20 best Forex Brokers compared | List & reviews 2024

Are you about to start with forex trading, but still need a reliable forex broker to partner up? You have come to the right place; in this article, I will explain the different types of forex brokers, share my list of the top 20 Forex brokers, and give you helpful tips and tricks, on how you can determine the seriosity of a broker.

The hard truth is, that there are many scam brokers out there, especially in the Forex niche, but hey, there are a few things to look out for in order to avoid them. After ten years of trading experience, I tested hundreds of different trading companies, and now, without further ado, let me share the list of my top 20 favorite Forex brokers and their most important advantages below:

Table of Contents

See the comparison for the top 20 Forex Brokers in the world below:

Forex Broker: | Review | Regulation: | Spreads | Assets: | Advantages: | Free account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips + $ 4.0 commission per 1 lot traded | 9,000+ (40+ currency pairs) | + Huge variety + Micro accounts + Bonus program + Leverage 1:2000 + ECN accounts | Live-account from $ 10(Risk Warning: Your capital can be at risk) | |

2. Capital.com  | CySEC, FCA, ASIC, SCB, SCA | Starting 0.3 pips + no commission per 1 lot traded (*other fees can apply) | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20 by card (Risk warning: 75% of retail CFD accounts lose money) | |

3. Vantage Markets  | ASIC, CIMA | Starting 0.0 pips + $ 2.0 commission per 1 lot | 120+ (40+ currency pairs) | + Leverage 1:500 + ECN Broker + Personal service + MT4/MT5 + Crypto payments | Live-account from $ 200(Risk warning: Your capital can be at risk) | |

4. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips + negotiable commission per 1 lot | 100+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution | Live-account from $ 200(Risk warning: Your capital can be at risk) | |

5. IQ Option  | Not regulated | Starting 0.0 pips variable (low commission) | 300+ (40+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) | |

6. Pepperstone  | FCA, ASIC | Starting 0.0 pips + $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5 | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

7. Etoro  | CySEC, FCA, ASIC | Starting 1.0 pips variable (no commission) | 3,000+ (52+ currency pairs) | + Best for beginners + Social Trading + PayPal + No commissions + Copy portfolios | Live-account from $ 5076% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. | |

8. Tickmill  | FCA, CySEC, FSA | Starting 0.0 pips + $ 2.0 commission per 1 lot | 100+ (60+ currency pairs) | + VIP conditions + Fast execution + Personal service | Live-account from $ 100(Risk warning: 70% of retail CFD accounts lose) | |

9. XM Forex  | IFSC, CySEC, ASIC | Starting 0.0 pips + $ 3.5 commission per 1 lot | 1,000+ (55+ currency pairs) | + Huge variety + Micro accounts + Daily webinars + Personal service | Live-account from $ 5(Risk warning: 75.59% of retail CFD accounts lose) | |

10. OctaFX  | CySEC | Starting 0.3 pips – No commissions | 100+ (45+ currency pairs) | + Support 24/7 + Crypto payments + Free bonus + Contests + Copytrading | Live-account from $ 100(Risk Warning: Your capital is at risk) | |

11. IC Markets  | ASIC, CySEC, FSA | Starting 0.0 pips + $ 3.0 commission per 1 lot | 232+ (50+ currency pairs) | + Good conditions + RAW Spreads + High liquidity + High leverage | Live-account from $ 200(Risk Warning: Your capital can be at risk) | |

12. FXCM  | FCA, AFSL, FSCA | Starting 0.2 pips variable | 200+ (50+ currency pairs) | + NDD/ECN Broker + High liquidity + Institutional service | Live-account from $ 50(Risk warning: 74% of CFD accounts lose money) | |

13. XTB  | More than 10 | Starting 0.0 pips + 3.5$ commission per 1 lot | 3,000+ (50+ currency pairs) | + Huge variety + Good platform + Best service + Personal service | Live-account from $ 0(Risk warning: 72% of retail CFD accounts lose money) | |

14. FxPro  | FCA, CySEC, FSCA, DFSA, SCB | Starting 0.0 pips variable | 250+ (50+ currency pairs) | + High liquidity + NDD Broker + No requotes + No commissions | Live-account from $ 100(Risk warning: 72.87% of CFD accounts lose money) | |

15. Markets.com  | CySEC, FSCA, ASIC, FCA | From 0.6 pips variable (no commission) | 2,200+ (67+ currency pairs) | + Easy to use + PayPal + Professional tools + Low spreads + Personal support | Live-account from $ 100(Risk warning: 67% of retail CFD accounts lose money) | |

16. Deriv.com  | VFSC, FSC, FSA | Starting 1.0 pips variable | 100+ (40+ currency pairs) | + Trade with 1$ + Options & Forex + Broker since 1999 | Live-account from $ 10(Risk Warning: Your capital can be at risk) | |

17. Libertex  | CySEC | 0.0 pips + 0,01% commission of the trading volume | 300+ (40+ currency pairs) | + Beginner-friendly + No spread trading + 50+ Cryptocurrencies + Professional charting | Live-account from $ 100(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) | |

18. Admiral Markets  | FCA, ASIC, CySEC, EFSA | Starting 0.0 pips variable + $ 3.0 commission per 1 lot | 3,000+ (40+ currency pairs) | + Multi-regulated + Huge variety + Special offers + DMA access | Live-account from $ 100(Risk warning: 76% of retail CFD accounts lose money) | |

19. InstaForex  | CySEC, BVI FSC | Starting 0.0 pips + 0.02% – 0.07% commission per 1 lot | 300+ (107+ currency pairs) | + Good conditions + Personal service + Bonus program | Live-account from $ 1(Risk Warning: Your capital can be at risk) | |

20. AXI  | FCA, ASIC, DFSA | Starting 0.0 pips + 3.5$ commission per 1 lot | 140+ (40+ currency pairs) | + Multi regulated + Fast execution + High security | Live-account from $ 0(Risk warning: 73.4% of retail CFD accounts lose money) |

See my comparison in this video:

See my reviews of the top Forex Brokers via list:

- RoboForex – Free bonus, high leverage, ECN trading, and cashback

- Capital.com – The best userfriendly platform and offers

- Vantage Markets – High leverage ECN trading

- BlackBull Markets – Deep liquidity and high leverage

- IQ Option – Start forex trading with only $1

- Pepperstone – Fast execution and low spreads

- Etoro – The best choice for beginners

- XM – Micro accounts are possible

- Tickmill – Best trading conditions

- OctaFX – Crypto payments available

- IC Markets – 0.0 pips real spreads

- FXCM – Many platforms are available

- XTB – Professional platform

- FxPro – No requotes with no dealing desk

- Markets.com – Big player in the forex industry

- Deriv – Supports automated trading

- Admiral Markets – Overall, good conditions

- Libertex – Trade without spread

- InstaForex – Bonus and contests

- AXI – Competitive broker

How I tested each Forex Broker:

In contrast to many other comparison sites, I present you on this website only the safest providers with the best conditions for traders. As an expert with ten years of experience, I have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

Unfortunately, it is not uncommon to hear of fraud on the internet. To help you stay away from these frauds, I created this comparison. There are a few characteristics every trustworthy Forex broker should have. In general, a good rule of thumb when choosing your Forex broker is to stick with a brand with a proven track record of satisfied clients and a long company history.

In addition, I am going to introduce you to the key points I look at when reviewing a company.

Regulation

A valid license from a reputable regulator is, without a doubt, one of the single most important considerations. Regulated brokers are supervised by the authorities and need to meet a number of criteria in order to keep their license. The chances of you getting scammed by a regulated broker are very slim, as the companies risk losing their license immediately if the regulators hear of shady tactics. Also, regulations will allow you to keep the companies accountable if they refuse to pay your funds, for example. Even if it should happen, your chances of success are very good in front of a court, versus if an unregulated broker refuses to pay you, there is practically nothing you can do.

It is important to mention not all regulations are worth the same, however. Some unethical Forex brokers might even have a license from a third-world country, which is easier to obtain, and there are fewer regulations. Such a regulation means you would potentially need to make a legal claim in Cambodia, Maledives, or Cook Island, which is a lot harder. Therefore, I would highly recommend choosing a Forex broker with a highly reputable, well-known regulation.

Some of the most popular regulators are:

How to check for a Forex broker regulation

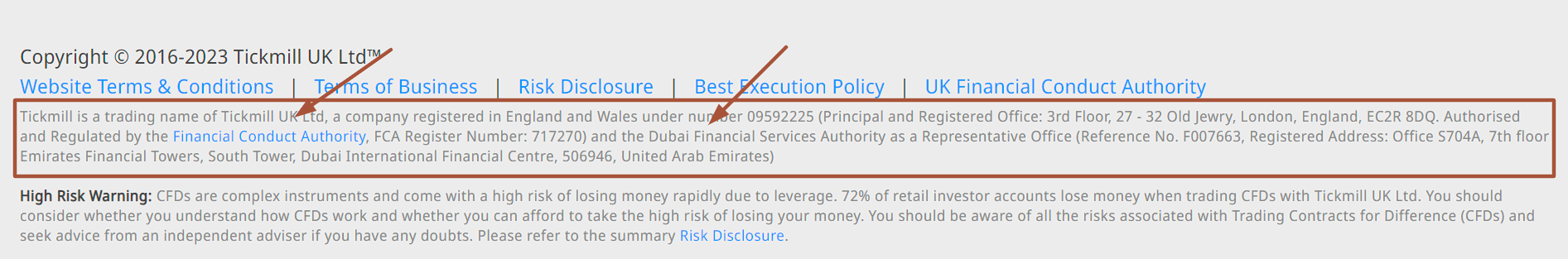

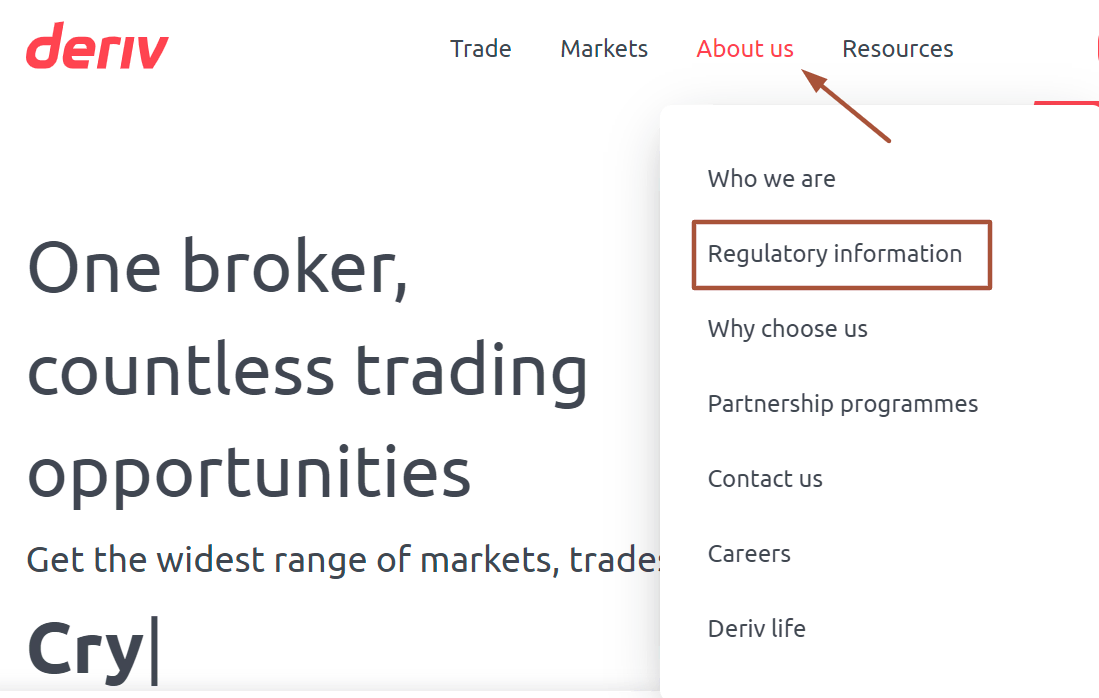

If a broker has a regulation from a reputable source, you can assume they will showcase or talk about it on their website, as it is an important sign of trust for potential clients. In other words, if there is absolutely nothing about any regulation on their website, it’s probably because there isn’t any, and you should move on.

Now, the structure of every site is slightly different, but from my personal experience, you will often find information about the regulation in the footer section of the website if you scroll to the very bottom.

Alternatively, you can also check the “about us” section, and you will very often find regulatory information.

Once you know the license number (e.g.51268), the last step is to validate if the regulation is still valid on the official website of the respective regulator.

Offer

Another important point to consider is the offer of the broker. There are huge differences in terms of how many forex pairs are available. For example, the top broker in that regard offers more than 12,000 different options (RoboForex), while other competitors only offer around 1,000 currency pairs. A greater selection gives you more flexibility and additional trading opportunities, that’s why I personally prefer brokers with a lot of options to choose from.

Software

While some brokers offer access to their own in-house trading platform, others will also give you access to popular trading software such as MetaTrader, or cTrader. It really comes down to your personal preferences and what’s important to you, and most in-house software gives access to plenty of tools and indicators.

Account types

The range of account types goes from one account type to more than five different types to choose from, depending on the broker. Besides the minimum deposit amount, a distinction in the pricing structure is also very common. Many brokers offer two different account types:

- Spread-based accounts : On these account types, the broker will add a so-called spread and earn money per trade.

- Comission-based accounts: Alternatively, there are also account types with no spreads, in this case, you will pay a fixed fee per lot.

Payment and withdrawal conditions

Fast processing of withdrawal requests and a good selection of payment methods are of utmost importance for a reliable broker. I tested each and every broker in this article with my own money to give you my unbiased experience, when it comes to depositing and withdrawing money.

Demo account

A demo account is a basic courtesy 99% of all reliable forex brokers will offer to their clients and something I expect to see when I test brokers. It’s important for you to familiarize yourself with the platform and develop and improve your strategies without risking your own money. A Forex demo account should always be totally free for you, and many brokers offer unlimited accounts, while others limit it to $10,000 of virtual funds, for example.

Support

Should you ever run into any issues, professional and fast support is crucial. In my reviews, I take a look at the contact options (chat, E-Mail, phone) and the availability. The best brokers offer 24/7 support availability in multiple languages and often have a knowledge base section with commonly asked questions. To help you succeed, free training courses, blog posts, or even webinars are an added bonus and a very helpful resource I highly recommend you to make use of it, if it is offered to you.

What makes the best online forex broker?

If you should ever come across an online forex broker, and there is no detailed review on my site yet, here is a quick checklist to help you determine, whether it is a good broker or not:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small Forex Trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional multi-lingual support

- Fast deposit and withdrawal methods

What is a forex broker?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies. In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

In addition to this definition above, there are a few terms and differences in Forex trading you should understand. There are multiple types of forex brokers, tailored to the specific characteristics and needs of different traders.

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee do you know the exact functions. A market maker forex broker is not bad or a scam. Nowadays, most providers offer good and exact executions.

ECN broker:

ECN (Electronic Communication Network) means direct access to the interbank market through various liquidity providers and other traders. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So, the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Also, you will get the best trading conditions with these types of brokers. You can read our ECN forex broker comparison here.

No dealing desk broker:

Most forex brokers have no dealing desk. That means there is no influence from the broker on the trader’s orders. NDD brokerage is safe to use, and there is also no conflict of interest. You will have no requotes with a no-dealing desk broker like with an ECN broker. Dealing desk brokers can manually influence the spreads and execution of traders. You can read our NDD broker comparison here.

STP broker:

STP stands for straight thought processing and is a well-known term in forex and CFD trading. It is similar to an ECN and NDD broker. STP means you have no dealing desk, and all orders are executed directly on the market or by liquidity providers. You can read our STP broker comparison here.

Forex broker with high leverage:

Not all forex brokers offer high leverage for currency trading. The regulators in Europe and Australia limit the leverage for retail clients to 1:30. To get higher leverage, you have to be a professional trader. Most retail traders can not achieve this status because there are hard requirements for it. The solution is to switch to a forex broker with another regulation authority that has no restrictions to high-leverage trading. You can read our comparison of forex brokers with high leverage here.

Forex broker with cent accounts:

The standard forex trading order size is determined in lots. There are 1.00 lots (standard), 0.10 lot (mini), and 0.01 lot (micro). One lot means 100,000 units of the base currency. There are opportunities to trade with a smaller order size like 0,01 lot. It is called cent accounts. 0.01 lot means 1,000 units of the base currency. With a cent account, it means only 100 units. Cent accounts are suitable for traders who want to start with very small amounts of money. You can read our comparison of cent accounts here.

Forex broker with zero spreads:

Zero spread accounts are offered by ECN or NDD brokers. That means you will get raw spreads from the markets. Depending on the broker, it can be really 0.0 pip spread. This type of trading account is suitable for scalp traders and traders who are using a high order volume. Read our comparison of zero-spread accounts here.

How to find the best broker (for your situation)

You have already learned important principles and best practices to avoid fraudulent brokers, but how can you find the best broker for you out of many great options? To answer that, you need to understand your motivation and goals when trading. Take a moment and ask yourself some questions to develop your individual trading strategy.

- Do you have any preexisting knowledge or experience with forex trading?

- What are the financial goals you would like to achieve with trading?

- How much time per day can you invest?

- What currency pairs would you like to trade?

- How much capital can you afford to invest? (and loose in the worst case)

- What does your risk management look like and how much of a risk are you willing to take?

- What trading approach do you plan to use? (day-trading, swing-trading, scalping, etc.)

Based on the answers and the strategy you develop, you will get a better idea of what to look for, and begin to compare different brokers against each other. From my own experience, I can tell it’s worth investing the time. to compare different options and not just to go with the first one.

Ultimately, there is no universal answer to the question of which broker is best (although there are a few. indications), but the more you compare and test, the better are the chances for you to find the perfect match.

The importance of trading with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in Europe must have regulations or licenses if they want to offer their services. The regulation can be in any European country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies in mine are always concerned about keeping the highest criteria and guaranteeing a safe trade. Many brokers, for example, are regulated in Cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused, or delays occurred.

Is Forex trading risky?

In short, yes Forex trading comes with some risks, but the good news is that you can manage and minimize them a lot. Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls, and this is not without reason, as the past has shown. Account balances could slip into negative balances. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC Markets and Vantage Markets). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always be aware of sensible risk management.

Note:

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

What is negative balance protection in Forex trading?

Negative balance protection is an added layer of security, more and more brokers offer to their clients. New traders can sometimes underestimate how quickly markets can change, especially after the announcement of economic or political news. In extreme market conditions in combination with a high leverage effect, it’s theoretically possible for an account balance to go negative despite safety measurements such as stop-loss orders. If this should happen, a broker will automatically reset the account balance to zero. In other words, traders will never lose more money than their initial investment with an active negative balance protection.

Factors to consider when choosing a leverage level

Determining an appropriate leverage level takes knowledge and experience, and is, therefore, a challenging task. Although I totally understand, why a high leverage level might be tempting for any new trader, I would personally recommend starting as low as possible. For me, this is the most sustainable way to get a feeling for it and make sure you completely understand the mechanisms.

Several critical factors should be taken into account when you increase your leverage level. Firstly, higher leverage amplifies potential gains but also magnifies losses, so finding a balance that aligns with your risk appetite is crucial.

Consider your trading strategy and time horizon, as shorter-term traders tend to strive for higher leverage to capitalize on immediate market movements, while long-term investors may prefer lower leverage for stability. Evaluate the volatility and liquidity of the assets you’re trading, as more volatile or illiquid markets may warrant lower leverage to manage risk effectively.

How to sign up with a Forex broker

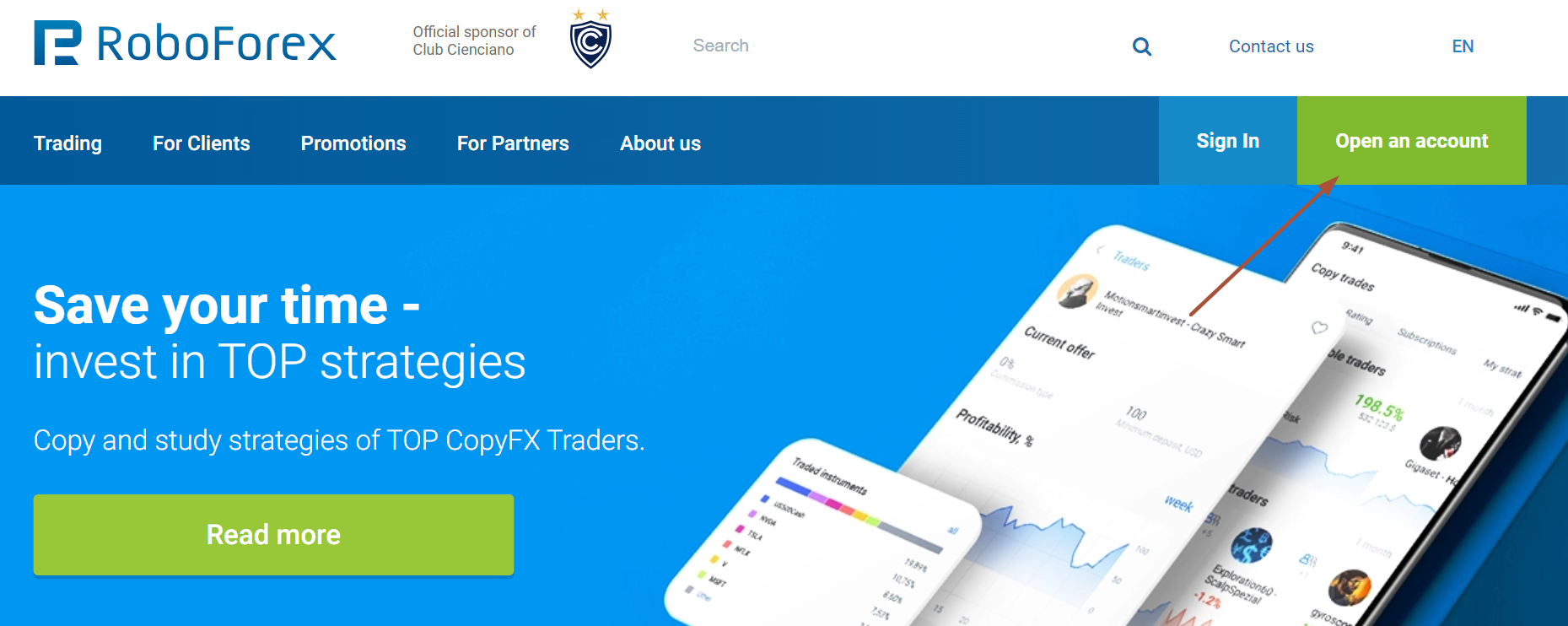

In this section, I will show you step-by-step, how to sign up for an account with RoboForex as an example. First, you visit their official website and hit on “open account”

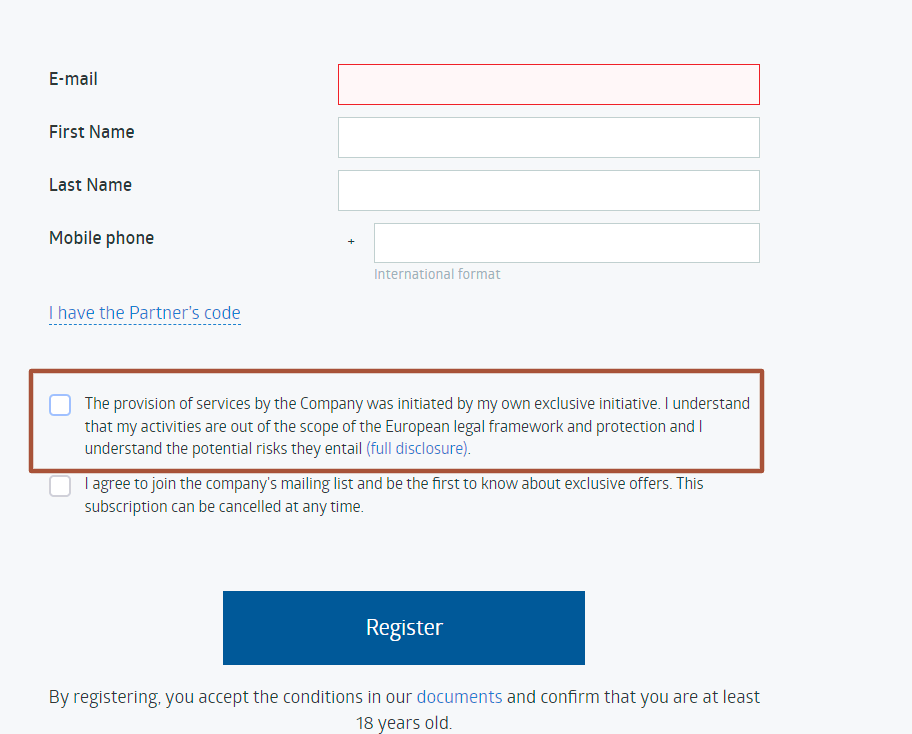

1) Enter personal details

The second step is to fill in some personal information, such as name, E-mail address, phone number, etc. Don’t forget to tick the first box to acknowledge the site’s terms and conditions.

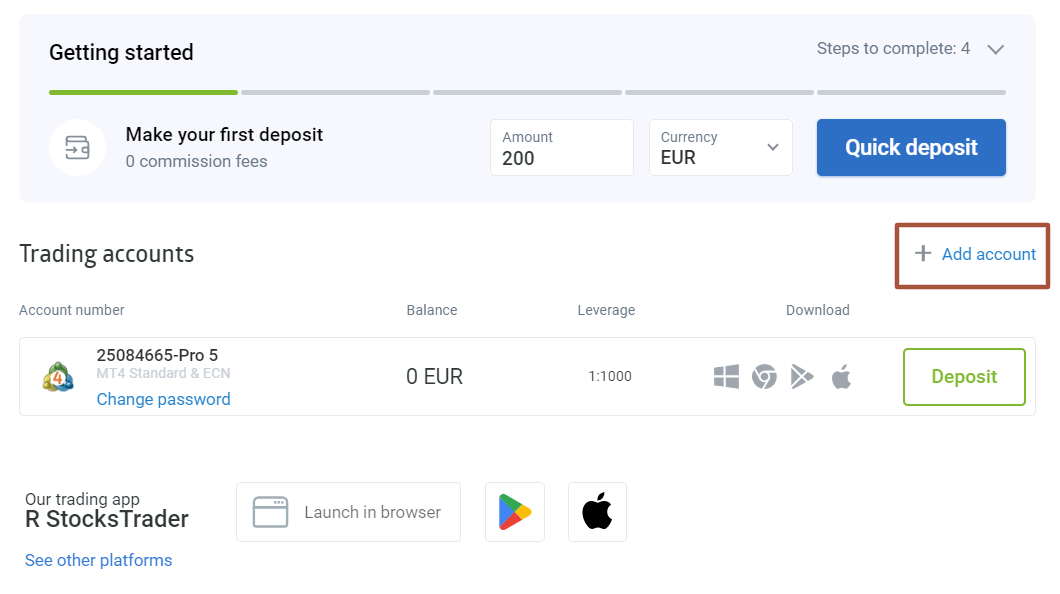

2) Add a demo account

If you are just starting out, I highly recommend adding a free demo account to practice, as an experienced trader you can also skip this step. Add your demo account by clicking. on the “add account” button.

3) Deposit Funds

Once you are ready, you can make your first deposit with just a few clicks. Remember to verify your account within 14 days after the first deposit. You will get detailed instructions via E-mail.

How to deposit and withdraw money on a Forex Broker

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex Brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, PayPal, crypto) or with the classic way of bank transfer. Electronic methods work in real time, and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account for as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customers money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200, most forex brokers take over the fees, but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic Methods (Skrill, Neteller, PayPal, and more)

- Cryptocurrencies

- Bank wire

How does a Forex broker make money?

When you are starting out with forex trading, you will soon realize how important the coexistence of traders and brokers is. You need a trustworthy broker as a partner to gain access to the markets. Just as with any company in our world, brokers also need to make some kind of revenue to pay their support staff, maintain licenses for trading software, improve the site’s security, and so on – in short. to keep the site attractive for you.

So, how do they make money from you? In my ten years as a trader, I came across three types of revenue streams, that each and every forex broker relies on. Obviously, not every company offers the same conditions to their clients, that’s why it is so important to compare them.

Spreads

Spreads are the first source of income, for forex brokers. A spread is the difference between the ask price and the bid price. In other words, it is the cost of trading. For example, if the Euro to US dollar is trading with an ask price of 1.14030 and a bid price of 1.14000, then the spread will be the ask minus the bid price. In this case, 0.0003.

How high a spread is will depend on multiple factors, mainly the currency pair, conditions of the underlying markets, account type, and other factors, but typically range from 0,00 pip spread, up to more than 50 pip spread (mostly for exotic currency pairs)

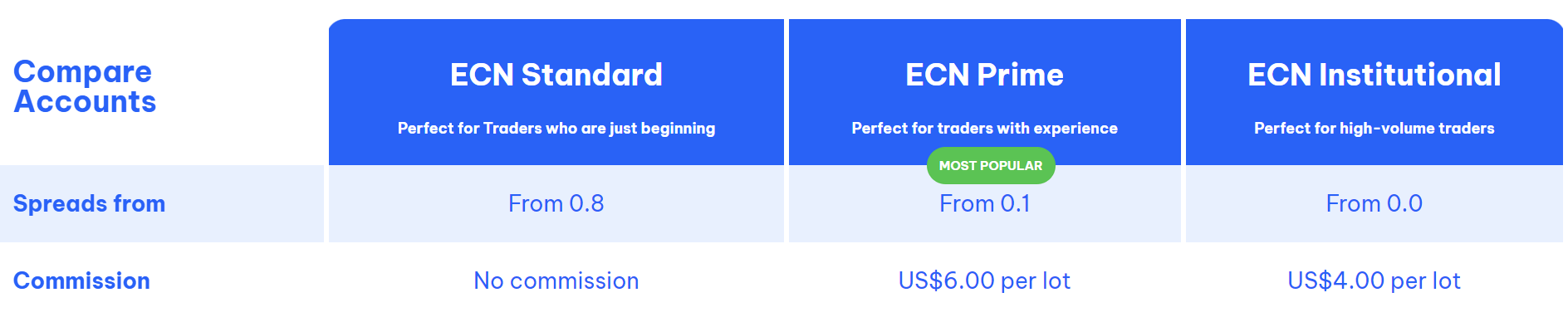

Commissions

You will also commonly find account types with no spread. If that’s the case, you will usually pay a fixed commission per lot. The commission is often between $3-10 per lot. Some brokers will also combine spreads and commissions as you can see in the account comparison of Blackbulls below.

Pro tip:

Most beginners open their first trading account in a spread-based model because the minimum deposit amount is often lower. However, in terms of commissions, I found commission-based models to be slightly cheaper in many cases.

Fees

Fees are the type of expenses where you can save most of your money, by making smart choices. The differences are really considerable. I will introduce you to the most common potential fees in forex trading, to keep an eye out for now.

- Overnight fees or rollover fees: The most common fee almost every forex broker will charge if you keep a position open after the official market hours. In trading, the term overnight fee is used to refer to the interest paid on leverage. Therefore, you can totally avoid overnight fees if you choose a day trading or scalping strategy.

- Deposit or withdrawal fees: Some brokers still automatically deduct a service fee for withdrawals or (in very rare cases) deposits. However, those charges are very easy to avoid, as the majority of brokers offer free. deposits and withdrawals to their clients.

- Inactivity fees: If you are not active on your trading account, it’s not impossible your brokers will charge you with inactivity fees on a daily basis after 30 days. Check the terms and conditions of your broker to learn more about it. These fees aren’t very high usually, maybe 5-10 USD per day, but they can sum up quickly.

How much money do you need to start forex trading?

This is by far the most asked question I get from trading beginners. Some broker platforms offer accounts with very small deposit requirements, often only $10 or $20. This varies from broker to broker and is ultimately a company decision. For your reference, I have listed the minimum deposit of some popular Forex brokers below.

Broker | Minimum Deposit |

RoboForex | $10 |

Capital.com | $20 (by card) |

Vantage Markets | $200 |

Blackbull Markets | No minimum deposit |

IQ Option | $10 |

But, unfortunately, that’s only half of the truth. As mentioned above briefly, the standard forex trading order size is determined in lots. There are 1.00 lots (standard), 0.10 lot (mini), and 0.01 lot (micro). One lot means 100,000 units of the base currency. There are opportunities to trade with a smaller order size like 0,01 lot. It is called cent accounts. 0.01 lot means 1,000 units of the base currency.

In reality, if you start trading with extremely small positions, it comes with a number of disadvantages. Firstly, with very small positions (I am talking about positions with less than $10), even if you use leverage, you will only make very small gains and losses and only make a couple of cents here and there. Also, professional traders never risk more than 1-2% of their account, to ensure proper risk management, which is basically impossible with an account of 100$ for example.

My personal recommendation is to start with an account of at least $500, better $1,000 if you are serious about trading. With smaller accounts, chances are you won’t be able to make a considerable investment, that’s worth your time.

Country-specific limitations in Forex trading

Not every country is available for Forex Brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So, it is too much for some companies to get the license, and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients from the United States of America.

From my experience, the fastest-growing countries are in Africa and Asia. Because of the development of the mobile internet, more people are connected to the forex market. India, Nigeria, the Philippines, Malaysia, and China are, at the moment, the fastest-growing countries.

Is forex trading legal?

Yes, Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review have official regulations, so they act fully legally. If you want to be 100% sure, you can double-check for any restrictions via the official regulators in your country, but in my experience, I can tell forex trading is legal in 99% of all countries.

Review conclusion: Start trading with a trusted Forex Broker

On this page, I have presented you with our current list of the top 20 Forex Brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to me to only present providers here, that I have tested by myself with real money and can be trusted. This is not the case with most comparisons.

My goal is that you can benefit from the best conditions through my ten years of trading experience. With these providers, you are 100% safe and can take your Forex trading to the next level. If you are asking me about the best broker for forex trading, my answer is RoboForex. A good leverage is essential for a very good forex broker and the company is best-in-class in that aspect. In addition, the negative balance protection, access to MetaTrader 5, and access to 50+ tradable currency pairs. That’s everything you need to become a successful trader.

I hope you learned something from this comparison and act now with better providers through my recommendations. If you still can’t make up your mind, you can also read my more detailed reviews for each broker.

For secure forex trading, choose a regulated forex broker. On our website, you will find the best ones.

Trusted Broker Reviews

Experienced and professional traders since 2013FAQ – The most asked questions about Forex Broker :

Is a Forex Broker free to use?

Forex Brokers are free to use, and this includes account sign-up, trading platforms, market data, demo accounts, and live accounts most of the time. If you want to trade with real money, the forex broker will charge an additional spread or commission for each trade.

How are Forex Brokers regulated?

Trustworthy forex brokers are regulated by an official finance authority like the CFTC or CySEC. The authority gives licenses to forex businesses which are applying to the common standards for investments and trading. Through these licenses, the forex broker is allowed to offer its service to retail clients. However, some forex brokers are operating unregulated.

Do Forex Brokers offer a demo account?

Yes, most forex brokers are offering free demo accounts, which are filled up with virtual money. There are only a few cases of brokers who are not offering practice accounts. Feel free to sign up for a demo account with the forex broker of your choice.

Which Forex Broker is best?

RoboForex is the best forex broker in my personal experience, although there is no universal answer to this question. They are my favorite, due to their easy-to-understand trading platform, excellent customer support, and access to MetaTrader 5 platform.

Which Forex broker has the best trading platform?

Again, the answer here is RoboForex in my opinion. For beginners, their in-house trading platform is very easy to understand, while still giving access to all relevant indicators and information. You also get a licence for the MetaTrader 5 platform, one of the world’s most popular trading platforms out there.

Which Forex broker has the most currency pairs?

Capital.com is the broker with the most tradable currency pairs at the moment. They are offering a selection of 70+ currency pairs and more than 3,000 tradable assets in total.

Which Forex Broker should you use as a professional?

Vantage Markets is my preferred recommendation for experienced traders. They offer personalized service, high leverage access to MetaTrader 4/5, and allow deposits and withdrawals with cryptocurrencies.

Which forex broker is the best for beginners?

The best Forex Broker for beginners is RoboForex. The name comes with one of the best mobile trading platforms with high-tech tools for trading and the best client support. They also charge a very low minimum deposit of $ 10 which makes it quite easy to start forex trading. Apart from it, they are regulated by the end of 2 tier-1 financial entities and have no hidden charges for trading. So, why not try the application that is filled with features like live stock market details, your portfolio value, hundreds and thousands of stocks in one place, and much more?

Find the right Forex broker in our other comparisons:

Account types:

- Islamic Forex Broker accounts

- Forex Broker with mini accounts

- Forex Broker with raw spread accounts

- Forex Broker with micro accounts

- Forex Broker with Tradingview accounts

- Forex Broker with Hedging accounts

- Forex Broker App accounts

- Forex Broker with scalping accounts

- Forex Broker for small accounts

- Forex Broker without KYC

- Forex Broker with cTrader

- Best forex account

- Best forex demo accounts

- Forex Broker with STP accounts

- Forex Broker with Cent accounts

- Forex Trading Platforms

- Forex Broker for beginners

- Forex Broker ECN accounts

Features:

- Forex Broker with Depth of market

- Forex Broker with guaranteed stop loss

- Forex Broker with the best execution speeds

- Forex Broker regulated with high leverage

- Regulated Forex brokers

- Forex Brokers for Social trading

- Forex MyFXbook brokers

- Forex Brokers with Autochartist

- Forex Brokers with Zulutrade

- Forex Broker with A-book execution

- Forex Broker with exchange execution

- Forex Broker with instant execution

- Forex Broker with market execution

- Forex Broker with no commissions

- Forex Brokers for cryptocurrency

- Forex Broker without margin

- Forex Broker without swap fees

- Forex Broker without leverage

- Forex Broker, which allows HFT

- Forex Broker with DMA

- Forex Broker with bonuses

- Forex Broker with low spreads

- Forex Broker with welcome bonus

- Forex Broker with low spread and no commission

- Forex Broker with no minimum deposit

- Forex Broker with high leverage

- Forex Broker with zero spread

Countries:

- Offshore Forex Broker

- Forex Broker for USA

- Forex Broker in the United Kingdom

- Forex Broker in Europe

- Forex Broker in Australia

- Forex Broker in Indonesia

- Forex Broker in Japan

- Forex Broker in Africa

- Forex Broker in the Philippines

- Forex Broker in India

- Forex Broker in Sri Lanka

- Forex Broker in Malaysia

- Forex Broker in New Zealand

- Forex Broker in Sweden

- Forex Broker in Turkey

- Forex Broker in UAE

- Forex Broker in Vietnam

- Forex Broker in Egypt

- Forex Broker in Kenya

- Forex Broker in Russia

- Forex Broker in Pakistan

- Forex Broker in Singapore

- Forex Broker in Brazil

- Forex Broker in South Africa

- Forex Broker in Canada

- Forex Broker in Asia

- Forex Broker in South America

- Forex Broker in China

- Forex Broker in Nigeria

- Forex Broker in Bangladesh

- Forex Broker in Mexico

- Forex Broker in Ethiopia

- Forex Broker in Democratic Republic Kongo

- Forex Broker in Iran

- Forex Broker in Germany

- Forex Broker in Thailand

- Forex Broker in France

- Forex Broker in Italy

- Forex Broker in Tanzania

- Forex Broker in Myanmar

- Forex Broker in South Korea

- Forex Broker in Colombia

- Forex Broker in Spain

- Forex Broker in Uganda

- Forex Broker in Argentina

- Forex Broker in Algeria

- Forex Broker in Sudan

- Forex Broker in Ukraine

- Forex Broker in Iraq

- Forex Broker in Afghanistan

- Forex Broker in Poland

- Forex Broker in Morocco

- Forex Broker in Saudi Arabia

- Forex Broker in Uzbekistan

- Forex Broker in Peru

- Forex Broker in Angola

- Forex Broker in Mozambique

- Forex Broker in Ghana

- Forex Broker in Yemen

- Forex Broker in Nepal

- Forex Broker in Venezuela

- Forex Broker in Madagascar

- Forex Broker in Cameroon

- Forex Broker in Ivory Coast

- Forex Broker in North Korea

- Forex Broker in Niger

- Forex Broker in Taiwan

- Forex Broker in Burkina Faso

- Forex Broker in Mali

- Forex Broker in Romania

- Forex Broker in Malawi

- Forex Broker in Chile

- Forex Broker in Kazakhstan

- Forex Broker in Zambia

- Forex Broker in Guatemala

- Forex Broker in Ecuador

- Forex Broker in Syria

- Forex Broker in the Netherlands

- Forex Broker in Senegal

- Forex Broker in Cambodia

- Forex Broker in Chad

- Forex Broker in Somalia

- Forex Broker in Zimbabwe

- Forex Broker in Guinea

- Forex Broker in Rwanda

- Forex Broker in Benin

- Forex Broker in Burundi

- Forex Broker in Tunisia

- Forex Broker in Bolivia

- Forex Broker in Belgium

- Forex Broker in Haiti

- Forex Broker in Cuba

- Forex Broker in South Sudan

- Forex Broker in the Dominican Republic

- Forex Broker in the Czech Republic

- Forex Broker in Greece

- Forex Broker in Jordan

- Forex Broker in Portugal

- Forex Broker in Azerbaijan

- Forex Broker in Honduras

- Forex Broker in Hungary

- Forex Broker in Tajikistan

- Forex Broker in Belarus

- Forex Broker in Austria

- Forex Broker in Papua New Guinea

- Forex Broker in Serbia

- Forex Broker in Switzerland

- Forex Broker in Togo

- Forex Broker in Sierra Leone

- Forex Broker in Hong Kong

- Forex Broker in Laos

- Forex Broker in Paraguay

- Forex Broker in Bulgaria

- Forex Broker in Libya

- Forex Broker in Lebanon

- Forex Broker in Nicaragua

- Forex Broker in Kyrgyzstan

- Forex Broker in El Salvador

- Forex Broker in Turkmenistan

- Forex Broker in Denmark

- Forex Broker in Finland

- Forex Broker in the Republic of Congo

- Forex Broker in Slovakia

- Forex Broker in Norway

- Forex Broker in Oman

- Forex Broker in the State of Palestine

- Forex Broker in Costa Rica

- Forex Broker in Liberia

- Forex Broker in Ireland

- Forex Broker in Central African Republic

- Forex Broker in New Zealand

- Forex Broker in Mauritania

- Forex Broker in Panama

- Forex Broker in Kuwait

- Forex Broker in Croatia

- Forex Broker in Moldova

- Forex Broker in Georgia

- Forex Broker in Eritrea

- Forex Broker in Uruguay

- Forex Broker in Bosnia and Herzegovina

- Forex Broker in Mongolia

- Forex Broker in Armenia

- Forex Broker in Jamaica

- Forex Broker in Qatar

- Forex Broker in Albania

- Forex Broker in Puerto Rico

- Forex Broker in Lithuania

- Forex Broker in Namibia

- Forex Broker in Gambia

- Forex Broker in Botswana

- Forex Broker in Gabon

- Forex Broker in Lesotho

- Forex Broker in North Macedonia

- Forex Broker in Slovenia

- Forex Broker in Guinea-Bissau

- Forex Broker in Latvia

- Forex Broker in Bahrain

- Forex Broker in Estonia

- Forex Broker in Mauritius

- Forex Broker in Luxembourg

- Forex Broker in Fiji

- Forex Broker in Malta

- Forex Broker in the Bahamas

- Forex Broker in Israel

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5) (4.7 / 5)

(4.7 / 5)