NordFX review – Is it a scam or not? – Test of the broker

Table of Contents

Choosing the best broker to invest your time and hard-earned money in requires so much attention to detail. Some of the critical questions you need to ask are “Is this broker safe and secure?”, “Will I learn anything new?”, “Do they have all the assets and tools I need?” and many more.

In this review, you will find all the information you need about NordFX to determine if this is the right broker.

(Risk warning: Your capital can be at risk)

What is NordFX?

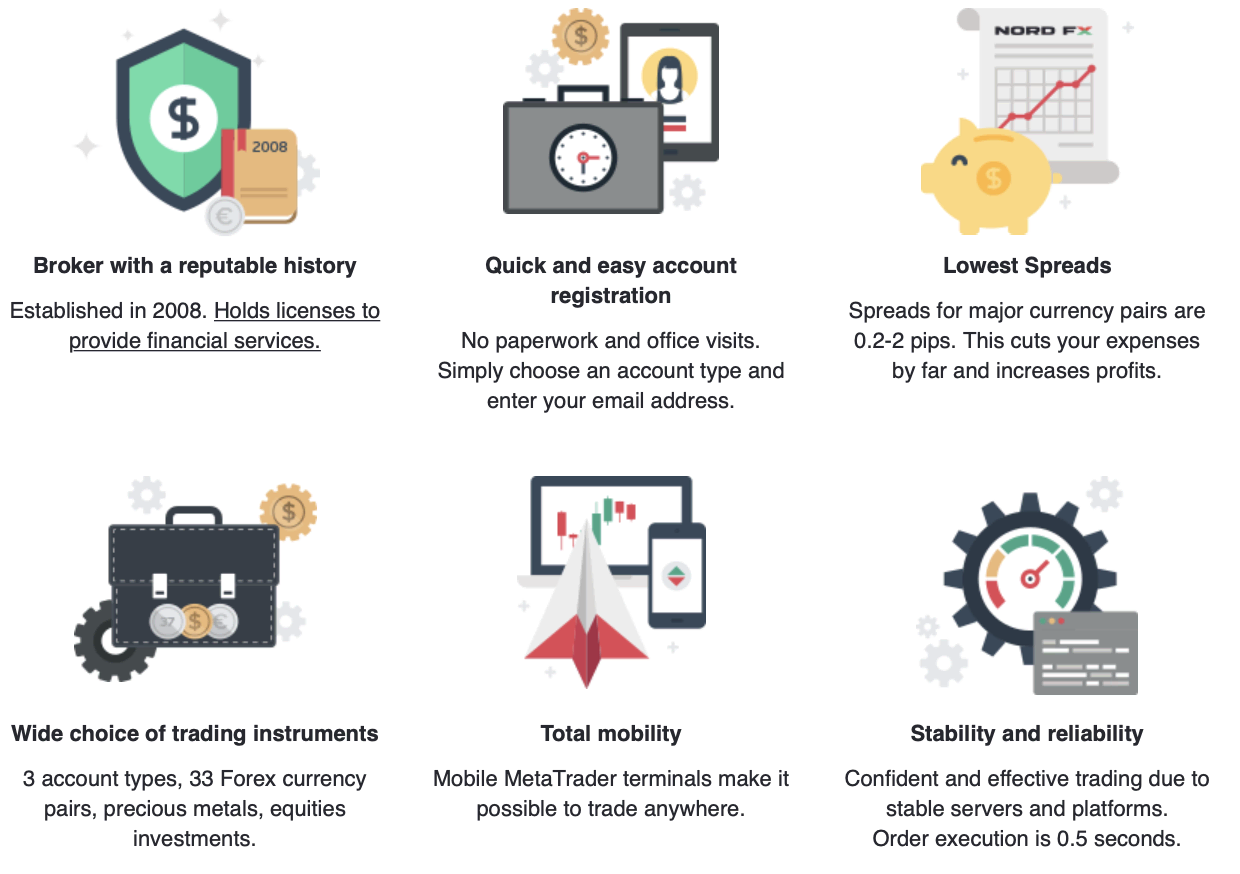

NordFX is a multi-asset broker company that was founded in the year 2008. This company boasts more than ten years of exposure on the trading scene. They have quite a global reach having more than a million clients from over 100 countries. Their main office can be found in Port Louis and Mauritius, and they have support branches in Sri Lanka, India, Thailand, China, and Russia.

Over the years, they have won over 50 awards, including The Forex Awards Most Reliable Broker of 2016, Masterforex-V EXPO World Best Broker of 2017, and Forex Awards Best Social Trading Network of 2019.

Here is a quick overview of NordFX:

⭐ Rating: | (5 / 5) |

⚖️ Regulation: | VFSC |

🏛 Founded: | 1993 |

💻 Trading platforms: | MT4, MT4 MultiTerminal, iPhone, Android, iPad |

💰 Minimum deposit: | From $10, depending on account type |

💸 Withdrawal limit: | No limit |

⌨️ Demo account: | Free and unlimited |

🕌 Islamic account: | Available |

📊 Assets: | Forex, metals, cryptocurrencies, stocks, indices |

💳 Payment methods: | Various payment methods available, depending on country. Visa, Mastercard, Neteller, Skrill, Webmoney, Maestro, Perfect Money, Ngan Luong, PayToday, Dragonpay are offered, among others. |

🧮 Fees: | Low spreads from 0.0 pips |

📞 Support: | 24/7 phone and email |

🌎 Languages: | More than 15 |

Is NordFX regulated?

NordFX is regulated by the Vanuatu Financial Services Commission and the Securities and Exchange Board of India.

See all facts about the security and regulation of NordFx here:

Here are some facts about their security:

SSL: | Yes |

Data protection: | Yes |

2-factor authentication: | Yes |

Regulated payment methods: | Yes, available |

Negative balance protection: | Not available. The platform may restore a negative balance on one of the customers’ accounts at the expense of the funds available on the other account. |

Trading conditions

NordFX has different trading conditions per account and asset type. You will find typical spreads here and all the other details you need below.

Typical spreads for the fix trading account:

ASSET: | SPREADS FROM: |

|---|---|

EUR/USD | 2 pips |

GBP/USD | 3 pips |

USD/JPY | 2 pips |

XAGUSD | 5 pips |

XAUUSD | 5 pips |

(Risk warning: Your capital can be at risk)

Products offered at NordFX

Foreign exchange

NordFX is known to specialize in foreign exchange or forex. You can expect to see several major currency pairs on their platform. These include EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. Aside from these, minor and exotic pairs are also tradeable with NordFX.

NordFX offers forex trading with spreads as low as 0.0 pips and zero commission fees. This depends on what account type you’re using. For Fix account holders, the pip difference per trade will always be 2 pips, and there is no commission fee.

For Pro NordFX accounts, the spreads start at 0.9 pips, and you won’t incur a commission fee, just like the Fix account. Lastly, for Zero accounts, the pip difference starts at 0.0. however, you will be charged a commission fee of 0.0035% per trade. The leverage for trading this asset class depends on the leverage you selected for your account type.

The minimum lot size for trading forex is 0.01, and the maximum is 50 lots. A single lot is valued at 100,000 USD, EUR, GBP, AUD, NZD, CHF, or CAD. You can trade forex from midnight Monday until 10:00 PM Friday server time.

Metals

With NordFX, clients can trade two of the most precious metals. These are silver and gold. Spreads for this asset class also depend on your account type. For Fix accounts, spreads will always be 5. For Pro accounts, the minimum spread for gold starts at 0.8 and can go above 2.9. Silver spreads range from 1.2 and can even go higher than 1.6. Trading metals with a Zero account typically gives you zero spreads, but it could reach 0.2 up to 0.3.

When it comes to leverage, it’s important to note that leverage for gold can only reach up to 1:200. This will be implemented until the high volatility period that started last 2020 ends. For silver, however, this depends on the leverage you chose on your account type.

For gold, one lot value is 100 troy ounces, while silver is valued at 1000 troy ounces. Trading time is similar to forex, from midnight Monday until 10:00 PM Friday server time.

Cryptocurrency pairs

For a forex-specializing broker, NordFX offers quite a bit of cryptocurrency for their clients to trade. Below, you will find all 11 tradeable crypto pairs along with their margin per lot, minimum lot size, and maximum lot size.

Cryptocurrency Pair | Margin per lot | Minimum lot size | Maximum lot size |

OMG/USD | 0.36 | 1 | 1000 |

LTC/USD | 10 | 1 | 100 |

ETC/USD | 0.6 | 1 | 100 |

EOS/USD | 0.3 | 1 | 1000 |

ZEC/USD | 15 | 0.1 | 10 |

XRP/USD | 0.02 | 100 | 10000 |

BSV/USD | 15 | 0.1 | 10 |

BAB/USD | 30 | 0.1 | 10 |

DSH/USD | 20 | 0.1 | 10 |

ETH/USD | 15 | 0.1 | 10 |

BTC/USD | 150 | 0.01 | 10 |

Spreads for this asset class start from 1 pip, and the commission fee is always 0.09% of the traded value. You can trade cryptocurrency pairs all day, every day.

Stocks

Only stocks from the United States of America and Europe are tradeable with NordFX’s platform. You will find some of the most popular stocks as CFDs, including Tesla, Netflix, Twitter, Uber, Apple, McDonald’s, eBay, Coca-Cola, and many more.

The commission rate for stocks is always 0.2%, and the leverage can be set up to 1:5. You can also trade from 1 up to 100 lots. The trading session depends on the asset you’re trading. To see the full schedule, refer to their website.

(Risk warning: Your capital can be at risk)

Indices

NordFX offers up to 6 tradeable indices. Commission rates for all of these are 0.005% per round turn. Leverage ranges from 1:1 up to 1:10. You can trade from 0.1 up to 1000 lots depending on the index you’re trading. You will find a list of all the indices available on NordFX.

- Hang Seng Index (Hong Kong 50)

- Nikkei Stock Average (JP225)

- Nasdaq Composite Index (NAS100)

- Dax Performance-Index (Germany 30)

- S&P 500 (SPX500)

- Dow Jones Industrial Average (Dow Jones 30)

To see when the market for indices opens and closes, refer to their website.

Commodities

With NordFX, clients can trade West Texas Crude Oil and Crude Oil Brent Cash. Commission rates for these are at a fixed 0.005%, the minimum lot size is one, and the maximum lot size is 1000. When it comes to the leverage of these commodities, West Texas Crude Oil starts from 1:1 and can reach up to 1:5. For Crude Oil Brent Cash, leverage can be set up to 1:10.

The trading hours for this asset are from 2:00 AM until 11:00 PM on weekdays, server time.

NordFX’s trading platforms

NordFX utilizes the popular and reliable trading platform MetaTrader 4. This software contains all the essential tools their clients would need to be able to trade efficiently.

With MetaTrader 4, traders are given the option to customize their charts with their desired indicators and ideal timeframe. The MT4 platform also allows you to create personalized indicators and scripts to trade manually or automatically.

You can instantly execute your trades or plan them ahead at a specific price point. This allows you to trade even when you’re not in front of your computer. You will also have access to news articles and research materials on the platform. This helps keep you updated on the current market trends and important market events.

MetaTrader 4 MultiTerminal

This platform has all the features and tools that can be found on the MetaTrader 4 software. The only difference is this additional application is ideal for traders with multiple accounts. It’s important to note that all the accounts you plan to use are on the same server.

Mobile MetaTrader Platform

Their mobile application allows clients to execute trades on the go. It’s pretty limited compared to the desktop version. However, it has all the essential features and tools that you need to trade the assets that NordFX offers.

This is available for both Android and Apple devices. You can download this application from the Google PlayStore or Apple Store.

Learn to trade with NordFX

Since NordFX specializes in foreign exchange, they have a lot of educational materials that focus on forex. However, they also offer videos and courses that talk about trading in general. You will find topics specifically for beginners and advanced traders.

You can also learn about the different terms as well as strategies used by well-seasoned traders. If you’re not familiar with the MetaTrader 4 platform, NordFX has four videos that will help you understand how the platform works.

NordFX also has a glossary that can be accessed by anyone. Here, you will find essential trading terms and their definitions.

Market Analysis

NordFX occasionally uploads essential and valuable articles that cover everything involved in the trading scene. Their topics range from forex trading robots to discussing trend indicators.

(Risk warning: Your capital can be at risk)

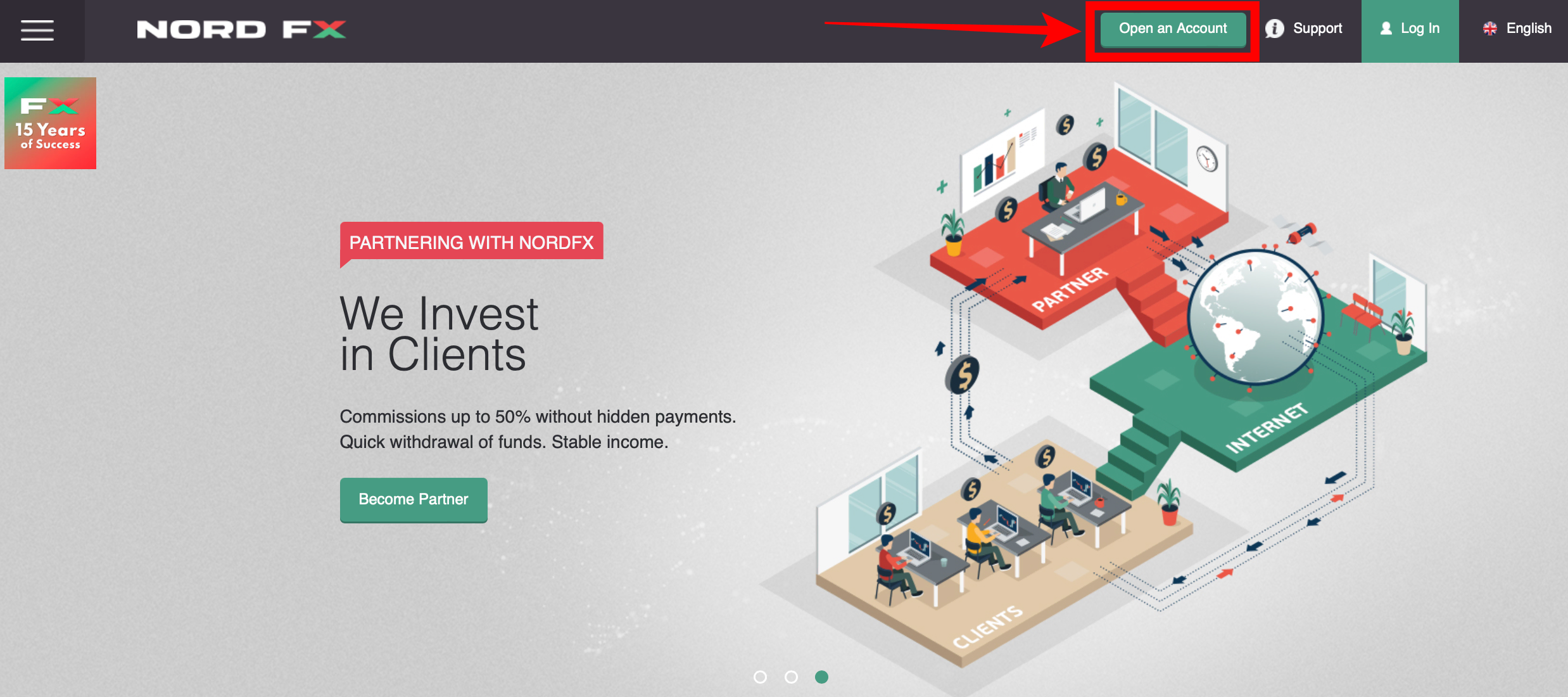

How to open an account with NordFX

Opening an account with NordFX is a fairly simple process. To register, you will need to input your full name, email address, and contact number. You will also be asked to choose which account type you’d want to sign up for. For your preferred currency, you can choose either USD, BTC, or ETH. Lastly, you will need to select your credit leverage. Your choices are 1:100, 1:200, 1:500, or 1:1000.

You are also given the option to register using your Google+, Facebook, or Twitter social media accounts.

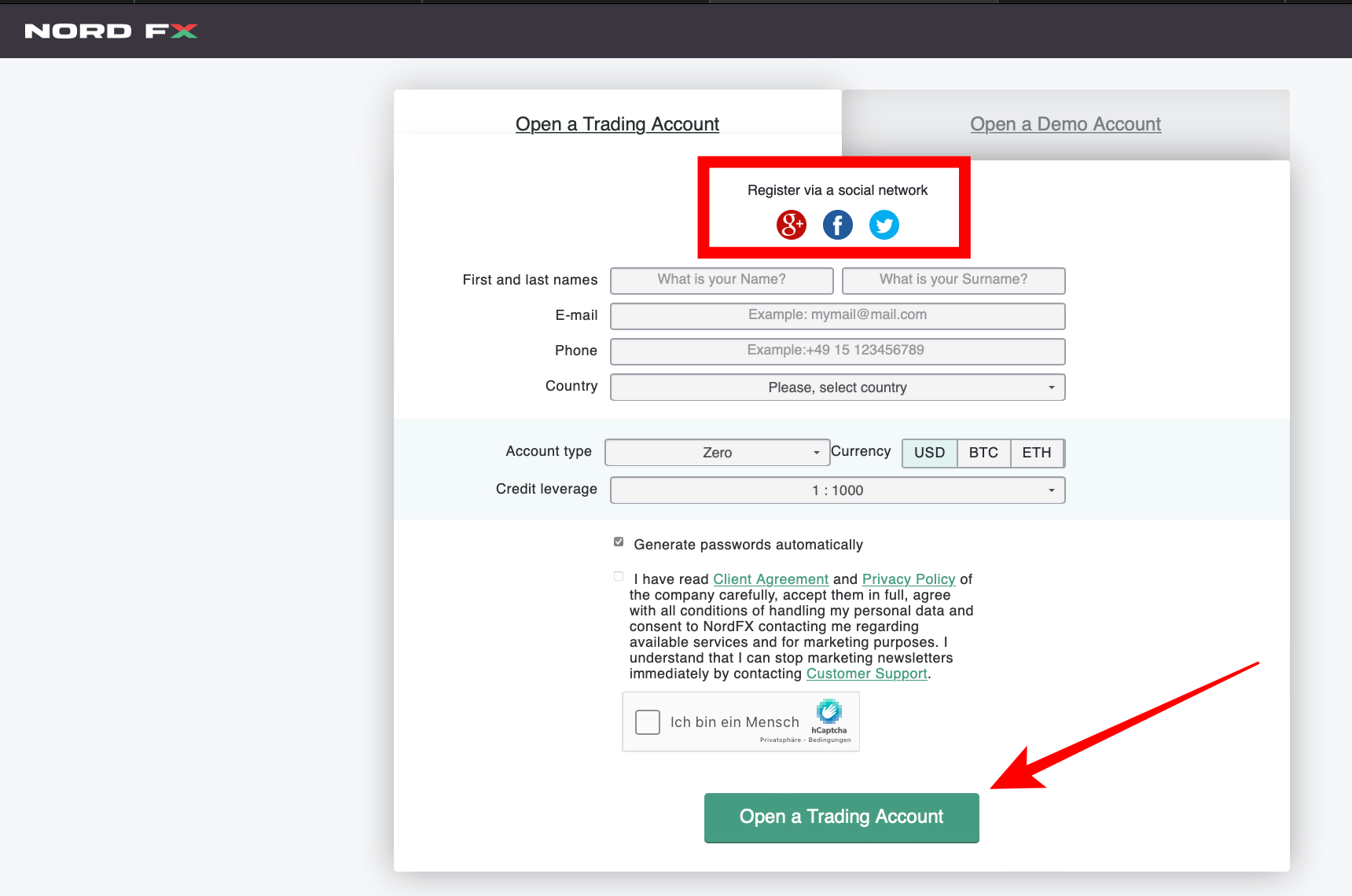

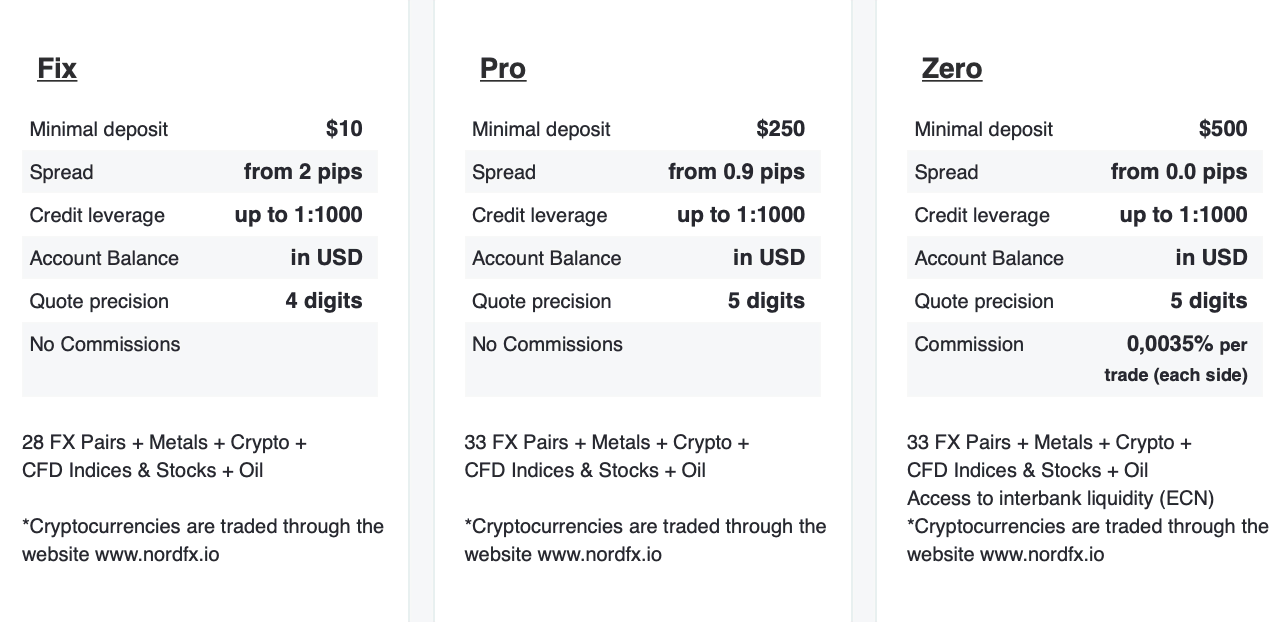

Different types of accounts on NordFX (Pro, Fix, Zero)

NordFX fix account ($10 Minimum deposit)

NordFX’s Fix account is ideal for both new traders who are new to the foreign exchange market and experienced traders who are already familiar with forex. The minimum deposit of $10 is also significant for traders who are cautious and aren’t ready to invest massive amounts of money.

With this account, you will be able to trade up to 11 cryptocurrency pairs, 28 currency pairs, commodities like gold, silver, and oil, and CFD contracts for major stock indexes. You will have a maximum of 100 pending or open positions with a margin call of 40% and a stop-out level of 20%.

NordFX Pro account ($250 minimum deposit)

This specific account type is excellent for well-seasoned traders. You will have access to a wide range of trading tools that will help increase your probability of gain, and you can take advantage of the fast execution of your trades.

With NordFX’s Pro account, clients can trade up to 11 crypto pairs, 33 currency pairs, metals, CFD, and indices. Just like the Fix account, you are given a maximum of 100 open and pending positions with a margin call of 40% and a stop-out call of 20%.

NordFX zero account ($500)

NordFX’s Zero account offers the best trading conditions and a vast number of trading instruments to both beginners and professional traders. The tradeable assets on this account are the same as the Pro account.

The only difference is the spreads and commission. These two fees depend on the asset you’re trading.

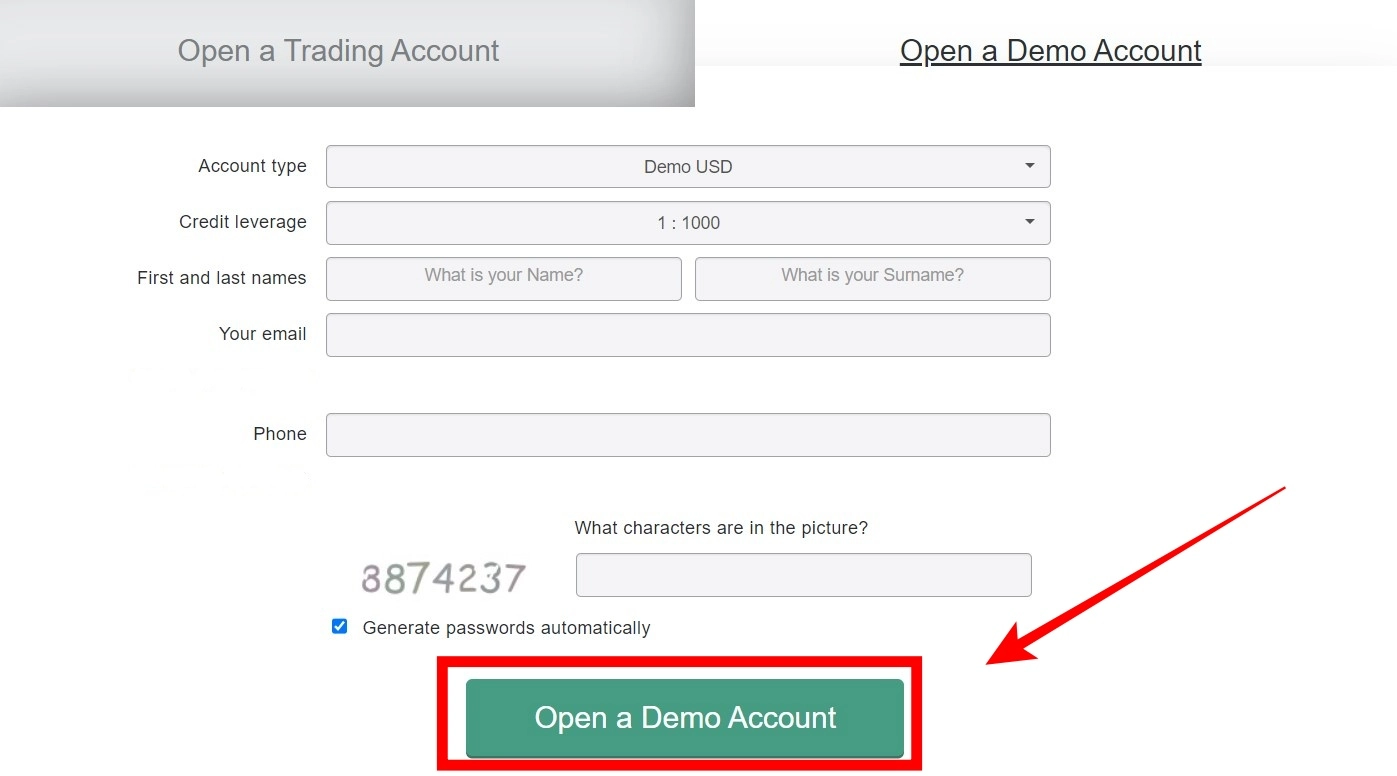

NordFX demo account

Newbie traders are recommended to test their skills using a demo account on NordFX before they decide to commit to a live account. Here, you will be given a virtual balance of $10,000, and you can use this to practice your trading strategies. You can also take your time and familiarize yourself with the tools and features of their platform on their free demo account.

(Risk warning: Your capital can be at risk)

Negative balance protection

In the event that you get a negative balance on your account, you will need to email NordFX’s finance department and request for your account balance to be brought back to zero. You have to provide your account number and password in your email request.

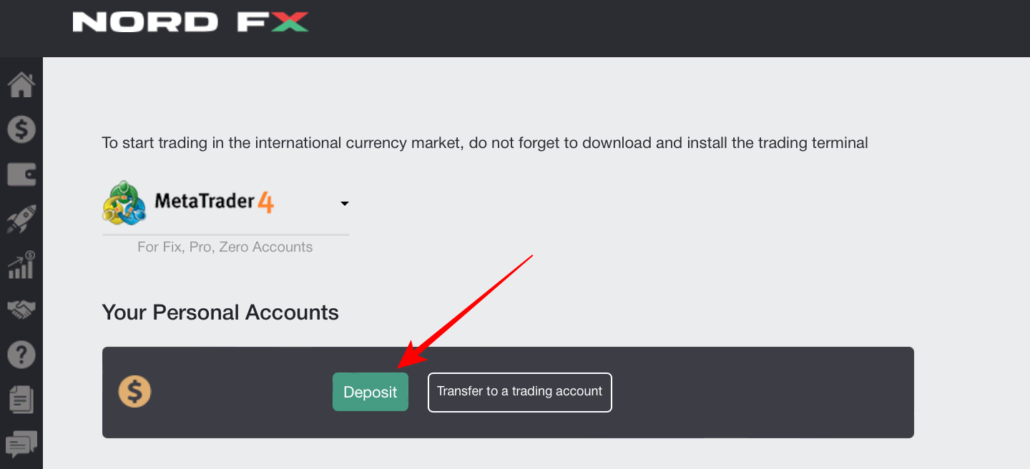

Depositing funds on your NordFX account

You can add funds to your account via bank wire transfers, bank cards, and online payment systems. For bank transfers, the currencies available are USD and EUR. NordFX won’t charge any fees. However, if there are any bank fees to be paid, you will have to shoulder that. The amount you deposited will reflect on your account within three to five business days.

For adding funds via bank card, you have the option to use your Visa or MasterCard. Currencies for these cards are USD and EUR, and you won’t be charged a fee. Transferring funds using a bank card is instant.

The available online payment systems are WebMoney, Skrill, NETELLER, NETELLER CARDS (Visa or Maestro), and Perfect Money. The currencies for these are USD and EUR, except for NETELLER and NETELLER cards. The only available currency for that mode of funding is USD.

For WebMoney, you will be charged 0.8% of the amount you deposited, but it’s important to note that you won’t be charged higher than $50. For NETELLER Visa cards, NordFX will charge 1.75 to 4.95% of your deposit. For NETELLER Maestro cards, the commission is 0 to 4.95%.

When it comes to depositing with Perfect Money, the commission rates depend on your Perfect Money account. For Premium and Verified accounts, you will incur a fee of 0.5% of your deposit. For Unverified accounts, the commission rate is 1.99%.

For traders located in Asia, you can fund your account via Ngan Luong (VND), PayToday (THB), and Dragonpay (PHP). The transfer period is usually instant, except for Dragonpay. With this online payment platform, it may take up to 24 hours. You won’t be charged a fee when you deposit via Ngan Luong and Dragonpay. NordFX, however, will charge you a commission for a deposit of 4% when you use PayToday.

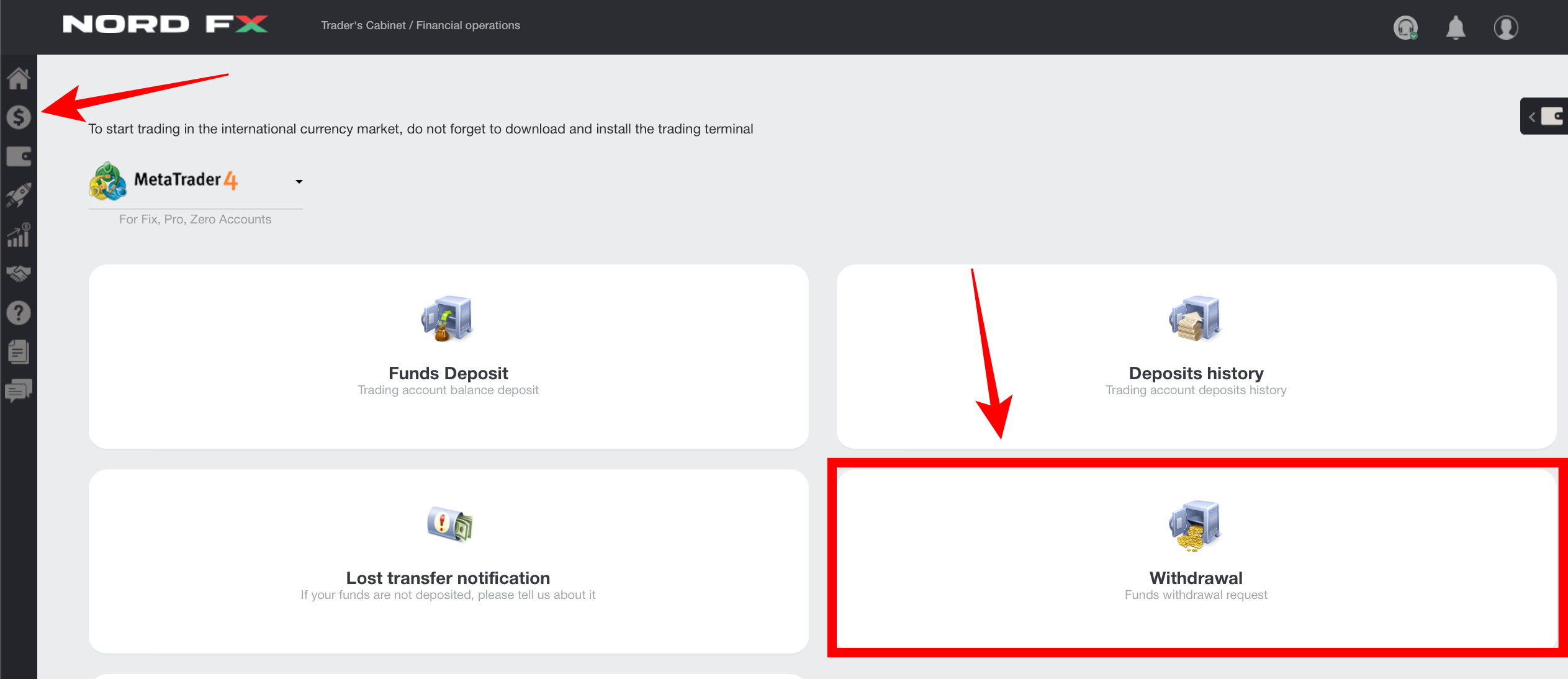

Withdrawing funds

You can withdraw funds via bank transfer, MasterCard and Visa cards, WebMoney, Skrill, QIWI, and other online payment systems. All you need to do is log in to Trader’s Cabinet and click on the withdrawal tab. Choose which mode you prefer and send your request. It’s important to note that the minimum withdrawal is $1.

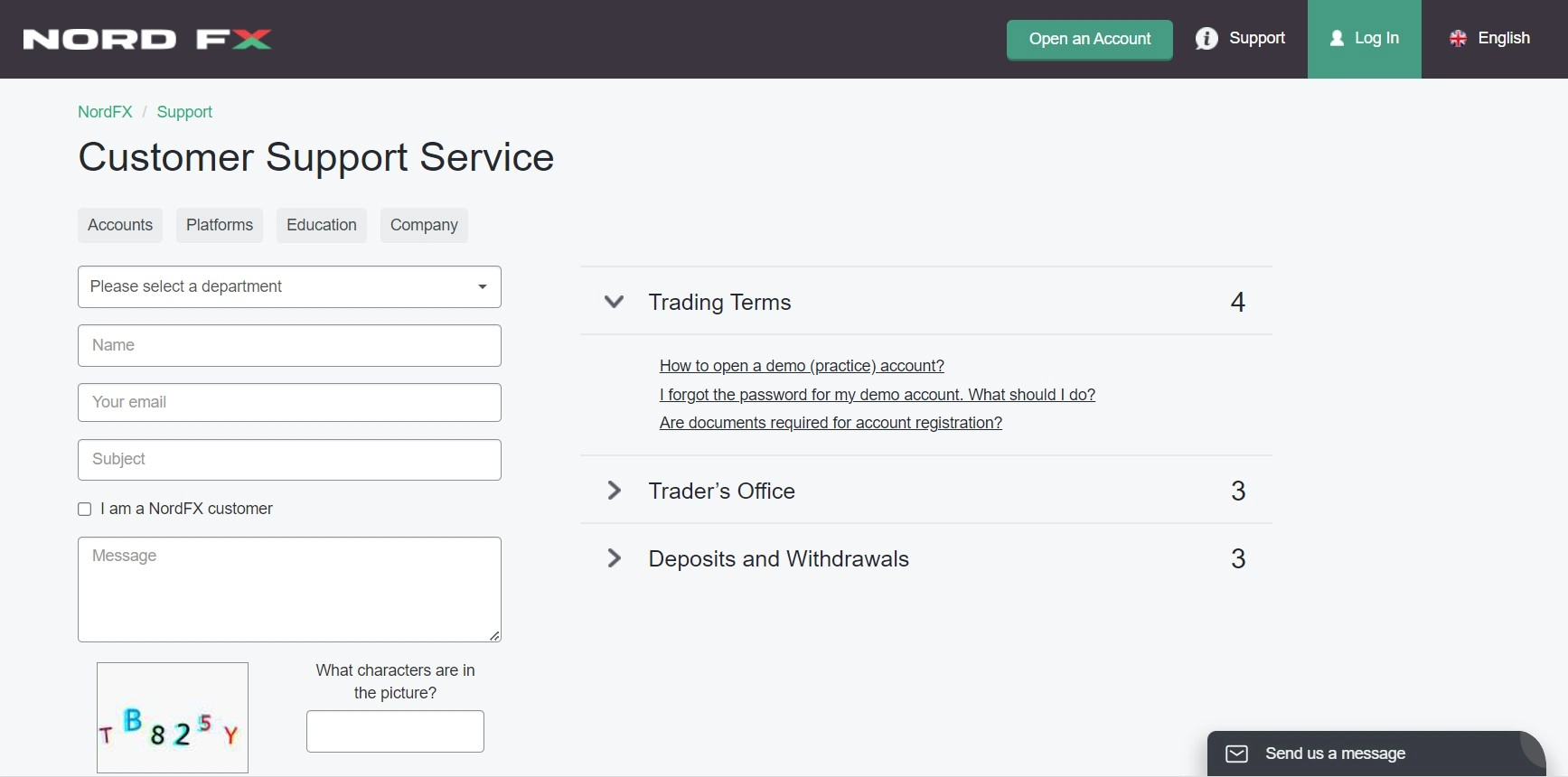

NordFX’s customer service

NordFX has a built-in chat system on its website where you can chat with a live agent. You can also contact their offices via telephone, email, or social media.

You also have the option to send in your queries using their website. Go to the support page and fill up the form with all the necessary information.

Their website supports 14 different languages. These are English, Chinese, Indonesian, Spanish, Portuguese, Arabic, Hindi, Persian, Thai, Bangla, Sinhala, Vietnamese, Japanese, and Malay.

See all details about the NordFx support here:

ADDRESS: | PHONE: | EMAIL: | SUPPORT AVAILABLE: |

|---|---|---|---|

Pot 615/304, Rock Terrace Building, Kumul Highway, Port Vila, Vanuatu | +447458197795 (Bangladesh) +86 108 4053677 (China) +357-25030262 (Europe) +972559662836 (India) +593-9-97-221410 (Latam) +972559661848 (Sri Lanka) +66600035101 (Thailand) +447458197293 (UAE) | 24/5 via phone & email |

Accepted and forbidden countries

Traders from Qatar, Kuwait, Luxembourg, Denmark, Italy, Saudi Arabia, Sweden, Germany, Norway, India, France, Singapore, Hong Kong, South Africa, Canada, Australia, Thailand, the United Kingdom, United Arab Emirate, and others can sign up for NordFX and use their platform to trade.

Traders from the United States, however, are not permitted to use NordFX.

(Risk warning: Your capital can be at risk)

Other services offered by NordFX

NordFX is hosting a lottery where participants can win a portion of $100,000. This is exclusive to NordFX clients with a valid Pro account. Clients will need to enter lottery tickets to get a chance to win. To get tickets, you will need to add funds to your accounts, specifically $200 or more, and have a trading turnover of 2 lots. There’s no limit to how many tickets a participant can earn.

The $100,000 prize is split among 101 winners. 70 winners will get $500, 20 winners will get $1,000, 10 winners will get $2,500, and only one winner will get $20,000. The winners will be announced on the first of July 2021 and the first of October 2021, and the winner of the grand prize of $20,000 will be drawn on the third of January 2022.

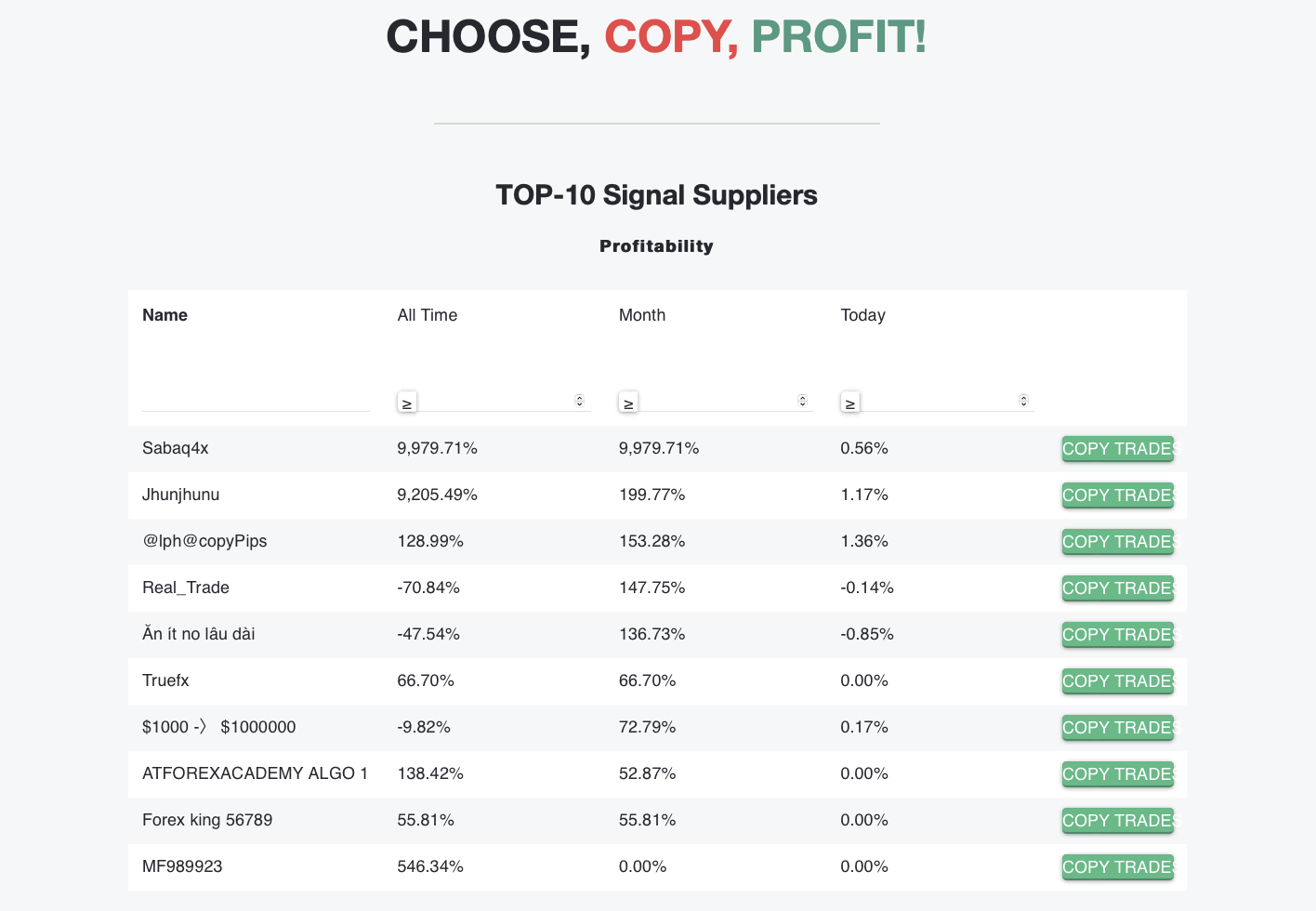

Social trading

NordFX offers Copy Trading as an additional service for signal providers and subscribers. Signal providers can earn extra income depending on the number of subscribers they have. There are no restrictions in becoming a signal provider, and the registration process for this is quite simple. You even get an analysis of your trading performance.

Signal subscribers can choose the signal provider they prefer. For a minimum deposit of $100, you can earn up to 90% of your invested fund. You also have control over your invested amount, and you can choose to withdraw this at any time. You don’t need any special knowledge to become a signal subscriber and enjoy its perks.

VPS

NordFX hosts a virtual private server that offers uninterruptable trading from anywhere around the globe. It is available 24/7 and operates 200 times faster. This feature can be utilized by any desktop or mobile device.

All NordFX clients have the option to avail of their virtual private server provided by Fozzy. This costs $13.95 per month.

Currency Converter Tool

NordFX has a currency converter tool that allows traders to easily convert any currency to another. It’s elementary to use. Simply which currency you want to convert and which currency you want to convert it to and hit the convert button.

Economic calendar

With NordFX’s economic calendar, you can stay up to date on important market news to help you plan your trades accordingly.

Advantages and disadvantages of NordFX

Compared to other big-time brokers, NordFX could be considered small in terms of the products offered. They only offer a few assets, and this might not be enough for some traders. They don’t offer soft commodities like wheat, cotton, cocoa, coffee, or sugar. They also don’t have hard commodities like copper, aluminum, or platinum.

NordFX also doesn’t use the more updated and user-friendly MetaTrader 5 platform. The MT4 platform can be considered good enough for some traders, but some prefer MT5. Their market analysis is few and far between, but their articles are helpful to an extent.

Not anyone can gain access to their educational materials. You will need to sign up or create an account to be able to start learning with NordFX. The built-in chat support is also relatively slow. Their response time is not as prompt as you expect it to be. It usually depends on the availability of customer service representatives.

(Risk warning: Your capital can be at risk)

Conclusion – NordFX is an excellent online multi-asset broker

Generally, NordFX doesn’t stand out. It lacks a lot of essential factors and assets. However, this doesn’t mean that this broker does not perform well. Their educational materials can be helpful, especially to new traders. Their website is easy to navigate and has all the essential information you need.

All in all, this broker is trustworthy and offers excellent service.

With NordFx you get a reliable partner for investing in almost any financial market.

Trusted Broker Reviews

Experienced and professional traders since 2013FAQ – The most asked questions about NordFX:

Is NordFX good?

NordFX is a great broker that was founded in 2008, and since then, it has received over 60 valuable professional awards for providing trading solutions internationally for over 14 years. NordFX has its headquarters in many parts of the world, such as Cyprus, Thailand, and India. They can provide their trading services in Forex and CFDs to clients worldwide. The Vanuatu Financial Services Commission (VFSC) also regulates the broker.

What payment methods does NordFX offer to deposit and withdraw funds?

Through NordFX’s numerous payment method options, clients are given the convenience of transferring their funds into their trading accounts with ease. You can make a deposit or withdraw your funds through card banking, Bank Wire, Neteller, WebMoney, Skrill, Perfect Money, and a lot more options to choose from. The clients must visit the client portal and choose their preferred payment method to deposit or withdraw funds.

What are the different types of accounts at NordFX?

NordFX provides its clients with three types of live trading accounts and a demo account for beginners to gain experience in trading. The three types of accounts are the NordFX Fix account, NordFX Pro account, and NordFX Zero account. The minimum deposit to trade from the NordFX Fix account is 10 dollars; through the NordFX Pro account is 250 dollars, and through the NordFX Zero account is 500 dollars.

Does NordFX charge a fee for depositing funds?

NordFX does not charge a commission for depositing funds. However, if your chosen payment method has a fee, you must shoulder that.

Will I be able to change my account type and currency?

You will not be permitted to change your account type or currency. You must create a new account with your preferred currency and account type.

What is the time shown on their trading platform?

NordFX uses Central European Time or CET. For daylight saving time, they use GMT +2. Wintertime is GMT +1

Can I change my account data after I register?

Changing the name on the account is not permitted. It can only be corrected. To make the necessary corrections, you must fill up and send a request to their email [email protected].

To change or correct your contact number, email, and leverage, you must send a request form to [email protected]. Input the correct information so they can make the necessary changes.

What’s the NordFX telephone number?

You can call NordFX at their different phone numbers. Below is a list of the countries and contact numbers.

Bangladesh – +91-7303716826

LATAM – +593-9-80-909032

China – +86 108 4053677

Sri Lanka – +91-120-4562896

Europe – +357-25030262

Thailand – +66600035101

India – +91-120-4333948

Last Updated on February 27, 2023 by Arkady Müller