10 best CFD Brokers in comparison – Full list & reviews 2024

CFD trading is becoming more and more popular and with the amount of CFD brokers growing quickly, finding a reliable, and trustworthy CFD broker is a daunting task.

With today’s CFD brokers list, I use my 10 years of trading experience and review the 10 best CFD brokers currently available, to ultimately help you find the broker with the best trading conditions. Thanks to my expertise, I know exactly what to look for, we will go over the advantages and disadvantages of CFD trading, and reveal how top CFD brokers make money from you.

See the CFD broker comparison table below:

CFD BROKER: | REVIEW: | REGULATION: | SPREADS: | ASSETS: | ADVANTAGES: | OPEN ACCOUNT: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, ASIC, FCA, SCB. SCA | Starting variable 0.3 pips no commissions (other fees can apply) | 3,000+ | + DMA execution + AI platform + PayPal + Userfriendly + Best education + Personal support | Live-account from $ 20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | IFSC | Starting 0.0 pips variable no commissions | 16,000+ | + Huge diversity + Awarded as most trusted broker in 2022 + On the market since 2009 + Professional support and education | Live-account from $ 0(Risk warning: Your capital can be at risk) | |

3. Plus500  | FCA, CySEC (#250/14), MAS, FSA and ASIC | Variable spreads from the market | 2,000+ CFDs | + Support 24/7 + PayPal + Cryptocurrencies CFDs + Guaranteed stops + Alarms | Live-account from $ 100Risk warning: 82% of retail CFD accounts lose money. | |

4. XTB  | More than 10 | Starting 0.8 pips variable | 3,000+ | + Huge variety + Good platform + Best service + Personal service | Live-account from $ 0(Risk warning: 72% of retail CFD accounts lose money) | |

5. eToro  | CySEC, FCA, ASIC | Starting 1.0 pips variable | 3,000+ | + Best for beginners + Social Trading + PayPal + No commissions + Copy portfolios | Live-account from $ 200 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. | |

6. Vantage Markets  | CIMA, ASIC | Starting 0.0 pips + $ 3.5 commission per 1 lot | 300+ | + High leverage + Bonus accounts + Daily webinars + Personal service | Live-account from $ 200(Risk warning: Your capital can be at risk) | |

7. IQ Option  | Starting 0.0 pips variable – only in main trading hours (no commission) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ (Risk warning: Your capital might be at risk.) | |||

8. Markets.com  | CySEC, FSCA, ASIC, FCA | Starting 0.6 pips variable | 2,200+ | + Easy to use + PayPal + Professional tools + Low spreads + Personal support | Live-account from $ 100(Risk warning: 67% of retail CFD accounts lose money) | |

9. ActivTrades  | FCA | 0.45 pips variable | 450+ | + High financial security + Low spreads + Professional platform | Live-account from $ 1,000(Risk warning: 66 - 79% of retail CFD accounts lose money) | |

10. CMC Markets  | FCA, ASIC, FMA, MAS | Starting 0.7 pips variable | 10,000+ | + Huge diversity + Very good platform + Broker since 1989 + Exclusive support | Live-account from $ 0(Risk warning: 73% of retail CFD accounts lose money) |

Watch my full video review about the top 10 CFD Brokers:

How I tested the CFD Brokers on this list – Criteria for the reviews

In order to help you find a serious CFD Broker I believe in full transparency. Therefore, I will go over the criteria I look for, whenever I test and review a broker. I only include established and regulated broker companies with a proven track record in customer satisfaction and I thoroughly test all of them personally with my own money.

Having that said, you can also take some easy steps to minimize the risk of being scammed, by doing your independent research before investing any money online. Especially dubious companies hope for the ignorance of the new customers or try to put time pressure on you, which is always a huge red flag. Also, if an offer is too good to be true, it probably is, so it’s very important to maintain a healthy level of skepticism – especially online.

For more background information about the companies, click on “Read the review” in the list above and you will get many more facts about the respective CFD Broker.

Now, without further delay, let’s go over the most important factors, of what makes a good CFD broker from my experience.

Regulation

Before you sign up with any CFD Broker you should check if it is a regulated company. Brokers with no regulation or license are not secure to invest your money. Unfortunately, the internet is full of complaints about fraud from unregulated brokers, and pursuing legal action against those is very difficult.

As a customer, you should check the license and security for customer funds. Every reputable broker company with good intentions will showcase those certifications and licenses on their website prominently.

From my experience, online brokers with an official license from a financial authority are reliable and secure. You can make profits and withdraw your money without running into any issues. I have never personally experienced it with regulated brokers, but just know, that no professional broker will ever ask you to invest more money (to pay for taxes, for anti-money laundering purposes, etc.) before processing the withdrawal request.

Offers of CFDs

One of the main advantages of CFD trading is the possibility for investors to trade CFDs on a wide range of financial products in many of the world’s global markets around the clock. Therefore, how many assets a CFD broker offers on their site, is a highly relevant consideration.

As you are making your profits with price changes in the underlying market, financial instruments with high volatility such as forex, cryptos, or stocks are predestinated for CFD trading.

Costs of CFD trading

A sleek cost structure with minimal fees and commissions determines your profitability and is definitely one of the most important factors when choosing your broker. Your trading strategy will largely influence which commission structure is best for you (commission-based model or spread-based model).

The biggest saving potential lies in the platform fees. I would personally recommend investing some time in comparing the different companies and choosing a provider without withdrawal or inactivity fees.

Trade execution speed

Over the past ten years, I often realized how vital execution speed is for securing my intended trades in volatile markets. Slow execution speed can easily minimize your profits, especially when the market moves quickly after a major announcement for example.

The execution speed is measured in milliseconds. Anything less than 100 is considered excellent, anything more than 200 is fairly poor and could lead to price slippage or failure. Broker companies will indicate their execution average speed on their website in many cases.

Leverage

The maximum available leverage you can choose will be determined by two main factors: Your broker and the regulatory limits of your trading account. Keep in mind that if you are opening a trading account with European regulation, the maximum leverage is 1:30 by law. However, the best CFD trading platforms offer trading accounts with other regulations and a leverage of up to 1:1000.

Before you start trading on an account with high leverage make sure you understand the principles and risks associated with it. Personally, I usually recommend starting with a small leverage and increasing it over time, once you gain more confidence and knowledge.

Minimum deposit & demo account

For many CFD brokers, the minimum deposit you need to start is very low, often between 1-100$. However, maintaining proper risk management is quite challenging with small accounts, and it comes with some other disadvantages, I would recommend starting with at least 500-1,000$.

A demo account is an absolute necessity and allows you to test and improve your trading strategy and familiarize yourself with the platform. They are always free and a great way to test the broker. Larger platforms in particular often offer additional educational resources such as webinars, blog articles, and videos to help their clients become successful traders at no additional costs.

Customer support

Many of my readers are at the very beginning of their trading careers, that’s why I always put a special emphasis on excellent customer support. 24/5 support via chat, E-mail, and phone is an industry standard you can easily expect from your broker, but the best-in-class offers 24/7 support in multiple languages.

Besides that, I always contact the support team on multiple channels to test the responsiveness and knowledge of the support staff.

Platforms

Lastly, I always check which trading software and platforms a broker offers.

- Is there a trading app for mobile trading?

- Does the broker provide access to external trading software, such as MetaTrader, cTrader, or any other option?

- Which indicators are available on the web platform?

Those are questions you should consider before signing up.

What makes a good CFD provider? – A quick checklist

Now, after you learn about my expertise and how I carefully test any company before writing about them here. Therefore, if you want to be safe, I recommend signing up with one of the options below. Still, there are instances where it is helpful to quickly analyze how good a new broker is. Below I have a quick checklist for you to help you with a first assessment.

Criteria for a good CFD Broker:

- Official regulation and financial license

- Safety of customer funds (separated funds)

- Fast execution of trades

- Good trading data and charting

- Free demo account with virtual money

- Regulated payment methods

- Fast withdrawal of profit

- Professional customer support and service in different languages

On this website, I guarantee that any broker I recommend is carefully tested and reviewed. With more than 9 years of experience in financial trading, I know how the industry works and how to get the best conditions for traders.

What are CFDs?

The shortcut CFDs means Contact for Difference. These are contracts between the trader and the CFD Broker. The Contract For Difference can be used to invest in every market you want. The contract shows you an exact copy of the underlying asset. It is an over-the-counter product which means you invest in the contract and not in the real asset. The broker has to hedge the risk on the markets or against other traders of the platform.

CFDs were developed to avoid taxation and nowadays it is a popular financial product for retail traders and CFD trading companies play a critical role here. Without these companies, retail traders have no access to the markets. The advantages of CFDs are very clear. You can invest in rising and falling prices on the stock market. Short trades are not a problem for stock trading with CFDs. Furthermore, it is possible to start investing with a very small amount of money and you can use high leverage which depends on the CFD Broker.

My list of the top 10 best CFD Brokers

- Capital.com – best for variety

- Roboforex – best for high-leverage

- Plus500 – best for low spreads

- XTB – best for low minimum deposit

- Etoro – best for copy traders

- Vantage Markets – best trading platform

- IQ Option – best for binary options

- Markets.com – best for trading beginners

- ActivTrades – best for platform security

- CMC Markets – best for professional CFD traders

1. Capital.com – Huge variety of offers and the best platform

Capital.com is well-known in Europe and is expanding its service to other continents. The support is available in more than 20 different languages. Capital.com is regulated inside and outside Europe.

The broker offers a free demo account and a low minimum deposit of only $ 20 (for deposits via credit card) for trading CFDs. For trading the popular platforms MetaTrader 4 is available. But from our experience, you should use the Web-Trader. Capital.com developed its own web trading platform and mobile app which supports KI-functionality.

Overall, Capital.com is my clear winner for the best CFD broker and my primary recommendation. The company offers by far the best overall package of security, a great trading platform, attractive trading conditions, personal support, and innovation.

Advantages of capital.com | Disadvantages of capital.com |

|---|---|

✔ Multi-regulated CFD broker | ✘ No price alerts on the web platform |

✔ More than 3,000 markets to trade | ✘ Capital.com doesn’t accept US clients |

✔ Minimum deposit of only $ 20 (by credit card) | |

✔ Direct market access CFD accounts | |

✔ Spreads from 0.3 pips without commission | |

✔ Variable leverage available | |

✔ Intelligent AI-platform | |

✔ MetaTrader 4 platform | |

✔ Personal support | |

✔ Webinars, trading analysis, and more |

(Risk warning: 75% of retail CFD accounts lose money)

2. RoboForex – Trusted CFD Broker with high leverage

RoboForex is a well-established and prominent broker in the trading industry, gaining recognition for its extensive experience and offerings. The company is recognized for its global presence and adherence to regulatory standards.

As an FSC-regulated broker, RoboForex operates internationally and showcases a commitment to ensuring a high level of trust and reliability for its clients.

Traders have access to a range of 16,000+ markets and financial products, including forex, cryptocurrencies, stocks, commodities, indices, and more. The platform offers an abundance of choices for traders, making it a versatile option for different trading preferences.

RoboForex emphasizes providing optimal conditions for traders, with a focus on excellent service and educational resources. Their dedication to offering comprehensive educational materials and aiding traders in developing their skills showcases their customer-centric approach, aiming for long-term success in their trading endeavors.

advantages of roboforex | disadvantages of roboforex |

|---|---|

✔ Professional broker founded in 2009 | ✘ No fixed-spread accounts |

✔ The company was awarded most trusted and most transparent broker in 2022 | |

✔ More than 16,000 markets to trade | |

✔ Free demo account | |

✔ Low spreads (variable 0.0 pips) and no hidden fees | |

✔ Very good support and education | |

✔ Bank wire and Credit Cards accepted for funding and withdrawal | |

✔ High financial security thanks to FSC regulation and Civil Liability insurance program for a limit of 2,500,000 EUR |

(Risk warning: Your capital can be at risk)

3. Plus500 – One of the world’s largest trading brands

When it comes to CFD trading many traders know the brand Plus500 because of its advertising. It is an international broker where you can trade more than 2,000 assets as Contract For Differences. This includes stocks, currencies, indices, cryptocurrencies, commodities, and options. It is such a large brand that the Plus500 is listed on the main market of the London Stock Exchange. The CFD Broker is multi-regulated and has different branches around the world.

Traders get a clear and powerful trading platform that is good to use and understand. You get access to CFDs on currencies, stocks, commodities, cryptocurrencies, options, and more. Also, the spreads are variable and always depend on the market conditions and assets. For trading, you can use a guaranteed stop-loss which is a huge advantage for the broker. Just start with a low minimum deposit of $ 100 and use many different payment methods. In conclusion, Plus500 is one of the popular CFD Brokers because the trading platform is professional to use for traders and you get good conditions.

advantages of plus500 | disadvantages of plus500 |

|---|---|

✔ Multi-regulated CFD Broker | ✘ Rather high fee structure compared to other competitors |

✔ Plus500 is listed on the main market of the London Stock Exchange | ✘ The trading platform comes with limited functionality and only a few indicators |

✔ More than 2,000 assets | |

✔ New and innovative markets to trade | |

✔ A low minimum deposit of $ 100 | |

✔ Competitive spreads and no hidden fees | |

✔ Support 24/7 | |

✔ PayPal, bank wire, E-wallets, and other regulated payment methods |

Risk warning: 82% of retail CFD accounts lose money.

4. XTB – Well-known address for Stock CFD trading

XTB was founded in Poland and is also listed on the Poland stock exchange. The CFD Broker is mainly based in Europe and has a lot of different branches there. Furthermore, the company is expanding and acquiring licenses outside Europe. With XTB you can trade more than 6,000 markets (depending on the regulator). Sometimes, the variety is depending on the regulation authority you choose. Trade CFDs and even real stocks or ETFs without commission.

There is no minimum deposit and you can start with a free demo account. The spreads are very low and start from 0.8 pips in forex. Indices are available with a spread below 1.0 points. XTB established its own trading platform xStation 5 which is one of the best platforms for traders. It is an all-one software for analysis, trading, and doing research. For example, using the stock screen can help you to find markets with certain characteristics. Moreover, the support is very good. You have access to personal support, live webinars, daily analysis, and coaching.

advantages of xtb | disadvantages of xtb |

|---|---|

✔ Multi-regulated brand | ✘ MetaTrader software is not supported |

✔ International branches with more than 1,000 employees | ✘ Demo account is limited to four weeks |

✔ More than 6,000 markets (depending on regulator) | |

✔ No minimum deposit | |

✔ Free demo account | |

✔ Spreads from 0.8 pips (no commission) | |

✔ Professional trading software xStation 5 | |

✔ Direct market access | |

✔ Webinars, personal support, coaching |

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

5. eToro – best offer for copy traders

Etoro is one of the most famous CFD brokers worldwide. Next, to a huge range of assets, they offer you to do social and copy trading. For example, you copy the trades of professional traders or become a copied trader by yourself to earn additional money. Also, funds for investing are available on the platform. It is a very user-friendly trading platform for beginners. Moreover, advanced traders will find the right tools and charting analysis for their successful trading.

The CFD Broker is based in many different countries and has official financial licenses. Customer funds are managed on big European banks and are separated from the broker money. You can use different payment methods like PayPal, credit card, or bank wire to deposit and withdraw your money. Furthermore, you get professional support through their support team. All in all, eToro offers the best overall package for CFD traders.

advantages of etoro | disadvantages of etoro |

|---|---|

✔ Multi-regulated and licensed CFD Broker founded in 2007 | ✘ Lack of advanced trading tools |

✔ They know how to serve clients’ desires | ✘ Cost structure and spreads are often relatively high |

✔ More than 3,000 assets (forex, CFDs, real stocks, commodities) | |

✔ Competitive spreads from 1.0 pips | |

✔ Fast execution and high liquidity | |

✔ Social and copy-trading | |

✔ Professional and user-friendly trading platform | |

✔ Good support for traders (phone and email) | |

✔ Free education and analytics | |

✔ Regulated payment methods (PayPal, Bank wire, credit card, e-wallets) |

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

6. Vantage Markets – Trade with every type of capital

Vantage Markets (Vantage FX) was founded 10 years ago and is a big growing company in Asia. The CFD prover has more than 2 regulators in Australia and Cayman Island. Next to high security, the broker offers you to trade with very small amounts of money. Every customer of Vantage Markets can use high leverage up to 1:500. That means all position sizes are divided by 10.

For trading and investing Vantage Markets offers the popular MetaTrader platform in versions 4 and 5. If you are new to this platform, no problem, Vantage Markets can give you real-time coaching for this software. More than 300 markets are tradeable via CFDs and high leverage. You can go long and short in currencies, stocks, indices, and commodities.

The spreads are also very low and we recommend using the Vantage Markets RAW ECN but then you have to deposit at least $ 500. Overall, the broker gives you good opportunities to invest in a lot of different markets with good conditions. Furthermore, there are a lot of resources to learn and improve your trading with Vantage Markets.

advantages of vantage markets | disadvantages of vantage markets |

|---|---|

✔ CFD broker for more than 10 years | ✘ Rather slow processing of withdrawal requests |

✔ Multi-regulated company | |

✔ Free $ 100,000 demo account | |

✔ A low minimum deposit of $ 200 | |

✔ Raw spreads from 0.0 pips and low commission | |

✔ High leverage available (1:500) | |

✔ MetaTrader 4/5 platform | |

✔ Personal support | |

✔ Live-webinars and analysis |

[(Risk warning: Your capital can be at risk)

7. IQ Option – User-friendly and customizable platform with new assets

IQ Option is another international broker for trading CFDs. Especially the trading platform of this company is especially unique. It is user-friendly and very customizable. You can do multi-charting and use more than 100 different tools to do technical or fundamental analysis. Compared to other platforms is IQ Option easy to use.

You can start with a minimum deposit of $ 10 or with a free demo account. The minimum investment for one trade is only $ 1 which is very unique. IQ Option offers more than 500 different markets traded with CFDs or other financial instruments. Moreover, different options are available to traders with the possibility of a profit of 900%+.

Next, to the good conditions, the broker offers 24/7 support in different languages. If you are searching for an easy way to invest you definitely should try IQ Option.

advantages of iq option | disadvantages of iq option |

|---|---|

✔ Regulated broker since 2014 | ✘ CFD product range is limited |

✔ Minimum deposit $ 10 | ✘ No support for external trading platforms |

✔ Minimum investment amount $ 1 | |

✔ Userfriendly platform and easy to use | |

✔ Stocks, Commodities, ETFs, CFDs, Binary Options (only for customers outside Europe), and more | |

✔ Yield 80 – 100% for options | |

✔ Competitive spreads | |

✔ High leverage up to 1:1000 (no EEA) | |

✔ Support 24/7 | |

✔ Fast deposit and withdrawal |

(Risk warning: Your capital might be at risk.)

8. Markets.com – Comfortable trading platform with the best spreads

When it comes to online trading most traders want to invest in a trading platform that is easy to use and very compact. Compared to the other CFD Brokers on this site Markets.com is one of the largest companies for online investing too. The advantages of the trading platform are that the software is very user-friendly and when you want to trade with more professional tools you can use the platform MarketsX.

Markets.com belongs to Playtech PLC which is listed on the London Stock Exchange. This shows us very high trust and safety. In addition, the customer funds are very safe with this broker because of the Financial Service Compensation Scheme (£85,000). The CFD Broker is multi-regulated by important regulators like FCA, CySEC, and ASIC. International clients are accepted.

The trading platform is very compact and recommended for beginners. You clearly see what you can trade and where you can invest. New traders can try the free demo account to test the platform. Two platforms are offered. MarketsX is a new chapter of the broker. You will get more tools, analysis, and chances to do professional strategies. All in all, Markets.com is recommended to trade with because of the huge range of assets, trustworthiness, and user-friendly platform.

advantages of markets.com | disadvantages of markets.com |

|---|---|

✔ Multi-regulated CFD Broker | ✘ The platform can be confusing for new traders |

✔ The company is listed on the London Stock Exchange (Playtech PLC) | |

✔ 2,000 different markets and assets to trade | |

✔ CFDs on forex, commodities, cryptocurrencies, stocks, and more | |

✔ Free and unlimited demo account | |

✔ Variable spreads (0.6 pips) and no hidden fees | |

✔ VIP accounts and professional platforms | |

✔ PayPal, bank wire, Credit Cards for funding and withdrawal | |

✔ High security of customer funds |

(Risk warning: 67% of retail CFD accounts lose money)

9, ActivTrades – Professional brokerage with high security

On this page, we present you with only reputable and safe CFD Brokers. ActivTrades is one of them. Founded in Switzerland the company moved to the financial center in London (United Kingdom). In addition, ActivTrades is regulated there by the FCA (Financial Conduct Authority) like many other CFD Brokers.

ActivTrades offers very professional software and support for its clients. Besides that, the minimum deposit is $ 1,000 very high but we want to present you with this broker because of the good conditions and services. Also, you can open a free demo account to test the platform.

For trading, more than 450 available assets the software ActivTrader and MetaTrader 4/5 are offered. The ActivTrader gives you professional market data with market depth and volume for the best execution. The spreads are starting from 0.45 pips. In addition, financial security is very high and there is insurance protection up to £1,000,000.

advantages of activetrades | disadvantages of activetrades |

|---|---|

✔ Regulated by the famous FCA (UK) | ✘ Their conversion fees are relatively high |

✔ Financial Services Compensation Scheme £85,000 | ✘ The customer support is on the slow side |

✔ Additional insurance protects customers up to £1,000,000 | |

✔ Free demo account | |

✔ $ 1,000 minimum deposit | |

✔ Spreads starting 0.45 pips | |

✔ More than 450 assets | |

✔ Professional trading platform ActivTrader | |

✔ Good support and education for traders |

(Risk warning: 66 - 79% of retail CFD accounts lose money)

10. CMC Markets – Professional CFD Broker

CMC Markets is a well-known brand because the company exists since 1989 and is listed on the London Stock Exchange which shows us high trust. The CFD Broker is multi-regulated and accepts international clients. The main customer base is in Europe where the trader is managed by the FCA (UK) license.

The financial security is very high and there is a Financial Services Compensation Scheme (FSCS) for more than £85,000. The customer funds are managed in big international banks with high liquidity. The history of the company shows that the customer base and revenue of the broker are growing continuously.

Traders can trade more than 10,000 different markets. Currencies, cryptocurrencies, bonds, stocks, ETFs, and more are available on the professional trading platform “Next Generation”. The platform provides more professional features than the popular MetaTrader. In addition, traders can trade Spread Betting products next to the CFDs. From our experience, CMC Markets is a highly reliable broker that offers a good service for its clients.

advantages of CMC markets | disadvantages of CMC markets |

|---|---|

✔ Professional broker since 1989 | ✘ No 24/7 customer support |

✔ The company is listed on the London Stock Exchange | ✘ Fees, mainly for CFD stocks are very high |

✔ More than 10,000 markets to trade | |

✔ CFDs and Spread Betting | |

✔ Free demo account and $ 0 minimum deposit | |

✔ Low spreads (0.7 pips variable) and no hidden fees | |

✔ Exclusive Support (Webinars and more) | |

✔ High financial security | |

✔ Professional Trading Platform “Next Generation” |

(Risk warning: 73% of retail CFD accounts lose money)

What is the best CFD trading platform overall?

From the list in this article, I can confidently recommend each and every one of them. If I had to award the best CFD trading platform, I would probably say Capital.com is the winner overall. To me, their excellent, personalized customer support, in combination with a modern, AI-supported trading platform put them just a little ahead of their completion. Not to forget, about the the huge selection of free educational material and guides, as well as the access to MetaTrader 4 software.

Can I test a CFD Trading platform for free?

Most of the CFD Trading platforms have demo or virtual accounts that allow the user to trade without using real money. It works like a free trial where the customer gets firsthand experience of the platform without a commitment or deposit.

In choosing the right demo account for you, look at factors such as the amount of virtual money you can use, the number of free accounts you can use per day, and the ability to trade simultaneously between the demo and the live account.

There are different terms and conditions associated with demo accounts. Some require a minimum deposit amount, while others will want to get you on a call to activate the free trial. It is essential to read the terms and conditions of each free trial account to be sure that your privacy and security are protected.

How does a CFD Broker make money?

CFD trading companies are looking for ways to make money, like any other business in this world. Part of the funds will be reinvested to improve the broker’s security, customer support, and customer satisfaction. In short, we can break down the revenue stream of a CFD broker into four parts.

Commissions

Commissions per lot traded is a revenue model you will commonly find. The commission can be a flat fee per trade or a percentage of the trade’s total value. In total, you can commonly expect commissions to range between 1-15$ per lot.

Spreads

Trading companies make revenue with every trading order via the added spread. That’s the difference between the ask and the bid price. Because the broker companies compete with each other, you will often find nearly similar spreads on the most popular financial instruments. However, on less popular CFDs, the differences can be considerable.

Swap fee differences with interest rates

Swap fees, also known as rollover fees or overnight financing fees, are charges incurred by traders in the Forex and CFD markets when holding a position overnight. These fees are associated with the difference in interest rates between the two currencies being traded.

Platform fees

Platform fees are the last revenue source for CFD brokers and consist of fees such as added currency exchange rates, deposit and withdrawal fees, or inactivity fees if you are not trading for more than 90 days.

Are CFD Brokers a scam or not?

CFD brokers are generally legitimate financial instruments you can use for trading various assets, allowing traders to speculate on price movements without owning the underlying asset.

However, like any industry, there are reputable and reliable CFD brokers, as well as fraudulent and unethical ones. Therefore it’s essential for you to thoroughly research and choose licensed, regulated, and well-established brokers to mitigate the risk of scams.

Additionally, I recommend carefully reading the terms and conditions, and exercising caution by only investing what you can afford to lose. CFDs are complex financial instruments, and most new traders lose money when they start out. Due diligence and due care are crucial in the financial markets to ensure a safe and secure trading experience.

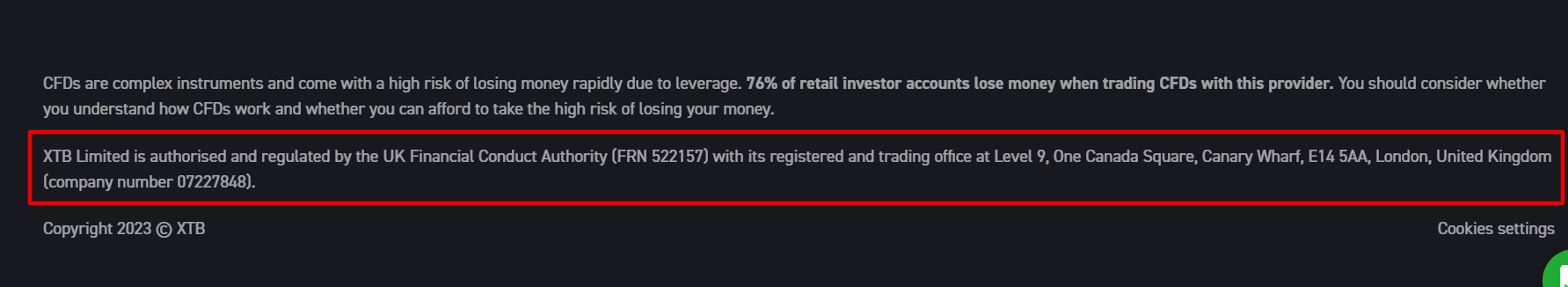

How to check for a CFD broker regulation

Knowing how to check if a CFD broker has a valid regulation is absolutely crucial to avoid fraud. The good news is, that the process is actually very simple and shouldn’t take you more than two minutes.

1) Look up the broker’s license number

The easiest way to check if CFD trading companies are regulated by a trusted regulatory is to scroll to the footer section of the webpage. If the broker is regulated you will find the license number down there.

Keep in mind not every regulation is worth the same, I recommend looking for well-known regulations such as the one from the Financial Conduct Authority (FCA), just as in the XTB example below.

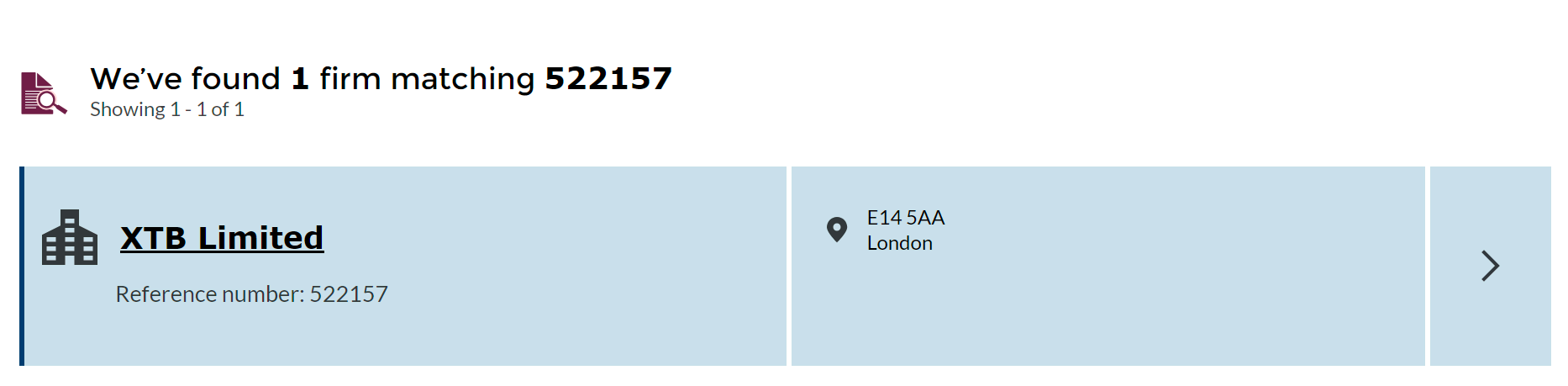

Next, you should always verify, if the indicated license number is valid because the number alone could also be fake. In my case, I take the XTB regulation number I found on the website(522157) and double-check it on the official FCA website.

2) Verify the regulation

As you can see, in our example, everything looks good in this case and you can be sure, XTB is a trustworthy, FCA-regulated broker.

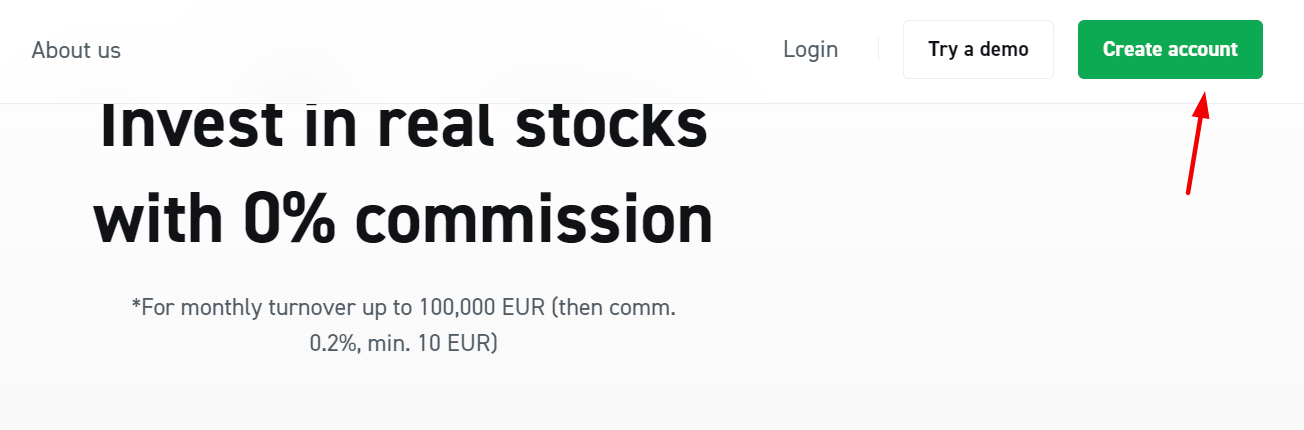

How to Sign up with a CFD Broker

Now, after we verified, that the CFD broker of our choice is a trusted and regulated one, I will show you how to sign up for a trading account while using XTB as an example again. The principle is very similar with most brokers, only the location of buttons can slightly change.

1) Choose account type

If you are signing up, in most cases you will need to decide if you want to sign up for a demo account or a live account, as the sign-up forms are different. XTB is no different here. For the purpose of this tutorial, I will sign up for a live account. However, if you have no trading experience I highly recommend to familiarize yourself with the platform and test your strategies on a demo account.

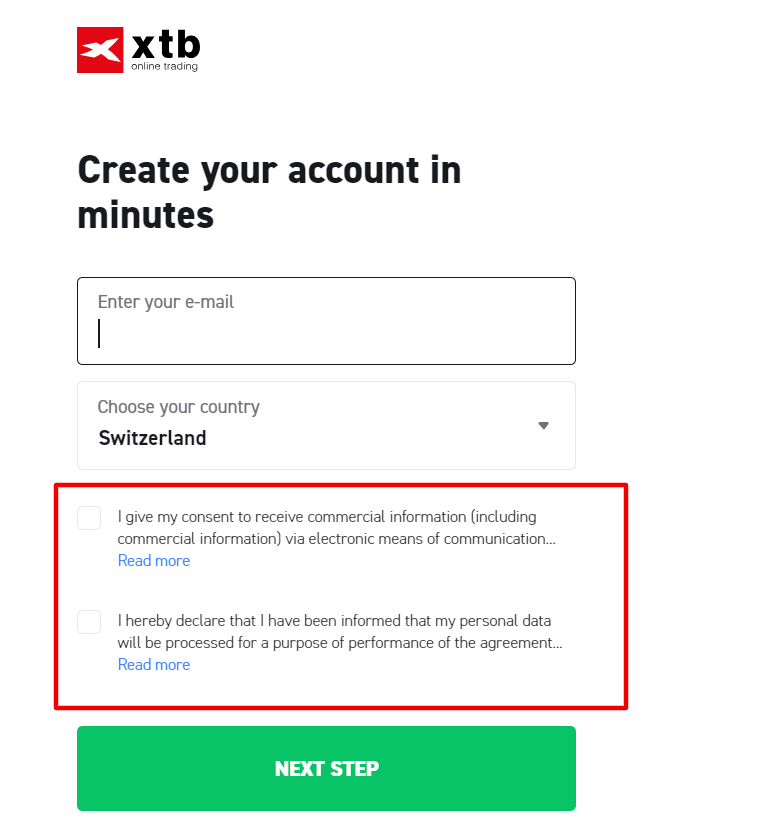

2) Enter E-mail and country of residence

The next step is to enter your E-mail and country of residence. It is also important the read the “key information documents” which contain information about how CFDs work and about the platform. You will also need to choose a secure account password in this step.

3) Enter your personal details and upload identification documents

Submit your personal information such as full name, phone number, address, nationality, etc. You will also need to declare your FATCA and CRS Statements. The entire process takes around five minutes and includes some screening questions regarding your past experience in the financial markets and how you make your income. It’s very important to answer these questions truthfully and provide all necessary documents for identification for speedy approval of your live account.

4) Wait for the approval of your account

Once you submit the required documents, the broker will manually review your application, but it shouldn’t take longer than 12-48 hours normally. I have also seen instances when my account got approved within one hour. Check your inbox regularly as the broker will reach out to you if they require additional information. In the meantime, you can test and improve your trading strategies on a demo account.

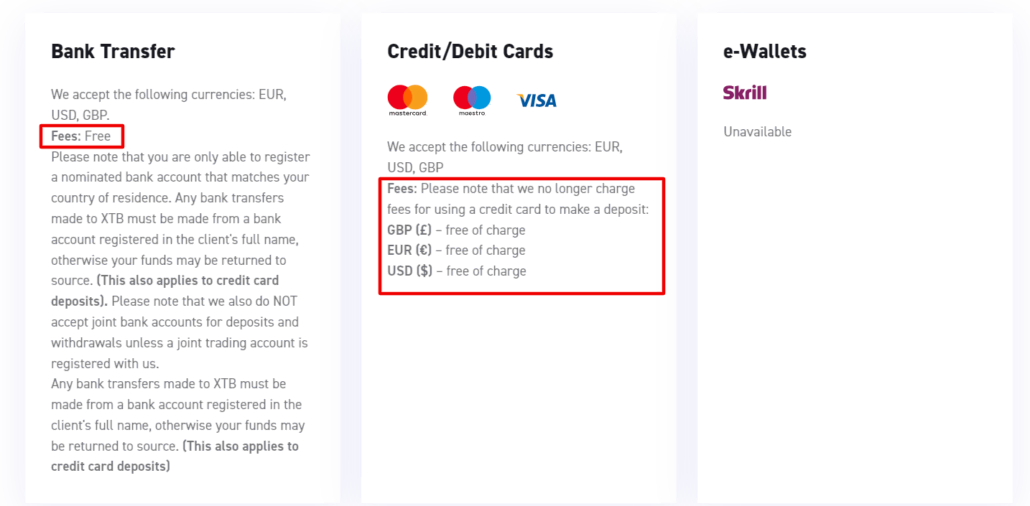

How to deposit and withdraw on a CFD Broker

This is the last step but for many traders most important step, is once your account is approved. Both deposit and withdrawal options and processing time are different from broker to broker. The best way to check out the deposit and withdrawal methods of your broker is on their website.

It’s important that many brokers have a policy that the payment methods for the first deposit and withdrawal need to be the same. For example, if you make your first deposit via a bank account, you need to withdraw the deposit from the same bank account. This procedure is intended to prevent anti-money laundering, but you should know this role because if you don’t comply with it, it can result in withdrawal delays.

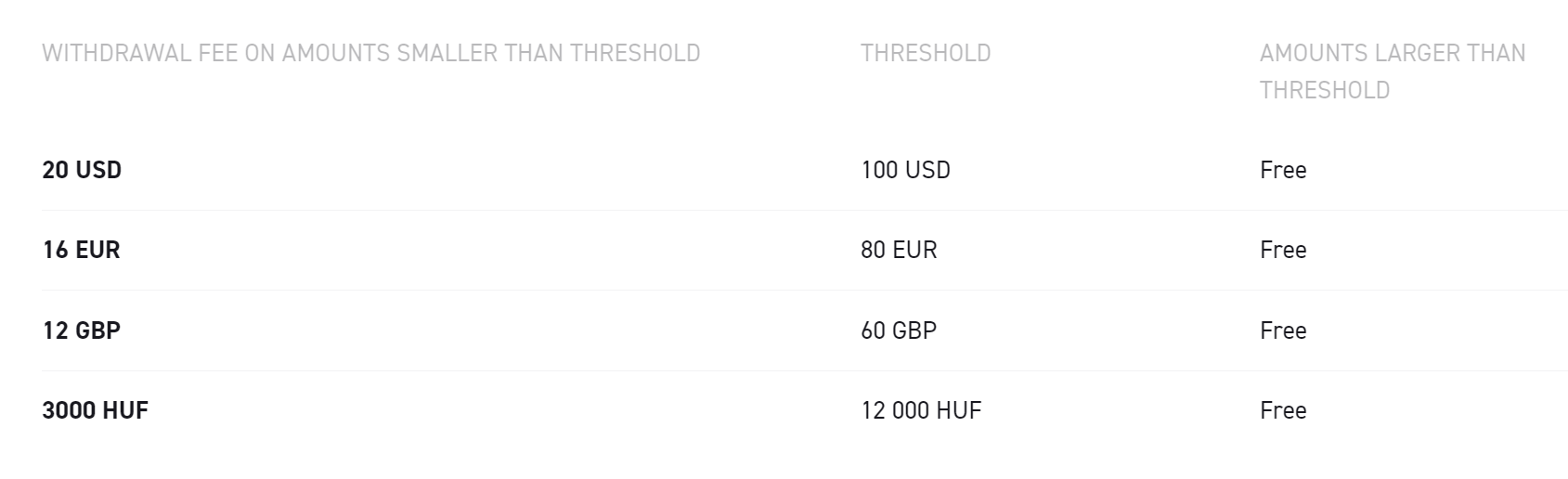

Lastly, some brokers also have a certain minimum and maximum withdrawal limit. Sometimes you also need to pay a withdrawal fee if you request the withdrawal of very small amounts.

Pros and Cons of CFD Trading

Before I conclude the article, I like to give you a short overview of the pros and cons of CFD trading, so you can decide for yourself. Please understand, that CFDs are complex products and many new traders lose money when they start out. If your motivation is to make boatloads of money with no work, I can guarantee you will fail. A proven trading strategy, in-depth knowledge, understanding of the financial markets, discipline, and a will to continuously learn and improve are basic necessities for any successful trader.

Here is an overview of the most important pros and cons of CFD trading:

Pros of cfd trading | cons of cfd trading |

|---|---|

✔ The investment costs are lower than with other forms of investments. | ✘ Many new traders tend to underestimate the risks if they are not used to trading with leverage. |

✔ You have great flexibility and can make profits, no matter if the market is rising or falling. | ✘ Not every CFD broker is serious, unfortunately. There are many fraudulent offers from brokers or trading signals. |

✔ There are nearly endless options for CFD traders in terms of tradable assets. | |

✔ You can benefit from generous leverage and therefore great revenue potential (depending on your broker). | |

✔ Great accessibility and trading options are available 24/7. |

Conclusion on the 10 best CFD Brokers

In the digital century, CFD trading has become more and more popular. It is an easy way to participate in the financial markets. Traders can invest in rising or falling prices with leverage if they want. Nowadays, CFD brokers offer a wide range of markets. Currencies, cryptocurrencies, stocks, indices, commodities, and more markets are available to trade. The fees are also low if you are choosing a good CFD Broker.

On this website, I presented you with my top 10 providers which I tested by using my real money. All of them are very reliable and offer good conditions for traders. If you ask about the best CFD broker, I would award capital.com as the winner. The focus on attractive trading conditions, great support, and constant innovations to help you become successful is what ultimately make them stand out in my opinion. I will say, however, that with any of the top ten CFD brokers on my, you have a great foundation to become successful.

Happy trading!

Most asked questions about CFD Brokers:

Are CFDs suitable for beginners?

Yes, CFD trading is suitable for beginners due to the lower investment requirements, compared to other forms of investments. However, you will need a proven trading strategy, proper risk management, and a good understanding of the financial markets to succeed long term. If you are a trading beginner, I highly recommend starting out with a demo account and making sure you understand how leverage works, before investing any real money.

What’s the difference between CFDs and shares?

When you trade CFDs, you will make money from the price changes of a specific asset, but you don’t own that asset. That is the main difference versus investing in shares on the stock market. Also, with CFDs, you can make profits no matter if the price of an asset is rising or falling. If you own shares from a company, you will lose money, if the price goes down.

Is CFD trading risky?

Yes, there is no investment without risks and many trading beginners will lose money in the beginning. You can minimize but not fully eliminate those risks, with proper risk management, an adjusted position size, and constantly using stop-loss orders for example. I also recommend testing any new trading strategy on a demo account with virtual money first, no matter how experienced you are.

Which CFD broker offers the highest leverage?

RoboForex offers the highest leverage of up to 1:2000. Because the broker has no European regulation, they are allowed to do that. Due to the laws of the European Union, companies with a European may only offer leverage of 1:30. Always remember, that high leverage allows you higher profits but also increases the risk if the market moves against you. It’s also possible, that you will need to invest more money quickly if your margin drops below the limit, to avoid your positions being closed automatically.

Which CFD broker is best?

My personal favorite is Capital.com. While you can’t go wrong with any company on this list, the platform and the fact is you can trade on a TradingView chart is what makes capital.com so special from my experience. But, the preferences of every trader are different, and just because I like it doesn’t automatically mean, it’s the best fit for your situation. I recommend testing multiple platforms and signing up for more than one demo account to find your best match.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)