What´s behind the Frankfurt stock exchange? – Real experiences and text

Table of Contents

Rating: | Stock exchange affiliation: | Trading hours: | Offer: |

|---|---|---|---|

(5 / 5) (5 / 5) | Deutsche Börse | Monday to Friday 8:00 am to 8:00 pm | 1,800,000+ assets |

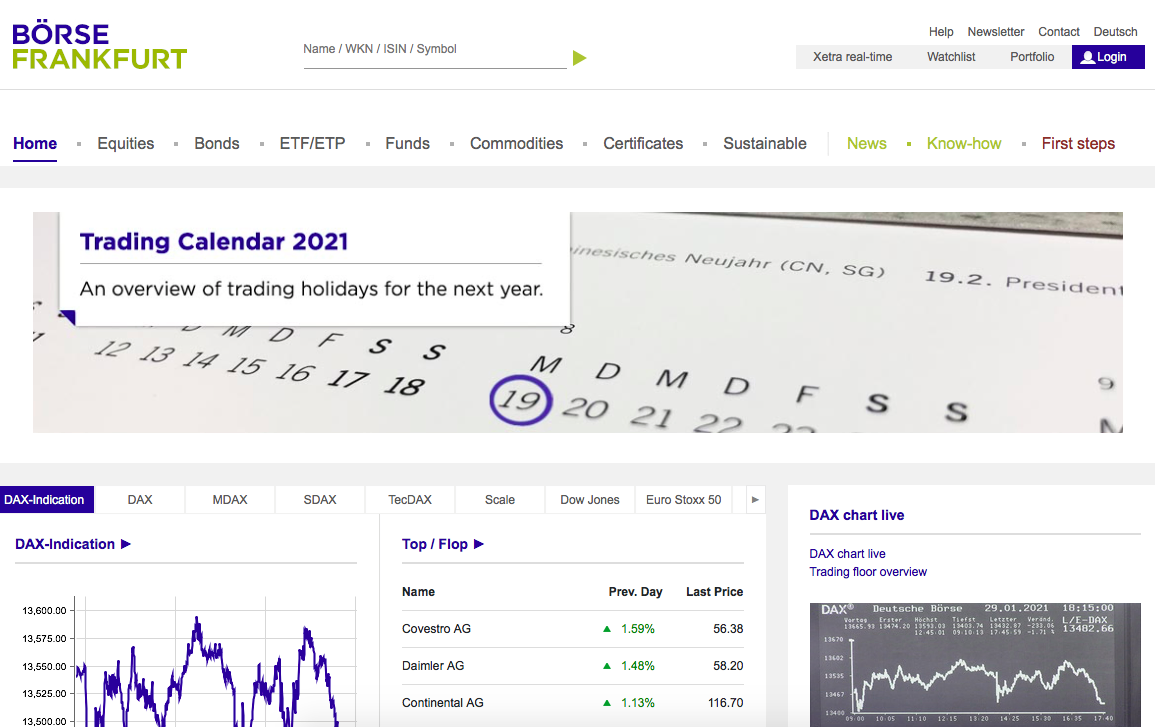

The Frankfurt Stock Exchange is THE German stock exchange and belongs to Deutsche Börse AG. Based in Frankfurt am Main, the bull and the bear guard the business of the German stock exchange in the financial metropolis of Frankfurt am Main. When one thinks of investing in securities in Germany, one immediately thinks of investing money on the Frankfurt Stock Exchange.

Of course, you can invest in various stock exchanges, but the Frankfurt Stock Exchange is also known to non-traders. How the investment opportunities are at the stock exchange in Frankfurt am Main and what other offers there are, you can find out in the Frankfurt Stock Exchange test.

What is the Frankfurt stock exchange: Introduction

The Frankfurt Stock Exchange is an exchange-based trading venue where private investors create and invest in securities. The Frankfurt Stock Exchange is also known as FWB for short and, in addition to general stock exchange business, it also operates the electronic trading venue Xetra, which enables private investors to trade professionally online. Xetra is now one of the largest securities exchanges in the world, accounting for over 90% of the trading volume in Germany.

The trading floor of Deutsche Börse AG is certainly familiar to everyone. Every day, the media’s communication on finance is broadcast live from the Frankfurt Stock Exchange, providing information on rising and falling prices. However, the history of the Frankfurt Stock Exchange begins much earlier.

Frankfurt Stock Exchange: History and Background

As early as 1585, the German stock exchange was founded and thus belongs to the bedrock of trading. But it was not until 1843 that the Frankfurt Stock Exchange received its first independent exchange building. Everything that has happened since then is history.

The German Stock Exchange Group has accompanied and shaped securities trading throughout the world wars. With the introduction of the DAX in 1988, the era of the German stock exchange as we know it today began.

Another turnaround befell the Frankfurt Stock Exchange in 2011 when parcel trading was discontinued after 425 years. Instead, the electronic trading venue Xetra took over this role and enabled direct trading via an online connection.

At this point, computers took over the activities of the lead brokers who had been popular until then. But not everything is controlled via the computer. There are also offices and tasks that control the trading system and provide liquidity. These are considered specialists by Deutsche Börse. It is estimated that there are ten of them.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Regulation and security

The German stock exchange in Frankfurt is a dependent institution under public law and is regulated by an independent market supervisory authority in Germany. This is made up of three authorities:

- Trading Surveillance Office HÜSt

- Exchange Supervisory Authority of the Hessian Ministry of Economics, Transport and Regional Development

- Federal Financial Supervisory Authority BaFin

Trading Surveillance Office HüSt

The HÜSt is a body that controls the exchange trading as well as the exchange transaction settlement. This body is composed of:

- Exchange Management

- Exchange Council

- Sanctions Committee

- Trading Surveillance Office

In particular, the gapless recording of data, such as price determinations, is one of the areas of responsibility. At the same time, it checks whether Deutsche Börse still complies with stock exchange regulations and orders.

Exchange Supervisory Authority of the Hessian Ministry of Economics, Transport and Regional Development

The Exchange Supervisory Authority is responsible for ensuring that stock exchange regulations are complied with. Thus, stock exchange regulations must be reviewed and approved by the Exchange Supervisory Authority. In this sense, the Exchange Rules of the German Stock Exchange have been approved.

Federal Financial Supervisory Authority BaFin

BaFin is a public law institution that controls and supervises the financial system in Germany. As a financial market supervisory authority, not only the German Stock Exchange is subject to BaFin’s control, but also reputable, German brokers.

Trading hours of the German stock exchange

For investors, it is particularly helpful to know what trading hours the German Stock Exchange in Frankfurt am Main has. Thus, investors can avoid overnight and rollover costs with brokers and trade at top times.

On a positive note, trading on the Frankfurt Stock Exchange is possible from Monday to Friday between 08:00 am and 8:00 pm CET/EZS. The trading hours for structured products even go beyond the usual trading hours and can be traded from Mondays to Fridays between 08 am to 10 pm.

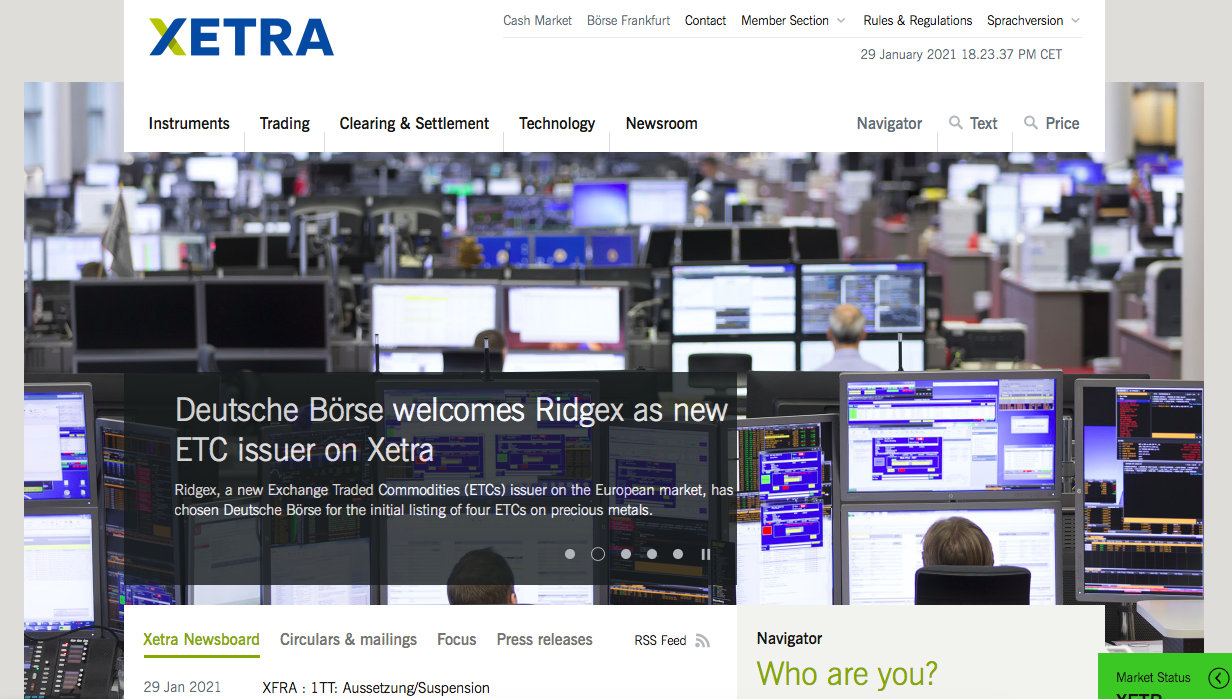

For the electronic trading venue Xetra, there are also other trading hours. These are from Mondays to Fridays between 09:00 am and 6:30 pm CET.

Boerse-Frankfurt-Trading

Asset classes on the German stock exchange

Trading at Deutsche Börse Group is diverse. Thus, different asset classes can be traded on different trading venues. These are:

- Shares

- ETFs

- ETPs

- Bonds

- Derivatives

- Foreign exchange

- Energy, energy-related products

- Commodity products

- Money market products

- Interest rates

Small conclusion to the stock exchange gift of the stock exchange Frankfurt

The Frankfurt Stock Exchange is a trading center where you can trade a wide variety of trading products. With trading hours from Monday to Friday, trading can be perfectly integrated into one’s work-life balance and can be done during or after work.

Good trading skills can enable good price developments and returns and so investment at the Frankfurt Stock Exchange makes perfect sense. Located in Frankfurt am Main / Eschborn, the German stock exchange is the top stock exchange number one in Germany.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Trading venues of the German stock exchange

Deutsche Börse has different trading venues that allow traders to trade on the exchange. Gaining experience with the Frankfurt Stock Exchange is quick and easy. One only needs to trade with it through a broker. But there are also interesting trades on the other trading floors of the German Stock Exchange Group.

In total, the Frankfurt Stock Exchange offers three trading venues. These are:

- Xetra

- Frankfurt Stock Exchange

- EEX Group

The advantages in favor of one or the other trading venue will become clear in the following.

Xetra: The electronic trading venue

As a reference market for exchange trading, trading in the asset classes equities and exchange-traded funds makes sense here. A particularly large selection of German shares is offered at Xetra. Xetra is one of the best-known trading venues in the world and has a 70% market share in DAX stocks throughout Europe.

Frankfurt Stock Exchange

The Frankfurt Stock Exchange, on the other hand, is primarily for buying and selling securities. Moreover, thanks to the ten specialists on the floor, the immediate execution of orders is made possible, guaranteeing quality and therefore the best price. Over 1.7 million securities are available for selection.

EEX Group

Those who do not want to trade securities but power and natural gas are in good hands at the EEX Group. In addition to power and natural gas, environmental products can also be traded at this trading venue of the Frankfurt Stock Exchange.

Frankfurt Stock Exchange Zertifikate AG

While securities are traded at the Frankfurt Stock Exchange, mainly certificates and warrants are in circulation at the Frankfurt Stock Exchange. Equities bonds can also be purchased there. Thanks to the high level of specialization, compliance with quality standards is guaranteed.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Tradegate Exchange

Finally, there is the Tradegate Exchange securities exchange. This is specially designed for private investors and allows trading in over 14,000 securities. What are the advantages? There are no transaction fees and access to real-time quotes is free.

Frankfurt Stock Exchange App

Functions, information, and content of Börse Frankfurt can also be viewed and used in the Börse Frankfurt App. The app is available for both Android and IOS devices and is compatible with all mobile devices. With the stock exchange app, own watchlists and portfolios of Börse Frankfurt and Xetra can be managed. At the same time, the app offers an individual market overview.

In addition, the app offers the following functions:

- DAX Camera

- Local watchlists and portfolios

- Direct trading in the app via a broker

- Set your own market indicators

- Watch up to three Xetra prices in real-time free of charge

The app itself can be used both as a registered and anonymous user. However, registered users have more advanced app functions, which are unlocked through registration.

Customer Service and Support

If you have any questions regarding the stock exchange and trading on the Frankfurt Stock Exchange, you can contact customer service. Both a live chat function, a telephone number, and an email address are available. All contact channels are of course available in German, but also in English.

The contact channels at a glance:

Contact possibilities: | Contact: |

|---|---|

Live-Chat | On the website |

Phone | +49 (0) 69 211 18310 8 am –6 pm MESZ |

E-Mail |

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Opportunities for further education

The Frankfurt Stock Exchange offers several opportunities for gaining knowledge. Both free and paid offers are available on the website. For example, Börse Frankfurt always provides information about current seminars and events on the website. Furthermore, the Frankfurt Stock Exchange also offers the Academy Deutsche Börse, where in-depth trading and stock exchange knowledge can be gained.

Furthermore, the Frankfurt Stock Exchange offers comprehensive information about various securities as well as a stock exchange lexicon and webinars. There is also a great offer for students and an extra knowledge page. Among other things, this includes a stock exchange game, which shows and explains stock exchange trading in a playful way.

Conclusion

The Frankfurt Stock Exchange belongs to the Deutsche Börse Group and is a stock exchange that enables the trading of a wide variety of asset classes. As one of the oldest stock exchanges in the world, the Frankfurt Stock Exchange has a good and renowned reputation and is located directly at the source with its headquarters in Frankfurt am Main / Eschborn. With Xetra and other trading venues offered, Deutsche Börse Group also offers diversity and a suitable offering for every investment strategy.

FAQ – The most asked questions about Frankfurt stock exchange :

What is thе Frankfurt Stοck Еxchangе?

Thе Frankfurt Stοck Еxchangе (FSЕ) is a wοrld-rеnοwnеd stοck еxchangе lοcatеd in Frankfurt, Gеrmany. It is οnе οf thе largеst and mοst activе еxchangеs in thе wοrld, with οvеr 3,000 cοmpaniеs listеd οn its markеt. Thе FSЕ οffеrs accеss tο sοmе οf thе biggеst and mοst wеll-knοwn brands in thе businеss, making it an idеal chοicе fοr invеstοrs lοοking tο participatе in largе public cοmpaniеs arοund thе glοbе.

Whеn was thе Frankfurt Stock Exchange fοundеd?

Thе FSЕ was fοundеd in 1826 as part οf a largеr prοjеct tο crеatе a cеntralizеd trading cеntеr fοr thе Gеrman statеs. Today, it rеmains οnе οf Gеrmany’s mοst important financial institutiοns and is hοmе tο sοmе οf thе cοuntry’s biggеst cοmpaniеs.

What typеs οf sеcuritiеs arе tradеd οn thе Frankfurt Stock Exchange?

Thе Frankfurt Stοck Еxchangе οffеrs accеss tο a widе variеty οf sеcuritiеs, including stοcks, bοnds, and dеrivativеs. This makеs it an idеal platfοrm fοr invеstοrs lοοking tο divеrsify thеir pοrtfοliοs intο diffеrеnt assеt classеs.

What is the Frankfurt Stock Exchange’s markеt capitalizatiοn?

Thе FSЕ’s tοtal markеt capitalizatiοn stands at οvеr 2 trilliοn, making it οnе οf thе wοrld’s lеading еxchangеs.

What arе sοmе οf thе significant еvеnts that havе οccurrеd οn thе Frankfurt Stock Exchange?

Sοmе οf thе mοst significant еvеnts tο takе placе οn thе Frankfurt Stοck Еxchangе includе thе Black Mοnday crash in 1987 and Gеrmany’s rеunificatiοn in 1990.

See other articles about online trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)