LegacyFX review and test for investors – Scam or not?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Special: |

|---|---|---|---|---|

(4.5 / 5) (4.5 / 5) | FCA, BaFin, CySEC | $500 | 250+ | VIP EU Mastercard |

When it comes to finding the right broker to partner with, you will have to go through the process of weighing their pros and cons. You will also need to find out if they’re trustworthy enough for you to invest your hard-earned money in them. Most importantly, you have to know if the services they offer meet your standards, and you can rest assured that you will not encounter any problems in your trading journey with the broker you choose.

With that said, you might want to consider LegacyFX. With the amount of experience they have in the trading scene, this broker will surely provide the services that most traders need. They may look like your typical multi-asset trading specialist, but they have a couple of tricks up their sleeve.

In this review, you will find information about the products and services they offer. We will also be talking about the pros and cons of this particular broker to help you deduce whether this broker is right for you.

What is LegacyFX? – The broker presented

LegacyFX has been around since 2012, but they only rebranded their company and started offering their services all over the world in the year 2017. This doesn’t mean they only set foot in the trading scene in 2017. They are proud of all the professional years of experience that they have in the financial market, which helped them earn the title of being one of the most well-known and trusted brokers.

Their parent company is A.N. All New Investments Ltd., and their main office is located at Q Tower, 5th floor, Ioanni Konylaki 47, 6042, Larnaca, Cyprus.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) IndicesTo gain exposure to a particular country’s market, you would have to trade indices. As CFDs, you are given the option to trade according to your market sentiment. Whether you are bullish or bearish, you can go long or short, respectively. LegacyFX offers maximum leverage of 1:100 and a margin requirement of 1% for major indices. For minor indices, the margin requirement is 1% to 5%, while leverage is 1:20 to 1:100. For both classifications, the minimum lot size per trade is just one, while the maximum lot per asset are 10,000. Here is a list of all both major and minor indices that you trade with LegacyFX: Major Indices:

Minor Indices:

Additionally, LegacyFX also offers financial indices such as USDX or the Dollar Index and USVIX or the Volatility Index. The margin requirements for both of these is 1% with a leverage of 1:100. The minimum lot size for USDX is 0.10, and for USVIX, it’s 1. MetalsAs a safe-haven asset, gold and silver are used as passive investments that appreciate over time. Some traders prefer trading these metals as a hedge against market volatility and uncertainty. Trading these as CFDs allows traders and investors alike to purchase metals without having to hold them physically. This also allows the use of leverage and margin to increase the number of purchasable metals.  Margin requirements of metals offered on LegacyFX range from 1% to 5%, while usable leverage is from 1:20 up to 1:100. This allows the client to use more than 500% of their equity. Keep in mind that with higher leverage, there also comes a higher risk of losing money. The minimum number of lots that you could buy is just 0.10 lots, while the maximum could go up to 100,000 when you are trading gold. LegacyFX offers the said metals and many more. Below is a list of all tradeable metals with LegacyFX:

CommoditiesThe commodities offered by LegacyFX are CFDs that have the leverage of 1:20 and 1:100 depending on the asset you’re trading. You can invest in both energy and agricultural commodities with a margin requirement of 1% and 5%. Again, this depends on the commodity you’re dealing with. It’s important to note that the minimum lots for both energy and agricultural commodities start at 0.10 except for the soft commodity known as sugar. The minimum lots for this is 1. You will find a complete list of the commodities found on LegacyFX: Agriculture

Energy

CryptocurrenciesCryptocurrency is gaining more and more popularity nowadays, especially Bitcoin. If you’re looking to invest in Bitcoin, Litecoin, Ethereum, and Ripple, LegacyFX has got you covered. The fixed leverage for trading crypto is 1:5, and the margin requirement is 20%. Since the crypto available on LegacyFX are CFDs, you are not limited to a specific asset. Here are some popular CFD cryptocurrencies:

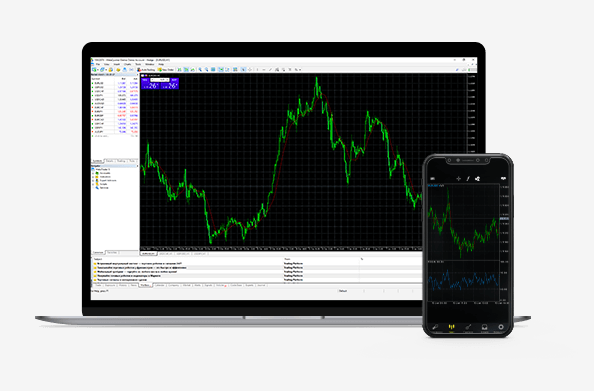

StocksLegacyFX offers a dozen global equities from Germany, the USA, Switzerland, Netherland, Belgium, Spain, France, Norway, and the United Kingdom. You can also find ETF or exchange-traded fund stocks on their platform. Considering the number of stocks available on LegacyFX, traders definitely have the opportunity to diversify their portfolios. This asset has a fixed leverage of 1:5 and a margin requirement of 20%. You can take a look at their complete list of tradable stocks on their website. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Test and review of the Legacy FX trading platformLegacyFX clients get access to the MetaTrader 5 or MT5 platform. This is the updated successor of the MetaTrader 4 or MT4 software. The great thing about the MT5 is that it supports trading cryptocurrency, and it comes with new features that cater to this asset. This platform comes with more than 80 graphical tools and indicators that any trader would find helpful. It also comes with a built-in economic calendar that gives traders updates on data and other important economic events. These are available on both Windows and IOS desktops. If downloading the software isn’t ideal for you, MetaTrader 5also has a web platform. You can easily access this by going to their webpage and logging into your account.  Mobile PlatformThe MetaTrader 5 platform is also available on mobile devices. Their app features One-click trading. This basically allows the trader to open a position with just one tap on the mobile app. You can download this app on the Google Play Store or Apple App Store. The MetaTrader 5 platform is great for professional or advanced traders. Newbie traders, however, are recommended to practice trading on a demo account. It takes less than ten minutes to open up a demo account. This comes equipped with a virtual fund of $10,000, and you can access the MT5 platform for one month.  LegacyFX’s account typesLegacyFX has eight account types clients could choose from. These are Standard, Bronze, Silver, Gold, Platinum, Premium, VIP, and Islamic account. To register for any of these live accounts, you will need to sign up via their website and fill up all the necessary information and submit all the required documents. You’ll also be able to choose your preferred currency: USD, EUR, or GBP. Signing up to any account type is completely free, and there are no additional fees. However, the minimum initial deposit varies.

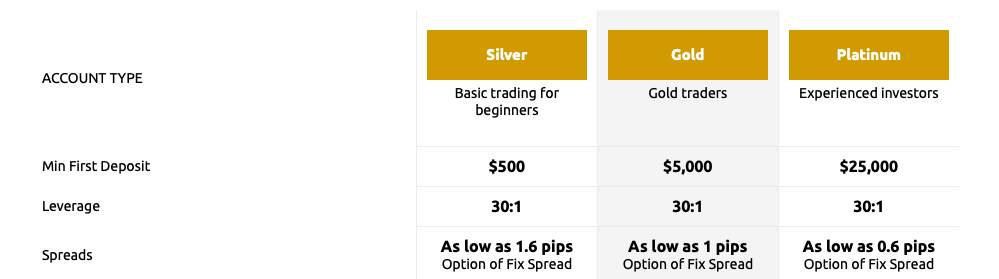

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) LegacyFX deposit and withdrawalIn the event that your account incurs a negative balance, LegacyFX will zero it out back to 0.00. Keep in mind that this is not immediate, though. The negative amount will continue to reflect on your account for a while. Funding your account: LegacyFX accepts deposits via bank wire transfer, Mastercard and Visa credit card, Neteller, Skrill, VLoad, and Bitcoin. This broker won’t charge you any fees for deposits, but the minimum deposit is 500 USD. They accept EUR, USD, and GBP currencies. However, VLoad only takes EUR and USD. You can withdraw your earnings the same way you fund your account. There are no restrictions when it comes to withdrawing, except if you choose to cash out via wire transfer. The minimum withdrawal should be no less than 150 USD. It might take a while for your funds to reflect on your account. It’s best to wait up to five to seven business days after your withdrawal request has been approved. You won’t be charged a closure fee, however, it’s worth noting that you might incur a fee according to their terms and conditions.  Learn to trade with LegacyFXThis company has so many educational tools to choose from. Whether you’re just starting out as a trader or you’re a well-seasoned professional, LegacyFX has additional knowledge that can prove to be helpful to you.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|