5 best Forex Brokers with cTrader in comparison

Table of Contents

See the list of the best 5 Forex brokers with cTrader:

Broker: | Review: | Supports CTrader: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex  | Yes | IFSC | 9,000+ (40+ currency pairs) | + Many awards + Huge diversity + Many account types + High leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. OctaFX  | Yes | CySEC | 100+ (28+ currency pairs) | + Leverage up to 1:500 + Supports MT4 & MT5 + Spreads from 0.2 pips + Low commissions + Deposit bonus + Many account types | Live account from $100(Risk warning: Your capital can be at risk) | |

3. IC Markets  | Yes | ASIC, FSA, CySEC | 232+ (65+ currency pairs) | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

4. FxPro  | Yes | FCA, CySEC, FSCA, SCB | 250+ (70+ currency pairs) | + Multi-regulated + User-friendly + Mobile trading + Competitive spreads + Free demo account | Live account from $100(Risk warning: 72.87% of CFD accounts lose money) | |

5. Pepperstone  | Yes | FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA | 180+ (60+ currency pairs) | + Authorized broker + Multi-regulated + 24/5 support + Low spreads + Leverage up to 1:500 | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

More traders have recently developed an interest in the popular cTrader platform and are searching for the best cTrader forex broker.

Today, the technological advancement experienced by the forex world has facilitated the creation of several new trading tools and advanced trading platforms. All of which is geared at improving how users execute trades, evaluate the market, and try to profit from it.

cTrader is an ideal example of a platform that has been designed to fit into the new technologically advanced trading market. The features seen in the cTrader platform contain some elements that can make a world for the difference in any trading strategy, both for newbies and advanced traders.

These distinguishing features have made the cTrader platform a prime choice among the best ECN forex brokers as its high efficiency makes it ideal for ECN trading. In addition, the platform was developed with speed and quality performance as the principal focus.

Some other types of brokers that benefit from the cTrading platform include copy trading brokers, technical trading brokers, and day trading brokers. Being a sophisticated trading platform with advanced trading capabilities, fast entry, synchronization, and lightning-fast order processing, it is no news that while beginner traders can leverage the functions and features of this platform, the cTrader platform may be better suited for experienced traders.

Working with a cTrader broker on the cTrader platform offers several advantages, some of which include the maximum flexibility and the possibility of synchronous and asynchronous execution of orders simultaneously. The platform also offers a wide range of technical indicators to improve your trading strategy.

The role of a cTrader broker is to help users or traders with the cTrader platform. A cTrader will help in the account opening process. From the demo account to the live account. Although, when it is time to open the live account, the trader is redirected to a relevant webpage. That is, the trading live account is not opened on the cTrader platform.

Although most cTrader brokers are well-known industry brands and are sufficiently regulated, some cTrader brokers are not regulated or have very weak regulations. Regulation ensures traders’ funds are properly secured. Therefore, it is crucial to choose a cTrader broker that provides adequate trader protection or fund security.

Also, while the cTrader platform is packed with essential features, it is equally vital that your cTrader broker is trustworthy and able to deliver top-notch services from timely execution of trades, handling withdrawals and deposits, to the safekeeping of trading capital and personal details. A cTrader broker should also offer competitive fees and excellent customer service.

Without a doubt, finding a cTrader broker that offers these outstanding features and more can be a daunting task. This is why this article will be comparing the five best forex brokers with the cTrader platform. This will enable you to choose only reputable and recognized cTrader brokers to trade with. But, first, let’s explore the cTrader platform and all it entails.

What is the cTrader?

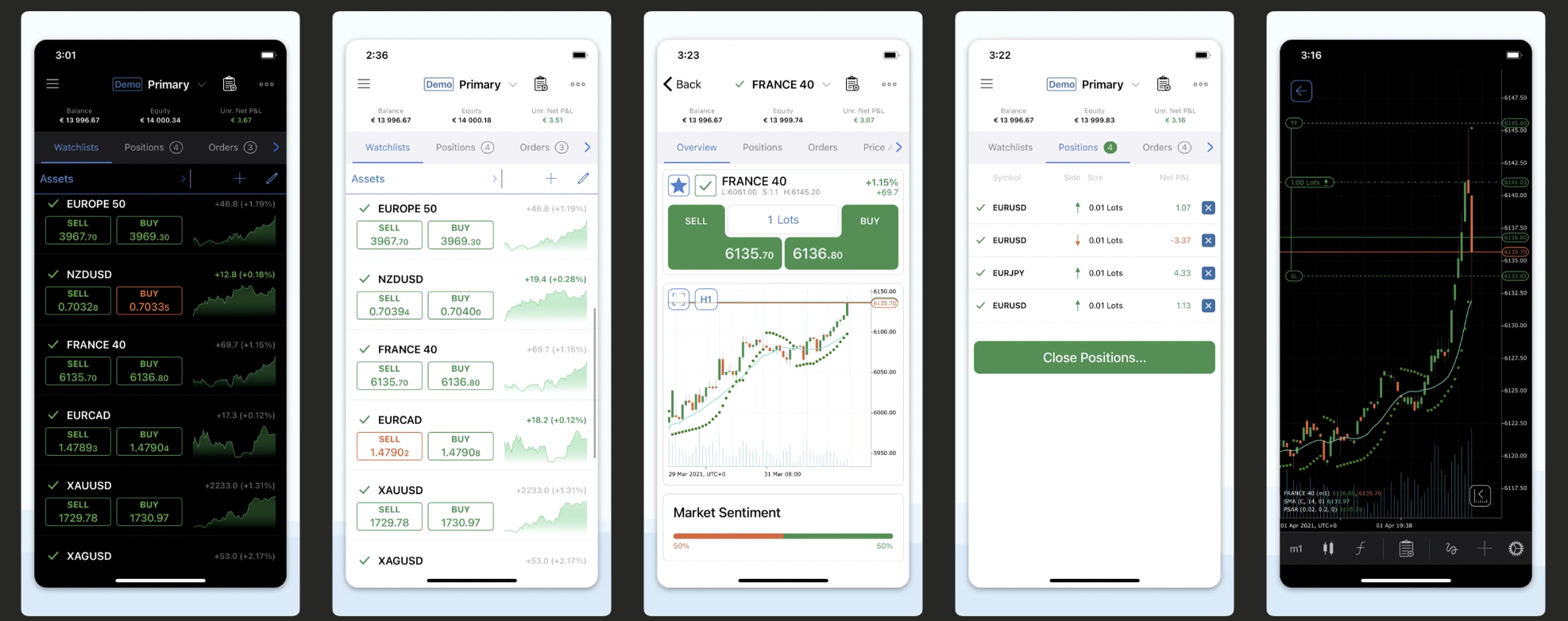

cTrader is a leading and advanced Forex trading platform with an attractive user interface that is easy to use and made available on multiple devices. The cTrader platform is famous for its modern trading capabilities and functionalities, such as fast order execution and charting.

The trading platform was designed by an award-winning Fintech provider, Spotware Systems Ltd. Its design was explicitly customized with Electronic Communication Network (ECN) brokers. From the time of its launch, it has been the choice platform for multiple ECN brokers, including Pepperstone, Admiral markets, Australia-based market leaders, and Liquid Markets.

The cTrader has a clean and uncluttered user interface with an easy-to-use and navigate layout. It also stands out because of its intuitive design solution. As a result of its simplicity, it attracts both beginner and professional traders, giving it an edge over more complicated trading platforms.

The platform offers quite a number of charting tools to cater to specific trading needs. cTrader also provides a rich potential for customization, giving traders the opportunity to automate their trading strategies.

The cTrader Automate, formerly known as cAlgo, is a powerful and all-inclusive algorithmic trading solution that is easy to use and enables traders to modify indicators and robots.

It has become a highly demanded trading platform by leading brokers and traders because it provides a responsive and transparent trading environment. In addition, the cTrader platform offers its customers direct access to interbank rates using the No Dealing Desk technology.

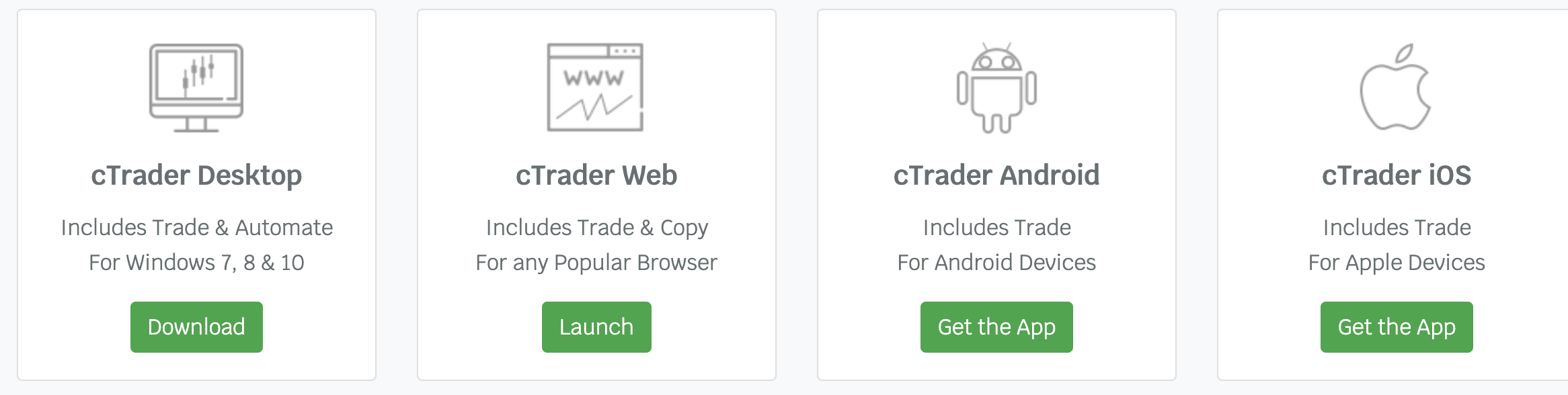

The cTrader platform can be used on Desktop and mobile devices. It offers numerous features such as level II pricing, fast entry execution of orders, a live trading atmosphere, and algorithmic-based trading systems. It also provides

- advanced order protection,

- various pre-sets and detachable charts, and

- direct access to the interbank market.

The platform supports numerous trading styles and strategies, and its powerful features allow traders to trade both manually and automatically.

On the cTrader platform, valuable guides, videos, indicators, and other necessary tools can help you correctly navigate the financial market, fine-tune your trading style and maximize profit opportunities.

Key features of cTrader platform:

Some significant features of the cTrader platform are:

1. User-friendly interface

The cTrader user interface is clean, attractive, and easy on the eye. As a result, there is little or no difficulty navigating and familiarizing the interface. In addition, its simplicity and unambiguous trading space make it quite compelling to traders of different levels.

The ease of use of the cTrader interface is also notable. While the platform has numerous features, the interface is such that traders access these features without challenges.

2. No Dealing Desk

cTrader offers traders real-time market trading opportunities, in that traders’ orders are sent directly to liquidity providers, banks, or other traders. In addition, traders can see financial centers that are open during regular market hours.

Also, the NDD broker feature implies that traders buy and sell instruments, engaging directly with a real-life counterparty and transacting in the real world.

3. Timeframe

In comparison to other platforms, cTrader offers a more inclusive timeframe. For example, traders can access the standard 1,5, and 15-minutes timeframe from several different platforms. However, cTrader offers more comprehensive options ranging from 45, 20, and 10 all the way down to a 1-hour timeframe.

List of the best forex brokers that support the cTrader platform:

1. RoboForex

RoboForex is a top forex broker regulated by the Cyprus Securities Exchange Commission (CySEC) and the International Financial Service Commission (IFSC) Belize. They offer ECN execution, a spread of 0 pips, and a low minimum deposit.

RoboForex is sufficiently regulated and offers insurance of up to $5 million. Before depositing real funds, traders can use the demo account for practice. The broker also provides copy trading as well as several trading platforms and account types.

The broker is suitable for all types of brokers. RoboForex provides a range of payment methods and a generally good trading experience for traders. However, depending on the type of account you choose to trade with, the commissions and spread fees may be higher than those offered by other brokers.

RoboForex permits the use of Expert Advisors (EAs) and other trading strategies, including scalping and hedging. Traders also access the popular trading platforms MetaTrader 4 and MetaTrader 5.

There are also some drawbacks to choosing RoboForex as a cTrader broker. First, the demo account used for trial trading is not unlimited. This implies that traders can no longer use the demo account after some time. Also, the high commission charges on ECN and prime account types aren’t an advantage.

In addition, the spreads on a Pro and a Pro Cent account are also exceptionally high. Although the ECN and Prime account holders face high commissions, they also benefit from low spreads.

(Risk Warning: Your capital can be at risk)

2. OctaFX

OctaFX is equally a well-regulated broker with St. Vincent and The Grenadine Forex Broker Incorporation and Cyprus Securities Exchange Commission (CySEC) licenses. The brokerage company is characterized by speed and is also high in demand among scalpers because they provide ECN execution and overall fast market execution.

OctaFX is also a good DMA broker as it offers auto trading. Although they also provide top trading platforms such as cTrader, MT4, and MT5, they do not provide a wide range of assets. There is also copy trading available for traders and a low minimum deposit.

Unlike RoboForex, OctaFX offers unlimited access to demo accounts and also offers competitive spreads. Choosing OctaFX benefits both experienced and beginner traders as they can carry out different trading techniques, including scalping, hedging, and use of Expert Advisors (EAs).

One of the downsides of choosing OctaFX as your forex broker cTrader is that there is no guarantee on stop-loss. The limited number of assets and the fact that traders can only access two base currencies (EUR and USD) may also not be favorable to advanced traders.

OctaFX provides negative balance protection to keep traders’ funds safe. For additional security, traders’ funds are held in segregated accounts with top banks, ensuring that the broker’s financial situation does not matter.

(Risk Warning: Your capital can be at risk)

3. IC Markets

IC Markets is a well-known Australia-based ECN DMA broker. It is popular among traders who use automated and algorithmic trading strategies. It is an international license from the Australian Security and Investment Commissions (ASIC), Cyprus Securities and Exchange Commissions (CySEC), and Financial Services Authority (FSA). IC Markets qualify as a safe broker, which is one reason forex traders choose them.

IC Market is a top choice among traders because they offer deep liquidity, low minimum deposit, and competitive, and lightning-fast speed. This makes it a good forex broker cTrader for algo traders, scalpers, and high-volume traders.

They give their clients easy access to the market by offering online and mobile trading platforms. The IC Markets trading platform offers over 232 instruments while offering access and connectivity to various financial markets worldwide.

In addition, IC Markets segregates clients’ funds, and the number of currency pairs offered is 65. Their platforms include MT4, MT5, Zulu Trader, cTrader, Mirror Trader, and Mac. In regard to fees, IC Markets are pretty transparent. The minimum deposit fee is 200, and their offers for forex and relatively competitive.

Like every brokerage company with advantages, IC Markets also has some downsides. One of which includes the long wait time for withdrawals. It takes up to 2 weeks for a withdrawal to be effected in most cases. There are also higher fees for withdrawing into an international account.

(Risk Warning: Your capital can be at risk)

4. FxPro

FxPro is an experienced broker and is also sufficiently regulated. They are regulated by Cyprus Securities and Exchange Commissions (CySEC), Financial Conduct Authority (FCA), Financial Sector Conduct Authority (FSCA), and Securities Commission of the Bahamas (SCB).

FxPro offers low minimum deposit and spread betting. Before funding a live account, traders can practice with a free demo account. FxPro accepts various trading types, strategies, and techniques.

One of the benefits of choosing FxPro as your forex broker cTrader is that traders do not have to worry about inactivity fees. Also, they offer low spreads. However, the commission charged for a round-turn trade is about $9. This is higher than other brokers in the market.

FxPro offers a VIP account that provides competitive spreads, free VPS, and low commission for large-volume traders. This helps create a better trading environment where profit can be maximized.

(Risk warning: 72.87% of CFD accounts lose money)

5. Pepperstone

Pepperstone is another broker that allows high-frequency trading. They are incorporated in the Bahamas and licensed by the Securities Commissions of the Bahamas (SCB). They also provide professional tools that help increase the efficiency of trade.

Pepperstone has an international license to provide services from the Financial Conduct Authority (FCA), Australian Security and Investment Commissions (ASIC), Cyprus Security and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Service Authority (DFSA), Capital Markets Authority of Kenya.

They are used by about 89,000+ traders and offer 60 forex currency pairs, including major and minor forex currency pairs. Traders are required to pay a minimum deposit of $200, after which there is no extra charge for deposit fee, withdrawal fee, or inactivity fee.

Pepperstone is well suited for algo traders and copy traders. Choosing them as your forex broker, cTrader offers you access to fast order execution, easy accounting opening and withdrawal processes, low trading cost, and zero pips from the spread.

Clients’ capital is also guaranteed as top banks hold traders’ assets in an aggregate account.

Some of the funding and withdrawal facilities offered by Pepperstone are PayPal, Skrill, Bank Transfer, Credit Card, Neteller. When it comes to customer service, they provide traders with live chat, phone support, and email support systems.

Pepperstone customer support is also available in twelve languages: English, Thai, Spanish, Chinese, Portuguese, Russian, Vietnamese, Polish, German, Arabic, French, and Italian.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

How to use the cTrader:

Step 1: Download the cTrader platform

The primary step to using the cTrader platform is to download it. The platform is available for download on www.software.com. Traders can also download the cTrader from any cTrader broker. Ensure you have gone over our review and comparison and know the best forex broker cTrader to make sure you have a smooth trading experience.

Here are the recommended system specification for a cTrader installation

- Operating System: Windows 7, Windows 8, Windows 8.1, Windows 10, Vista

- System Processor: Dual-Core CPU

- Memory (RAM): 4GB

- Internet Connection: Stable network connection, 1Mbps and above

- Monitor: 13-15 inch screen

On www.software.com, there are three cTrader download options. To access the option, click ‘Get Demo.’ The download options are:

- cTrader download for iOS

- cTrader download for Android

- cTrader download for Desktop

After downloading the cTrader demo from either of the options, proceed to your downloaded files and search for ‘cTrader-spotware-setup.exe.’

Right-click on the file and ‘Run as administrator.’ The program will download in a few seconds with a good internet connection. If you get a prompt to restart your system, don’t fret, the cTrader will start right after your desktop restarts.

Step 2: Set up your cTrader demo account

After installing and launching the cTrader, you can open the platform and click the login option if you have an existing account.

If you do not, click the signup button and sign up by filling out your email address and choosing a password. After you register, you will receive a verification mail, proceed to your mailbox, click the link, and complete the verification process.

Your email will contain your email address, your cTrader ID (cTID), and some links. You can personalize your details from each of these links by resetting your password, choosing a different email, or changing your client ID.

Head back to the platform and click ‘Acknowledge and Continue’ after reading the terms and conditions.

By now, you should be able to see and access the complete interface of the cTrader platform. At the top of the page is an option to open a live account. You can proceed to register for a live performance if you want to open one immediately.

Click on the cTrader beside the three parallel horizontal lines to open your demo account. Click on open a demo account. Choose the type of demo account you want from the screen pop-up that shows up next. The two options available are:

- Hedging account

- Netting account

Move on to select the amount you wish you put in your demo account (remember, this is not a live account, so your money isn’t in yet). Also, choose your preferred currency and the leverage.

Step 3: Set up your cTrader live account

Simply head back to the three parallel horizontal lines if you want to set up a live account on the cTrader platform. This time, click ‘Open a live account.’ You will be required to select a broker from the list provided. The cTrader brokers include:

- IC Markets

- FX Pro

- RoboForex

- Fondex

- Pepperstone

- OctaFX

Choose your forex broker cTrader and complete the registration process.

Step 4: Acquaint yourself with the cTrader interface

You can start by exploring the currency pairs. On the left side of the cTrader platform, you will find a list of options from which to choose your currency pairs.

After selecting a currency pair, the chart for that currency pair appears at the center of your screen. You can choose multiple currency pairs and switch between the charts for each currency pair.

You will find the Accounts bar at the top left of the platform. This is where you can view all your accounts and switch between them. This accounts bar will show you the account number, the account type, the currency, and the leverage.

Down the left side of the platform is the Market Watch. This is where you can find all trading symbols offered by your broker.

Next, you can go through the cTrader main menu and familiarize yourself with the rest of its features. The content in the main menu includes

- Trade

- Copy

- Automate

- Analyze

- Depositing or Withdrawing funds

- Settings

- Account Bar

- Trade Watch

- Market Watch

- CTID

- Charts

- Place an order

Advantages of cTrader:

While there are many electronic trading platforms, it is essential to understand what sets each platform apart. These are some advantages of the cTrader software.

- Fast market access and quick trade execution

- Adequate security

- Clean, easy, and intuitive user interface

- Copy-trading option

- Availability of a wide range of instruments

- No dealing desk (NDD) system

Disadvantages of cTrader:

Although the benefits of cTrader are undeniable, as with any electronic trading platform, there are also some cons, such as

- A limited number of trading tools and automated strategies

- The interface might be too advanced for a beginner trader because of the numerous features.

- Radical fluctuation of stop-loss

Conclusion – There are great brokers that support the cTrader platform

The cTrader platform is an advanced forex trading platform with numerous features and a highly commended user interface. However, in using the cTrader platform, you need a forex broker, cTrader, also known as cTrader broker. With this, it is essential that you are thorough in your decision-making process.

There are several reliable brokers to choose from, all that is needed to evaluate their features in line with your trading strategies and general trading needs.

FAQ – The most asked questions about Forex Brokers with cTrader:

How does cTrader operate?

When traders login to the cTrader web application with cTrader ID, they can move on to the Copy section. From there, they can review the available strategies. They can see if it is of their use. Or they can apply it in their trading business. After that, they can analogize their history, details, and fees. Then, they can allot the funds. After that, they can begin with the cTrader. And they can start copying any of them in just two clicks.

Can I consider cTrader for scalping?

Yes, you can opt for scalping on cTrader without any doubt. The cTrader Smart Scalping Tool is an on-screen panel that is equivalent to a kind of magic key. It helps you quickly submit, close, and handle orders at extremely high speed. In addition, cTrader makes an effort to provide its clients with the best service and safety. So, you can rely on the platform. And you can start scalping Forex, Indices, Crypto & Shares.

What is the process to link my broker with cTrader?

1. First, log in to the cTrader account with your credentials, i.e., email and password.

2. Once you are logged in, go to the menu button.

3. Keep scrolling until you see “Connect your broker.” You can find it below the “Trading” section.

4. From there, select “cTrader” by clicking on it.

5. At last, Click “Log In.”

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)