5 best Forex Brokers & platforms for scalping in comparison

Table of Contents

The list of the 5 best Forex brokers for scalping:

Broker: | Review: | Spreads: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Vantage Markets  | Starting from 0.0 pips | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

2. RoboForex  | Depending on the account type, the spreads start from 0.01 pips | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + Leverage up to 1:2000 + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

3. IC Markets  | 0.0-0.6 pips, depending on the account type | ASIC, FSA, CySEC | 232+ (65+ currency pairs) | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

4. Capital.com  | 0.8 pips, free from commissions | FCA, CySEC, ASIC | 6,000+ (138+ currency pairs) | + Low spreads + No commissions + High security + Multi-Regulated + 6000+ markets + Personal support + Education center | Live account from $20(Risk warning: 76% of retail CFD accounts lose money) | |

5. XTB  | Depending on the account type, the spreads start from 0.1 pips | More than 10 | 3000+ (48+ currency pairs) | + Low spreads + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $0(Risk warning: 76% of retail CFD accounts lose money) |

The forex industry has an estimated 10 million forex brokers who trade various financial markets regularly. Some forex brokers trade full time while others trade it when working their jobs or businesses as another income stream.

Trading forex requires trading strategies depending on the type of market you want to access and your trading objectives. Some traders trade for a long time, and those who trade for a short time.

Traders can apply several strategies when trading short term, one of them is scalping. It is a trading strategy that many professional traders use. It requires time and commitment to profit and is best suited for traders who trade forex full time.

What is scalping?

It is a trading strategy that traders use to make small trades throughout the day. It works through trading the small spikes in prices and placing several similar trades. At the day’s end, the combined profits make a quantitative income. This strategy is demanding and requires focus through entering and exiting the market in a short time. It also needs discipline as one mistake could lose all the small profits made throughout the day.

This technique needs a forex trader who can manage small profits through numerous trades. The financial markets have small movements even if the asset is not volatile. Scalpers take advantage of these small movements to enter and exit the market.

How does scalping work in forex?

A scalper has to find a financial market that has volatility to trade. Some scalpers trade from news released by performing a short technical analysis before trading. It is tedious waiting for small spikes and is why most scalpers prefer a volatile market.

After identifying a favorable market for scalping, traders then wait for an opportunity to enter the market. There are various ways scalpers trade, some make profits through shorting, others trade long trading, while others do both.

The recommended method is picking one, long trading, or shorting the asset. It makes it easy to follow a strategy compared to trying both. A crucial aspect of scalping is exiting the market quickly before the prices reverse and lose.

Scalping is making short trades that take 30 seconds to twenty or thirty minutes based on the market. Scalpers are looking for 6-20 pips and have twenty to fifty trades in a day. From these trades, the cumulative profit is significant.

Characteristics of a good forex broker for scalping:

For scalpers to profit through scalping, one crucial factor to consider is the type of forex broker you are using. Scalpers need speed, low to zero latency, and low trading fees. Here are some factors to consider when choosing a forex broker for scalping;

- A regulated forex broker that allows scalping

- Fast execution rates, which means a forex broker with ECN or DMA account with low or negligible slippage

- Low spreads and commission

- High leverage

- Access to numerous trading and research tools like the advanced charting software with several time frames.

- Comprehensive and reliable research materials

- The responsive customer care team

List of the 5 best forex brokers for scalping in comparison:

1. Vantage Markets

It is a forex broker founded in 2009 in Australia with over 400,000 forex traders. It offers three hundred trading instruments ranging from metals, shares, forex, CFDs, indices, commodities, and cryptocurrency CFDs.

Regulation

- Australian Securities and Investments Commission

- Vanuatu Financial Services Commission

- Cayman Islands Monetary Authority

Account types

Users of Vantage Markets can open one of the three accounts it offers. Standard STP account with an initial deposit of $200, Raw ECN account has a minimum of $500. The Pro ECN account has a minimum deposit of $20,000 in narrow spreads and a commission of $4.00 per round turn.

All these account types have the fast execution rates that scalpers require. It also has liquidity pools where scalpers enter and exit the market fast.

Fees

Forex spreads for the Standard STP account average 1.4 pips and has no commission. The Raw ECN forex spreads range from 0.0 and a commission of $6 per round turn. Pro ECN account has forex spreads starting from 0.0 pips and commissions of $ 4 per round turn.

Vantage markets have free deposits and withdrawals through bank transfers, credit/debit cards, and e-wallets. It has no inactivity, conversion, or hidden fees.

Leverage

The leverage ratios start from 1:100, but forex traders can access up to 1:500. Forex leverage depends on your location, and some regions have a strict leverage policy. Forex traders can take advantage of it to scalp various financial markets.

(Risk warning: Your capital can be at risk)

Features of Vantage Markets

- The free demo account is fast and easy to register and start trading with virtual funds.

- It has integrated the top trading platforms, MT4 and MT5, with fast execution rates.

- The MT4 and MT5 offer over 170 trading instruments through the RAW ECN and Standard STP accounts.

- Traders can open position sizes starting from 0.01 lots.

- It allows scalping and hedging options for both MT4 and MT5.

- The MT4 offers trading charts of up to 9 time-frames, while the MT5 reaches 21.

- Users can access automated trading using MQL4 and MQL5.

- Vantage Markets forex broker is available via a mobile application, desktop, and web-based version.

- Social/copy trading is available via MyFXbooks Autotrade, Zulutrade, and Duplitrade.

- Users can access more than 50 technical indicators, 30+drawing tools, and over 7 Watchlists.

- It has additional trading tools from Smart Trader and Trading view.

- Clients with more than $1000 in their accounts can access the Pro-trader tools, while others have Trading central, News, and market updates.

- Its educational content consists of videos and articles covering various topics and financial markets.

- Customer support is present 24/7 via live chat, phone calls, and emails.

Pros of Vantage Markets

- Low spreads and commissions

- Fast execution rates due to the STP and ECN accounts

- Fast and efficient withdrawal and deposit process

- High leverage of up to 1:500

- Quality trading and research materials

Cons

- It has limited access to financial markets

(Risk warning: Your capital can be at risk)

2. RoboForex

It was founded in Belize in 2009 and has grown for the past 10+ years serving over three million forex traders. Its clients can trade 12000 financial markets starting from metals, commodities, forex, stocks indices ETFs, cryptocurrency, and CFDs.

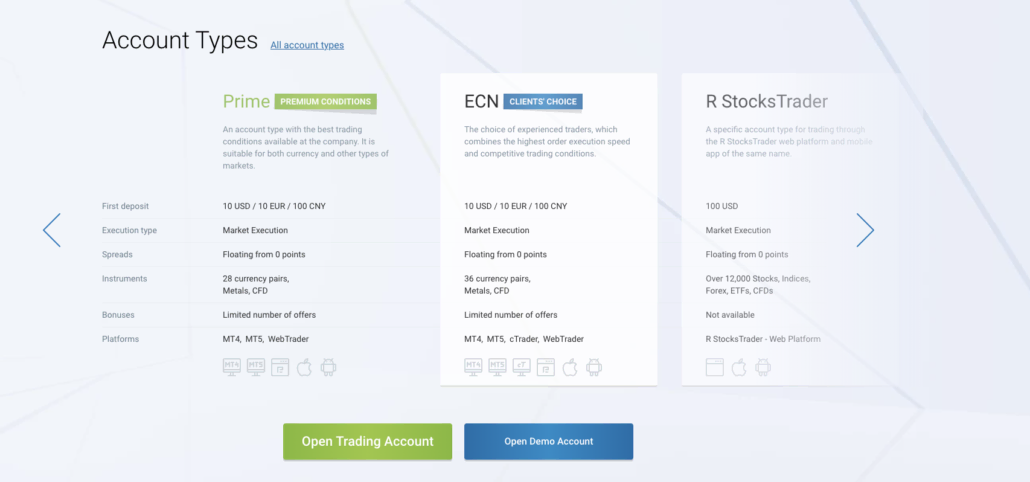

Account types

Roboforex has five types of trading accounts, a Prime account with an initial deposit of $10, position size starting from 0.01-500pips, and maximum orders of 500.

ECN account has a minimum deposit of $10, traders can open position sizes starting from 0.01 to 500pips, and traders can make active orders of up to 500.

R stocks trader has an initial deposit of $100, 12000 CFDs and also has open positions that are limitless.

Pro Cent account has an initial deposit of $10, forex traders can open trade sizes from 0.1 lots to 10,000. They can have up to 200 open positions for MT4, and 1000 for MT5.

The Pro account has a minimum deposit of $10, position sizes starting from 0.01 -500 pips, and a maximum number of open positions is 1000.

Fees

The forex fees defer with the type of trading account. The pro and pro cent have forex spreads starting from 1.3 pips and are free from commissions. The best trading accounts for scalping would be the ECN and Prime accounts with forex spreads as low as 0.0 pips and fixed commissions that are different for various assets.

The R stocks trader also has forex spreads starting from 0.01 pips and a commission of $15 for 1 million traded base currency. An inactivity fee of $10 every month gets charged after a year of inactivity in a trading account.

Deposits and withdrawals are free via bank transfer, credit/ debit cards, and digital wallets.

Leverage

RoboForex has high leverage that could be beneficial for scalpers. The Pro Cent and pro accounts have forex leverage of up to 1:2000. R stocks trader and prime accounts have 1:300. The ECN account has forex leverage of 1:500.

(Risk Warning: Your capital can be at risk)

Features

- It has a free demo account for users to practice their trading strategies.

- It has integrated four types of trading platforms, MT4, MT5, R stocks trader, and the cTrader.

- The MT4 has trading tools such as 50+ technical indicators, 3 types of order executions, 9 time-frames, and the MQL4 algorithmic trader.

- MT5 has more technical indicators, 21 time-frame chats, hedging options, faster execution rates, 4 types of market orders, and other graphical tools.

- C trader has 54 technical indicators, 14 time-frames, algorithmic trading, and 9 types of charting software.

- R stocks trader has 13 technical indicators, and several advanced drawing, and charting tools.

- Roboforex allows its clients to compete with an advanced copy trading platform, Copy FX.

- Roboforex is available in 22 languages via a mobile app, a desktop, and a website version.

- Educational materials cover different financial markets through videos, guides, blogs, analysis, community forums, and the economic calendar.

- Customer support is present in 24 languages 24/7 through live chat, emails, and phone calls.

Pros of Roboforex

- Numerous trading platforms and accounts

- Fast execution rates

- A wide range of trading instruments

- Low minimum deposit of $10

- Quality trading tools

- It has regulations from Belize by the International Financial Services Commission

Cons

- It is not available in some countries

(Risk Warning: Your capital can be at risk)

3. IC Markets

It is an Australian-based forex broker founded in 2007 with headquarters in Sydney Australia. Its clients have access to trading instruments such as commodities, equities, CFDs, cryptocurrency, stocks, equities, futures, and forex.

Regulation

- Financial Services Authority in Seychelles

- Cyprus Securities and Exchange Commission

- Australian Securities Investment Commission

Account types at IC Markets

IC Markets offers three types of trading accounts, a Raw spread Meta trader account with an initial deposit of $200. Position sizes start from 0.01 lots and 500 limits of position orders.

The Raw spread cTrader account has a minimum deposit of $200. Traders can open trading positions as low as 0.01 micro-lots and a limit of 2000 position orders.

A standard meta trader account has a minimum deposit of $200. Position sizes start from 0.01 micro-lots and a limit of 200 position orders.

(Risk Warning: Your capital can be at risk)

Fees

IC Markets has low trading fees favorable for scalpers, Raw spread cTrader account has spreads starting from 0.0 pips and a commission of $3 per traded lot. Raw spread Meta trader has forex spreads starting from 0.0 pips and a commission of $3.5 per lot.

The standard meta trader account has spread from 0.6 pips and is free from any commission. It has no inactivity fee, while deposits and withdrawals are also free of charge. The payment platforms accepted at IC markets are bank transfers, credit/ debit cards, and e-wallets such as Skrill, Neteller, and others.

Leverage

IC Markets is a suitable forex broker for scalpers due to its high leverage ratios. All of its three accounts offer forex traders high forex leverage of 1:500. It is not the same in many countries since some have restrictions for forex leverage of up to 1:50.

Features

- The demo account is available for all three trading accounts, so clients can test trading features.

- It offers three trading platforms, MT4, MT5, and cTrader, which scalpers can choose.

- It has trading tools including 51 technical indicators, 30 drawing tools, and charts offered by the MT4, MT5, and cTrader.

- It has a data center in New York close to the leading liquidity providers dedicated to ensuring fast execution rates of orders.

- Traders get trading research resources through regularly published blogs, trading ideas, and signals from Trading Central, Expert Advisor, and Auto chartist.

- A free virtual private server is present for traders who can surpass some trading conditions.

- Social and copy trading features via Zulu trade and MyFXbook.

- It has algorithmic trading offered by the MQL4, MQL5, and c Algo.

- The MT4 and MT5 are available on the mobile app, desktop, and web versions, and the c Trader on the desktop and web versions.

- Its clients can get fundamental and technical analysis from experts through blogs, videos from Trading Central, and IC TV on the website version.

- Educational content is through articles, video courses, and podcasts via its YouTube channel.

- Its customer support is present 24/7 through emails, live chat, and phone calls.

Pros of IC Markets

- Low spreads and commissions on trades

- Fast execution rates

- a wide range of trading instruments

- Fast and free deposits and withdrawals

- Quality customer support

Cons

- Limited research and educational resources

(Risk Warning: Your capital can be at risk)

4. Capital.com

It is a forex broker founded in 2016 and has grown to serve 700,000+ forex traders in 183 countries. It offers 3700 trading instruments such as commodities, shares, forex, indices, and cryptocurrencies.

Regulation

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities Exchange Commission (CySEC)

- National Bank of the Republic of Belarus

Fees

The average forex spread at Capital.com is 0.8 pips and is free from commissions. It is a great offer for scalpers, as it is also free from deposit/withdrawal fees. It has an overnight fee that gets charged according to the size of the position open using leverage.

It has no inactivity fee or account maintenance fee. It accepts payment methods such as bank wire, and credit/debit cards.

(Risk warning: 76% of retail CFD accounts lose money)

Leverage

Capital.com has forex leverage rates as high as 1:500 for expert traders. Capital.com is compliant with ESMA rules that regulate the use of leverage to not more than 1:30. Forex retail traders around the EU have a limit of 1:30.

Expert traders can apply for leverage of 1:500, although the negative account balance protection offered by Capital.com only covers up to 1:30.

Features

- The demo account offered up to $10,000 in virtual funds for practice trading.

- It offers MT4 and its own proprietary web trading platform.

- Traders access advanced charts, 75+ technical indicators and drawing tools, 6 watch lists, and stock screeners.

- Third-party research tools from Trading Central feature trading signals, trading views, and ideas from different financial markets.

- Access to research articles, videos, charts, and analysis published weekly for fundamental analysis.

- Capital.com has extensive educational materials such as lessons, courses, educational videos, tests, and on its YouTube channel.

- Invest mate app that covers educational resources all in one mobile application.

- Customer care is present in 13 languages 24/7 via live chat, SMS, emails, and phone call.

Pros of Capital.com

- It has low forex spreads and no commission

- Advanced trading tools from MT4

- High forex leverage

- It is a secure trading platform with regulations from tier 1 jurisdiction

- Fast registration process

- Low initial deposits

Cons

- It does not offer MT5

(Risk warning: 76% of retail CFD accounts lose money)

5. XTB

It is a long-serving forex broker that has worked in the forex industry for more than twenty years since its launch in 2002. Its users can access 1500 trading instruments such as forex, indices, CFDs, ETFs, stocks, indices, and commodities

Regulation

- International Financial Services Commission in Belize

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities and Exchange Commission

- Polish Securities and Exchange Commission

Account types on XTB

It offers two types of trading accounts, the Standard and Pro account. The standard account has no minimum deposit and forex brokers can open trading sizes from 0.01 lots. It has access to Forex, indices, cryptocurrency, CFDs, ETF CFDs, and commodities.

The Pro account has some qualifications to open the trading account, and expert or professional forex traders have to meet some conditions to access it.

(Risk warning: 76% of retail CFD accounts lose money)

Fees

Forex spreads start from as low as 0.5 pips for the Standard account has zero commissions on many assets. The Pro account has lower forex spreads starting from 0.1 pips and commissions of $3.50 per lot. It also has an inactivity fee of $10 charged every month after 12 months of inactivity.

Traders can make free deposits and withdrawals via bank transfers, credit/debit cards, and digital wallets like Skrill and Pay Pal.

Leverage

Forex leverage on XTB depends on the location you are trading. For countries within the EU, XTB has strict laws to offer forex leverage of up to 1:30. Countries outside the EU have higher forex leverage of up to 1:500.

Features

- A free demo account, forex traders can use for testing its platform or practice trading.

- It has its own proprietary trading platform, X station 5, and X station mobile.

- X station 5 has user-friendly designs and its charting software is easy to understand and use.

- It has risk management tools, a built-in trading calculator, and an economic calendar.

- SMS and email notifications on the status of open trade.

- The X station 5 has fast execution, several charts, technical indicators, and a stocks screener function.

- Forex traders can also use the copy trading feature on the XTB trading platform.

- Its platform is available via a desktop and website version, which has the X station 5 and the mobile app that uses the X station mobile platform.

- It has various courses and tests, live webinars, and educational articles to sample.

- Its trading academy has content for all traders, basic and expert traders.

- Customer support is available 24/5 via calls, email, and live chat.

Pros of XTB

- It has served for a long time and built trust among forex brokers

- It has low trading fees

- Industry-leading research and trading tools

- Fast execution rates

Cons

- MT4 and MT5 are unavailable.

(Risk warning: 76% of retail CFD accounts lose money)

Conclusion – There are a few good brokers that allow scalping

Trading forex is challenging for scalpers since they have to be fast. It requires a good forex broker who can offer trading services corresponding to your needs. It is why scalpers need to choose their forex brokers wisely.

Scalping can be very lucrative if you find a suitable trading strategy and a reliable forex broker. For scalpers, low forex spreads and fast execution rates allow easy trading.

FAQ – The most asked questions about Forex Brokers for scalping :

Which type of forex broker is suitable for scalping?

The best forex broker should be a Non-dealing forex broker, preferably a broker with direct market access or an ECN broker. A scalper needs to check the trading costs as they play a role in the overall profits you want to achieve.

Can new traders use scalping when trading?

Yes, new traders can use scalping, as it requires less input to start, but traders need to understand how to apply technical analysis.

Is scalping the best trading strategy?

The best trading strategy varies with the type of trader you are. There are many trading strategies, and scalping is lucrative if you master it. It requires focus, fast analytical /decision-making skills, and discipline to achieve good results.

Which kind of forex broker is suitable for scalping?

If you go by our recommendation. Then we would suggest that you must go for a non-dealing forex broker, specifically one who has a direct connection to the market or is an ECN broker. It is the responsibility of the scalper to check the trading cost since it plays a vital role in the scale of profits that you aspire to achieve.

Can new traders use scalping when trading forex?

Yes, certainly, the new traders can use scalping. Since it is not necessary to initiate trading with a huge investment, a simple and small start can work wonders. But it is also essential for traders to remember the exact way to apply technical analysis.

Is scalping the best forex trading strategy?

If you want to get detailed information about the best trading strategy, then all we can say is that it largely depends on the kind of trader you are personally. There are numerous trading strategies through which you can choose and make your decisions; amongst them, scalping is a highly lucrative one, necessarily if you master the art. All that it requires is diligence, unwavering focus, rapid analytical / decision-making skills, and also a disciple to get the desired results.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)