4 best Bitcoin trading demo accounts in comparison

Table of Contents

The popular cryptocurrency, Bitcoin, has been gaining popularity through the years. Naturally, people think of investing in the said crypto, but the problem for most is they don’t know how or where to start.

In this review, you will be presented with the 4 best Bitcoin trading demo accounts that you can practice on. You will also gain more knowledge on how to trade this famous cryptocurrency properly.

See the list of the 4 best Bitcoin trading demo accounts:

Bitcoin Broker: | Review: | demo account: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. IQ Option | Yes, free | Starting from 0.0 pips | 300+ | + Free and unlimited demo account + Very good and reliable trading platform + 24/7 support + More than 300 different markets | Free demo account(Risk warning: Your capital might be at risk.) | |

2. Capital.com | Yes, free | Starting from 0.5 pips | 3,000+ | + Low spreads and no commissions + Professional trading platform + Mobile app + Personal support + Huge variety of educational material | Free demo account(Risk warning: Your capital might be at risk) | |

3. Libertex | Yes, free | Starting from 0.0 pips | 250+ | + Available in over eight languages + Multifunctional and user-friendly platform + The minimum deposit is € 100 + No deposit fees and reasonable trading fees | Free demo account(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) | |

4. Binance | Yes, free | Starting from 0.0 pips | 500+ | + High security + Beginner-friendly + Easy to create an account + Mobile app + Fast support | Free demo account(Risk warning: Your capital might be at risk) |

The list of the 5 best Bitcoin trading demo accounts includes:

- IQ Option – Regulated European company

- Capital.com – Huge variety of educational material

- Libertex – Multifunctional and user-friendly platform

- Binance – Beginner-friendly

#1: IQ Option

IQ Option is a broker that was established in 2013 and has since been improving and extending its global presence. To date, this broker has over 48 million registered clients and has a trading volume of 1.3 million per month.

This specific broker has its own trading platform that is specifically designed for IQ Option clients. What makes this platform so unique is the number of advanced trading tools that clients can use to their own advantage. Examples of these popular technical indicators are RSI, MACD, Bollinger Bands, and Moving averages. IQ Option’s trading platform is also available on mobile devices. You can download it from the Google Play Store or Apple App store.

Here, you can practice trading Bitcoin with a virtual fund of $1,000. This will help you hone your skills and devise new strategies for trading this popular cryptocurrency without taking cash out of your wallet. To sign up for a demo account, you can link your Facebook or Google account. You may also register by filling out the form. It will ask for your complete name, country of residence, contact number, email address, and password.

IQ Option is also somewhat proud of its customer support service. Customer service representatives are available round the clock to ensure smooth transactions and executions for their clients. You can contact them via email or live chat on Facebook, Telegram, Twitter, and Instagram. Below is a list of telephone numbers with their corresponding supported country.

IQ Option’s website supports 22 languages. These are English, Russian, German, Chinese, Spanish, Portuguese, Indonesian, Arabic, Turkish, Italian, Korean, French, Thai, Vietnamese, Malay, Afrikaans, Azerbaijani, Hindi, Dutch, Tamil, Zulu, and Urdu.

IQ Option accepts traders from most countries except Ireland, the Czech Republic, the United Kingdom, Portugal, Spain, Romania, Netherlands, Italy, Germany, Canada, Australia, the Russian Federation, Belgium, Turkey, Israel, Japan, and the United States of America.

(Risk warning: Your capital might be at risk.)

#2: Capital.com – Huge variety of educational material

Capital.com is a Forex and CFD Broker platform where users can trade CFDs on the basis of cryptocurrencies, foreign exchange, forex, where you can trade real stocks and stock CFDs, and also different kinds of markets. Capital.com was founded in 2016 and is authorized and regulated by the CySEC, FCA, ASIC, and FSA. Its users can trade on more than 6,000+ different financial CFD instruments. It provides its users and traders to learn at the same time by providing technical analysis and AI-based reviews on their trades.

It has got an immense amount of users within no time due to its simple interface and the dedicated team. It also makes its users aware of the current market potential through its qualified team of economic, political, and psychological experts. This feature of capital.com makes it unique from competitors and helps its users to flourish their growth exponentially.

Apart from providing multiple markets of the world, it also educates its users by giving them video lecture series and providing feedback through the use of artificial intelligence (AI) on their trades. The platform offers a demo account for practice and has a crystal clear deposit and withdrawal process. It has about 285,000 active users. This platform lays great stress on the future bullish markets of electric vehicles and robotics due to the challenges posed by global warming.

Trading conditions are the principal trading terms in CFDs and may include Margin, Spread, offers, Swaps, Initial Margin, Necessary Margin, Normal Market Size, and the minimum level for placing Stop Loss, Take Profit, and Limit Order. Capital.com has clearly mentioned the trading conditions for its users.

Capital.com provides a free demo account or a live trading account with a minimum deposit of $20 by credit card and $250 by wire transfer. Trades are executed by their own developed trading platform. The software is available for browsers, desktops, and mobile devices. More than 6,000+ markets can trade with variable spreads and no commissions. Traders are supported in more than 24 languages. Overall, capital.com has an outstanding offer for new and advanced traders.

- Minimum deposit on Capital.com is $20 by credit card and $ 250 by wire transfer

- Free demo account

- Maximum leverage 1:30 for retail clients

- Personal supporting more than 24 languages

- Professional trading platform for desktop, browser, and app

- A lot of different payment methods

- No hidden fees

- More than 6,000 markets are available via CFD

(Risk warning: 75% of retail CFD accounts lose money)

#3: Libertex – Multifunctional and user-friendly platform

Libertex is a Cyprus-based broker that has been operating since 1997. It is part of Indication Investments Ltd, which is a part of the Libertex Group. To date, this broker has over 2.2 million registered users from 11 countries around the globe.

With more than 20 years of experience, this trustworthy brand has won more than 40 industry awards, including Best Trading Platform of 2020 and many more. To add to its fame, this multi-asset broker is the official trading partner of Tottenham Hotspur, a Premier League team that is one of the top contenders in European football.

With Libertex, you can trade on the MetaTrader 4, MetaTrader 5, or their own Libertex trading platform. Libertex’s platform is entirely web-based, which means you won’t need to download the software in order to start trading with them. Their proprietary platform is also available on mobile devices. You can download it from the Apple App Store, Google Play store, or Huawei AppGallery.

Libertex’s trading platform features fast execution speeds and a number of tools that will help you trade efficiently. It is considered one of the most user-friendly trading platforms available, which makes it perfect for newbie traders.

Signing up for a demo account entitles you to a virtual fund of €50,000 that you can use to practice trading Bitcoin without risking your hard-earned money. You will be trading in a simulated environment that mimics live market conditions.

Opening a demo account won’t take more than a minute. The account registration form will only ask for your email address and your desired password. Remember that when you register, you will own both a live and demo account. However, you won’t be able to access your live account without first depositing money.

You can contact their customer support representatives via email or telephone. You also have the option to contact them via their social media accounts on Facebook or Twitter. The average wait time for a response from them is one hour.

Libertex’s website supports eight languages. These are English, Spanish, Italian, Polish, German, French, Dutch, and Portuguese. This broker accepts traders from Belgium, Bulgaria, Czechia, Denmark, Cyprus, Latvia, Lithuania, Luxembourg, Spain, France, Croatia, Italy, Poland, Portugal, Slovenia, Romania, Hungary, Netherlands, Malta, Austria, Liechtenstein, Iceland, Norway, Finland, Slovakia, Sweden, Estonia, Germany, Ireland, and Greece.

(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.)

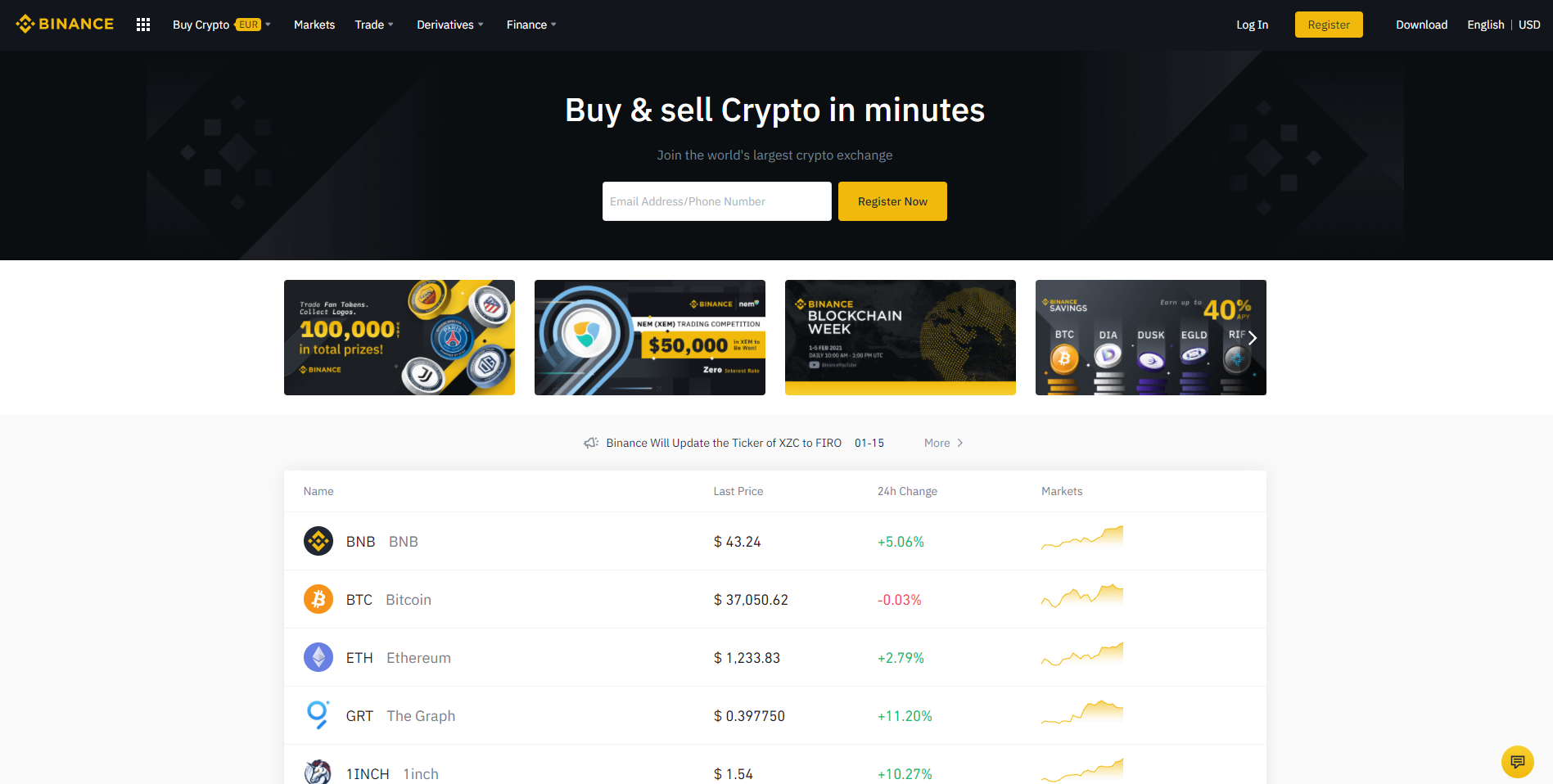

#4: Binance – Beginner-friendly

Binance is a secure online cryptocurrency trading platform. It was founded in 2017 by Changpeng Zhao, a famous developer that is known for programming high-frequency trading software. Despite only being around for a couple of years, Binance already has a daily trading volume of more than $2 billion with over 1.4 million transactions per second. It is currently the leading cryptocurrency exchange worldwide.

The brand name Binance is a combination of the words Bitcoin and finance. As the name suggests, its main product is Bitcoin. This is why this broker is perfect for beginners looking to trade this particular cryptocurrency.

What makes this company so great is it focuses on educating and helping newbie traders. Their educational tab, Binance Academy, offers both intermediate and beginner courses and informative articles that will surely help you grow as a Bitcoin trader.

However, signing up for a practice account with this broker can be quite tricky. On Binance’s main website, you are not given the option to open a demo account. To access their training grounds, you will need to type in testnet.binance.org on your browser’s URL and hit enter. This will open Binance’s TestNet page, which serves as their demo platform.

After you register, you will be given a virtual value of $100,000 that you can use to practice trading Bitcoin on their platform with zero risks. It’s important to note that you must download the TestNet software or its browser extension before opening a demo account. There are video tutorials that will guide you through this.

Binance has a built-in live chat system on its website that is readily available 24/7. It supports English, Filipino, Italian, French, Vietnamese, Spanish, Turkish, Japanese, Portuguese, Chinese, and Russian. You may also send them a message through their social media accounts on Telegram, Facebook, Twitter, Reddit, and Instagram.

Binance currently does not accept traders from Zimbabwe, Yemen, Syria, South Sudan, Venezuela, Sudan, Somalia, Iraq, Iran, Kosovo, Liberia, Lebanon, Libya, Moldova, Macedonia, Cuba, Herzegovina, Cuba, Croatia, the Crimea region of Ukraine, The Democratic Republic of Congo, Democratic People’s Republic of Korea, Cote D’Ivoire, Central African Republic, Bosnia, Burma, Belarus, Albania, and the United States of America.

(Risk warning: Your capital can be at risk)

What is a Bitcoin demo account?

A Bitcoin demo account, as the name suggests, is a demo account that allows you to trade Bitcoin. As a demo account, you will not be risking any funds, nor will you be asked to deposit even a single cent. All you need is to make an account by providing a few details, such as your email address and name. Sometimes, you’ll be asked to provide your phone number.

Demo accounts, in general, will provide an experience akin to a live account. That means you will get to try trading with market conditions such as commissions, spreads with leverage, and margins. For Bitcoin demo accounts, you’ll be allowed to trade Bitcoin virtually, most likely with other assets and asset classes, depending on your broker.

In your demo account, you’ll be given either a set or adjustable amount of cash with an adjustable margin. Assuming you get 10,000 dollars in virtual funds, you can use this however you wish. Even if you blow up the account or perhaps incur a negative value, you can refresh your virtual funds by contacting customer service or adjusting this value in the setting tab, or you can always make a new account since there is no charge for this.

You can even make multiple accounts designed for different strategies, whether manual or automatic, via bots. Depending on your broker, you can also copy-trade other traders on their future performance when trading Bitcoin.

Why should you use a Bitcoin demo account?

When Bitcoin was created in 2009, not a lot of people knew of its existence, and it wasn’t used for any transactions. As time went on, worldwide adoption of Bitcoin began, but a majority of people still have doubts about this new asset and the cryptocurrency asset class as a whole.

Nevertheless, the prices of numerous cryptocurrencies have skyrocketed to gains of thousands. This brings about the opportunity to trade multiple assets to both traders and investors alike while rewarding those that have invested earlier on.

With the doubt circulating around, trading cryptocurrencies bear an added fear that they might be worthless in the end. For this concern, having a Bitcoin demo account lets you try trading Bitcoin in the short and long term with no risk involved.

This would give you confidence in trading Bitcoin since it’s almost the same as trading the other asset classes. You could buy and sell these cryptos, or you could also do transactions that involve futures and options, and you can even use margin and leverage.

Since Bitcoin and other related assets are slightly different, you would learn more about each coin as most are paired or traded against Bitcoin. These are called crypto pairs. There are more crypto pairs, such as those paired with Ethereum and Tether, which you will undoubtedly learn about and your trade.

Trading terminologies slightly differ as well. In the crypto world, you will encounter words like satoshis, meme coins, and mining.

Volatility in cryptocurrencies is also on a different level compared to regular stocks or other asset classes, as it’s regular to see multiple high gainers per day. With this, of course, comes significant risk since this new form of currency can drop as fast as it can go up. Having a demo account would prepare you for all of these.

Advantages and disadvantages

Trading Bitcoin virtually gives you the advantage of having the confidence to trade it with real money during bull markets. Taking advantage of months of the uptrend that could reach hundreds and thousands of percentage gains would greatly benefit your portfolio. Bitcoin also opens up new avenues to invest in because BTC allows you also to buy other cryptocurrencies that have the same if not more potential than Bitcoin itself.

Learning to use Bitcoin as a hedge during quantitative easing is also an advantage. Since Bitcoin and Gold have been used as safe-haven assets in the past few months, they could benefit from this scenario.

For diversification purposes, Bitcoin can be an excellent addition to any portfolio. It has been rising in value for many months, and even a small allocation to your portfolio will probably do great things. Some might also want exposure to this asset class even if they don’t believe in it because of the high chance of profitability and adoption.

Since Bitcoin is a fast-moving and volatile asset, trading it in lower time frames is a good practice for aspiring day traders. It’s a good trading ground to strategize new set-ups to help you in real trading. The volatility will also help you manage your own expectations and emotions with trading.

Though there are only a few disadvantages to trading Bitcoin, they can be pretty significant. One of those disadvantages is the chance that Bitcoin crashes because of volatility or because of non-adoption. BTC not having any use in the future would pose a problem for long-term believers.

Another disadvantage is that since BTC is digital, it could be hacked. There have been numerous reports of stolen Bitcoin that could not be tracked anymore because of BTC’s anonymity feature.

As BTC demo and live accounts, you might find it a hassle if your broker does not offer other asset classes. For example, Binance does not offer index or forex trading but has just only offered stock trading through its platform.

How to trade Bitcoin

Upon logging in to your virtual portfolio or virtual wallet, in some cases, there are a few steps you’ll have to take to trade Bitcoin. First, you need to find this asset as it is listed on your broker’s exchange. It could be coded as BTC, BTCUSD, BTCUSDT, or perhaps something else. Double-check Bitcoin’s code on your broker to avoid mistakes in trading.

Then to trade Bitcoin, either you will be using virtual cash in the form of USD, USDT, or your desired currency. You then select the desired amount you want to trade and the price you want to buy or sell Bitcoin. Upon confirming this amount and the amount of Bitcoin you’ll be receiving, you can enter your trade.

Binance and other crypto-exclusive brokers handle trading a bit differently. First, you need to create a Testnet account through Binance. If you’re having difficulty creating a Testnet account, Binance has a unique guide on its website.

Once you’re on their web platform, either on Testnet or on the live account, you’ll realize that you have five different ways to buy Bitcoin, and these differ based on the interface and the type of trade you’re going to do. These five ways are namely Convert, Classic, Advanced, Margin, and P2P.

The most basic way is through their Convert option, wherein you select the amount you wish to convert into, which is Bitcoin, and the amount you want to convert, which is usually in Tether, the dollar equivalent in crypto. After this step, your chosen amount of Tether will be converted to Bitcoin, which will be reflected in your wallet.

Both the Classic, Advanced, and Margin options show you a trading platform where you can see the order book of BTC, which contains the complete list of all buyers and sellers of Bitcoin at a given price. You can also set your leverage here, and it could be as cross leveraging or isolated leveraging.

Once you choose to use leverage or not, you can also select your order type to be limit order, market order, or stop-limit order. You can then input your order price and the amount of USD you want to spend in buying Bitcoin.

Do note that as much as Classic, Advanced, and Margin conversion is mostly the same, the Advanced option features a one-click order system that facilitates faster order entries. The Margin option, on the other hand, will instantly set your orders to have a cross-leveraging setting.

Although only for live accounts, you will also see P2P conversion as an option in your test-net accounts. P2P conversion allows you to buy Bitcoin directly via Bank transfer from other users. Depending on where you live, you can make bank transfers in different currencies from different countries.

Tips and tricks

No matter how long you plan to hold your Bitcoin, it would always be beneficial to check its chart. Do not blindly hold without a plan. Even having a simple indicator to tell you if it’s okay to buy, hold, or sell will ensure that you will be safe if Bitcoin crashes, or you can take advantage of it if it rises.

As mentioned, the volatility of Bitcoin should be taken advantage of as a tool for practice and profit. It doesn’t matter if you trade breakouts or trade the ranges. As long as you learn or profit from what you’re doing, you will succeed as a trader.

Do not take leverage for granted. As much as leverage and margin will allow you to profit more, they will also make you lose more. Losing a big chunk of your capital would lead you to have more hardships because it’s harder to get back that cash. For example, losing 50% of your money would need you to double your capital on the next trade.

FAQ – The most asked questions about the Bitcoin demo account:

What is a bitcoin demo account?

A Bitcoin demo account is a practice account for novice traders that want to trade Bitcoins on a trading platform. The demo account helps beginners how to trade with actual bitcoins effectively. The account is also useful for professional traders to sharpen their trading skills.

Why should I open a demo account to trade bitcoins?

If you are new to bitcoin trading, you may not acquire enough trading skills. Opening a Bitcoin demo account can help you practice trading with fake bitcoins and know how to use trading strategies and tools effectively.

How can I open a bitcoin demo account?

The process of opening a Bitcoin demo account is straightforward and fast. All you need is to visit the website of a reputed and reliable broker and fill in the registration form featured on the site. Once registered, you can then practice bitcoin trading on the platform.

Will I lose my actual capital while using my Bitcoin demo account?

No, you will be free from loss of capital using your Bitcoin demo account. As the Demo account is free to open, you can rest guaranteed that you will not lose your capital while practicing bitcoin trading. Instead, you will be capable of improving your trading skills to get yourself ready to trade with actual bitcoins efficiently and professionally.

Last Updated on January 4, 2024 by Arkady Müller

(4.6 / 5)

(4.6 / 5) (5 / 5)

(5 / 5)