3 best Forex brokers & platforms for ZuluTrade with comparisons

Table of Contents

See the list of the 3 best Forex brokers for ZuluTrade:

Broker: | Review: | Zulutrade integration: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. FXCM  | Yes | FCA, AFSL, FSCA | 100+ (10+ currency pairs) | + Reputable broker + Since 1999 + Multi-regulated + 100+ markets + Low spreads + Low fees + Low min. deposit + High safety | Live account from $50(Risk warning: 74% of CFD accounts lose money) | |

2. Tickmill  | Yes | FCA (UK), CySEC (EU), FSA (SE) | 250+ (91+ currency pairs) | + UK regulation + High customer safety + Excellent support + Low trading fees + Cheap forex broker + Great conditions | Live account from $100(Risk warning: Your capital can be at risk) | |

3. AAAFX  |  (4.8 / 5) (4.8 / 5) | Yes | FSA, HCMC | 100+ (35+ currency pairs) | + Low fees + Multi-regulated + Great support + Secure broker + Huge variety | Live account from $300(Risk warning: Your capital can be at risk) |

Zulutrade is one platform that provides social trading services in the financial market. The platform is one of the famous ones, especially among forex traders. It allows traders and investors to imitate strategies of successful accounts. All it requires is setting up an account with Zulutrade. Then choose a broker that supports the service. This guide will explain the essential parts of the Zulutrade service, including how it works and how to use the features for effective forex trading.

You can not enjoy the Zulutrade service without first signing up with a broker.

Below, we will introduce to you three (3) of our recommended brokers for the Zulutrade service.

Their platforms and trading conditions are among the best and most compatible with the services that Zulutrade offers.

List of the 3 best forex brokers for Zulutrade:

1. FXCM

2. Tickmill

3. AAAFX

Let us give you a brief summary of their offerings.

1. FXCM

Overview:

- Regulation – ASIC, FCA, CONSOB, SFC, BaFIN

- Minimum deposit – $50

- Headquarters – London

- Trading platform – Mt4, FXCM trading station mobile, FXCM web trading station, Zulutrade.

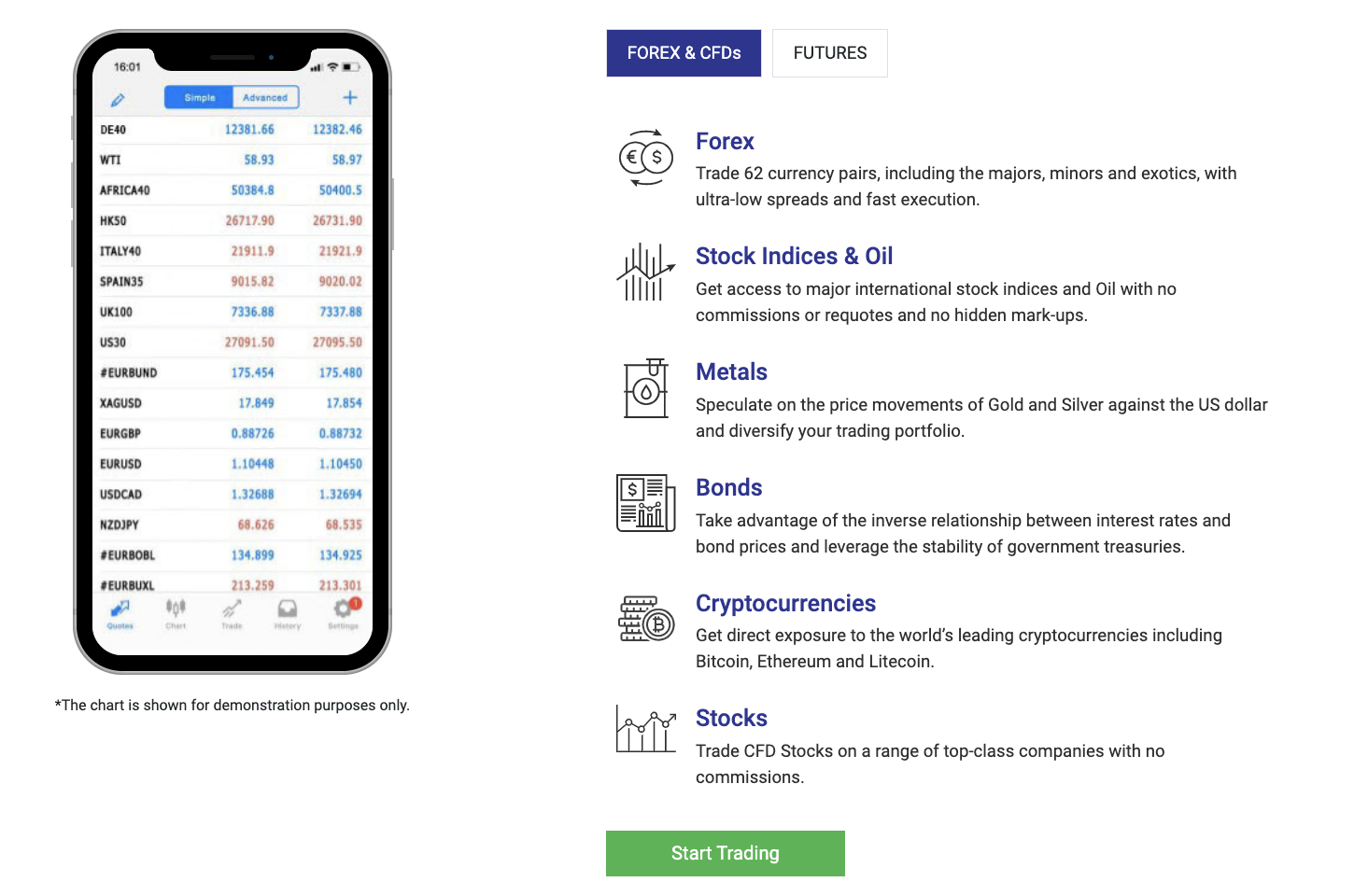

FXCM Group is one of the market-leading brokerages that provide trading and investment services for forex, stocks, spread betting, CFDs, and other related instruments.

As mentioned above, the brokerage is registered with multiple global regulatory bodies, including FCA, BaFIN, and SFC.

FXCM is known among forex traders for useful selections of effective trading tools, such as the Zulutrade. The brokerage gives traders access to an enormous network of liquidity providers, which ensures low spreads for traders. Its trading platform is available for mobile phones too. So clients can see real-time quotes and place trades on the go.

FXCM London subsidiary offers clients the opportunity to trade world commodities through CFDs, such as gold, oil, stock indices, and more.

(Risk warning: 74% of CFD accounts lose money)

The broker provides its trading services on Metatrader 4, FXCM trading station for mobile and web, and Zulutrade. You can start trading with this broker with a minimum deposit of $50. Though, the broker may require a higher deposit to use Zulutrade’s copy trading function.

FXCM provides quality research and education content in form of its webinars, trading tutorials, and other educational materials.

Multilingual customer support service is available round the clock for clients via phone, email, or live chat.

Deposit and withdrawal are easy to do here as the broker provides several popular methods for clients to choose from.

Pros of FXCM trading account:

1. The broker offers social copy trading through the Zulutrade platform.

2. This broker posts a detailed report of trade executions on its platform every month. The report also includes slippage statistics and execution quality across all types of orders.

3. The broker is safe, well regulated, providing quality financial services at reasonable costs.

4. FXCM is an award-winning broker for its high-tech trading tools including Zulutrade. These tools enrich the client’s experience and boost trading effectiveness.

Cons of FXCM trading account:

1. FXCM does not offer the Metatrader 5.

2. Trading instruments can be increased.

3. Its fees are slightly higher than the market average.

(Risk warning: 74% of CFD accounts lose money)

2. Tickmill

Overview:

- Regulations – FCA, FSA, CySEC

- Minimum deposit – $100

- Headquarters – Seychelles

- Trading platforms – Mt4

Tickmill is a relatively new brokerage firm founded in 2014, offering forex and CFD trading. The broker is regulated by the FCA, CySEC, and FSA. These regulations prove its credibility and make it a safe avenue to trade forex and CFDs. Though its CFD offerings are very few for now.

Tickmill provides trading services on Metatrader 4 and the Zulutrade, giving clients access to the helpful and effective tools of both platforms.

The broker won two awards just recently (2021) for providing the best customer service and also as the best broker for MENA region (Middle East and North Africa). The recognition indicates a driven brokerage firm providing world-class service at competitive fees.

Tickmill offers three (3) account options that are commission-free and commission-based. Its classic account is commission-free which traders should expect slightly higher spreads than the other two.

The pro and VIP accounts are commission-based and spread start from 0.13pip for major pairs. This rate is tighter than the average in the market, making Tickmill’s pricing highly competitive.

Traders will have access to the Metatrader 4 with all its features, such as indicators, autochartist, trade signals, and more. The Zulutrade is also offered for social copy trading. Clients can trade with this broker on their mobile phones or laptops.

(Risk warning: 70% of retail CFD accounts lose)

The brokerage firm also provides competitive research and education content. There are weekly live webinars presented in different languages. Courses and eBooks are also available for both novice and experienced traders. Its old webinars can be accessed on its archive via YouTube videos.

Withdrawals and deposits are free and several famous methods are provided for clients to use, including Mastercard, Visa, and Bank transfers.

Benefits of trading with Tickmill:

1. Sign-up process is fast and straightforward.

2. Clients enjoy a low cost of trading with the broker.

3. Copy trading is available on several platforms, including Zulutrade.

Drawbacks of trading with Tickmill:

1. Limited options of CFD to trade.

2. Metatrader 5 and a proprietary trading app should be added to the broker’s platform.

3. No negative balance protection.

(Risk warning: 70% of retail CFD accounts lose)

3. AAAFX

Overview:

- Regulations – HCMC and FSA.

- Minimum deposit – $300

- Head office – Athens, Greece.

- Trading platforms – Mt4, Zulutrade.

AAAFX is an online broker established in 2008 in Greece. Since its creation, the broker has expanded and now provides trading opportunities in forex, social trading, and binary options.

The brokerage provides multiple language platforms where clients can buy and sell over 100 market instruments.

AAAFX is registered with the Hellenic Capital Markets Commission(Greece) and the Financial Service Authority(Seychelles). This indicates that it is a genuine broker operating under strict policies.

The broker has strong ties with Zulutrade and therefore, offers one of the best social trading services in the market.

With a minimum deposit of $300, you can start trading on any of the three account types that the brokerage firm offers.

Linking your Zulutrade account to the classic account offered by this broker is an automatic process. Though the classic account is not recommended for novice traders.

The profit-sharing account is suitable for both rookie and experienced traders. However, linking it with your Zulutrade account attracts a $30 monthly fee for a subscription. This might discourage clients as a few other brokers do not charge such.

(Risk Warning: Your capital can be at risk)

AAAFX brokerage firm uses an ECN business model and charges both spreads and commission fees. Due to the model, the spreads are among the tightest in the market. Clients enjoy as low as 0.2pip spreads on major pairs. The commission fee is fixed at 0.8pip for major pairs, such as EUR/USD.

Various withdrawals and deposit options are provided to make funding and transfers easy to do. We should state that the broker set a minimum deposit of $2000 if the client chooses to use the bank transfer option. But for online payments and debit or credit cards, the minimum is $300.

There are no limits for withdrawals. Using any of the methods, clients can withdraw whatever amount they wish.

The broker offers traders the opportunity to trade on Zulutrade and the Mt4, with all their full functionalities. Clients can enjoy the automated trading feature and rich technical indicators on the Mt4. While Zulutrade offers the chance to copy successful trading strategies and connect with better traders.

Its customer support is available 24-5 in multiple languages, including French, Italian, Portuguese, Russian, and Japanese. Its support team is reliable and responsive, giving traders peace of mind while using its platform.

Pros of AAAFX brokerage account:

1. Outstanding customer support, available in several languages.

2. Renowned and regulated broker with millions of clients in Europe and North Africa.

3. Bonus offers are available for both newly registered and existing clients.

Cons of AAAFX brokerage account:

1. The lack of FCA license may appear discouraging for some prospective clients.

2. Relatively high minimum deposit of $300.

3. $30 monthly subscription for profit-sharing accounts with Zulutrade.

The three brokers presented here are among the best for Zulutrade.

(Risk Warning: Your capital can be at risk)

What is ZuluTrade?

Zulutrade is a Greece-based online financial solutions company that provides social copy trading services to traders and investors in the financial market.

The service lets users imitate successful trading techniques in forex and other instruments. You will have access to over 10,000 experienced traders to choose and copy from. The search feature comes with filters to allow you to customize your search and follow the appropriate accounts based on your trading objectives.

Zulutrade allows you to follow multiple trading accounts to broaden your choice of traders to copy.

How does ZuluTrade work?

The performance table lines up traders according to the feedback received from the community and other factors, such as the trader’s performance, stability, and trading behavior.

Users can then choose the traders to follow and mimic their trading strategies. Zulutrade allows users to customize the trading parameters, such as the lot size, trading times, and the number of trades.

With this, one is able to trade according to their preference and the risks they can handle, while copy trading.

How to connect your forex broker with ZuluTrade

To take advantage of the Zulutrade social trading service, you must register with a broker who supports the service. After that, you have to link your brokerage account with Zulutrade.

Follow these steps to connect your forex brokerage account to Zulutrade:

Step-1. Register a forex trading account with a supporting broker.

Find a reputable Zulutrade supporting broker and register with them by visiting the website and filling out the form. Verify the account by clicking on the link that would be sent to your emails.

Step-2. Create a Zulutrade account

Visit the Zulutrade website and set up an account. Select your broker’s brand name to link both accounts. The linking and confirmation might take 2 – 3 days to complete. After that, both accounts are now connected. You can begin by trading with a demo before funding your account.

Zulutrade requires a $100 balance in your account at all times to use the copy trading service. But the minimum deposit also depends on your broker’s requirements.

Step-3. Fund your account to trade.

As we have said, the initial deposit required to enjoy Zulutrade service would depend on the broker. Though it can not be lower than $100 according to Zulutrade’s terms and conditions.

Your broker provides several methods through which you can transfer funds to the account for trading. These may include Visa, MasterCard, Paypal, Skrill, bank wire, etc.

Step-4. Set your trading strategy on Zulutrade.

Setting your strategy can help you determine the traders to follow according to your preferred trading style. Include your trading times, risk measures, and lot size in this step.

Note that Zulutrade allows algorithm trading and scalping.

After this step, your brokerage account is now fully connected to Zulutrade.

You can follow a few seasoned traders to find the one whose trading style and approach appeal to you. From among these accounts, you can choose one to copy.

Apart from being one of the famous copy trading platforms, Zulutrade offers several other benefits to forex market enthusiasts and traders. We will outline these along with the few drawbacks that come with its service.

Advantages

1. Regulated social trading platform.

Zulutrade is one of the few social trading platforms that is entirely regulated in the United States, Japan, and Europe. The platform is one of the safest and most trusted in the market.

2. User-friendly platform.

Zulutrade offers an intuitive and easy-to-use platform that allows you to choose top-performing traders to copy. Traders are ranked according to success rates, stability, followers, etc. It lets you choose the right account to copy according to your goal.

3. Cryptocurrency copy trading section.

Zulutrade dedicates a special section for cryptocurrency copy trading. So the platform is properly organized and segregated. Forex traders who wish to try out crypto trading can find profitable accounts to copy.

4. Signal providers earn a specified fee.

As a signal provider, you get paid every time your trading strategy is copied and used. So you get to make money both from trading and being copied.

5. Zuluguard to safeguard your position.

Zuluguard is an auto-protect feature that helps you guard your positions against sudden changes in strategy. It also safeguards your trades against unsuccessful moves made by your signal provider.

Disadvantages

1. Difficult to become a signal provider.

A signal provider is a special position in the platform that earns you extra cash for getting copied. It is not easy to attain this position.

2. Assets are limited to what your broker offers.

On Zulutrade, you deal with assets and instruments that your broker provides. This means, for instance, that if your broker does not have cryptocurrency, you can not trade this digital asset.

3. Unprofitable accounts are listed on the performance tab.

There is a chance of following non-profitable traders. Copying their trading strategy equals bad trading decisions, which can lead to loss of funds.

How to use ZuluTrade

Follow these steps to use Zulutrade effectively:

1. Link your broker to Zulutrade

First, you need to link your brokerage account to Zulutrade. We have described how to do this above. Making sure your broker supports Zulutrade before signing up with them is vital. Otherwise, you can not use its services.

2. log in to Zulutrade and test with a demo.

If you have already connected your broker to Zulutrade, you can simply log in to the platform to start copy trading.

3. Test with a demo.

Zulutrade offers a free demo that allows you to test all its functionalities. Through this demo, you can also learn to use the platform, see all its features, and view the different traders and strategies available without financial risk. This is a good way to truly familiarize yourself with the Zulutrade environment.

4. Choose a trader (Signal Provider).

Click on the traders’ tab and search for experienced traders with proven success. Make sure their trading technique suits you in terms of risk tolerance and trading style.

Check their performance, the assets they trade, and track records to confirm your choice.

5. Fund your account with the minimum and start copying.

Once you find your choice of trader, follow them. Then fund your account with the required minimum for a start. Ensure you set your risk measure according to what you can handle. After this, start copying and trading on Zulutrade.

How to deposit and withdraw funds on Zulutrade

Funding and transfers are usually processed by the broker, and depend on the platform. The methods through which you can deposit and withdraw funds will also greatly depend on your location.

Generally, bank transfers and credit and debit cards are common methods accepted in most regions.

Deposits:

1. Log in to your broker’s platform directly and click on

2. Click on the FUNDS tab and select the option to deposit funds in your trading account.

3. Choose the easiest and most available method of funds transfer. It could be a wire transfer, Visa, Paypal, etc.

4. Enter the necessary details and the amount you wish to move to the account for trading.

5. Confirm your information and wait to have your account credited. For most brokers, this happens almost immediately. But your account should be funded with the full amount within the same day no matter the broker. The funds would appear on your Zulutrade account.

Withdrawals:

1. Follow the process and click on the FUNDS MANAGER tab.

2. Select withdrawal and fill in your information, including the amount you wish to transfer from the account.

3. Choose the method of withdrawal. Select bank wire if you’d like to transfer to your bank account. For debit or credit cards, click on the appropriate one.

4. Confirm the information you entered and click on submit.

5. Your broker then processes the withdrawal and sends the funds to your selected account. The time frame depends on the broker, but it shouldn’t take longer than 48-hours to receive your money.

Conclusion – ZuluTrade provides a great copy trading service

Copy trading is a great avenue for new traders to get into the forex market with relative ease. Zulutrade provides one of the best copy trading services in the market.

You need to create an account with Zulutrade then find a partnered broker to register with. The three brokers listed here are among traders’ preferred ones for Zulutrade. They are all genuine, offer quality service, and charge competitive fees.

Link your brokerage account to Zulutrade and start copying. We recommend trying out the demo before you begin as this introduces you to its environment and prepares you mentally for the investment.

Zulutrade’s benefit outweighs its few disadvantages. So we recommend it for copy trading to develop your skills. Once you start to trade profitably, you can also become a Signal provider and earn extra money.

FAQ – The most asked questions about Forex broker for Zulutrade:

Is Zulutrade a broker?

No, Zulutrade is not a broker. Zulutrade is a financial technology company that provides social trading services for traders through partnered brokers.

Is Zulutrade free?

Registration on Zulutrade is free. However, users must be registered with a partnered broker to use Zulutrade’s social trading feature. The broker determines the fee for this service. With some brokers, it is free, though a specified minimum deposit will be required to use Zulutrade. With others, users have to pay monthly subscription fees.

Is Zulutrade regulated?

Yes, Zulutrade is regulated in the United States, the EU, and Japan.

How do I become a Zulutrade signal provider?

To become a signal provider on the Zulutrade platform, your trading time must reach at least two weeks. Your drawdowns must be less than 30%, and your profits need to exceed 3 pips per trade. Once you meet these conditions, other traders can see you on the performance tab. Traders can then follow and copy you. You can also edit your profile to describe your strategy. Zulutrade has to approve your signal-provider profile once they check your performance.

Is Zulutrade a broker?

No, unfortunately, Zulutrade is not a broker. It is a financial technology company that offers various social trading services to its traders through partnered brokers.

Is Zulutrade free, or does it has any charges applied to it?

If you want to register yourself in Zulutrade, then feel relaxed, for you don’t need to pay anything for it. But it must be remembered that the traders must partner with brokers to use this platform. It is the broker who determines the fees that are charged for the services that are provided. With some partner brokers, there is no fee charged, while some partners charge a minimum deposit that is essential to be paid before joining this platform.

What is the process to become a Zulutrade signal provider?

In order to become an approved signal provider, the only criterion is that your trading tenure must be a minimum of two weeks. All over, the drawdowns must be below 30%, and the profits must be at least 3 pips every trade. Once you have hit these targets, other traders who are trading through this platform can see you on the performance tab. Traders can easily follow and locate you.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)