bonds, and mutual funds. Commission-free trading is available, but only through the Score Priority Trading Platform. Otherwise, you operate on a per-trade basis.

Though zero commission trading is possible, there are exclusions you should note. It does not apply during extended trading hours or to Pink Sheets and the OTC Bulletin Board. Other fees may also apply, so commission-free comes with several asterisks attached. While aimed at retail traders and day traders, Score Priority offers a package of propositions for institutional clients. This is separate from the main Score Priority website and sits on Lime, a Score Priority division that offers institutional services and products. You won’t be confused as the institutional portal is lime-colored, predictably enough.

However, both retail and institutional customers are onboarded using the same registration form. You are also unlikely to mistake the websites either. The retail site looks quite dated and clunky compared to the contemporary and fresh modern design of the Lime website. It is not only better, but it’s also much easier to navigate and find information.

Even if you are a retail customer, you should take a nose around in the Lime site. The institutional site can be accessed from the banner on the Priority Score home page header or via the carousel.

If you don’t, you won’t stumble upon the Priority blog, which is packed with valuable tips and guides for retail customers. Strangely, there’s no direct link from the Score Priority site; you can only get into the blog from the Lime site for reasons that are not evident.

The main topic categories in the blog are:

- Market Trends

- Trading Lifestyle

- Trading Strategy and Insight

- SPC News and Media

Regulation and safety of Score Priority

Score Priority’s regulator is FINRA, the Financial Industry Regulatory Authority, which also issues its registration.

As a broker, Score Priority is licensed to operate in all 50 US states, plus DC, Puerto Rico, and the US Virgin Islands. Score Priority is also registered as a member of a couple of well-respected industry bodies.

They are signed up with the Securities Investor Protection Corporation. This is an organization that protects investors against their brokerage company going bust. The other trade body of which Score Priority is a member is the National Futures Association. Membership of these two industry organizations gives your investments, personal data, and accounts an extra layer of protection.

Is there negative balance protection?

No. But Score Priority goes on at length in their risk disclosure documentation about the risks involved. They point out, quite rightly, that a stop loss and other contingent orders are not enough to limit losses. Score Priority also points out market conditions, network traffic, and technology malfunctions could lead to losses. They warn, too, that leverage or margin can amplify losses as well as gains. Adding that in addition to losing all their funds, clients can easily incur losses beyond their initial investment for which they would be responsible.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

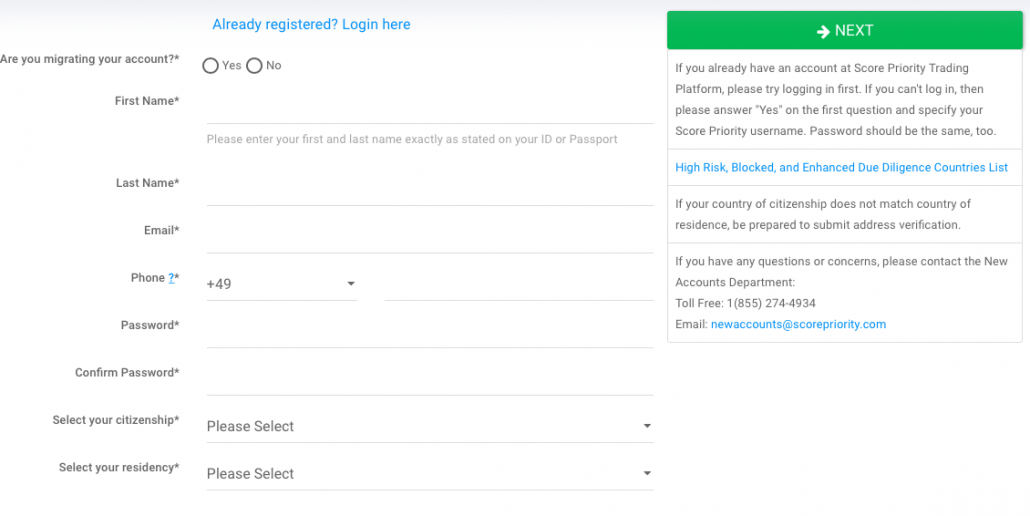

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) How to tradeAs mentioned, Score Priority is not in any way set up for novice traders. There’s no social trading. And there are precious few educational resources bar the blog on the Lime site. Score Priority clearly is focused on experienced traders who wish to up their game and become more active. The rebranding in 2020 was without a doubt about seeing the company repositioning itself and seeking out intermediate and experienced traders. If you enjoy the demo account and wish to press on with Score Priority, you would be well advised to seek further alternative learning and training resources. There’s not much to get your teeth into on Score Priority. Given the financial markets’ volatility having the best possible grounding before you start trading is the best way to prevent disaster. How to open an accountTo register with Score Priority, click or tap on the Open Account button on the home page of scorepriority.com. Or any of the other Open An Account buttons that pepper the website. Your name should be that which appears in your passport. If you encounter problems with the registration process or have any questions, you can email [email protected] for help. If you are either a permanent resident or a citizen of the USA, you will be asked to declare whether you have an Individual Taxpayer Identification Number or a Social Security Number. If you have neither an ITIN nor an SSN, basically anyone living outside the US, you will be obliged to provide additional documentation and meet specific other criteria.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) If you are employed or self-employed, you will need to:

If you are retired, a student, or unemployed, you will need to:

The documents required to prove employment or income include:

The next step is to choose your account type. The widest choice is for customers based in the US. There’s a vast range of account types for US clients:

If you select other, the options are:

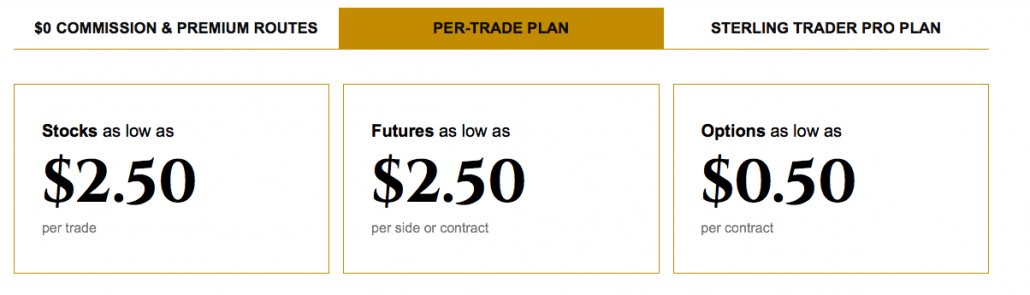

When you complete the form and all the selections, click “Next“. Depending on your selections, etc., you will face several more screens’ worth of form-filling. A US citizen looking for a joint entirety account has the pleasure of completing six more tabs of forms to reach the end of the quest. If Score Priority’s registration process is anything, it’s thorough. However, you do come away with the feeling it could be drastically streamlined and some other information completed later once you finally get on the platform. As onboarding goes, it’s a dreary trudge to the end. However, if you are curious enough to go searching, you will strike gold in the FAQs. Predictably, the link to the FAQs is buried in the bottom menu of the home page. But here’s the link to the FAQ section to save you time. You are, though, probably going to be underwhelmed by the one-sentence answers and the clickathon that’s involved. So zero points for presentation. Per trade planThis plan is the basic Score Priority pricing structure. On Score Priority Plus, the commission is $2.50 per trade.

Options account – per trade planHere are the facts:

The account facts at a glance:

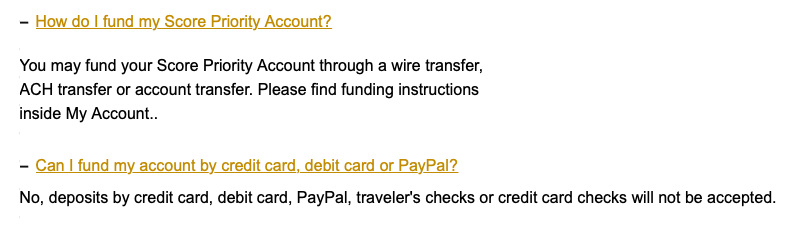

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Deposit and withdrawalsThere are various ways to fund your Score Priority account. And some methods that are not accepted. Acceptable payment methods include:

Not accepted, and some will surprise you, are:

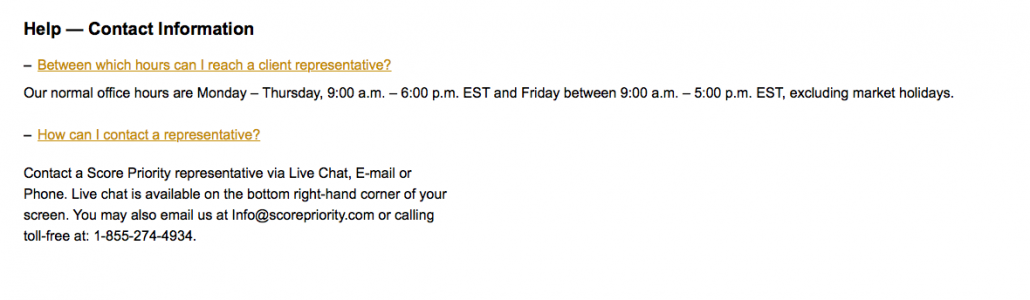

So if you are not a US resident, your pay in methods are limited. However, if you are interested in ACH, which stands for Automated Clearing House, an electronic financial network used in the USA. Once your bank account has been okayed and linked to your Score Priority account, you can transfer funds between them without any charge. However, ACH is currently not available for IRA accounts. It takes around five to seven days to activate ACH on your account, with fund transfers taking two to three business days. Regular US domestic wire transfers typically take up to 24 hours to reach your account. Overseas bank wire transfers can take up to 48 hours to clear. Withdrawals are via the method you used to pay in. In the case of ACH, you can withdraw deposits via ACH ten business days following the initial deposit. There is a $100 ACH minimum on deposits and withdrawals. Support and serviceIf there’s one thing Score Priority excels in, it’s its contact ability. You can raise customer support using the following:

You can also use good old-fashioned email ([email protected]) and the telephone. There’s toll-free calling to 1-855-274-4934. The domestic US phone number is +1 646 558-3232. Live Chat and the other instant messaging platforms can be summoned via the floating menu panel at the bottom of your screen. You can reach a Score Priority contact person:

There’s no support during normal market holidays. For overseas clients, EST is five hours behind GMT during the winter months and four hours behind when the clocks go forward for the summer. Their postal address is One Penn Plaza, New York, NY 10119. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Accepted countries and forbidden countriesAs Score Priority is US-based, it has to comply with strict federal regulations. It, therefore, does not do business with residents of the following countries:

Score Priority also exercises extra caution and additional due diligence for clients in the following countries:

If you are not on this either list, such as the UK, the United States, the European Union, etc., you are good to go. Special offersThere are no special offers per se with Score Priority. Indeed, there are no deposit or trading bonuses, promotions, or special offers of any kind. None of the incentives you can sometimes pick up with brokers registered and licensed in offshore jurisdictions. But the net is closing on promotional offers everywhere else. Today, these types of offers are becoming the exception increasingly. However, there are a few perks with Score Priority. You can go paperless and sign up for digital soft copies of statements and trade confirmations. You can arrange this by logging on to the client portal, then going Statements/Statements & Confirmations. Check three or more of the options, then Save. However, you will still receive some mail as certain information has to be delivered as a hard copy. Typically, this will include interest rate changes, shareholder information, and tax-related notifications. These are sent free of charge. Similarly, there are no charges for mailing out proxy, regulatory, or corporate action communications. Conclusion of the review: Should I invest with Score Priority? – We think, yes!Score Priority is very much US-centric and geared up to dealing with US residents. International clients are accepted, but the restrictions and hoops you have to jump through you may find challenging. Unless you specifically want to use Score Priority to trade in the US markets, there are probably better options for overseas traders. That said, Score Priority is upfront and clear-cut about its fees and commissions. The only other misgiving is over the trading platform. There are few features to get in the way, but advanced traders may find it a little lacking. Particularly so if they were weaned on MT 4 and 5. So is Score Priority a scam? We think, no. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) FAQ – The most asked questions about ScorePriority:Is Score Priority legit and safe?While Score Priority is registered by FINRA, this regulatory body lacks the reputation of more respectable financial supervising entities. We also noted some negative reviews from clients online regarding the reliability of an offshore site. Before you sign up with Score Priority, make sure you understand the implications of getting in business with an unregistered online broker. What can I trade at Score Priority?Clients can trade stocks, options, and ETFs. What is the minimum deposit amount at Score Priority?If you are employed or self-employed, you will need to: If you are retired, a student, or unemployed, you will need to: Is Lime Financial related to ScorePriority?Lime Financial is the new corporate brand of Score Priority. It provides a comprehensive array of consulting, trading and fintech products to a diverse set of traders, investors, and developers. Clients of Lime can trade stocks, futures, and options, including multi-leg options. Improved accessibility is made possible through Lime Trader, an original web-based platform, a smartphone application, third-party client interfaces, and application programming protocols. What is the Score Priority Dashboard like?The dashboard of Score Priority contains market news, portfolio holdings, and market sectors. If you are an investor, you can also set up your list of favorite stocks to follow to further customize your experience. You can use both your desktop and mobile to log in to Score Priority, so it becomes easy to check your trading details anytime, anywhere. While there are various methods to configure the dashboard for stocks, there are presently no choices for adding screeners for ETFs, mutual funds, options, or fixed income. How flexible is the trading experience at ScorePriority?You can customize your trading dashboard using notifications, alerts, screeners, and favorites that make your trading at Score priority easy. The primary trading interface makes it simple to place a market order, limit order, or conditional order. There is also a fantastic trade from chart function, and you can use your mouse to change the one-cancels-the-other (OCO) pricing. Learn more about brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/SCORE-Priority-Logo.png 72 255 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-03-22 19:52:542023-01-27 20:03:40Score Priority |