The best Forex Brokers without KYC and ID verification

Table of Contents

See the list of the best Forex Brokers without KYC:

Broker: | Review: | ID verification required: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Cedar FX  | No | FCA (UK), CySEC (CY), ASIC (AU), NBRB (BLR) | 6,000+ | + Individual offers + Best trading platform + Raw spreads + No commissions + Best education + Personal support | Live account from $20(Risk warning: Your capital can be at risk) | |

2. Eagle FX  | No | Not regulated | 30+ | + Huge variety + Micro accounts + Bonus program + Leverage 1:2000 + ECN accounts | Live account from $10(Risk warning: Your capital can be at risk) | |

3. Hugosway  |  (5 / 5) (5 / 5) | No | Not regulated | 35+ | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live account from $10(Risk warning: Your capital can be at risk) |

4. Longhorn FX  |  (5 / 5) (5 / 5) | No | Not regulated | 160+ | + Huge variety + Good platform + Best service + Personal service | Live account from $50(Risk warning: Your capital can be at risk) |

The forex industry has an estimated six trillion worth of transactions daily. It has more than ten million market participants making it the largest active market. This kind of volume has attracted many forex traders and forex brokers alike.

There has been a rise in concern about whether the forex market is safe for investors. It is due to many complaints of market participants using manipulative schemes to benefit illegally.

Third-party organizations are set up to regulate the forex brokers by providing strict laws that forex brokers adhere to. One of these laws is the Know Your Customer, better known as KYC, which requires forex brokers to set up a profile for all their clients.

What is a KYC verification?

Know Your Customer is a law under the Anti-Money Laundering policy that forex brokers follow by ensuring they take the identification details and verify them. This process is crucial to curb unlawful use of forex, such as money laundering and criminal activity.

It also helps to ensure that forex traders do not evade tax charged on their revenue. It does this by capturing all the personal details of forex traders. The functions of the KYC regulations include;

- Acquiring the details of a forex trader as they register for a trading account.

- Verify these details by getting copies of the identification certificates.

- Monitoring the transactions for any suspicious activities and reporting to the appropriate authorities.

Some details a forex broker is required to get from a registered forex trader are:

- The full legal names of the client

- Date of birth

- Nationality

- Home address

- Picture of the forex trader

- Phone number

- Email address

Other personal financial details like:

- Financial history

- Employment status

- Objectives for joining forex trading

The verification of the name and date of birth requires a picture of a legal Identification card. A utility bill to verify the home address, while the email and the SMS will use a text or email code. This process can be time-consuming, that is why forex brokers have to create a user-friendly registration process.

Forex brokers have special software designed to ensure that this process runs fast and smooth. Forex brokers have to comply with these regulations according to the location of the forex traders. The process varies according to forex brokers, as some forex brokers have tough regulations for forex brokers.

If the forex brokers outsource a company to collect the required data from the forex traders, they also have to be verified. The third-party company has to get licensed with the appropriate AML certificates annually. It ensures that the data is secure and the company follows all the procedures.

Importance of KYC regulations:

- It reduces the cases of money laundering and illegal activities through unidentified forex traders.

- It creates a safe trading environment for forex traders within the jurisdiction implementing these laws.

- Allows forex brokers to look at the financial history of forex traders and see whether they can handle the risk that comes with forex trading.

- Improves the reliability and credibility of a forex broker since it is compliant with the laws.

- It allows market participants like corporates and institutions to offer more funds for forex trading.

The KYC regulations are there to create a safe environment for forex traders. Some forex traders may use the forex industry as a way of laundering ill acquired money. It is why forex brokers have the mandate of monitoring the forex activities of forex traders.

List of forex brokers without KYC and ID verification:

1. Cedar FX

It is a forex broker founded in 2020 and is known for its dedication to environmental concerns. This is through the eco-friendly trading account it offers. Traders can donate $1 as commission to Ecologi, an organization saving the environment.

At Cedar, FX traders can access forex, cryptocurrency, metals, commodities, indices, and stocks. It also has a zero commission trading account with low spreads and high forex leverage of 1:500. It has no clear indication of regulation from any jurisdiction.

It does not require much information, and traders can open an account by filling in their name, and email address, and setting the password.

Features of Cedar FX:

- Has MT4, MT5, and the web trader trading platforms

- It has various technical indicators, charts, and drawing tools.

- It has automated trading and forex signals through the MT4 trading platform.

- It has a demo account integrated with the MT4.

- It allows scalping and has the Expert Advisor for research.

(Risk Warning: Your capital can be at risk)

Pros of Cedar FX:

- It has an eco-friendly trading account

- It has low trading fees

- It has a wide range of forex trading instruments

- Low minimum deposit of $10

- Fast account opening process

Cons:

- Limited educational and research materials

- The withdrawals are only in bitcoin, which has transfer charges

- It has no regulation from any tier 1 or 2 jurisdiction

(Risk Warning: Your capital can be at risk)

2. Eagle FX

It is an ECN forex broker based in Dominica, with a low minimum deposit of $10. It accesses financial markets such as cryptocurrency, Commodities, forex, indices, and stocks. Forex traders should note that it is an unregulated forex broker.

If you want to open a trading account, they ask for names, email addresses, dates of birth, and set your password. They offer no client protection for its forex traders.

Features:

- It has variable forex spreads starting from 0.1 pips and commissions at $6 per round turn lot.

- It has a demo account and a social trading feature.

- It is available as a mobile app and website version

- Traders can access algorithmic trading from the MT4 trading platform that incorporates Expert advisors.

- It has a standard account that has a minimum deposit of $10.

- Their customer care team is available 24/7 via live chat.

- Payments are through Bitcoin, credit/debit cards, and wire transfers.

(Risk Warning: Your capital can be at risk)

Pros:

- It has low trading fees

- Low minimum deposit

- It accepts bitcoin funding

- 24/7 live customer support

Cons:

- Has no educational resources

- It is unregulated

(Risk Warning: Your capital can be at risk)

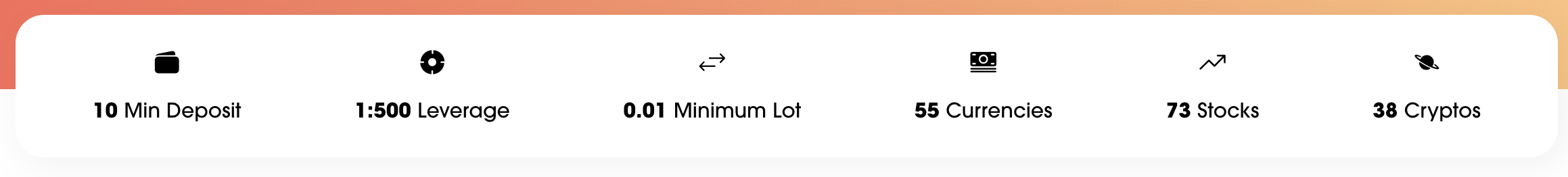

3. Hugosway

It is a forex broker based in St. Vincent and the Grenadines founded in 2017 with over 5000 registered traders. It offers access to commodities, cryptocurrency, stocks, indices, and forex. Furthermore, it holds clients’ funds in a segregated account, but it is unregulated.

Hugosway has no KYC policy, so forex traders who register on its platform input their names, and email addresses and set the password. They only verify the email by sending a verification email to your inbox.

Features:

- It has only one trading account, the Hugo account, with a minimum deposit of $10

- The demo account is available to its users

- It offers forex leverage of up to 1:500

- It has the MT4 integrated on its mobile, desktop, and website version

- There is the Expert Advisor that comes with the MT4 trading platform.

- The customer care team is present 24/7 and supports different languages.

- Deposit and withdraw through wire transfer, credit/debit cards, and digital wallets.

(Risk Warning: Your capital can be at risk)

Pros:

- Fast account opening process

- Has a low minimum deposit

- Low trading fees

- It has a two-step identification process for the desktop and mobile platforms.

Cons:

- It is unregulated

- Limited research resources

- No educational materials

- Limited trading tools available

(Risk Warning: Your capital can be at risk)

4. Longhorn FX

It is also a forex broker based in Saint Vincent and Grenadines founded in 2020. Forex traders have access to indices, stocks, commodities, cryptocurrency, forex, and commodities. It has no regulation from any known forex regulators.

It has no KYC registration process when opening a trading account. They require your name, date of birth, and email address to register an account.

Features:

- It has a demo account that forex traders can use to practice trading.

- It uses the MT4 trading platform present in the desktop, mobile, and website versions.

- The MT4 trading platform offers trading tools such as trading charts, technical indicators, and fast execution rates.

- It has the Expert trader and the inbuilt custom trading indicators and backtesting features.

- It has an education section which has articles covering a few topics in forex

- It has one trading account which you can open many trades.

- It offers a leverage of up to 1:500

(Risk Warning: Your capital can be at risk)

Pros:

- Low minimum deposit of $10

- It has the MT4 trading platform

- Their support team is available 24/7 via live chat

Cons:

- Limited educational materials

- It is unregulated

- Limited trading tools

(Risk Warning: Your capital can be at risk)

Conclusion – Not all brokers require ID verification

KYC compliance is crucial for forex brokers as it improves the trust between the brokers and the traders. Forex brokers that apply the AML and KYC regulations find it easy to solve any disputes between the forex traders as they can trace the transactions.

It is crucial to note that most forex brokers that are uncompliant with KYC regulations are often unlicensed and unregulated. It is easy for them to walk away with any misconduct to the forex broker. Most of these forex brokers are scams and should not be trusted.

Forex traders should be careful when depositing funds on forex brokers without KYC or ID verification.

FAQ – The most asked questions about Forex Brokers without KYC:

What is KYC in forex?

It is a registration process requiring traders to provide more details during registration. The forex broker verifies this information before creating a trading account.

How does KYC help in forex?

KYC or Know Your Customer assists forex brokers with knowledge about the traders in their platform. They can access enough information to solve any issues with the forex trader.

It helps them monitor and finds any illegal activities that forex traders could undertake on their trading platform.

What exactly is KYC verification?

Most Forex brokers abide by the Know Your Customer rule, which is part of the Anti-Money Laundering policy, by making sure to collect and validate the identifying information. The prevention of illegal FX use, including money laundering and criminal behavior, is made possible by this method.

Who exactly are no-KYC forex brokers?

No-KYC forex brokers allow customers to trade foreign exchange (FX) and other CFD assets without requesting KYC verification or supporting evidence from them. They are able to do this because they provide cryptocurrency, a kind of payment that bypasses conventional banking institutions.

Why do people engage in anonymous forex trading?

Malicious entities can exploit the forex market and the Internet to get access to traders’ sensitive and secret information, such as identity documents and financial information. Loss of money and identity theft may result from this.

Where will I be able to trade without being KYC verified?

The majority of peer-to-peer cryptocurrency exchange platforms do not mandate that you go by the Know-Your-Customer (KYC) and other verification rules. These include Longhorn FX, Hugosway, Cedar FX, and Eagle FX, some of which allow trading up to 2BTC.

Last Updated on January 27, 2023 by Arkady Müller