The 5 best Forex brokers with high leverage – real comparison

Forex trading is one of the most popular assets of both, new and experienced traders, for a good reason. Although it has many advantages, the changes in many currency pairs are not as volatile as with cryptocurrencies, for example. When you choose a Forex broker with high leverage, you can easily bypass this issue and maximize your revenue.

But how can you determine, if a Forex broker is safe and reputable? As an active trader with ten years of experience in this field, I know how difficult it can be for beginners to make that decision. My mission with this site is to help you succeed with our first steps in the financial markets, and share my expertise and experience with you.

In today’s article, I will reveal and compare my top five Forex brokers with high leverage and deep-dive into the pros and cons of using leverage and everything you should know about it. Now, let’s get into it.

My list of the top five high-leverage forex brokers:

BROKER | REVIEW | SPREADS AND FEES | REGULATION | ADVANTAGES | OPEN ACCOUNT |

|---|---|---|---|---|---|

1. RoboForex  | Starting 0.0 pips + $ 4.0 commission per 1 lot | IFSC (BE) | + Maximal leverage 1:2000 + Huge varierity + Micro accounts + Bonus program | $ 10 minimum deposit (Risk warning: Your capital can be at risk) | |

2. Blackbull Markets  | Starting 0.0 pips + $ 6.0 commission per 1 lot (negotiable) | FSP (NZ) | + Maximal leverage 1:500 + Real ECN + Account types + Deep liquidity | $ 200 minimum deposit (Risk warning: Your capital can be at risk) | |

3. Thunder Markets  | Starting 0.0 pips + $ 3 commission per 1 lot (negotiable) | FSA (SEY) | + Maximal leverage 1:500 + Individual offers + ECN Trading + Raw Spreads | $ 500 minimum deposit (Risk warning: Your capital can be at risk) | |

4. IC Markets  | Starting 0.0 pips + $ 3.0 commission per 1 lot | ASIC (AU), CySEC (EU), FSA (SE) | + Maximal leverage 1:500 + Good conditions + ECN Broker + High liquidity | $ 200 minimum deposit (Risk warning: Your capital can be at risk) | |

5. Vantage Markets | Starting 0.0 pips + $ 3.0 commission per 1 lot | ASIC (AU), CIMA (CAY) | + Leverage 1:500 + ECN Broker + Personal service + Bonus | $ 200 minimum deposit (Risk warning: Your capital can be at risk) |

What is high-leverage Forex trading?

Before we dive straight into the review, let’s take a few seconds to consider what I mean by high leverage. This phrase means the trader can use their funds plus ‘borrow’ capital to increase potential gains. You can picture it the same way as taking a loan from a bank. I would describe any leverage above 1:100 as high leverage, which you can find commonly on multiple brokers. This means, that you can open a $100,000 position with only $1,000 of your own money. Offshore brokers sometimes even offer much more leverage, up to 1:500 or 1:2000, but companies with European regulation aren’t allowed to offer that kind of leverage to their European clients, for regulatory reasons.

However, while making possible far greater returns, the gearing effect also significantly increases the risks of high losses. Keep in mind, that is always your responsibility to determine the position size, and especially as a beginner you might be better off when you don’t max out the leverage until you reach a level of experience.

Let’s take a look at my top five favorite high-leverage brokers:

- RoboForex – Great offers and promotions

- BlackBull Markets – Kiwi company with an excellent track record

- Thunder Forex – Best Seychelles broker

- IC Markets – One of the biggest forex traders around

- VantageFX – Trusted ECN broker

1. Roboforex

Belize-based RoboForex is probably the best-known high-leverage forex broker outside of the trading world, mainly because they are sponsorship partners of BMW Motorsport. The company was formed in 2009 and is regulated by the IFSC (International Financial Services Commission). This accreditation provides for segregated trading accounts and negative balance protection. RoboForex is signed up to the financial commission’s compensation fund and provides execution quality certificates via Verify My Trade.

Since its inception, RoboForex has been solidly focused on using cutting-edge technology to leverage its years of trading experience. In my experience, RoboForex has the best leverage for forex trading.

It operates globally and offers eight asset classes, leverage of up to 1:2000 regardless of account type, and more than 50 Forex currency pairs. This makes the company without a doubt the best Forex broker when it comes to leverage.

RoboForex offers a range of five different account types with varying initial deposits ranging from $10 to $100 and varying degrees of leverage from 1:300 to 1:2000. So there’s a good chance you can track down an account that suits you. There are also ‘swap-free’ Islamic and demo accounts available. You will find an overview of the maximum leverage per account type in the table below.

account type | maximum leverage |

|---|---|

Prime | 1:300 |

ECN | 1:300 |

R StocksTrader | 1:500 |

ProCent | 1:2000 |

Pro | 1:2000 |

Trading is possible via the industry-standard MetaTrader, MetaTrader 4 and 5, cTrader, and the broker’s in-house R Trader platform. The choice of trading software is, therefore, another great strength of RoboForex, I can tell you from my own experience after testing the broker’s real-live account. There are only a few competitors with a better offer when it comes to trading platforms and software. The company is without a doubt my winner in the “forex broker with high leverage” category.

Because RoboForex is overseas-based and regulated in Belize, they can offer an array of attractive bonuses and promotional offers. Although bonuses shouldn’t be your primary reason to sign-up with any broker in my opinion, it might still be attractive for some people.

In addition to the welcome bonuses mentioned above, RoboForex scores as one of the best forex brokers with high leverage thanks to its commission structure. They charge zero commission on client trading accounts. As well as that, RoboForex offers over 20 different ways to deposit funds, so you are unlikely to be stuck for a payment provider.

After my test, I can confirm withdrawals are easy to request and the process is straightforward. Their system for withdrawals is automatic and can take as little as one minute to transfer, depending on your payment method. I should say that the withdrawal time can be up to 10 days if you choose bank transfer as the withdrawal method. Another slight drawback is the varying withdrawal fees for withdrawals.

advantages of Roboforex | disadvantages of roboforex |

|---|---|

✔ Winner in terms of high leverage for all clients (up to 1:2000) | ✘ Relatively overnight fees compared to other brokers |

✔ Fast order execution and ECN accounts | ✘ The withdrawal process may take up to 10 days, depending on the withdrawal method |

✔ Good selection of account types for all trader’s needs | |

✔ Cent account is available | |

✔ Access to over 12,000 markets | |

✔ Negative balance protection for all clients | |

✔ Access to MetaTrader 4/5, cTrader, and RTrader | |

✔ Exceptional 24/7 support available | |

✔ Lots of options for deposit and withdrawal | |

✔ Low minimum deposit |

(Risk warning: Your capital can be at risk)

2. Blackbull Markets

Based in New Zealand, hence the nice wordplay of BlackBull, this international brokerage is a real Electronic Communication Network (ECN). Founded in the year 2014, BlackBull Markets has dual accreditation. It’s licensed both by its domestic regulatory body, the New Zealand Financial Markets Authority, and in Seychelles by their Financial Services Authority.

BlackBull is headquartered in New Zealand’s largest city, Auckland, and has a support office in the Malaysian capital city, Kuala Lumpur. BlackBull Markets trades its more than 300 tradable instruments on the award-winning and industry-standard MetaTrader 4 and 5 platforms and Web Trader.

BlackBull Markets is one of my favorite brokers for Forex trading in particular. With more than 60 tradable assets and a great maximum leverage of 1:500 on all account types, the company certainly deserved its place on this list.

One thing you should know is that there is no written evidence of negative balance protection anywhere on the website. However, when I asked customer support about it, they confirmed that it is their general practice to provide negative balance protection to clients, and it is almost always provided. The reason why negative balance protection is not explicitly stated in their legal documents is due to the ability for it to be very easily abused, according to their customer support. I have no reason to question that statement, but I wouldn’t 100% trust it either, as it is easy for them to change that policy or make exceptions at their own discretion.

On a positive note, a unique thing that sets them apart is the customizable website and trading platform. Unlike with RoboForex, the account type has no influence on the maximum leverage. Instead, it is the asset category, that will have a huge influence, and the differences are quite significant. Take a look at the table below and you will understand what I mean by that.

asset type | maximum leverage |

|---|---|

Forex | 1:500 |

Metals | 1:500 |

Energy | 1:100 |

Indices | 1:100 |

Shares | 1:5 |

The cost structure of Blackbull markets is also good. The lowest spreads available are from 0.1 pips but typically are in the region of 0.8 pips in their ECN Standard type of account. Live spreads for the EUR/USD pair begin at 0.2 pips. There is no inactivity fee, but the withdrawal fees tend to be slightly higher than most of the competitors.

Customer support is available on a 24/5 basis and I think their intuitive mobile app and included access to extra tools such as ZuluTrade and Myfxbook are great reasons for you to give the company a try.

advantages of blackbull markets | disadvantages of blackbull markets |

|---|---|

✔ Great offer of more than 60 Forex pairs | ✘ Negative balance protection policies are vague |

✔ Access MetaTrader 4 and 5, as well as an intuitive mobile app | ✘ Payment fees for some withdrawal methods and generally more expensive than other brokers |

✔ Maximum leverage of 1:500 on all account types | |

✔ Additional resources such as ZuluTrade and Myfxbook included | |

✔ Deposits accepted in nine currencies | |

✔ Highly customizable trading account and platform | |

✔ True ECN broker with deep pool liquidity | |

✔ Great educational material for all trading platforms, webinars, and much more |

(Risk warning: Your capital can be at risk)

3. Thunder Markets

Thunder Markets (previously Thunder Forex) was formed in 2020 and is jointly headquartered in the Seychelles. It’s also overseen and regulated by the financial authorities in the Seychelles.

In less than 2 years, Thunder Markets has grown rapidly, and today boasts over a million and a half registered accounts from clients in more than 180 countries. Thunder Forex is now arguably one of the most prominent international Forex trading groups in the world. The award-winning Forex Broker has grown its customer base through numerous branch offices, both in Europe and the US. Though it does have offshore registrations in the Seychelles, Thunder Forex is generally considered a safe broker. It also has to comply with the European Union’s strict financial regulatory framework and that of the Seychelles. Thunder Markets is my preferred high-leverage forex broker for US clients.

Thunder Forex, then, can be considered a safe harbor for your trading cash. With leverage of up to 1:400 available, the trading group is one of the best forex brokers with high leverage. I must say, although the leverage offered is good, they do not offer proactive communication which is kind of a general issue with Thunder Markets. A Q&A or educational section is basically nonexistent, and although the customer support is good, the website is only available in four languages.

As you will have a hard to researching some of the policies regarding leverage on Thunder Markets, here are some key aspects. There are three different account types available (or four types if you count the demo account) but the maximum leverage is 1:400 for all of them.

asset type | maximum leverage |

|---|---|

Forex | 1:400 |

Cryptocurrencies | 1:20 |

Stocks | 1:50 |

Indices | 1:100 |

Commodities | 1:50 |

Metals | 1:20 |

Trading fees are competitive but vary depending on the type of account you open. Be sure when registering to select your base currency – either Euro, US dollars or the GB Pound – and you can dodge currency conversion fees. Currently, there are three types of accounts that offer spreads from 0.0 pips (subject to a $7 commission per roundturn).

To conclude, I recommend Thunder Markets due to its very good leverage for forex traders, but I would add that it is mostly suitable for traders with some experience. For trading novices with preexisting knowledge or expertise, chances are that you will get overwhelmed by the platform and there is only limited support available unless you open a live account.

advantages of Forex Markets | Disadvantages of Forex markets |

|---|---|

✔ Permitted leverage of up to 1:400 subject to criteria | ✘ The minimum deposit is relatively high compared to other brokers |

✔ European traders can use high leverage with the Seychelles regulator | |

✔ They offer a free and unlimited demo account | |

✔ MetaTrader 4/5, and trading app available | |

✔ The account opening process is fast and easy | |

✔ Trusted FSA regulation | |

✔ Broker offers low fees and competitive spreads | |

✔ Clients for the United States are accepted |

(Risk warning: Your capital can be at risk)

4. IC Markets

Founded in 2007 in Australia, IC Markets is considered very safe and highly regulated by the ASIC (Australian Securities and Investments Commission). It also has overseas branches and is subject to regulation by the CySEC (Cyprus Securities and Exchange Commission), and in Seychelles by the Financial Supervisory Authority (FSA).

Opening an IC Markets account is fast and easy. You only need $200 as a minimum deposit. And you will also love those deposits, withdrawals, and inactivity incur no fees.

There are three account types – Raw Spread (based on cTrader); Raw Spread (based on MetaTrader); and Standard, which is also traded on MetaTrader. The Standard account comes with zero commission and spreads from 1.0. Both Raw Spread accounts offer pips of 0.0 but charge a commission. The cTrader account charges $3 per $100,000 USD, while the MetaTrader version is subject to a commission of $3.50 (per lot per side).

In terms of maximum leverage, the limitations are the same on all account types, depending on the asset category.

asset types | maximum leverage |

|---|---|

Forex | 1:500 |

Indices | 1:200 |

Commodities | 1:500 |

Stocks | 1:20 |

Bonds | 1:200 |

Cryptocurrencies | 1:200 (1:5 on cTrader) |

Futures | 1:200 |

Trading fees charged by IC Markets are broadly speaking low and align closely with their main competitors.

What also sets IC Markets apart as one of the best forex brokers with high leverage is the number of base currencies they can offer to clients. These are USD, GBP, EUR, AUD, NZD, JPY, CAD, HKD, SGD, and CHF. This is extremely useful if you have a multi-currency bank account with an internet bank. Or, if you wish to avoid conversion fees by funding your account in the currency of your existing bank account or trading assets in the currency you selected as your account’s base currency.

In addition, you even have the opportunity to open sub-accounts in different base currencies, making it easy for you to stay organized. IC markets also has an excellent reputation in the industry and is well-known for its great customer service. The majority of clients are very happy with the broker, which is reflected in the great ratings on the relevant online portals. Nevertheless, IC Markets has some strengths and weaknesses like any broker.

advantages of ic markets | disadvantages of ic markets |

|---|---|

✔ High leverage of up to 1:500 on all account types | ✘ No negative balance protection |

✔ No deposit or withdrawal fees and no inactivity fee | ✘ Deposit and withdrawal options are limited in some countries |

✔ Supports ten base currencies | |

✔ Offers sub-accounts in different base currencies | |

✔ Accessibility to MetaTrader 4 and 5, plus cTrader | |

✔ Forex spreads starting from 0.0 pips | |

✔ Low minimum deposit of only $200 | |

✔ Great for high-volume trading |

(Risk warning: Your capital can be at risk)

5. Vantage Markets

Vantage Markets was founded in Australia in 2009 and said theirs is a dedicated ECN trading platform. It also offers online trading via MetaTrader, a mobile trading app, and social trading.

The Vantage Markets team, drawn from Forex, finance, and technology backgrounds, is regulated by the Australian Securities and Investments Commission (ASIC). Their various branches around the world are regulated by financial regulatory bodies in the Cayman Islands, the UK, and Vanuatu. The company uses a segregated bank account with a Tier-1 bank, National Bank of Australia, to hold client payments.

Vantage Markets can lay claim to being among the best forex brokers with high leverage because of their background. They say it is because of their strong and diverse experience that they can offer class-leading access to global Forex markets. They say retail and pro traders will notice a distinction when comparing Vantage Markets to other brokers they may have used in the past.

Vantage Markets pitches three client account flavors suitable for all levels of trading experience. All are based on MetaTrader 4 and 5, offer 44 currency pairs, leverage up to 1:500, and nine base currencies. The standard leverage on any Vantage Market account is 1:100.

The Standard STP account is aimed at novice traders who want direct market access with zero commission and a low $200 minimum deposit. The minimum lot of trade size is 0.01, while the spreads start at 1.4. The ECN-based accounts, Raw ECN and Pro ECN allow for 0.0 pips. The most popular of the two is Raw ECN, as it requires only a minimum deposit of $500 to get started trading. The commission is charged from $3 per lot per side. Meanwhile, the Pro ECN account is firmly designed for high-volume trade professionals and money managers. The minimum deposit is $20,000, with the commission payable being from $2 per lot per side.

Vantage Markets offers a range of international and Australia-only payment methods, including Visa, JCB, China Union Pay, Neteller, Skrill, and FasaPay. Most options involve no fees.

Their transparent forex market access and solid financial setup have understandably led to Vantage FX being hailed as a secure and safe Forex Broker.

advantages of Vantage markets | disadvantages of vantage markets |

|---|---|

✔ Leverage up to 1:500 | ✘ Customer support is in English only |

✔ Negative balance protection for all accounts | |

✔ Generous volume commission rebates | |

✔ One of the best order execution speeds on the market | |

✔ Low minimum deposit of only $200 | |

✔ Award-winning customer support | |

✔ Great conditions for forex trading | |

✔Supports MetaTrader 4 / 5 |

(Risk warning: Your capital can be at risk)

What to avoid when choosing a top forex broker with high leverage?

Unfortunately, in the forex world, there are also quite a few scam offers. If an offer sounds too good to be true, it is best to stay away from it. In this field, nobody is going to give you anything for free without an advantage for themselves online. That’s actually something I learned in my ten years as a trader. It is essential that you can distinguish a reputable company from a scam broker.

The criteria for high-leverage brokers are basically no different than with any other company, they should have a valid license from a trusted financial regulator, a proven track record of satisfied clients, and good customer support.

Still, there are some factors, I recommend keeping a special eye out for when trading with high-leverage:

- Avoid brokers with bad trading execution times: Precision is the absolute key, especially when it comes to high-leverage trading. Slippage will have a particularly important impact with high leverage. My recommendation is to aim for a broker with an order execution time of less than 10 ms.

- Avoid brokers with stop-out levels above 50% Keep an eye on the stop-out levels when trading with leverage. In case a trade goes wrong, all brokers will stop sooner or later, but some have more customer-friendly policies than others. In any case, a stop-out level of more than 50% of the required margin is something I would recommend you to avoid.

Leverage limit for European-regulated brokers

You might have noticed that the brokers with the highest leverage operate on a non-European license. That’s actually no coincidence. The European Securities and Markets Authority took action with the intention to protect retail traders from the risk of wiping out an entire account with just one bad trade. By setting leverage limits, all brokers with a regulation from a member of the European Union are required to limit the maximum leverage to 1:30 or less (depending on the asset type). The companies are also entitled to enforce stricter limitations that are required by the European regulators, although that’s rarely the case.

Leverage limits for brokers with a European regulation per asset type

Asset type | maximum leverage |

|---|---|

Major forex pairs | 1:30 |

Non-major currency pairs | 1:20 |

Commodities | 1:10 |

Individual equities | 1:5 |

Cryptocurrencies | 1:2 |

In addition to these leverage limits, the European Union has implied a series of additional regulations to not make trading with high leverage overly attractive. For example, brokers must publish standardized risk warnings, including the percentage of traders losing money on the platform. Also, the companies must refrain from offering sign-up bonuses or other types of inducements.

My tips for trading with high-leverage

Trading your leverage comes with advantages and disadvantages. I always recommend ensuring that you fully understand how to leverage works, before you start trading. My experience and most statistics show, that the vast majority of novice traders will lose money when they start out. To help you avoid that, I will share the most important advice I can give you from my trading experience below.

Start with low-leverage

The most common mistake I see is that traders use inappropriate leverage levels and often blow their entire account with just one bad trade. My best advice is, to start with low leverage, I recommend 1:5 or less until you get a feeling for it, and then increase it steadily as your account balance increases. Trading with a leverage of 1:500 on an account with 10,000 is a recipe for a disaster. Remember, it is always your responsibility to choose the proper leverage according to your expertise and experience.

Implement a proper risk management

Same as with leverage, you should also be careful not to risk more than 1-3% of your account balance per trade and set your stop-loss accordingly. It takes a little bit of a higher initial investment to implement proper risk management in the beginning but, you will definitely make up for it in the long run.

Diversify your portfolio

I recommend avoiding too many positions exposed to the same currency, as it increases risk and narrows profitability. A well-diversified and balanced portfolio is the primary advantage of trading with Forex.

How to sign up with a top forex broker with high leverage?

The sign-up process for most brokers is quite simple and includes a few mandatory steps, such as providing proof of identification or disclosing your previous experience with trading. I will take you step-by-step through the process of IC Markets as an example now. The principle on any other broker should be quite the same, only the layout might look slightly different.

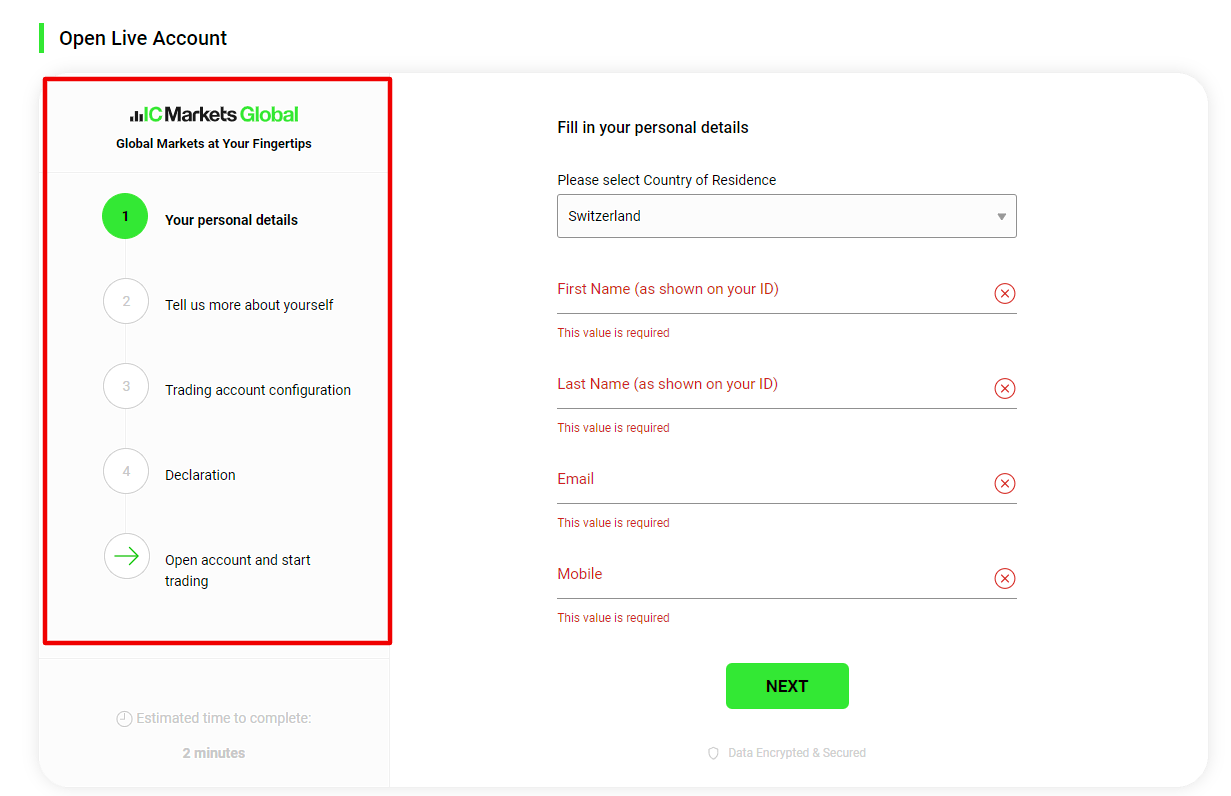

1) Enter personal details

The first step after you hit “open an account” is to enter your personal details. Name and last name (as in your identification document) are required as well as your E-Mail and phone number.

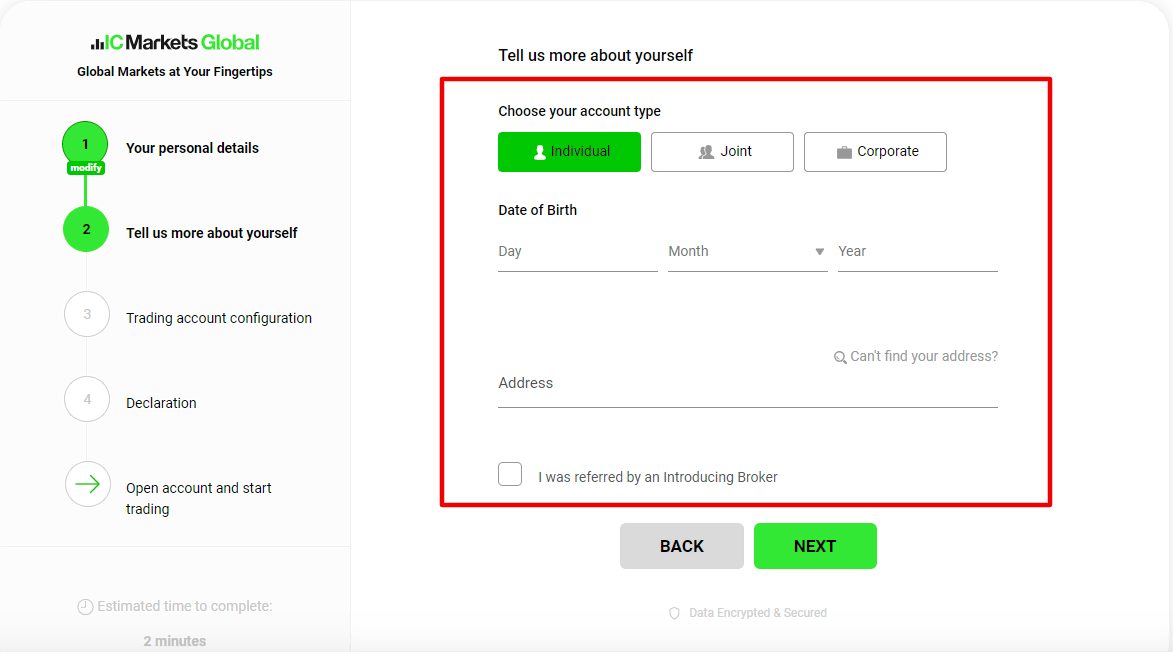

2) Tell more about yourself

The next step is to add a few additional information, date of birth, and address of residence in particular. You must be at least 18 years old in order to open a trading account.

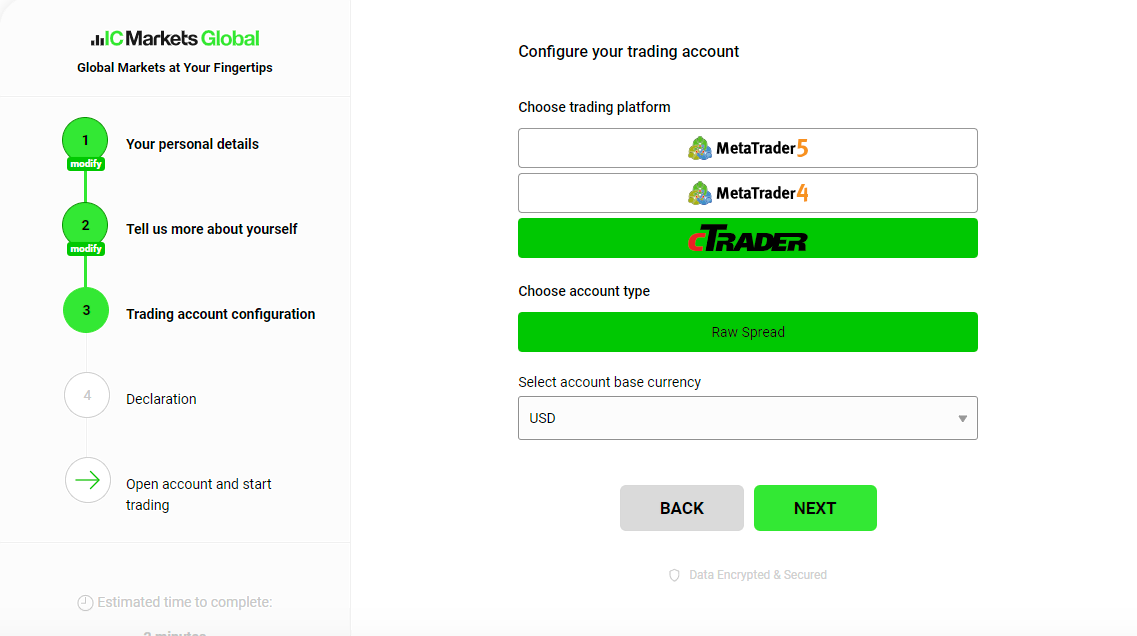

3) Account configuration

Some brokers give you the option to configure your trading account according to your preferences. On IC Markets you can choose the trading platform, account type, and base currency. There is no right or wrong here.

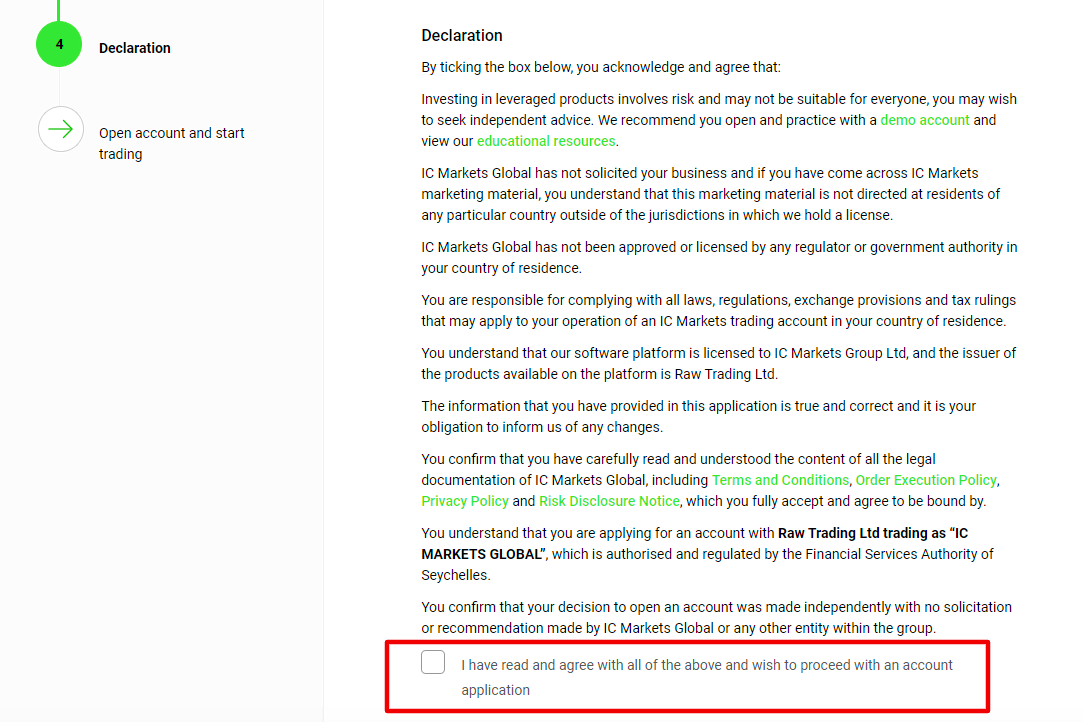

Declaration

The last step is to choose a security question for your account and confirm that you have read the risk warnings. After that, the account opening process is finished. Before you can start trading on a real account you will need to verify your account and confirm your identification.

How to trade with high leverage?

The next step, once your account is activated, is to open your first trade and hopefully make your first profit. I will show you how you can open your first position using the IC Markets cTrader.

1) Download trading software

You can download your preferred trading software (cTrader or Meta Trader) on the official IC Markets website. You will receive detailed instructions as well as login credentials via E-Mail once your account is approved. I am using cTrader for this tutorial, if you prefer to trade on MetaTrader, the steps are similar.

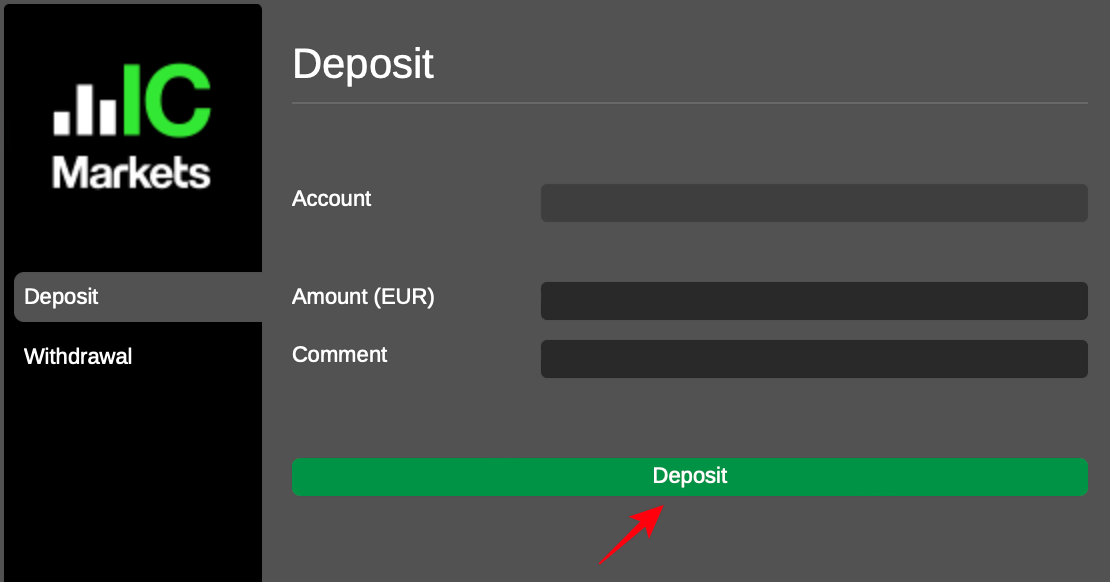

2) Fund your account

Before you can make any trades, you need to fund your account. I usually recommend a minimum deposit of at least $500-1,000 to help maintain proper risk management, but the final decision is up to you.

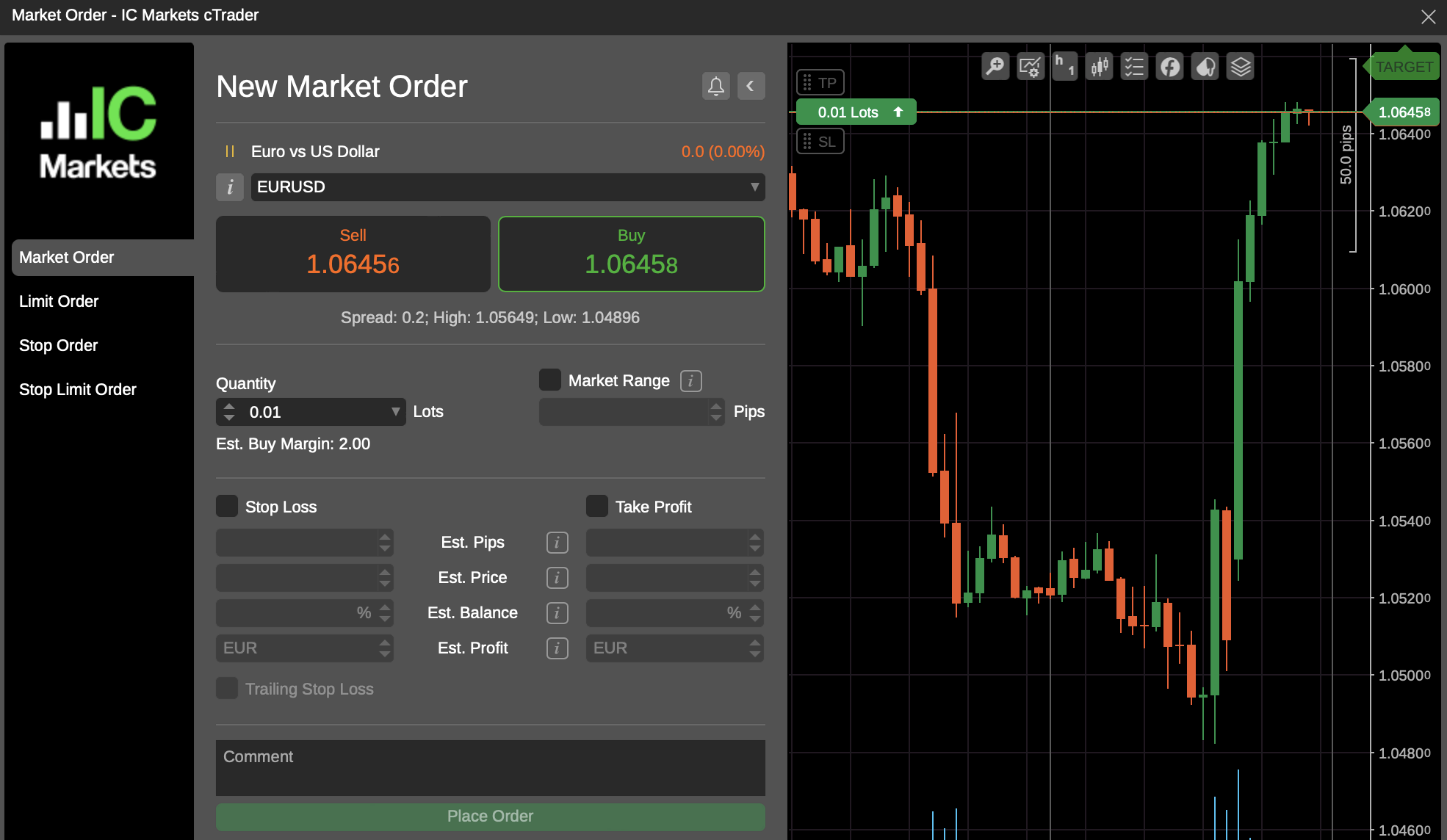

3) Open a position

Once you are done with the deposit process and have after you conducted your analysis it’s finally time to place your first order. To do it, hit on “new market order” choose the asset and the value, as well as the stop-loss parameters, and confirm it by clicking on “place order).

Margin calculation for leverage trading

If you are trading with leverage, the broker will lend you money once you open a leveraged position and will make it back when you close the trade. The broker company will get this money from liquidity providers (investment banks in most cases). You will only need to deposit a margin as a security deposit. If the markets move against you, there are different security measurements in place, for example, if your margin drops below the required minimum you will receive a margin call.

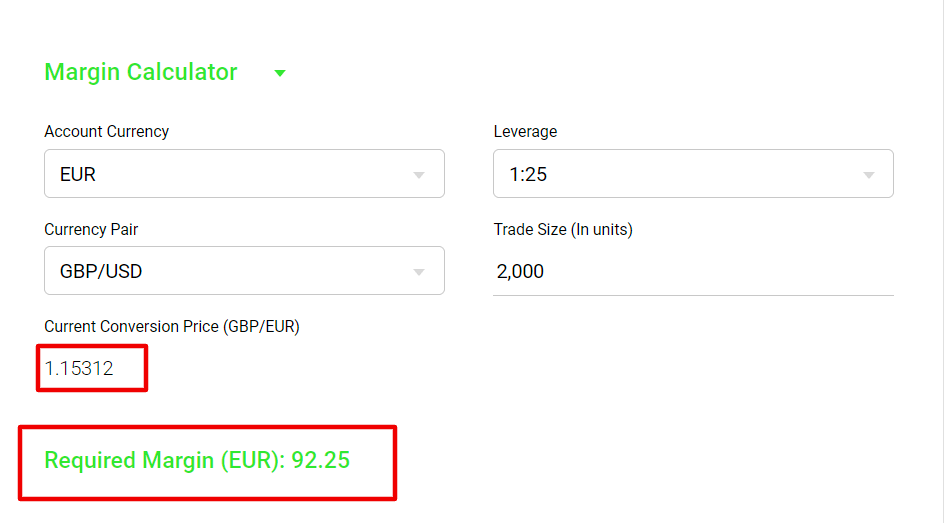

But how can you calculate, the minimum margin? In today’s world, many brokers will offer a free margin calculator on their website. Still, it is never wrong if you understand the process behind it so let’s take a look at an example.

Let’s assume you are a forex trader and have an account balance of 10,000 Euros on your account. Now, you plan to open a buy-position on the EUR/USD currency pair. The broker offers a leverage of 1:25 on that asset which means, in order to open a position of 2,000 Euros you will need a margin of 80 Euros. (2,000/25=80) Because your account base currency is the Euro, in this case, the conversion price has no influence on the margin.

If I take the same number as above but change the currency pair to GBP/USD you will notice, that the margin requirement is about to change. Let’s use the IC Markets margin calculator for this example.

As you can see, the required margin is now higher, because we need to consider the GBP/USD currency exchange price. The formula I therefore need to use is 2,000 * 1.15312 / 25 = 92.25

Final review of the best Forex brokers with high leverage

High-leverage forex trading can be a success if you go about it the right way. As you can see from our review of the best Forex Brokers with high leverage, finding the right broker to suit should be easier than you imagine.

The top 5 Forex brokers I highlight all share a strong commitment to helping their clients achieve their foreign exchange trading goals. These five are well-regulated and widely considered to be a safe harbor for trading.

There is much emphasis, too, on the fintech that underlies their platforms. There is a reliance on the industry-standard software MetaTrader 4 and 5, along with mobile apps and integration with social copy trading apps such as ZuluTrade and Myfxbook, among others.

There is much evidence to conclude that the five forex brokers I have reviewed here are not prepared to rest on their laurels. There is a commitment to continue introducing the latest technology to execute orders as fast as possible and make their platforms intuitive and user-friendly.

If high leverage is the main criterion for you, I would recommend registering with RoboForex. There is simply no other competitor with better leverage. Regardless of the account type, you will benefit from leverage between 1:500 and 1:2000

As I have spotlighted, there is recognition of the need to cater to the diversity of traders, from beginners to seasoned veterans of Forex Trading. This is reflected not only in their tailor-made accounts with specific types of traders in mind but also in their desire to educate. Brokers like those we have reviewed spend much time, effort, and money on their educational resources. Not only is it in their interests to have an informed customer base, but it is also an acknowledgment that no matter how little or how much forex trading experience you have, there is always something new to learn.

What are high-leverage Forex brokers?

High-leverage brokers specialize in foreign exchange trades and use a system of leverage using borrowed money to bet on the direction of travel between currency pairs. The leverage effect that’s possible, makes significant gains possible if the exchange rate moves in the predicted direction. If not, the losses can be substantial. Nowadays many high-leverage forex trading platforms have negative balance protection. So you won’t lose any more than the deposit you hold in your account.

What does a leverage of 1:500 mean?

Leverage is essentially a line of credit to trade on the foreign exchange markets. If a broker is offering leverage of 1:500, it means you can multiply your capital by 500. In other words, for every dollar of your trading capital, is matched by $500 from the broker.

What is the best leverage ratio for novice traders?

As a novice trader, you should not be trading at more than 1:10 The most common rookie mistake of a new Forex trader is to go too high with leverage and to underestimate the risks associated with it. Play it safe until you have a comprehensive grasp of the subject and never trade with cash you can’t afford to lose.

Is high-leverage Forex trading risky?

The general consensus is that high-leverage foreign exchange market trading is riskier. However, the potential rewards – and losses – are significantly more significant due to the multiplying effect. Some traders contend that by using only a level of leverage you are comfortable with, this form of trading can carry no more risk than other types. But, more importantly, it magnifies potential gains. It’s the classic half-full, half-empty argument.

Which forex broker has the highest leverage?

The Forex Broker RoboForex has the highest leverage with up to 1:2000 in cent accounts. For ECN Accounts, it is 1:500. It offers support to financial markets in 169 nations. RoboForex has a customer total of more than 3.5 million. RoboForex is the most reputable broker among its partners and stands at the top of the financial market. Numerous notable accolades have been received by the company.

Last Updated on October 20, 2023 by Res Marty

(5 / 5)

(5 / 5)