5 best Forex brokers & platforms with the best execution speeds in comparison

Table of Contents

See the list of 5 best execution speeds brokers:

Broker: | Review: | Execution SPeed: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Vantage Markets  | 0.1 milliseconds | CIMA, ASIC, VFSC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

2. RoboForex  | 0.1 milliseconds | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + 1:2000 Leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

3. Tickmill  | 0.15 milliseconds | FCA (UK), CySEC (EU), FSA (SE) | 250+ (91+ currency pairs) | + UK regulation + High customer safety + Excellent support + Low trading fees + Cheap broker + Great conditions | Live account from $100(Risk warning: Your capital can be at risk) | |

4. IC Markets  | 30 milliseconds | ASIC, FSA, CySEC | 232+ (65+ currency pairs) | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

5. Pepperstone  | 30 milliseconds | FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA | 180+ (60+ currency pairs) | + Authorized broker + Multi-regulated + 24/5 support + Low spreads + Leverage up to 1:500 | Live account from $200(Risk warning: Your capital can be at risk) |

When choosing a forex broker, some factors help decide the best forex brokers. Speed of execution is one of these factors, and it is imperative to test the speed of the forex broker before you work with it.

The execution rate of forex brokers helps avoid losing money due to latency. There are a few things to know when testing the execution speed of a broker.

We will look at some things forex traders should keep in mind when looking for a fast execution forex broker. We will find some of the best forex brokers with fast execution speeds in the forex industry.

What is a Forex execution speed?

It is the time between when you place an order with your forex broker and when it responds to forex orders at a price. Execution speeds depend on the type of forex broker, the distance between you and your forex broker server, its software, and other factors. Forex brokers have different execution speeds, the best falls between 0 to 100 milliseconds.

Types of order executions

There are two types of order executions traders use, market and instant. Forex traders can measure how a forex broker offers execution speeds.

Market order execution

It is when a forex broker executes an order at the best market prices available. It is susceptible to slippages, and the price might be higher or lower than the exact price indicated. But, it is faster, and traders make profits with this type of order.

Limit/ instant/ pending order execution

It happens when the forex trader specifies a specific price that a forex broker has to execute. There are many types of limit orders, such as:

Buy limit– when the forex broker has to buy at a specific price or lower.

Sell limit- a forex broker sells at a specific price or higher

Buy stop – a forex broker buys if the market prices reach the buy stop price

Sell stop– a forex broker sells if the market prices get to the specified sell stop price.

This type of order is such that a forex broker cannot sell at another price and has to get consent from the forex trader before selling at a different price. It is called requotes and happens with the limit orders.

What is latency?

Latency is when the speed of execution slows due to the distance between the trader and the forex broker server. It is why forex traders are encouraged to register under a forex broker whose server is close to them.

The further the distance between the forex broker servers and the forex trader, the higher the latency. The order executions can delay by some millisecond to execute an order if the server is in another country.

How can I increase my execution speeds?

1. Using a Virtual Private Server (VPS)

A VPS ensures that you get the fastest internet speeds when trading. Most VPS services have 99 5 uptime such that the cases of latency are low or negligible. Some forex brokers offer their own VPS at a price, while others are free as long as you meet the conditions to use it.

If your forex broker does not offer a VPS service, some companies sell services at affordable prices for retail traders.

2. Register with a Forex broker located closer to where you are

When choosing a forex broker, find one whose server is closer to you. It improves the Execution speeds as your orders take a shorter time than when the server is in another continent or country.

3. Purchase quality trading devices

The quality of the devices you use should match the industry standards. Some hardware tools you have to check are monitors, CPUs, and Hard drives. Ensure you have enough space to use when trading. It will help you have an easy time trading.

List of 5 forex brokers with the best execution speeds:

1. Vantage Markets

Vantage Markets is a forex broker with six data centers and serves half a million traders in 172 countries. It offers more than 400 trading instruments such as share CFDs, forex, CFDs, commodities, indices, metals, and energies.

Execution speeds

It uses the market execution method to execute orders, and its market execution speeds fall between 100 to 250 milliseconds.

Regulation

- Vanuatu Financial Services Commission

- Cayman Islands Monetary Authority

- Australian Securities and Investments Commission

Account types

It has three trading accounts

Standard STP account for new traders has a minimum deposit of $200. It also offers forex spreads from 1.0 pips and has no commissions.

The Raw ECN account has an initial deposit of $500 with forex spreads from 0.0 pips. It also has commissions of $6per round turn.

The Pro ECN is a trading account for professional and volume traders who have a minimum deposit of $20,000. It has forex spreads from 0.0 pips and a commission of $4 per round turn.

(Risk warning: Your capital can be at risk)

Trading costs

Apart from spreads and commissions, it has no inactivity fee, there are no account maintenance charges. It has overnight charges depending on the size of positions overnight and the leverage used. Vantage markets offer forex leverage as high as 1:500.

Deposits and withdrawals are free through bank wires and credit/debit cards. It accepts e-wallets such as Skrill, Neteller, PayPal, Union Pay, and other methods.

Features of Vantage Markets:

- It has an unlimited demo account that traders use to practice trading.

- Vantage markets have integrated the MT5 /MT4 Pro trader and web trader trading platforms.

- Traders can access numerous trading tools on the MT4 and MT5 trading platforms, such as hedging and scalping options, 50+ technical indicators, customizable trading tools, and advanced charts.

- MT4 offers 9-time frames on its charts, while MT5 offers 21-time frames.

- Traders can also access automated trading with the help of Expert Advisors and the MQL4 and MQL5 for building custom robots.

- The Pro trader trading platform offers more than 350 trading assets, 50+ technical indicators, 12 different charts with 8-time frames, and 100+ indicators.

- Traders have a free VPS service after successful application and approval. Forex brokers eligible for this service have to meet some of these conditions.

- It also offers copy trading via Zulu Trade, Dupli trade, and MyFXbook Auto-trade, where new traders share trading strategies that work on various financial markets.

- Research resources include trading ideas, signals, news, and economic calendar from financial experts and third-party trading signals from Trading Central.

- Educational materials cover various markets from basics to advanced levels through video courses, articles, and online webinars.

- The Customer care team is present 24/7 to assist traders with any concerns. They can get contracted through live chat, emails, and phone calls.

Pros:

- The fast account registration process

- Quality trading tools

- Fast order execution rates

- Low trading costs

Cons:

- Limited trading instruments

(Risk warning: Your capital can be at risk)

2. Tickmill

It is a forex broker founded in 2014 and has data centers in three locations. It has access to over 85 trading instruments such as Indices, bonds, metals, CFDs, and forex.

Execution rates

Tick mill has fast execution speeds up to 150 milliseconds for the limit orders, while the market orders have an average of 160 milliseconds.

Regulations

- Financial Conduct Authority

- Financial Services Authority

- Cyprus Securities and Exchange Commission

- Financial Sector Conduct Authority

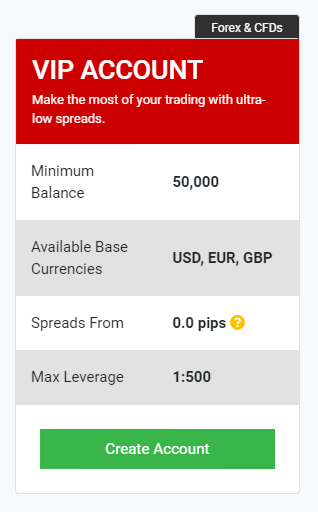

Account types at Tickmill:

Tickmill has three types of trading accounts, Pro, Classic, and VIP accounts, the Classic account is the smallest with a minimum deposit of $100. It has forex spreads from 1.6 pips and no commissions.

The Pro account is for advanced traders, it has a minimum deposit of $100 and commissions of four units per round turn for every 100,000 units traded.

The VIP account is for expert or professional traders who trade volumes and has an initial deposit of $100. But, to access this account, you require an account balance of not less than $50,000. It has forex spreads from 0.0 pips and commissions of two units ($2) per round turn for every 100,000 units traded.

(Risk warning: 70% of retail CFD accounts lose)

Trading costs

It has rollover costs for positions open overnight that applies at 00:00 according to the time of the platform. Its maximum forex leverage is 1:500 for the three trading accounts but has no inactivity fee, but dormant accounts are closed after a year if they have account balances, not more than $10.

Withdrawals and deposits are free on Tick mill and accept Bank transfers and credit/ debit cards.

Features of Tickmill

- Traders can start with risk-free trading using virtual funds available on the demo account.

- It has incorporated the MT4 and MT5 trading platforms to access the financial markets.

- It offers one-click trading, three/four order types, 50+ technical indicators, and numerous charts having multiple time frames.

- UK clients have an advantage as they are the first to test out its CQG trading platform.

- Algorithmic trading is also available with the help of the Expert Advisor and the Auto chartist signal scanner.

- Tick mill has a VPS connection for its traders, making automated trading more efficient.

- Novice traders can learn new trading strategies from seasoned traders through the social trading platform Zulu trade.

- Forex traders get market execution orders available on the three trading accounts.

- It offers research and analysis of financial markets through articles, economic calendars, and videos published on the platforms. Traders can also get third-party trading ideas from Auto- chartists.

- It offers educational materials such as informative articles, e-books, video courses, and weekly webinars. Traders can access the videos on their Youtube channel.

- Customer support is present 24/5 via phone calls, live chat, and email.

Pros

- Fast order execution rates

- Low initial deposit

- Low trading costs

- A fast account registration process

- Quality trading tools

Cons

- Customer support is only available 24/5

- Limited trading instruments

(Risk warning: 70% of retail CFD accounts lose)

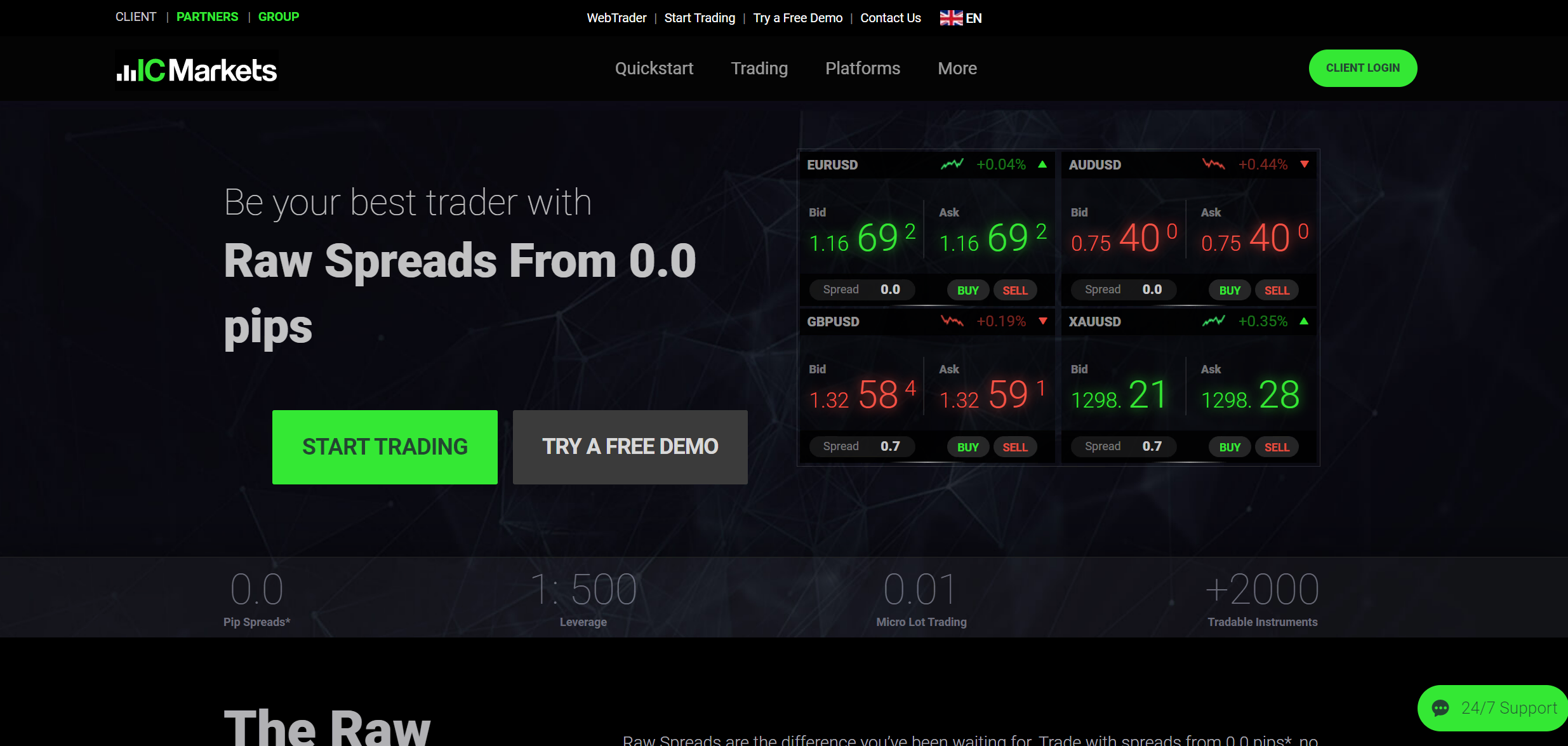

3. IC Markets

It is a forex broker founded in Australia and serves 180,000 forex traders for more than ten years since its launch in 2007. It offers access to 850+ financial markets ranging from Stocks, indices, bonds, cryptocurrencies, forex, and commodities.

Execution speeds

It has data centers based in NY4 New York and LD5 in London, the center for liquidity providers. Traders can get average execution speeds ranging from 44 milliseconds. These are also the regions where the MT4, MT5, and cTrader trading platform servers are.

Regulation

- Financial Services Authority in Seychelles

- Cyprus Securities and Exchange Commission

- Australian Securities Investment Commission

Account types at IC Markets

IC Markets has three trading accounts, Raw spread Meta trader account has a minimum deposit of $200. It has forex spreads from 0.0 pips and a commission of $7 per round turn.

The Raw spread cTrader account has a minimum deposit of $200, and forex spreads from 0.0 pips. It also has commissions of $6 per round turn.

The Standard Meta trader account, for new traders, has a minimum deposit of $200. It has forex spreads from 0.6 pips and has no commissions charged.

(Risk Warning: Your capital can be at risk)

Fees

It has no inactivity fee, but overnight fees apply when you open a position overnight using leverage. The maximum leverage traders can access is 1:500, and the minimum is 1:50. Deposits and withdrawals are free using Credit/ debit cards and bank transfers.

It accepts payments from electronic wallets such as Skrill, Neteller, Pay pal, UnionPay, FasaPay, and Poli.

Features

- It has a free demo account for practicing strategies

- Traders can access financial markets using the MT4, MT5, and cTrader trading platforms.

- These trading platforms offer numerous trading tools such as multiple charts, 100+ technical indicators, advanced drawing tools, and one-click trading.

- Muslim traders can open the Islamic account available on IC markets that uses MT5 and MT4, with similar trading conditions as regular trading accounts.

- cTrader offers level two pricing, fast execution rates, scalping, risk management tools such as the Smart stop out, micro lots trading, and one-click trading.

- Traders can access social/ copy trading through ZuluTrade, and MyFXbook Autotrade integrated on the IC markets platform.

- It also has automated trading through Expert Advisors and MQL4/ MQL5 on the Mt4/MT5. cTrader has the cTrader automate algorithmic trader.

- IC markets trading accounts are available through its trading app on phones and desktop/ website versions.

- Traders can enjoy analysis from experts through ICTV, blogs, and videos. It also has third-party trading ideas and signals from Trading Central.

- Educational materials include video courses, podcasts, and articles covering various trading topics and financial markets.

- Customer support is available 24/7 via emails, live chat, and phone calls.

Pros

- Fast order execution speed

- Fast account opening process

- Low initial deposits

- Low trading costs

Cons

- Limited trading instruments

- Limited educational materials

(Risk Warning: Your capital can be at risk)

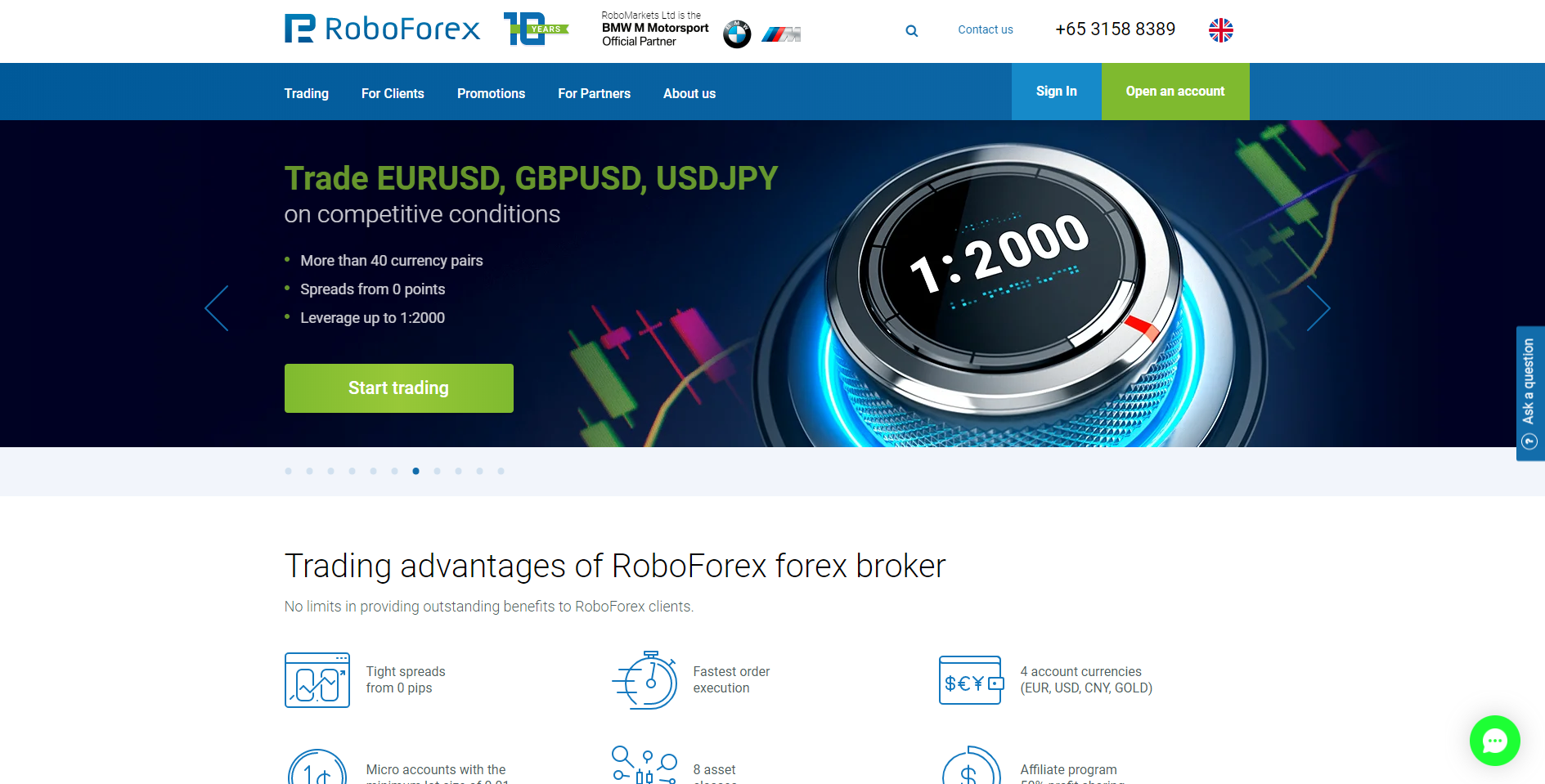

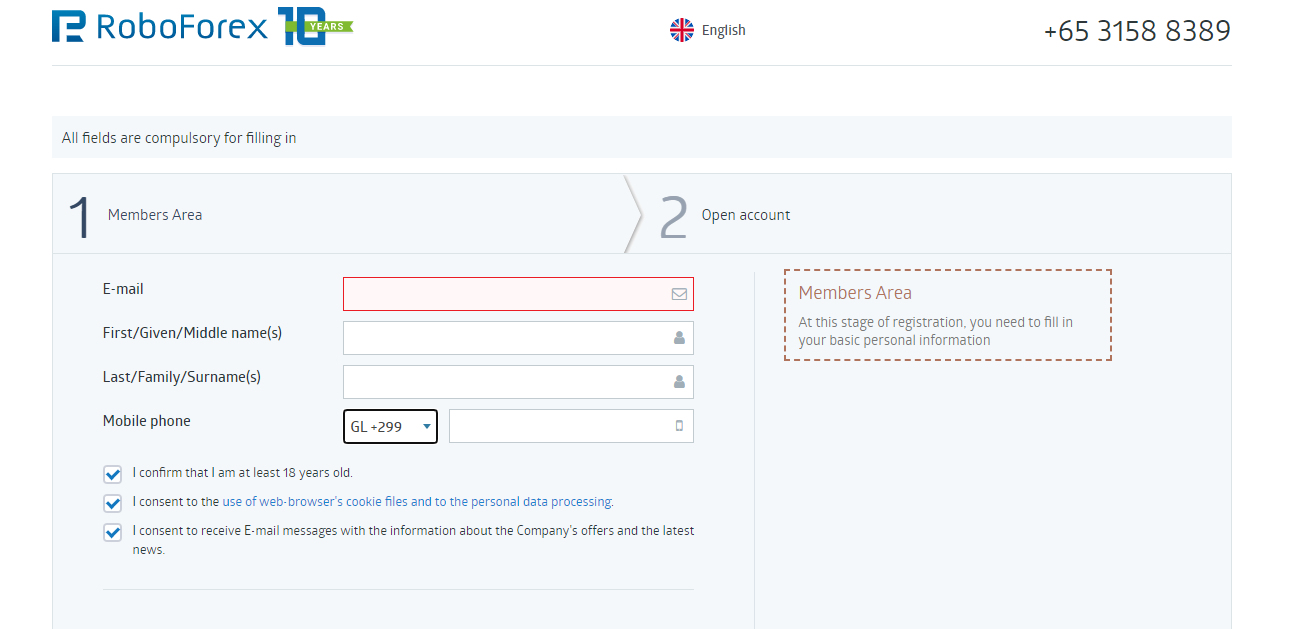

4. RoboForex

It is a forex broker founded in 2009 and serves three million forex traders worldwide. It offers access to 12000 trading instruments such as commodities, forex, metals, stocks, indices, ETFs, Cryptocurrency, and CFDs.

Execution speed

RoboForex has fast execution rates and offers market and instant order execution rates provided by four data centers. The data centers are in Amsterdam, Frankfurt, London, and New York. The average execution speed is 100 milliseconds, depending on the location and your server.

Regulation

- International Financial Services Commission

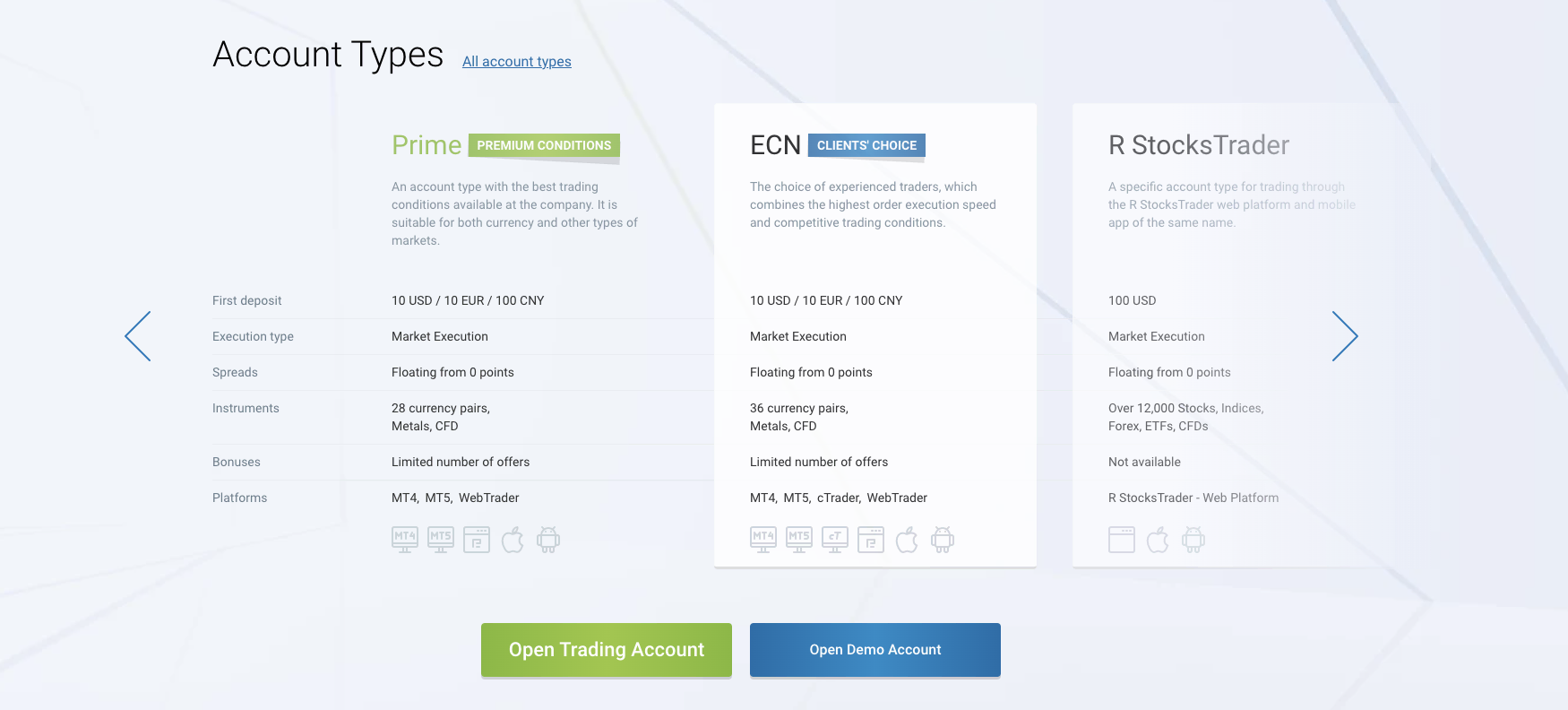

Account types

It offers five trading accounts, a Pro-cent account with market execution, and a minimum deposit of $10. Forex spreads start from 1.3 pips and zero commissions.

The Prime account has a minimum deposit of $10, and forex spreads from 0.0 pips. It also has commissions charged the rates depending on the size of the position and uses market execution.

The ECN account has a minimum deposit of $10 and uses market execution orders. It has forex spreads from 0.0 pips, and commissions vary with the size of the position.

The R stocks Trader has a minimum deposit of $100, and commissions and spreads depend on the type of financial asset.

The pro account has a minimum deposit of $10 and uses a market execution order. The minimum deposit is $10 and has zero commissions.

(Risk Warning: Your capital can be at risk)

Trading costs

The highest leverage offered is 1:200 for the Pro and Pro-Cent account. The Prime and R stocks trader have a leverage of 1:300 while the ECN account has 1:300. It also has rollover fees for open accounts, and overnight costs depending on the asset and the size of the position.

Inactive accounts for over 12 months will attract an inactivity fee of $10 monthly. Deposits and withdrawals are free using bank transfers, credit/ debit cards, and digital wallets.

Features

- Roboforex encourages new traders to open a demo account that is free to use and trader risk-free.

- It has four trading platforms, MT5/MT4, R stocks trader, and the cTrader.

- MT4 and MT5 offer a range of trading tools such as technical indicators, several charts with 9-21 time frames, one-click trading, and drawing tools.

- C trader offers fast execution rates, risk management strategies like stop-loss, 14-time frames, and 100+ technical indicators.

- R stocks trader is a trading platform offering CFDs and Stocks trading. It has 13 technical indicators, advanced drawing tools, and charts.

- The Copy FX platform is a platform that allows traders to social/copy trade and share trading strategies from expert traders.

- It has a swap-free or Islamic account for forex traders from the Muslim community who follow Sharia laws.

- Automated trading is available with the MQL4/ MQL5 programing language, Expert Advisor, and cTrader automate for algorithmic trading.

- Its traders can access the Roboforex platforms using the RoboForex mobile app, the desktop version for laptops and desktops, and the website version compatible with all OS and browsers.

- Research materials are available on the platform at the free analytics center, forex analysis, forecasts articles, and the economic calendar.

- Traders can access educational resources via informative articles, video courses, guides, tutorials, community forums, and analysis.

- Customer service is available in 24 languages via live chat, emails, and phone calls.

Pros

- Fast execution speeds

- Numerous trading accounts

- Excellent customer support

- Industry-leading trading tools

- Low trading costs

- Low initial deposits

Cons

- It has regulations from a few forex trading countries.

(Risk Warning: Your capital can be at risk)

5. Pepperstone

It is a forex broker founded in 2010 with over 300,000 forex traders using its platform. It offers more than 2000 trading instruments such as forex, shares, commodities, ETFs, indices, and CFDs.

Execution speed

Pepperstone has an average of 30 milliseconds, but it varies with the location you are from their servers. It has servers located in Europe, Asia, South America, the Middle East, Australia, and North America. Traders can get fast execution rates from these data centers.

Regulation

- Dubai Financial Services Authority

- Australian Securities and Investment commission

- Financial Conduct Authority

Account types at Pepperstone

Pepperstone has two trading accounts, the Standard account for new traders, which has an initial deposit of $200. It has forex spreads from 1.0 to 1.3 pips and zero commissions charged.

The Razor account for advanced or expert traders has an initial deposit of $200. It has forex spreads from 0.0 to 0.3 pips and commissions of $7 per round turn in every $100,000volume of

trades.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Trading costs

The maximum leverage for both accounts is 1:400, and overnight fees get charged depending on the asset and the size of the position open overnight.

It has no Inactivity fee, and the deposits and withdrawals are also free. It accepts various payment methods like bank transfers, credit/debit cards, and e-wallets such as PayPal.

Features

- It has a demo account for new traders to start from, which lasts for thirty days after registration.

- It has incorporated the cTrader MT5 and MT4 trading platforms.

- Traders can access various trading tools provided on MT4 and MT5, such as multi-chart tools, one-click trading, technical indicators, and charting software with multiple time frames.

- Traders also get three order types on MT4 and four order execution types on MT5.

- Clients using the c trader platform have access to advanced charts with 14-time frames and the risk management options offered.

- Automated trading is present in MT5 and MT4 with the help of Expert Adviser, MQL4, and MQL5 strategy builder. C trader has algorithmic trading through cTrader automate.

- It also offers copy trading services via MyFXbook auto trade.

- Traders can also exchange Razor or Standard accounts for the swap-free account by filling in an online application form.

- Its client’s trade using their phones, laptops, or desktop platforms as it has a mobile app and a desktop version.

- Research tools and resources offered include trading tips, analysis, and ideas on their articles, videos, and the comprehensive economic calendar.

- It has educational content for various assets through articles, guides, and webinars.

- Customer Service is available 24/5 via phone calls, live chat, and emails.

Pros

- Fast execution speeds

- A fast account registration process

- Low trading costs

- Quality trading tools

Cons

- Limited educational materials

- Customer care is available 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Conclusion – Make sure to check the execution speeds before you choose a broker

Execution speeds are crucial as they determine the losses or profits you will make. Forex traders prefer having a forex broker that ensures low or negligible latency reducing requotes and slippage.

Therefore it is imperative that when you are choosing a forex broker, you ensure that they have high execution rates and that you are closer to one of their data centers.

FAQ – The most asked questions about Forex brokers with best execution speeds:

How many Forex executions are there in forex?

There are two types of execution limits and market executions. You can choose which account has what you want to use.

How do I profit from fast execution speeds?

Fast execution speeds are imperative for scalpers or day traders, who make profits by opening and closing positions fast. Other traders like trend or volume traders require fast execution speeds to reduce requites and slippage.

Which is the fastest execution speed in forex?

The fastest execution lies between 0 to 100 milliseconds achieved using VPS or choosing a forex broker with servers closest to you.

What does forex execution speed mean?

It should take under 100 milliseconds or 0.1 seconds. You should also find out how many trades are completed in a second or less. Orders that take more than a second to execute will almost certainly experience slippage since prices changes with time.

How quickly are forex trades executed?

The execution speed of a trade by high-frequency trading computers is less than 10 milliseconds, and they frequently arbitrage match orders multiple times in a retail execution of one second. Orders are carried out in the sequence that they are received.

How many trades could be executed simultaneously while trading forex?

As long as you can manage and track them, the overall number of trades is OK. When you start trading and are unsure of your market position’s net long or net short, a problem can occur. If orders have already been placed before yours, your order will only be filled if the orders are put in before it is filled.

What is the best execution trade in forex trading?

Best execution is a crucial investor protection rule that effectively requires a broker-dealer to use reasonable efforts to execute a customer’s transaction in a way that secures the best conditions for the customer.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)