3 best TradingView brokers in India – Comparison & test

Table of Contents

Through this article, we’re about to elaborate on and discuss the three best TradingView brokers in India. But to do it effectively, we need to compare these three varied brokers for your benefit. We’ll be delving deeper and researching the basic features that can’t be overlooked, such as the fee structure, the security, and the other relevant features worth mentioning. As we go ahead and discuss this topic further, you’ll be able to realize and make intelligent decisions on choosing the broker you want to go for.

Here, in this article, we’ll compare and analyze the three brokers: Vantage Markets, Pepperstone, and BlackBull Markets, when you are curious about taking that baby step and initiating your journey with trading. You must remember that when you are comparing and testing the brokers that we have shortlisted for you for trading crypto pairings, you must go through the criteria and the requirements that serve your personal purpose. These criteria can be completely different and unique depending on your specific needs. Hence, never compare your choices with someone else, for every need is different and unique.

See the list of the 3 best TradingView brokers in India:

Tradingview Broker: | Review: | Regulation: | TradingView: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. Vantage Markets | Regulated by the CIMA & ASIC | Get all versions for free and trade via TradingView and the ProTrader | # Regulated and safe # Real ECN trading # Fast order execution # No hidden fees # Free bonus available | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

2. BlackBull Markets  | Regulated by the FSPR, FSCL | Get pro for free and trade via TradingView | # 24-hour support # No hidden fees # Free demo account # 100+ different markets # Excellent liquidity | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

3. Pepperstone | Regulated by the FCA, ASIC, DSFA & SCB | Trade via TradingView | # Award-winning broker # Excellent client support # Competitive spreads # Advanced tools # Free demo account for 30 days | Live account from $ 200 (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

3 best TradingView brokers in India

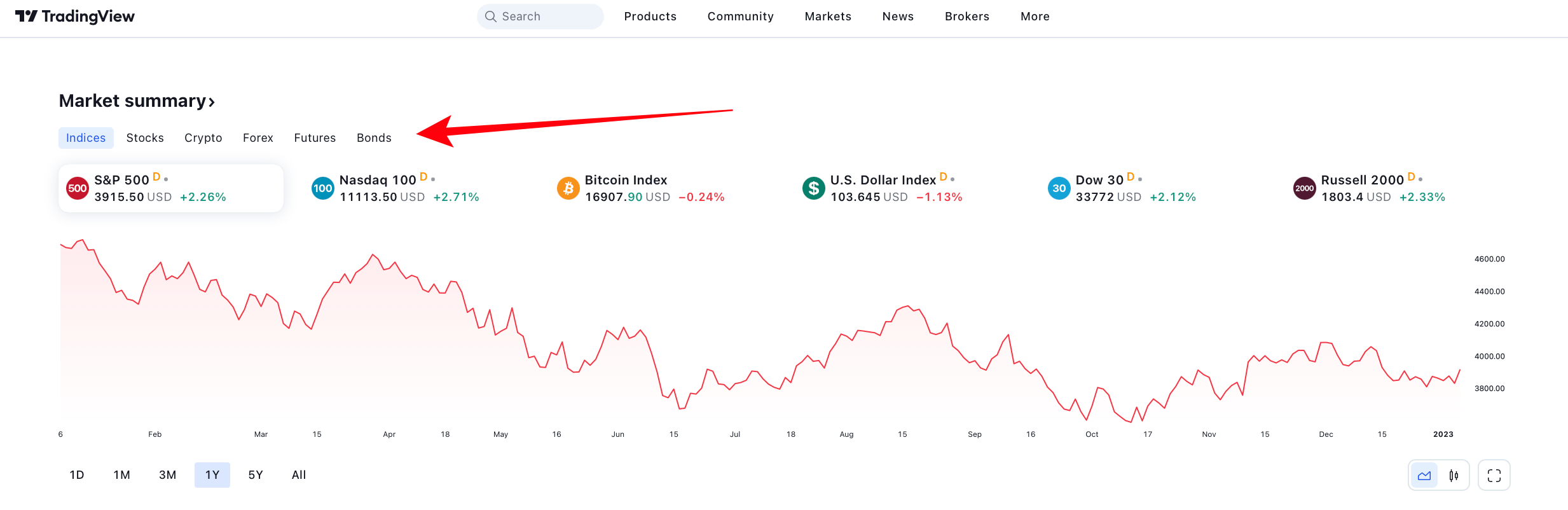

TradingView is one such place that is a web-based charting platform where you can benefit yourself through the various offers that the platform provides to traders in the form of features such as technical analysis. For instance, when registering with TradingView, you can design charts and analyze crypto pairs. Also, in certain situations, you can place your orders directly.

Besides that, it popularly serves as a social network for traders and investors. Through this super effective platform, the traders and the investors can speedily connect to the other trading competitors.

We can talk about brokers available in India; we must get that the broker’s sole purpose is to serve as an intermediary and connect the traders to the platforms where the trading generally takes place. Particularly mentionable is the market. Thus, giving traders quick and instant access to the crypto world. In the world of trading, there are multiple options for expansion, growth, and major profits. If you look deeper, you’ll realize that various crypto brokers are available all over India. But when deciding to go with a particular broker, certain facts must be considered.

After a deep analysis and considering the various facts and features, we’ve top-picked the best three TradingView brokers available in India to lay your trust in for buying and selling various assets.

The list of the 3 best TradingView brokers in India includes:

- Vantage Markets – Trade with $0 commission

- BlackBull Markets – 26000+ assets available

- Pepperstone – Rated #1 for client satisfaction

Now, let us have a look at the brokers in detail.

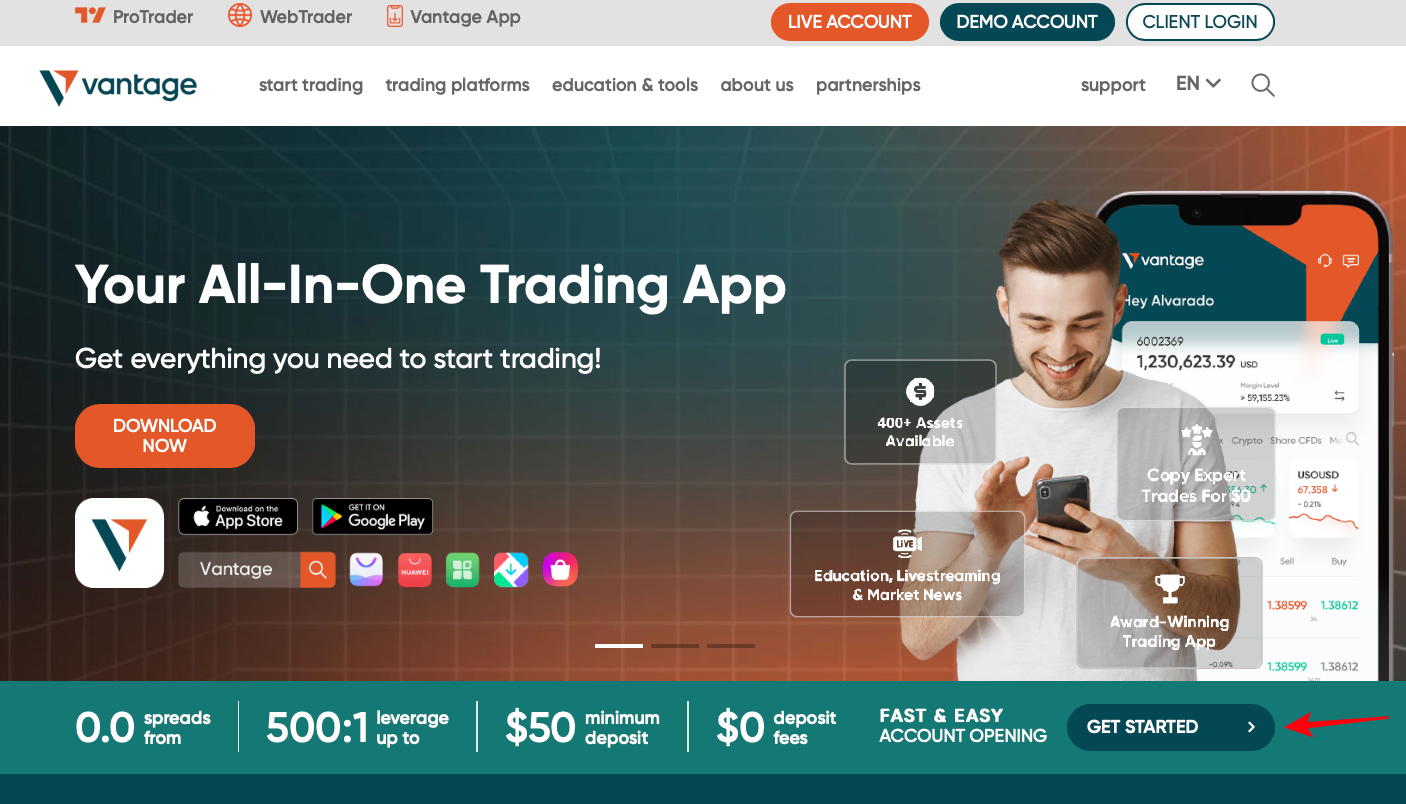

1. Vantage Markets – Trade with $0 commission

Vantage Markets is one of the leading brokers that are available in India. It is one such platform where you can avail of a stress-free trading experience to enhance your trading experience and capitalize on your market opportunities. This award-winning platform has experience of more than 10 years, and it has been providing uninterrupted services ever since. It has benefitted both the traders as well as the entire trading ecosystem.

This section will further analyze the platform’s various trading tools, instruments, multiple accounts, and other options. And help you make intelligent decisions if you should go ahead with Vantage market brokers.

Let’s elaborate on some of the benefits that Vantage Market can provide:

- The traders can easily make use of TradingView via the Vantage Markets Pro Trader

- The serviceability of the platform is provided 24/7

- More than 500 different instruments are available here on this platform.

- Over 40 various cryptocurrencies are offered to the trades as well as the investors.

- This platform is supported in about 172 countries

- The spreads and fees of Vantage Markets from 0.0 pips

- The leverage is quite high. It is up to 1:500 available

- There are distinct as well as unique features such as demo account trading, and various other features.

- A unique feature, a Swap-free or Islamic account, is also provided to the customer.

(Risk warning: Your capital can be at risk)

2. BlackBull Markets – 26000+ assets available

BlackBull Markets is a basic MetaTrader broker with an expanding product offering and compatibility for a few third-party social copy trading sites. BlackBull Markets has 281 tradeable symbols, which is around average for the industry.

BlackBull Markets is primarily a MetaTrader broker, with the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform suites available for desktop and online trading.

BlackBull Markets is rated moderate risk, having a Trust Score of 74 out of 99. New Zealand’s Financial Markets Authority has approved BlackBull Markets for trading assets.

(Risk warning: Your capital can be at risk)

3. Pepperstone – Rated #1 for client satisfaction

Pepperstone has always provided traders with an ever-expanding range of tradable markets, high-quality research, and an excellent guide for varied social copy trading platforms; with the help of these, traders can excel in trading.

This platform provides both MetaTrader along with cTrader. Other than that, it also provides a diverse as well as a unique range of applications. Indians looking for a low-cost and reliable NDD broker with proper training, reasonable selection of trading instruments, and market analysis must try Pepperstone at least once in their life.

Some of the features of a Pepperstone broker account are:

- No minimum deposit on Pepperstone is needed to start trading, and costs are included in the EUR/USD spreads, which average 0.77 pip.

- Pepperstone provides a swap-free account for customers who cannot pay interest, which mostly involves inhabitants of Muslim-majority countries.

- You will have to give an administration cost rather than a nightly swap fee for deals that have been open for more than 10 days.

- Pepperstone religiously takes care of all the Anti-Money Laundering regulations and rules.

- Pepperstone offers cost-free deposit and withdrawal options, but it charges a fee of USD 20 for international bank transfers and USD 1 for withdrawals made using Skrill or Neteller.

- Despite the need for more information surrounding financing sources and prices, Pepperstone frequently does not charge deposit or withdrawal fees.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

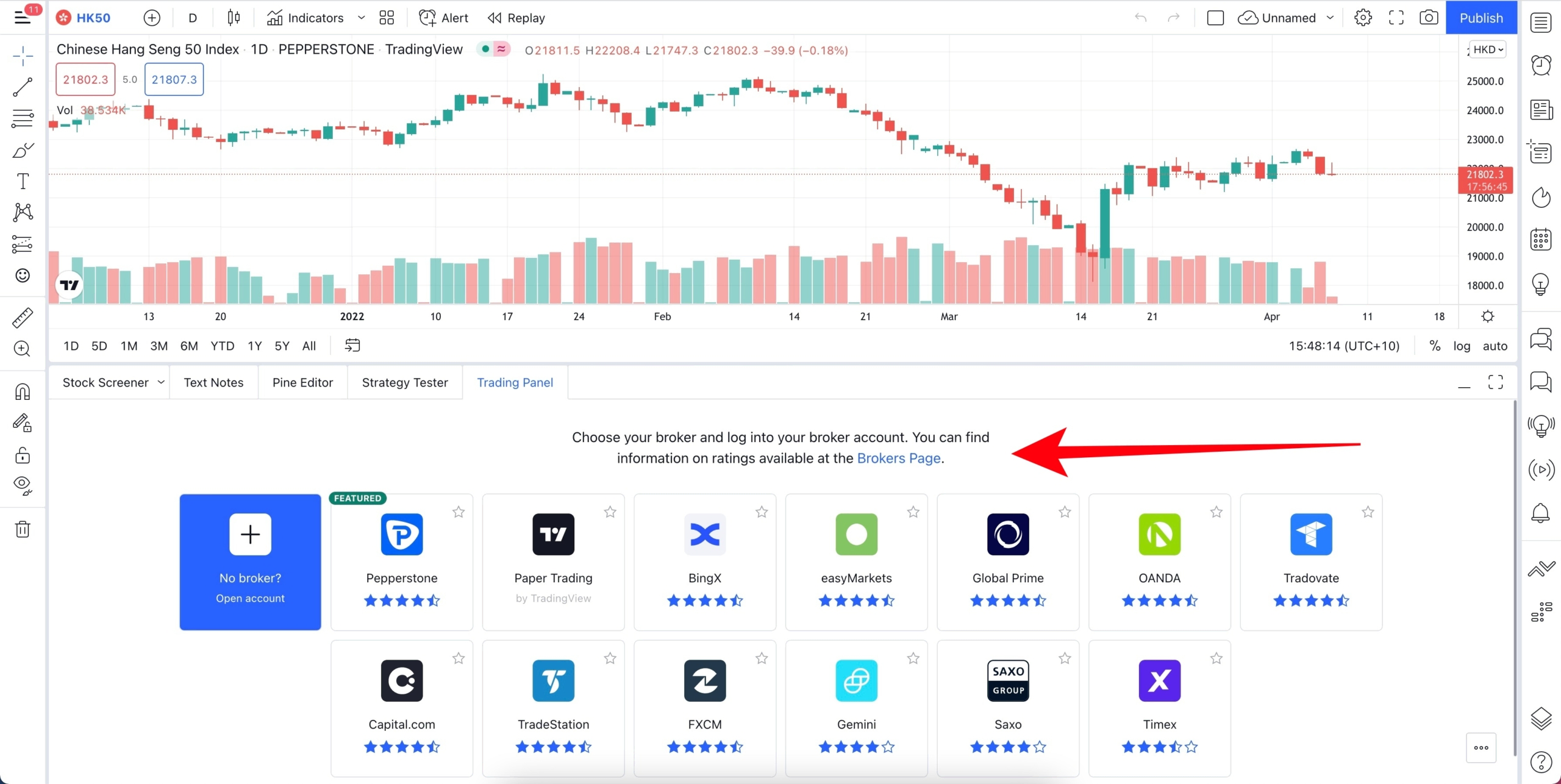

How to connect with brokers in India with TradingView

To connect with the Tradingview brokers in India, you must create a brokerage account. Once your account is created, here are a few steps to proceed:

- Start with a Tradingview demo account, and once you have learned trading and how to use the tools of Tradingview, go for a paid option.

- Open a TradingView Pro Account because it will provide you with all the perks needed for seamless trading, especially the fast data flow that is very important for fast real-time data.

- Next, open the trading view chart window and select the trading panel tab on the page’s bottom.

- You can expand your trading panel window and check all the broker options available.

- Click on the brokerage platform you already have an account on and click “connect.”

- Log in to your brokerage platform using your username and password. A green light will be visible after successfully logging in. Your account balance, orders, open positions, account summary, history, and all other details will be visible there.

- Minimize the order window and start trading live using your broker account in Tradingview.

Sign up for a trading account

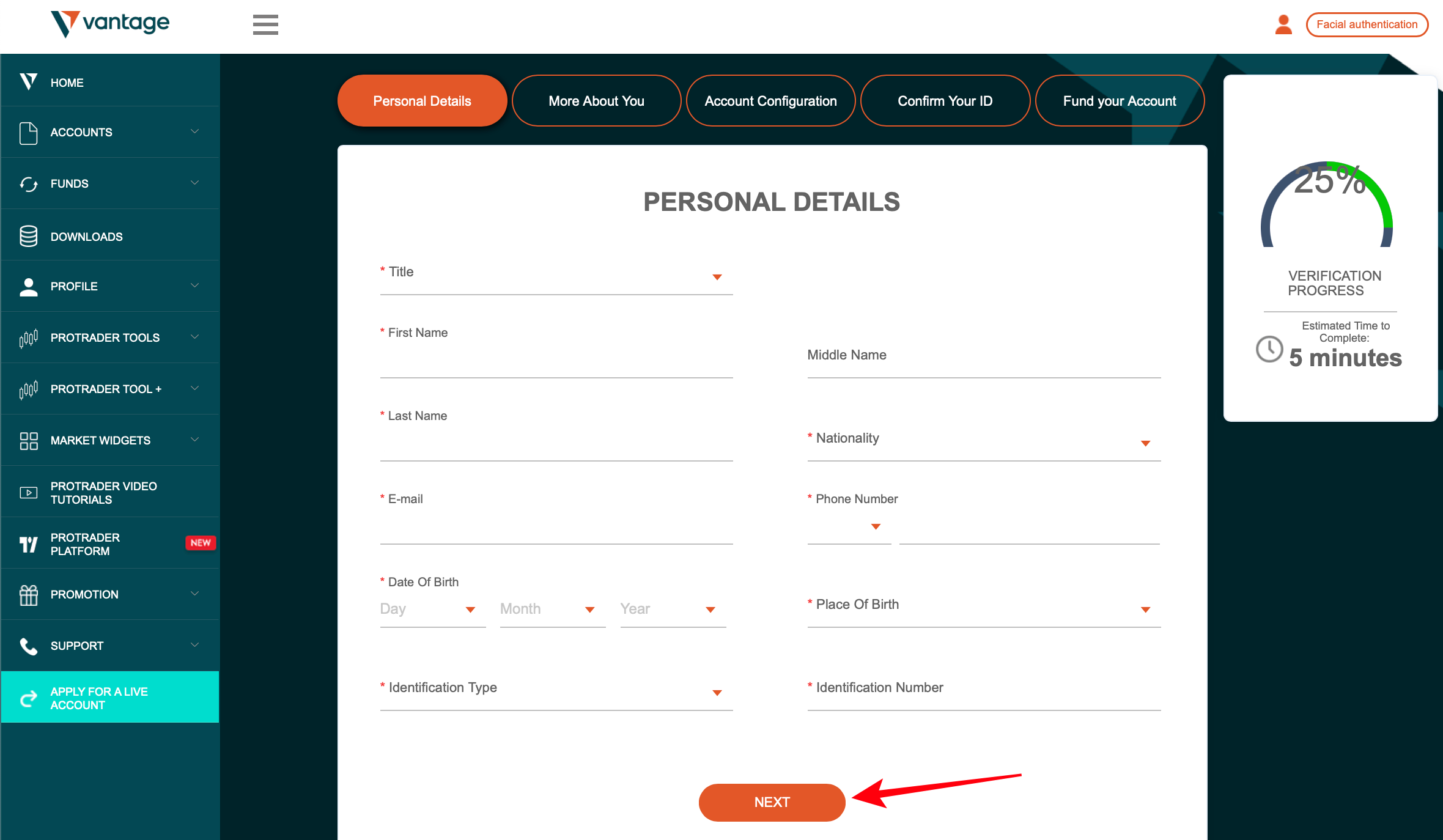

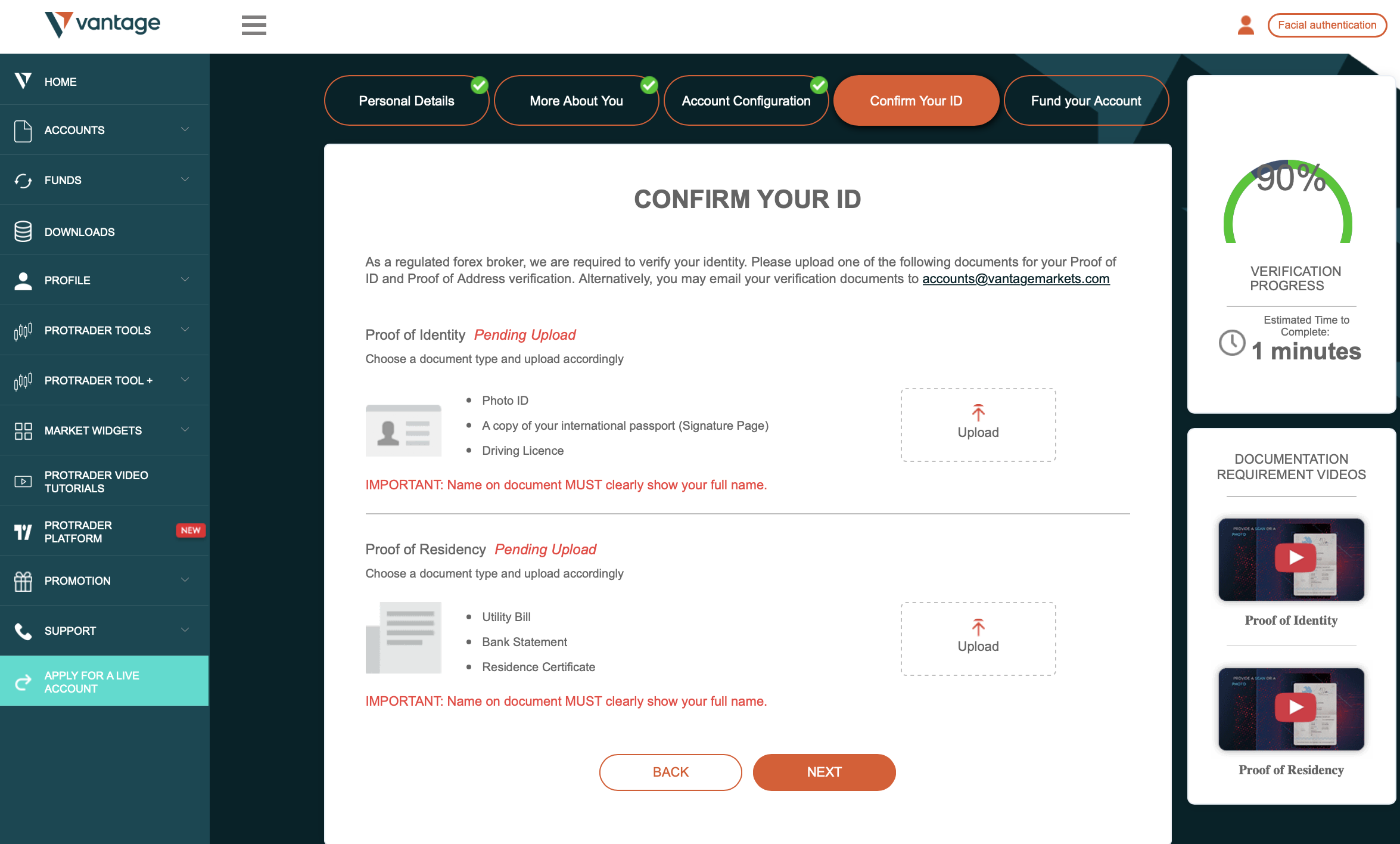

A stockbroker can give you a Demat and Trading Account to trade in the stock market. Still, you must first submit your information and complete the relevant procedures as the regulatory authorities need. The process of opening an online trading account begins with research to identify a reputable stockbroker. Here are the steps to sign up for a trading account.

(Risk warning: Your capital can be at risk)

#1 Choosing the stock broker

Two types of stock brokers are available- traditional and discount brokers. Choose any one from them.

#2 Compare the rates

Traditional brokers will provide you with a trading account and extra services such as advising, suggestions, and research reports. Because of the additional services, the brokerage on your trading transactions will be greater. Discount brokers give you a trading account and access to basic tools you may use to make your own trading decisions. Therefore, discount brokers charge less than traditional brokers.

#3 Contact the selected broker

You can contact the broker online and check their years of experience, services, costs, and all other details.

#4 Fill out the KYC and account opening form

If you live in India, you need to fill up an online account opening form with the help of Bajaj Financial Securities. Also, upload the KYC details for identity proof, address, photo, and signature. You must also submit basic bank details, including a canceled cheque.

#5 Verification

Your online account opening form will be reviewed and verified by the verification team from the broker’s end. If any discrepancies are found, your application can be rejected.

#6 Trading Account Details

Once verified, a confirmation mail will be sent along with the login credentials. After opening your account, details like the live share price, watchlist, and buy shares options will be available. Before starting trading, deposit the minimum amount to your trading account.

#7 Place Buy or Sell Order

When you login into your account, the stockbroker will send you a Power of Attorney document. Send the completed paperwork to the broker before beginning to trade. This allows the broker to deduct shares from your account whenever you place a sell order.

(Risk warning: Your capital can be at risk)

How to trade on TradingView with a broker in India

When your brokerage becomes available on the TradingView Web Platform, TradingView customers may log into their brokerage accounts (or create new ones if necessary), get streaming data from the broker, and place orders straight to the broker.

TradingView provides partners with access to one of the world’s top audiences and a pay-by-performance inventory that allows them to expand based on their success. Integrated trading partners will be granted prominence in the Top Brokers area of TradingView and access to premium marketing inventory.

TradingView key facts

- TradingView’s most notable feature and benefit is its enormous community of traders who actively share and participate with each other’s material. The community creates custom indicators, shares trading ideas as static charts or movies, and hosts live trading sessions and commentary as either static charts or films.

- TradingView also allows you to set up numerous customizable market notifications, so you are always up to date on what is happening in the markets.

- Although its social network for traders is exciting and innovative, its trading and analysis environment is not only as feature-rich as the competition. Still, it offers more than other trading platforms, such as 12 Chart Types, bar replay, user-defined timeframes, and visibility of 8 charts per browser tab.

- TradingView’s social trading network and trading environment also allow you to test your methods, Paper trading, and trading directly from the chart Access a wide range of analytical tools and integrated chat features.

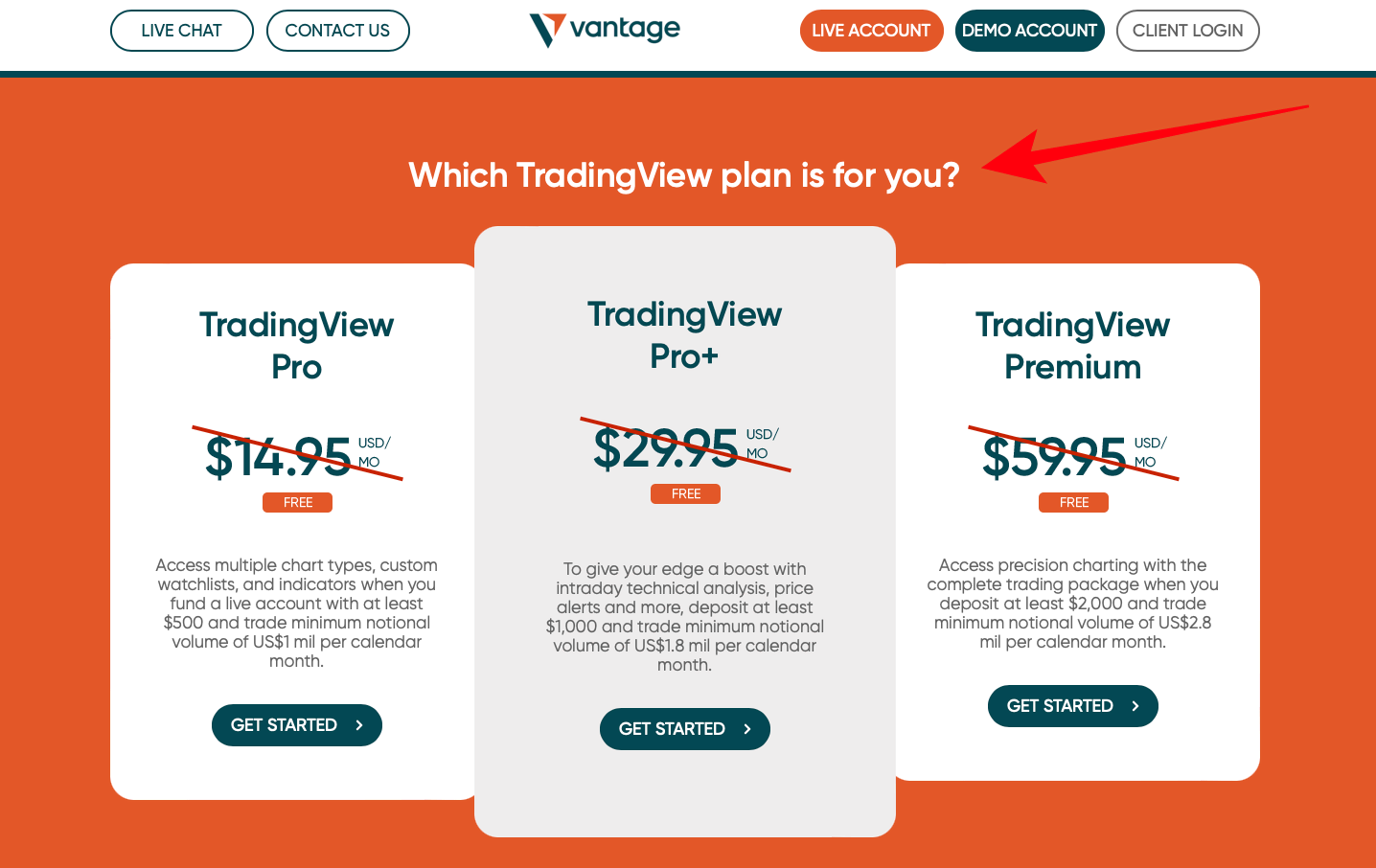

Fees and costs

Tradingview is free up to some level which is sufficient for beginners. However, its paid plans range from $14 to $60 per month. You can also choose the annual subscriptions for the paid plans ranging from $155 to $600 per year.

If you choose the yearly subscription, you get a discount of 16% overall, which means you will get up to two months of the free subscription in the paid yearly plans compared to the monthly plans.

Keep in mind that the subscription fees listed are based on retail pricing. The TradingView review begins with a thorough breakdown of how to cut the price by up to 50%.

Available assets to trade

Subscription to Tradingview will allow you to trade with a wide variety of assets which will help you diversify and balance your trade with better instruments.

Some of the popular assets available in Tradingview are:

- Stocks are available in many industries, including pharmaceuticals, technology, social media, EVs, luxury brands, etc., and the stock selection includes many popular brands like Microsoft, Tesla, Amazon, etc.

- Cryptocurrencies- in the past and even before. Bitcoin, Ethereum, Ripple, and other cryptocurrencies fundamentally transformed trading, providing incredibly active instruments that sometimes moved more in a single day than conventional markets moved in months or even years.

- Indices- Indices are more stable than other securities since they represent a group of equities that average out individual stock volatility within that collection.

- Energy And Agricultural Commodities- Commodities such as maize, wheat, sugar, oil, and natural gas were among the first items traded on futures markets. They may be an interesting addition to any trading strategy or portfolio.

- Precious Metals- Gold and silver are often regarded as safe-haven investments. Supply and demand and industrial output determine the prices of industrial metals such as copper, palladium, and platinum.

- Forex- Forex is the most popular trading option after cryptocurrencies because of its incredible features, like the availability of news, currency linkages, and economic calendar events.

Conclusion – There are great TradingView brokers in India

Now that you know everything about all the top three Tradingview brokers in India, you should choose your broker on TradingView wisely. All the other information about trading in Tradingview has been made available for your convenience if you are a beginner. So, while choosing a broker, always compare and test the brokers shortlisted in this article and check which one surpasses your criteria for trading.

(Risk warning: Your capital can be at risk)

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)