Fusion Markets review and test – Is it the right broker for you?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.8 / 5) (4.8 / 5) | ASIC, AFSL, VFSC | 0€ | 120+ | 0.01 (often 10c per pip) |

Fusion Markets stands by its mission statement: “The world’s biggest market, the world’s lowest-cost broker.” It was based on a statistical sampling of top CFD (Contract for Difference) and foreign exchange brokers for commissions and spreads in the entire world, overseen recently on February 2021. They reached a consensus that this online platform was a step above the others in the financial industry and relatively easy to utilize. Fusion Markets take pride in having the lowest prices of financial products that clients can trade. They have a radically effective and original trading platform that provides for a consistent and user-friendly experience.

We have over nine years of experience and have made a thorough examination of this platform and the services it provides. Once you have read this review, it will aid in your decision-making process if you are going to use it or not.

What is Fusion Markets? – the company presented

Fusion Markets is a relatively new brokerage firm and was founded in November 2017. It is a trading name of a premier Australian-based company, called Gleneagle Asset Management Limited or GAML. They are veterans in the Australian forex community and specifically catered it for their countrymen. They have become illustrious in their chosen fields in finance. With a combined fifty years of highly profitable experience, they wanted to share their knowledge and skill with others and make trading an accessible and uncomplicated undertaking.

They have agreed on a few simple rules to live by and instituted them on their trading platform:

- Drastically lower pricing enables regular and inexperienced people to trade in financial assets like CFDs and forex.

- Usage of top-quality and cutting-edge technology to assist traders in a perfectly coherent and consistent trading experience.

- Providing the friendliest service and support towards traders of different skill levels.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

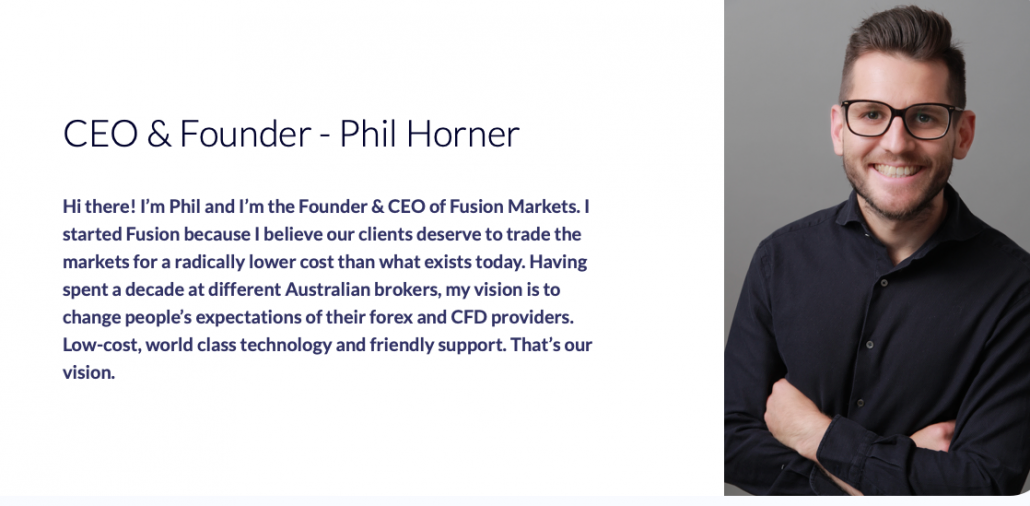

The CEO and founder of Fusion Markets is named Phil Horner. He has over ten years of experience in the Australian financial industry. He worked in different companies like AxiTrader and Pepperstone Group Limited (which he became the CEO, but left nonetheless in 2017). He wanted to pursue his dream to be the boss of his own brokerage company. Thus Fusion Markets was born.

His vast and illustrious experience enabled him to become a veritably seasoned broker and trader. He took that precious knowledge and molded it into this highly efficient internet trading platform of today. One of the best tools of the Fusion Markets platform is the highly effective and popular MT4 or Meta Trader 4. It is user-friendly and easy to navigate and gives traders a great opportunity to trade in over one-hundred-twenty assets.

Australian traders prefer this from the other sites because they can garner higher earnings from the commission rates, which are thirty-six percent cheaper than the other brokerage platforms. Also, there are no credit and debit card deposit fees which makes them all the more appealing.

Company vision:

Fusion Market’s goal is to give quicker and easier access to the financial markets of the world. Therefore, getting the lowest cost of financial products compared to what is currently available. Being known as a low-cost brokerage platform is not enough. They want to permanently alter the perceptions and expectations of people of what CFD and forex providers are.

Is Fusion Markets regulated?

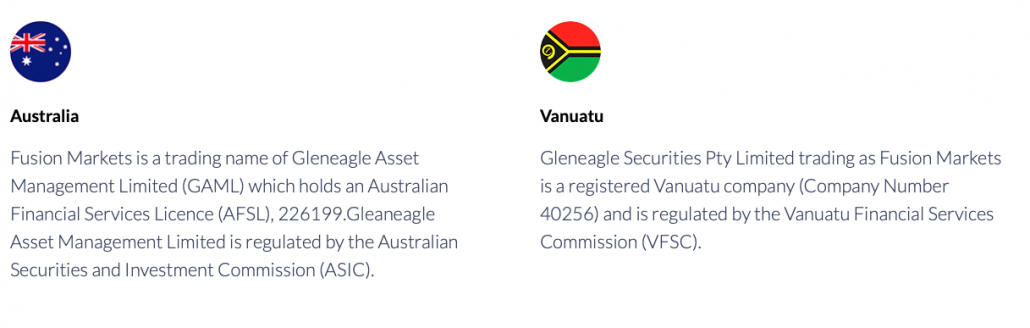

Fusion Markets has a license and regulation by ASIC (Australian Securities and Investment Commission). It also has a license from AFSL (Australian Financial Services License, along with a 226199 number designation. It is also regulated by VFSC or Vanuatu Financial Services Commission and is a registered Vanuatu company whose company number is 40256.

Companies that apply for these licenses undergo strict standards for compliance to qualify. These include a capital of one million Australian dollars minimum requirement. And thus, rigorous compliance in filing regularly scheduled reports allows the regulating entities for third-party audits. There are also safety measures established by the company, like having the funds of the customers in segregated Westpac Bank accounts.

What does that mean?

The company has built a substantial reputation for having a safe and secure platform where people can trade with ease.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) MT4 / Meta Trader 4It is the most popular and essential tool in the Fusion Markets arsenal. It is a trading software first developed by MetaQuotes in 2005, which licensed it to forex brokers (like Fusion Markets) to their customers. Furthermore, it is praised highly by advanced traders and novices alike for its spectacular implements like multiple timeframes, powerful charting capabilities, efficient features, and customizability. It has an automated program called Expert Advisors, which has been praised in the financial community for its highly effective functionality. It was designed utilizing the MetaQuotes program language. Furthermore, it is also a distinct element that most traders look for when using MT4. You can purchase EAs on the internet via the MT4 terminal. Traders should also take note that when the clients first see it, it will look like an empty shell with nary a thing on it and what will happen next is the most interesting because it will be compelling to see the things that the broker fills it with.  The specific Fusion Markets MT4 has a range of features that complement the platform itself, like Multi Account Manager for more expert traders and a Virtual Private Server to guarantee that there will be no connectivity interruptions while trading. It also has a powerful mechanism that enables extremely low pricing, the capability to link up to the Fusion Markets Clients Hub for account management, and the ultra-fast trade execution of 0.02 milliseconds. Here are some of the reasons why a majority of online traders prefer it:

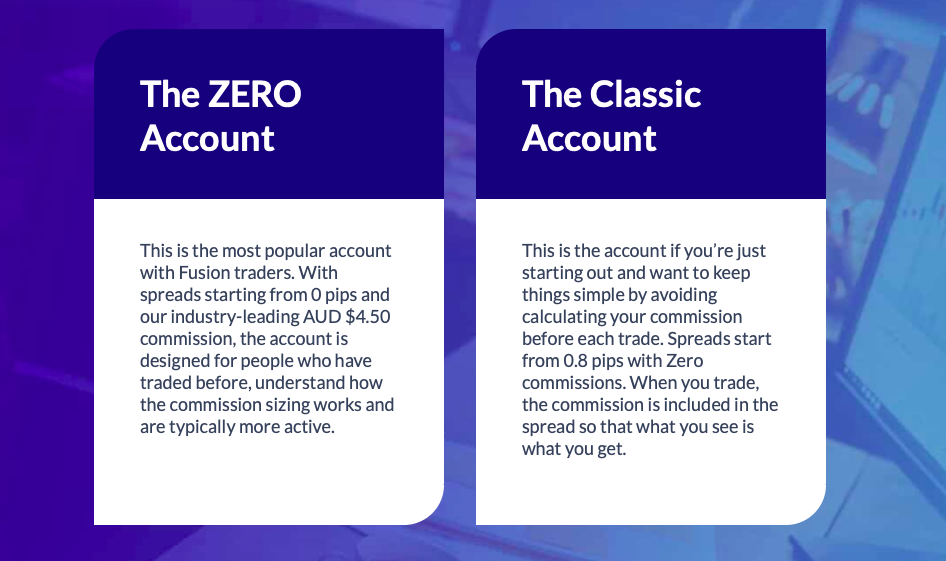

All the most prolific online brokers have enlisted this software for their online platforms. It has become an industry-standard in the foreign exchange industry due to its speed, stability, and convenience. Web Trader for MT4If you are unwilling to install or download the platform on your laptop or desktop computer, but you want to utilize it, there is still a way to do that, with extra help from the cloud-based version of the MT4 Web Trader.  It’s still the MT4 tool with all the same abilities and features. And can be accessed directly on the internet browser of the computer. You do not need to install or download it, which further increases its level of effectiveness for the users. Note: It is accessible anywhere else on the planet, from whoever has an internet connection, with the same functionalities as the desktop trading platform. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) MT4 mobile applicationFusion Markets still provides access to traders that are too busy to stay in one place. They can still trade with their smartphone using two native MT4 apps, one for iOS devices and the other for Android users. You can freely download it on either App Store or Google Play, which is dependent on the OS or operating system you have on your device.  It enables mobile users the freedom and flexibility to trade wherever they may be. They can do anything with their Fusion Markets accounts, like trading or exploring the many open forex markets. It’s done by utilizing the graphical tools and indicators of the application. Novice traders can prodigiously learn and benefit from the many types of executions, real-time forex quotes, and detailed history. It is beneficial to the more sophisticated traders also, providing free market updates and charts that you can customize. The charts you can select for yourself to use are either candlestick, Japanese, line, or bar. You can interact with it by scrolling and zooming in. You can choose from either of the time frames like MN, M1, M30, M15, M5, M1, W1, H1, H4, W1, and D1. Fusion Markets types of accountsTrading is already regarded as a complex task, and choosing an account is the crux of the matter. It’s a crucial undertaking, which you need to make sure you are doing correctly. It’s because it is dependent on whether you can earn money with the account or not. Good thing that Fusion Markets only has two account types for clients to select. It would fix any confusion and quandary the new users may have (there is also a demo account, which will be discussed in another segment). Each has similar access to the tools, instruments, and features. The differences are only minimal, as mentioned below:

Since this is regarded as a more superior account to the other, there are no required trading volumes and minimum deposits. This type befits the more experienced and active trader since it necessitates a thorough understanding of commission sizing.

Its best feature is a simplistic and easy-to-understand computer interface. You do not have to calculate a commission before opening a position to trade. With this account type, there are no commissions because they are already built-in spreads. The spreads for this type of account begin at 0.8 pips. Calculation of the average spread is done by including the listed spread in a particular trade to 0.8. Example: 0.15 + 0.8 or 0.95. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Demo accountIf you are still a newcomer and not yet confident in your trading abilities, then you can practice in a demo account. It is a way to sharpen your skills and test the available products without spending and losing real money. It’s relatively easy to try it out and register. Go to the Fusion Markets home page, scroll down below to find the “try a free demo” link, and click it.

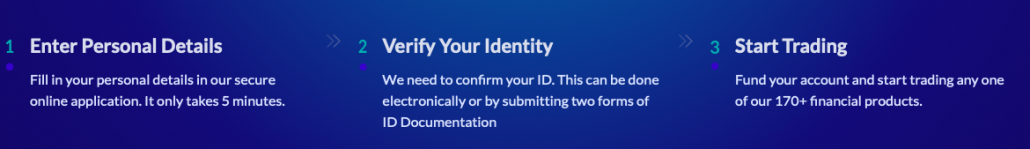

Opening an accountCreating a Fusion Markets account is as easy as pie. They are proud of its uncomplicated and user-friendly interface. Thereby, opening an account requires little effort. The whole process is similar to making a demo account (mentioned above). You will still fill out the web form with your details and upload documents to verify your address and identification. The best way to get a clear copy of a particular document is to scan it with a computer scanner. If you’re going to use utility bills (gas, phone, or electricity) as proof of residence, be sure it is current, not more than three months old. After you have filled out the info and uploaded all the necessary documents, just wait for an email from the accounts department to let you know that you have a verified account. Then you can deposit funds into your account and begin trading.  Fusion Markets payment methodsFusion Markets provide an impressive selection of payment methods. A few payment options are tailored specifically to the region in the Asia Pacific, like Malaysia and Thailand. The most popular funding choices are with debit/credit cards by Visa and Mastercard. It is a good choice since there would not be additional charges for this. Once you deposit the funds, they will immediately appear on your account. You can opt for bank transfers. But this option has a long waiting time, and you can wait up to five business days until the deposit will appear on your account. The exact period will depend on the country you’re in. E-wallets are not yet available.  Deposit and withdrawalThe Fusion Markets platform does not have many options for a trader to withdraw and deposit funds in an account that includes debit/credit cards and wire transfers. Also, there are no fees for depositing using debit/credit cards. Withdrawing funds can be fulfilled on the same day. In some instances, withdrawal can happen the next day if it is outside banking hours. Bank-to-bank transfers can occur in a couple of business days. Yet some other ways can be immediate. Some payment online systems might have requirements, restrictions, and transaction limits. These details are usually shown on their websites. Third-part payments are not accepted on the platform. In some countries, customers might have to undergo an account verification procedure in removing limitations for either withdrawal or depositing. Customers can choose a currency to use for their Fusion Markets accounts like AUD, USD, EUR, SGD, GBP, and JPY. The various currency choices can benefit traders because there are no fees for currency conversion when utilizing your currency for your account. Countries that accept Fusion Markets:

Countries that don’t accept Fusion Markets:

Fusion Markets customer supportThere is a chat feature on the website located on the lower right portion. Here are Fusion Market’s contact details:

Fusion Markets education and researchFusion Markets have a new educational feature called “Our Blog.” They have posted many practicable articles that can help either novice or expert traders. You can subscribe to this by putting in your email address. New articles will be sent directly to your email. If you do not want this service anymore, you can opt-out anytime.  Conclusion: Fusion Markets opens its doors to low budget tradersFusion Markets have indeed accomplished its mission statement from the moment it opened its doors to the public. They have made a name for themselves in such a short time and will greatly benefit you if you’ll try it out. Moreover, with MetaTrader as a trading platform to trade with, Fusion Markets offers a great deal for trading like an expert on a low budget. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) FAQ – The most asked questions about Fusion Markets :Who is the owner of Fusion Markets?Phil Horner is the Chief Executive Officer of Fusion Markets and has been in the financial industry for ten years in Australia. He previously worked in companies like Pepperstone Group Limited as a CEO and also in AxiTrader. But he wanted to become the boss of his own company that offered broker services. Therefore, he gave birth to Fusion Markets with a vision to change people’s overview and expectations of their forex and CFD trading providers. Who regulates Fusion Markets?Fusion markets have proven to provide clients with secured trading solutions where people can deposit funds and trade with a great experience. They are an authorized trading platform regulated by the ASIC. Fusion Markets is also a registered company in Vanuata and is regulated by Vanuatu Financial Services Commission (VFSC). What type of broker is Fusion MarketsFusion Markets comes under the category of a young forex broker that prioritizes low-cost commissions intending to shake up the markets. It follows the style of ECN style of trading and offers an excellent level of customer service to all its clients. It is an ASIC-regulated trading platform that gives foreign exchange trading options in more than 90 currencies and more than 10 cryptocurrencies. It also offers trading platforms like MetaTrader 4 and MetaTrader 5. More articles about Brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Fusion-Markets-Logo.png 61 153 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-04-15 21:07:132023-01-27 20:18:15Fusion Markets |